Professional Documents

Culture Documents

Discontinued Operations, Segment and Interim Reporting, Biological Assets

Uploaded by

Elaine Joyce Garcia0 ratings0% found this document useful (0 votes)

12 views5 pagesOriginal Title

Discontinued Operations, Segment and interim reporting, Biological Assets

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views5 pagesDiscontinued Operations, Segment and Interim Reporting, Biological Assets

Uploaded by

Elaine Joyce GarciaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

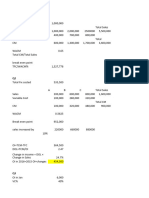

#4 Total 2021 Revenue (50M + 7M) 57,000,000

Less: Total 2021 Expenses (30M + 10M) 40,000,000

Termination benefits 2,000,000 42,000,000

Net amount 15,000,000

Less: Impairment loss (36M - 40M) 4,000,000

Pretax loss on disposal of assets 5,000,000 9,000,000

Pretax income from discontinued operation 6,000,000

Less: Tax expense (25% x 6M) 1,500,000

Income from disontinued operation (net of tax) 4,500,000 B

#5 Total 2021 Revenue (1.5M + 700K) 2,200,000

Less: Total 2021 Expenses (2M + 900K)) 2,900,000

Severance and relocation 100,000 3,000,000

Net amount -800,000

Less: Impairment loss (1.8M - 2M) 200,000

Pretax income from discontinued operation -1,000,000 A

#6 Total 2021 Revenue 23,000

Less: Cost of goods sold 14,000

Gross profit 9,000

Less: Other expenses 17,000

Operating profit -8,000

Less: Gain on disposal of assets 15,000

Pretax income from discontinued operation 7,000

Less: Tax expense (25% x 7,000) 1,750

Income from disontinued operation (net of tax) 5,250 D

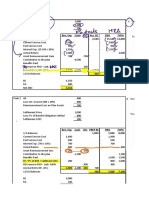

#4 Segment Sales Ratio

1 10,000,000 16.67%

2 20,000,000 33.33%

3 30,000,000 50.00%

60,000,000

Segment 1 Sales 10,000,000

Less: Segment 1 Expenses 4,000,000

Net profit before common cost 6,000,000

Less: Allocated common cost (9M x 16.67%) 1,500,000

Net operating profit 4,500,000 A

#6 Segment Sales Ratio

STEEL 5,000,000 41.67%

GARMENTS 4,000,000 33.33%

RETAIL 3,000,000 25.00%

12,000,000

RETAIL Segment Sales 3,000,000

Less: Traceable Expenses 1,500,000

Net profit before common cost 1,500,000

Less: Allocated common cost

Indirect expenses (2M x 25%) 500,000

Interest expense (500k x 25%) 125,000

Income tax (400k x 25%) 100,000 725,000

Net profit after common cost 775,000 A

#7 Sales 5,000,000

COGS -3,000,000

Selling expense incurred -250,000

Allocated depreciation (1.2M / 4) -300,000

Allocated real property tax expense (600k / 4) -150,000

Temporary inventory loss fully recognized -400,000

2nd Quarter Net Income 900,000.00 B

#8 Loss from hurricane (fully recognized) 500,000

Allocated insurance expense (400k / 4) 100,000

First Quarter Expenses 600,000 C

#9 Unadjusted 3rd Quarter Net Income 4,000,000

Allocated gain from 2nd Quarter (1.2M / 3) -400,000

Change in accounting policy (should be RE adj.) 200,000

Allocated 4th Quarter loss (600k / 2) -300,000

Should be allocated year-end bonus (2M / 4) -500,000

Adjusted 3rd Quarter Net Income 3,000,000 A

#10 1st Q (20M x 5%) 1,000,000

2nd Q (15M x 5%) 750,000

3rd Q (25M x 5%) 1,250,000

Total for 3 Quarters 3,000,000

Total computed bad debts expense for the year 4,500,000

Less: Interim total bad debts expense for 3 quarters 3,000,000

4th Quarter bad debts expense 1,500,000 B

#1 FV less cost to sell at date of purchase 1,650,000

Less: Purchase price 1,500,000

Gain on FV change 150,000 1. A

Increase in FV 400,000

Decrease in FV -50,000

FV of newborn BA 200,000

Net gain from change in FV of BA 550,000 2. B

CA on 1/1/22 1,650,000

Add: Net Gain from change in FV 550,000

CA on 12/31/22 2,200,000 3. C

FV less cost to sell of AP at the point of harvest 100,000 4. C

#3 10 Dairy Cattle 2 yo 400,000

20 Hogs 3 yo 500,000

15 Horses 1 yo 1,000,000

8 Carabaos 2.5 yo 200,000

Total CA 1/1/21 2,100,000

4 Dairy Cattle 1 yo 150,000

6 Carabaos 6 mos. 100,000

Total cost of BA purchased on June 30 250,000

Total CA befor FV adjustment (2.1M + 250k) 2,350,000

