Professional Documents

Culture Documents

U8 - DCM1103 - Fundamentals of Accounting I

Uploaded by

owaisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

U8 - DCM1103 - Fundamentals of Accounting I

Uploaded by

owaisCopyright:

Available Formats

Unit 8

Illustration 1:

A company purchased Machinery for Rs.1,00,000. Its installation costs amounted to

Rs.10,000. It’s estimated life is 5 years and the scrap value is Rs.5,000. Calculate

the amount and rate of depreciation

Sol:

Total Cost of the Machinery = Price + Installation Cost

= Rs. 1,00,000 + Rs. 10,000

= Rs. 1100000

𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡−𝑆𝑐𝑟𝑎𝑝 𝑉𝑎𝑙𝑢𝑒

Amount of the Depn = 𝐿𝑖𝑓𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑚𝑎𝑐ℎ𝑖𝑛𝑒𝑟𝑦 𝑖𝑛 𝑌𝑒𝑎𝑟𝑠

= (1,10,0000 – 5000) / 5 years

= Rs. 21000

Rate of Depn = Depn / Total Cost * 100

= (Rs. 21000 / Rs. 110000) *100

= 19.09%

Illustration 2:

If the asset is purchased for Rs.1,00,000 and depreciation is to be charged at 10%

p.a. on reducing balance method. Calculate the depreciation for three years.

Sol:

First Year

Total Cost = Rs. 100000

Less: Depn (10% 0n Rs. 100000) = Rs. 10000

2nd Year

Opening Balance = Rs. 90000

Less: Depn (10% on Rs. 90000) = Rs. 9000

3rd Year

Opening Balance = Rs. 81000

Less: Depn (10% on Rs. 81000) = Rs. 8,100

4th Year

Opening Balance = Rs. 72900

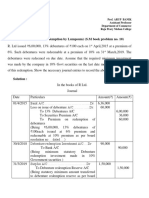

Illustration 3:

Raheem & Co. purchased a fixed asset on 1.4.2018 for Rs.2,50,000. Depreciation is

to be provided @10% annually according to the Straight-line method. The books are

closed on 31st March every year. Pass the necessary journal entries, prepare Fixed

asset Account and Depreciation Account for the first three years.

Sol:

Journal Entry in the books Raheem & Co -_______

Date Particular Debit Credit

Rs Rs

1/4/2018 Fixed Assets A/C Dr 2,50,000

To Cash A/C 2,50,000

(Being the fixed assets purchased)

31/3/2019 Depreciation A/C Dr 25000

To Fixed Assets A/C 25000

31/3/2019 Profit and Loss A/C Dr 25000

To Depreciation A/C 25000

Dr Fixed Assets Cr

Date Particular Rs Date Particular Rs

1/4/18 To Cash A/C 250000 31/3/2019 By Depreciation 25000

31/3/2019 By Balance 225000

250000 250000

1/4/19 To Balance 225000 31/3/20 By Depreciation 25000

31/3/20 By Balance 200000

225000 225000

1/4/20 To Balance 200000

Dr Depreciation Account Cr

Date Particular Rs Date Particular Rs

31/3/19 To Fixed Assets 25000 31/3/19 By Profit & Loss 25000

31/3/20 To Dep 25000 31/3/20 By P/L ac 25000

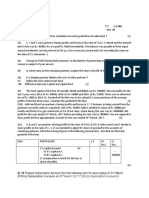

Illustration 4:

A Ltd. purchased a 5 years lease on 1 April 2013 for ₹500000. It is decided to write

off depreciation on lease using the Annuity Method. The rate of interest is presumed

to be 6% p.a. The annuity for ₹1 for 5 years at 6% interest is 0.237396. Prepare the

Lease A/c and the Profit & Loss A/c for 5 years.

Sol:

Depreciation Amount = Rs. 500000 * 0.237396 = Rs. 118698

Dr Lease A/C Cr

Date Particular Rs Date Particular Rs

1/4/13 To Bank A/C 500000 31/3/14 By Depreciation 118698

31/3/14 To Interest A/C 30000

(6% on 500000) By Balance 411302

530000 530000

1/4/14 To Balance 411302 31/3/15 By Depreciation 118698

31/3/15 To interest 24678 By Balance 317282

(6% on 411302)

435980 435980

1/4/15 To Balance 317282 31/3/16 By Depreciation 118698

31/3/16 To interest 19037 By Balance 217621

(6% on 317282) 386319

386319

1/4/16 To Balance 217621 31/3/17 By Depreciation 118698

31/3/17 To interest 13057 By Balance 111980

(6% on 217621)

230678 230678

1/4/16 To Balance 111980 31/3/17 By Depreciation 118698

31/3/17 To interest 6718

(6% on 111980)

118698 118698

Dr Profit and Loss A/C Cr

Date Particular Rs Date Particular Rs

31/3/14 To Depreciation 118698 31/3/14 By Interest 30000

Illustration 5

Ram manufacturing company purchased on 1st April 2002, Machinery for

Rs.1,00,000. After having used it for three years it was sold for Rs. 85,000.

Depreciation is to be provided every year at the rate of 10% per annum on the

straight-line method. Books are closed on 31st March every year. Find out the profit

or loss on sale of machinery

Sol:

1/4/2002 Cost of the Assets = Rs. 1000000

31/3/2003 Less: Dep = Rs. 10000

1/4/2003 Balance = Rs. 90000

31/3/2004 Less: Dep = Rs. 10000

1/4/2004 Balance = Rs. 80000

31/3/2005 Less: Dep = Rs 10000

1/4/2005 Balance = Rs. 70000

Sales Vales = Rs. 85000

Profit = Sales Value – Book Value = Rs. 85000 – Rs. 70000 = Rs. 15000

You might also like

- DepreciationDocument9 pagesDepreciationPriyank JainNo ratings yet

- Depreciation AccountingDocument12 pagesDepreciation Accountingshreyu14796No ratings yet

- DepreciationDocument21 pagesDepreciationDark XYNo ratings yet

- Chapter 6 ACCA F3Document12 pagesChapter 6 ACCA F3siksha100% (1)

- Depreciation-2Document9 pagesDepreciation-2divya shindeNo ratings yet

- Depreciation Provision ReservesDocument60 pagesDepreciation Provision ReservesjonesmbNo ratings yet

- Class 11 Notes CBSE Accountancy Chapter 7 - Depreciation, Provisions and ReservesDocument19 pagesClass 11 Notes CBSE Accountancy Chapter 7 - Depreciation, Provisions and ReservesMithraNo ratings yet

- Depreciation: Accountancy - II 1Document9 pagesDepreciation: Accountancy - II 1M JEEVARATHNAM NAIDUNo ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- Classes Unit 4 Commerce DepreciationDocument25 pagesClasses Unit 4 Commerce Depreciationhappy lifeNo ratings yet

- C4 Depreciation SolutionsDocument8 pagesC4 Depreciation SolutionsSiva SankariNo ratings yet

- 5 Investment AccountsDocument11 pages5 Investment AccountsBAZINGANo ratings yet

- Financial AccountingDocument60 pagesFinancial AccountingSurajNo ratings yet

- Depreciation WorksheetDocument17 pagesDepreciation WorksheetMayank VermaNo ratings yet

- Hire Purchase Lease Financing - Part 2Document38 pagesHire Purchase Lease Financing - Part 2KomalNo ratings yet

- 15 Sample Papers Accountancy 2019-20Document119 pages15 Sample Papers Accountancy 2019-20hardik50% (2)

- Depreciation and Its AccountingDocument4 pagesDepreciation and Its AccountingSatish SheoranNo ratings yet

- Accounts Compiler by Rahul Malkan Sir-73-98Document26 pagesAccounts Compiler by Rahul Malkan Sir-73-98sanketNo ratings yet

- Kendriya Vidyalaya Sangathan, Chennai Region: Model Paper AccountancyDocument12 pagesKendriya Vidyalaya Sangathan, Chennai Region: Model Paper AccountancyJoanna GarciaNo ratings yet

- Hire Purchase and Installament SystemDocument16 pagesHire Purchase and Installament SystemMujieh NkengNo ratings yet

- Unit-7 Absorption and Marginal CostingDocument29 pagesUnit-7 Absorption and Marginal Costingprakashee1No ratings yet

- CBSE Class 12 Accountancy Question Paper 2012 With SolutionsDocument38 pagesCBSE Class 12 Accountancy Question Paper 2012 With SolutionsRavi AgrawalNo ratings yet

- Depreciation On Non Current Assets - OnlineDocument59 pagesDepreciation On Non Current Assets - OnlineRaiqueNo ratings yet

- Problem 4: Redemption by Lumpsum Using Sinking FundDocument5 pagesProblem 4: Redemption by Lumpsum Using Sinking FundGopal DasNo ratings yet

- DepreciationDocument3 pagesDepreciationSarath kumar CNo ratings yet

- 5 DepDocument2 pages5 Depshreyash436No ratings yet

- Lab Solutions - Chapter 5 and 7Document5 pagesLab Solutions - Chapter 5 and 7Abdullah alhamaadNo ratings yet

- CF Unit 2 Solutions 09-01-2022Document22 pagesCF Unit 2 Solutions 09-01-2022SuganyaNo ratings yet

- Unit 2 - Accountingformanager - AnanduDocument52 pagesUnit 2 - Accountingformanager - Ananducraziestidiot31No ratings yet

- 02 Sample PaperDocument43 pages02 Sample Papergaming loverNo ratings yet

- Uj 38361+SOURCE1+SOURCE1.1Document9 pagesUj 38361+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- Chapter 5 DepreciationDocument20 pagesChapter 5 DepreciationanuradhaNo ratings yet

- Velasquez - Assignment - Sales Type & Sales and LeasebackDocument7 pagesVelasquez - Assignment - Sales Type & Sales and LeasebackGiddel Ann Kristine VelasquezNo ratings yet

- New Microsoft Office Word DocumentDocument51 pagesNew Microsoft Office Word DocumentBasavaraj OkkundNo ratings yet

- XDocument5 pagesXSAI KISHORENo ratings yet

- Problem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Document5 pagesProblem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Gopal DasNo ratings yet

- Depreciation AccountingDocument22 pagesDepreciation AccountingRajat srivastavaNo ratings yet

- Reconstitution of Partnership FirmDocument36 pagesReconstitution of Partnership FirmjdsiNo ratings yet

- Topic 2C - Part 2 - Provision For Depreciation Account - Disposal AccountDocument23 pagesTopic 2C - Part 2 - Provision For Depreciation Account - Disposal AccountVarsha GhanashNo ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- Comprehension Questions: 1. What Are Minimum Lease Payments'?Document13 pagesComprehension Questions: 1. What Are Minimum Lease Payments'?Amit ShuklaNo ratings yet

- AnswerDocument83 pagesAnswerTavnish SinghNo ratings yet

- Accountancy Pre BoardDocument15 pagesAccountancy Pre BoardkenaNo ratings yet

- Ventura K PlansDocument8 pagesVentura K PlansRakesh PrasadNo ratings yet

- RERETESTDocument4 pagesRERETESTshveta0% (1)

- Account Ch-1 Partnership Firm - FundamentalsDocument19 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Bcom 3 Sem Corporate Accounting 1 21100518 Mar 2021Document5 pagesBcom 3 Sem Corporate Accounting 1 21100518 Mar 2021abin.com22No ratings yet

- Generally Accepted Accounting Principles (GAAP) andDocument58 pagesGenerally Accepted Accounting Principles (GAAP) andamithkiran100% (1)

- AccountsDocument13 pagesAccountsAnamika VatsaNo ratings yet

- Chapter 09 - Change in Accounting Estimate: Problem 9-1 (IAA)Document6 pagesChapter 09 - Change in Accounting Estimate: Problem 9-1 (IAA)Kimberly Claire Atienza100% (3)

- 04 Sample PaperDocument45 pages04 Sample Papergaming loverNo ratings yet

- Sample Paper - 2008 Class - XII Subject - Accountancy MM 80 Time 3Hrs Part ADocument5 pagesSample Paper - 2008 Class - XII Subject - Accountancy MM 80 Time 3Hrs Part Apawankumar311No ratings yet

- Commission and Brokerage CPJCC SLMDocument6 pagesCommission and Brokerage CPJCC SLMShubh LuniyaNo ratings yet

- DepreciationDocument3 pagesDepreciationSumanth KumarNo ratings yet

- Sample Paper For Final ExaminationDocument3 pagesSample Paper For Final ExaminationAbhay MoreNo ratings yet

- Acc 308-Week3 - 3-2 Homework Chapter 11Document7 pagesAcc 308-Week3 - 3-2 Homework Chapter 11Lilian LNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Unit 6 - Trial BalanceDocument67 pagesUnit 6 - Trial BalanceowaisNo ratings yet

- U6 - DCM1103 - B.Com - Fundamentals of AccountingDocument4 pagesU6 - DCM1103 - B.Com - Fundamentals of AccountingowaisNo ratings yet

- Unit 5 - Cash BookDocument27 pagesUnit 5 - Cash BookowaisNo ratings yet

- Unit 4 - Secondary BooksDocument27 pagesUnit 4 - Secondary BooksowaisNo ratings yet

- Unit 1 - Introduction To AccountingDocument18 pagesUnit 1 - Introduction To AccountingowaisNo ratings yet

- Unit 2 - Accounting Principles, Concepts and ConventionsDocument20 pagesUnit 2 - Accounting Principles, Concepts and ConventionsowaisNo ratings yet

- Unit 3 - Recording of TransactionsDocument20 pagesUnit 3 - Recording of TransactionsowaisNo ratings yet

- Beam Deflection FormulaeDocument2 pagesBeam Deflection Formulae7575757575100% (6)

- Practice Test On MatricesDocument10 pagesPractice Test On MatricesowaisNo ratings yet

- 1t02211a PDFDocument1 page1t02211a PDFowaisNo ratings yet

- 1t02211a PDFDocument1 page1t02211a PDFowaisNo ratings yet

- Corporate ProfileDocument44 pagesCorporate ProfileowaisNo ratings yet

- Bayaz e Kabeer Urdu PDFDocument1 pageBayaz e Kabeer Urdu PDFowais40% (5)

- Lec17 Bearing CapacityDocument57 pagesLec17 Bearing CapacityMuhammad EhtshamNo ratings yet

- Lec17 Bearing CapacityDocument57 pagesLec17 Bearing CapacityMuhammad EhtshamNo ratings yet

- Concrete Pre Stress NotesDocument117 pagesConcrete Pre Stress NotesowaisNo ratings yet

- Foundation DesignDocument121 pagesFoundation DesignowaisNo ratings yet

- Theory of Easticity Plasticity and StabilityDocument102 pagesTheory of Easticity Plasticity and StabilityowaisNo ratings yet

- The Equilibrium EquationsDocument6 pagesThe Equilibrium EquationsJoão DiasNo ratings yet

- Anchor Bolts in Tension and Shear-2Document8 pagesAnchor Bolts in Tension and Shear-2owaisNo ratings yet

- 07 3DElasticity 02 3D StressStrain PDFDocument19 pages07 3DElasticity 02 3D StressStrain PDFMishel Carrion Cuadros100% (1)

- E C, j"-4 - N-K: I Nou.r) QuestionsDocument8 pagesE C, j"-4 - N-K: I Nou.r) QuestionsowaisNo ratings yet

- SurajSir KDK ConferenceDocument6 pagesSurajSir KDK ConferenceowaisNo ratings yet

- Static, Dynamic WindxDocument1 pageStatic, Dynamic WindxowaisNo ratings yet

- Anchor Bolts in Tension and Shear-2Document7 pagesAnchor Bolts in Tension and Shear-2Nithin Kannan100% (1)

- SurajSir KDK ConferenceDocument6 pagesSurajSir KDK ConferenceowaisNo ratings yet

- Ch05 Design Code and Commentary Approved Version Revised 13-01-18Document17 pagesCh05 Design Code and Commentary Approved Version Revised 13-01-18owaisNo ratings yet

- Chapter2 Com PDFDocument20 pagesChapter2 Com PDFbra22222No ratings yet

- Description About Moon: Earth SatelliteDocument6 pagesDescription About Moon: Earth SatellitePurva KhatriNo ratings yet

- Kpolovie and Obilor PDFDocument26 pagesKpolovie and Obilor PDFMandalikaNo ratings yet

- SchedulingDocument47 pagesSchedulingKonark PatelNo ratings yet

- 20 Ijrerd-C153Document9 pages20 Ijrerd-C153Akmaruddin Bin JofriNo ratings yet

- Ethics FinalsDocument22 pagesEthics FinalsEll VNo ratings yet

- Purchasing and Supply Chain Management (The Mcgraw-Hill/Irwin Series in Operations and Decision)Document14 pagesPurchasing and Supply Chain Management (The Mcgraw-Hill/Irwin Series in Operations and Decision)Abd ZouhierNo ratings yet

- How Should We Allocate Scarce Resources Over Our Business Portfolio?Document20 pagesHow Should We Allocate Scarce Resources Over Our Business Portfolio?Vivek AryaNo ratings yet

- Communication MethodDocument30 pagesCommunication MethodMisganaw GishenNo ratings yet

- Language EducationDocument33 pagesLanguage EducationLaarni Airalyn CabreraNo ratings yet

- Higher Vapor Pressure Lower Vapor PressureDocument10 pagesHigher Vapor Pressure Lower Vapor PressureCatalina PerryNo ratings yet

- Application of The Ritz Method To The Analysis of Non-Linear Free Vibrations of BeamsDocument12 pagesApplication of The Ritz Method To The Analysis of Non-Linear Free Vibrations of BeamsKuldeep BhattacharjeeNo ratings yet

- Service Manual: NISSAN Automobile Genuine AM/FM Radio 6-Disc CD Changer/ Cassette DeckDocument26 pagesService Manual: NISSAN Automobile Genuine AM/FM Radio 6-Disc CD Changer/ Cassette DeckEduardo Reis100% (1)

- Form PersonalizationDocument5 pagesForm PersonalizationSuneelTejNo ratings yet

- 1000 Base - T Magnetics Modules P/N: Gst5009 LF Data Sheet: Bothhand USA Tel: 978-887-8050Document2 pages1000 Base - T Magnetics Modules P/N: Gst5009 LF Data Sheet: Bothhand USA Tel: 978-887-8050DennisSendoyaNo ratings yet

- Manual de Utilizare HUMAX DIGI TV RDSDocument116 pagesManual de Utilizare HUMAX DIGI TV RDSenamicul50No ratings yet

- A List of 142 Adjectives To Learn For Success in The TOEFLDocument4 pagesA List of 142 Adjectives To Learn For Success in The TOEFLchintyaNo ratings yet

- Rules of Bursa Malaysia Securities Clearing 2019Document11 pagesRules of Bursa Malaysia Securities Clearing 2019Evelyn SeethaNo ratings yet

- Electromyostimulation StudyDocument22 pagesElectromyostimulation StudyAgnes Sophia PenuliarNo ratings yet

- 4.9 Design of Compression Members: L 4.7 UsingDocument22 pages4.9 Design of Compression Members: L 4.7 Usingctc1212100% (1)

- Installation, Operation & Maintenance Manual - Original VersionDocument11 pagesInstallation, Operation & Maintenance Manual - Original VersionAli AafaaqNo ratings yet

- ISP SFD PDFDocument73 pagesISP SFD PDFNamo SlimanyNo ratings yet

- CFodrey CVDocument12 pagesCFodrey CVCrystal N FodreyNo ratings yet

- Millennium Development GoalsDocument6 pagesMillennium Development GoalsSasha Perera100% (2)

- BQ - Structural Works - CompressedDocument163 pagesBQ - Structural Works - CompressedLee YuxuanNo ratings yet

- Piston Master PumpsDocument14 pagesPiston Master PumpsMauricio Ariel H. OrellanaNo ratings yet

- Venere Jeanne Kaufman: July 6 1947 November 5 2011Document7 pagesVenere Jeanne Kaufman: July 6 1947 November 5 2011eastendedgeNo ratings yet

- Jurnal Direct and Indirect Pulp CappingDocument9 pagesJurnal Direct and Indirect Pulp Cappingninis anisaNo ratings yet

- Color Coding Chart - AHGDocument3 pagesColor Coding Chart - AHGahmedNo ratings yet

- Nugent 2010 Chapter 3Document13 pagesNugent 2010 Chapter 3Ingrid BobosNo ratings yet