Professional Documents

Culture Documents

Den FY2021 Financial Report-16

Uploaded by

PAVANKUMAR S BCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Den FY2021 Financial Report-16

Uploaded by

PAVANKUMAR S BCopyright:

Available Formats

ANNUAL COMPREHENSIVE FINANCIAL REPORT

FINANCIAL SECTION

December 31, 2021 and 2020

At December 31, 2020, the Airport’s proportion was 12.06361%, which was a decrease of 1.672430% from

its proportion measured as of December 31, 2019. At December 31, 2019, the Airport’s proportion was

13.73604%, which was an increase of 1.01011% from its proportion measured as of December 31, 2018.

The components of the Airport’s net pension liability related to DERP as of December 31, 2021 and 2020,

respectively, are presented below ($ in thousands):

2021 2020

Total pension liability $ 473,283 $ 510,104

Plan fiduciary net position (285,507) (310,226)

Net pension liability $ 187,776 $ 199,878

The change in net pension liability for the year ended December 31, 2021 was ($ in thousands):

Beginning Ending

balance Additions Reductions balance

$ 199,878 $ 39,522 $ (51,624) $ 187,776

The change in net pension liability for the year ended December 31, 2020 was ($ in thousands):

Beginning Ending

balance Additions Reductions balance

$ 191,995 $ 48,122 $ (40,239) $ 199,878

For the years ended December 31, 2021 and 2020, pension expense recognized by the Airport was $21.4

million and $33.1 million, respectively. At December 31, 2021, the Airport reported deferred outflows of

resources and deferred inflows of resources related to pensions from the following sources ($ in

thousands):

Deferred outflows Deferred inflows

Sources: of resources of resources

Difference between expected and actual experience $ 4,042 $ -

Changes of assumptions or other inputs 8,863 -

Net difference between projected and actual earnings - 3,267

on pension plan investments

Changes in proportion and differences between 5,500 15,529

contributions recognized and proportionate share of

contributions

Contributions subsequent to the measurement date 13,778 -

Total $ 32,183 $ 18,796

CITY & COUNTY OF DENVER | MUNICIPAL AIRPORT SYSTEM Page 87 of 142

ANNUAL COMPREHENSIVE FINANCIAL REPORT

FINANCIAL SECTION

December 31, 2021 and 2020

At December 31, 2020, the Airport reported deferred outflows of resources and deferred inflows of

resources related to pensions from the following sources ($ in thousands):

Deferred outflows Deferred inflows

Sources: of resources of resources

Difference between expected and actual experience $ 6,289 $ -

Changes of assumptions or other inputs 6,248 -

Net difference between projected and actual earnings - 3,660

on pension plan investments

Changes in proportion and differences between 12,095 1,033

contributions recognized and proportionate share of

contributions

Contributions subsequent to the measurement date 13,133 -

Total $ 37,765 $ 4,693

At December 31, 2021 and 2020, the Airport reported $13.8 million and $13.1 million, respectively, as

deferred outflows of resources related to pensions resulting from Airport contributions subsequent to the

measurement date that will be recognized as a reduction of the net pension liability in the following year.

Other amounts reported as deferred outflows of resources and deferred inflows of resources related to

pensions will be recognized as presented below ($ in thousands):

Deferred inflows/

outflows of

Year: resources

2022 $ 4,250

2023 (780)

2024 (3,531)

2025 (330)

2026 -

Thereafter -

Total $ (391)

The total pension liability in the December 31, 2020 and 2019 actuarial valuations were determined using

the actuarial assumptions as follows:

2020 DERP

Investment rate of return 7.25%

Salary increases 3.00% to 7.00%

Inflation 2.50%

2019 DERP

Investment rate of return 7.50%

Salary increases 3.00% to 7.00%

Inflation 2.50%

CITY & COUNTY OF DENVER | MUNICIPAL AIRPORT SYSTEM Page 88 of 142

ANNUAL COMPREHENSIVE FINANCIAL REPORT

FINANCIAL SECTION

December 31, 2021 and 2020

Mortality rates were based on the Adjusted RP-2014 Mortality Tables, with general projections using

Ultimate MP Scale (changed in 2018 from RP-2000 Combined Mortality Projected with Scale AA to 2020).

