Professional Documents

Culture Documents

ASCERTAINING FINANCIAL DATA

Uploaded by

Garima GarimaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ASCERTAINING FINANCIAL DATA

Uploaded by

Garima GarimaCopyright:

Available Formats

1. Ascertainment of sales.

Sales may be of two types (i) Credit Sales, and (ii) Cash Sales.

Credit Sales should be found out by preparing a Total Debtors Account while cash sales

should be found out fromthe Cash Book.

2. Ascertainment of purchases. The purchases may be of two types (i) Credit Purchases,

and (U) Cash purchases. The amount of credit purchases can be ascertained by preparing a

Total Creditors Account.

3. Ascertainment of stocks. Stocks may be classified into two categories: (1) Opening Stock,

and (ii) Closing Stock. The amount of Opening Stock or Closing Stock can be ascertained by

preparing a Memorandum Trading Account.

4. Ascertainment of cash and bank balances. The amount of Cash in Hand or Cash at Bank

can be ascertained by preparing a Receipts and Payments Account in case Cash Book

completed in all respects has not been given.

5. Preparation of Trading and P&L accounr and Balance Sheet.

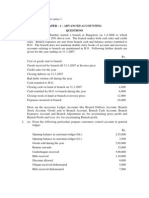

Que: A Trader does not keep a complete set of books. On 1st March 2014 his debtors were

Rs. 24,500 and Creditors were Rs. 7,500. A summary of his cash book is as follows:

Dr.

Cr.

Particulars Cash Bank Particulars Cash Bank

To Debtors for sale 21,250 By Payment to 1,350 11,250

Creditors

To Sale of 13,000 By Balance c/d 17,040 16,250

Machinery

To Rent of 390

warehouse sublet

To Cash sales 5,000 3,750

To Cash capital 2,500

introduced in

business

18,390 27,500 18,390 27,500

At March 2015 the debtors and creditors respectively amounted to Rs. 44,000 and 9,750.

Cash discount allowed to debtors were Rs. 230 and those received from creditors were Rs.

810. Ascertain Total Sales and Total Purchases.

Que: From the following fact supplied by A, who keeps his books on single entry you are

required to calculate Total Purchases and Bills Payable Accounr.

Opening balance of Bills Payable 5,000

Opening balance of Creditors 6,000

Closing balance of Bills Payable 9,000

Closing balance of Creditors 4,000

Bills payable discharged during the year 8,900

Cash Paid to Creditors during the year 30,200

Return outward 1,200

Cash Purchases 25,800

Que: The following is a summary of the Bank Account of Mr. Khanna, a trader, for the year

2015.

Bank Summary

Particulars Amount Particulars Amount

Balance on 1st April 2014 5,140 Payment to creditors 1,87,860

Cash Receipts on a/c of cr. sales 2,43,720 General Expenses 16,970

Balance on 31st March 2015 1,180 Rent & Rates 7,710

Drawings 37,500

2,50,040 2,50,040

All business takings had been paid into the bank except Rs. 21,180 out of which he paid

wages amounting to Rs. 12,800. He retained Rs. 8,380 for private purposes. The following

information is obtained from the books.

Particulars 31/03/2014 31/03/2015 Particulars 31/03/2014 31/03/2015

Stock in trade 24,300 31,500 Rates paid in advance 420 450

Creditors for Goods 19,450 17,090 Creditors for General 810 1,340

Debtors for Goods 22,400 26,900 expenses

Furniture & Fittings 10,000 10,000 Amount owing to a 600

customer who had

overpaid his account

Discounts received from trade creditors during 2014 – 15 amounted to Rs. 1,500. No

discounts were allowed to customers. The amount due to the customer who overpaid his

account was set off against sales to him in 2014 only.

You are required to prepare a Trading and Profit & Loss Account for the year ended

31.03.2015 and a Balance sheet as on that date.

Solution:

Ascertainment of Opening Capital (01.04.2014)

Liabilities Amount Assets Amount

Creditors for goods 19,450 Furniture & Fittings 10,000

Creditors for general expenses 810 Stock – in – trade 24,300

Capital (balancing figure) 41,400 Debtors (Rs. 22,400 – 600) 21,800

Rates in paid in advance 420

Cash at Bank 5,140

61,660 61,660

Total Debtors Account

Dr. Cr.

Particulars Amount Particulars Amount

To Balance b/f 22,400 By Balance b/f 600

To Sales (balancing fig.) 2,70,000 By Cash (Rs. 2,43,720 + Rs. 21,180) 2,64,900

By Balance c/d 26,900

2,92,400 2,92,400

Total Creditors Account

Dr. Cr.

