Professional Documents

Culture Documents

5532 $F

Uploaded by

SarahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5532 $F

Uploaded by

SarahCopyright:

Available Formats

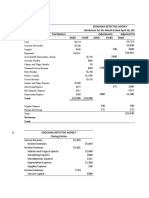

Statement of Cash Flows: [5532]

Balance Sheets Starting Ending

Cash $560 $100

Accounts Receivable 900 500

Supplies Inventory 600 700

Prepaid Insurance 200 100

Prepaid Salaries 400 600

Prepaid Rent 500 300

Property, Plant and Equipment 3,000 4,000

(Acc. Depr.) (660) (460)

Investments 400 700

Total Assets $5,900 $6,540

Accounts Payable $600 $500

Unearned Revenues 900 740

Salaries Payable 300 700

Notes Payable 3,000 3,000

Total Liabilities $4,800 $4,940

Contributed Capital $100 $300

Retained Earnings 1,000 1,300

Total Owners’ Equity $1,100 $1,600

Total Liab. & Owners’ Equity $5,900 $6,540

Income Statement for the Year Ended December 31:

Sales $1,900

Gain on Sale of Investment 100

Gain on Sale of PPE 600

Total Revenues and Gains $2,600

Expenses:

Salaries Expense $600

Supplies Expense 300

Insurance Expense 100

Rent Expense 500

Depreciation Expense 100

Interest Expense 200 1,800

Income Before Income Taxes $800

Tax Expense 300

Net Income $500

Additional Information:

1. The firm sold PPE for $1,000 cash. The original cost of the PPE was $700. $300 of depreciation had

been taken on the asset up to the time of its sale.

2. The firm declared and paid a $200 cash dividend to stockholders.

3. The owners invested another $200 in the firm.

4. The firm sold investments for $100 more than their $200 original cost.

Required: Determine the proper sources or uses of cash from each of these three activities: Operations,

Investing and Financing.

You might also like

- Bloomberg Cheat SheetsDocument45 pagesBloomberg Cheat Sheetsuser12182192% (12)

- Cash and Cash Equivalents ReviewerDocument4 pagesCash and Cash Equivalents ReviewerEileithyia KijimaNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- UntitledDocument10 pagesUntitledRima WahyuNo ratings yet

- DRAFT CHIEF FINANCIAL 2020 Actualizado PDFDocument21 pagesDRAFT CHIEF FINANCIAL 2020 Actualizado PDFGlenn Sandoval100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Dimensional Fund Advisors 2002 Case SolutionDocument10 pagesDimensional Fund Advisors 2002 Case SolutionRohit Kumar80% (5)

- When Big Acquisitions Pay OffDocument7 pagesWhen Big Acquisitions Pay OffoliverNo ratings yet

- Tax Reviewer Montero PDFDocument61 pagesTax Reviewer Montero PDFJan Ceasar ClimacoNo ratings yet

- Banking Midterms ReviewerDocument6 pagesBanking Midterms ReviewerFlorence RoseteNo ratings yet

- Articles of Association and MOADocument12 pagesArticles of Association and MOAmasoodNo ratings yet

- PGPEM Brochure 2017 v12Document18 pagesPGPEM Brochure 2017 v12srikar_scribdNo ratings yet

- Watson Answering ServiceDocument3 pagesWatson Answering Servicemohitgaba1967% (6)

- Financial Accounting - Tugas 1Document6 pagesFinancial Accounting - Tugas 1Alfiyan100% (1)

- Accounting Compeleting The CycleDocument14 pagesAccounting Compeleting The CyclecamilleNo ratings yet

- FAR610 Consolidated Cashflow Past Semester FinalexamDocument18 pagesFAR610 Consolidated Cashflow Past Semester FinalexamANIS SYAKIRAH ADHWA MAHDILLAHNo ratings yet

- Balance Sheets at Dec. 31, Years 1 and 2: Statement of Cash Flows: (5562.1)Document2 pagesBalance Sheets at Dec. 31, Years 1 and 2: Statement of Cash Flows: (5562.1)audrey.rose.angNo ratings yet

- AFR Session 4 ExercisesDocument10 pagesAFR Session 4 ExercisesSherif KhalifaNo ratings yet