The latest experience study was conducted in 2018 covering the 5-year period of January 1, 2013 to

December 31, 2017.

The long-term expected rate of return on pension plan investments was determined using a building block

method in which best-estimate ranges of expected future real rates of return (expected returns, net of

pension plan investment expense and inflation) are developed for each major asset class. These ranges are

combined to produce the long-term expected rate of return by weighing the expected future real rates of

return by the target asset allocation percentage and by adding expected inflation. Best estimates of

arithmetic real rates of return were adopted by the plan’s trustees after considering input from the plan’s

investment consultant and actuary(s).

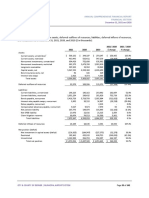

For each major asset class that is included in the pension plan’s target asset allocation as of December 31,

2020 and 2019 these best estimates are summarized in the following table:

2020

Long-term expected

Asset class Target allocation real rate of return

US equity 22.00%

Large cap 18.00% 7.20%

Small cap 4.00% 7.90%

International equity 22.00%

Developed markets 14.00% 7.90%

Emerging markets 8.00% 9.10%

Fixed income 25.50%

Core fixed income 17.00% 2.60%

Private debt 4.00% 6.20%

Distress debt 2.50% 7.00%

Emerging market debt 2.00% 4.80%

Real estate 8.00% 7.50%

Absolute return 5.00% 4.90%

MLP 5.00% 8.50%

Alternatives 12.50%

Private equity 7.00% 9.40%

Natural resources 5.50% 8.80%

Total 100.00%

CITY & COUNTY OF DENVER | MUNICIPAL AIRPORT SYSTEM Page 89 of 142

ANNUAL COMPREHENSIVE FINANCIAL REPORT

FINANCIAL SECTION

December 31, 2021 and 2020

2019

Long-term expected

Asset class Target allocation real rate of return

US equity 21.00%

Large cap 17.00% 5.50%

Small cap 4.00% 5.70%

International equity 21.00%

Developed markets 13.00% 5.90%

Emerging markets 8.00% 7.80%

Fixed income 25.50%

Core fixed income 17.00% 0.80%

Private debt 4.00% 4.10%

Distress debt 2.50% 4.70%

Emerging market debt 2.00% 2.70%

Real estate 8.00% 4.40%

Absolute return 5.00% 2.80%

MLP 7.00% 6.40%

Alternatives 12.50%

Private equity 7.00% 7.50%

Natural resources 5.50% 6.90%

Total 100.00%

Discount Rate - A single discount rate of 7.25% and 7.50% was used to measure the total pension liability

at December 31, 2020 and 2019, respectively. This single discount rate was based on the expected rate of

return on pension plan investments of 7.25% and 7.50%, respectively. The projection of cash flows used to

determine this single rate assumed that plan member contributions will be made at the current contribution

rate and that employer contributions will be made at rates equal to the difference between actuarially

determined contribution rates and the member rate. Based on these assumptions, the pension plan’s

fiduciary net position was projected to be available to make all projected future benefit payments of current

plan members. Therefore, the long-term expected rate of return on pension plan investments was applied

to all periods of projected benefit payments to determine the total pension liability.

Regarding the sensitivity of the net pension liability to changes in the single discount rate, the following

presents the plan’s net pension liability, calculated using a single discount rate of 7.25%, as well as what

the Plan’s net pension liability would be if it were calculated using a single discount rate that is 1-percentage

point lower or 1-percentage point higher ($ in thousands):

1 % decrease Current discount rate 1% increase

2021 6.25% 7.25% 8.25%

Proportionate share of net pension liability $ 239,814 $ 187,776 $ 144,116

Pension Plan Fiduciary Net Position: Detailed information about DERP's fiduciary net position is available in

DERP's separately issue of financial reports at https://www.derp.org/.

