Professional Documents

Culture Documents

CH 05B (Empty)

Uploaded by

Riley CareOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 05B (Empty)

Uploaded by

Riley CareCopyright:

Available Formats

Managerial Accounting - Prof.

Beg Free work cells

Chapter 5: ABC Answer cells

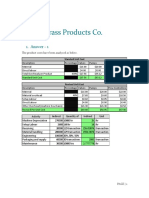

Quinnipiac Padfolio Club makes two products (Padfolios and Business Cards) for students to use during interview season. The company has two

production departments (Forming and Assembly) and operates at capacity. The controller has asked you to compare plant-wide, department, and

activity- based cost allocation.

Direct Material and Direct Labor is incurred in both production departments (Forming & Assembly) and is directly traced to the two product lines

(Padfolios & Business Cards). There are also two types of overhead (Setup & Supervision) incurred in the departments. Overhead costs need to be

allocated to the two product lines so the Quinnipiac Padfolio Club can calculate the costs of each product line.

Budgeted information for the year ended December 31, 2017 is as follows:

Forming Department Padfolios Business Cards Total

Direct Materials $ 25,000 $ 24,000 $ 49,000

Direct Manufacturing Labor $ 41,000 $ 17,000 $ 58,000

Overhead Costs

Setup $ 22,500

Supervision $ 20,500

Assembly Department Padfolios Business Cards Total

Direct Materials $ 4,500 $ 20,000 $ 24,500

Direct Manufacturing Labor $ 17,500 $ 22,000 $ 39,500

Overhead Costs

Setup $ 50,000

Supervision $ 24,000

Other information about the departments' activities follows:

Setup costs in each department vary with the number of batches processed in each department. The budgeted number of batches for each product

line in each department is as follows:

Setup Batches Padfolios Business Cards Total

Forming Department 28 120 148

Assembly Department 43 90 133

Supervision Costs: Vary with direct manufacturing labor costs in each department.

Calculate the total budgeted cost of each product line (Padfolios vs. Business Cards) based on a single plant-wide overhead rate,

1 if total overhead is allocated based on total direct costs.

(Direct costs should be traced to the products as identified above. Indirect costs should be allocated to the products based on a

single overhead allocation rate.)

Budgeted OH Pool OH Pool Amount Alloc Base Allocation Rate Alloc Base

Overhead Rate Description Amount Description

OH Rate 1 $ 0.6842

Total Costs Assigned Padfolios Business Cards Total

Direct Materials $ 25,000 $ 24,000 $ 49,000

Direct Manufacturing Materials $ 41,000 $ 17,000 $ 58,000

$ 4,500 $ 20,000 $ 24,500

642222859.xlsx_x000D_19:59:12 02/01/2023 Page 1 of 3

Managerial Accounting - Prof. Beg Free work cells

Chapter 5: ABC Answer cells

$ 17,500 $ 22,000 $ 39,500

Total Direct Costs $ 88,000 $ 83,000 $ 171,000

setup

supervision

Total Overhead Costs $ 60,211 $ 56,789 $ 117,000

Total Manufacturing Costs $ 148,211 $ 139,789 $ 288,000

Calculate the budgeted cost of each product line (Padfolios vs. Business Cards) based on departmental overhead rates, where:

2 (a) Forming department overhead costs are allocated based on direct manufacturing labor costs of the forming department, and

(b) Assembly department overhead costs are allocated based on total direct costs of the assembly department.

(Direct costs should be traced to the products as identified above. Indirect costs should be allocated to the products based on

two overhead allocation rates -- one for each department.)

Budgeted OH Pool Alloc Base Alloc Base

Overhead Rate Description OH Pool Amount Amount Allocation Rate Description

OH Rate 1 $ 0.7414

OH Rate 2 $ 1.1563

Total Costs Assigned Padfolios Business Cards Total

$ 29,500 $ 24,000

$ 58,500

Total Direct Costs $ 88,000 $ 83,000 $ 171,000

$ 30,397 $ 12,603

$ 25,438 $ 48,563

Total Overhead Costs $ 55,834 $ 61,166 $ 117,000

Total Manufacturing Costs $ 143,834 $ 144,166 $ 288,000

Calculate the budgeted cost of each product line (Padfolios vs. Business Cards) if Quinnipiac Padfolio Club allocates overhead

3 costs in each department using activity-based costing. (i.e. Each type of overhead in each department is allocated using the

relevant activity in the department.)

(Direct costs should be traced to the products as identified above. Indirect costs should be allocated to the products based on

four overhead allocation rates -- one for each activity.)