- UntitledDocument27 pagesUntitledJasmine MinminNo ratings yet

- 592198Document11 pages592198mohitgaba19No ratings yet

- Exercise 2.1Document9 pagesExercise 2.1Stephanie XieNo ratings yet

- Module - 3 Trial Balance QuestionsDocument7 pagesModule - 3 Trial Balance QuestionsMuskan Rathi 5100No ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Jawaban Individual AssignmentDocument3 pagesJawaban Individual AssignmentAtoy SomarNo ratings yet

- TUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA NewDocument8 pagesTUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA Newrico anantaNo ratings yet

- Chapter 4Document6 pagesChapter 4HelloWorldNowNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Take Home Quiz 3Document3 pagesTake Home Quiz 3Sergio NicolasNo ratings yet

- Soal Latihan Chapter 01Document3 pagesSoal Latihan Chapter 01Indrian Sibi todingNo ratings yet

- Statement of Cash Flow: A Teaching NoteDocument6 pagesStatement of Cash Flow: A Teaching NoteMichealNo ratings yet

- Uas Komp AkuntansiDocument3 pagesUas Komp AkuntansiDesy manurungNo ratings yet

- ACCT 2010 Asm2Document3 pagesACCT 2010 Asm2蛋卷 PsyvidNo ratings yet

- Chap 1Document14 pagesChap 1Nguyen Thi Diem Quynh (K17 HCM)No ratings yet

- CHP 1 and 2 Exercise - Fatimatuz Zahro - 2401986913Document4 pagesCHP 1 and 2 Exercise - Fatimatuz Zahro - 2401986913Drwskincare SuirabayaNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- CH1 AssignmentDocument11 pagesCH1 AssignmentDhence BasigaNo ratings yet

- Cash Flow QuestionsDocument5 pagesCash Flow QuestionssigiryaNo ratings yet

- S1 SDocument7 pagesS1 SROHIT PANDEYNo ratings yet

- Syukur Tugas Akl IiDocument3 pagesSyukur Tugas Akl IiMuhammad SyukurNo ratings yet

- Trial BalaneDocument2 pagesTrial BalaneBang BangNo ratings yet

- HE 2 Questions - Updated-1Document6 pagesHE 2 Questions - Updated-1halelz69No ratings yet

- Chapter 4 Exercise Recording TransactionDocument4 pagesChapter 4 Exercise Recording TransactionHusen ChaabanNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Income Statement: IVAN IZO Law OfficeDocument4 pagesIncome Statement: IVAN IZO Law OfficeClaudio AbinenoNo ratings yet

- Fahmi Gilang Madani - 120110170024 - Tugas AKLDocument6 pagesFahmi Gilang Madani - 120110170024 - Tugas AKLFahmi GilangNo ratings yet

- Quiz IntermediateDocument3 pagesQuiz IntermediateAndreasNo ratings yet

- (IFA 3) - Rendy Filiang - 1402210324Document11 pages(IFA 3) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Jawaban Latihan SoalDocument31 pagesJawaban Latihan SoalRizalMawardiNo ratings yet

- GB255: Sage 50 Set Up Company With Skeleton Data - Chapter 4Document2 pagesGB255: Sage 50 Set Up Company With Skeleton Data - Chapter 4Num Num TastyNo ratings yet

- Team Assignment - Team 5 - TK1Document12 pagesTeam Assignment - Team 5 - TK1Benyamin AminNo ratings yet

- Cash Furniture Note Payable Account Receiable Store EquipmentDocument6 pagesCash Furniture Note Payable Account Receiable Store EquipmentTrinh Duc Manh (k15 HL)No ratings yet

- Praktikum Ke-1 Chapter 3: Financial Statement and Ratio AnalysisDocument3 pagesPraktikum Ke-1 Chapter 3: Financial Statement and Ratio AnalysisTaram 1003No ratings yet

- Buad 803 Ahmad Jibrilindv. AssignmentDocument3 pagesBuad 803 Ahmad Jibrilindv. AssignmentAhmad JibrilNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Problem 3.1 - Financial Accounting With IFRS 4th Edition - UELDocument7 pagesProblem 3.1 - Financial Accounting With IFRS 4th Edition - UELChristyNo ratings yet

- Konsolidasi Pada Saat Tanggal Akuisisi: Irwin/Mcgraw-HillDocument23 pagesKonsolidasi Pada Saat Tanggal Akuisisi: Irwin/Mcgraw-HillAbraham Niel puteranataNo ratings yet

- Sasse - Roofing - Financial - Books (1) (Trial Balance)Document4 pagesSasse - Roofing - Financial - Books (1) (Trial Balance)Jennette Solano100% (1)

- CINA Start-Up ExpensesDocument2 pagesCINA Start-Up Expenses4022005No ratings yet

- Practice 6 Consolidated Statement One Year After AcquisitionDocument10 pagesPractice 6 Consolidated Statement One Year After AcquisitionGloria Lisa SusiloNo ratings yet

- (Kunci) Asistensi 4Document8 pages(Kunci) Asistensi 4Randomly EmailNo ratings yet

- Chapter 3Document3 pagesChapter 3Hussein BaidounNo ratings yet

- CH 3 Cost ControlDocument3 pagesCH 3 Cost ControlAli B BasahiNo ratings yet

- Tyasa Putri R - Tugas Akl 1 TM 4Document6 pagesTyasa Putri R - Tugas Akl 1 TM 4Rayhan MametNo ratings yet

- Company Accounting Equation For The Month Ended . AssetsDocument6 pagesCompany Accounting Equation For The Month Ended . AssetsChau ThuNo ratings yet

- Consolidation Basics SolutionDocument20 pagesConsolidation Basics SolutionUmmar FarooqNo ratings yet

- Fin CH 2 ProblemsDocument9 pagesFin CH 2 Problemsshah118850% (4)

- Ex 2Document13 pagesEx 2Phuong Vu HongNo ratings yet

- Ca5101 Ustamv TaskDocument6 pagesCa5101 Ustamv Taskroseberrylacopia18No ratings yet

- Adani Green Script RsbeditDocument7 pagesAdani Green Script Rsbeditannu priyaNo ratings yet

- MJ 2021Document11 pagesMJ 2021Yusuf MohamedNo ratings yet

- India Business GuideDocument8 pagesIndia Business Guidesachin251No ratings yet

- Midsize2012booklet 1865031Document250 pagesMidsize2012booklet 1865031maleemNo ratings yet

- Finolex Industries - Initiating CoverageDocument15 pagesFinolex Industries - Initiating CoverageaparmarinNo ratings yet

- Follow Fibonacci Ratio Dynamic Approach in TradeDocument4 pagesFollow Fibonacci Ratio Dynamic Approach in TradeLatika DhamNo ratings yet

- 59456181584Document3 pages59456181584Abeer Abd ElatifNo ratings yet

- How To Plan A Home BudgetDocument10 pagesHow To Plan A Home BudgetshreyassrinathNo ratings yet

- Okusko V Tezos 11/27/17 ComplaintDocument20 pagesOkusko V Tezos 11/27/17 ComplaintcryptosweepNo ratings yet

- Budget Ch04 NewDocument17 pagesBudget Ch04 NewJoe OgleNo ratings yet

- Punjabi University Patiala FM Assignment - N BDocument8 pagesPunjabi University Patiala FM Assignment - N BVishvesh GargNo ratings yet

- Economics For Decision Making MBA 641Document25 pagesEconomics For Decision Making MBA 641Binyam RegasaNo ratings yet

- Guinea Special Analysis Jan 2013Document88 pagesGuinea Special Analysis Jan 2013Dan Israel - MediapartNo ratings yet

- Open Your Investment AccountDocument1 pageOpen Your Investment AccountDax EspinosaNo ratings yet

- Finmarket ReviewerDocument7 pagesFinmarket ReviewerRenalyn PascuaNo ratings yet

- Chapter 1 - Buyback Additional QuestionsDocument9 pagesChapter 1 - Buyback Additional QuestionsMohammad ArifNo ratings yet

- National SA Sports Toursim StrategyDocument20 pagesNational SA Sports Toursim StrategyEmmanuel Ezekiel-Hart EdemNo ratings yet

- Ke1155 Xls EngDocument167 pagesKe1155 Xls EngKit KatNo ratings yet

- China's Electricity Generation SectorDocument41 pagesChina's Electricity Generation Sectoramit_narang_7No ratings yet

- Lec 4 Optimal Portfolio Selection A Few Analytical Results 20170923102633 PDFDocument12 pagesLec 4 Optimal Portfolio Selection A Few Analytical Results 20170923102633 PDFMassimiliano RizzoNo ratings yet

- Adani PowerDocument10 pagesAdani PowerMontu AdaniNo ratings yet