CITY & COUNTY OF DENVER | MUNICIPAL AIRPORT SYSTEM Page 90 of 142

ANNUAL COMPREHENSIVE FINANCIAL REPORT

FINANCIAL SECTION

December 31, 2021 and 2020

(18) Plan Postemployment Healthcare Benefits under GASB Statement No. 75

The Airport has two Other Postemployment Healthcare Benefit (OPEB) plans: Denver Employees

Retirement Plan (DERP) and DERP Implicit Rate Subsidy. The liability associated with these plans is

calculated annually, based on the measurement date, for the citywide financial statements and is allocated

to the Airport as of the end of the fiscal year as follows:

2021 2020

DERP OPEB plan net OPEB liability $ 11,725 $ 13,555

DERP implicit rate subsidy OPEB plan total OPEB liability 11,745 8,061

Total/Net OPEB liability $ 23,470 $ 21,616

(a) DERP OPEB Plan

Plan Description - The Denver Employees Retirement Plan (the Plan) administers a cost-sharing multiple-

employer defined benefit plan providing pension and postemployment health benefits to eligible members.

The Plan was established in 1963 by the City. During 1996, the Denver Health and Hospital Authority (DHHA)

was created and joined the Plan as a contractual entity. In 2001, the Plan became closed to new entrants

from DHHA. All risks and costs are shared by the City and DHHA. There is a single actuarial evaluation

performed annually that covers both the pension and postemployment health benefits. All assets of the

Plan are funds held in trust by the Plan for its members for the exclusive purpose of paying pension and

postemployment health benefits.

Sections 18-401 through 18-430.7 of the City’s Revised Municipal Code should be referred to for complete

details of the Plan. DERP issues a publicly available annual comprehensive financial report that can be

obtained at https://www.derp.org/.

Benefits Provided - The Plan provides retirement, death, and disability benefits for its members and their

beneficiaries. Members who were hired before September 1, 2004 and retire at or after age 65 (or at age

55 if the sum of their age and credited service is at least 75) are entitled to an annual retirement benefit, in

an amount equal to 2.0% of their final average salary for each year of credited service, payable monthly for

life. Effective for employees hired on or after September 1, 2004, the formula multiplier was reduced to

1.5%. Final average salary is based on the member’s highest salary during consecutive 36-month period of

credited service. Members with five years of credited service may retire at or after age 55 and receive a

reduced retirement benefit.

For members who were hired on or after July 1, 2011, they must be age 60 and have combined credited

service of at least 85 in order to receive a normal retirement prior to age 65. Final average salary is based

on the member’s highest salary during a consecutive 60-month period of credited service. Five-year vesting

is required for all employees in order to qualify for a benefit, regardless of their age at the time of

termination of employment.

Annual cost-of-living adjustments are granted on an ad hoc basis. The estimated cost of benefit and

contribution provisions is determined annually by an independent actuary, recommended by the Plan’s

Board, and enacted into ordinance by the Denver City Council.

CITY & COUNTY OF DENVER | MUNICIPAL AIRPORT SYSTEM Page 91 of 142

ANNUAL COMPREHENSIVE FINANCIAL REPORT

FINANCIAL SECTION

December 31, 2021 and 2020

The health benefits account was established by City Ordinance in 1991 to provide, beginning January 1,

1992, post-employment health care benefits in the form of a premium reduction to retired members, their

spouses and dependents, spouses and dependents of decreased active and retired members, and members

of the Plan awaiting approval of retirement applications. During 2020, the monthly health insurance

premium reduction was $12.50 per year of service for retired participants not yet eligible for Medicare, and

$6.25 per year of service for retirees eligible for Medicare. The health insurance premium reduction can be

applied to the payment of medical, dental, and/or vision insurance premiums. The benefit recipient pays

any remaining portion of the premiums.

Contributions – During 2020 and 2019, the Airport was required to contribute at a rate of 1.28% and 1.34%

of annual covered payroll, respectively. The contribution requirements for the Airport are established

under the City’s Revised Municipal Code. For the year ended December 31, 2021 and 2020, contributions

to the DERP OPEB plan were $0.7 and $0.7 million, respectively.

