Professional Documents

Culture Documents

Pagsinuhin, Marjorie Act. 4 AudSPI Foreign Operations Translation

Pagsinuhin, Marjorie Act. 4 AudSPI Foreign Operations Translation

Uploaded by

Marjorie PagsinuhinCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPagsinuhin, Marjorie Act. 4 AudSPI Foreign Operations Translation

Pagsinuhin, Marjorie Act. 4 AudSPI Foreign Operations Translation

Uploaded by

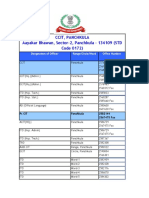

Marjorie PagsinuhinPagsinuhin, Marjorie A.

AUDSPI 10-11AM

46234 BSA 3 Ms. Leneilyn Poblete

Trial Balance Approach - Closing/Current Rate Method

asset & liab - closing rate income statement items - average

equity - date of transaction

retained earnings:

net income - average

dividends - date of transaction

In USD In PHP

Dr. Cr. Exchange Rate Dr. Cr.

Cash 1,116,000 40.25 44,919,000

Accounts Receivable 729,600 40.25 29,366,400

Inventory 996,000 40.25 40,089,000

Land 600,000 40.25 24,150,000

Buildings 780,000 40.25 31,395,000

Equipment 516,000 40.25 20,769,000

Accounts Payable 768,000 40.25 30,912,000

Short Term Notes Payable 762,000 40.25 30,670,500

Bonds Payable 1,080,000 40.25 43,470,000

Common stock, par P10 1,152,000 40.00 46,080,000

Paid-in capital in excess of par 360,000 40.00 14,400,000

Sales 3,624,000 40.20 145,684,800

Cost of Goods Sold 2,220,000 40.20 89,244,000

Depreciation Expense 120,000 40.20 4,824,000

Other Expenses 786,000 40.20 31,597,200

Income Tax Expense 98,400 40.20 3,955,680

Retained Earnings, Jan. 2 576,000 40.00 23,040,000

Dividends Declared, Sept. 1 360,000 40.10 14,436,000

Total 8,322,000 8,322,000 334,745,280 334,257,300

Translation Gain - OCI 487,980

TOTAL 8,322,000 8,322,000 334,745,280 334,745,280

Trial Balance Approach - Closing/Current Rate Method

Balance Sheet Items Income Statement Items

a. Monetary - Closing Rate Order of Priority:

b. Non-Monetary: 1. date of transaction

i. measured @HC - date of transaction 2. average rate (practicability)

ii. measured @FV - rate at date when FV was

determined

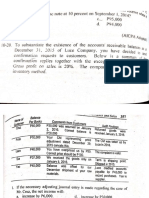

Assuming that the beginning balance of inventory is $900,000, then:

Schedule 1 USD Exchange Rate PHP

Inventory, beg. (assumed) 900,000 40.00 36,000,000

Purchases (squeezed) 2,316,000 40.20 93,103,200

Total Goods Available for Sale 3,216,000 129,103,200

Inventory, end 996,000 40.22 40,059,120

Cost of Goods Sold 2,220,000 89,044,080

In USD In PHP

Dr. Cr. Exchange Rate Dr. Cr.

Cash 1,116,000 40.25 44,919,000

Accounts Receivable 729,600 40.25 29,366,400

Inventory 996,000 40.25 40,089,000

Land 600,000 40.25 24,150,000

Buildings 780,000 40.25 31,395,000

Equipment 516,000 40.25 20,769,000

Accounts Payable 768,000 40.25 30,912,000

Short Term Notes Payable 762,000 40.25 30,670,500

Bonds Payable 1,080,000 40.25 43,470,000

Common stock, par P10 1,152,000 40.00 46,080,000

Paid-in capital in excess of par 360,000 40.00 14,400,000

Sales 3,624,000 40.20 145,684,800

Cost of Goods Sold 2,220,000 Schedule 1 89,044,080

Depreciation Expense 120,000 40.00 4,800,000

Other Expenses 786,000 40.20 31,597,200

Income Tax Expense 98,400 40.20 3,955,680

Retained Earnings, Jan. 2 576,000 40.00 23,040,000

Dividends Declared, Sept. 1 360,000 40.10 14,436,000

Total 8,322,000 8,322,000 334,521,360 334,257,300

Remeasurement Gain - OCI 264,060

TOTAL 8,322,000 8,322,000 334,521,360 334,521,360

You might also like

- Survey of Accounting 7th Edition Warren Test BankDocument27 pagesSurvey of Accounting 7th Edition Warren Test Bankdevinsmithddsfzmioybeqr100% (13)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Which of The Following Statements About The Average Wholesale Price A Company Charges Footwear Retailers in A Given Geographic Region Is IncorrectDocument7 pagesWhich of The Following Statements About The Average Wholesale Price A Company Charges Footwear Retailers in A Given Geographic Region Is IncorrectTrung HậuNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Test Bank - Chapter13 Relevant CostingDocument43 pagesTest Bank - Chapter13 Relevant CostingAiko E. Lara93% (14)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Profit and Loss Forecast v1.0Document4 pagesProfit and Loss Forecast v1.0Jessica AngelinaNo ratings yet

- Gestion Financière Exercices CorrigéDocument2 pagesGestion Financière Exercices CorrigéMohamed Taleb Boubacar100% (3)

- Information Technology Outsourcing Transactions: Process, Strategies, and ContractsFrom EverandInformation Technology Outsourcing Transactions: Process, Strategies, and ContractsNo ratings yet

- The Pursuit of New Product Development: The Business Development ProcessFrom EverandThe Pursuit of New Product Development: The Business Development ProcessNo ratings yet

