Professional Documents

Culture Documents

AFAR 2304 Government Accounting

Uploaded by

Dzulija TalipanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR 2304 Government Accounting

Uploaded by

Dzulija TalipanCopyright:

Available Formats

AFAR 2304

GOVERNMENT ACCOUNTING

INSTRUCTOR: DAVE U. CERVAS, CPA U.S. CMA CTT MRITax

Content Author: ARMEE JAY L. CRESMUNDO, CPA MSA

I. Basic Concepts in Government Accounting

• Government accounting encompasses the processes of analyzing, recording,

classifying, summarizing, and communicating all transactions involving the receipt

and disposition of government funds and property, and interpreting the results

thereof. (State Audit Code of the Philippines, P.D. No. 1445, Sec. 109)

• Compared to the accounting for business entities, government accounting places

greater emphasis on the following:

1. Sources and utilization of government funds; and

2. Responsibility, accountability, and liability of entities entrusted with government

funds and properties.

• Government resources must be utilized efficiently and effectively in accordance

with the law. The head of a government agency is directly responsible in

implementing this policy. All other personnel entrusted with the custody of

government resources are responsible to the head of the government agency, are

accountable for the safeguarding thereof, and are liable for any losses.

• The following offices are charged with government accounting responsibility:

1. Commission on Audit (COA)

• Promulgate accounting and auditing rules

• Keep the general accounts

• Submit financial reports

2. Department of Budget and Management (DBM)

• Implementation of the national budget

3. Bureau of Treasury (BTr)

• Cash custody and control of disbursements.

4. Government agencies

• Maintain accounting books and budget registries which are reconciled with

the cash records of the BTr and the budget records of the COA and DBM.

II. The GAM for NGAs

• The Government Accounting Manual for National Government Agencies (GAM

for NGAs) is promulgated by the COA under the authority conferred to it by the

Philippine Constitution.

• The GAM for NGAs was promulgated primarily to harmonize the government

accounting standards with the International Public Sector Accounting Standards

(IPSAS). The IPSASs are based on the IFRSs.

AFAR 2304 GOVERNMENT ACCOUNTING 1

• Objectives of the GAM for NGAs:

To update the following:

1. Standards, policies, guidelines and procedures in accounting for government

funds and property;

2. Coding structure and accounts; and

3. Accounting books, registries, records, forms, reports, and financial statements.

• Basic Accounting and Budget reporting Principles

1. Compliance with PPSAS and relevant laws, rules, and regulations

2. Accrual basis of accounting

3. Budget basis for presentation of budget information in the financial statements

4. Revised Chart of Accounts

5. Double entry bookkeeping

6. Financial statements based on accounting and budgetary records

7. Fund cluster accounting

Code Fund clusters

01 Regular Agency Fund

02 Foreign Assisted Projects Fund

03 Special Account – Locally Funded/ Domestic Grants Fund

04 Special Account – Foreign Assisted/ Foreign Grants Fund

05 Internally Generated Funds

06 Business Related Funds

07 Trust Receipts

• Qualitative Characteristics

1. Understandability

2. Relevance

3. Materiality

4. Timeliness

5. Reliability

6. Faithful representation

7. Substance over form

8. Neutrality

9. Prudence

10. Completeness

11. Comparability

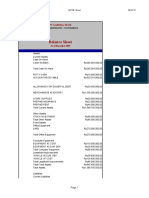

• Components of General-Purpose Financial Statements

1. Statement of Financial Position;

2. Statement of Financial Performance;

3. Statement of Changes in Net Assets/Equity;

4. Statement of Cash Flows;

5. Statement of Comparison of Budget and Actual Amounts; and

6. Notes to the Financial Statements

AFAR 2304 GOVERNMENT ACCOUNTING 2

III. The Budget Process

• The national budget (government budget) is the government’s estimate of the

sources and uses of government funds within a fiscal year. This forms the basis for

expenditures and is the government’s key instrument for promoting its socio-

economic objectives.

• The Budget Cycle: (PLEA)

1. Budget Preparation – bottom-up approach; zero-based budgeting

a. Budget Call

b. Budget Hearings

c. Presentation to the Office of the President

2. Budget Legislation

a. House Deliberations

b. Senate Deliberations

c. Bicameral Deliberations

d. President’s Enactment

3. Budget Execution

a. Release Guidelines and BEDs

b. Allotment – is an authorization issued by the DBM to government agencies to

incur obligations for specified amounts contained in a legislative

appropriation in the form of budget release documents. It is also referred to

as Obligational Authority.

c. Incurrence of Obligations

d. Disbursement Authority

i. Notice of Cash Allocation (NCA) – authority issued by the DBM to central,

regional, and provincial offices and operating units to cover their cash

requirements. The NCA specifies the maximum amount of cash that can be

withdrawn from a government servicing bank in a certain period.

ii. Notice of Transfer of Allocation – authority issued by an agency’s Central

Office to its regional and operating units to cover the latter’s cash

requirements.

iii. Non-Cash Availment Authority – authority issued by the DBM to agencies

to cover the liquidation of their actual obligations incurred against

available allotments for availment of proceeds from loans/grants through

supplier’s credit/constructive cash.

iv. Cash Disbursement Ceiling – authority issued by the DBM to agencies

with foreign operations allowing them to use the income collected by their

Foreign Service Posts to cover their operating requirements.

4. Budget Accountability

a. Budget Accountability Reports

b. Performance Reviews

c. Audit

AFAR 2304 GOVERNMENT ACCOUNTING 3

• The following table summarizes the difference among important terms in the budget

process:

Authorization by a legislative body to allocate funds for

APPROPRIATION

specified purposes

Authorization to agencies to incur obligations (i.e., obligational

ALLOTMENT

authority)

Amount contracted by an authorized officer for which the

OBLIGATION government is held liable

DISBURSEMENT Actual amount paid out of the budgeted amount

• The approved budget consists of the following:

1. New General Appropriations

2. Continuing Appropriations

3. Supplemental Appropriations

4. Automatic Appropriations

5. Unprogrammed Funds

6. Retained Income/Funds

7. Revolving Funds

8. Trust Receipts

• Appropriation – is the authorization made by a legislative body to allocate funds for

purposes specified by the legislative or similar authority.

1. New General Appropriations – annual authorizations for incurring obligations,

as listed in the GAA.

2. Continuing Appropriations – authorizations to support the incurrence of

obligations beyond the budget year (e.g., multi-year construction projects).

3. Supplemental Appropriations – additional appropriations to augment the

original appropriations which proved to be insufficient.

4. Automatic Appropriations – authorizations programmed annually which do not

require periodic action by Congress.

5. Unprogrammed Funds – standby appropriations which may be availed only

upon the occurrence of certain instances.

6. Retained Income/Funds – collections which the agencies can use directly in

their operations.

7. Revolving Funds – receipts from business-type activities of agencies which are

authorized to be constituted as such. These are self-liquidating and all obligations

and expenditures incurred by virtue of said business-type activity shall be

charged against the fund.

8. Trust Receipts – receipts by a government agency acting as agent.

• Responsibility accounting is a system of providing cost and revenue information

over which a manager has direct control of. It requires the identification of

responsibility centers and the distinction between controllable and non-controllable

costs.

AFAR 2304 GOVERNMENT ACCOUNTING 4

IV. The Government Accounting Process

A. Books of Accounts and Registries

1. Journals

a. General Journal

b. Cash Receipts Journal

c. Cash Disbursements Journal

d. Check Disbursements Journal

2. Ledgers

a. General Ledgers

b. Subsidiary Ledgers

3. Registries

a. Registries of Revenue and Other Receipts (RROR)

b. Registry of Appropriations and Allotments (RAPAL)

c. Registries of Allotments, Obligations and Disbursements (RAOD)

d. Registries of Budget, Utilization and Disbursements (RBUD)

B. Object of Expenditures

1. Personnel Services (PS) – pertain to all types of employee benefits.

2. Maintenance and Other Operating Expenses (MOOE) – pertain to various

operating expenses other than employee benefits and financial expenses.

3. Financial Expenses (FE) – pertain to finance costs.

4. Capital Outlays (CO) – pertain to capitalizable expenditures.

C. Basic Recordings

Recording in:

Transaction

Registries & Other records Journal & Ledger

1. Appropriation RAPAL None

RAPAL and appropriate

2. Allotment None

RAODs

3. Incurrence of Obligations ORS and appropriate RAODs None

Cash-MDS, Regular xx

4. NCA RANCA xx

Subsidy from NG

Expense/Asset xx

Payable xx

Updating of ORS and

5. Disbursements

appropriate RAODs

Payable xx

Cash-MDS, Regular xx

Cash-TRA xx

6. Tax Remittance Advice

Subsidy from NG xx

(TRA is used for Updating of ORS and

remittance of taxes appropriate RAODs

Due to BIR xx

withheld) Cash-TRA xx

Accounts receivable xx

Cash-CO xx

7. Billings, Collections, & Cash-CO xx

RROR, RCD/CRReg

Remittances Accounts receivable xx

Cash-Deposit, Regular xx

Cash-CO xx

AFAR 2304 GOVERNMENT ACCOUNTING 5

Subsidy from NG xx

8. Reversion of Unused NCA RANCA Cash-MDS, Regular xx

D. Revenues and Other Receipts

• All revenues shall be remitted to the BTr and included in the General Fund, unless

another law specifically allows otherwise. Recording in other types of funds (e.g.,

Special Fund) shall be made only when authorized by law.

• Receipts shall be properly acknowledged through pre-numbered ORs. Receipts

can be in the form of checks.

• Revenues may arise from exchange and non-exchange transactions:

1. Exchange transaction – examples: sale of goods and rendering of services.

2. Non-exchange transactions – examples: tax revenue, fines and penalties and

donations.

• Revenue from the sale of goods shall be recognized when all of the following

conditions are satisfied:

1. Significant risks and rewards of ownership of the goods are transferred to the

buyer;

2. The entity does not retain continuing managerial involvement or effective

control over the goods sold;

3. It is probable that economic benefits will flow to the entity;

4. Revenue can be measured reliably; and

5. Costs relating to the transaction can be measured reliably.

• Revenue from rendering of services is recognized on a straight-line basis over

the contact term. However, revenue is recognized by reference to the stage of

completion if the outcome of the transaction can be estimated reliably, such as

when all of the following conditions are satisfied:

1. The stage of completion can be measured reliably;

2. It is probable that economic benefits will flow to the entity;

3. Revenue can be measured reliably; and

4. Costs relating to the transaction can be measured reliably.

• When the outcome cannot be estimated reliably, revenue is recognized only

to the extent of recoverable costs.

• Interest is recognized on a time proportion basis that takes into account the

effective yield on the asset.

• Royalties is recognized as they are earned in accordance with the substance of

the relevant agreement.

AFAR 2304 GOVERNMENT ACCOUNTING 6

• Dividends are recognized when the entity's right to receive payment is

established.

• Revenue from exchange transactions are measured at the fair value of the

consideration received or receivable. Any trade discounts and volume rebates

shall be taken into account. When cash flows are deferred, the fair value of the

consideration is the present value of the consideration receivable.

• For exchange of goods, the following rules shall be applied:

a. Similar – no revenue is recognized

b. Dissimilar – revenue is recognized, measured using the following order of

priority:

i. Fair value of the goods or services received, adjusted by the amount of any

cash transferred.

ii. Fair value of the goods or services given up, adjusted by the amount of any

cash transferred.

• Revenue from non-exchange transactions are derived mostly from taxes, fines

and penalties, gifts, donations and goods in-kind.

c. Disbursements

1. Check

MDS Check Commercial Check

Asset/Expense/Liability xx Asset/Expense/Liability xx

Cash-MDS, Regular xx Cash in Bank-Local Currency, CA xx

2. Cash

Advances for/to (Appropriate Account) xx

Cash-MDS, Regular xx

To record the grant of cash advances.

Expenses (Appropriate Account) xx

Advances for/to (Appropriate Account) xx

To record the liquidation of cash advances.

3. Cashless payments:

a. Advice to Debit Account (ADA) – the ADA is an accountable form used as an

authorization issued by a government agency to the MDS-GSB instructing the

bank to debit a specified amount from its available NCA to pay the

creditors/payees listed in the LDDAP-ADA.

Accounts payable xx

Cash-MDS, Regular xx

To record payment of payables to suppliers/contractors through ADA.

b. Electronic Modified Disbursement System (eMDS) – the eMDS is like the

ADA except that disbursements are made directly from the accounts of the BTr

that are maintained with the Land Bank of the Philippines (LBP). Agencies

AFAR 2304 GOVERNMENT ACCOUNTING 7

subscribed under LBP’s eMDS can make online disbursements for selected

transactions.

c. Cashless Purchase Card System (Credit Card) – made through the use of an

electronic card (i.e., credit card).

Office supplies inventory xx

Accounts payable xx

To recognize purchase of office supplies through CPC.

Accounts payable xx

Cash-MDS, Regular xx

To recognize settlement of CPC billing statement.

d. Non-Cash Availment Authority (NCAA)

Books of Entity A Books of BTr

Communication Equipment xx

Accounts payable xx

To recognize receipt of PPE procured through

the direct payment scheme.

Accounts payable xx Subsidy to NGAs xx

Subsidy from NG xx Loans Payable – Foreign xx

To recognize receipt of NCAA and payment of To recognize the replenishments made to AGSB

payable. negotiated MDS-checks and payments on

account of the NGA.

e. Tax Remittance Advice (TRA)

Books of Entity A

Cash-Tax Remittance Advice xx

Subsidy from NG xx

To recognize the constructive receipt of NCA for TRA.

Due to BIR xx

Cash-Tax Remittance Advice xx

To recognize constructive remittance of taxes withheld to the BIR through TRA.

Books of BIR Books of BTr

Cash-TRA xx Subsidy to NGAs xx

Income tax xx Cash-TRA xx

To recognize constructive receipt of taxes To recognize constructive receipt of remittance

remitted by NGAs through TRA. of taxes by NGAs through TRA.

• Disallowances refer to expenditures made by an agency that are subsequently

invalidated or disallowed by the COA because they are found to be irregular,

unnecessary, excessive, extravagant, or unconscionable. Disallowances are recorded

in the books of accounts only when they become final and executory.

AFAR 2304 GOVERNMENT ACCOUNTING 8

MULTIPLE CHOICE QUESTIONS

1. What is the title of the revised government accounting system for national government

agencies which will be effective starting January 1, 2016?

A. Government Accounting Manual (GAM)

B. New Government Accounting System (NGAS)

C. Philippine Government Accounting System (PGAS)

D. National Government Accounting Manual (NGAM)

2. Under Article IX-D Section 2 of the 1987 Constitution of the Republic of the Philippines,

it shall have the exclusive authority, subject to the limitations in this Article, to define

the scope of its audit and examination, establish the techniques and methods required

therefore, and promulgate accounting and auditing rules and regulations, including

those for the prevention and disallowance of irregular, unnecessary, excessive,

extravagant, or unconscionable expenditures, or uses of government funds and

properties. It shall also be responsible to keep the general accounts of the Government

and, for such period as may be provided by law, preserve the vouchers and other

supporting papers pertaining thereto.

A. Commission on Audit

B. Civil Service Commission

C. Commission on Elections

D. Commission on Human Rights

3. The Government Accounting Manual aims to update the following, except

A. Standards, policies, guidelines, and procedures in accounting for government funds

and property

B. Coding structure and accounts

C. Accounting books, registries, records, forms, reports, and financial statements

D. Scope and objectives of audit

4. It encompasses the processes of analyzing, recording, classifying, summarizing and

communicating all transactions involving the receipt and disposition of government

funds and property, and interpreting the results thereof.

A. Government auditing

B. Government reporting

C. Government accounting

D. Government analyzing

5. It refers to the financial plan of a government for a given period, usually for a fiscal year,

which shows what its resources are, and how they will be generated and used over the

fiscal period.

A. Government budget

B. Government financial position

AFAR 2304 GOVERNMENT ACCOUNTING 9

C. Government financial statements

D. Government financial performance

6. It refers to the first step in the government budgetary process wherein the President,

through the assistance of the Department of Budget and Management, shall prepare and

submit to the Congress within 30 days from the opening of regular session of Congress

a budget of expenditures and sources of financing, including receipts from existing and

proposed revenue measures.

A. Budget preparation

B. Budget legislation or authorization

C. Budget execution

D. Budget accountability

7. It refers to the second step in the government budgetary process which involves the

enactment by the Congress of the General Appropriation Act (GAA) based on the budget

submitted by the President which cannot be increased by the Congress. The initiative

for the enactment of the appropriation law shall come from the House of

Representatives.

A. Budget preparation

B. Budget legislation or authorization

C. Budget execution

D. Budget accountability

8. It refers to the third step in the government budgetary process which involves the

implementation of the general appropriation act which includes the release of revenue

allotment under the supervision of Department of Budget and Management.

A. Budget preparation

B. Budget legislation or authorization

C. Budget execution

D. Budget accountability

9. It refers to the final step in the government budgetary process which involves the

submission of proper documentary reports by responsible officer, liquidation of

expenditures and audit conducted by Commission of Audit to ensure the public funds

are spent in accordance with the appropriation act.

A. Budget preparation

B. Budget legislation or authorization

C. Budget execution

D. Budget accountability

10. Under the Government Accounting Manual (GAM), the financial reporting system of the

Philippine government consists of accounting system on accrual basis and budget

reporting system on budget basis under the statutory responsibility of the National

AFAR 2304 GOVERNMENT ACCOUNTING 10

Government Agencies (NGAs), Bureau of Treasury (BTr), Department of Budget and

Management (DBM), and the Commission on Audit (COA). Which of the following is

incorrect under the Government Accounting Manual?

A. Each entity of the National Government (NG) maintains complete set of accounting

books by fund cluster which is reconciled with the records of cash transactions

maintained by the BTr.

B. The BTr accounts for the cash, public debt and related transactions of the NG.

C. Each entity maintains budget registries which are reconciled with the budget

records maintained by the DBM and the Government Accountancy Sector (GAS),

COA.

D. Each entity shall maintain Regular Agency (RA) books and National Government

(NG) books for the recording of its transactions.

11. The General Accounting Manual enumerates the following components of the General-

Purpose Financial Statements of National Government Agencies except

A. Statement of Financial Position

B. Statement of Financial Performance

C. Statement of Retained Earnings

D. Statement of Cash Flows

E. Statement of Changes in Net Assets/Equity

F. Statement of Comparison of Budget and Actual Amounts

G. Notes to the Financial Statements, comprising a summary of significant accounting

policies and other explanatory notes.

12. The books of accounts of National Government Agencies under the GAM shall consist of

the following except

A. General Journal

B. Cash Receipts Journal

C. Cash Disbursement Journal

D. Regular Agency and National Government Books

E. Check Disbursements Journal

F. General Ledgers

G. Subsidiary Ledgers

13. The registries of National Government Agencies under the GAM shall consist of the

following except

A. Registries of Revenue and Other Receipts (RROR)

B. Registries of Appropriations and Allotments (RAPAL)

C. Registries of Allotments, Obligations and Disbursements (RAOD)

D. Registries of Budget, Utilization and Disbursements (RBUD)

E. Registries of Priority Development Assistant Program (RPDAP)

AFAR 2304 GOVERNMENT ACCOUNTING 11

14. It refers to the registry maintained by NGA unit to monitor the revenue and other

receipts estimated/budgeted, collected and remitted/deposited.

A. Registries of Revenue and Other Receipts (RROR)

B. Registries of Appropriations and Allotments (RAPAL)

C. Registries of Allotments, Obligations and Disbursements (RAOD)

D. Registries of Budget, Utilization and Disbursements (RBUD)

15. It refers to the registry maintained by NGA unit to show the original, supplemental and

final budget for the year and all allotments received charged against the corresponding

appropriation.

A. Registries of Revenue and Other Receipts (RROR)

B. Registries of Appropriations and Allotments (RAPAL)

C. Registries of Allotments, Obligations and Disbursements (RAOD)

D. Registries of Budget, Utilization and Disbursements (RBUD)

16. It refers to the registry maintained by NGA unit to show the allotments received for the

year, obligations incurred against the corresponding allotment and the actual

disbursements made.

A. Registries of Revenue and Other Receipts (RROR)

B. Registries of Appropriations and Allotments (RAPAL)

C. Registries of Allotments, Obligations and Disbursements (RAOD)

D. Registries of Budget, Utilization and Disbursements (RBUD)

17. It refers to the registry maintained by NGA unit to record the approved special budget

and the corresponding utilizations and disbursements charged to retained income

authorized under the law and other retained income collection of a national government

agency with similar authority.

A. Registries of Revenue and Other Receipts (RROR)

B. Registries of Appropriations and Allotments (RAPAL)

C. Registries of Allotments, Obligations and Disbursements (RAOD)

D. Registries of Budget, Utilization and Disbursements (RBUD)

18. The following are the classifications of different RAPAL, RAOD, and RBUD except

A. RAPAL/RAOD/RBUD – Personal Services

B. RAPAL/RAOD/RBUD – Maintenance and Other Operating Expenses

C. RAPAL/RAOD/RBUD – Financial Expenses

D. RAPAL/RAOD/RBUD – Capital Outlays

E. RAPAL/RAOD/RBUD – Noncash Expenses

AFAR 2304 GOVERNMENT ACCOUNTING 12

19. Which of the following statements concerning the period of validity of Notice of Cash

Allocations (NCAs) is incorrect?

A. NCA issued and credited to the Regular MDS Sub-Accounts of agencies/OUs for their

regular operations, shall be valid until the last working day of the 3rd month of that

quarter pursuant to DBM Circular Letter (CL) No. 2013-12.

B. NCA issued and credited to the Special MDS Accounts of agencies specifically for

payment of RGITL benefits shall be valid until the last working day of the following

month when the NCA was issued, except when issued in December, pursuant to DBM

Budget Circular No. 2013-1.

C. NCA issued for trust receipts and credited to the Trust MDS Account of agencies shall

be valid until the last working day of the year.

D. NCA issued to the BTr for working funds of agencies shall be valid until the last

working day of the year.

E. NCA, regardless of source, shall be valid only for a period of 1 month from the date

of receipt.

20. On December 31, 2019, the Department of Finance billed its lessee on one of its buildings

in the amount of P10,000. On January 31, 2020, the Department of Finance collected all

the accounts receivable. On February 29, 2020, the Department of Finance remitted the

entire amount to the Bureau of Treasury. What is the journal entry to record the

remittance by the Department of Finance to the Bureau of Treasury?

A. Debit – Accounts Receivable P10,000; Credit – Rent Income P10,000

B. Debit – Accounts Receivable P10,000; Credit – Retained Earnings P10,000

C. Debit – Cash- Collecting Officer P10,000; Credit – Accounts Receivable P10,000

D. Debit – Cash- Treasury/Agency Deposit, Regular P10,000; Credit – Cash- Collecting

Officer P10,000

21. On January 1, 2019, the Department of Public Works and Highways (DPWH) received a

P10,000,000 appropriation from the national government for the acquisition of

machinery. On February 1, 2019, DPWH received the allotment form the Department of

Budget and Management. On March 1, 2019, DPWH entered into a contract with CAT Inc.

for the acquisition of the machinery with a price of P8,000,000. On April 1, 2019, DPWH

received the Notice of Cash Allocation from DBM net of 1% withholding tax for income

tax of supplier and 5% withholding of final tax on VAT of supplier. On May 1, 2019, CAT

Inc. delivered the machinery to DPWH. On June 1, 2019, DPWH paid the obligation to

CAT Inc. On July 1, 2019, DPWH remitted the withheld income tax and final VAT to BIR.

What is the journal entry on March 1, 2019?

A. No entry but just posting to appropriate RAPAL

B. No entry but just posting to appropriate RAPAL and to RAOD

C. No entry but just posting of ORS (Obligation Request and Status) to appropriate

RAOD

D. Debit Machinery P8,000,000; Credit Accounts Payable P8,000,000

AFAR 2304 GOVERNMENT ACCOUNTING 13

22. Using the same data on number 21, what is the journal entry on April 1, 2019?

A. Cash- MDS, Regular P7,520,000

Subsidy Income from National Government P7,520,000

B. Machinery P8,000,000

Accounts Payable P8,000,000

C. Accounts Payable P8,000,000

Due to BIR P480,000

Cash- MDS, Regular P7,520,000

D. Due to BIR P480,000

Subsidy Income from National Government P480,000

23. The salary accountant of DENR provided the following data concerning the salaries of

its officers and employees for the month ended December 31, 2019:

Salaries and Wages P510,000

Personal Economic Relief Allowance (PERA) 55,000

Gross Compensation 565,000

Withholding Income Tax 51,000

GSIS 15,300

PAG-IBIG 10,200

PhilHealth 510

Net P487,990

DENR received the Notice of Cash Allocation from the DBM net of 10% tax on basic

salary. Afterwards, DENR granted cash advance to the cashier for the payroll.

Afterwards, the DENR cashier paid the employees and submitted the liquidation report

of the payroll fund with the corresponding supporting documents. Afterwards, DENR

remitted the withheld tax to BIR and the withheld contribution to GSIS, PAG-IBIG and

PhilHealth. What is the journal entry to recognize grant of cash advance to the cashier

for the payroll?

A. Cash- MDS, Regular 508,500

Subsidy Income from National Government 508,500

B. Salaries and Wages Regular 510,000

PERA 55,000

Due to BIR 51,000

Due to GSIS 15,300

Due to PAG-IBIG 10,200

Due to PhilHealth 510

Due to Officers and Employees 487,990

C. Advances for payroll 487,990

Cash- MDS, Regular 487,990

D. Due to Officers and Employees 487,990

Advances for payroll 487,990

E. Due to BIR 51,000

Subsidy Income from National Government 51,000

AFAR 2304 GOVERNMENT ACCOUNTING 14

F. Due to GSIS 15,300

Due to PAG-IBIG 10,200

Due to PhilHealth 510

Cash- MDS, Regular 26,010

24. Department of Health (DOH) received Notice of Cash Allocation in the amount of

P100,000 from DBM. DOH made a total cash disbursement in the amount of P95,000.

What is the journal entry to recognize reversion of unused NCA by DOH in its books?

A. Debit Subsidy Income from National Government P5,000; Credit Cash- MDS, Regular

P5,000

B. Debit Retained Earnings of DOH P5,000; Credit Cash- MDS, Regular P5,000

C. Debit Expenses of DOH P5,000; Credit Cash- MDS, Regular P5,000

D. Debit Investment of DOH P5,000; Credit Cash- MDS, Regular P5,000

25. Which of the following closing entries in the accounting book of Department of Tourism

is incorrect if the following data are provided by its chief accountant?

Total Income, aside from SING P1,598,000

Total expenses 791,652

Total Subsidy Income from National Government 1,181,882

A. Income account other than SING 1,598,000

Revenue and Expense Summary account 1,598,000

B. Revenue and Expense Summary account 791, 652

Expense Account 791,652

C. Subsidy Income from National Government 1,181,882

Revenue and Expense Summary account 1,181,882

D. Revenue and Expense Summary account 1,988,230

Accumulated Surplus (Deficit) 1,988,230

E. Ordinary Shares 3,931,534

Share Premium 3,931,534

26. On January 31, 2016, the collecting officer of Bureau of Customs collected P350,000

import duties plus fines of P10,000 on the goods of an importer. On February 28, 2016,

the Bureau of Customs remitted the 350,000 to the Bureau of Treasury. What is the

journal entry to record the collection of the import duties and fines?

A. Debit Cash- Collecting Officer P360,000; Credit Import Duties P350,000 and

Fines/Penalties P10,000

B. Debit Cash- Treasury/Agency Deposit, Regular P360,000; Credit Cash- Collecting

Officer P360,000

C. Debit Cash- Treasury/Agency Deposit, Regular P360,000; Credit Import Duties

P350,000 and Fines/Penalties P10,000

AFAR 2304 GOVERNMENT ACCOUNTING 15

27. Using the same data in number 26, but assuming the importer directly deposited the

350,000 import duties and 10,000 fines through Authorized Agent Banks instead of

collection by a customer collecting officer, what is the journal entry to record the

collection/remittance of import duties to Bureau of Treasury?

A. Debit Cash- Collecting Officer P360,000; Credit Import Duties P350,000 and

Fines/Penalties P10,000

B. Debit Cash- Treasury/Agency Deposit, Regular P360,000; Credit Cash- Collecting

Officer P360,000

C. Debit Cash- Treasury/Agency Deposit, Regular P360,000; Credit Import Duties

P350,000 and Fines/Penalties P10,000

28. The Bureau of Treasury received P20,000 cash remittance from Department of Agrarian

Reform (DAR) from its miscellaneous income. What is journal entry of the Bureau of

Treasury in its accounting books to record the receipt of cash remittance from the

income of a national government agency?

A. Debit Cash in Bank, Local Bank P20,000; Credit Cash- Treasury/Agency Deposit,

Regular P20,000

B. Debit Cash in Bank, Local Bank P20,000; Credit Miscellaneous Income of DA P20,000

C. Debit Cash in Bank, Local Bank P20,000; Credit Savings of DA, Regular P20,000

D. Debit Cash in Bank, Local Bank P20,000; Credit Cash- Collecting Officer, DA P20,000

29. The Department of National Defense obtained a loan from Asian Development Bank to

finance the acquisition of Philippines’ first aircraft carrier. The principal of the loan is

$1B. What is the journal entry in the accounting book of Bureau of Treasury to record

the receipt of loan proceeds based on credit advice from BSP?

A. Debit Cash in Bank, Local Bank or BSP $1B; Credit Cash- Treasury/Agency Deposit,

Regular $1B

B. Debit Cash in Bank, Foreign Currency BSP $1B; Credit Loans Payable- Foreign $1B

C. Debit Cash in Bank, Foreign Currency BSP $1B; Credit Subsidy Income from Asian

Development Bank $1B

D. Debit Cash in Bank, Foreign Currency BSP $1B; Credit Capital Account, ADB $1B

30. On February 1, 2016, the Department of Health received P10M cash from PLDT for

medical expenses of victims of calamities. The collection of the P10M donation is

considered as authorized special account. DOH remitted the donation to the Bureau of

Treasury on March 1, 2016. What is the journal entry on March 1, 2016 in DOH book?

A. Debit Cash- Collecting Officer P10M; Credit Medical Fees P10M

B. Debit Cash- Treasury/Agency Deposit Special Account P10M; Credit Cash- Collecting

Officer P10M

C. Debit Cash in Bank- Local Currency, Savings Account P10M; Credit-

Treasury/Agency Deposit, Special Account P10M

D. Debit Cash- Treasury/Agency Deposit P10M; Credit Medical Fees P10M

AFAR 2304 GOVERNMENT ACCOUNTING 16

31. On September 1, 2019, $10M donation is deposited directly by United Nations World

Health Organization to the Bureau of Treasury to help the Philippine government battle

Zika virus. What is the journal entry in the accounting book of Bureau of Treasury to

record the receipt of grants or donation from UN-WHO?

A. Debit Cash in Bank, Foreign Currency Savings Deposit $10M; Credit Income from

Grants and Donations $10M

B. Debit Cash- Collecting Officer P10M; Credit Income from Grants and Donations $10M

C. Debit Cash in Bank, Foreign Currency Savings Deposit $10M; Credit Loans Payable

$10M

D. Debit Cash- Collecting Officer P10M; Credit Ordinary Share, UN-WHO $10M

32. On February 1, 2016, the Department of Environment and Natural Resources (DENR)

transferred P450,000 fund to the Department of Public Works and Highway (DPWH) for

the construction of DENR’s irrigation project. The P450,000 fund was then remitted by

DPWH to Bureau of Treasury on May 1, 2016. The project was completed and turned

over by DPWH to DENR on October 31, 2016. What is the journal entry in DENR’s book

to record the transfer of funds on February 1, 2016?

A. Debit Due from DPWH P450,000; Credit Cash- MDS, Regular P450,000

B. Debit Cash- Treasury/Agency Deposit/Trust P450,000; Credit Cash- Collecting

Officers P450,000

C. Debit Cash- Collecting Officers P450,000; Credit Due to DENR P450,000

D. Debit Cash- Treasury/Agency Deposit/Trust P450,000; Credit Cash- Collecting

Officers P450,000

33. Using the same data in number 32, what is the journal entry of DPWH to record the

turnover of the irrigation project to DENR on October 31, 2016?

A. Debit Due to DENR P450,000; Credit PPE Account P450,000

B. Debit PPE Account P450,000; Credit Due from DPWH P450,000

C. Debit Due to DENR P450,000; Credit Cash- Collecting Officer P450,000

D. Debit Cash- Collecting Officer P450,000; Credit Due from DPWH P450,000

AFAR 2304 GOVERNMENT ACCOUNTING 17

You might also like

- Government Accounting NotesDocument24 pagesGovernment Accounting Noteszee abadilla100% (1)

- Government Accounting: Accounting For Non-Profit OrganizationsDocument28 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsDe GuzmanNo ratings yet

- Credit TransactionsDocument8 pagesCredit TransactionsLoyce Grace MorenteNo ratings yet

- ATFX Advantages: Regulated Broker with MT4 PlatformDocument39 pagesATFX Advantages: Regulated Broker with MT4 PlatformNurul Mutmainnah NadarNo ratings yet

- Chapter 2Document19 pagesChapter 2robert matutinaNo ratings yet

- Accounting for Budgetary AccountsDocument63 pagesAccounting for Budgetary Accountselisha mae cardeñoNo ratings yet

- Chapter 1 Acct09Document3 pagesChapter 1 Acct09Joseph LapasandaNo ratings yet

- Government Accounting: Accounting For Non-Profit OrganizationsDocument88 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsDe GuzmanNo ratings yet

- Government Exam Notes 1-3Document8 pagesGovernment Exam Notes 1-3Joseph LapasandaNo ratings yet

- Group 1 Budget ProcessDocument26 pagesGroup 1 Budget ProcessCassie ParkNo ratings yet

- Government Budget ProcessDocument5 pagesGovernment Budget ProcessSteffany RoqueNo ratings yet

- Chapter 1 Acct09Document8 pagesChapter 1 Acct09Joseph LapasandaNo ratings yet

- Government Budget ProcessDocument16 pagesGovernment Budget Processmaria ronoraNo ratings yet

- Copy 7 ACP 313 QuickNotes On Government AccountingDocument10 pagesCopy 7 ACP 313 QuickNotes On Government AccountingRodken VallenteNo ratings yet

- New Government Accounting System (NGAS) OverviewDocument20 pagesNew Government Accounting System (NGAS) OverviewIsiah Jarrett Trinidad Abille100% (1)

- Government Accounting SystemDocument46 pagesGovernment Accounting SystemMeshack NyekelelaNo ratings yet

- Gov Acc 2019 JaaDocument9 pagesGov Acc 2019 JaaGlaiza Lerio100% (1)

- Government Accounting OverviewDocument18 pagesGovernment Accounting OverviewCherrie Arianne Fhaye Naraja100% (1)

- Actgnp Rev.Document11 pagesActgnp Rev.Krizah Marie CaballeroNo ratings yet

- Diaz Haidie R Assessment 1Document3 pagesDiaz Haidie R Assessment 1Christel OrugaNo ratings yet

- Government Accounting PunzalanDocument5 pagesGovernment Accounting PunzalanN Jo88% (17)

- Government AccountingDocument7 pagesGovernment AccountingErica EgidaNo ratings yet

- NOTESDocument2 pagesNOTESJñelle Faith Herrera SaludaresNo ratings yet

- Chapter 1 - New Government Accounting System (Ngas)Document28 pagesChapter 1 - New Government Accounting System (Ngas)MA ValdezNo ratings yet

- Lesson 1,2 and 3 1 and 2: Introduction To Government AccountingDocument5 pagesLesson 1,2 and 3 1 and 2: Introduction To Government Accountingyen claveNo ratings yet

- Overview of Government AccountingDocument2 pagesOverview of Government Accountingwhin LimboNo ratings yet

- Government Accounting Auditing & ProcurementDocument97 pagesGovernment Accounting Auditing & Procurementjamie c100% (1)

- Task Performance-Gov T Acctg - PrelimDocument5 pagesTask Performance-Gov T Acctg - PrelimAnonymouslyNo ratings yet

- Chapter 1 - Overview of Government AccountingDocument4 pagesChapter 1 - Overview of Government AccountingChris tine Mae MendozaNo ratings yet

- Chapter 1 - Nature and Scope of NGASDocument26 pagesChapter 1 - Nature and Scope of NGASJapsNo ratings yet

- Why Accounting is Essential for Government: A 40-Character SummaryDocument14 pagesWhy Accounting is Essential for Government: A 40-Character SummaryJoanna TiuzenNo ratings yet

- Prelim-ExaminationDocument8 pagesPrelim-Examinationshi shiiisshh100% (1)

- New Government Accounting System (NGAS) in The PhilippinesDocument24 pagesNew Government Accounting System (NGAS) in The PhilippinesJingRellin100% (1)

- Gov Acc Post TestDocument15 pagesGov Acc Post Test수지No ratings yet

- Governmental Entities: Introduction and General Fund Accounting Chapter 17Document99 pagesGovernmental Entities: Introduction and General Fund Accounting Chapter 17IKRAR AGUNG DEWANTORO 12119072No ratings yet

- Chapter 1 Nature and Scope of NGASDocument26 pagesChapter 1 Nature and Scope of NGASRia BagoNo ratings yet

- GA - Assessment 1Document2 pagesGA - Assessment 1Christel OrugaNo ratings yet

- AC316 Module 8Document5 pagesAC316 Module 8Jaime PalizardoNo ratings yet

- An Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsDocument38 pagesAn Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsPhrexilyn PajarilloNo ratings yet

- Sec. 1. Legal Basis. The Government Accounting Manual (GAM) Is Prescribed by COADocument3 pagesSec. 1. Legal Basis. The Government Accounting Manual (GAM) Is Prescribed by COAElla Mae TuratoNo ratings yet

- Government Accounting ManualDocument9 pagesGovernment Accounting ManualGabriel PonceNo ratings yet

- Public Sector Accounting: CUAC 406 by ChengeramangaDocument101 pagesPublic Sector Accounting: CUAC 406 by ChengeramangaTanyahl MatumbikeNo ratings yet

- Chapter 1Document68 pagesChapter 1Merrill Ojeda SaflorNo ratings yet

- Government Accounting (AFA-II) : Governmental Entities: Introduction and General Fund AccountingDocument8 pagesGovernment Accounting (AFA-II) : Governmental Entities: Introduction and General Fund AccountingMd. Rejaul Ahsan Chowdhury100% (1)

- Government AccountingDocument13 pagesGovernment AccountingReniella Villondo100% (1)

- Government Accounting Punzalan SolmanDocument4 pagesGovernment Accounting Punzalan SolmanAlarich Catayoc100% (1)

- Acctg For GovernmentDocument12 pagesAcctg For GovernmentNurse NotesNo ratings yet

- On Audit:: Government Accounting Manual (Gam) PointersDocument9 pagesOn Audit:: Government Accounting Manual (Gam) PointersPepsi ColaNo ratings yet

- Chapter 1Document8 pagesChapter 1Adan EveNo ratings yet

- Financial Statements OverviewDocument36 pagesFinancial Statements OverviewIrvin OngyacoNo ratings yet

- 1.maintenance of AccountsDocument32 pages1.maintenance of AccountsShahid ShafiNo ratings yet

- 2, Conceptual FrameworkDocument14 pages2, Conceptual FrameworkkarismaNo ratings yet

- Government Accounting Reviewer Chapter 1: General Provisions, Basic Standards and PoliciesDocument5 pagesGovernment Accounting Reviewer Chapter 1: General Provisions, Basic Standards and PoliciesPatricia GalvezNo ratings yet

- Note 1 - MEC 34Document7 pagesNote 1 - MEC 34S GracsNo ratings yet

- GAS-21 - Accounting for Income, Collections and Related TransactionsDocument21 pagesGAS-21 - Accounting for Income, Collections and Related TransactionsBenzon Agojo OndovillaNo ratings yet

- Chapter 1 Ethiopian Govt AcctingDocument22 pagesChapter 1 Ethiopian Govt AcctingwubeNo ratings yet

- GOVERNMENT ACCOUNTING FUNDAMENTALSDocument22 pagesGOVERNMENT ACCOUNTING FUNDAMENTALSDaniel CalmaNo ratings yet

- Government AccountingDocument93 pagesGovernment Accountingpilonia.donitarosebsa1993No ratings yet

- Chapter 1 Overview of Government AccountingDocument4 pagesChapter 1 Overview of Government AccountingSteffany Roque100% (1)

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija TalipanNo ratings yet

- Principles of TaxationDocument13 pagesPrinciples of TaxationHazel OrtegaNo ratings yet

- MAS 2023 Module3 Cost Volume Profit AnalysisDocument10 pagesMAS 2023 Module3 Cost Volume Profit AnalysisDzulija TalipanNo ratings yet

- Module On SalesDocument17 pagesModule On SalesDzulija TalipanNo ratings yet

- MAS 2023 Module3 Cost Volume Profit AnalysisDocument10 pagesMAS 2023 Module3 Cost Volume Profit AnalysisDzulija TalipanNo ratings yet

- ABC Costing Problem 1Document2 pagesABC Costing Problem 1Dzulija TalipanNo ratings yet

- The Law On Sales Agency and Credit TransDocument5 pagesThe Law On Sales Agency and Credit TransIke100% (1)

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija Talipan100% (1)

- AFAR 2303 Cost Accounting-1Document30 pagesAFAR 2303 Cost Accounting-1Dzulija TalipanNo ratings yet

- Job Order Costing ProblemsDocument1 pageJob Order Costing ProblemsDzulija TalipanNo ratings yet

- AFAR 2306 - Home Office, Branch & Agency AcctgDocument5 pagesAFAR 2306 - Home Office, Branch & Agency AcctgDzulija TalipanNo ratings yet

- AFAR 2305 Not-for-Profit OrganizationsDocument14 pagesAFAR 2305 Not-for-Profit OrganizationsDzulija TalipanNo ratings yet

- Consumer Protection ActDocument8 pagesConsumer Protection ActDzulija TalipanNo ratings yet

- Afar2303b Service Cost Allocation Cost AccountingDocument1 pageAfar2303b Service Cost Allocation Cost AccountingDzulija TalipanNo ratings yet

- Case 3 - Wallys Billboard Sign SupplyDocument2 pagesCase 3 - Wallys Billboard Sign SupplyDzulija TalipanNo ratings yet

- IAS 28 Investment in AssociatesDocument7 pagesIAS 28 Investment in AssociatesDzulija TalipanNo ratings yet

- ADVACC 1 AssignDocument3 pagesADVACC 1 AssignDzulija TalipanNo ratings yet

- 5 - FAAC Rules PDFDocument4 pages5 - FAAC Rules PDFDzulija TalipanNo ratings yet

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Document21 pagesAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Dzulija TalipanNo ratings yet

- 5 - FAAC Rules PDFDocument4 pages5 - FAAC Rules PDFDzulija TalipanNo ratings yet

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Document24 pagesAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Dzulija Talipan100% (1)

- ADVACC 1 AssignDocument3 pagesADVACC 1 AssignDzulija TalipanNo ratings yet

- Partial Topics AccountingDocument51 pagesPartial Topics AccountingDzulija Talipan100% (1)

- Clarifying Tax Rules for Homeowners' Association DuesDocument2 pagesClarifying Tax Rules for Homeowners' Association DuesMarieal InotNo ratings yet

- MSC Actuarial Science May2011Document18 pagesMSC Actuarial Science May2011Kalaiarasan GovindarasuNo ratings yet

- 2020-02-29 IFR Asia - UnknownDocument42 pages2020-02-29 IFR Asia - UnknownqbichNo ratings yet

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocument2 pagesThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNo ratings yet

- PT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Document26 pagesPT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Ananda LukmanNo ratings yet

- SAT exam instructions and questionsDocument11 pagesSAT exam instructions and questionskrishnaNo ratings yet

- Acknowledgement FormDocument3 pagesAcknowledgement FormfafcoNo ratings yet

- Orsted Q3 2023 Investor PresentationDocument44 pagesOrsted Q3 2023 Investor Presentationshen.wangNo ratings yet

- Income Tax Rates PDFDocument1 pageIncome Tax Rates PDFAditi SharmaNo ratings yet

- Ali Asghar Textile Mills LTD: Ratios: TotalDocument7 pagesAli Asghar Textile Mills LTD: Ratios: TotalakhlaqjatoiNo ratings yet

- Emrm5103 (Project Risk Management)Document54 pagesEmrm5103 (Project Risk Management)syahrifendi100% (3)

- Directors Report 2011 12 WCLDocument146 pagesDirectors Report 2011 12 WCLsarvesh.bhartiNo ratings yet

- Essential GST Audit ChecklistDocument3 pagesEssential GST Audit ChecklistBaiju DevNo ratings yet

- Afar ToaDocument22 pagesAfar ToaVanessa Anne Acuña DavisNo ratings yet

- Nick Leeson Barings BankDocument32 pagesNick Leeson Barings Bankdonald.g.white100% (1)

- MCQ 3Document6 pagesMCQ 3Senthil Kumar Ganesan100% (1)

- Compre ExamDocument11 pagesCompre Examena20_paderangaNo ratings yet

- Topic 3 Long-Term Construction Contracts ModuleDocument20 pagesTopic 3 Long-Term Construction Contracts ModuleMaricel Ann BaccayNo ratings yet

- Go.151 Leave Travel Concession-Ltc-RulesDocument3 pagesGo.151 Leave Travel Concession-Ltc-RulesVanagantinaveen Kumar100% (1)

- 21 Republic Vs de GUzman PDFDocument22 pages21 Republic Vs de GUzman PDFShivaNo ratings yet

- Jobberman INV-018126 PDFDocument2 pagesJobberman INV-018126 PDFnfplacideNo ratings yet

- PT Garuda Tech December 2019 Balance SheetDocument2 pagesPT Garuda Tech December 2019 Balance SheetSMKJTRGNo ratings yet

- PartnershipDocument8 pagesPartnershipOllie WattsNo ratings yet

- Rule 39 Section 9 (B) : Satisfaction by LevyDocument8 pagesRule 39 Section 9 (B) : Satisfaction by LevyLeo Balante Escalante Jr.No ratings yet

- Raw DataDocument28 pagesRaw DataMaya IstiNo ratings yet

- CapstoneDocument29 pagesCapstonelajjo1230% (1)

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMathilda UllyNo ratings yet

- Pivot Point Trading StrategyDocument8 pagesPivot Point Trading StrategyBadrul 'boxer' Hisham50% (4)

- Financing of Constructed FacilitiesDocument24 pagesFinancing of Constructed FacilitiesLyka TanNo ratings yet