OPEB Liabilities, OPEB Expense, and Deferred Outflows of Resources and Deferred Inflows of Resources

Related to OPEB - At December 31, 2021, the Airport reported a liability of $11.7 million for its

proportionate share of the net OPEB liability. The net OPEB liability for DERP was measured as of December

31, 2020, and the total OPEB liability used to calculate the net OPEB liability was determined by an actuarial

valuation as of January 1, 2020. Standard update procedures were used to roll-forward the total OPEB

liability to December 31, 2020. The Airport’s proportion of the net OPEB liability was based on contributions

to DERP for the calendar year 2020 relative to the total contributions of participating employers to the

DERP.

At December 31, 2020, the Airport reported a liability of $13.6 million for its proportionate share of the net

OPEB liability. The net OPEB liability for DERP was measured as of December 31, 2019, and the total OPEB

liability used to calculate the net OPEB liability was determined by an actuarial valuation as of January 1,

2019. Standard update procedures were used to roll-forward the total OPEB liability to December 31, 2019.

The Airport’s proportion of the net OPEB liability was based on contributions to DERP for the calendar year

2019 relative to the total contributions of participating employers to the DERP.

At December 31, 2020, the Airport’s proportion was 12.080280% percent for OPEB, which was a decrease

of 1.702040% from its proportion measured as of December 31, 2019. At December 31, 2019, the Airport’s

proportion was 13.782320% percent for OPEB, which was an increase of 0.784580% from its proportion

measured as of December 31, 2018.

The components of the Airport’s proportionate share of the net OPEB liability related to DERP as of

December 31, 2021 and 2020 are presented below ($ in thousands):

OPEB plan 2021 2020

Total OPEB liability $ 20,786 $ 23,436

Plan fiduciary net position (9,061) (9,881)

Net OPEB liability $ 11,725 $ 13,555

For the year ended December 31, 2021 and 2020, the Airport recognized OPEB expense for the DERP plan

of ($0.2) million and $0.5 million, respectively.

CITY & COUNTY OF DENVER | MUNICIPAL AIRPORT SYSTEM Page 92 of 142

You might also like

- Budget Rigidity in Latin America and the Caribbean: Causes, Consequences, and Policy ImplicationsFrom EverandBudget Rigidity in Latin America and the Caribbean: Causes, Consequences, and Policy ImplicationsNo ratings yet

- Wings of Hope Equitherapy 7-31-2021 Audited Financial StatementsDocument16 pagesWings of Hope Equitherapy 7-31-2021 Audited Financial StatementsWings of Hope EquitherapyNo ratings yet

- CAPS 2020 Audited Financial Statements ReportDocument16 pagesCAPS 2020 Audited Financial Statements ReportScooter SchaeferNo ratings yet

- UCP Annual Report 2020Document25 pagesUCP Annual Report 2020ahmad princeNo ratings yet

- Den FY2021 Financial Report-20Document6 pagesDen FY2021 Financial Report-20PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-12Document6 pagesDen FY2021 Financial Report-12PAVANKUMAR S BNo ratings yet

- Otc Fcob 2019Document44 pagesOtc Fcob 2019gaja babaNo ratings yet

- Den FY2021 Financial Report-13Document6 pagesDen FY2021 Financial Report-13PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-18Document6 pagesDen FY2021 Financial Report-18PAVANKUMAR S BNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Learnie Inc Annual Financial Statements Review Report - FinalDocument13 pagesLearnie Inc Annual Financial Statements Review Report - FinalThuy Duong HoangNo ratings yet

- Informasi Keuangan Tambahan/Supplementary Financial InformationDocument8 pagesInformasi Keuangan Tambahan/Supplementary Financial Informationyeyen bbNo ratings yet

- 63fe51726e19ff9dd6043006 - AFJ FS21 - FINALDocument21 pages63fe51726e19ff9dd6043006 - AFJ FS21 - FINAL220shanadrNo ratings yet

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikNo ratings yet

- BFINDocument105 pagesBFINMuh AdnanNo ratings yet

- BPI Condensed FS 3Q 2022Document32 pagesBPI Condensed FS 3Q 2022canlasjazminenicholeNo ratings yet