Particulars Amount Particulars Amount

To Bank 1,87,860 By Balance b/f 19,450

To Discount received 1,500 By Purchases (balancing fig) 1,87,000

To Balance c/d 17,090

2,06,450 2,06,450

Trading and Profit & Loss Account

Dr. Cr.

Particulars Amount Particulars Amount

To Opening Stock 24,300 By Sales 2,70,000

To Purchases 1,87,000 By Closing Stock 31,500

To Gross profit c/d 90,200

3,01,500 3,01,500

To General Expenses 17,500 By Gross profit b/d 90,200

(16,970 + 1,340 – 810)

To Rent & Rates 7,680 By Discount received 1,500

(7,710 + 420 – 450)

To Wages 12,800

To Net Profit 53,720

91,700 91,700

Balance Sheet of Khanna as at 31.03.2015

Liabilities Amount Assets Amount

Capital 49,240 Furniture & Fittings 10,000

Creditors for goods 17,090 Stock – in – trade 31,500

Creditors for general expenses 1,340 Debtors 26,900

Bank Overdraft 1,180 Rates in paid in advance 450

68,850 68,850

Working Not:

Capital = Opening balance + Net Profit – Drawings

= 41,400 + 53,720 – 45,880 = 49,240

You might also like

- Balance Sheet As On 1-4-2012: Liabilities RS Assets RSDocument2 pagesBalance Sheet As On 1-4-2012: Liabilities RS Assets RSL.D TECHNICAL POINTNo ratings yet

- Solution Aman BHDDocument4 pagesSolution Aman BHDIZZAH ATHIRAH MOHD SALIMINo ratings yet

- Assignment of Banking Company 22-23Document6 pagesAssignment of Banking Company 22-23DARK KING GamersNo ratings yet

- Financial Accounting exam questionsDocument3 pagesFinancial Accounting exam questionsVishwas Srivastava 371No ratings yet

- Vertical Financial StatementsDocument3 pagesVertical Financial StatementsMANAN MEHTANo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- Corporate Liquidation Home Office and Branch Accounting ProblemsDocument5 pagesCorporate Liquidation Home Office and Branch Accounting ProblemsJustine CruzNo ratings yet

- AFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTDocument5 pagesAFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTMakisa YuNo ratings yet

- Module II AfmDocument27 pagesModule II Afmshuklayuvaan22No ratings yet

- Single Entry AccountingDocument12 pagesSingle Entry AccountingArjun ThawaniNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Revision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownDocument5 pagesRevision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownKys AlinaNo ratings yet

- Financial Mangement-Midterm ExamDocument12 pagesFinancial Mangement-Midterm ExamChaeminNo ratings yet

- June 2017Document34 pagesJune 2017subham8555No ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Periodic Method Illustrative ProblemDocument30 pagesPeriodic Method Illustrative ProblemRose Marie Hermosa100% (3)

- UNIT-4Document33 pagesUNIT-4b21ai008No ratings yet

- Cebu Car-Tech CenterDocument17 pagesCebu Car-Tech CenterAlbert Moreno100% (2)

- Introduction To Accounting Bba 2103Document6 pagesIntroduction To Accounting Bba 2103Elisha JoelNo ratings yet

- PAMANTASAN NG LUNGSOD NG MAYNILA INTERMEDIATE ACCOUNTING 3 QUIZ NO. 1Document5 pagesPAMANTASAN NG LUNGSOD NG MAYNILA INTERMEDIATE ACCOUNTING 3 QUIZ NO. 1Trixie HicaldeNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Notes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dDocument10 pagesNotes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dar5769584No ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- Control Account Tutorial Questions 2023-2024Document10 pagesControl Account Tutorial Questions 2023-2024nyimbilene23No ratings yet

- MB0025 Financial and Management AccountingDocument7 pagesMB0025 Financial and Management Accountingvarsha100% (1)

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- ACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Document3 pagesACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Zyrille Corrine GironNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- From NetDocument51 pagesFrom NetAsma ShoaibNo ratings yet

- Control Accounts Review Questions SolvedDocument6 pagesControl Accounts Review Questions SolvedJaneth Patrick100% (2)

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- Topic 3 Accounting For Incomplete RecordsDocument25 pagesTopic 3 Accounting For Incomplete Recordstwahirwajeanpierre50No ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- Review QuestionsDocument9 pagesReview QuestionsGamaya EmmanuelNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Accounting Cycle CompletedDocument29 pagesAccounting Cycle CompletedMUHAMMAD HARIS PERVAIZNo ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- Question Bank Financial Accounting: M0Dule 1Document17 pagesQuestion Bank Financial Accounting: M0Dule 1Jaseena Ibrahim researchNo ratings yet

