Professional Documents

Culture Documents

Guide to Percentage Taxes in the Philippines

Uploaded by

joven umandapOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide to Percentage Taxes in the Philippines

Uploaded by

joven umandapCopyright:

Available Formats

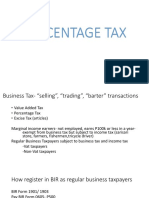

Percentage Tax (OPT)

Section 116: Tax on exempt person from VAT

- Those sales or receipt are exempt under VAT and who is not a VAT registered person shall pay

3% of gross receipt or sales. Cooperatives are exempt, 1% percentage tax July 1, 2020 – June 30,

2023.

- Exempt person (CREATE LAW)

1. Cooperatives

2. Self employed individuals and professional availing 8% tax on gross sales or receipt.

REQUISITES

1. Not a VAT Registered Person

2. Gross sales or receipt do not exceed 3,000,000

3. Not exempt from VAT under sec. 109 (1) (A) to 109 (BB) amended by create Law.

Section 117: Domestic Carriers and Keepers of Garages

Also known as Common Carriers Tax on Domestic on transport of passenger by land

Tax base (Whichever is higher) 3%

1. Actual Gross Receipts

2. Minimum Gross Receipts

Exempt

1. Owner of bancas

2. Animal-drawn two wheeled vehicles

Section 118: International Carriers

Transport of Goods or Cargoes originating in Philippines (Air, Ship)

3% of Gross receipts

- Cargo, mail and baggage OUTGIONG

Section 119: Tax on Franchise

Also known as Franchise Tax on franchise Grantees

Liable

1. Franchise on Gas and Water utilities (2%)

2. Franchise on radio and/or Television broadcasting companies’ gross receipt not exceed 10M

(3%)

Section 120: Tax on overseas dispatch, message or conversation originating from Philippines

Also known as Overseas Communication Tax (OCT)

Exempt persons:

1. Philippine Government or any of its political subdivision and instrumentalities

2. Diplomatic services

3. International Organizations

4. News Services

10%

Section 121: Tax on banks and non-banks financial intermediaries performing Quasi-banking functions

Also known as Gross Receipt Tax (GRT)

Interest income, commissions and Discount

from Lending activities and Financing Lease

a. Remaining maturity period 5yrs or less 5%

b. More than 5yrs 1%

Dividends and shares in net income of 0%

subsidiaries

Royalties, rentals of property, real or personal, 7%

profits from exchange and all other treated as

gross income

Net trading gains within taxable year on foreign 7%

currency, debts securities, derivatives and other

similar financial instrument

Section 122: Tax on other non-bank financial intermediaries not performing quasi-banking functions

Interest, commissions, discount and all other 5%

items treated as gross income under the tax code

Interest, commissions and discounts from lending

activities and financial leasing

1. 5yrs or less 5%

2. More than 5yrs 1%

Section 123: Tax on Life insurance premium

Also known as Premium Tax

2% premium tax

Exempt

1. Premiums refund within six 6 months after payment on account of rejection of risk

2. Premiums paid upon reissuance by a company that has already paid tax

3. Premiums collected or received from abroad by branches of domestic corporation doing

business in Philippines

4. Excess of premiums on variable contracts in excess of the amount necessary to insure the

lives of the variable contract owners

5. Premium collected by purely cooperatives company or association.

Section 124: Tax on agents of foreign insurance company

Also known as Premiums Tax on agents of nonresident foreign insurance companies

Liable

- Fire, marine or miscellaneous agents of non-resident foreign corporation engaged in insurance

business

4% - tax on agents of nonresident foreign corporation

Section 124(B): Tax on owners of property obtaining insurance directly with nonresident foreign

corporation

5%

Section 125: Amusement Taxes

Liable

- Proprietor, lessee or operator of cockpits, cabarets, night or day club, boxing exhibitions,

professional basketball games, jai-alai and racetracks.

Gross receipts

Place for boxing exhibition 10%

Place for professional basketball games 15%

Cockpits, cabarets, night or day club 18%

Jai-alai and racetracks 30%

Section 126: Tax on winnings

Liable

1. Owners of the winning horse

2. Bettor in a horse race or jai-alai

Ordinary winnings and owner of winning horse 10%

Bettor in horse race or jai-alai 4% (double, forecast/quinella, trifecta)

Section 127: Tax on stocks transactions

Also known as stock transaction tax (STT)

- Kinds of stock transaction tax

1. Tax on sale, barter or exchange of shares of stock listed and traded through PSE. Sec.127(A)

60% of 1% Selling price or Gross Value in money

REQ.

- Seller is not a dealer in securities; and

- Shares sold is listed and traded through PSE

2. Tax on shares of stock sold or exchange through Initial Public Offering (IPO). Sec. 127(B)

Up to 25% 4%

Over 25% but not over 33 ½ 2%

Over 33 1/2 1%

ReQ.

- Sale is made thorough PSE

- It is an initial public offering of “closely held Corporation”

Person Liable

1. Primary offering – Issuing Corporation

2. Secondary offering – seller

Repealed the effect of Sec.127(B), RR 23-2020

Took effect on September 15, 2020

You might also like

- TAXES ON OTHER PERCENTAGESDocument29 pagesTAXES ON OTHER PERCENTAGESmark anthony espirituNo ratings yet

- Cpar Tax Problems ReviewerDocument8 pagesCpar Tax Problems ReviewerAnonymous swtSOYwLrMNo ratings yet

- RR 2-98Document85 pagesRR 2-98Elaine LatonioNo ratings yet

- Sunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsDocument2 pagesSunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsAmit PandeyNo ratings yet

- VC Introduction and Players OverviewDocument35 pagesVC Introduction and Players Overviewblake0528100% (1)

- TAX-401: Percentage TAX (P 1) : - T R S ADocument6 pagesTAX-401: Percentage TAX (P 1) : - T R S AEira ShaneNo ratings yet

- CPA Review Batch 42 Tax Week 4 SummaryDocument7 pagesCPA Review Batch 42 Tax Week 4 SummaryJuan Miguel UngsodNo ratings yet

- (Bustax) ReviewerDocument4 pages(Bustax) Reviewerphia triesNo ratings yet

- Percentage TaxesDocument8 pagesPercentage TaxesTokha YatsurugiNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJeffrey BionaNo ratings yet

- Percentage TaxDocument28 pagesPercentage TaxkemboseNo ratings yet

- TAX REVIEWER: PERCENTAGE AND EXCISE TAXESDocument55 pagesTAX REVIEWER: PERCENTAGE AND EXCISE TAXESherbertwest19728490No ratings yet

- Business and Transfer TaxationDocument5 pagesBusiness and Transfer TaxationElizabeth OlaNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJohn Felix Morelos DoldolNo ratings yet

- Percentage Tax Excise Tax Documentary Stamp: Taxation LawDocument23 pagesPercentage Tax Excise Tax Documentary Stamp: Taxation LawB-an JavelosaNo ratings yet

- Opt HandoutDocument4 pagesOpt HandoutjulsNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Module 3 Percentage TaxDocument10 pagesModule 3 Percentage TaxDay DreamNo ratings yet

- Business Tax Chapter 9 ReviewerDocument3 pagesBusiness Tax Chapter 9 ReviewerMurien LimNo ratings yet

- Business TaxationDocument10 pagesBusiness TaxationJaypee Verzo SaltaNo ratings yet

- BusinessDocument59 pagesBusinessKenncy70% (10)

- Understanding Percentage Tax in the PhilippinesDocument12 pagesUnderstanding Percentage Tax in the PhilippinesPablo InocencioNo ratings yet

- Opt 1Document5 pagesOpt 1Bridget Zoe Lopez BatoonNo ratings yet

- OTHER PERCENTAGE TAXES - Imposed in Lieu of VAT. Section 117: Tax On Common CarriersDocument3 pagesOTHER PERCENTAGE TAXES - Imposed in Lieu of VAT. Section 117: Tax On Common CarriersXerez SingsonNo ratings yet

- Percentage TaxDocument5 pagesPercentage Taxedadkoay14No ratings yet

- Business Tax SummaryDocument10 pagesBusiness Tax SummaryJohn Raymond MarzanNo ratings yet

- Withholding of Percentage TaxesDocument17 pagesWithholding of Percentage TaxesNilda Sahibul BaclayanNo ratings yet

- Quarterly Percentage Tax Rates TableDocument8 pagesQuarterly Percentage Tax Rates TableAngelyn SamandeNo ratings yet

- Other Percentage Tax and Zero RatedDocument6 pagesOther Percentage Tax and Zero RatedRenalyn Ps MewagNo ratings yet

- Quarterly percentage tax rates and stock transaction tax ratesDocument4 pagesQuarterly percentage tax rates and stock transaction tax ratesKathrine CruzNo ratings yet

- Other Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasDocument4 pagesOther Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasLumingNo ratings yet

- Other Percentage Taxes TableDocument5 pagesOther Percentage Taxes TableKim EspinaNo ratings yet

- Philippine VAT and Percentage Tax RatesDocument41 pagesPhilippine VAT and Percentage Tax RatesKim AranasNo ratings yet

- TAX Percentage TaxDocument19 pagesTAX Percentage TaxkmabcdeNo ratings yet

- BL04 - Chapter 9 ModuleDocument8 pagesBL04 - Chapter 9 ModuleAriel A. YusonNo ratings yet

- Tax Rates: Coverage Basis Tax RateDocument3 pagesTax Rates: Coverage Basis Tax RateDymphna Ann CalumpianoNo ratings yet

- Other Percentage Taxes (OPT)Document56 pagesOther Percentage Taxes (OPT)Vince ManahanNo ratings yet

- Percentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedDocument4 pagesPercentage Tax Description: Under Sections 116 To 126 of The Tax Code, As AmendedAndrea TanNo ratings yet

- Business Percentage Taxes ExplainedDocument6 pagesBusiness Percentage Taxes ExplainedFrancis Ysabella BalagtasNo ratings yet

- PERCENTAGE TAXES EXPLAINEDDocument12 pagesPERCENTAGE TAXES EXPLAINEDIrish Gracielle Dela CruzNo ratings yet

- Opt and Excise TaxDocument20 pagesOpt and Excise TaxDana Marie FamorNo ratings yet

- Percentage Tax CTBDocument16 pagesPercentage Tax CTBDon CabasiNo ratings yet

- Percentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDocument16 pagesPercentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDon CabasiNo ratings yet

- Taxes 1Document2 pagesTaxes 1HappyPurpleNo ratings yet

- Type Who / What Are Subject RA TE TAX Basis Additional NotesDocument7 pagesType Who / What Are Subject RA TE TAX Basis Additional NotesSavage KongNo ratings yet

- Taxation Basics & PrinciplesDocument8 pagesTaxation Basics & PrinciplescesalyncorillaNo ratings yet

- Percentage Tax Who Are Required To File?Document4 pagesPercentage Tax Who Are Required To File?Angelyn SamandeNo ratings yet

- Understanding Withholding TaxDocument16 pagesUnderstanding Withholding TaxNyaba NaimNo ratings yet

- Taxation Reviewer - Percentage TaxDocument3 pagesTaxation Reviewer - Percentage TaxDaphne BarceNo ratings yet

- TAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationDocument5 pagesTAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationMakoy BixenmanNo ratings yet

- GOVERNMENT MONEY PAYMENT GUIDEDocument17 pagesGOVERNMENT MONEY PAYMENT GUIDErickmortyNo ratings yet

- WwweeerDocument1 pageWwweeerVinylcoated ClipsNo ratings yet

- Other Percentage TaxesreportDocument40 pagesOther Percentage TaxesreportZhee BillarinaNo ratings yet

- Percentage Tax- Concept and ImpositionDocument17 pagesPercentage Tax- Concept and ImpositionMitzi Caryl EncarnacionNo ratings yet

- Business Tax GuideDocument19 pagesBusiness Tax GuideDiossaNo ratings yet

- Opt, Excise Tax and DSTDocument4 pagesOpt, Excise Tax and DSTHiedi SugamotoNo ratings yet

- Percentage TaxDocument22 pagesPercentage TaxMa.annNo ratings yet

- Other Percentage TaxesDocument40 pagesOther Percentage TaxesKay Hanalee Villanueva NorioNo ratings yet

- Other Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateDocument18 pagesOther Percentage Tax Summary of Other Percentage Tax Rates: Coverage Taxable Base Tax RateZaaavnn VannnnnNo ratings yet

- Final Income Tax Rates and RulesDocument26 pagesFinal Income Tax Rates and RulesJason MablesNo ratings yet

- J.K. Lasser's Small Business Taxes 2019: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2019: Your Complete Guide to a Better Bottom LineNo ratings yet

- Basic Income TaxDocument2 pagesBasic Income Taxjoven umandapNo ratings yet

- MAS Short Term Budgeting and Forecasting TechniquesDocument1 pageMAS Short Term Budgeting and Forecasting Techniquesjoven umandapNo ratings yet

- Pas 24, Pas 10, PFRS 5Document2 pagesPas 24, Pas 10, PFRS 5joven umandapNo ratings yet