- PNM - LK 2021-12 Audited CompressedDocument274 pagesPNM - LK 2021-12 Audited Compressedalma rosmaliaNo ratings yet

- Aldo LKDocument88 pagesAldo LKdwi amaliaNo ratings yet

- Practice Solution 1Document8 pagesPractice Solution 1Luigi NocitaNo ratings yet

- Den FY2021 Financial Report-11Document6 pagesDen FY2021 Financial Report-11PAVANKUMAR S BNo ratings yet

- Save The Children Federation, Inc. and Related EntitiesDocument30 pagesSave The Children Federation, Inc. and Related EntitiesEmerson BiggensNo ratings yet

- Mitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020Document17 pagesMitchell Regional Habitat For Humanity-Mitchell Habitat Audit Report 06-30-2020api-308302326No ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- PT Putra Mandiri Jembar TBK Dan Entitas Anak/and Its SubsidiariesDocument97 pagesPT Putra Mandiri Jembar TBK Dan Entitas Anak/and Its SubsidiariesAbieZen TorettoNo ratings yet

- Consolidated Financial Highlights: - Amortized Cost: Investment SecuritiesDocument2 pagesConsolidated Financial Highlights: - Amortized Cost: Investment SecuritiesRimsha SiafNo ratings yet

- Den FY2021 Financial Report-21Document6 pagesDen FY2021 Financial Report-21PAVANKUMAR S BNo ratings yet

- PT Bank Syariah Indonesia TBK 31 Dec 22Document160 pagesPT Bank Syariah Indonesia TBK 31 Dec 22wawanNo ratings yet

- FY 2022 April 20 2022 Comptroller LetterDocument18 pagesFY 2022 April 20 2022 Comptroller LetterHelen BennettNo ratings yet

- UntitledDocument113 pagesUntitledHammad Muqtadirul ImadNo ratings yet

- Tbig LK TW Iv 2020Document150 pagesTbig LK TW Iv 2020Daniel R GoldmanNo ratings yet

- Monthly Budget Review - February 2024, Congressional Budget OfficeDocument7 pagesMonthly Budget Review - February 2024, Congressional Budget OfficeDaily Caller News FoundationNo ratings yet

- BBLDDocument110 pagesBBLD2211070141 AISYAH NUR ISNAENINo ratings yet

- Grameenphone Audited Financial Statements 2022Document60 pagesGrameenphone Audited Financial Statements 2022S.R. EMONNo ratings yet

- Tugas Accounting - Putra Ash S - 29121094Document5 pagesTugas Accounting - Putra Ash S - 29121094putraNo ratings yet

- D&A: 28082020 NIH Grant NoticeDocument386 pagesD&A: 28082020 NIH Grant NoticeD&A Investigations, Inc.No ratings yet

- Hope Education Foundation International 2008 WPDDocument12 pagesHope Education Foundation International 2008 WPDHopeEducationNo ratings yet

- Chapter 19Document41 pagesChapter 19Tati AnaNo ratings yet

- Tugas Accounting - Putra Ash S - 29121094Document5 pagesTugas Accounting - Putra Ash S - 29121094putraNo ratings yet

- Reconciliation q4 Fy23Document5 pagesReconciliation q4 Fy23Shady FathyNo ratings yet

- Chapter 19 in Class ExercisesDocument14 pagesChapter 19 in Class ExercisesByul ProductionsNo ratings yet

- 105 PrelimDocument10 pages105 PrelimEly DoNo ratings yet

- This Study Resource Was: Airlines International Balance SheetDocument6 pagesThis Study Resource Was: Airlines International Balance SheetAlina ZubairNo ratings yet

- Metro October Staff ReportDocument39 pagesMetro October Staff ReportThe UrbanistNo ratings yet

- Strategic Data Management Pty Limited Financial Statements (Unaudited) For The Year Ended 31 March 2022Document7 pagesStrategic Data Management Pty Limited Financial Statements (Unaudited) For The Year Ended 31 March 2022Rupesh raiNo ratings yet

- Zenith Bank 2020Document2 pagesZenith Bank 2020Fuaad DodooNo ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Analyzing, Interpreting, and Capitalizing Operating Lease: $ in Millions Mar. 2019 Dec. 2018Document3 pagesAnalyzing, Interpreting, and Capitalizing Operating Lease: $ in Millions Mar. 2019 Dec. 2018zuhaib zulfiqarNo ratings yet

- Den FY2021 Financial Report-10Document6 pagesDen FY2021 Financial Report-10PAVANKUMAR S BNo ratings yet

- Charging All Costs To Expense When IncurredDocument27 pagesCharging All Costs To Expense When IncurredAnonymous N9dx4ATEghNo ratings yet

- Sample 10KDocument29 pagesSample 10KabhishekNo ratings yet

- Chapter 19 SolutionsDocument34 pagesChapter 19 SolutionsRachel Rajanayagam100% (1)

- REPORT BPT 2022 - Release With SPD OpiniDocument110 pagesREPORT BPT 2022 - Release With SPD OpinilokestriyuNo ratings yet

- 2021Q3 Alphabet Earnings ReleaseDocument10 pages2021Q3 Alphabet Earnings ReleasegigokiNo ratings yet

- SBR Practice Questions 2019 - ADocument305 pagesSBR Practice Questions 2019 - AALEX TRANNo ratings yet

- 2021 Summarised Financial Statement 1 Pager Final SignedDocument1 page2021 Summarised Financial Statement 1 Pager Final SignedFuaad DodooNo ratings yet

- Orange County TDT Collections July 2023Document4 pagesOrange County TDT Collections July 2023Deanna GugelNo ratings yet

- Laporan Keuangan Audited 31 Desember 2020Document69 pagesLaporan Keuangan Audited 31 Desember 2020Tiara Alley NissaLcNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 10Document12 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 10Hung LeNo ratings yet

- Laporan Keuangan PT BTEL 31 Des 2021Document141 pagesLaporan Keuangan PT BTEL 31 Des 2021Muhammad Mahdi HakimNo ratings yet

- Hope Education Foundation International.2009 - RevisedwpdDocument17 pagesHope Education Foundation International.2009 - RevisedwpdHopeEducationNo ratings yet

- Den FY2021 Financial Report-13Document6 pagesDen FY2021 Financial Report-13PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-15Document6 pagesDen FY2021 Financial Report-15PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-11Document6 pagesDen FY2021 Financial Report-11PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-8Document6 pagesDen FY2021 Financial Report-8PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-21Document6 pagesDen FY2021 Financial Report-21PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-19Document6 pagesDen FY2021 Financial Report-19PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-24Document6 pagesDen FY2021 Financial Report-24PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-22Document6 pagesDen FY2021 Financial Report-22PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-3Document6 pagesDen FY2021 Financial Report-3PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-23Document6 pagesDen FY2021 Financial Report-23PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-14Document6 pagesDen FY2021 Financial Report-14PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-18Document6 pagesDen FY2021 Financial Report-18PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-10Document6 pagesDen FY2021 Financial Report-10PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-5Document6 pagesDen FY2021 Financial Report-5PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-4Document6 pagesDen FY2021 Financial Report-4PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-25Document2 pagesDen FY2021 Financial Report-25PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-6Document6 pagesDen FY2021 Financial Report-6PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-7Document6 pagesDen FY2021 Financial Report-7PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-1Document6 pagesDen FY2021 Financial Report-1PAVANKUMAR S BNo ratings yet

- Den FY2021 Financial Report-2Document6 pagesDen FY2021 Financial Report-2PAVANKUMAR S BNo ratings yet

- Allowable DeductionsDocument4 pagesAllowable DeductionsdailydoseoflawNo ratings yet

- TX-UK and ATX-UK - FA 2020 Exam Docs June 21 To March 22 - FinalDocument7 pagesTX-UK and ATX-UK - FA 2020 Exam Docs June 21 To March 22 - FinalRidwan AhmedNo ratings yet

