Professional Documents

Culture Documents

NCAHS & Discontinued Operations

Uploaded by

夜晨曦Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NCAHS & Discontinued Operations

Uploaded by

夜晨曦Copyright:

Available Formats

ADDITIONAL CLASSROOM EXERCISES ON NON-CURRENT ASSET

HELD FOR SALE AND DISCONTINUED OPERATIONS

Problem 1 – Identifying discontinued operations

Determine if the following activities are discontinued operations. All companies have their financial year–end at

December 31. Explain your answers.

(a) ROMANS Company has three product groups which are reported as separate segments: baby’s clothes, baby dolls,

and office equipment. In June 2020, management decided to dispose of its baby doll segment. In mid–September,

management announced its plan to dispose of the baby doll segment, which has become unprofitable and costly to

maintain.

(b) CORINTHIANS Company has four segments: soft drinks, ice cream, real estate, and insurance. Management has

decided to discontinue producing ice cream containing nuts. Instead, it will add ice cream containing fruits to its

assortment.

(c) The processed meat division, one of the segments of GALATIANS Corporation, has been operating at a loss since

2013. In 2020, the board of directors has been discussing during several of its meetings whether to dispose of this

segment. The board cannot agree whether to continue the segment’s activities. In its October 2020 board meeting,

the board members finally agreed to dispose of at least some of the facilities within the processed meat division in

the remaining quarter of the year. In 2021, some other facilities within the segment would probably be disposed of.

(d) In September 2020, the management of EPHESIANS Company decided to close one of its three facilities in the

United States as it is much cheaper to produce its products in the Philippines. The facilities are included in the

cosmetics segment together with the facilities in the United States, Spain, and the Philippines. Management has

already formalized the plan and informed its employees of its decision.

(e) COLOSSIANS Inc. has four different business segments. One of the segments is producing desiccated coconut

candies. The factories where these candies are produced are located in fields where the coconut trees are grown.

These are situated in Southern Luzon. In November 2020, management decided to dispose of this segment and

worked out a detailed plan for the disposal. Management announced its plan to the press after its January 2021

board meeting.

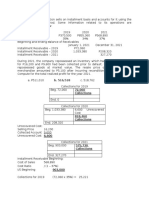

Problem 2 – Presentation of discontinued operations

Presented below are the condensed income statements of PHILIPPIANS Corporation for the years ended December 31,

2019 and 2020.

2020 2019

Sales P 10,000,000 P 9,800,000

Cost of goods sold (6,700,000) (6,600,000)

Gross income 3,300,000 3,200,000

Operating expenses (1,350,000) (1,300,000)

Operating income 1,950,000 1,900,000

Gain on sale of division 400,000 0

Income before tax 2,350,000 1,900,000

Income tax expense (35%) (822,500) (665,000)

Net income P 1,527,500 P 1,235,000

On October 10, 2020, the firm entered into an agreement to sell the assets of one of its geographical segments. The

geographical segment comprises operations and cash flows that can be clearly distinguished operationally and for

financial reporting purposes, from the other sections/parts of the company.

The segment was sold on December 31, 2020 for P3,500,000. The book value of the segment’s assets was P3,100,000.

The segment’s contribution to PHILIPPIANS’ operating income before tax for each year was as follows:

2020 (P227,500)

2019 162,500

Based on the above data, calculate the following:

(a) Income net of tax from continuing operations in 2019.

(b) Income net of tax from continuing operations in 2020.

(c) Net income after tax in 2019.

(d) Net income after tax in 2020.

(e) Assume that by December 31, 2020, the segment had not yet been sold but was considered held for sale. The fair

value of the segment’s asset on December 31 was P3,500,000. How much should be the post-tax income (loss)

from discontinued operations for 2020?

(f) Assume that by December 31, 2020, the segment had not yet been sold but was considered held for sale. The fair

value of the segment’s assets on December 31, 2020 was P2,500,000. How much should be the post-tax income

(loss) from discontinued operations for 2020?

October 2020

You might also like

- Classroom Exercises On Ncahs & Discontinued Operations 1st Term Sy2018-2019Document3 pagesClassroom Exercises On Ncahs & Discontinued Operations 1st Term Sy2018-2019alyssaNo ratings yet

- Comprehensive QuizDocument4 pagesComprehensive QuizBea LadaoNo ratings yet

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- Assignment 1 - Discontinued Operation Test 10 ItemsDocument4 pagesAssignment 1 - Discontinued Operation Test 10 ItemsJeane Mae BooNo ratings yet

- Chapter 33 PFRS 5 Discontinued OperationsDocument2 pagesChapter 33 PFRS 5 Discontinued OperationsstudentoneNo ratings yet

- Quiz Discontinued OperationsDocument2 pagesQuiz Discontinued OperationsMENDOZA, GLENDA S.No ratings yet

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Document12 pagesChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNo ratings yet

- Error Correction - ExercisesDocument4 pagesError Correction - ExercisesDe Chavez May Ann M.No ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument171 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNo ratings yet

- SolutionQuestionnaireUNIT 3 - 2020Document5 pagesSolutionQuestionnaireUNIT 3 - 2020LiNo ratings yet

- 2021 Spring-Comm 321 - Assignment #2 Questions - 1Document4 pages2021 Spring-Comm 321 - Assignment #2 Questions - 1Smelly DonkeyNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Chapters-1-10-Exam-Problem (2) Answer JessaDocument6 pagesChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonNo ratings yet

- Discontinued OperationsDocument2 pagesDiscontinued OperationsBwwwiiiiiNo ratings yet

- Intax-Activity 1Document1 pageIntax-Activity 1Venus PalmencoNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- FR 2021 Paper PrelimDocument10 pagesFR 2021 Paper PrelimshashalalaxiangNo ratings yet

- Chapter 10Document8 pagesChapter 10Coursehero PremiumNo ratings yet

- Afar 104 Installment SalesDocument3 pagesAfar 104 Installment SalesReyn Saplad PeralesNo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- PDF Topic No 2 Statement of Cash Flows PDF - CompressDocument3 pagesPDF Topic No 2 Statement of Cash Flows PDF - CompressMillicent AlmueteNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Classroom Exercises On Consolidation With Intercompany Sale of InventoryDocument7 pagesClassroom Exercises On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- Installment Sales Multiple QuestionsDocument36 pagesInstallment Sales Multiple QuestionsTrixie CapisosNo ratings yet

- NCHS Discontinued Operations ClassworkDocument5 pagesNCHS Discontinued Operations ClassworkKathleen Tabasa ManuelNo ratings yet

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Acctg 323 MT ExamDocument10 pagesAcctg 323 MT ExamJoyluxxiNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- 02 Audit of Expenditure and Disbursements Cycle (Cont.)Document4 pages02 Audit of Expenditure and Disbursements Cycle (Cont.)Becky GonzagaNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- Balance Sheet Errors: Problem 1Document2 pagesBalance Sheet Errors: Problem 1Alyana SandiegoNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- NCAHS & Discontinued OperationsDocument2 pagesNCAHS & Discontinued Operations夜晨曦No ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Intermediate Accounting Chapters 9,10Document31 pagesIntermediate Accounting Chapters 9,10Jonathan NavalloNo ratings yet

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Erika Larinay100% (1)

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Angela MartiresNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- B. 516,518 72,060 CollectionsDocument2 pagesB. 516,518 72,060 CollectionsMichelle Galapon LagunaNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- MINI CASE 3-Deferred Tax - A201 - StudentDocument3 pagesMINI CASE 3-Deferred Tax - A201 - Studentdini sofiaNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/33Document12 pagesCambridge International AS & A Level: Accounting 9706/334ycvrzfjgfNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.No ratings yet

- AC15 Quiz 2Document6 pagesAC15 Quiz 2Kristine Esplana Toralde100% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- CVP1Document1 pageCVP1夜晨曦No ratings yet

- RemindersDocument4 pagesReminders夜晨曦No ratings yet

- Cost AccountingDocument1 pageCost Accounting夜晨曦No ratings yet

- Ethics and CSRDocument52 pagesEthics and CSR夜晨曦No ratings yet

- 3 e 11-10Document1 page3 e 11-10夜晨曦No ratings yet

- CVPDocument2 pagesCVP夜晨曦No ratings yet

- CE Interim ReportingDocument2 pagesCE Interim ReportingalyssaNo ratings yet

- PEL FactorsDocument37 pagesPEL Factors夜晨曦No ratings yet

- CultureDocument41 pagesCulture夜晨曦No ratings yet

- Activity 1Document1 pageActivity 1夜晨曦No ratings yet

- Internaltional BusinessDocument24 pagesInternaltional Business夜晨曦No ratings yet

- Chapter 5Document59 pagesChapter 5WilliamNo ratings yet

- CE On Events After The Reporting PeriodDocument2 pagesCE On Events After The Reporting PeriodalyssaNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- Spiceland GE2 SM Ch7.1Document98 pagesSpiceland GE2 SM Ch7.1夜晨曦No ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- HW On INVESTMENT PROPERTY - 1Document2 pagesHW On INVESTMENT PROPERTY - 1Charles TuazonNo ratings yet

- NCAHS & Discontinued OperationsDocument2 pagesNCAHS & Discontinued Operations夜晨曦No ratings yet

- PPE Acquisition and Borrowing CostDocument3 pagesPPE Acquisition and Borrowing Cost夜晨曦No ratings yet

- CRP List For MM29 - 09Document50 pagesCRP List For MM29 - 09Kaustav PalNo ratings yet

- Syllabus - GEC004-Math in The Modern WorldDocument2 pagesSyllabus - GEC004-Math in The Modern WorldRachel PetersNo ratings yet

- Royal Caribbean Cruises Client ReportDocument36 pagesRoyal Caribbean Cruises Client Reportمرزا احسن بیگNo ratings yet

- Benzonan Vs CADocument9 pagesBenzonan Vs CAL100% (1)

- Everest Group Names HCL As A Leader For IT Outsourcing in Global Capital Markets (Company Update)Document3 pagesEverest Group Names HCL As A Leader For IT Outsourcing in Global Capital Markets (Company Update)Shyam SunderNo ratings yet

- Multinational Corporations: Some of Characteristics of Mncs AreDocument7 pagesMultinational Corporations: Some of Characteristics of Mncs AreMuskan KaurNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 11-1: True or FalseDocument13 pagesHome Office, Branch and Agency Accounting: Problem 11-1: True or FalseVenz Lacre100% (1)

- CR Sample L6 Module 2 PDFDocument4 pagesCR Sample L6 Module 2 PDFDavid JonathanNo ratings yet

- Institutional Support For SSIDocument11 pagesInstitutional Support For SSIRideRNo ratings yet

- 2624 Saipem Sem 13 Ing FiDocument116 pages2624 Saipem Sem 13 Ing FiRoxana ComaneanuNo ratings yet

- Ubte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Document18 pagesUbte 2013 Entrepreneurship: Universiti Tunku Abdul Rahman (Utar)Jyiou YimushiNo ratings yet

- Value Based Questions in Economics Class XIIDocument8 pagesValue Based Questions in Economics Class XIIkkumar009No ratings yet

- NMR 8 Suryanto Dan Dai 2016 PDFDocument15 pagesNMR 8 Suryanto Dan Dai 2016 PDFanomimNo ratings yet

- Ias 38 - TSVHDocument37 pagesIas 38 - TSVHHồ Đan ThụcNo ratings yet

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Document3 pagesInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiNo ratings yet

- Meaning of Financial StatementsDocument2 pagesMeaning of Financial StatementsDaily LifeNo ratings yet

- Application For Bank FacilitiesDocument4 pagesApplication For Bank FacilitiesChetan DigarseNo ratings yet

- Virgin Media's - Diversification StrategyDocument6 pagesVirgin Media's - Diversification StrategyRachita SinghNo ratings yet

- Evaluation On The Effectiveness of The CDocument104 pagesEvaluation On The Effectiveness of The CAilene Quinto0% (1)

- Blake and Scott FS AnalysisDocument38 pagesBlake and Scott FS AnalysisFaker PlaymakerNo ratings yet

- Airline Operating CostsDocument27 pagesAirline Operating Costsawahab100% (7)

- FM 415 Money MarketsDocument50 pagesFM 415 Money MarketsMarc Charles UsonNo ratings yet

- Practice Set 1Document6 pagesPractice Set 1moreNo ratings yet

- Datian Subic Shoes, Inc.: General Ledger For The Period From 2022 Jan 1 To 2022 Dec 31Document8 pagesDatian Subic Shoes, Inc.: General Ledger For The Period From 2022 Jan 1 To 2022 Dec 31Kenneth Vallejos CesarNo ratings yet

- American National Insurance Company v. Fidelity Bank, N. A., 691 F.2d 464, 10th Cir. (1982)Document6 pagesAmerican National Insurance Company v. Fidelity Bank, N. A., 691 F.2d 464, 10th Cir. (1982)Scribd Government DocsNo ratings yet

- Document 886483241Document38 pagesDocument 886483241Cirillo Mendes RibeiroNo ratings yet

- Difference Between Accounts & FinanceDocument4 pagesDifference Between Accounts & Financesameer amjadNo ratings yet

- IIFL Car Lease Policy: 1. Objective of The PolicyDocument5 pagesIIFL Car Lease Policy: 1. Objective of The PolicyNanda Babani0% (1)

- 7e - Chapter 10Document39 pages7e - Chapter 10WaltherNo ratings yet

- Analysis of ITC Financial StatementDocument7 pagesAnalysis of ITC Financial StatementPrashant AminNo ratings yet