Professional Documents

Culture Documents

Bac MQ2 1

Uploaded by

JESSON VILLAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bac MQ2 1

Uploaded by

JESSON VILLACopyright:

Available Formats

Quizz 1

Test 1. Prepare the adjusting entries required by the following information made available to you on

December 31, 2019, the end of the reporting period:

a. On December 31, two notes are on-hand:

● 1,500.00 for 60 days dated December 16, 2019 at 14% was received from a customer. (use 360

days)

● 1,800.00, 90 days, issued to BPI on December 1, 2019 at 1% monthly interest.

b. The Unexpired insurance account balance of 23,000.00 represents premium paid on a two-year

insurance policy taken on December 1, 2018. The expired portion for the year 2018 has been adjusted.

c. The business has Accounts Receivable of 14,500 as at the end of 2019. It is estimated that only 90% of

this is collectible. Allowance for Doubtful Accounts has an unadjusted balance of 750.00.

d. A six-month advertising contract was entered into by the business which required an advance

payment of 2,400.00 on November 2, 2019 and was debited to Advertising Expense.

e. Rent Income was credited for 18,000.00 representing three months rent received from a lessee on

October 15, 2019.

f. Office equipment costing 75,000.00 was purchased on October 1, 2019 and estimated to have useful

life of five years after which it could be sold for 5,000.00.

g. Supplies Expense has a balance of 9,500.00 representing supplies purchased during the year of which

only 4,500.00 has been taken out from the stockroom.

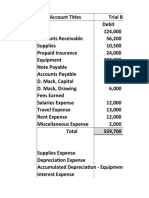

Test II. The trial balance of Ty’s business which started only on November 1, 2019 has the following

information:

1. Computer system has a useful life of 5 years after which scrap value will be 5,000.00.

2. The office equipment has a useful life of 5 years. Scrap value will be 20,000.00.

3. Supplies unused amounted to 500.00

4. Revenue includes 7,500.00 already collected but not due for consultancy until 2020.

5. December utility bills for 5,000.00 were received only on January 2020.

6. Salaries for 15th and 30th of employees are only paid 5 days after the said dates. Total monthly

salaries amounted to 45,000.00.

Business Solution Company

Trial Balance

December 31, 2019

Cash on hand 9,730.00

Cash in bank 40,000.00

Accounts Receivable 6,000.00

Computer Supplies 1,420.00

Computer System 20,000.00

Office Equipment 80,000.00

Ty, Capital 100,000.00

5% 30 day note issued December 15 (use 360 days) 45,000.00

Ty, Drawings 3,000.00

Computer Fees Revenue 33,400.00

Advertising 1,500.00

Repairs 1,750.00

Salaries 15,000.00 _________

Totals 178,400.00 178,400.00

Prepare the worksheet for the statement of Financial Position and Performance.

Quiz No. 2

Test 1. Sleepy Hallow is an inn located at Bagong Buhay Cavite and is owned by Mr. Sawyer. It opened

on May 1, 2019 and uses the fiscal accounting period ending June 30. The unadjusted trial balance

(thousands omitted) below is as of June 30, 2020.

Account Account Title Debits Credits

No.

101 Cash on Hand 5,000.00

102 Cash in Bank 20,000.00

103 Prepaid Insurance 24,000.00

104 Linen Supplies 19,000.00

201 Land 150,000.00

202 Lodge 700,000.00

203 Furniture 168,000.00

301 Accounts Payable 53,000.00

302 Unearned Rent 46,000.00

303 Mortgage Payable 350,000.00

401 Sawyer, Capital 600,000.00

402 Sawyer, Personal 10,000.00

501 Rent Revenue 92,000.00

601 Advertising Expense 5,000.00

602 Salaries Expense 30,000.00

603 Utilities Expense 10,000.00

Total 1,141,000.00 1,141,000.00

Additional Information:

● Insurance expires 2,000.00 per month. Insurance was acquired on July 2019.

● 9,000.00 of the linen supplies remain on hand.

● Annual depreciation is 10% for the lodge and 5% for the furniture.

● The mortgage was taken on August 1, 2019 and is at a rate of 8%.

● 25,000.00 of the unearned rent has been earned.

● Salaries of 8,000.00 have accrued and are unpaid.

Instructions: Prepare the Worksheet of the above information. After which, prepare the necessary

closing entries, Post-Closing Trial Balance, and Reversing Entries.

You might also like

- Parisian Store Is Engaged in Selling Furniture On Credit Term of 2Document3 pagesParisian Store Is Engaged in Selling Furniture On Credit Term of 2Now OnwooNo ratings yet

- Ipil Grocery T AccountsDocument5 pagesIpil Grocery T AccountsJelaina Alimansa100% (1)

- Sue Feria Travel AgencyDocument5 pagesSue Feria Travel AgencyMa Sophia Mikaela Erece100% (1)

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Basic Acco VariousDocument26 pagesBasic Acco VariousJasmine Acta100% (1)

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Page 327 To 328Document3 pagesPage 327 To 328Elirose O. BaladjayNo ratings yet

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- Partnership Dissolution Withdrawal Retirement Death and IncapacityDocument25 pagesPartnership Dissolution Withdrawal Retirement Death and IncapacityGale KnowsNo ratings yet

- Exercise #11 (Sue Feria) DehnieceMangawangDocument3 pagesExercise #11 (Sue Feria) DehnieceMangawangPhaelyn YambaoNo ratings yet

- Merchandising Accounting (Erlinda See Chua)Document1 pageMerchandising Accounting (Erlinda See Chua)Shaira Nicole VasquezNo ratings yet

- Solution To Selected Exercises Partnership Formation of ManuelDocument5 pagesSolution To Selected Exercises Partnership Formation of ManuelShayne Pagwagan100% (1)

- Assignment Adjusting EntriesDocument2 pagesAssignment Adjusting EntriesKim Patrick VictoriaNo ratings yet

- Chapter 8Document27 pagesChapter 8Francesz VirayNo ratings yet

- Set 7Document11 pagesSet 7Gil Diane AlcontinNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Assignment 15 Partnership Liquidation and CorporationDocument21 pagesAssignment 15 Partnership Liquidation and CorporationSova ShockdartNo ratings yet

- Chapter 2 Far 2Document7 pagesChapter 2 Far 2Crestina100% (1)

- Assignment AccountingDocument6 pagesAssignment AccountingColine DueñasNo ratings yet

- Martinez, Althea E. Abm 12-1 (Accounting 2)Document13 pagesMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNo ratings yet

- 1) - E. Abad Signs A P30,000 Note For 9 Months. The Banker Discounts The Note at 5%. Find The Amount ofDocument2 pages1) - E. Abad Signs A P30,000 Note For 9 Months. The Banker Discounts The Note at 5%. Find The Amount ofchezyl cadinongNo ratings yet

- Santos ChaDocument18 pagesSantos ChaSANTOS, CHARISH ANNNo ratings yet

- CHAPTER 6 (Payroll)Document9 pagesCHAPTER 6 (Payroll)lc100% (1)

- ACCOUNTING 2 ReviewDocument4 pagesACCOUNTING 2 ReviewAhnJello100% (1)

- ParCor Chapter 3 - Hernandez - BSA 1-1 PDFDocument11 pagesParCor Chapter 3 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- Module 10 (Accounting)Document8 pagesModule 10 (Accounting)Jasmine ActaNo ratings yet

- Book 1Document4 pagesBook 1Sly BlueNo ratings yet

- ProblemDocument1 pageProblemGemmie Barsobia100% (2)

- Trial BalanceDocument1 pageTrial BalanceLaurice RacraquinNo ratings yet

- GROUP 6 Problem 3 7 To 3 9Document24 pagesGROUP 6 Problem 3 7 To 3 9Hans ManaliliNo ratings yet

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocument4 pagesExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfNo ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- Comprehensive ReceivablesDocument41 pagesComprehensive ReceivablesddalgisznNo ratings yet

- CFAS Sample ProblemsDocument5 pagesCFAS Sample ProblemsChristian MartinNo ratings yet

- Bhebu Lero TransactionDocument5 pagesBhebu Lero TransactionLeo Marbeda FeigenbaumNo ratings yet

- Accounting 1 ValeDocument13 pagesAccounting 1 ValeAhmadnur JulNo ratings yet

- Week 4 5 ULOc Lets Analyze Activities SolutionDocument3 pagesWeek 4 5 ULOc Lets Analyze Activities Solutionemem resuentoNo ratings yet

- Answer Problem 1Document9 pagesAnswer Problem 1MARY JUSTINE PAQUIBOTNo ratings yet

- PARCOR - 2Nature-and-Formation-of-a-PartnershipDocument30 pagesPARCOR - 2Nature-and-Formation-of-a-PartnershipHarriane Mae GonzalesNo ratings yet

- Problem 5-1 PDFDocument1 pageProblem 5-1 PDFJaira AsuncionNo ratings yet

- Estimated Value of Merchandise Destroyed by FloodDocument2 pagesEstimated Value of Merchandise Destroyed by FloodLoli WalkerNo ratings yet

- 5 2Document8 pages5 2Evelyn MorilloNo ratings yet

- Adjusting Entries and Reversing Entries: Arden Trading DECEMBER 31, 2015Document10 pagesAdjusting Entries and Reversing Entries: Arden Trading DECEMBER 31, 2015John Carlo LorenzoNo ratings yet

- Activity No. 3 - Principles of Accounting: AnswersDocument2 pagesActivity No. 3 - Principles of Accounting: AnswersLagasca Iris100% (1)

- Acct 2 Problem 3Document1 pageAcct 2 Problem 3Alfie boy100% (1)

- Accounting Problem 16Document1 pageAccounting Problem 16sabbyveraNo ratings yet

- P 2-1 (Cash and Net Assets Contributions)Document7 pagesP 2-1 (Cash and Net Assets Contributions)pjmerinNo ratings yet

- 24-Month Note Due To BDODocument3 pages24-Month Note Due To BDOEliza CruzNo ratings yet

- ACCBP100 - ULOcdefg Lets Check ActivityDocument2 pagesACCBP100 - ULOcdefg Lets Check ActivityWennonah Vallerie LabeNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Problem 11-4 (Vicente, Kate Iannel C.)Document1 pageProblem 11-4 (Vicente, Kate Iannel C.)Kate Iannel VicenteNo ratings yet

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Chapter 1 & 2Document13 pagesChapter 1 & 2Ali100% (1)

- Worksheet 1Document8 pagesWorksheet 1Kevin Espiritu100% (1)

- Assignment Module 5Document2 pagesAssignment Module 5Hazel Jane MejiaNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Chapter 3 (Cultures in Mindanao)Document34 pagesChapter 3 (Cultures in Mindanao)JESSON VILLANo ratings yet

- Darwin LetterDocument1 pageDarwin LetterJESSON VILLANo ratings yet

- Glenn HardDocument4 pagesGlenn HardJESSON VILLANo ratings yet

- Construction Tools and EquipmentDocument4 pagesConstruction Tools and EquipmentJESSON VILLANo ratings yet

- Villa, Jesson Bsa2a Finman Information SheetDocument4 pagesVilla, Jesson Bsa2a Finman Information SheetJESSON VILLANo ratings yet

- GlendaDocument2 pagesGlendaJESSON VILLANo ratings yet

- Terminologies Used in Volleyball GameDocument9 pagesTerminologies Used in Volleyball GameJESSON VILLANo ratings yet

- SynopsisDocument2 pagesSynopsisJESSON VILLANo ratings yet

- Introduction To Sport Management Syllabus (2018)Document5 pagesIntroduction To Sport Management Syllabus (2018)JESSON VILLANo ratings yet

- Case StudyDocument6 pagesCase StudyJESSON VILLA100% (1)

- Date Particulars Debit CreditDocument2 pagesDate Particulars Debit CreditJESSON VILLANo ratings yet

- AutobiographyDocument1 pageAutobiographyJESSON VILLANo ratings yet

- Who Am I?: by Jesson M. VillaDocument3 pagesWho Am I?: by Jesson M. VillaJESSON VILLANo ratings yet

- Jesson M. Villa Bs Accountancy 2ADocument1 pageJesson M. Villa Bs Accountancy 2AJESSON VILLANo ratings yet

- MSS SP 69pdfDocument18 pagesMSS SP 69pdfLaura CaballeroNo ratings yet

- Manual Bms8n2 e LowDocument58 pagesManual Bms8n2 e Lowzoranbt80_324037655No ratings yet

- C305 - QTO Workshop PDFDocument90 pagesC305 - QTO Workshop PDFJason SecretNo ratings yet

- PD750-01 Engine Data Sheet 12-29-20Document4 pagesPD750-01 Engine Data Sheet 12-29-20Service Brags & Hayes, Inc.No ratings yet

- CE Laws L8 L15Document470 pagesCE Laws L8 L15Edwin BernatNo ratings yet

- MELASMA (Ardy, Kintan, Fransisca)Document20 pagesMELASMA (Ardy, Kintan, Fransisca)Andi Firman MubarakNo ratings yet

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutNo ratings yet

- SOP For Operation & Calibration of PH Meter - QualityGuidancesDocument9 pagesSOP For Operation & Calibration of PH Meter - QualityGuidancesfawaz khalilNo ratings yet

- Hazop Close Out ReportDocument6 pagesHazop Close Out ReportKailash PandeyNo ratings yet

- Definition Nature and Scope of Urban GeographyDocument4 pagesDefinition Nature and Scope of Urban Geographysamim akhtarNo ratings yet

- Celestino vs. CIRDocument6 pagesCelestino vs. CIRchristopher d. balubayanNo ratings yet

- Proposed 4way D54 Proposed 2way D56: Issue Date DescriptionDocument3 pagesProposed 4way D54 Proposed 2way D56: Issue Date DescriptionADIL BASHIRNo ratings yet

- ENGLISH 4 (General & Specific Sentence, Main Idea & Key Sentence) )Document3 pagesENGLISH 4 (General & Specific Sentence, Main Idea & Key Sentence) )Analiza Dequinto BalagosaNo ratings yet

- Cross System Create Supplier ProcessDocument14 pagesCross System Create Supplier ProcesssakthiroboticNo ratings yet

- Electric Machinery and Transformers - I. L. Kosow PDFDocument413 pagesElectric Machinery and Transformers - I. L. Kosow PDFzcjswordNo ratings yet

- Braun MR30 Hand BlenderDocument2 pagesBraun MR30 Hand BlenderHana Bernard100% (1)

- Evolution of Strategic HRM As Seen Through Two Founding Books A 30TH Anniversary Perspective On Development of The FieldDocument20 pagesEvolution of Strategic HRM As Seen Through Two Founding Books A 30TH Anniversary Perspective On Development of The FieldJhon Alex ValenciaNo ratings yet

- Rotc Reviewer FinalsDocument11 pagesRotc Reviewer FinalsAngel Atienza100% (1)

- Check List For Design Program of A Parish ChurchDocument11 pagesCheck List For Design Program of A Parish ChurchQuinn HarloweNo ratings yet

- The Incidence of COVID-19 Along The ThaiCambodian Border Using Geographic Information System (GIS), Sa Kaeo Province, Thailand PDFDocument5 pagesThe Incidence of COVID-19 Along The ThaiCambodian Border Using Geographic Information System (GIS), Sa Kaeo Province, Thailand PDFInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Essential Study SkillsDocument86 pagesEssential Study SkillsFady NgunyuNo ratings yet

- Bubble SortDocument6 pagesBubble SortRollin RevieNo ratings yet

- Asme Bladder Accumulator DatasheetDocument3 pagesAsme Bladder Accumulator DatasheetSamad A BakarNo ratings yet

- Financial Analysis of Ashok LeylandDocument120 pagesFinancial Analysis of Ashok LeylandSiva Kumaravel0% (1)

- General Information Exhibition Guide Lines - 3P 2022Document6 pagesGeneral Information Exhibition Guide Lines - 3P 2022muhammad khanNo ratings yet

- 3rd Quarter SUMMATIVE TEST in MAPEHDocument3 pages3rd Quarter SUMMATIVE TEST in MAPEHzaile felineNo ratings yet

- Pesud Abadi Mahakam Company Profile Abdul Basith-DikonversiDocument48 pagesPesud Abadi Mahakam Company Profile Abdul Basith-DikonversiAndi HafizNo ratings yet

- Data Analyst Chapter 3Document20 pagesData Analyst Chapter 3Andi Annisa DianputriNo ratings yet

- Marketing Measurement Done RightDocument16 pagesMarketing Measurement Done RightWasim Ullah0% (1)

- File 1) GRE 2009 From - Nov - 18 PDFDocument84 pagesFile 1) GRE 2009 From - Nov - 18 PDFhuyly34No ratings yet