Professional Documents

Culture Documents

Mayank Aggarwal October2022

Uploaded by

Mayank AggarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mayank Aggarwal October2022

Uploaded by

Mayank AggarwalCopyright:

Available Formats

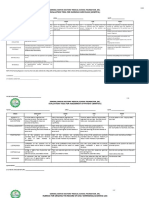

Mayank Aggarwal

FE-01240

Bachelor of Management Studies

5th-November-2022

What Are Subsidizing Rounds

There are different kinds of financing adjusts accessible to new

companies, contingent on the business and the degree of premium among

expected financial backers. It's normal for new businesses to participate in

what is known as "seed" subsidizing or private supporter financing at the

start.

Then, these financing rounds can be trailed by Series A, B and C

subsidizing adjusts, as well as extra endeavors to procure capital too, if

suitable. Series A, B and C are fundamental elements for a business that

chooses bootstrapping, or only getting by off of the liberality of

companions, family, and the profundity of their own pockets, won't do the

trick.

Underneath, we'll investigate what these subsidizing adjusts are, the way

they work and what separates them from each other. The way for every

startup is fairly unique, similar to the timetable for subsidizing. Numerous

organizations go through months or even a long time looking for

subsidizing, while others (especially those with thoughts considered

genuinely progressive or those joined to people with a demonstrated

history of progress) may sidestep a portion of the rounds of financing and

travel through the most common way of building capital all the more

rapidly.

How Financing Rounds Work

Prior to investigating how a series of financing functions, recognizing the

various participants is fundamental. To start with, there are the people

wanting to acquire subsidizing for their organization. As the business turns

out to be progressively experienced, it will in general progress through the

subsidizing adjusts; it's normal for an organization regardless a seed round

and go on with A, B, and afterward C financing adjusts.

On the opposite side are possible financial backers. While financial

backers wish for organizations to succeed on the grounds that they

support business and have faith in the points and reasons for those

organizations, they additionally desire to recover something from their

venture.

Hence, practically all speculations made during some phase of formative

financing is organized with the end goal that the financial backer or

contributing organization holds halfway responsibility for organization. On

the off chance that the organization develops and procures a benefit, the

financial backer will be compensated equivalent with the speculation

made.

What Is the Financing Valuation?

Before any round of subsidizing starts, experts embrace a valuation of the

organization being referred to. Valuations are gotten from a wide range of

elements, including the executives, demonstrated history, market size, and

chance.

One of the vital qualifications between financing adjusts has to do with the

valuation of the business, as well as its development level and

development possibilities. Thus, these elements influence the sorts of

financial backers prone to reach out and the justifications for why the

organization might be looking for new capital.

Seed Subsidizing

Seed subsidizing is the primary authority value financing stage. It

commonly addresses the main authority cash that an undertaking or

venture raises. A few organizations never stretch out past seed subsidizing

into Series A rounds or past.

You can imagine the "seed" financing as a component of a relationship for

establishing a tree. This early monetary help is preferably the "seed" which

will assist with developing the business. Given sufficient income and an

effective business technique, as well as the tirelessness and commitment

of financial backers, the organization will ideally in the end develop into a

"tree."

Seed subsidizing assists an organization with supporting its initial steps,

including things like statistical surveying and item improvement. With seed

financing, an organization has help with figuring out what its end results

will be and who its objective segment is. Seed subsidizing is utilized to

utilize an establishing group to finish these jobs.

You might also like

- Capital Catalyst: The Essential Guide to Raising Funds for Your BusinessFrom EverandCapital Catalyst: The Essential Guide to Raising Funds for Your BusinessNo ratings yet

- Series A, B, C Funding: How It WorksDocument2 pagesSeries A, B, C Funding: How It WorksSachin KhuranaNo ratings yet

- BPL - Unit 06 - FundingDocument11 pagesBPL - Unit 06 - FundingSuresh SubramaniNo ratings yet

- Startup Funding in IndiaDocument5 pagesStartup Funding in IndiaManoj Kumar MannepalliNo ratings yet

- Mayank Aggarwal August2022Document4 pagesMayank Aggarwal August2022Mayank AggarwalNo ratings yet