Budgeted OH Pool Alloc Base Alloc Base

Overhead Rate Description OH Pool Amount Amount Allocation Rate Description

OH Rate 1 $ 152.0270

OH Rate 2 $ 0.3534

OH Rate 3 $ 375.9398

OH Rate 4 $ 0.6076

642222859.xlsx_x000D_19:59:12 02/01/2023 Page 2 of 3

Managerial Accounting - Prof. Beg Free work cells

Chapter 5: ABC Answer cells

Total Costs Assigned Padfolios Business Cards Total

Total Direct Costs $ 88,000 $ 83,000 $ 171,000

$ 4,257 $ 18,243

$ 14,491 $ 6,009

$ 16,165 $ 33,835

$ 10,633 $ 13,367

Total Overhead Costs $ 45,546 $ 71,454 $ 117,000

Total Manufacturing Costs $ 133,546 $ 154,454 $ 288,000

642222859.xlsx_x000D_19:59:12 02/01/2023 Page 3 of 3

You might also like

- Business Environment Q & ADocument16 pagesBusiness Environment Q & ASadaf NazneenNo ratings yet

- Sports Illustrated - 2021.11Document108 pagesSports Illustrated - 2021.11Epi SidaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 2022 Schedule 3 (Form 1040)Document2 pages2022 Schedule 3 (Form 1040)Riley CareNo ratings yet

- 416E, 422E and 428E Backhoe Loader Hydraulic System: Fluid Power SymbolsDocument2 pages416E, 422E and 428E Backhoe Loader Hydraulic System: Fluid Power SymbolsJorge Mendoza100% (2)

- Natural Gas StudyDocument104 pagesNatural Gas StudyaakashtrivediNo ratings yet

- Glencoe Life Science2Document93 pagesGlencoe Life Science2Cosmina MariaNo ratings yet

- HTM 05-03 Part F FinalDocument20 pagesHTM 05-03 Part F FinalRashidNo ratings yet

- DLL SubstanceDocument3 pagesDLL SubstanceReign Honrado100% (1)

- Quiz Infection Prevention and Control MDocument3 pagesQuiz Infection Prevention and Control MGareth McKnight0% (1)

- Managerial Accounting 9th Edition Crosson Solutions ManualDocument39 pagesManagerial Accounting 9th Edition Crosson Solutions ManualKennethSparkskqgmrNo ratings yet

- Input Form: Input For Venture Guidance AppraisalDocument7 pagesInput Form: Input For Venture Guidance AppraisalgenergiaNo ratings yet

- Wcdma Kpi Optimization: Presented by Ahmed AzizDocument64 pagesWcdma Kpi Optimization: Presented by Ahmed AzizCesar Ivan Alvear Vega100% (5)

- BRM Group 10 - PaezDocument13 pagesBRM Group 10 - Paezpriyam dixitNo ratings yet

- Plantwide, Department, and ABC Indirect Cost Rates.: ProblemDocument4 pagesPlantwide, Department, and ABC Indirect Cost Rates.: ProblemPappy TresNo ratings yet

- CH 05B (Empty)Document3 pagesCH 05B (Empty)Riley CareNo ratings yet

- Pma Test 1 2022Document6 pagesPma Test 1 2022Janielle LambertNo ratings yet

- Soal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DDocument4 pagesSoal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DSarah Dzuriyati SamiyahNo ratings yet

- Exam 2 ReviewDocument18 pagesExam 2 ReviewBrad MellerNo ratings yet

- Example-2 With SolutionDocument4 pagesExample-2 With SolutionDeepNo ratings yet

- Project 1 vxm0001 Attempt 2019 05 23 23 51 19 P1Martin 40Document2 pagesProject 1 vxm0001 Attempt 2019 05 23 23 51 19 P1Martin 40Faheem ManzoorNo ratings yet

- Chapter 5Document9 pagesChapter 5Dishantely SamboNo ratings yet

- Practice Questions - SolDocument8 pagesPractice Questions - SolNicholas LeeNo ratings yet

- No.4-22-23 Page 139Document4 pagesNo.4-22-23 Page 139Nemalai VitalNo ratings yet

- Chap 4 Job CostingDocument9 pagesChap 4 Job CostingWadiah AkbarNo ratings yet

- Solutions-Chapter 6Document4 pagesSolutions-Chapter 6Saurabh SinghNo ratings yet

- CH 1 Pre-Assignment PracticeDocument6 pagesCH 1 Pre-Assignment PracticeFaizan Bashir SidhuNo ratings yet

- Problems: AF102 Additional Tutorial - S2 2017Document4 pagesProblems: AF102 Additional Tutorial - S2 2017Yashaal ChandNo ratings yet