- 02 G.R. No. 209468 UDMC Vs Bernadas DigestDocument2 pages02 G.R. No. 209468 UDMC Vs Bernadas DigestRonnie Garcia Del Rosario100% (1)

- Stephen Softech Limited: Memorandum of AssociationDocument9 pagesStephen Softech Limited: Memorandum of AssociationChandanJangidNo ratings yet

- Paystub 202102Document1 pagePaystub 202102dsnreddyNo ratings yet

- TSPI Corporation vs. TSPI Employees UnionDocument2 pagesTSPI Corporation vs. TSPI Employees UnionD. RamNo ratings yet

- Wel 7Document8 pagesWel 7NoobinderNo ratings yet

- Quarter 2 - Module 7 General MathematicsDocument6 pagesQuarter 2 - Module 7 General MathematicsKristine AlcordoNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- Compare Old Jeevan Anand Plan No 149 To New Jeevan Anand Plan No 815 - New LIC Plans in 2014 - LIC Plans & PoliciesDocument3 pagesCompare Old Jeevan Anand Plan No 149 To New Jeevan Anand Plan No 815 - New LIC Plans in 2014 - LIC Plans & Policiesu4rishiNo ratings yet

- Tax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CityDocument12 pagesTax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CityPallavi PalluNo ratings yet

- POI MaterialDocument11 pagesPOI MaterialMukesh ChoudharyNo ratings yet

- Member Withdrawal Claim FormDocument2 pagesMember Withdrawal Claim FormKapunza MbevyaNo ratings yet

- Aspen Application Information SheetDocument5 pagesAspen Application Information SheetextremeusNo ratings yet

- Nivetha Mba Final Yr ProjectDocument22 pagesNivetha Mba Final Yr ProjectNivethaNo ratings yet

- Impact of Compensation and Reward SystemDocument88 pagesImpact of Compensation and Reward SystemDhanshri KavatkarNo ratings yet

- CHAPTER 8 Compensation Income (Module)Document6 pagesCHAPTER 8 Compensation Income (Module)Shane Mark CabiasaNo ratings yet

- Accounting Assignment - 1Document9 pagesAccounting Assignment - 1Idah MutekeriNo ratings yet

- Equity Investments in Unlisted CompaniesDocument32 pagesEquity Investments in Unlisted CompaniesANo ratings yet

- F6zwe 2015 Dec ADocument8 pagesF6zwe 2015 Dec APhebieon MukwenhaNo ratings yet

- Retirement Claim Documentary RequirementsDocument6 pagesRetirement Claim Documentary RequirementsMahaplag Fire Station Northern LeyteNo ratings yet

- LBPF No. 2 - Budget Estimate 2020Document2 pagesLBPF No. 2 - Budget Estimate 2020Bplo CaloocanNo ratings yet

- IndiaFirst Life Smart Pay Plan - One PagerDocument2 pagesIndiaFirst Life Smart Pay Plan - One PagerN-1397-10 KANISHKA Y HARDASANINo ratings yet

- Harlan Foundation: Company BackgroundDocument4 pagesHarlan Foundation: Company BackgroundPrachiNo ratings yet

- Cmfas M 9: OduleDocument23 pagesCmfas M 9: Odulezihan.pohNo ratings yet

- Compensation Salary Slip AsgnDocument9 pagesCompensation Salary Slip AsgnShivani PanchalNo ratings yet

- Notification No. G.S.R. 332E Income Tax Dated 03.04.2018Document179 pagesNotification No. G.S.R. 332E Income Tax Dated 03.04.2018kshitijsaxenaNo ratings yet

- Quiz On Chapter 13B&CDocument23 pagesQuiz On Chapter 13B&Cdianne caballeroNo ratings yet

- Ubaf 1Document6 pagesUbaf 1ivecita27No ratings yet

- Ecr CHLN Rec Ngaur1372571000 3112201002052 1641646242516 2022010866042516799Document1 pageEcr CHLN Rec Ngaur1372571000 3112201002052 1641646242516 2022010866042516799Rashid KhanNo ratings yet