Professional Documents

Culture Documents

Appendix II. 1

Appendix II. 1

Uploaded by

guntur pramono0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

Appendix_II._1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageAppendix II. 1

Appendix II. 1

Uploaded by

guntur pramonoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Validation Guidelines Part II Annex 1

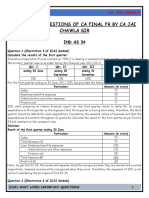

EXAMPLES FOR THE CALCULATION OF THE OPERATIONAL RISK

CAPITAL REQUIREMENT UNDER THE SIMPLE APPROACHES

1.1. BASIC INDICATOR APPROACH

Business Line Year 1 Year 2 Year 3

A 30 20 30

B 20 -20 10

C -10 -10 -20

To be considered: 40 0 20

Value of the relevant indicator: (40+20)/2=30

Value of the capital requirement: 30*0.15=4.5

1.2. STANDARDISED APPROACH

Business Year 1 Year 2 Year 3 To be Business line

Line considered by relevant

business line indicators

A (12%) 30 20 30 60 20

B (15%) 20 -20 10 30 10

C (18%) -10 -10 -20 -30 -10

Total: 40 -10 20 - -

Pursuant to CRD Annex X Part 2 Paragraph 1, if the annual profit or loss for the business line is

negative, it may be included in the numerator of the business line’s relevant indicator as a

negative figure. (Business Line C).

Pursuant to CRD Annex X Part 2 Paragraph 1, due to the negative total in year 2 (representing

the aggregate of the profit or loss of all business lines covered by the Standardised Approach), all

business lines are to be considered as zero for the calculation of the average for year 2.

Unlike with the Basic Indicator Approach, the number of years to be considered for the

calculation of the average is always 3.

Value of the capital requirement: (20*0.12)+(10*0.15)+(-10*0.18)=2.1

You might also like

- Solutions On CBFDDocument66 pagesSolutions On CBFDSreedhar Reddy100% (4)

- Applications of Matrices To Business and EconomicsDocument24 pagesApplications of Matrices To Business and EconomicsAkash Gupta93% (175)

- Finance and Project Management AssignmentDocument22 pagesFinance and Project Management AssignmentMashaal FNo ratings yet

- Comparative & Common Size StatementDocument2 pagesComparative & Common Size StatementTaaran ReddyNo ratings yet

- Comparative & Common Size SPCC Term 2 PDFDocument2 pagesComparative & Common Size SPCC Term 2 PDFTaaran ReddyNo ratings yet

- Engineering Economics (BEG495MS) - 1Document2 pagesEngineering Economics (BEG495MS) - 1Subas ShresthaNo ratings yet

- Nov 2019 Suggested AnsDocument27 pagesNov 2019 Suggested Ansinter g19No ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- AECOM Market Forecast Q2 2020 FINALDocument11 pagesAECOM Market Forecast Q2 2020 FINALMahmoud MoussaNo ratings yet

- BcvTnl-BMAN30111 Exam Paper 2019-20Document7 pagesBcvTnl-BMAN30111 Exam Paper 2019-20ruoningzhu7No ratings yet

- Cash Flow Illustrations: Exhibit 9.2 Project Cash FlowsDocument14 pagesCash Flow Illustrations: Exhibit 9.2 Project Cash FlowsSchone CoolbearNo ratings yet

- UntitledDocument25 pagesUntitledAyesha AlliNo ratings yet

- ECF04 Exam Sem I 2019 SolutionsDocument16 pagesECF04 Exam Sem I 2019 SolutionsZaid DeanNo ratings yet

- GST QP BBA V SemesterDocument3 pagesGST QP BBA V SemesterENTERTAINMENT PACKAGENo ratings yet

- No 1: Menghitung Nilai NPV: Proyek ADocument4 pagesNo 1: Menghitung Nilai NPV: Proyek AAbdullahNo ratings yet

- Day1 GroupWorkDocument3 pagesDay1 GroupWorkswati.up1905No ratings yet

- School of Business: Revision Question One: 20 MarksDocument2 pagesSchool of Business: Revision Question One: 20 MarksDanielNo ratings yet

- US Internal Revenue Service: f6765 - 1995Document2 pagesUS Internal Revenue Service: f6765 - 1995IRSNo ratings yet

- Adv Issues in CapBud - Gr2 9-02 WipDocument24 pagesAdv Issues in CapBud - Gr2 9-02 WipHimanshu GuptaNo ratings yet

- TXVNM 2019 Jun ADocument8 pagesTXVNM 2019 Jun AFive FifthNo ratings yet

- US Internal Revenue Service: f6765 - 2003Document4 pagesUS Internal Revenue Service: f6765 - 2003IRSNo ratings yet

- Machine A 000 Machine B 000: The End of The Relevant YearDocument1 pageMachine A 000 Machine B 000: The End of The Relevant YearPranjal JaiswalNo ratings yet