- 7Document101 pages7Navindra JaggernauthNo ratings yet

- Fundamentals of Product and Service CostingDocument28 pagesFundamentals of Product and Service CostingPetronella AyuNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- Accy 211 - Week 7 Tut HWDocument1 pageAccy 211 - Week 7 Tut HWIsaac ElhageNo ratings yet

- Economic Feasibility Workbook: Created By: Date Created: August 27, 2021 Purpose: WorksheetsDocument9 pagesEconomic Feasibility Workbook: Created By: Date Created: August 27, 2021 Purpose: WorksheetsAashutosh ChandraNo ratings yet

- Management Accounting Part5Document20 pagesManagement Accounting Part5Trần Doãn HuyNo ratings yet

- Chapter 5 ABC System For StudentsDocument14 pagesChapter 5 ABC System For StudentsNour Al Kaddah100% (1)

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainNo ratings yet

- Accounting Project Segment 3Document2 pagesAccounting Project Segment 3Zach James LebreiroNo ratings yet

- P1NGUYENDocument2 pagesP1NGUYENFaheem ManzoorNo ratings yet

- Ma PHD01003 Harshad Savant Term2 EndtermDocument8 pagesMa PHD01003 Harshad Savant Term2 EndtermHarshad SavantNo ratings yet

- Cost of Goods ManufacturedDocument26 pagesCost of Goods ManufacturedAb.Rahman AfghanNo ratings yet

- Garrison 8 Ex 5-20, PR 5-25Document17 pagesGarrison 8 Ex 5-20, PR 5-25Shalini VeluNo ratings yet

- Actg 1Document12 pagesActg 1oconn1No ratings yet

- (SOAL) Soal Kuis Pararel ABDocument6 pages(SOAL) Soal Kuis Pararel ABAris KurniawanNo ratings yet

- Group 7 Tutorial AnswersDocument27 pagesGroup 7 Tutorial AnswersKwang Yi Juin0% (1)

- KimmelWaterways Problems StatementsDocument10 pagesKimmelWaterways Problems StatementsKRISHAN SINGHNo ratings yet

- Coverage of Learning ObjectivesDocument55 pagesCoverage of Learning ObjectivesReyansh SharmaNo ratings yet

- Destin Brass Products Co.: 1. Answer - 1Document5 pagesDestin Brass Products Co.: 1. Answer - 1Chetan DasguptaNo ratings yet

- Coverage of Learning ObjectivesDocument55 pagesCoverage of Learning ObjectivesRaam Tha BossNo ratings yet

- Tutorial 1 - SolutionsDocument14 pagesTutorial 1 - SolutionsLijing CheNo ratings yet

- Assignment On CH 3 and 4 Cost 2Document4 pagesAssignment On CH 3 and 4 Cost 2sadiya AbrahimNo ratings yet

- Lesson No 5 (Process Costing)Document8 pagesLesson No 5 (Process Costing)Arun kumarNo ratings yet

- BondsDocument119 pagesBondssai krishnaNo ratings yet

- Bergerac Systems: The Challenge of Backward IntegrationDocument8 pagesBergerac Systems: The Challenge of Backward IntegrationSujith KumarNo ratings yet

- ABC Class QuestionDocument2 pagesABC Class QuestionNouman SheikhNo ratings yet

- Core2 - English - Dashboard - Assessment ReviewDocument130 pagesCore2 - English - Dashboard - Assessment Reviewpawand347No ratings yet

- ManAc Midterms Chuckie ChukieDocument2 pagesManAc Midterms Chuckie ChukieVAUGHN MARTINEZNo ratings yet

- PROBLEM 4 (Evaluation of Performance) : TotalDocument3 pagesPROBLEM 4 (Evaluation of Performance) : TotalArt IslandNo ratings yet

- Group 12 - Wilkerson Company - Case SubmissionDocument3 pagesGroup 12 - Wilkerson Company - Case SubmissionAKANKSHA KUMARINo ratings yet

- Do Homework - Chapter #5Document1 pageDo Homework - Chapter #5rajkanwwar2004No ratings yet

- Job CostingDocument24 pagesJob CostingElaine YapNo ratings yet

- Case Study - ABC CostingDocument3 pagesCase Study - ABC CostingDaiannaNo ratings yet

- Wilkerson Company - Class PracticeDocument5 pagesWilkerson Company - Class PracticeYAKSH DODIANo ratings yet

- Chapter 5 - A2, B1, & 59Document5 pagesChapter 5 - A2, B1, & 59詹鎮豪No ratings yet

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocument4 pagesFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNo ratings yet

- Faithjames Servano - SA No. 4 - Chapter 3 Job Order CostingDocument1 pageFaithjames Servano - SA No. 4 - Chapter 3 Job Order CostingFaith James ServanoNo ratings yet

