Professional Documents

Culture Documents

ICARE-AFAR-Part 1 - Encrypted

Uploaded by

Elaine Joyce GarciaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICARE-AFAR-Part 1 - Encrypted

Uploaded by

Elaine Joyce GarciaCopyright:

Available Formats

No. 125 Brgy.

San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

AFAR PREWEEK MATERIALS – PART 1

Problem 1

On January 1, 20298, Entity A acquired 90% of outstanding ordinary shares of Entity B. On July

1, 20298, Entity A purchased 80% of outstanding ordinary shares of Entity C. Entity A, Entity B

and Entity C reported the following sales and cost of goods sold for the years ended December 31,

2029, and December 31, 2030:

Entity A Entity B Entity C

2029 Sales P5,000,000 P3,000,000 P2,000,000

2029 Cost of Sales 3,000,000 2,100,000 1,600,000

2030 Sales P6,000,000 P4,000,000 P3,000,000

2030 Cost of Sales 4,200,000 3,200,000 1,800,000

The following intercompany sales of goods involving different set of inventories occurred during

2029 and 2030:

➢ During 2029, Entity C sold inventory to Entity A at a price of P200,000. ¼ of those

inventories were resold by Entity A to third persons during 2029 while the

remainders were resold to third persons during 2030.

➢ During 2029, Entity B sold inventory to Entity C at a price of P300,000. 1/3 of

those inventories were resold by Entity C to third persons during 2029 while the

remainders were resold to third persons during 2030.

➢ During 2030, Entity C sold inventory to Entity B at a price of P400,000. 1/5 of

those inventories remained in the ending inventory of Entity B at the end of

December 31, 2030.

➢ During 2030, Entity A sold inventory to entity B at a price of P500,000. 2/5 of those

inventories were resold by Entity B to third persons during 2030.

1. What is the consolidated sales to be reported by Entity A in its Consolidated Statement of

Comprehensive Income for the year ended December 31, 2030?

a. P12,500,000

b. P12,600,000

c. P12,100,000

d. P11,600,000

2. What is the consolidated cost of sales to be reported by Entity A in its Consolidated

Statement of Comprehensive Income for the year ended December 31, 2030?

a. P8,302,000

b. P8,912,000

c. P8,532,000

d. P8,652,000

Problem 2

On January 1, 2030, Entity A acquired 80% of the outstanding common stocks of Entity B at a

gain on bargain purchase of P100,000. At the date of acquisition, all the assets of Entity B are

property valued except for a building that is overvalued of P50,000 and an inventory that is

undervalued by P30,000. The said overvalued building has a remaining useful life of 5 years on

January 1, 2030 while 1/3 of the said undervalued inventory remained unsold as of December 31,

2030. The following intercompany transactions occurred during the year:4

• On July 1, 2030, Entity B leased a machinery to Entity A at an annual rental of

P120,000.

• On October 1, 2030, Entity A rendered management services to Entity B at a

consideration of P40,000.

1|P a g e R. FERRER/P. DE JESUS/A.TANG

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

Entity A accounted its Investment in Entity B using cost method in its separate financial

statements. For the year ended December 31, 2030, Entity A reported net income of P1,000,000

and declared dividends of P200,000 in its separate financial statements while Entity B

reported P500,000 and declared dividends of P100,000 in its separate financial statements.

3. What is the consolidated net income attributable to Entity A's shareholders to be

reported by Entity A in its Consolidated Income Statement for the year ended December

31, 2030?

a. P1,354,000

b. P1,452,000

c. P1,416,000

d. P1,282,000

4. Using the same data from preceding number, what is the net income attributable to non-

controlling interest to be reported by Entity A in its Consolidated Income Statement for the

year ended December 31, 2030?

a. P94,000

b. P106,000

c. P86,000

d. P96,000

Problem 3

On January 1, 2030, Entity A acquired 70% of outstanding ordinary shares of Entity B at

a price of P1,000,000. Entity A incurred P200,000 cost related to acquisition. At acquisition

date, the book value of net assets of Entity B is P2,500,000 but a machinery with useful

life of 10 years is overstated by P500,000. For the year ended December 31, 2030, Entity

B reported net income of P350,000 and declared dividend in the amount of P100,000 to its

ordinary shareholders. The fair value of the Investment in Entity B is measured at

P1,800,000 on December 31, 2030 with cost to sell of 15% while its value in use is

discounted at P1,750,000.

5. If Entity A accounted its Investment in Entity B using equity method in its separate

financial statements, what is the book value of Investment in Entity B to be reported by

Entity A on December 31, 2030 in its separate statement of financial position?

a. P1,750,000

b. P1,800,000

c. P1,530,000

d. P1,610,000

6. Using the same data in preceding number, what is the net effect in Entity A's net profit in

its separate income statement assuming it accounted its Investment in Entity B using fair

value model through profit or loss in its separate income statement?

a. Increase in profit by P670,000

b. Increase in profit by P870,000

c. Increase in profit by P600,000

d. Increase in profit by P800,000

7. Using the same data in preceding number, what is the book value of Investment in Entity

B to be reported by Entity A on December 31, 2030 in its separate statement of financial

position assuming it accounted its Investment in Entity B using cost method?

a. P1,800,000

b. P1,530,000

c. P1,200,000

d. P1,000,000

2|P a g e R. FERRER/P. DE JESUS/A.TANG

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

Problem 4

SM Holdings Inc. owns 90% of ordinary shares of SM Prime Inc., a company whose shares of

stocks are publicly traded in Philippine Stock Exchange. SM Prime Inc., owns 80% of ordinary

shares of SM Cinema Inc. The chief accountants of the aforementioned corporations record and

recognize all dividends received from different companies as dividend income. The parent

corporations use cost method in their separate financial statements in accounting for their

respective investment in subsidiaries. For the year ended December 31, 2030, the following data

are obtained from the accounting records of the three corporations concerning its dividends:

SM Holdings Inc. SM Prime Inc. SM Cinema Inc.

Dividends Declared P2,000,000 P1,000,000 P500,000

during the year

Reported Dividend P1,500,000 P1,200,000 P800,000

Income during the

year

Dividends received P200,000 P? P500,000

from Associate

during the year

Dividends received P? P100,000 P?

from Fair Value

Investments during

the year

8. What is the dividend income to be presented for the year ended December 31, 2030 in the

respective Consolidated Statement of Comprehensive Income of SM Prime Inc. and SM

Holdings Inc.?

a. P400,000 and P800,000 respectively

b. P300,000 and P500,000 respectively

c. P400,000 and P500,000 respectively

d. P500,000 and P900,000 respectively

Problem 5

On December 31, 2030, PNB reported contributed capital of P5,000,000 and retained earnings of

P3,000,000 with total liabilities of P4,000,000 while Allied Bank reported total assets of

P6,000,000 with total liabilities of P2,000,000. On January 1, 2031, PNB and Allied Bank entered

into merger whereby PNB will issue 1,000,000 ordinary shares with par value of P2 and quoted

price of P3 on January 1, 2031 to incumbent shareholders of Allied Bank. Aside from shares of

stocks, PNB will issue bonds payable classified as financial liability at amortized cost with face

value of P1,500,000 and fair market value of P1,200,000 on January 1, 2031.

On January 1, 2031, the independent appraiser determined that the current asset of PNB has fair

value of P1,000,000 although its book value recorded is only P800,000. On the other hand, the

noncurrent asset of Allied Bank has carrying amount of P4,000,000 with fair value of P3,500,000.

On the same date, the noncurrent liabilities of PNB have fair value of P2,500,000 which is above

its carrying value by P500,000. On the other hand, the current liabilities of Allied Bank have book

value of P1,500,000 an amount which is above its fair market value by P1,000,000.

On January 1, 2031, PNB incurred and paid acquisition related to business combination cost

amounting to P200,000. Aside from that, PNB incurred and paid stock issuance costs amounting

to P300,000 and bond issue costs amounting to P100,000.

9. Compute for the following amount in PNB’s Statement of Financial Position immediately

after the business combination:

3|P a g e R. FERRER/P. DE JESUS/A.TANG

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

Total Assets Total Liabilities Stockholder’s Equity

a. P17,100,000 P6,000,000 P10,700,000

b. P16,900,000 P6,100,000 P10,800,000

c. P17,200,000 P6,200,000 P11,000,000

d. P17,100,000 P6,600,000 P10,500,000

Problem 6

On July 1, 2030, SM Holdings acquired 80% of common stocks of China Bank at a price of

P2,000,000. The book value of net assets of China Retail on July 1, 2030 amounted to P3,300,000.

The assets and liabilities of China Retail are properly valued except to the inventories which have

fair value of P200,000 and book value of P500,000. On October 1, 2030, China Retail sold an

equipment to SM Holdings at a price of P360,000 when its book value is P120,000. The equipment

has remaining life of 2 years on the said date. As of December 31, 2030, P150,000 out of the said

P500,000 overstated inventory remained in China Retail’s ending inventory. For the year ended

December 31, 2030, China Retail reported net income of P1,000,000 and declared dividends of

P300,000. On December 31, 2030, the fair value of the Investment in China Retail is determined

to be P2,500,000 while its cost to sell is 10% of the fair value. The discounted value of cash flows

from the possible disposal and dividends of the said Investment in China Retail on December 31,

2030 is P1,800,000.

10. In the Separate Statement of Financial Position of SM Holdingson December 31, 2030,

what amount shall be presented as Investment in China Bank under the following

models?

Cost Method Fair Value Model Equity Method

a. P1,800,000 P2,250,000 P2,560,000

b. P2,000,000 P2,500,000 P2,250,000

c. P2,250,000 P1,800,000 P2,572,000

d. P2,500,000 P2,000,000 P1,800,000

Partnership

11. On January 1, 2020, Mike, Jay and Bong organized MJB partnership by investing P5M, 2M

and P3M for capital interest ratio of 4:5:1 respectively. Bong has been appointed as managing

partner. During year 2020, MJB partnership reported net income of P3,000,000. Their

profit/loss distribution and drawing agreement are presented below:

i. 20% interest on beginning capital

ii. P10,000, P20,000 and P50,000 monthly salary, respectively

iii. 25% bonus of net income after interest and salary to managing partner

iv. The remainder will be divided equally among the partners.

v. The partners must withdraw at the end of the year 50% of their share in net income

for the period.

What is the capital balance of Bong on December 31, 2020?

a. P1,410,000 c. P1,610,000

b. P3,410,000 d. P3,610,000

12. H and I are partners sharing profits and losses in the ratio of 6:4 respectively. On January 2,

the partners decided to admit J as a new partner upon his investment of P96,000. On this date,

the interest in the partnership of H and I are as follows: H, P138,000; I, P111,600. Assuming

that the new partner is given a 1/4 interest in the firm. The agreed capital of the partnership is

P360,000. The admission of a new partner will result to which of the following:

a. Revaluation is P20,400

b. Bonus from I is P2,400

c. Bonus to J is P6,000

d. Capital balance of H after admission is P150,240

4|P a g e R. FERRER/P. DE JESUS/A.TANG

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

NPO

13. ABC, an NPO, received funds during its annual campaign that were specifically pledged by

the donor to another NPO health organization. How should ABC record the funds?

a. Increase in assets and increase in liabilities

b. Decrease in assets and decrease in liabilities

c. Increase in asset and increase in deferred revenues

d. Increase in assets and increase in revenues

14. Which if the following categories are used in an NPO statement of financial position?

a. Income, expenses and unrestricted net assets

b. Net assets, income and expenses

c. Changes in unrestricted, temporarily restricted and permanently restricted net assets

d. Assets, liabilities and net assets

Government

15. The approved appropriation of Department XYZ for 2022 was P3,600,000. 85% of this

appropriation was allotted by the Department of Budget and Management (DBM)

accompanied with Notice of Cash allocation (80%) of the allotment. During the year, the

amount of obligations incurred was equivalent to 90% of the NCA but only 70% of these

obligations were paid by checks.

What is the entry to record the incurrence of obligation?

a. No entry, Posting to appropriate Registries of Budget, Utilization and Disbursements

(RBUD)

b. No entry, Posting to appropriate Obligation Request and Status (ORS)

c. No entry, Posting to appropriate Registry of Allotments, Obligations and Disbursements

(RAOD)

d. No entry, Posting to appropriate Registries of Appropriations and Allotments (RAPAL)

16. Entity A constructed a building by administration with total costs of P1,048,000, consisting of

construction materials [inclusive of VAT; labor costs and various overhead expenses

amounting to P448,000; P350,000 and P250,000, respectively. The journal entry to recognize

the payment of construction materials would be:

Construction in Progress - Investment Property,

a. Bldg. 448,000

Construction Materials Inventory 448,000

b. Construction Materials Inventory 448,000

Due to BIR 24,000

Cash - MDS, Regular 424,000

c. Accounts Payable 448,000

Cash - MDS, Regular 448,000

d. Accounts Payable 424,000

Due to BIR 24,000

Cash - MDS, Regular 448,000

5|P a g e R. FERRER/P. DE JESUS/A.TANG

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : icarecpareview@gmail.com

Process

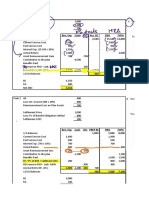

17. Yoder Company uses the weighted-average method in its process costing system. The

following data pertain to operations in the first processing department for a recent month:

Work in process, beginning:

Units in process ............................. 40,000

Percent complete with respect to

materials .................................... 70%

Percent complete with respect to

conversion ................................. 60%

Costs in the beginning inventory:

Materials cost ............................. P8,600

Conversion cost.......................... P4,800

Units started into production during

the month ...................................... 750,000

Units completed and transferred out

during the month........................... ?

Costs added to production during

the month:

Materials cost ................................ P223,000

Conversion cost ............................. P149,000

Work in process, ending:

Units in process ............................. 30,000

Percent complete with respect to

materials .................................... 40%

Percent complete with respect to

conversion ................................. 30%

What was the cost per equivalent unit for materials during the month?

a. P0.30

b. P0.25

c. P0.20

d. P0.15

18. How much cost, in total, was assigned to the ending work in process inventory?

a. P2,600

b. P4,300

c. P15,000

d. P5,400

FOREX

19. Paul Corporation issued a promissory note denominated in foreign currency for the purchase

made from a supplier in England on December 1, for a 60-day, 18% promissory note for

108,000 pounds, at a selling rate of 1FC to P74.20. On December 31, the selling spot rate is

1FC to P74.85. On January 30, the selling spot rate is 1FC to P75.75.

On the settlement date, how much is the foreign exchange gain/loss?

a. P172,422 gain c. P172,422 loss

b. P100,116 loss d. P98,658 loss

6|P a g e R. FERRER/P. DE JESUS/A.TANG

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- ICARE-Preweek-AFAR-Part 1Document6 pagesICARE-Preweek-AFAR-Part 1john paul100% (1)

- Consolidated Financial Statements - IntercomapnyDocument6 pagesConsolidated Financial Statements - IntercomapnyCORNADO, MERIJOY G.No ratings yet

- FAR04-15 - PFRS For SMEs and SEsDocument6 pagesFAR04-15 - PFRS For SMEs and SEsAi NatangcopNo ratings yet

- FAR 03-25 PFRS For SMEs and Micro EnterprisesDocument4 pagesFAR 03-25 PFRS For SMEs and Micro EnterprisesMila VeranoNo ratings yet

- FAR FPB With Answer KeysDocument16 pagesFAR FPB With Answer KeysPj ManezNo ratings yet

- ICARE - FAR - PreWeek - Batch 4Document15 pagesICARE - FAR - PreWeek - Batch 4john paulNo ratings yet

- AFAR02 01 PartnershipDocument9 pagesAFAR02 01 PartnershipThan TanNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- Conceptual FrameworkDocument9 pagesConceptual FrameworkAveryl Lei Sta.Ana0% (1)

- Use The Following Information To Answer Items 3 and 4Document15 pagesUse The Following Information To Answer Items 3 and 4charlies parrenoNo ratings yet

- Investment in Associate-Mytha Isabel D. SalesDocument9 pagesInvestment in Associate-Mytha Isabel D. SalesMytha Isabel SalesNo ratings yet

- I. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsDocument4 pagesI. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsRoxell CaibogNo ratings yet

- FAR - RQ - Investment in AssociatesDocument2 pagesFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Assignment Auditing Problemmichelle PagulayanDocument7 pagesAssignment Auditing Problemmichelle PagulayanEsse ValdezNo ratings yet

- AFAR PracDocument13 pagesAFAR PracTeofel John Alvizo PantaleonNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- Audit of InvestmentsDocument9 pagesAudit of InvestmentsMark Lawrence YusiNo ratings yet

- FAR 1st Preboard QuestionairesDocument15 pagesFAR 1st Preboard Questionairesyzhlansang.studentNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- Assessment 3 2024 Financial AssetDocument9 pagesAssessment 3 2024 Financial Assetmarinel pioquidNo ratings yet

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- AFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedDocument5 pagesAFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedSophia PerezNo ratings yet

- FAR Practical Exercises InvestmentDocument5 pagesFAR Practical Exercises InvestmentAB CloydNo ratings yet

- Icare Batch 6 Joshua 1 Preboard AFARDocument17 pagesIcare Batch 6 Joshua 1 Preboard AFARRica Mae TestaNo ratings yet

- Investment in Associate 2022Document3 pagesInvestment in Associate 2022lirva cantonaNo ratings yet

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- Seminar 2Document13 pagesSeminar 2Precious Diamond DeeNo ratings yet

- ReceivableDocument3 pagesReceivableBellaNo ratings yet

- FAR Pre-Week Part 1Document24 pagesFAR Pre-Week Part 1John DoeNo ratings yet

- ASSET 2019 Mock Boards - FARDocument7 pagesASSET 2019 Mock Boards - FARKenneth Christian WilburNo ratings yet

- AudcisDocument6 pagesAudcisJessa May MendozaNo ratings yet

- FAR Final Preboard QuestionaireDocument18 pagesFAR Final Preboard Questionaireyzhlansang.studentNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDocument5 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoNo ratings yet

- Quiz Midterm - Answer KeyDocument11 pagesQuiz Midterm - Answer KeyGloria BeltranNo ratings yet

- Assignment 1 - Discontinued Operation Test 10 ItemsDocument4 pagesAssignment 1 - Discontinued Operation Test 10 ItemsJeane Mae BooNo ratings yet

- AUDIT PROBS-2nd MONTHLY ASSESSMENTDocument7 pagesAUDIT PROBS-2nd MONTHLY ASSESSMENTGRACELYN SOJORNo ratings yet

- FAR03 08 Accounting For DividendsDocument4 pagesFAR03 08 Accounting For Dividendskisheal kimNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Cfas Exam3 ProblemsDocument8 pagesCfas Exam3 ProblemspolxrixNo ratings yet

- Activity 1b - Current LiabilitiesDocument2 pagesActivity 1b - Current LiabilitiesUchayyaNo ratings yet

- Quiz FARDocument5 pagesQuiz FARGlen JavellanaNo ratings yet

- AP03-03-Audit of Liabilities - EncryptedDocument7 pagesAP03-03-Audit of Liabilities - EncryptedMark Ehrolle S. SisonNo ratings yet

- Chapter 3Document6 pagesChapter 3You Knock On My DoorNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- INVESTMENTS inDocument7 pagesINVESTMENTS inJessa May MendozaNo ratings yet

- Acctg 323 MT ExamDocument10 pagesAcctg 323 MT ExamJoyluxxiNo ratings yet

- 1912 Derivatives Investment Property and Other InvestmentDocument5 pages1912 Derivatives Investment Property and Other InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- Prof. Francis O. Mateos, CPA: Bappaud - Applied AuditingDocument5 pagesProf. Francis O. Mateos, CPA: Bappaud - Applied AuditingElisha Batalla80% (5)

- Auditing Problem 1 22 22 PDFDocument26 pagesAuditing Problem 1 22 22 PDFKate NuevaNo ratings yet

- Questions Problems Pre BQTAP 2018 2019Document12 pagesQuestions Problems Pre BQTAP 2018 2019GuinevereNo ratings yet

- Problem No. 1: Practice Set Property Plant and EquipmentDocument4 pagesProblem No. 1: Practice Set Property Plant and EquipmentFiona MoralesNo ratings yet

- FAR 04-11 Revaluation-and-ImpairmentDocument4 pagesFAR 04-11 Revaluation-and-ImpairmentAi NatangcopNo ratings yet

- Quiz Conso FSDocument3 pagesQuiz Conso FSMark Joshua SalongaNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Corp Liq Part IIDocument6 pagesCorp Liq Part IIElaine Joyce GarciaNo ratings yet

- Discontinued Operations, Segment and Interim Reporting, Biological AssetsDocument5 pagesDiscontinued Operations, Segment and Interim Reporting, Biological AssetsElaine Joyce GarciaNo ratings yet

- P1 3705Document5 pagesP1 3705Elaine Joyce GarciaNo ratings yet

- Excel Discussion in Define Benefit PlanDocument5 pagesExcel Discussion in Define Benefit PlanElaine Joyce GarciaNo ratings yet

- Leases SolManDocument15 pagesLeases SolManElaine Joyce GarciaNo ratings yet

- RFBT03-11 - Law On Sales - Supplemental QuizzerDocument7 pagesRFBT03-11 - Law On Sales - Supplemental QuizzerElaine Joyce GarciaNo ratings yet

- LTCCDocument35 pagesLTCCElaine Joyce GarciaNo ratings yet

- RFBT03-18a - Negotiable Instruments Law - For DiscussionDocument10 pagesRFBT03-18a - Negotiable Instruments Law - For DiscussionElaine Joyce GarciaNo ratings yet

- RFBT03-13 - Law On Partnership - For Discussion - Part TwoDocument10 pagesRFBT03-13 - Law On Partnership - For Discussion - Part TwoElaine Joyce GarciaNo ratings yet

- Consultation-7 28Document11 pagesConsultation-7 28Elaine Joyce GarciaNo ratings yet

- RFBT03-10 - Law On Sales - Supplemental NotesDocument7 pagesRFBT03-10 - Law On Sales - Supplemental NotesElaine Joyce GarciaNo ratings yet

- RFBT03-12 - Law On Partnership - For Discussion - Part OneDocument8 pagesRFBT03-12 - Law On Partnership - For Discussion - Part OneElaine Joyce GarciaNo ratings yet

- Financial Management Chapters 1 4 CabreraDocument22 pagesFinancial Management Chapters 1 4 CabreraElaine Joyce GarciaNo ratings yet

- TAX5Document1 pageTAX5Elaine Joyce GarciaNo ratings yet

- 19 ArtDocument2 pages19 ArtElaine Joyce GarciaNo ratings yet

- RFBT03-07 - Law On Pledge, Mortgage and AntichresisDocument36 pagesRFBT03-07 - Law On Pledge, Mortgage and AntichresisElaine Joyce GarciaNo ratings yet

- TAX2Document1 pageTAX2Elaine Joyce GarciaNo ratings yet

- TAX4Document1 pageTAX4Elaine Joyce GarciaNo ratings yet

- TAX3Document1 pageTAX3Elaine Joyce GarciaNo ratings yet

- TAX2Document1 pageTAX2Elaine Joyce GarciaNo ratings yet

- Script Art AppDocument3 pagesScript Art AppElaine Joyce GarciaNo ratings yet

- SPOLIARIUMDocument1 pageSPOLIARIUMElaine Joyce GarciaNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Process Costing QuizDocument8 pagesProcess Costing QuizElaine Joyce GarciaNo ratings yet

- Cup 3 AFAR 1Document9 pagesCup 3 AFAR 1Elaine Joyce GarciaNo ratings yet

- Absorption and Variable Costing Quiz and SolutionsDocument11 pagesAbsorption and Variable Costing Quiz and SolutionsElaine Joyce GarciaNo ratings yet

- CVP Analysis Quiz and SolutionDocument18 pagesCVP Analysis Quiz and SolutionElaine Joyce GarciaNo ratings yet

- Job Order Costing Quiz AnswerDocument7 pagesJob Order Costing Quiz AnswerElaine Joyce GarciaNo ratings yet

- Cost Acctg Cycle Activity AnswerDocument2 pagesCost Acctg Cycle Activity AnswerElaine Joyce GarciaNo ratings yet

- Cost Behavior AnswerDocument3 pagesCost Behavior AnswerElaine Joyce GarciaNo ratings yet

- Tejano, Jr. vs. Ombudsman, 462 SCRA 560, G.R. No. 159190 June 30, 2005Document8 pagesTejano, Jr. vs. Ombudsman, 462 SCRA 560, G.R. No. 159190 June 30, 2005CherNo ratings yet

- OCA Circular No. 75 2016Document2 pagesOCA Circular No. 75 2016janezahrenNo ratings yet

- 10 PNB v. Andrada Electric and Engineering Co.Document3 pages10 PNB v. Andrada Electric and Engineering Co.Stephen Daniel JavierNo ratings yet

- Manila Metal Container Corporation Vs Philippine NationalDocument2 pagesManila Metal Container Corporation Vs Philippine NationalBernadetteGaleraNo ratings yet

- Historical Perspective Worldwide: Module 3/ Chapter 3 4. 2nd Century A.D Modern Banking Functions IncludingDocument12 pagesHistorical Perspective Worldwide: Module 3/ Chapter 3 4. 2nd Century A.D Modern Banking Functions IncludingTrisha May OcampoNo ratings yet

- PNB Vs CabasagDocument8 pagesPNB Vs CabasagJoan Tan-CruzNo ratings yet

- Philippine National Bank vs. Cua, 861 SCRA 569Document15 pagesPhilippine National Bank vs. Cua, 861 SCRA 569Athena Jeunnesse Mae Martinez TriaNo ratings yet

- Sales DigestDocument5 pagesSales DigestJohansen FerrerNo ratings yet

- Centro Escolar University Manila: Bolima, Joanne Shena Gutierrez, Angel Allyn Solis, Julianne MiguelDocument8 pagesCentro Escolar University Manila: Bolima, Joanne Shena Gutierrez, Angel Allyn Solis, Julianne MiguelWilliam DC RiveraNo ratings yet

- Credit Transaction - Case DigestDocument32 pagesCredit Transaction - Case Digestjuan dela cruzNo ratings yet

- FINAL Narrative Report Philippine National BankDocument38 pagesFINAL Narrative Report Philippine National BankTanyelle LouvNo ratings yet

- Naseco Vs NLRCDocument2 pagesNaseco Vs NLRCPiaNo ratings yet

- PNB Madecor V UyDocument21 pagesPNB Madecor V UyRio Grant PacitengNo ratings yet

- Philippine National Bank v. Hydro Resources Contractors Corporation G.R. No.Document4 pagesPhilippine National Bank v. Hydro Resources Contractors Corporation G.R. No.JetJuárez100% (1)

- PNB vs. Santos ESCRADocument24 pagesPNB vs. Santos ESCRAGuiller C. MagsumbolNo ratings yet

- Labor CDocument20 pagesLabor CMA. TRISHA RAMENTONo ratings yet

- Sbi & PNBDocument20 pagesSbi & PNB9869380989No ratings yet

- PNB AR 2007 With BH NamesDocument152 pagesPNB AR 2007 With BH NamesShingie0% (1)

- JG Summit Holdings v. CA PDFDocument28 pagesJG Summit Holdings v. CA PDFMarton Emile DesalesNo ratings yet

- No. 9 PNB Vs CabansagDocument2 pagesNo. 9 PNB Vs Cabansagnhizza dawn DaligdigNo ratings yet

- Credit Transactions SyllabusDocument4 pagesCredit Transactions SyllabusJasper Allen B. BarrientosNo ratings yet

- 1Document1 page1Khym Morales CosepNo ratings yet

- Comparative Study of Home Loans of PNB and Sbi BankDocument75 pagesComparative Study of Home Loans of PNB and Sbi Bankvsmitha122No ratings yet

- 10 JG Summit Holdings Inc. v. CADocument4 pages10 JG Summit Holdings Inc. v. CAJul A.No ratings yet

- Decision (En Banc) Laurel, J.: I. The Facts: (The Court DENIED The Petition.)Document28 pagesDecision (En Banc) Laurel, J.: I. The Facts: (The Court DENIED The Petition.)Veah CaabayNo ratings yet

- NATIONAL INVESTMENT AND DEVELOPMENT CORPORATION Vs AQUINODocument1 pageNATIONAL INVESTMENT AND DEVELOPMENT CORPORATION Vs AQUINOเจียนคาร์โล การ์เซียNo ratings yet

- PNB V Bacani DigestDocument1 pagePNB V Bacani DigestSha Santos0% (1)

- Bicol Vs Guinhawa DigestDocument7 pagesBicol Vs Guinhawa Digestgrego centillasNo ratings yet

- Integrated Reaty Corp. Vs PNBDocument8 pagesIntegrated Reaty Corp. Vs PNBaudreyracelaNo ratings yet

- Philippine National Bank v. PasimioDocument1 pagePhilippine National Bank v. PasimioTJ Paula Tapales JornacionNo ratings yet