- Mayank Aggarwal - June ReportDocument4 pagesMayank Aggarwal - June ReportMayank AggarwalNo ratings yet

- What Is Venture Capital?Document9 pagesWhat Is Venture Capital?Stephane LabrosseNo ratings yet

- SUF Capital FinDocument7 pagesSUF Capital FingsrrsNo ratings yet

- Investment 101Document5 pagesInvestment 101Emikah MakorNo ratings yet

- Startup Funding StagesDocument4 pagesStartup Funding StagesSachin KhuranaNo ratings yet

- Financing A New Venture: IndroductionDocument11 pagesFinancing A New Venture: IndroductionAjiLalNo ratings yet

- Strategic Financial ManagementDocument11 pagesStrategic Financial ManagementmiscemailkkayNo ratings yet

- Startup Funding Rounds: 60% of All Startups NeedDocument9 pagesStartup Funding Rounds: 60% of All Startups Needs gurung100% (1)

- Module 3 Financial Incentives and Funding ProgramsDocument22 pagesModule 3 Financial Incentives and Funding ProgramsAxel HagosojosNo ratings yet

- Incorporation:: Incorporation, Investment, and Intellectual Property For Start-Ups in IndiaDocument5 pagesIncorporation:: Incorporation, Investment, and Intellectual Property For Start-Ups in IndiaRISHAB RNo ratings yet

- Marquee JulyDocument3 pagesMarquee JulyMayank AggarwalNo ratings yet

- Entrepreneurship AssignmentDocument7 pagesEntrepreneurship AssignmentMazhar ArfinNo ratings yet

- Unit 2 Venture FinanceDocument8 pagesUnit 2 Venture Financelaket64875No ratings yet

- What Is Capital Venture: Type of Financing That Investors Provide To StartupDocument20 pagesWhat Is Capital Venture: Type of Financing That Investors Provide To StartupMembrebe Ma. Trina GermoNo ratings yet

- How Venture Capital Firms WorkDocument8 pagesHow Venture Capital Firms Worksanket sunthankarNo ratings yet

- Most BusinessDocument6 pagesMost Businesssridhar KMNo ratings yet

- Anandu S February 2023Document2 pagesAnandu S February 2023NanduNo ratings yet

- Business Plan and PlanningDocument4 pagesBusiness Plan and PlanningHugoh Kansirgi DavidNo ratings yet

- CF Assignment 2 Noel George MathewDocument10 pagesCF Assignment 2 Noel George MathewNoel GeorgeNo ratings yet

- 3 Disadvantages of VC FundingDocument2 pages3 Disadvantages of VC FundingYashaswiniNo ratings yet

- Simarleen Kaur 0223Document3 pagesSimarleen Kaur 0223simar leenNo ratings yet

- Fund Raising 4 Start-UpsDocument8 pagesFund Raising 4 Start-UpsMister PhilipsNo ratings yet

- Entrep Module 1Document4 pagesEntrep Module 1JM NavarretteNo ratings yet

- 5 Stages of Startup FundingDocument1 page5 Stages of Startup FundingSachin Khurana0% (1)

- Funding Your StartupDocument8 pagesFunding Your Startup153KAPIL RANKANo ratings yet

- Capital VenturesDocument4 pagesCapital Ventures114325jishnuNo ratings yet

- Nned To WriteDocument2 pagesNned To WriteChristine Joyce Apa-ap OñasNo ratings yet

- EntrepreneurshipDocument19 pagesEntrepreneurshipNandita vermaNo ratings yet

- Gaurav Sharma 0223Document3 pagesGaurav Sharma 0223simar leenNo ratings yet

- Procurement of Venture CapitalDocument8 pagesProcurement of Venture CapitalLaxman SheralNo ratings yet

- Assignment 02 - Ayush Kapoor - 012Document7 pagesAssignment 02 - Ayush Kapoor - 012Ayush KapoorNo ratings yet

- What Is 'Startup Capital': (1) Your Own / Company's CashDocument13 pagesWhat Is 'Startup Capital': (1) Your Own / Company's CashLian Emerald SmithNo ratings yet