10 Dairy Cattle 3 yo 580,000

20 Hogs 4 yo 600,000

15 Horses 2 yo 1,350,000

8 Carabaos 3.5 yo 290,000

4 Dairy Cattle 1.5 yo 200,000

6 Carabaos 1 yo 140,000

FV on 12/31 with both Physical and Price Change 3,160,000 2. C

FV on 12/31 with both Physical and Price Change 3,160,000

Less: Total CA befor FV adjustment (2.1M + 250k) 2,350,000

Total gain from FV change 810,000 1. B

10 Dairy Cattle 2 yo 520,000

20 Hogs 3 yo 550,000

15 Horses 1 yo 1,200,000

8 Carabaos 2.5 yo 250,000

4 Dairy Cattle 1 yo 170,000

6 Carabaos 6 mos. 110,000

FV on 12/31 with Price Change W/O physical change 2,800,000

FV on 12/31 with both Physical and Price Change 3,160,000

Less: FV on 12/31 with Price Change W/O physical change 2,800,000

Gain from physical change 360,000 3. D

FV on 12/31 with Price Change W/O physical change 2,800,000

Less: Total CA befor FV adjustment (2.1M + 250k) 2,350,000

Gain from Price Change 450,000 4. A

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Solutions 6352 To 6372Document33 pagesSolutions 6352 To 6372river garciaNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- 3 Departmental AccountsDocument13 pages3 Departmental AccountsJayesh VyasNo ratings yet

- Statement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Document4 pagesStatement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Jayash KaushalNo ratings yet

- REVIEW FINANCIAL ACCOUNTING & REPORTING EXAMDocument21 pagesREVIEW FINANCIAL ACCOUNTING & REPORTING EXAMClene DoconteNo ratings yet

- CPAR B94 TAX Final PB Exam - Answers - SolutionsDocument12 pagesCPAR B94 TAX Final PB Exam - Answers - SolutionsSilver LilyNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- MAS-03 WorksheetDocument32 pagesMAS-03 WorksheetPaupauNo ratings yet

- Z Company Income Statement ComparisonDocument11 pagesZ Company Income Statement ComparisonMohamed RefaayNo ratings yet

- Class Discussion BLEMBA 31A Day2Document27 pagesClass Discussion BLEMBA 31A Day2Bayu Aji PrasetyoNo ratings yet

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Accounting ExerciseDocument2 pagesAccounting Exercisejolingui0511No ratings yet

- How To Fill Up Tax Return FormDocument19 pagesHow To Fill Up Tax Return Formmukulful2008100% (4)

- Unit Sales Analysis and Break-Even CalculationDocument4 pagesUnit Sales Analysis and Break-Even CalculationChryshelle LontokNo ratings yet

- Answer c22Document3 pagesAnswer c22Võ Huỳnh BăngNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Auditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DDocument14 pagesAuditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DKim Cristian MaañoNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- RUNNING HEAD: Accounting Questions 1Document6 pagesRUNNING HEAD: Accounting Questions 1Chirayu ThapaNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- AFAR ANSWER KeyDocument6 pagesAFAR ANSWER KeyCheska JaplosNo ratings yet

- SS Tutorial 2Document2 pagesSS Tutorial 2Nur PasilaNo ratings yet

- CVP, AVC, BudgetingDocument8 pagesCVP, AVC, BudgetingLeoreyn Faye MedinaNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Accounting 15 Investment SolutionsDocument18 pagesAccounting 15 Investment Solutionskhyla Marie NooraNo ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- M03Document4 pagesM03Anne Thea AtienzaNo ratings yet

- STAR LORD CORP. EMPLOYEE STOCK OPTIONSDocument20 pagesSTAR LORD CORP. EMPLOYEE STOCK OPTIONSadieNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- Intermediate Accounting 3Document18 pagesIntermediate Accounting 3Cristine MayNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- 2017 Vol 3 CH 9 AnsDocument3 pages2017 Vol 3 CH 9 AnsDiola QuilingNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- CH 3 Problem SolutionsDocument9 pagesCH 3 Problem SolutionsFrancisco PradoNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- Intermediate Accounting Midterm Exam KeyDocument10 pagesIntermediate Accounting Midterm Exam KeyRenalyn ParasNo ratings yet

