Professional Documents

Culture Documents

M8A Preparation of Worksheet EXERCISE 2

Uploaded by

Shean VasilićOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M8A Preparation of Worksheet EXERCISE 2

Uploaded by

Shean VasilićCopyright:

Available Formats

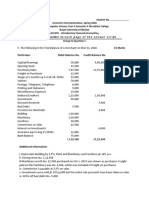

EXERCISE 2

(Source: Principles of Accounting 2nd Edition by Weygant, Chalmers, et al)

The Mercury Motel opened for business on May 1, 2022. Its trial balance before adjustment on May 31,

2022.

MERCURY MOTEL

Trial Balance

As at May 31, 2022

Debit Credit

Cash 25,000

Supplies 19,000

Prepaid Insurance 24,000

Land 150,000

Buildings 700,000

Furniture 168,000

Accounts Payable 53,000

Unearned Rent Income 36,000

Mortgage Payable 350,000

Sue Philips, Capital 600,000

Rent Revenue 92,000

Advertising Expense 5,000

Salaries Expense 30,000

Utilities Expense 10,000

1,131,000 1,131,000

In addition to those accounts listed on the trial balance, the chart of accounts for Mercury Motel also

contains the following: Allowance for Doubtful Accounts, Accumulated Depreciation - Building;

Accumulated Depreciation - Furniture, Salaries Payable; Interest Payable; Depreciation Expense -

Buildings; Depreciation Expense - Furniture; Doubtful Accounts Expense; Supplies Expense; Interest

Expense; Insurance Expense.

Othe data:

1) Insurance expires at the rate of P 2,000 oer month.

2) A count of supplies show P 9,000 of unsued supplies on May 31.

3) Annual depreciation is P 24,000 on the buildings and P 30,000 on Furniture.

4) The mortgage interest rate is 12%. The mortgage was taken out on May 1.

5) Unearned rent revenue of P 25,000 has been earned.

6) Salaries of P 8,000 are accrued and unpaid as at May 31.

Instructions:

1) Prepare the necessary adjusting journal entries for the month of May.

2) Prepare 10-column working paper to prepare financial statements for the month ended May 31,

2022.

You might also like

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Illustration 1:: Particulars Dr. Cr.Document2 pagesIllustration 1:: Particulars Dr. Cr.akashNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- MC 4 - Deferred Tax - A231Document4 pagesMC 4 - Deferred Tax - A231Patricia TangNo ratings yet

- Adjustments To Financial Statements Tutorial No: 13Document6 pagesAdjustments To Financial Statements Tutorial No: 13me myselfNo ratings yet

- Feu Fundact 2 Reviewer 2Document40 pagesFeu Fundact 2 Reviewer 2anneNo ratings yet

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulNo ratings yet

- Accounts QuestionDocument8 pagesAccounts QuestionMaitri SaraswatNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Accountancy & Auditing Paper - 1-2015Document3 pagesAccountancy & Auditing Paper - 1-2015Qasim IbrarNo ratings yet

- 2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Document5 pages2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Shoaib AhmedNo ratings yet

- Additional Illustrations-20Document16 pagesAdditional Illustrations-20Gulneer LambaNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- CARAGA Finals-FABM1 SHSABM11-6Document22 pagesCARAGA Finals-FABM1 SHSABM11-6eshanecaragaNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- Part One: True /false Items: Write "True" If The Statement Is Correct & Write "False" If TheDocument3 pagesPart One: True /false Items: Write "True" If The Statement Is Correct & Write "False" If TheAbatneh MengistNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Bac MQ2 1Document3 pagesBac MQ2 1JESSON VILLANo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- Xi Accounting Set 4Document8 pagesXi Accounting Set 4aashirwad2076No ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- Exercise 2ADocument3 pagesExercise 2A31231020764No ratings yet

- CPA Paper 1 Financial Accounting 2Document9 pagesCPA Paper 1 Financial Accounting 2philipisingomaNo ratings yet

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessDocument4 pagesExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- Insurance Company AccountDocument8 pagesInsurance Company AccountRidoy100% (1)

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Answer All Four QuestionsDocument8 pagesAnswer All Four QuestionsTawanda Tatenda HerbertNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- April 2022 (Fa4)Document7 pagesApril 2022 (Fa4)Amelia RahmawatiNo ratings yet

- Additional Questions 02Document7 pagesAdditional Questions 02SharomyNo ratings yet

- Writeyour Studentnumber On Each Page of The Answer ScriptDocument2 pagesWriteyour Studentnumber On Each Page of The Answer ScriptKezang WangchukNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- BAICC2X-Solution Supplementary - Week 1docxDocument7 pagesBAICC2X-Solution Supplementary - Week 1docxMitchie FaustinoNo ratings yet

- Activity in FABM 2Document2 pagesActivity in FABM 2CHERIE MAY ANGEL QUITORIANONo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Practice Qns - Final AccountsDocument13 pagesPractice Qns - Final Accountscaphoenix mvpaNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Assignment FarDocument5 pagesAssignment FarALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- QuestionPaperDec 2010Document50 pagesQuestionPaperDec 2010Md.Reza HussainNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- Af 314 Corporate Accounting FLEXI-SCHOOL: 2022 Individual AssignmentDocument6 pagesAf 314 Corporate Accounting FLEXI-SCHOOL: 2022 Individual AssignmentShiv AchariNo ratings yet

- 9-2-2022 PT2 Accountancy Class XiDocument2 pages9-2-2022 PT2 Accountancy Class XiNINJA STUDIESNo ratings yet

- Bbfa Assigment Question 2 2023Document2 pagesBbfa Assigment Question 2 2023Bdq ArrogantNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- Sample Trial BalanceDocument2 pagesSample Trial BalanceNikka VelascoNo ratings yet

- Activity 4 CLDocument2 pagesActivity 4 CLfrancesdimplesabio06No ratings yet

- Basic Principles of Accounting: National Law University Odisha, CuttackDocument2 pagesBasic Principles of Accounting: National Law University Odisha, CuttackAnanya SonakiyaNo ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- Revision Sheet - 2023 - 2024Document27 pagesRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)

- M8C Closing The Accounting BooksDocument9 pagesM8C Closing The Accounting BooksShean VasilićNo ratings yet

- Malicdem, Shean - 2nd ActivityDocument2 pagesMalicdem, Shean - 2nd ActivityShean VasilićNo ratings yet

- Malicdem - Midterm ExamDocument2 pagesMalicdem - Midterm ExamShean VasilićNo ratings yet

- Payroll AccountingDocument26 pagesPayroll AccountingShean VasilićNo ratings yet

- Preparation of 10Document5 pagesPreparation of 10Shean VasilićNo ratings yet

- Accounting For Manufacturing BusinessDocument29 pagesAccounting For Manufacturing BusinessShean VasilićNo ratings yet