- Write Briefly: Total No. of Pages:03Document3 pagesWrite Briefly: Total No. of Pages:03Kîràn ShèttyNo ratings yet

- ExcelsDocument45 pagesExcelsCA Bharath Bhushan D VNo ratings yet

- Economy Exam - .2016 Final MSCDocument3 pagesEconomy Exam - .2016 Final MSCabdullah 3mar abou reashaNo ratings yet

- Be4z9 24a55Document7 pagesBe4z9 24a55samidan tubeNo ratings yet

- Capital Budgeting Practice Question With Solution (EXAM)Document10 pagesCapital Budgeting Practice Question With Solution (EXAM)imfondofNo ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Practical Exam 12Document2 pagesPractical Exam 12P Janaki RamanNo ratings yet

- Manajemen Keuangan (Z-Akunt)Document2 pagesManajemen Keuangan (Z-Akunt)hayin santosoNo ratings yet

- Oak University School of Business Bba312: Financial ManagementDocument2 pagesOak University School of Business Bba312: Financial ManagementDanielNo ratings yet

- Municipal Corporation of Greater MumbaiDocument5 pagesMunicipal Corporation of Greater MumbaiMrigank AggarwalNo ratings yet

- F6 AnsDocument9 pagesF6 AnsRaza AliNo ratings yet

- PROBLEM 9 (Net Present Value)Document8 pagesPROBLEM 9 (Net Present Value)Kathlyn TajadaNo ratings yet

- Corporate ValuationDocument9 pagesCorporate ValuationPRACHI DASNo ratings yet

- Or It Can Be Answered: ARR MethodDocument3 pagesOr It Can Be Answered: ARR MethodPranjal JaiswalNo ratings yet

- Comparative Statement of Profit and LossDocument6 pagesComparative Statement of Profit and LossHimanshi ChopraNo ratings yet

- BMP6015 FRM - Exam PaperDocument7 pagesBMP6015 FRM - Exam PaperIulian RaduNo ratings yet

- November 2020: Gauteng Department of Education Provincial ExaminationDocument8 pagesNovember 2020: Gauteng Department of Education Provincial Examinationmelinencube2002No ratings yet

- Engineering Economics (BEG495MS)Document1 pageEngineering Economics (BEG495MS)Subas ShresthaNo ratings yet

- MJ17 Hybrids F9 Clean ProofDocument6 pagesMJ17 Hybrids F9 Clean ProofVinny Lu VLNo ratings yet

- CA Inter FM ECO Suggested Answer Nov 2022Document27 pagesCA Inter FM ECO Suggested Answer Nov 2022Abhishant KapahiNo ratings yet

- Adv MTP A20Document14 pagesAdv MTP A20Pawan AgrawalNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeDocument2 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeHarsh MishraNo ratings yet

- Tutorial 6 - Business Income (P3) Capital AllowanceDocument6 pagesTutorial 6 - Business Income (P3) Capital AllowanceCHAN KER XINNo ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/21Document4 pagesCambridge International AS & A Level: BUSINESS 9609/21ইন্টারন্যাশনাল বুক সাপ্লাইNo ratings yet

- November 2020 Mark Scheme Paper 33Document15 pagesNovember 2020 Mark Scheme Paper 33Yahya UmerNo ratings yet

- Ma 2020Document8 pagesMa 2020Hamsa PNo ratings yet

- 1709846089operational Level English AnswersDocument6 pages1709846089operational Level English AnswersC ComNo ratings yet

- Comparative & Common Size 2024 SPCCDocument23 pagesComparative & Common Size 2024 SPCCborichaharsha08No ratings yet

- 4.2 Making Capital Investment Decisions/ Estimation of Project Cash Flows Illustration 1Document4 pages4.2 Making Capital Investment Decisions/ Estimation of Project Cash Flows Illustration 1Geetika RaniNo ratings yet

- FM. Final Exam (December 2018)Document11 pagesFM. Final Exam (December 2018)elodie Helme GuizonNo ratings yet

- BFC 3379 Investment Analysis and Portfolio Management PDFDocument3 pagesBFC 3379 Investment Analysis and Portfolio Management PDFdouglas kimaniNo ratings yet

- Touch StoneDocument45 pagesTouch StoneSubba RamaNo ratings yet

- Audit of The Payroll and Personnel Cycle: Chapter Opening Vignette - The Staff Auditor Must Never "Simply Follow Orders"Document7 pagesAudit of The Payroll and Personnel Cycle: Chapter Opening Vignette - The Staff Auditor Must Never "Simply Follow Orders"ዝምታ ተሻለ0% (1)

- Cost Accounting - 2 2020Document5 pagesCost Accounting - 2 2020Shone Philips ThomasNo ratings yet

- Ind As 34Document3 pagesInd As 34qwertyNo ratings yet

- Type Answers On This Side of The Page OnlyDocument40 pagesType Answers On This Side of The Page Only嘉慧No ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet