Professional Documents

Culture Documents

Merchandising Handout - Perpetual Vs Periodic

Uploaded by

TineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merchandising Handout - Perpetual Vs Periodic

Uploaded by

TineCopyright:

Available Formats

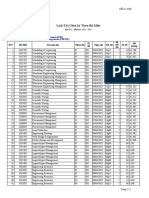

Financial Accounting and Reporting

Institute of Accounts Business and Finance

Merchandising Operations

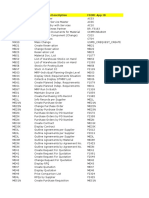

Periodic Inventory System Perpetual Inventory System

1 Sold merchandise on account costing P8,000 for P10,000; terms were 2/10, n/30

Accounts Receivable P10,000 Accounts Receivable 10,000

Sales P10,000 Sales 10,000

Cost of Sales 8,000

Merchandise Inventory 8,000

2 Customer returned merchandise costing P400 that had been sold on account which is part of the P10,000 sale

Sales Returns and Allowances 500 Sales Returns and Allowances 500

Accounts Receivable 500 Accounts Receivable 500

(P10,000*400/8,000)

Merchandise Inventory 400

Cost of Sales 400

3 Received payment from customer for the merchandise sold above. Cash Discount taken.

P10,000 sale minus P500 return x 2% discount = P190

Cash 9,310 Cash 9,310

Sales Discount 190 Sales Discount 190

Accounts Receivable 9,500 Accounts Receivable 9,500

4 Purchased on account merchandise for resale for P6,000; terms were 2/10 n/30.

Purchases 6,000 Merchandise Inventory 6,000

Accounts Payable 6,000 Accounts Payable 6,000

5 Paid P200 freight on the P6,000 purchase; terms were FOB shipping point, freight collect

Freight In 200 Merchandise Inventory 200

Cash 200 Cash 200

6 Returned merchandise costing P300 which is part of the P6,000 purchase

Accounts Payable 300 Accounts Payable 300

Purchase Returns and Allowances 300 Merchandise Inventory 300

7 Paid for merchandise purchased, cash discount taken

P6,000 minus P300 return x 2% discount = P114

Accounts Payable 5,700 Accounts Payable 5,700

Purchase Discounts 114 Merchandise Inventory 114

Cash 5,586 Cash 5,586

Marjorie Anne U. Baladad, CPA

You might also like

- MERCHANDISING BUSINESS (Periodic Vs Perpetual)Document3 pagesMERCHANDISING BUSINESS (Periodic Vs Perpetual)Laurence Karl CurboNo ratings yet

- Inventory Systems ComparisonDocument2 pagesInventory Systems ComparisonRan CañeteNo ratings yet

- Perpetual Inventory SystemDocument2 pagesPerpetual Inventory SystemBryan IsonNo ratings yet

- CHAPTER-7 Merchandising AnswerDocument24 pagesCHAPTER-7 Merchandising AnswersaphirejunelNo ratings yet

- Practice Quiz - Quiz 2: Answer: Debit Accounts Receivable 26,250 Debit Freight Out 1,250 Credit Sales 27,500Document5 pagesPractice Quiz - Quiz 2: Answer: Debit Accounts Receivable 26,250 Debit Freight Out 1,250 Credit Sales 27,500Kieht catcherNo ratings yet

- Inventories (Problems)Document6 pagesInventories (Problems)IAN PADAYOGDOGNo ratings yet

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- SRCBAI ABM1 Q3M10 Merchandising Concern Part1Document14 pagesSRCBAI ABM1 Q3M10 Merchandising Concern Part1Jaye RuantoNo ratings yet

- MerchandisingDocument13 pagesMerchandisingairanicolebrugada08No ratings yet

- Merchandising 105 Answer Key PeriodicDocument38 pagesMerchandising 105 Answer Key PeriodicPrincess Heart MacadatNo ratings yet

- Lesson 6 - FA1Document56 pagesLesson 6 - FA1angelo eleazarNo ratings yet

- Module 7 - Merchandising Business Special TransactionsDocument40 pagesModule 7 - Merchandising Business Special TransactionsMaria Nicole OroNo ratings yet

- Merchandise Operation ExerciseDocument4 pagesMerchandise Operation ExerciseRhea MendozaNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- AC Ace StoreDocument9 pagesAC Ace StoreNicole San JuanNo ratings yet

- Inventories (Financial Accounting)Document2 pagesInventories (Financial Accounting)Herlyn QuintoNo ratings yet

- AaDocument4 pagesAaJMerrill CaldaNo ratings yet

- Straight Problem Merchandising.Document2 pagesStraight Problem Merchandising.Kristine SandovalNo ratings yet

