Professional Documents

Culture Documents

ACCOUNTING 2 Review

Uploaded by

AhnJello100%(1)100% found this document useful (1 vote)

1K views4 pagesOriginal Title

ACCOUNTING-2-Review

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

1K views4 pagesACCOUNTING 2 Review

Uploaded by

AhnJelloCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 4

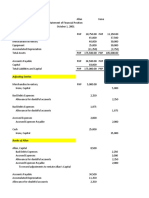

ACCOUNTING 2

Prepare Perpetual and Periodic Entry

1. Purchased 1,000 of goods at a cost of 600 each. Terms of

payment 1/10, net 45.

2. Sold 700 of goods to ACC Enterprise. The selling price was

900 per good. Terms: 1/10, net 30.

3. Returned 150 of the goods purchased because they were

defective.

4. ACC Enterprise returned 85 goods because of the defect.

5. Paid trucking firm 5,000 for the 1,000 goods purchased.

6. A buyer received an invoice for 6,000 dated June 10. If the

terms are 2/10, n/30, and the buyer paid the invoice within

the discount period, what amount will be the seller receive,

and what will be the entry?

7. Olive Valenzuela Traders purchased merchandise from San

Jose Suppliers for 3,600 list price, subject to a trade discount

of 25%. The goods were purchased on terms of 2/10, n/30,

FOB Destination. Valenzuela paid 100 transportation costs.

Valenzuela returned 400 (list price) of the merchandise to

San Jose and later paid the amount due within the discount

period. What will be the entry for the seller and buyer and

how much is the amount?

8. The December 31, 2010 trial balance for Aileen Maglana

Company included the following: purchases, 40 000;

purchase returns and allowances, 2 000; freight-in, 3 000;

ending inventory was 8 000. What was the cost of goods

sold for 2010?

9. On May 15, 2010, the Guzon Book Distributors acquired for

resale books on account with a list price of 108,000. Butuan

Publishing, the supplier, allowed a 15% trade discount as

well as credit terms of 2/10, n/30. Guzon paid the invoice in

full on May 2010. What will be the entry for seller and

buyer?

10.Sales on account, 650 000. Prepare perpetual entry.

You might also like

- ACEFIAR Quiz No. 7Document2 pagesACEFIAR Quiz No. 7Marriel Fate CullanoNo ratings yet

- Ipil Grocery T AccountsDocument5 pagesIpil Grocery T AccountsJelaina Alimansa100% (1)

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Accounting Problem 16Document1 pageAccounting Problem 16sabbyveraNo ratings yet

- Accbp100 2nd Exam Part 1Document2 pagesAccbp100 2nd Exam Part 1emem resuento100% (1)

- Martinez, Althea E. Abm 12-1 (Accounting 2)Document13 pagesMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNo ratings yet

- Merchandising Accounting (Erlinda See Chua)Document1 pageMerchandising Accounting (Erlinda See Chua)Shaira Nicole VasquezNo ratings yet

- FABM Assignment WS FS P C TB 1Document34 pagesFABM Assignment WS FS P C TB 1memae0044No ratings yet

- Chapter 5 PartnershipDocument3 pagesChapter 5 PartnershipRose Ayson0% (1)

- ProblemDocument1 pageProblemGemmie Barsobia100% (2)

- Closing EntriesDocument2 pagesClosing EntriesTey-yah Malumbres100% (1)

- Acct 2 Problem 3Document1 pageAcct 2 Problem 3Alfie boy100% (1)

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Acctgchap 2Document15 pagesAcctgchap 2Anjelika ViescaNo ratings yet

- Estimated Value of Merchandise Destroyed by FloodDocument2 pagesEstimated Value of Merchandise Destroyed by FloodLoli WalkerNo ratings yet

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- Accounting Sample ProblemsDocument1 pageAccounting Sample ProblemsKeitheia QuidlatNo ratings yet

- Module 10 (Accounting)Document8 pagesModule 10 (Accounting)Jasmine ActaNo ratings yet

- Worksheet and Financial Statement 4Document21 pagesWorksheet and Financial Statement 4Bhebz Erin MaeNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- Allan and Irene Answer KeyDocument9 pagesAllan and Irene Answer KeyApril NaidaNo ratings yet

- Valuation of Contributions of PartnersDocument3 pagesValuation of Contributions of Partnersfinn mertensNo ratings yet

- Santos ChaDocument18 pagesSantos ChaSANTOS, CHARISH ANNNo ratings yet

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- Problem 5-1 PDFDocument1 pageProblem 5-1 PDFJaira AsuncionNo ratings yet

- AIS Journal Entries and Adjusting EntriesDocument2 pagesAIS Journal Entries and Adjusting EntriesIeva Francheska Agustin83% (6)

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- Chapter 8-Problem 6Document6 pagesChapter 8-Problem 6kakaoNo ratings yet

- Illustration Chapter 1 1Document7 pagesIllustration Chapter 1 1PrincesipieNo ratings yet

- Illustrative Example Journal Entries For New AccountsDocument4 pagesIllustrative Example Journal Entries For New AccountsJoshua SolayaoNo ratings yet

- 601766e1ea0e740022470410-1612146674-COMPED 422 - EXAM 1Document2 pages601766e1ea0e740022470410-1612146674-COMPED 422 - EXAM 1Pritz Marc Bautista Morata100% (1)

- Comprehensive ProblemDocument1 pageComprehensive ProblemDavid Con RiveroNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Chapter 6 Lumpsum LiquidationDocument24 pagesChapter 6 Lumpsum LiquidationJenny BernardinoNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- Effects of Transactions Instructions: Indicate The Effects of Each Transaction by Writing The ChoicesDocument1 pageEffects of Transactions Instructions: Indicate The Effects of Each Transaction by Writing The ChoicesHessiel Mae Jumalon Garcines100% (1)

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditHerlyn Juvelle SevillaNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Answer Prob 1 and 2Document3 pagesAnswer Prob 1 and 2machelle franciscoNo ratings yet

- Chpter 1.problem 7.mullesDocument11 pagesChpter 1.problem 7.mullesKim OlimbaNo ratings yet

- Recording Transactions in A Financial Transaction WorksheetDocument1 pageRecording Transactions in A Financial Transaction WorksheetSHENo ratings yet

- Chapter 5 Double Entry Bookkeeping For A Service ProviderDocument8 pagesChapter 5 Double Entry Bookkeeping For A Service ProviderPaw Verdillo100% (1)

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Week 4 5 ULOc Lets Analyze Activities SolutionDocument3 pagesWeek 4 5 ULOc Lets Analyze Activities Solutionemem resuentoNo ratings yet

- Elite AISDocument70 pagesElite AISDiana Rose OrlinaNo ratings yet

- Bac MQ2 1Document3 pagesBac MQ2 1JESSON VILLANo ratings yet

- Chapter 11 SampleDocument6 pagesChapter 11 SamplePattraniteNo ratings yet

- Eto SagoDocument2 pagesEto SagoaleckNo ratings yet

- PARCOR - 2Nature-and-Formation-of-a-PartnershipDocument30 pagesPARCOR - 2Nature-and-Formation-of-a-PartnershipHarriane Mae GonzalesNo ratings yet

- Partnership Dissolution Withdrawal Retirement Death and IncapacityDocument25 pagesPartnership Dissolution Withdrawal Retirement Death and IncapacityGale KnowsNo ratings yet

- 7 Cost Formulas and LCNRVDocument6 pages7 Cost Formulas and LCNRVJorufel PapasinNo ratings yet

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Far 3 PDF FreeDocument6 pagesFar 3 PDF Freejunica casi�oNo ratings yet

- Accounting 1Document16 pagesAccounting 1Rommel Angelo AgacitaNo ratings yet

- MC 6 SolutionDocument16 pagesMC 6 SolutionkylaNo ratings yet

- Accounting 2 - Teresita BuenaflorDocument14 pagesAccounting 2 - Teresita BuenaflorElmeerajh JudavarNo ratings yet

- Revised Canvas - Exercises For MerchandisingDocument5 pagesRevised Canvas - Exercises For MerchandisingMaryrose Sumulong0% (1)

- Shyness EssayDocument2 pagesShyness EssayAhnJelloNo ratings yet

- Revised AMLADocument18 pagesRevised AMLAAhnJelloNo ratings yet

- BanksDocument34 pagesBanksAhnJelloNo ratings yet

- Comparative Notes On BP Bilang 22 and Estafa Article 315 Paragraph 2 (D) Under The Revised Penal Code and The Clearing House Rules and ProcedureDocument5 pagesComparative Notes On BP Bilang 22 and Estafa Article 315 Paragraph 2 (D) Under The Revised Penal Code and The Clearing House Rules and Procedurexdoubledutchess100% (1)

- What Is The Phosphorus CycleDocument3 pagesWhat Is The Phosphorus CycleAhnJelloNo ratings yet

- School EssayDocument1 pageSchool EssayAhnJelloNo ratings yet

- Elements of Quality ControlDocument4 pagesElements of Quality ControlAhnJelloNo ratings yet

- Older Bro Vs Younger BroDocument2 pagesOlder Bro Vs Younger BroAhnJelloNo ratings yet

- Unclaimed Balances LawDocument10 pagesUnclaimed Balances LawAhnJelloNo ratings yet

- M and EggsDocument4 pagesM and EggsAhnJelloNo ratings yet

- BussinessDocument4 pagesBussinessAhnJelloNo ratings yet

- Balthazars Marvelous AfternoonDocument4 pagesBalthazars Marvelous AfternoonAhnJelloNo ratings yet

- The Human Eye: Jalen Abijah VeranoDocument54 pagesThe Human Eye: Jalen Abijah VeranoAhnJelloNo ratings yet

- War of The Roses: by Jalen Verano and Celina SyDocument4 pagesWar of The Roses: by Jalen Verano and Celina SyAhnJelloNo ratings yet

- Balthazar'S Marvelous Afternoon: Presented By: Monday CleanersDocument17 pagesBalthazar'S Marvelous Afternoon: Presented By: Monday CleanersAhnJelloNo ratings yet

- People in MediaDocument27 pagesPeople in MediaAhnJelloNo ratings yet

- Motolite SwotDocument25 pagesMotolite SwotAhnJelloNo ratings yet

- Petron-Corporation SwotDocument25 pagesPetron-Corporation SwotAhnJello100% (3)

- Math Reviewer g10 1Document10 pagesMath Reviewer g10 1AhnJelloNo ratings yet

- Powers, Duties and Functions (PROVINCIAL GOVERNOR)Document2 pagesPowers, Duties and Functions (PROVINCIAL GOVERNOR)AhnJelloNo ratings yet

- One Dance: 'Cause This Is All We Know, Yeah 'Cause This Is All We KnowDocument2 pagesOne Dance: 'Cause This Is All We Know, Yeah 'Cause This Is All We KnowAhnJelloNo ratings yet

- Philippine-Veterans-Bank SwotDocument34 pagesPhilippine-Veterans-Bank SwotAhnJelloNo ratings yet

- BalthazarDocument9 pagesBalthazarskhan99No ratings yet

- Jollibee Corporation: Maria Justina MerleDocument24 pagesJollibee Corporation: Maria Justina MerleAhnJelloNo ratings yet

- TleDocument3 pagesTleAhnJelloNo ratings yet

- GOLDILOCKSDocument17 pagesGOLDILOCKSAhnJello50% (2)

- Philippine Long Distance TelephoneDocument31 pagesPhilippine Long Distance TelephoneAhnJelloNo ratings yet

- Potato-Corner SwotDocument18 pagesPotato-Corner SwotAhnJelloNo ratings yet

- Math Reviewer g10 1Document10 pagesMath Reviewer g10 1AhnJelloNo ratings yet

- Computer ReviewerDocument5 pagesComputer ReviewerAhnJelloNo ratings yet