- 88 Recurso Inominado Improcedência SocioeconomicaDocument17 pages88 Recurso Inominado Improcedência SocioeconomicaStara RegimanNo ratings yet

- ACA Audit and Assurance Professional: Exam Preparation KitFrom EverandACA Audit and Assurance Professional: Exam Preparation KitNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- Concentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpFrom EverandConcentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- Enabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesFrom EverandEnabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Sarbanes-Oxley Guide for Finance and Information Technology ProfessionalsFrom EverandSarbanes-Oxley Guide for Finance and Information Technology ProfessionalsNo ratings yet

- iCARE LTTContracts PDFDocument5 pagesiCARE LTTContracts PDFMarjorie PagsinuhinNo ratings yet

- Chapter 12 Testbank CapBud PDFDocument58 pagesChapter 12 Testbank CapBud PDFMarjorie PagsinuhinNo ratings yet

- iCARE Consignment PDFDocument3 pagesiCARE Consignment PDFMarjorie PagsinuhinNo ratings yet

- CPAR FringeDocument6 pagesCPAR FringeMarjorie PagsinuhinNo ratings yet

- RCC PDFDocument11 pagesRCC PDFMarjorie PagsinuhinNo ratings yet

- IACFMAS-ASSIGN MarjDocument4 pagesIACFMAS-ASSIGN MarjMarjorie PagsinuhinNo ratings yet

- Pagsinuhin, Marjorie Act. 3 AudSPIDocument2 pagesPagsinuhin, Marjorie Act. 3 AudSPIMarjorie PagsinuhinNo ratings yet

- Activity ReceivablesDocument6 pagesActivity ReceivablesMarjorie PagsinuhinNo ratings yet

- Dayag CH 10Document10 pagesDayag CH 10Marjorie PagsinuhinNo ratings yet

- Berk Prob AnswersDocument7 pagesBerk Prob AnswersMarjorie PagsinuhinNo ratings yet

- Audit Sampling PlanDocument2 pagesAudit Sampling PlanMarjorie PagsinuhinNo ratings yet

- ONLINE CHESS TOURNAMENT GuidelinesDocument1 pageONLINE CHESS TOURNAMENT GuidelinesMarjorie PagsinuhinNo ratings yet

- Pagsinuhin Reaction Paper - Dirty Money 46234Document2 pagesPagsinuhin Reaction Paper - Dirty Money 46234Marjorie PagsinuhinNo ratings yet

- This Is The New NormalDocument2 pagesThis Is The New NormalMarjorie PagsinuhinNo ratings yet

- I Modelli Per La Valutazione AziendaleDocument8 pagesI Modelli Per La Valutazione AziendaleandrespringNo ratings yet

- Dole Heart Fresh: Marketing PlanDocument54 pagesDole Heart Fresh: Marketing PlanMargaret LachoNo ratings yet

- RENTABILIDAD1Document10 pagesRENTABILIDAD1Balcázar Palomino MonyNo ratings yet

- CCIT PanchkulaDocument7 pagesCCIT PanchkulaNitin AgnihotriNo ratings yet

- Balance Sheet of Reliance Power LTDDocument6 pagesBalance Sheet of Reliance Power LTDbhus_meshNo ratings yet

- Product Disclosure Statement: Asb Kiwisaver SchemeDocument28 pagesProduct Disclosure Statement: Asb Kiwisaver SchemeMeNo ratings yet

- Accenture Mettle - QuantsDocument32 pagesAccenture Mettle - QuantsHarshithaNo ratings yet

- Palchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)Document19 pagesPalchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)SworajNo ratings yet

- Employee Tax Calculation ReportDocument10 pagesEmployee Tax Calculation ReportFawazilHamdalahNo ratings yet

- Income Tax - Chap 06Document2 pagesIncome Tax - Chap 06ZainioNo ratings yet

- DEPRECIACIONDocument3 pagesDEPRECIACIONDavid MendezNo ratings yet

- Ch.4 NotesDocument43 pagesCh.4 Notes張浩謙 CHEUNG HO HIM 5A06No ratings yet

- Intercompany Inventory Transactions: Mcgraw-Hill/IrwinDocument123 pagesIntercompany Inventory Transactions: Mcgraw-Hill/IrwinsresaNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklMelati SepsaNo ratings yet

- Test Bank SCFDocument114 pagesTest Bank SCFAnnabelle RafolsNo ratings yet

- Boletas de Pago CahuayaDocument73 pagesBoletas de Pago CahuayaAnonymous JoXVo7wNo ratings yet

- Inbound 1400148020110951276Document3 pagesInbound 1400148020110951276MarielleNo ratings yet

- SALAIREDocument8 pagesSALAIREvision cybercafeNo ratings yet

- MODULE 3-Short Problems (2.0)Document4 pagesMODULE 3-Short Problems (2.0)asdasdaNo ratings yet

- CA Inter Taxation A MTP 2 May 23Document13 pagesCA Inter Taxation A MTP 2 May 23olivegreen52No ratings yet

- Financial Statements and Cash Flow: Mcgraw-Hill/IrwinDocument37 pagesFinancial Statements and Cash Flow: Mcgraw-Hill/IrwinMUHAMMAD IHZA MAHENDRANo ratings yet

- Foundation Course - I: 1 Year B.SC.Document5 pagesFoundation Course - I: 1 Year B.SC.shanmukh kumar 2001No ratings yet

- Prefactura 62070853Document1 pagePrefactura 62070853Biosoty Duràn CòrdobaNo ratings yet

- Avis D Impot 2023 Sur Les Revenus 2022Document3 pagesAvis D Impot 2023 Sur Les Revenus 2022mokranehanane34No ratings yet

- MacroeconomiaDocument4 pagesMacroeconomiaNANDONo ratings yet