Professional Documents

Culture Documents

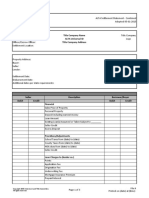

Sem 4 Interest MCQ

Sem 4 Interest MCQ

Uploaded by

Tushar HandeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sem 4 Interest MCQ

Sem 4 Interest MCQ

Uploaded by

Tushar HandeCopyright:

Available Formats

Deferrment in It

1 Interest u/s 234 A is applicable for _______________ delay in filing ITR Default in It payment payment Delay in IT payment

Excess refund given

2 Interest u/s 234 B is applicable for _______________ delay in filing ITR Default in It payment by IT Delay in IT payment

delay in filing TDS Deferrment in It Excess refund given by

3 Interest u/s 234 C is applicable for _______________ return Default in It payment payment IT

Excess refund given by Deferrment in It

4 Interest u/s 234 D is applicable for ______________ delay in filing ITR IT payment Delay in IT payment

delay in filing TDS Excess refund given by Deferrment in It

5 Fees u/s 234 E is applicable for _______________ return IT payment Delay in IT payment

Excess refund given by Deferrment in It

6 Fees u/s 234 F is applicable for _______________ delay in filing ITR IT payment Delay in IT payment

due date to actual due date to actual

7 Interest u/s 234 A is applicable for period _______________ date of filing ITR Default in It payment date of payment Delay in IT payment

1st day of Assessment due date of advance due date to actual date

8 Interest u/s 234 B is applicable from _______________ due date of filing ITR year tax payment of payment

due date of advance 1st day of previous

9 Interest u/s 234 C is applicable from _______________ due date of filing ITR tax payment year due date of TDS return

1st day of previous 1st day of

10 Interest u/s 234 D is applicable from _______________ date of issuing refund year Assessment year due date of TDS return

due date to actual

date of filing TDS Excess refund given by Deferrment in It

11 Fees u/s 234 E is applicable from _______________ return IT payment Delay in IT payment

Deferrment in It

12 Interest u/s 244 A is applicable for _______________ delay in filing ITR interest on refund due payment Delay in IT payment

1st day of Assessment due date of advance due date to actual date

13 Interest u/s 244 A is applicable from _______________ due date of filing ITR year tax payment of payment

14 Interest u/s 244 A is granted at _______________ 1% per month 0.5% per month 1.5% per month 2% per month

15 Interest u/s 234 A is charged at _______________ 1% per month 0.5% per month 1.5% per month 2% per month

1% per month from 2% per month from

1% per month from 1st day of Assessment 1st day of 2% per month from

16 Interest u/s 234 B is charged at _______________ due date of filing ITR year Assessment year due date of filing ITR

1% per month from 1% per month 1.5% per month 1.5% per month

due date of filing ITR fromdue date of from due date of fromdue date of

to actual date of filing advance tax payment filing ITR to actual advance tax payment

17 Interest u/s 234 C is charged at _______________ ITR to actua date date of filing ITR to actua date

18 Interest u/s 234 D is charged at ______________ Rs. 100 per day 0.5% per month Rs. 200 per month 2% per month

19 Fees u/s 234 E is charged at _______________ Rs. 200 per day Rs. 200 per month Rs. 100 per day Rs. 100 per month

20 Fees u/s 234 F is charged at ____________ upto December of AY Rs. 2000 Rs. 5000 Rs. 10000 Rs. 20000

21 Fees u/s 234 F is charged at ____________ beyond December of AY Rs. 2000 Rs. 5000 Rs. 10000 Rs. 20000

22 Inerest u/s 234 A & 234 B _________ charged at same time can cannot is alternatively is mandatorily

You might also like

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TSN Insurance 1st ExamDocument76 pagesTSN Insurance 1st ExamHannah Keziah Dela CernaNo ratings yet

- BillingStatement 315028328217Document2 pagesBillingStatement 315028328217Renier Palma CruzNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Gross Sales Declaration Form 2023Document1 pageGross Sales Declaration Form 2023Ramon Vinzon67% (9)

- Loan Sanction-Letter181240016761170869Document3 pagesLoan Sanction-Letter181240016761170869Sanjay MohapatraNo ratings yet