- Phases of StartupsDocument5 pagesPhases of StartupsSAARANSH AGARWALNo ratings yet

- 20 Venture Capital Advantages and DisadvantagesDocument9 pages20 Venture Capital Advantages and DisadvantagesFrancis BellidoNo ratings yet

- Entrepreneurial FinanceDocument11 pagesEntrepreneurial FinanceARUNSANKAR NNo ratings yet

- Difference Between A Startup, Small Business, and Large CorporationDocument2 pagesDifference Between A Startup, Small Business, and Large CorporationImene BentahaNo ratings yet

- Venture Capital Funding - FSDocument14 pagesVenture Capital Funding - FSashaya_j_007No ratings yet

- FUNDAMENTAL of ManagementDocument100 pagesFUNDAMENTAL of ManagementEralisa Paden100% (1)

- 10 Funding OptionsDocument6 pages10 Funding OptionsjbryanNo ratings yet

- Course: BSC - Project Management. Unit Name: Resourse Mobilization. Unit Code: Hepm 2401. REG NO - HDE224-2859/2015 Individual AssignmentDocument11 pagesCourse: BSC - Project Management. Unit Name: Resourse Mobilization. Unit Code: Hepm 2401. REG NO - HDE224-2859/2015 Individual Assignmentabraham kiprutoNo ratings yet

- Financial Model CapitalDocument8 pagesFinancial Model CapitalBEDOLIDO FERNIL R.No ratings yet

- Unit 21 Private Equity and Venture CapitalDocument10 pagesUnit 21 Private Equity and Venture CapitalHari RajNo ratings yet

- Sahil Kumar - October - 2022Document3 pagesSahil Kumar - October - 2022Shivani SinghNo ratings yet

- Financial Management: Hopeful Oby Kessa Diaz Rhealyn Vilasquez Shaira Mae TuazonDocument46 pagesFinancial Management: Hopeful Oby Kessa Diaz Rhealyn Vilasquez Shaira Mae TuazonDivine ParagasNo ratings yet

- Entrepreneur Task 2 Q3Document4 pagesEntrepreneur Task 2 Q3David SubraNo ratings yet

- Venture Capital FinalDocument18 pagesVenture Capital Finalprgupta92No ratings yet

- Chapter 5: Financial Plan and Resource GenerationDocument19 pagesChapter 5: Financial Plan and Resource GenerationKap DemonNo ratings yet

- Bootstrap Financing FatmaDocument3 pagesBootstrap Financing Fatmasalman24No ratings yet

- Module 3 Financial Incentives and Funding ProgramsDocument13 pagesModule 3 Financial Incentives and Funding ProgramsAxel HagosojosNo ratings yet

- Why Most Venture-Backed Companies Fail NotesDocument4 pagesWhy Most Venture-Backed Companies Fail NotesSaad KundiNo ratings yet

- Sources of Funds For EntrepreneursDocument5 pagesSources of Funds For Entrepreneursjames vishdasamNo ratings yet

- Module 6 - FIVE REASONS YOU SHOULD RAISE CAPITAL FOR YOUR STARTUPDocument4 pagesModule 6 - FIVE REASONS YOU SHOULD RAISE CAPITAL FOR YOUR STARTUPIrena Kusuma DewiNo ratings yet

- Startup Companies - PowerPointDocument16 pagesStartup Companies - PowerPointFranklin Rege100% (1)

- Rajdeep Khare June2022Document9 pagesRajdeep Khare June2022Mayank AggarwalNo ratings yet

- Marquee JulyDocument3 pagesMarquee JulyMayank AggarwalNo ratings yet

- Shashank September2022Document3 pagesShashank September2022Mayank AggarwalNo ratings yet

- Tushar Xaxa July2022Document5 pagesTushar Xaxa July2022Mayank AggarwalNo ratings yet

- Mayank Aggarwal January2023Document2 pagesMayank Aggarwal January2023Mayank AggarwalNo ratings yet

- Mayank Aggarwal September2022Document2 pagesMayank Aggarwal September2022Mayank AggarwalNo ratings yet

- Mayank Aggarwal - JULY REPORTDocument5 pagesMayank Aggarwal - JULY REPORTMayank AggarwalNo ratings yet

- Apush Leq Rubric (Long Essay Question) Contextualization (1 Point)Document1 pageApush Leq Rubric (Long Essay Question) Contextualization (1 Point)Priscilla RayonNo ratings yet

- Design and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionDocument11 pagesDesign and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionTejas PanchalNo ratings yet

- Corelation & Multiple Regression AnalysisDocument28 pagesCorelation & Multiple Regression AnalysisSaad Bin Tariq100% (1)

- ESS Revision Session 2 - Topics 5-8 & P1 - 2Document54 pagesESS Revision Session 2 - Topics 5-8 & P1 - 2jinLNo ratings yet

- The Civil Mutinies of Romeo and Juliet: Glenn ClarkDocument21 pagesThe Civil Mutinies of Romeo and Juliet: Glenn ClarkmilcahNo ratings yet

- Part A Questions and AnswersDocument10 pagesPart A Questions and Answerssriparans356No ratings yet

- FFT SlidesDocument11 pagesFFT Slidessafu_117No ratings yet

- Bio Lab Report GerminationDocument10 pagesBio Lab Report GerminationOli Damaskova100% (4)

- BROADCAST Visual CultureDocument3 pagesBROADCAST Visual CultureDilgrace KaurNo ratings yet

- Earnings Statement: Hilton Management Lane TN 38117 Lane TN 38117 LLC 755 Crossover MemphisDocument2 pagesEarnings Statement: Hilton Management Lane TN 38117 Lane TN 38117 LLC 755 Crossover MemphisSelina González HerreraNo ratings yet

- Vocabulary Inglés.Document14 pagesVocabulary Inglés.Psicoguía LatacungaNo ratings yet

- Deep MethodDocument13 pagesDeep Methoddarkelfist7No ratings yet

- Mangaid CoDocument50 pagesMangaid CoFk Fit RahNo ratings yet

- PEDIA OPD RubricsDocument11 pagesPEDIA OPD RubricsKylle AlimosaNo ratings yet

- Hirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlDocument2 pagesHirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlQurratulain Syarifuddinzaini100% (1)

- Coerver Sample Session Age 10 Age 12Document5 pagesCoerver Sample Session Age 10 Age 12Moreno LuponiNo ratings yet

- Steps For Copyright ApplicationDocument7 pagesSteps For Copyright ApplicationLeah MedenillaNo ratings yet

- Divorced Women RightsDocument41 pagesDivorced Women RightsAnindita HajraNo ratings yet

- X-Roc Latex: Product DescriptionDocument2 pagesX-Roc Latex: Product DescriptionAmr RagabNo ratings yet

- Agitha Diva Winampi - Childhood MemoriesDocument2 pagesAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiNo ratings yet

- The Structure of The Nazi Economy - Maxine Yaple SweezyDocument273 pagesThe Structure of The Nazi Economy - Maxine Yaple Sweezygrljadus100% (2)

- Hayat ProposalDocument22 pagesHayat Proposalsebehadinahmed1992No ratings yet

- How To Use The ActionDocument3 pagesHow To Use The Actioncizgiaz cizgiNo ratings yet

- DODGER: Book Club GuideDocument2 pagesDODGER: Book Club GuideEpicReadsNo ratings yet

- Send Me An AngelDocument3 pagesSend Me An AngeldeezersamNo ratings yet

- EFL Listeners' Strategy Development and Listening Problems: A Process-Based StudyDocument22 pagesEFL Listeners' Strategy Development and Listening Problems: A Process-Based StudyCom DigfulNo ratings yet

- Project CharterDocument10 pagesProject CharterAdnan AhmedNo ratings yet

- Daftar PustakaDocument6 pagesDaftar PustakaSeptian UtamaNo ratings yet

- Test Bank For Cognitive Psychology Connecting Mind Research and Everyday Experience 3rd Edition e Bruce GoldsteinDocument24 pagesTest Bank For Cognitive Psychology Connecting Mind Research and Everyday Experience 3rd Edition e Bruce GoldsteinMichaelThomasyqdi100% (49)

- 61 Point MeditationDocument16 pages61 Point MeditationVarshaSutrave100% (1)