- TRAIN Law Dealings in PropertiesDocument10 pagesTRAIN Law Dealings in PropertiesKyle BacaniNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Pham Le Thuy Duong - HW9Document4 pagesPham Le Thuy Duong - HW9Dương PhạmNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Chapter 40 - Teacher's ManualDocument8 pagesChapter 40 - Teacher's ManualHohohoNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Multiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)Document4 pagesMultiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)anitaNo ratings yet

- BTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsDocument21 pagesBTAXREV ACT 184 Week 3 Income Taxation - Tax ReturnsgatotkaNo ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- LTCCDocument35 pagesLTCCElaine Joyce GarciaNo ratings yet

- Leases SolManDocument15 pagesLeases SolManElaine Joyce GarciaNo ratings yet

- Corp Liq Part IIDocument6 pagesCorp Liq Part IIElaine Joyce GarciaNo ratings yet

- ICARE-AFAR-Part 1 - EncryptedDocument6 pagesICARE-AFAR-Part 1 - EncryptedElaine Joyce GarciaNo ratings yet

- Excel Discussion in Define Benefit PlanDocument5 pagesExcel Discussion in Define Benefit PlanElaine Joyce GarciaNo ratings yet

- RFBT03-10 - Law On Sales - Supplemental NotesDocument7 pagesRFBT03-10 - Law On Sales - Supplemental NotesElaine Joyce GarciaNo ratings yet

- RFBT03-18a - Negotiable Instruments Law - For DiscussionDocument10 pagesRFBT03-18a - Negotiable Instruments Law - For DiscussionElaine Joyce GarciaNo ratings yet

- RFBT03-12 - Law On Partnership - For Discussion - Part OneDocument8 pagesRFBT03-12 - Law On Partnership - For Discussion - Part OneElaine Joyce GarciaNo ratings yet

- Consultation-7 28Document11 pagesConsultation-7 28Elaine Joyce GarciaNo ratings yet

- RFBT03-13 - Law On Partnership - For Discussion - Part TwoDocument10 pagesRFBT03-13 - Law On Partnership - For Discussion - Part TwoElaine Joyce GarciaNo ratings yet

- 19 ArtDocument2 pages19 ArtElaine Joyce GarciaNo ratings yet

- RFBT03-11 - Law On Sales - Supplemental QuizzerDocument7 pagesRFBT03-11 - Law On Sales - Supplemental QuizzerElaine Joyce GarciaNo ratings yet

- TAX4Document1 pageTAX4Elaine Joyce GarciaNo ratings yet

- RFBT03-07 - Law On Pledge, Mortgage and AntichresisDocument36 pagesRFBT03-07 - Law On Pledge, Mortgage and AntichresisElaine Joyce GarciaNo ratings yet

- TAX3Document1 pageTAX3Elaine Joyce GarciaNo ratings yet

- TAX5Document1 pageTAX5Elaine Joyce GarciaNo ratings yet

- CVP Analysis Quiz and SolutionDocument18 pagesCVP Analysis Quiz and SolutionElaine Joyce GarciaNo ratings yet

- International Comity and Double Taxation Principles ExplainedDocument1 pageInternational Comity and Double Taxation Principles ExplainedElaine Joyce GarciaNo ratings yet

- Art Appreciation 101: Elements and Principles of ArtDocument3 pagesArt Appreciation 101: Elements and Principles of ArtElaine Joyce GarciaNo ratings yet

- Juan Luna's Spoliarium Painting Depicts StruggleDocument1 pageJuan Luna's Spoliarium Painting Depicts StruggleElaine Joyce GarciaNo ratings yet

- TAX2Document1 pageTAX2Elaine Joyce GarciaNo ratings yet

- Absorption and Variable Costing Quiz and SolutionsDocument11 pagesAbsorption and Variable Costing Quiz and SolutionsElaine Joyce GarciaNo ratings yet

- Cup 3 AFAR 1Document9 pagesCup 3 AFAR 1Elaine Joyce GarciaNo ratings yet

- Financial Management Chapters 1 4 CabreraDocument22 pagesFinancial Management Chapters 1 4 CabreraElaine Joyce GarciaNo ratings yet

- Process Costing QuizDocument8 pagesProcess Costing QuizElaine Joyce GarciaNo ratings yet

- Cost Behavior AnswerDocument3 pagesCost Behavior AnswerElaine Joyce GarciaNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Cost Acctg Cycle Activity AnswerDocument2 pagesCost Acctg Cycle Activity AnswerElaine Joyce GarciaNo ratings yet

- Job Order Costing Quiz AnswerDocument7 pagesJob Order Costing Quiz AnswerElaine Joyce GarciaNo ratings yet

- CIA3001 Pilot PaperDocument12 pagesCIA3001 Pilot PaperThiya Thiviya100% (1)

- Financial Modeling Planning Analysis Toolkit - Overview and ApproachDocument52 pagesFinancial Modeling Planning Analysis Toolkit - Overview and ApproachmajorkonigNo ratings yet

- Financial Analysis For Chevron Corporation 1Document12 pagesFinancial Analysis For Chevron Corporation 1Nuwan Tharanga LiyanageNo ratings yet

- Case Digest STATCONDocument6 pagesCase Digest STATCONLegal Division DPWH Region 6No ratings yet

- Accounting Assignment (Group 3)Document5 pagesAccounting Assignment (Group 3)Ayush SatyamNo ratings yet

- 02 Gross Income ModuleDocument106 pages02 Gross Income ModuleMoilah MuringisiNo ratings yet

- Foo Jia Hui Priscilla 5 2n2 Ms ExcelDocument7 pagesFoo Jia Hui Priscilla 5 2n2 Ms Excelapi-247309788No ratings yet

- Salary Slip (30677565 April, 2021)Document1 pageSalary Slip (30677565 April, 2021)MUHAMMAD SALEEM RAZANo ratings yet

- Discussion Questions: Hac311 - Tutorial Solutions Chapter 4: Accounting For RevenueDocument7 pagesDiscussion Questions: Hac311 - Tutorial Solutions Chapter 4: Accounting For RevenueAbdulaziz BsebsuNo ratings yet

- Exam (3) ASDocument6 pagesExam (3) ASUsama AslamNo ratings yet

- GROSS ESTATE OF MARRIED DECENDENTSDocument35 pagesGROSS ESTATE OF MARRIED DECENDENTSbetariceNo ratings yet

- MaithanDocument201 pagesMaithanSivaNo ratings yet

- Review of LiteratureDocument9 pagesReview of Literatureasir immanuvelNo ratings yet

- Factors Associated With Non Enrollment Into Community Based Health Insurance Schemes in The Bamenda Health District, CameroonDocument11 pagesFactors Associated With Non Enrollment Into Community Based Health Insurance Schemes in The Bamenda Health District, CameroonPremier PublishersNo ratings yet

- Audit of Inventory Chapter 5 ExercisesDocument1 pageAudit of Inventory Chapter 5 ExercisesMariz Julian Pang-aoNo ratings yet

- Exclusions From Gross Income-Regular Income TaxDocument19 pagesExclusions From Gross Income-Regular Income Taxjess IcaNo ratings yet

- Birla RatioDocument22 pagesBirla RatioveeraranjithNo ratings yet

- CementIndustry PDFDocument92 pagesCementIndustry PDFsolo66No ratings yet

- SBR NoteDocument27 pagesSBR Notejeewen thienNo ratings yet

- AP Long Test 3 - LiabilitiesDocument9 pagesAP Long Test 3 - LiabilitiesjasfNo ratings yet

- 12 Oc ProjectDocument5 pages12 Oc ProjectbhavnaNo ratings yet

- Psa MathsDocument11 pagesPsa MathsUtsav SrivastavaNo ratings yet

- ICICI Prudential Growth Leaders Fund - Series III - Presentation (Reg) - Dec 2023 (I)Document27 pagesICICI Prudential Growth Leaders Fund - Series III - Presentation (Reg) - Dec 2023 (I)Amit SharmaNo ratings yet

- L03 - Real Sector Accounts, Analysis and ForecastingDocument29 pagesL03 - Real Sector Accounts, Analysis and ForecastingDekon MakroNo ratings yet

- 401 Chap13 Flashcards - QuizletDocument8 pages401 Chap13 Flashcards - QuizletJaceNo ratings yet

- Barrick Gold Corporation Annual Report 1996Document78 pagesBarrick Gold Corporation Annual Report 1996Michele DiamondNo ratings yet

- Hero MotoCorp LTDDocument10 pagesHero MotoCorp LTDpranav sarawagiNo ratings yet

- Business FinanceDocument35 pagesBusiness FinanceJosephat MutamaNo ratings yet

- Trendsetter Term Sheet Comparison - YulinDocument3 pagesTrendsetter Term Sheet Comparison - YulinYulin ChenNo ratings yet

- Gelama Merah Field Development PlanDocument80 pagesGelama Merah Field Development PlanMuhammad Khairul Haziq100% (2)