- Acct602 Managerial AccountingDocument8 pagesAcct602 Managerial AccountingHaroon KhurshidNo ratings yet

- Soal Akuntansi ManajemenDocument7 pagesSoal Akuntansi ManajemenInten RosmalinaNo ratings yet

- MODULE 6 Mid-Term Exam Review Exercises ANSWER KEYDocument7 pagesMODULE 6 Mid-Term Exam Review Exercises ANSWER KEYpratibhaNo ratings yet

- CH9 Excel Analytics - Student - Form FinalDocument9 pagesCH9 Excel Analytics - Student - Form FinalruwanthiNo ratings yet

- Accounting Project Segment 4Document3 pagesAccounting Project Segment 4Zach James LebreiroNo ratings yet

- Q3Document11 pagesQ3anik022No ratings yet

- Data Analysis TemplateDocument3 pagesData Analysis TemplateRiley CareNo ratings yet

- CH 07B (Empty)Document4 pagesCH 07B (Empty)Riley CareNo ratings yet

- CH 08A (Empty)Document6 pagesCH 08A (Empty)Riley CareNo ratings yet

- CH 17A (Empty)Document5 pagesCH 17A (Empty)Riley CareNo ratings yet

- 2022 Draft Schedule 1Document3 pages2022 Draft Schedule 1Riley CareNo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- Scheme - I Sample Question Paper: Program Name: Diploma in Plastic EngineeringDocument4 pagesScheme - I Sample Question Paper: Program Name: Diploma in Plastic EngineeringAmit GhadeNo ratings yet

- Gear RatiosDocument2 pagesGear RatiosNagu SriramaNo ratings yet

- Why Am I A Living HeroDocument10 pagesWhy Am I A Living Herojf_dee24No ratings yet

- The Egyptian Intelligence Service (A History of The Mukhabarat, 1910-2009) - (2010, Routledge) (10.4324 - 9780203854549) - Libgen - LiDocument284 pagesThe Egyptian Intelligence Service (A History of The Mukhabarat, 1910-2009) - (2010, Routledge) (10.4324 - 9780203854549) - Libgen - LiMehmet ŞencanNo ratings yet

- Padron Femer Julio 2018Document229 pagesPadron Femer Julio 2018Álvaro EscobarNo ratings yet

- I N T e L L I G e N C e B U R e A U MS Word FileDocument175 pagesI N T e L L I G e N C e B U R e A U MS Word FileHashmat Ali AbbasiNo ratings yet

- 1st Fraserburgh Boys' Brigade: World War One 1914-19Document31 pages1st Fraserburgh Boys' Brigade: World War One 1914-19Michael Strachan100% (1)

- tv1 MagDocument6 pagestv1 MagKim SindahlNo ratings yet

- OCTG & PIPELINE Coatings Brochure PDFDocument41 pagesOCTG & PIPELINE Coatings Brochure PDFfelipe castellanosNo ratings yet

- Stormbrixx - Fisa TehnicaDocument108 pagesStormbrixx - Fisa Tehnicamureseanu_deliaNo ratings yet

- Dissertation Examples University of GlasgowDocument7 pagesDissertation Examples University of GlasgowBuyPsychologyPapersRanchoCucamonga100% (1)

- EPJ Web of Conferences - 170 X 250 MM Paper Size, One Column FormatDocument4 pagesEPJ Web of Conferences - 170 X 250 MM Paper Size, One Column FormatLaura ParkaNo ratings yet

- Preparation of Chalcones: Experiment 4Document4 pagesPreparation of Chalcones: Experiment 4Victor SimonNo ratings yet

- Reference Only: I Pus Pond StreetDocument132 pagesReference Only: I Pus Pond StreetJagdish ShindeNo ratings yet

- Produced Water Desalination Using High Temperature MembranesDocument8 pagesProduced Water Desalination Using High Temperature MembranesMOH AMANNo ratings yet

- Tri Review Turbidity Fact Sheet 01-08-15Document2 pagesTri Review Turbidity Fact Sheet 01-08-15Shyla Fave EnguitoNo ratings yet

- Allama Iqbal Open University, Islamabad (Assignment#2)Document12 pagesAllama Iqbal Open University, Islamabad (Assignment#2)ahsanNo ratings yet

- Rebuilding The Base: How Al-Qaida Could ResurgeDocument13 pagesRebuilding The Base: How Al-Qaida Could ResurgeguiludwigNo ratings yet

- Jawaban End PDFDocument8 pagesJawaban End PDFAwan SwargaNo ratings yet

- LP Unsung Heroes PDFDocument3 pagesLP Unsung Heroes PDFzfmf025366No ratings yet