Professional Documents

Culture Documents

Year 2015

Uploaded by

fahadullahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Year 2015

Uploaded by

fahadullahCopyright:

Available Formats

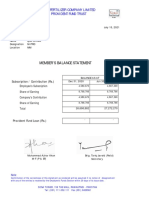

Certificate of Collection or Deduction of Income Tax (including salary)

(under rule 42)

S.No. Original Date of Issue 15.07.2015

Certified that the sum of Rupees 4,042 * (See note below) (amount of tax collected/deducted in figures)

FOUR THOUSAND FORTY-TWO ONLY

on account of income tax has been deducted/ Hamza Bin Ejaz

collected from (Name and Address of the C/O FFC Head Office Rawalpindi

person from whom tax collected/deducted) P.No. 3514

having National Tax Number

holder of CNIC No. 31304-3286897-1

on

Or during the period From 01.07.2014 To 30.06.2015

under section 149

On account of Salary Payment

vide Nil

on the value/amount of Rupee 480,831 *

This is to further certify that the tax collected/deducted has been deposited in the Federal Government Account as per the

following details:

Date of deposit SBP/NBP/Treasury Branch/City Amount(Rupees) Challan / Treasury No./CPR

No.

Various SBP Treasury Rawalpindi 4,042 * Various

Name FAUJI FERTILIZER COMPANY LIMITED

Address SONA TOWER, 156 THE MALL, RAWALPINDI

NTN (if any) 1435809-3

Date 15.07.2015

* After allowing admissible deductions, adjustments & tax credits, if any

based on copies of documentary evidences provided by the employee.

Pakarab Fertilizers Limited

Employee Full Name Hamza Bin Ejaz Organization PFL Machinery Maintenance

NTN/CNIC 31304-3286897-1 Location PFL Plantsite

Employee Number PFL-01563

Position Maintenance Engineer-Maintenance-PFL Employer Address KHANEWAL ROAD

Plantsite-PFL-None-None MULTAN,

PFL Monthly Payroll

PK

Bank Summit Bank Ltd

A/C Number 1-5-1-20311-714-160884

For the Month Dec-2015

Gross Earned Taxes Other Deductions Net Amount

46,724 0 3,441 43,283

Earnings Entitled

Description Amount Description Amount

Basic Pay 28,317 Basic Pay 30,304

Conveyance Allowance 2,832 Conveyance Allowance 3,030

House Rent Allowance 12,743 House Rent Allowance 13,637

Utilities Allowance 2,832 Utilities Allowance 3,030

LFA 0 Total 50,001

Deductions Absences

Description Amount Description Start Date End Date Absence

Total Tax Deduction 0 Days

PF Employee Cont. 2,360

EOBI Employee Cont. 80

Mess Recovery 513

Club Charges 488

Leave Balances Provident Fund Balances

Description Value Description Amount

Casual Leaves 1.0 Provident Fund Employee Contribution 2,360

Sick Leaves 1.0 Provident Fund Employer Contribution 2,360

Fiscal Year To Date (FYTD*) Balances

Description Amount

Basic Salary 28,317

House Rent Allowance 12,743

Utilities Allowance 2,832

Gross Salary 46,724

Total amount transferred to the salary account: 43,283

*FYTD Jul to Dec

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- PayslipDocument1 pagePayslipRijaa ArshadNo ratings yet

- MTHL PROJECT INSPECTION REPORTDocument1 pageMTHL PROJECT INSPECTION REPORTDeepak UpadhayayNo ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Rajasthan Rajya Vidyut Prasaran Nigam LTD.: Total Earnings NetpayDocument1 pageRajasthan Rajya Vidyut Prasaran Nigam LTD.: Total Earnings Netpayvinodk33506No ratings yet

- 1 2023 Calendar Month - 31-MAR-23 - 10112851-2 - 1.Document1 page1 2023 Calendar Month - 31-MAR-23 - 10112851-2 - 1.Caitlin HeaNo ratings yet

- Ed 9Document2 pagesEd 9Sanjay DuaNo ratings yet

- Jul 192017Document1 pageJul 192017Anonymous qqE8o5QNo ratings yet

- 4133104Document1 page4133104Ann BenjaminNo ratings yet

- Payslip March 2023Document3 pagesPayslip March 2023Indrasis gunNo ratings yet

- 1703918279_documents_0Document3 pages1703918279_documents_0rajindermechNo ratings yet

- Computation A.Y 2023 24 (Rahulbhai)Document3 pagesComputation A.Y 2023 24 (Rahulbhai)Rahul PambharNo ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- MAR 2024Document2 pagesMAR 2024Tuneer SahaNo ratings yet

- Bigbasket SsDocument1 pageBigbasket Ssudi969100% (3)

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- FORM47Document2 pagesFORM47net worldNo ratings yet

- STEAG Energy Services Pay Slip for August 2020Document1 pageSTEAG Energy Services Pay Slip for August 2020Tuhin ChakrabortyNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Salary Slip For The Month - Feb 2018: Earnings Amt. (INR) Deductions Amt. (INR)Document1 pageSalary Slip For The Month - Feb 2018: Earnings Amt. (INR) Deductions Amt. (INR)ROHIT RANJAN33% (3)

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- NTT DATA PayslipDocument1 pageNTT DATA PayslipROHIT RANJANNo ratings yet

- Sate-Lite Technologies Pvt. LTD.: Reimbursement As Per Company PolicyDocument1 pageSate-Lite Technologies Pvt. LTD.: Reimbursement As Per Company Policypsycho NehaNo ratings yet

- Bharti AXA Life Insurance Employee PayslipDocument1 pageBharti AXA Life Insurance Employee PayslipJoginderNo ratings yet

- Computation 22-23Document2 pagesComputation 22-23Raj DelhiNo ratings yet

- 2 PDFDocument1 page2 PDFsatyajit_manna_2No ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAshok KumarNo ratings yet

- Salary Sleep OctoberDocument1 pageSalary Sleep Octobermayank dubeyNo ratings yet

- Wipro Payslip for Oct 2019Document2 pagesWipro Payslip for Oct 2019Priyadharshini RavichandranNo ratings yet

- Payslip 4 2023Document1 pagePayslip 4 2023Vijaykrishna OrganicsNo ratings yet

- FormDocument2 pagesFormMukhtar AlamNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Salary Slip AprilDocument1 pageSalary Slip AprilDaya Shankar100% (2)

- MR. PAVANKUMAR BIPURI February 2021 payslipDocument2 pagesMR. PAVANKUMAR BIPURI February 2021 payslipBipuri PavankumarNo ratings yet

- Aug PDFDocument1 pageAug PDFDhirendraNo ratings yet

- Samasta Microfinance Limited: Earnings DeductionsDocument1 pageSamasta Microfinance Limited: Earnings DeductionsDhirendraNo ratings yet

- May 2019 Salary Payslip for Arpit KumarDocument1 pageMay 2019 Salary Payslip for Arpit KumarArPit GuptaNo ratings yet

- Pay SlipDocument1 pagePay SlipVishnu RaveendranNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Ay2023 24 Meharvan Mewada Eiapm7602g ComputationDocument2 pagesAy2023 24 Meharvan Mewada Eiapm7602g ComputationSteve BurnsNo ratings yet

- Employee Pay SlipDocument1 pageEmployee Pay SlipMalik of ChakwalNo ratings yet

- Toaz - Info Tata Consultancy Services Payslip PRDocument2 pagesToaz - Info Tata Consultancy Services Payslip PRRLP TECHNOLOGYNo ratings yet

- PayslipDocument1 pagePayslipKathy DagunoNo ratings yet

- Payslip details for Laxman Chandrakanth ChavanDocument2 pagesPayslip details for Laxman Chandrakanth Chavanlaxman lucky100% (2)

- Payslip 1Document1 pagePayslip 1Tamoghna DeyNo ratings yet

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Document1 pageVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeNo ratings yet

- Payslip For The Month of May, 2022: Annual Salary DetailsDocument1 pagePayslip For The Month of May, 2022: Annual Salary DetailsParveen SainiNo ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- Alorica - Ms. Trina - ReviseDocument1 pageAlorica - Ms. Trina - Revisebktsuna0201100% (1)

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAnkur murarkaNo ratings yet

- Punchh India Pvt. Ltd. Payslip for May 2022Document1 pagePunchh India Pvt. Ltd. Payslip for May 2022Parveen SainiNo ratings yet

- TCS employee payslip April 2014Document1 pageTCS employee payslip April 2014BalajiNo ratings yet