- Monthly Billing Statement: Account InformationDocument2 pagesMonthly Billing Statement: Account Informationarianne Dela cruz100% (1)

- Application and Certificate For Final PaymentDocument2 pagesApplication and Certificate For Final PaymentjohnmasefieldNo ratings yet

- Billingstatement - Franz Johann D. CeñidozaDocument2 pagesBillingstatement - Franz Johann D. Ceñidozajuan tamadNo ratings yet

- Sanction Letter BL Daily LoanDocument4 pagesSanction Letter BL Daily LoanKARTHICKEYANNo ratings yet

- (See Rule 186 (1) ) Application-Cum-Bill For Refund of DepositDocument1 page(See Rule 186 (1) ) Application-Cum-Bill For Refund of DepositKodali Harsha BabuNo ratings yet

- TDS On Real Estate Transactions: Flow of DiscussionDocument32 pagesTDS On Real Estate Transactions: Flow of DiscussionANILNo ratings yet

- 1 MIS Reporting 2 SOP's Required For Each Item in The Financials 3 Standalone and Consolidated of Financials For The FY2021-21Document8 pages1 MIS Reporting 2 SOP's Required For Each Item in The Financials 3 Standalone and Consolidated of Financials For The FY2021-21Suresh KattamuriNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- Neft Form For Credit of The Above Amount by NeftDocument1 pageNeft Form For Credit of The Above Amount by Neftsarbjeet kumarNo ratings yet

- Tybaf Sem Vi Indirect TaxDocument6 pagesTybaf Sem Vi Indirect TaxAditya DeodharNo ratings yet

- Voith - Mudita Agreement - FinalDraftDocument9 pagesVoith - Mudita Agreement - FinalDraftOpen AINo ratings yet

- Land Settlement Statement FormDocument3 pagesLand Settlement Statement FormASDFGHJKNo ratings yet

- BillingStatement - JO-ANN V. ESTEBANDocument2 pagesBillingStatement - JO-ANN V. ESTEBANJo-Ann Chan ValleNo ratings yet

- Application Form For Final Payment Gazetted Officer UpdatedDocument5 pagesApplication Form For Final Payment Gazetted Officer UpdatedMuhammad AsifNo ratings yet

- Consultant Timesheet 2Document1 pageConsultant Timesheet 2meaowguerreroNo ratings yet

- Www-Besttaxinfo-InDocument8 pagesWww-Besttaxinfo-Insukantabera215No ratings yet

- Issues Related To Taxation of NPOsDocument17 pagesIssues Related To Taxation of NPOsCA Poonam GuptaNo ratings yet

- Tulungan Application Form Rev. 7Document1 pageTulungan Application Form Rev. 7joyce DtNo ratings yet

- Indirect Tax Ty Bcaf Sample QuestionsDocument15 pagesIndirect Tax Ty Bcaf Sample QuestionssanjchandanNo ratings yet

- Preview Kfs AgreementDocument2 pagesPreview Kfs AgreementKama RajNo ratings yet

- MII Changes W.R.T. All in Cost 16jul09 CLDocument2 pagesMII Changes W.R.T. All in Cost 16jul09 CLankitshinde1No ratings yet

- US Internal Revenue Service: I1045 - 1993Document4 pagesUS Internal Revenue Service: I1045 - 1993IRSNo ratings yet

- Accoun1 SpaceDocument25 pagesAccoun1 SpacePerlas Flordeliza100% (1)

- Key Fact StatementDocument6 pagesKey Fact StatementAnkit KumarNo ratings yet

- Reimbursement Claim For Driver Salary: 18 September 2021Document1 pageReimbursement Claim For Driver Salary: 18 September 2021Pawan KatiyarNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- Fix DepositDocument2 pagesFix DepositHARSIMRAN SINGHNo ratings yet

- Average Due DateDocument19 pagesAverage Due DatePriyanshuNo ratings yet

- BillingStatement 364024053214Document2 pagesBillingStatement 364024053214MARY JERICA OCUPENo ratings yet

- Presentation+ +Manish+ShahDocument106 pagesPresentation+ +Manish+ShahAtul PatelNo ratings yet