- Please Review These Questions Before You Enter For Your Test and Final Examination Thank You AC405DDocument13 pagesPlease Review These Questions Before You Enter For Your Test and Final Examination Thank You AC405DELIZABETHNo ratings yet

- Financial Accounting and Reporting Problems Freebie PDFDocument46 pagesFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Financial Accounts ConceptDocument191 pagesFinancial Accounts ConceptsridhartksNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- Final Accounts From Single Entry NotesDocument5 pagesFinal Accounts From Single Entry NotesBamidele AdegboyeNo ratings yet

- CashFlowStatement ProblemsDocument19 pagesCashFlowStatement Problems8qyyyhy7jdNo ratings yet

- Auditing ProblemsDocument67 pagesAuditing ProblemsAngelica Ann Salen100% (1)

- Additional InformationDocument7 pagesAdditional InformationvasanthgurusamynsNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Investment QuestionsDocument4 pagesInvestment QuestionsGarima GarimaNo ratings yet

- Bank Reconciliation Statement TemplateDocument3 pagesBank Reconciliation Statement TemplateGarima GarimaNo ratings yet

- Chapter 1500Document28 pagesChapter 1500Divya Rekha MandulaNo ratings yet

- Single Entry Ques.Document6 pagesSingle Entry Ques.Garima GarimaNo ratings yet

- Importance of Bank ReconciliationDocument2 pagesImportance of Bank ReconciliationGarima GarimaNo ratings yet

- 212 IjstmDocument7 pages212 IjstmGarima GarimaNo ratings yet

- Charles Babbage Charlie Gabbage Champs Babbage Dit-Doto Matrix Printer Ink Jet Printer Dot Matrix Printer Laser PrinterDocument1 pageCharles Babbage Charlie Gabbage Champs Babbage Dit-Doto Matrix Printer Ink Jet Printer Dot Matrix Printer Laser PrinterGarima GarimaNo ratings yet

- Semester Syllabus First and Second, Higher Education, Madhya Pradesh, IndiaDocument1 pageSemester Syllabus First and Second, Higher Education, Madhya Pradesh, IndiaGarima GarimaNo ratings yet

- Disinvestment and Performance of Profit and Loss Making Central Public Sector Enterprises of IndiaDocument4 pagesDisinvestment and Performance of Profit and Loss Making Central Public Sector Enterprises of IndiaAnithaNo ratings yet

- What is an OSDocument2 pagesWhat is an OSGarima GarimaNo ratings yet

- 2003 July Sep 57 63Document7 pages2003 July Sep 57 63Garima GarimaNo ratings yet

- The Disinvestment Programme in India - Impact On Efficiency and Performance of Disinvested Government Controlled Enterprises (1991 - 2010)Document10 pagesThe Disinvestment Programme in India - Impact On Efficiency and Performance of Disinvested Government Controlled Enterprises (1991 - 2010)Garima GarimaNo ratings yet

- Computer TypesDocument6 pagesComputer TypesGarima GarimaNo ratings yet

- FM PDFDocument235 pagesFM PDFProfessor Sameer Kulkarni100% (2)

- Assembler: A Computer Will Not Understand Any Program Written in ADocument2 pagesAssembler: A Computer Will Not Understand Any Program Written in AIshika SinghNo ratings yet

- Definition - What Does High-Level Language (HLL) Mean?Document1 pageDefinition - What Does High-Level Language (HLL) Mean?Garima GarimaNo ratings yet

- Assembler, Linker and LoaderDocument6 pagesAssembler, Linker and LoaderSyed Shiyaz MirzaNo ratings yet

- Advantages & DisadvantagesDocument3 pagesAdvantages & DisadvantagesGarima GarimaNo ratings yet

- Definition - What Does High-Level Language (HLL) Mean?Document1 pageDefinition - What Does High-Level Language (HLL) Mean?Garima GarimaNo ratings yet

- Library & UtilitiesDocument1 pageLibrary & UtilitiesGarima Garima100% (1)

- Library & UtilitiesDocument1 pageLibrary & UtilitiesGarima Garima100% (1)

- Microsoft Word - Excise Explanatory NotesDocument10 pagesMicrosoft Word - Excise Explanatory NotesGarima GarimaNo ratings yet

- Classification of Prog. Lang.Document3 pagesClassification of Prog. Lang.Garima GarimaNo ratings yet

- Bailment and PledgeDocument3 pagesBailment and PledgeGarima GarimaNo ratings yet

- Types of InsuranceDocument15 pagesTypes of InsuranceGarima GarimaNo ratings yet

- ProvisionsTable CompActDocument11 pagesProvisionsTable CompActGarima GarimaNo ratings yet

- RoyaltyDocument44 pagesRoyaltyGarima GarimaNo ratings yet

- M.P. VAT Central Sales TaxAll Units DYC PDFDocument34 pagesM.P. VAT Central Sales TaxAll Units DYC PDFGarima GarimaNo ratings yet

- Excise DutyDocument1 pageExcise DutyGarima GarimaNo ratings yet

- 11 Procedure Text 2Document10 pages11 Procedure Text 2sebastian wibowoNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- Closingrates 202306junDocument20 pagesClosingrates 202306junTabrez IrfanNo ratings yet

- Credit Creation in Commercial BanksDocument12 pagesCredit Creation in Commercial BanksprasanthmctNo ratings yet

- Word Formation Suffixes Grammar Drills Oneonone Activities Tests - 112936Document2 pagesWord Formation Suffixes Grammar Drills Oneonone Activities Tests - 112936Kevser ArduçNo ratings yet

- Tugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiDocument3 pagesTugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiFICKY ardhikaNo ratings yet

- Housing Cooperative PresentationDocument82 pagesHousing Cooperative PresentationAl MarzolNo ratings yet

- Leases: Section 15Document9 pagesLeases: Section 15Chara etangNo ratings yet

- Lesson 1 - Introduction: Managers, Profits and MarketsDocument20 pagesLesson 1 - Introduction: Managers, Profits and Marketscleofe janeNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manual Full Chapter PDFDocument39 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Copley Solutions Manual Full Chapter PDFarianytebh100% (12)

- PROPOSAL PT BPF Bhs Inggris-2Document6 pagesPROPOSAL PT BPF Bhs Inggris-2Nanda AlkautsarNo ratings yet

- Uspto 97197301Document2 pagesUspto 97197301Sebastian SinclairNo ratings yet

- Kedia Advisory Mentha Oil Report As On 21022019 PDFDocument5 pagesKedia Advisory Mentha Oil Report As On 21022019 PDFmaazNo ratings yet

- Memo TaxDocument2 pagesMemo TaxKristine MagbojosNo ratings yet

- Emergency Luminaire U21 - Standard Non Maintained - 1 H - 70 LM - LedDocument1 pageEmergency Luminaire U21 - Standard Non Maintained - 1 H - 70 LM - Ledmouhcine meskiNo ratings yet

- Urban Symbolism and The New Urbanism of IndonesiaDocument12 pagesUrban Symbolism and The New Urbanism of IndonesiaZAHRA SHABRINANo ratings yet

- Reflection in Financial AssetsDocument1 pageReflection in Financial AssetsCessieNo ratings yet

- Capitalism - Meaning and Development GlobalizationDocument40 pagesCapitalism - Meaning and Development GlobalizationAliya AkhtarNo ratings yet

- 13.1 Objective 13.1: Chapter 13 Pricing Decisions and Cost ManagementDocument43 pages13.1 Objective 13.1: Chapter 13 Pricing Decisions and Cost ManagementAlanood WaelNo ratings yet

- New Directions in Federalism Studies (2010)Document126 pagesNew Directions in Federalism Studies (2010)CheesyPorkBellyNo ratings yet

- UM20MB551-Corporate Finance: DR C Sivashanmugam Sivashanmugam@pes - EduDocument45 pagesUM20MB551-Corporate Finance: DR C Sivashanmugam Sivashanmugam@pes - EduRU ShenoyNo ratings yet

- Mentoring Batch PulseDocument34 pagesMentoring Batch Pulsem s100% (2)

- UCSP - Q2 - Lesson 1 - State and Non State InstitutionsDocument47 pagesUCSP - Q2 - Lesson 1 - State and Non State InstitutionsZei VeursechNo ratings yet

- ACCOUNTIDocument18 pagesACCOUNTIIpang NoyoNo ratings yet

- World Oil Outlook 2022-2045 PDFDocument332 pagesWorld Oil Outlook 2022-2045 PDFDajevNo ratings yet

- Lab Assignment 5Document5 pagesLab Assignment 5wajiha batoolNo ratings yet

- Eco RevampDocument21 pagesEco RevampCriese lavileNo ratings yet

- Apuntes - UD 3 - THE SECONDARY SECTORDocument7 pagesApuntes - UD 3 - THE SECONDARY SECTORKhronos HistoriaNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Ir DBQ 2021Document5 pagesIr DBQ 2021Lizbeth HerreraNo ratings yet