0% found this document useful (0 votes)

212 views10 pagesAccounting Adjustments Guide

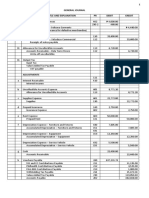

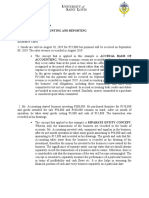

This document contains adjusting and reversing entries for Arden Trading for the year ending December 31, 2015. It includes entries for adjusting merchandise inventory, supplies expense, prepaid insurance, accrued salaries, interest receivable and payable, depreciation of buildings and equipment, and interest expense.

Uploaded by

John Carlo LorenzoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

212 views10 pagesAccounting Adjustments Guide

This document contains adjusting and reversing entries for Arden Trading for the year ending December 31, 2015. It includes entries for adjusting merchandise inventory, supplies expense, prepaid insurance, accrued salaries, interest receivable and payable, depreciation of buildings and equipment, and interest expense.

Uploaded by

John Carlo LorenzoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

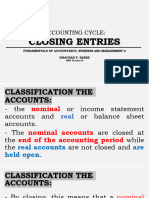

- Introduction

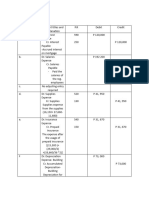

- Unsold Merchandise

- Store Supplies Unused

- Prepaid Insurance

- Salaries Accrued

- Notes Receivable

- Building Depreciation

- Store Equipment Depreciation

- Notes Payable

- Authors