- GPF PDFDocument24 pagesGPF PDFHimanshuKaushikNo ratings yet

- Revised Methodology 23.12.2015Document38 pagesRevised Methodology 23.12.2015ykbharti101No ratings yet

- PDFFile AspxDocument2 pagesPDFFile AspxJane Carpio MedinaNo ratings yet

- Ihfl Exchange Intimation 57 21042023 - 0187411001682085148Document1 pageIhfl Exchange Intimation 57 21042023 - 0187411001682085148Mudit NawaniNo ratings yet

- US Internal Revenue Service: I8582cr - 1993Document14 pagesUS Internal Revenue Service: I8582cr - 1993IRSNo ratings yet

- Tax Planning and ManagementDocument12 pagesTax Planning and Managementayushi chandraNo ratings yet

- Jhansi Aptc Form 40 A 1Document1 pageJhansi Aptc Form 40 A 1Siva KumarNo ratings yet

- Disposal Instruction For Handling Foreign Inward RemittancesDocument3 pagesDisposal Instruction For Handling Foreign Inward Remittancessishir chandraNo ratings yet

- 61807bos50279 cp6 U4Document23 pages61807bos50279 cp6 U4Vishvanath VishvanathNo ratings yet

- BA 119 - Government Accounting - For ClassDocument6 pagesBA 119 - Government Accounting - For ClassJuvy DimaanoNo ratings yet

- 6-Interest Payable by The TaxpayerDocument13 pages6-Interest Payable by The Taxpayerrip111176No ratings yet

- Form 47 BackDocument1 pageForm 47 BackGollapalli JRatnakar BabuNo ratings yet

- To Be Filled by The Officer Claiming ReimbursementDocument2 pagesTo Be Filled by The Officer Claiming ReimbursementrajneeshmmmecNo ratings yet

- keyFactStatement 1Document8 pageskeyFactStatement 1Mohd ParvezNo ratings yet

- GST Year End Checklist FY 2022-23-NynDocument4 pagesGST Year End Checklist FY 2022-23-NynCA Rajendra Prasad ANo ratings yet

- Sanction LetterDocument6 pagesSanction Letterbjoy.itinfoNo ratings yet

- CHAPTERS 1& 2 Class ExeerciseDocument4 pagesCHAPTERS 1& 2 Class ExeerciseBigAsianPapiNo ratings yet

- BillingStatement 315017330518Document2 pagesBillingStatement 315017330518Willy LumbresNo ratings yet

- PPP - Forgiveness Application and Instructions - 3508 (1.19.2021) - 508Document13 pagesPPP - Forgiveness Application and Instructions - 3508 (1.19.2021) - 508Srinivas Meduri100% (1)

- Section 194J: Fees For Professional or Technical ServicesDocument24 pagesSection 194J: Fees For Professional or Technical ServicesSAURABH TIBREWALNo ratings yet

- 98 Traditional IRA Custodial Plan Agreement and Disclosure Statement (3 - 2016)Document15 pages98 Traditional IRA Custodial Plan Agreement and Disclosure Statement (3 - 2016)sivakumar7No ratings yet

- 6-Interest Payable by The TaxpayerDocument13 pages6-Interest Payable by The TaxpayertadilakshmikiranNo ratings yet

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- Costing Revision Notes (1 Day Before Exam)Document6 pagesCosting Revision Notes (1 Day Before Exam)nagaraj9032230429No ratings yet

- Sem 4 Tax Planning MCQDocument1 pageSem 4 Tax Planning MCQTushar HandeNo ratings yet

- MCQ ReliefDocument14 pagesMCQ ReliefTushar HandeNo ratings yet

- DocScanner Aug 27, 2022 8-35 AMDocument13 pagesDocScanner Aug 27, 2022 8-35 AMTushar HandeNo ratings yet

- Sem 4 Tax Rates MCQDocument1 pageSem 4 Tax Rates MCQTushar HandeNo ratings yet

- Production ManagementDocument6 pagesProduction ManagementTushar HandeNo ratings yet

- Dnyandeep Cost Accounting - 3 Short NotesDocument10 pagesDnyandeep Cost Accounting - 3 Short NotesTushar HandeNo ratings yet

- Limited Liability PartnershipDocument12 pagesLimited Liability PartnershipTushar HandeNo ratings yet

- Project Book BMSDocument4 pagesProject Book BMSTushar HandeNo ratings yet

- Prakas: General Provisions Article 1Document16 pagesPrakas: General Provisions Article 1william brookeNo ratings yet

- Working With Dairy Businesses in Challenging TimesDocument49 pagesWorking With Dairy Businesses in Challenging TimesaamritaaNo ratings yet

- Chapter 02Document68 pagesChapter 02loveshare100% (1)

- Financial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsDocument7 pagesFinancial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsSidharth AnandNo ratings yet

- Birla Sun Life Century SIP PresentationDocument42 pagesBirla Sun Life Century SIP PresentationDrashti Investments100% (7)

- Cost Accounting CycleDocument2 pagesCost Accounting CycleJessica AningatNo ratings yet

- Junior Costs Accountant Resume ExampleDocument1 pageJunior Costs Accountant Resume ExamplesuraNo ratings yet

- Global Detergents (C) /FM-II/003Document3 pagesGlobal Detergents (C) /FM-II/003PRATIK MUKHERJEENo ratings yet

- Elaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Document2 pagesElaborate Activity: Evaluate: Straight Problems (Show Solutions in Good Accounting Form)Meghan Kaye LiwenNo ratings yet

- Formula Sheet: FV (Continuous Compounding) PVDocument5 pagesFormula Sheet: FV (Continuous Compounding) PVTanzim HudaNo ratings yet

- SYNOPSIS of Tata SteelDocument12 pagesSYNOPSIS of Tata SteelPrachi TanejaNo ratings yet

- Fin1013 Group L Assignment 1 (Financial Statements Analysis)Document14 pagesFin1013 Group L Assignment 1 (Financial Statements Analysis)zhekaiNo ratings yet

- Posb StatementDocument3 pagesPosb StatementDayana MhdNo ratings yet

- Tanjong PLC - Investor KitDocument33 pagesTanjong PLC - Investor Kitzamans98No ratings yet

- AcknowledgementDocument1 pageAcknowledgementBaldhariNo ratings yet

- Pre-Feasibility Study: Tea CompanyDocument20 pagesPre-Feasibility Study: Tea CompanyIPro PkNo ratings yet

- Homing Pigeon CandlestickDocument8 pagesHoming Pigeon CandlestickShane CabinganNo ratings yet

- PGBP Material PDFDocument182 pagesPGBP Material PDFAmrutha V KNo ratings yet

- COTY Student Guidelines 2023Document5 pagesCOTY Student Guidelines 202364xs9hs9thNo ratings yet

- Faqs On Sms & Email Based Trade Alerts Facility For InvestorsDocument3 pagesFaqs On Sms & Email Based Trade Alerts Facility For InvestorsVESTIGE GROS LEADERSNo ratings yet

- Sharjah Cement 2016Document35 pagesSharjah Cement 2016NotesfreeBookNo ratings yet

- Budget Workshop 3 FY 2022Document41 pagesBudget Workshop 3 FY 2022Dan LehrNo ratings yet

- CFAS Module 1 - ReviewerRRRDocument4 pagesCFAS Module 1 - ReviewerRRRAthena LedesmaNo ratings yet

- Fintech Industry in India The Digital Transformation of Financial ServicesDocument9 pagesFintech Industry in India The Digital Transformation of Financial ServicesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Paytm Payments BankDocument1 pagePaytm Payments Banksaty16No ratings yet

- United States v. Joseph Silvestri, 409 F.3d 1311, 11th Cir. (2005)Document38 pagesUnited States v. Joseph Silvestri, 409 F.3d 1311, 11th Cir. (2005)Scribd Government DocsNo ratings yet

- Unit-1 Introduction of Indian Financial SystemDocument23 pagesUnit-1 Introduction of Indian Financial Systempranali suryawanshiNo ratings yet

- Gitman Chapter9Document19 pagesGitman Chapter9Hannah Jane UmbayNo ratings yet

- Republic of The Philippines: (SK of Barangay, City/Municipality, Province)Document2 pagesRepublic of The Philippines: (SK of Barangay, City/Municipality, Province)Nestie BryalNo ratings yet