- Chapter IDocument29 pagesChapter Ijoven umandapNo ratings yet

- The Global Environment: Slide Content Created by Joseph B. Mosca, Monmouth UniversityDocument22 pagesThe Global Environment: Slide Content Created by Joseph B. Mosca, Monmouth UniversitySari BorseNo ratings yet

- An Introduction To The Chitsuroku Shobun: Part Two by Thomas SchalowDocument25 pagesAn Introduction To The Chitsuroku Shobun: Part Two by Thomas Schalowapi-260432934No ratings yet

- 53141BIR Form No. 0901 - R (Royalties) PDFDocument2 pages53141BIR Form No. 0901 - R (Royalties) PDFjohnbyronjakesNo ratings yet

- Ker & Co V LingadDocument10 pagesKer & Co V LingadyassercarlomanNo ratings yet

- CR Questions 60+Document102 pagesCR Questions 60+George NicholsonNo ratings yet

- Automobile Excise Technical PPT 08142017 PDFDocument181 pagesAutomobile Excise Technical PPT 08142017 PDFCuayo JuicoNo ratings yet

- (Tax) 17 - Compania General de Tabacos V City of Manila - LeshenDocument2 pages(Tax) 17 - Compania General de Tabacos V City of Manila - LeshenBrian Earl LeshenNo ratings yet

- Chapter 9 - Input VatDocument1 pageChapter 9 - Input VatPremium AccountsNo ratings yet

- ACC2001 Lecture 10 Interco TransactionsDocument42 pagesACC2001 Lecture 10 Interco Transactionsmichael krueseiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Omkesh PanchalNo ratings yet

- Introduction to GST: Key Concepts and Taxes SubsumedDocument229 pagesIntroduction to GST: Key Concepts and Taxes SubsumedRudra JhaNo ratings yet

- Business Plan by MIAN M.SHAHNAWAZDocument61 pagesBusiness Plan by MIAN M.SHAHNAWAZmsn_engrNo ratings yet

- MTP ExciseDocument123 pagesMTP ExciseNitin JainNo ratings yet

- Marcelo Investment vs. MarceloDocument14 pagesMarcelo Investment vs. MarceloLoi AniNo ratings yet

- Hearing Aid Price List 2017Document1 pageHearing Aid Price List 2017It'z VNo ratings yet

- Mock Test Paper 4Document7 pagesMock Test Paper 4FarrukhsgNo ratings yet

- Final Feasability StudyDocument67 pagesFinal Feasability StudyRICHA VERMANo ratings yet

- BDA PaikarapurDocument23 pagesBDA PaikarapurMitaliPujaNo ratings yet

- City Government of San Pablo V ReyesDocument2 pagesCity Government of San Pablo V ReyesNikita BayotNo ratings yet

- Pakistan - United States Income Tax TreatiesDocument12 pagesPakistan - United States Income Tax TreatiesMoazzamDarNo ratings yet

- Antero Resources Corp 10KDocument158 pagesAntero Resources Corp 10Kd1234dNo ratings yet

- GSK Annual Report 2008Document52 pagesGSK Annual Report 2008Soumya ParthasarathyNo ratings yet

- Tax Dispute Resolution - Challenges and Opportunities in India - 9789350356722 - Anna's ArchiveDocument210 pagesTax Dispute Resolution - Challenges and Opportunities in India - 9789350356722 - Anna's ArchiveSavvy ThakurNo ratings yet

- 2017-An Ordinance Enacting The Revised Pasig Revenue CodeDocument194 pages2017-An Ordinance Enacting The Revised Pasig Revenue CodeRandy PaderesNo ratings yet

- Coragt Gca00469 01677636 03 PGP P0351407 00006 T413 03SCHL Post 1Document3 pagesCoragt Gca00469 01677636 03 PGP P0351407 00006 T413 03SCHL Post 1firdausamir.mitsblNo ratings yet

- Taxation Philippines: Leasehold ImprovementsDocument17 pagesTaxation Philippines: Leasehold Improvementsmarklogan67% (3)

- COD Collect Rs. 1045Document10 pagesCOD Collect Rs. 1045Shakti MalikNo ratings yet

- Abing Vs WaeyanDocument3 pagesAbing Vs WaeyanAngelic ArcherNo ratings yet

- City of Ridgeland Docs - Part 4 892 - 1171 WORKING COPY (02203265)Document280 pagesCity of Ridgeland Docs - Part 4 892 - 1171 WORKING COPY (02203265)the kingfishNo ratings yet