- Shatrohan ComputationDocument2 pagesShatrohan ComputationaveenNo ratings yet

- Salary Slip for March 2019Document1 pageSalary Slip for March 2019Shivpratap Singh RajawatNo ratings yet

- COMPUTATIONDocument3 pagesCOMPUTATIONIshita shahNo ratings yet

- Payslip SummaryDocument2 pagesPayslip SummaryVyas Keshini100% (1)

- Payslip For The Month of April, 2022: Annual Salary DetailsDocument1 pagePayslip For The Month of April, 2022: Annual Salary DetailsParveen SainiNo ratings yet

- FFC Limited Provident Fund StatementDocument1 pageFFC Limited Provident Fund StatementfahadullahNo ratings yet

- Donation Slip-Dar Us Shifa Trust Hospital Sadiqabad (Rs 950,000)Document3 pagesDonation Slip-Dar Us Shifa Trust Hospital Sadiqabad (Rs 950,000)fahadullahNo ratings yet

- Bank Accounts, Property, Investments, and Tax Details for 2020Document20 pagesBank Accounts, Property, Investments, and Tax Details for 2020fahadullahNo ratings yet

- Year 2020Document18 pagesYear 2020fahadullahNo ratings yet

- Pfcert 2021 460Document1 pagePfcert 2021 460fahadullahNo ratings yet

- IG-2 Risk Assesment GCF SiteDocument19 pagesIG-2 Risk Assesment GCF SitefahadullahNo ratings yet

- Year 2016Document15 pagesYear 2016fahadullahNo ratings yet

- Dividend Zakat & Tax Deduction ReportsDocument4 pagesDividend Zakat & Tax Deduction ReportsfahadullahNo ratings yet

- Morning Shift 10-09-2022Document2 pagesMorning Shift 10-09-2022fahadullahNo ratings yet

- Year 2017Document19 pagesYear 2017fahadullahNo ratings yet

- Night Shift 10-09-2022Document2 pagesNight Shift 10-09-2022fahadullahNo ratings yet

- Bill StatementDocument98 pagesBill StatementfahadullahNo ratings yet

- Evening Shift 10-09-2022Document2 pagesEvening Shift 10-09-2022fahadullahNo ratings yet

- MPCL Utility EngineerDocument2 pagesMPCL Utility EngineerfahadullahNo ratings yet

- Budget in Brief 2020 21 English PDFDocument47 pagesBudget in Brief 2020 21 English PDFWaqar Ali SandhuNo ratings yet

- Morning Shift 01-09-2022Document2 pagesMorning Shift 01-09-2022fahadullahNo ratings yet

- Evening Shift 01-09-2022Document2 pagesEvening Shift 01-09-2022fahadullahNo ratings yet

- FFCMM Township Internet Bandwidth PackagesDocument1 pageFFCMM Township Internet Bandwidth PackagesfahadullahNo ratings yet

- FFC-MM Plant Shutdown Due to Secondary Reformer RuptureDocument11 pagesFFC-MM Plant Shutdown Due to Secondary Reformer RupturefahadullahNo ratings yet

- WP-015!05!174 HSE Auditing Performance Monitoring 4Document4 pagesWP-015!05!174 HSE Auditing Performance Monitoring 4fahadullahNo ratings yet

- Ammonia Release Mock Exercise Summary Sept 23, 2021Document11 pagesAmmonia Release Mock Exercise Summary Sept 23, 2021fahadullahNo ratings yet

- Chemicals StatusDocument1 pageChemicals StatusfahadullahNo ratings yet

- Housekeeping Inspection Responsibilities WTCR July-Aug 2022Document1 pageHousekeeping Inspection Responsibilities WTCR July-Aug 2022fahadullahNo ratings yet

- Night Shift 01-09-2022Document2 pagesNight Shift 01-09-2022fahadullahNo ratings yet

- Safety Audit Report 02 - 08-09-2022Document14 pagesSafety Audit Report 02 - 08-09-2022fahadullahNo ratings yet

- Night Shift 11-09-2022Document2 pagesNight Shift 11-09-2022fahadullahNo ratings yet

- Travel Request: General DataDocument1 pageTravel Request: General DatafahadullahNo ratings yet

- Ortho Phosphate TrendDocument2 pagesOrtho Phosphate TrendfahadullahNo ratings yet

- DuPont Methodology For Risk Assessment and Process Hazard AnalysisDocument65 pagesDuPont Methodology For Risk Assessment and Process Hazard Analysisfahadullah100% (1)

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Mock Exam A Morning SessionDocument23 pagesMock Exam A Morning Sessionkristaaal1237No ratings yet

- Motorola Inc. (2005) 095ITD00269 (DELHI) (SB)Document110 pagesMotorola Inc. (2005) 095ITD00269 (DELHI) (SB)Sanskar MaheshwariNo ratings yet

- Valuation - ScriptDocument2 pagesValuation - ScriptBhaveek OstwalNo ratings yet

- Cost Accounting Project - CSDDocument31 pagesCost Accounting Project - CSDMuhammad TalhaNo ratings yet

- Financial Snapshot: Goal Coverage Your Advisor Net Worth $8,020,000Document1 pageFinancial Snapshot: Goal Coverage Your Advisor Net Worth $8,020,000Arun KumarNo ratings yet

- Adjusting Entries for Accounting ClassDocument5 pagesAdjusting Entries for Accounting ClassChristine Mae BurgosNo ratings yet

- Europa Publications Financial AnalysisDocument4 pagesEuropa Publications Financial Analysisbella100% (1)

- SBI Scholar Loan Checklist PDFDocument1 pageSBI Scholar Loan Checklist PDFkshitiz singhNo ratings yet

- Special Journals - Quiz 36Document8 pagesSpecial Journals - Quiz 36Joana TrinidadNo ratings yet

- Municipality of Guipos: Republic of The Philippines Province of Zamboanga de SurDocument21 pagesMunicipality of Guipos: Republic of The Philippines Province of Zamboanga de SurMelvinson Loui Polenzo SarcaugaNo ratings yet

- 02 AddDocument14 pages02 AddHà My NguyễnNo ratings yet

- Swot Analysis: Square Square Square Square Square Square SquareDocument3 pagesSwot Analysis: Square Square Square Square Square Square SquareNahid ChadNo ratings yet

- Unit II Principles of AuditingDocument23 pagesUnit II Principles of AuditingSarath KumarNo ratings yet

- A Project Report On Detergent Powder Manufacturing CompanyDocument17 pagesA Project Report On Detergent Powder Manufacturing Companyhaq75% (4)

- 2002 100K Portfolio Report Cashing in On Coming TechDocument30 pages2002 100K Portfolio Report Cashing in On Coming TechMayNo ratings yet

- Accounts Theory Question Answer by SUBASH NEPALDocument31 pagesAccounts Theory Question Answer by SUBASH NEPALanish.ranabhat31No ratings yet

- Fundamentals of Partnership: Dhiman ClaimsDocument7 pagesFundamentals of Partnership: Dhiman ClaimsAyareena GiriNo ratings yet

- UOADEV - Annual Report 2019Document154 pagesUOADEV - Annual Report 2019Berkat MasNo ratings yet

- Unit 1 - Introduction To Cost AccountingDocument13 pagesUnit 1 - Introduction To Cost AccountingVaidehi sonawaniNo ratings yet

- Case Questions - Grocery GatewayDocument4 pagesCase Questions - Grocery GatewayPankaj SharmaNo ratings yet

- (Tax-Ho) Ease of Paying Taxes ActDocument8 pages(Tax-Ho) Ease of Paying Taxes ActJoshua Neil AdrinedaNo ratings yet

- CH 01Document56 pagesCH 01lalala010899No ratings yet

- Valuation Concepts Module 10 PDFDocument6 pagesValuation Concepts Module 10 PDFJisselle Marie CustodioNo ratings yet

- FIN924 Workshop Topic 1Document37 pagesFIN924 Workshop Topic 1Yugiii YugeshNo ratings yet

- This Spreadsheet Supports Analysis of The Case, "Coleco Industries Inc." (Case 60)Document6 pagesThis Spreadsheet Supports Analysis of The Case, "Coleco Industries Inc." (Case 60)kashanr82No ratings yet

- Cost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Document3 pagesCost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Jerel Aaron FojasNo ratings yet

- BAAC4206 CH 4 Employement IncomeDocument43 pagesBAAC4206 CH 4 Employement IncomeWijdan Saleem EdwanNo ratings yet

- Equity Valuation Models MCQ ChapterDocument45 pagesEquity Valuation Models MCQ ChapterAstrid TanNo ratings yet

- 0452 s18 QP 21 PDFDocument20 pages0452 s18 QP 21 PDFIG UnionNo ratings yet