- Inv AudDocument32 pagesInv AudAud Balanzi100% (1)

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- Computerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENTDocument24 pagesComputerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENThello nasty100% (1)

- Accounts ReceivableDocument11 pagesAccounts ReceivableEun Hae100% (1)

- Sample Problems Inventories (Solutions) : Problem 1Document2 pagesSample Problems Inventories (Solutions) : Problem 1krizzmaaaayNo ratings yet

- Perpetual Transactions: Journal EntriesDocument71 pagesPerpetual Transactions: Journal EntriesRona Mae AnteroNo ratings yet

- Periodic and Perpetual Inventory System ComparedDocument2 pagesPeriodic and Perpetual Inventory System Comparedkim aeong100% (2)

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Assignment#1 ADRIANOCAÑADADocument4 pagesAssignment#1 ADRIANOCAÑADAADRIANO, Glecy C.78% (9)

- COPY1Document30 pagesCOPY1kimberlynroqueNo ratings yet

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- 2 Assignment Unit III Accounts ReceivableDocument2 pages2 Assignment Unit III Accounts ReceivableSilverly Batisla-ongNo ratings yet

- AC Kendra Raphia Dress ShopDocument13 pagesAC Kendra Raphia Dress ShopNicole San JuanNo ratings yet

- Date Transactions Perpetual Inventory System Periodic Inventory SystemDocument4 pagesDate Transactions Perpetual Inventory System Periodic Inventory SystemBetina Maxine MendozaNo ratings yet

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- Prelim 2nd MeetingDocument6 pagesPrelim 2nd MeetingChristopher CristobalNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Summary of Videos - MerchandisingDocument7 pagesSummary of Videos - MerchandisingbanscharielNo ratings yet

- NC 3 Bookeeping Prcatice SetDocument39 pagesNC 3 Bookeeping Prcatice SetJEFFREY GALANZA71% (7)

- Acctg Merchandise Inventory and Cost of SalesDocument16 pagesAcctg Merchandise Inventory and Cost of SalesDaisy Marie A. Rosel100% (1)

- 5activity3 IgnacioMa - JosefaDocument1 page5activity3 IgnacioMa - JosefaRichmon RabeNo ratings yet

- Perpetualvs PeriodicDocument12 pagesPerpetualvs PeriodicPRINCESS MENDOZANo ratings yet

- Problem 2 JCDocument1 pageProblem 2 JCJay ann TolentinoNo ratings yet

- Audit of Inventory: Download NowDocument1 pageAudit of Inventory: Download NowMariz Julian Pang-aoNo ratings yet

- Periodic and Perpetual 2Document20 pagesPeriodic and Perpetual 2Edmond De Guerto100% (1)

- Module 3Document16 pagesModule 3Althea mary kate MorenoNo ratings yet

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Inventory Reporting Part 1Document1 pageInventory Reporting Part 1Ai ReenNo ratings yet

- Assignment No. 5Document11 pagesAssignment No. 5Angela MacailaoNo ratings yet

- Intermediate Accounting I - Inventories 2Document2 pagesIntermediate Accounting I - Inventories 2Joovs JoovhoNo ratings yet

- Intermediate Accounting I Inventories 2 PDFDocument2 pagesIntermediate Accounting I Inventories 2 PDFJoovs JoovhoNo ratings yet

- Merchandising Comprrehensive ProblemDocument3 pagesMerchandising Comprrehensive ProblemJalod Hadji AmerNo ratings yet

- Myco Paque InventoriesDocument5 pagesMyco Paque InventoriesMYCO PONCE PAQUENo ratings yet

- C14 - PAS 2 InventoriesDocument20 pagesC14 - PAS 2 InventoriesAllaine ElfaNo ratings yet

- Illustrative Example Journal Entries For New AccountsDocument4 pagesIllustrative Example Journal Entries For New AccountsJoshua SolayaoNo ratings yet

- SDocument18 pagesSdebate dd0% (1)

- NIAT Review 3Document7 pagesNIAT Review 3April Joy InductaNo ratings yet

- Practice Material 1Document8 pagesPractice Material 1Tine100% (1)

- Practice Material 1 SolutionDocument22 pagesPractice Material 1 SolutionTineNo ratings yet

- Margaux Mojica Trading Solution - Reversing EntriesDocument53 pagesMargaux Mojica Trading Solution - Reversing EntriesTineNo ratings yet

- Net Method Sample ProblemDocument6 pagesNet Method Sample ProblemTineNo ratings yet

- Timing and ReportingDocument23 pagesTiming and ReportingTineNo ratings yet

- On The Context of SamDocument1 pageOn The Context of SamTineNo ratings yet

- Atendance To WRP ActivitiesDocument1 pageAtendance To WRP ActivitiesTineNo ratings yet

- TakotDocument1 pageTakotTineNo ratings yet

- Implementation of Lean Six SigmaDocument11 pagesImplementation of Lean Six Sigmazizo abdelwahedNo ratings yet

- Group Assignment Student Copy 3Document6 pagesGroup Assignment Student Copy 3Risvana RizzNo ratings yet

- Test Bank For Accounting Information Systems Hall 8th EditionDocument23 pagesTest Bank For Accounting Information Systems Hall 8th Editioncynthiaacostabsjeiaxmqk100% (38)

- Eoq Notes and ProblemsDocument2 pagesEoq Notes and Problemsit's AngelSibyaNo ratings yet

- Sap MM Tables & FieldsDocument2 pagesSap MM Tables & Fieldstabti memeNo ratings yet

- Hans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentDocument4 pagesHans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentHans Gabriel T. CabatinganNo ratings yet

- SAP MM - Inventory ManagementDocument16 pagesSAP MM - Inventory ManagementMayank SolankiNo ratings yet

- SCM Fiori App ListDocument11 pagesSCM Fiori App ListYuvarani K NNo ratings yet

- SCM301 MDocument19 pagesSCM301 MHà My NguyễnNo ratings yet

- CH 13 Supply Chain ManagementDocument66 pagesCH 13 Supply Chain ManagementCOVID RSHJNo ratings yet

- InventoriesDocument64 pagesInventoriesMarjorie PalmaNo ratings yet

- Chapter 9 Test BankDocument31 pagesChapter 9 Test BankCameron RiverNo ratings yet

- Chapter7 Team4Document9 pagesChapter7 Team4Nguyên Ng.Phạm ThảoNo ratings yet

- Warehousing Logistics Storage Services Gurgaon - Warehousing ExpressDocument3 pagesWarehousing Logistics Storage Services Gurgaon - Warehousing ExpressGurjeet SinghNo ratings yet

- International Business: Competing in The Global MarketplaceDocument24 pagesInternational Business: Competing in The Global MarketplaceLêViệtPhươngNo ratings yet

- W.W. Grainger and Mcmaster-Carr: Mro Suppliers: Alejandro Casanueva Hurtado 23611Document5 pagesW.W. Grainger and Mcmaster-Carr: Mro Suppliers: Alejandro Casanueva Hurtado 23611Hitisha agrawal100% (1)

- Ihab Yacoub - Resume - JoDocument5 pagesIhab Yacoub - Resume - JoMuthanna AladwanNo ratings yet

- Inventory Optimization at Procter Gamble AchievingDocument14 pagesInventory Optimization at Procter Gamble Achievingahmed amiraliNo ratings yet

- Penerapan Untuk Mendukung Strategi Supply Chain: Distribution Resousrce PlanningDocument6 pagesPenerapan Untuk Mendukung Strategi Supply Chain: Distribution Resousrce Planningflagon eka wahyudiNo ratings yet

- 01.storage Guideline V3 6 0Document13 pages01.storage Guideline V3 6 0Yosef ZenebeNo ratings yet

- Chapter 6 Just in Time and Bacflush AccountingDocument17 pagesChapter 6 Just in Time and Bacflush AccountingだみNo ratings yet

- (Emirates) SCM PresentationDocument17 pages(Emirates) SCM PresentationassadullahdmNo ratings yet

- IE301 Operations ManagementDocument3 pagesIE301 Operations ManagementloshidhNo ratings yet

- Lich Tong Mid212 - Dot1-Khoa IemDocument2 pagesLich Tong Mid212 - Dot1-Khoa IemThu UyênNo ratings yet

- 2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Document8 pages2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Nadilla NurNo ratings yet

- Date Time Task Notes: Faizah'S Daily ScheduleDocument1 pageDate Time Task Notes: Faizah'S Daily ScheduleFaizah AsyiqinNo ratings yet

- Chapter 5 Inventory ManagementDocument8 pagesChapter 5 Inventory ManagementAsteway MesfinNo ratings yet

- Intacc Reviewer - Module 3Document20 pagesIntacc Reviewer - Module 3Lizette Janiya SumantingNo ratings yet

- SAP NOTES Cls 30-46Document18 pagesSAP NOTES Cls 30-46msbsarathNo ratings yet

- Performance Analysis of Supply Chain Management With Supply Chain Operation Reference ModelDocument9 pagesPerformance Analysis of Supply Chain Management With Supply Chain Operation Reference Modelbestof onepieceNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet