Professional Documents

Culture Documents

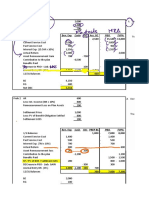

TAX2

Uploaded by

Elaine Joyce Garcia0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageTAX2

Uploaded by

Elaine Joyce GarciaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

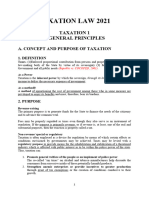

3 Inherent Powers of a State:

1) Power to Tax

2) Police Power

3) Power of Eminent Domain

The Power to Tax

Subject to inherent and constitutional limitations, the power of taxation is regarded as supreme,

plenary, unlimited, and comprehensive.1 As long as the legislature, in imposing a tax, does not

violate applicable constitutional limitations or restrictions, the courts have no concern with the

wisdom or policy of the exaction, the political or other collateral motives behind it, the amount to be

raised, or the persons, property, or other privileges to be taxed. 2

Police Power

Police power is the inherent power of a sovereign state to legislate for the protection of the health,

general welfare, safety, and morals of the public. It involves the power to regulate both liberty and

property for the promotion of the public good.

Note: The police power of the State may be exercised through taxation because taxes may be levied

for the promotion of the welfare of the public. 3

Power of Eminent Domain

The power of eminent domain is the inherent power of a sovereign state to take private property for

a public purpose. The Constitution limits the exercise of this power by providing that: “Private

property shall not be taken for public use without just compensation.” 4 Taxation covers three (3)

separate areas or aspects of government activity, namely:

1. Levying or imposition of the tax. This involves the passage of tax laws which is generally a

legislative act. In the Philippines, the taxing power is exercised by Congress.

2. Assessment. The process of determining the correct amount of tax due.

3. Collection and payment – the act of compliance with the tax law by the taxpayer.

Executive or administrative in nature. Done by the Bureau of Internal Revenue (“BIR”)

You might also like

- 3 Inherent Powers of The StateDocument12 pages3 Inherent Powers of The StateMarilou Gutierrez98% (42)

- Basic Principles of Taxation-1Document82 pagesBasic Principles of Taxation-1Abby Gail Tiongson83% (6)

- Income TaxationDocument10 pagesIncome TaxationRocel Domingo100% (1)

- 3 Inherent Powers of The StateDocument12 pages3 Inherent Powers of The StateRusty Nomad100% (1)

- General Principles of Taxation and Income TaxationDocument79 pagesGeneral Principles of Taxation and Income TaxationJoeban R. Paza100% (2)

- Financial Management Chapters 1 4 CabreraDocument22 pagesFinancial Management Chapters 1 4 CabreraElaine Joyce GarciaNo ratings yet

- Module 1 Lecture TAXationDocument7 pagesModule 1 Lecture TAXationJagi KimNo ratings yet

- Module No. 1 General Principles of Taxation (Inherent Powers of Sovereign State)Document2 pagesModule No. 1 General Principles of Taxation (Inherent Powers of Sovereign State)Yuki BarracaNo ratings yet

- Income TaxDocument40 pagesIncome TaxRomero, Rose Ann N.No ratings yet

- 1aabseatwork No. 1Document3 pages1aabseatwork No. 1Clare Matugas VallespinNo ratings yet

- TAX-General ConceptsDocument41 pagesTAX-General ConceptsJohn Lloyd GalloNo ratings yet

- Cases Studies and PowersDocument9 pagesCases Studies and PowersFeyre LunaNo ratings yet

- Module 1 General Principles of Taxation 01.1822.2024Document27 pagesModule 1 General Principles of Taxation 01.1822.2024charismae.silvelaNo ratings yet

- Reviewer in TaxationDocument19 pagesReviewer in TaxationMarco ComboyaNo ratings yet

- Unit 1 - General Principles of TaxationDocument12 pagesUnit 1 - General Principles of TaxationJoseph Anthony RomeroNo ratings yet

- Tax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersDocument10 pagesTax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersCracker Oats83% (6)

- Prelim TaxationDocument8 pagesPrelim TaxationJocel Añasco LabiosNo ratings yet

- General Principles and Concepts of TaxationDocument8 pagesGeneral Principles and Concepts of TaxationHERNANDO REYESNo ratings yet

- Introduction To TaxationDocument9 pagesIntroduction To TaxationMaica Jarie RiguaNo ratings yet

- Powers of The GovernmentDocument11 pagesPowers of The Governmentraulskie17No ratings yet

- General Principles of Taxation Part 1Document13 pagesGeneral Principles of Taxation Part 1Claudemir AriasNo ratings yet

- Nature of TaxationDocument40 pagesNature of TaxationSim BelsondraNo ratings yet

- Police Power NotesDocument4 pagesPolice Power NotesCMLNo ratings yet

- Fundamental Powers of The StateDocument3 pagesFundamental Powers of The StateKristine ReyesNo ratings yet

- Taxation 1 Lesson 1. Basic Concepts and Characteristics of TaxationDocument43 pagesTaxation 1 Lesson 1. Basic Concepts and Characteristics of Taxationjane quiambao100% (1)

- FS2122-INCOMETAX-01A: BSA 1202 Atty. F. R. SorianoDocument7 pagesFS2122-INCOMETAX-01A: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- 01 Introduction To Taxation - BigskyDocument6 pages01 Introduction To Taxation - BigskyAbigail Espiritu SantoNo ratings yet

- Taxation Week 1Document8 pagesTaxation Week 1JUAN GABONNo ratings yet

- RS Political Law LMTsDocument22 pagesRS Political Law LMTsMaurice Bryan RoslindaNo ratings yet

- 3 Inherent Powers of The State PDFDocument12 pages3 Inherent Powers of The State PDFFRANCO, Monique P.No ratings yet

- Income Tax Week 1Document16 pagesIncome Tax Week 1peter banjaoNo ratings yet

- CLJ 3 Madadagdagan PaDocument4 pagesCLJ 3 Madadagdagan PaMark Christian GalvezNo ratings yet

- Introduction of TaxationDocument3 pagesIntroduction of TaxationKristine LuarcaNo ratings yet

- 2018 Siosan Tax NotesDocument203 pages2018 Siosan Tax NotesAC PalmaresNo ratings yet

- Lecture Guide Notes: Guide Notes: Taxation I General Principles of Taxation Taxation: An Inherent Power of The StateDocument65 pagesLecture Guide Notes: Guide Notes: Taxation I General Principles of Taxation Taxation: An Inherent Power of The StateKristian ArdoñaNo ratings yet

- Fundamental of Principle of TaxationDocument13 pagesFundamental of Principle of TaxationLilian FredelucesNo ratings yet

- Chapter 1 - General Principles and Concepts of TaxationDocument13 pagesChapter 1 - General Principles and Concepts of Taxationchesca marie penarandaNo ratings yet

- General Principles and Concepts of TaxationDocument10 pagesGeneral Principles and Concepts of TaxationNekki Mae Guinto Dela CernaNo ratings yet

- Taxation+Law BedaDocument127 pagesTaxation+Law BedaAnthony Rupac EscasinasNo ratings yet

- Anabo, Ivan G. (Incotax)Document31 pagesAnabo, Ivan G. (Incotax)Ivan AnaboNo ratings yet

- Income Taxation ReviewerDocument84 pagesIncome Taxation ReviewerCharmaine Mejia100% (1)

- Income Taxation: Elline PasionDocument22 pagesIncome Taxation: Elline PasionMarvin OrdinesNo ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- Tax NotesDocument8 pagesTax NotesChristian Paul PinoteNo ratings yet

- Lecture Guide Notes: Atty. Lyndon A. Maceren, MBA CPA REBDocument55 pagesLecture Guide Notes: Atty. Lyndon A. Maceren, MBA CPA REBKristian ArdoñaNo ratings yet

- Accounting ModuleDocument104 pagesAccounting ModuleMa Fe PunzalanNo ratings yet

- What Are The Inherent Limitations of The Power To Tax? Explain EachDocument5 pagesWhat Are The Inherent Limitations of The Power To Tax? Explain EachAbegail PanangNo ratings yet

- What Do You Mean by Inherent?: Leunamme Gayle M. JaulaDocument5 pagesWhat Do You Mean by Inherent?: Leunamme Gayle M. JaulaLgayLecage TiieeNo ratings yet

- Income TaxationDocument5 pagesIncome TaxationRhea Mae CarantoNo ratings yet

- The Fundamental Powers of The StateDocument12 pagesThe Fundamental Powers of The Statedaphnie lorraine ramosNo ratings yet

- Business Law and Taxation With Laws Affecting MSMEs Week 02 Hand-OutDocument18 pagesBusiness Law and Taxation With Laws Affecting MSMEs Week 02 Hand-OutJohn Mar GaminoNo ratings yet

- Police Power: Inherent PowersDocument4 pagesPolice Power: Inherent PowersBhie TotzNo ratings yet

- Bsa 1202 - Chapter 1 8Document58 pagesBsa 1202 - Chapter 1 8Fritz ReyesNo ratings yet

- BBE Lawyers Notes Taxation LawDocument215 pagesBBE Lawyers Notes Taxation LawYoo PawNo ratings yet

- Summary - January 17, 2018Document4 pagesSummary - January 17, 2018Ken PioNo ratings yet

- Principles of TaxationDocument13 pagesPrinciples of TaxationHazel OrtegaNo ratings yet

- TAXATION General PrinciplesDocument26 pagesTAXATION General PrinciplesMarie Mendoza100% (1)

- Neral Principles of Taxation PDFDocument10 pagesNeral Principles of Taxation PDFKaren Joy MagsayoNo ratings yet

- General PrinciplesDocument10 pagesGeneral PrinciplesNoroNo ratings yet

- A Layman’s Guide to The Right to Information Act, 2005From EverandA Layman’s Guide to The Right to Information Act, 2005Rating: 4 out of 5 stars4/5 (1)

- ICARE-AFAR-Part 1 - EncryptedDocument6 pagesICARE-AFAR-Part 1 - EncryptedElaine Joyce GarciaNo ratings yet

- Leases SolManDocument15 pagesLeases SolManElaine Joyce GarciaNo ratings yet

- P1 3705Document5 pagesP1 3705Elaine Joyce GarciaNo ratings yet

- Consultation-7 28Document11 pagesConsultation-7 28Elaine Joyce GarciaNo ratings yet

- Corp Liq Part IIDocument6 pagesCorp Liq Part IIElaine Joyce GarciaNo ratings yet

- RFBT03-10 - Law On Sales - Supplemental NotesDocument7 pagesRFBT03-10 - Law On Sales - Supplemental NotesElaine Joyce GarciaNo ratings yet

- Excel Discussion in Define Benefit PlanDocument5 pagesExcel Discussion in Define Benefit PlanElaine Joyce GarciaNo ratings yet

- RFBT03-12 - Law On Partnership - For Discussion - Part OneDocument8 pagesRFBT03-12 - Law On Partnership - For Discussion - Part OneElaine Joyce GarciaNo ratings yet

- RFBT03-11 - Law On Sales - Supplemental QuizzerDocument7 pagesRFBT03-11 - Law On Sales - Supplemental QuizzerElaine Joyce GarciaNo ratings yet

- Discontinued Operations, Segment and Interim Reporting, Biological AssetsDocument5 pagesDiscontinued Operations, Segment and Interim Reporting, Biological AssetsElaine Joyce GarciaNo ratings yet

- LTCCDocument35 pagesLTCCElaine Joyce GarciaNo ratings yet

- RFBT03-13 - Law On Partnership - For Discussion - Part TwoDocument10 pagesRFBT03-13 - Law On Partnership - For Discussion - Part TwoElaine Joyce GarciaNo ratings yet

- TAX5Document1 pageTAX5Elaine Joyce GarciaNo ratings yet

- RFBT03-07 - Law On Pledge, Mortgage and AntichresisDocument36 pagesRFBT03-07 - Law On Pledge, Mortgage and AntichresisElaine Joyce GarciaNo ratings yet

- RFBT03-18a - Negotiable Instruments Law - For DiscussionDocument10 pagesRFBT03-18a - Negotiable Instruments Law - For DiscussionElaine Joyce GarciaNo ratings yet

- 19 ArtDocument2 pages19 ArtElaine Joyce GarciaNo ratings yet

- TAX3Document1 pageTAX3Elaine Joyce GarciaNo ratings yet

- TAX2Document1 pageTAX2Elaine Joyce GarciaNo ratings yet

- TAX4Document1 pageTAX4Elaine Joyce GarciaNo ratings yet

- Script Art AppDocument3 pagesScript Art AppElaine Joyce GarciaNo ratings yet

- SPOLIARIUMDocument1 pageSPOLIARIUMElaine Joyce GarciaNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Process Costing QuizDocument8 pagesProcess Costing QuizElaine Joyce GarciaNo ratings yet

- Cup 3 AFAR 1Document9 pagesCup 3 AFAR 1Elaine Joyce GarciaNo ratings yet

- Absorption and Variable Costing Quiz and SolutionsDocument11 pagesAbsorption and Variable Costing Quiz and SolutionsElaine Joyce GarciaNo ratings yet

- CVP Analysis Quiz and SolutionDocument18 pagesCVP Analysis Quiz and SolutionElaine Joyce GarciaNo ratings yet

- Job Order Costing Quiz AnswerDocument7 pagesJob Order Costing Quiz AnswerElaine Joyce GarciaNo ratings yet

- Cost Acctg Cycle Activity AnswerDocument2 pagesCost Acctg Cycle Activity AnswerElaine Joyce GarciaNo ratings yet

- Cost Behavior AnswerDocument3 pagesCost Behavior AnswerElaine Joyce GarciaNo ratings yet