Professional Documents

Culture Documents

rptHealthMax 2

Uploaded by

Nurtaleeb EbbahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

rptHealthMax 2

Uploaded by

Nurtaleeb EbbahCopyright:

Available Formats

Proposed Insured:

Ms. RICA MAE DELOS REYES MARQUEZ

Age 24, Female, Non-smoker

Policyowner or Payor:

Ms. RICA MAE DELOS REYES MARQUEZ

Age 24, Female

Dear RICA MAE,

Thank you for your interest in AXA’s insurance products. Health MaX is a lifetime health plan which provides coverage for major and

minor critical conditions to ensure that you will have the necessary funding for treatment and recovery. It also gives you lifetime insurance

coverage so you can be sure that your loved ones will be financially protected when the unexpected happens.

Enjoy the following benefits from Health MaX:

· Guaranteed Major Critical Conditions coverage* of PHP 1,200,000 if you are diagnosed with any of the 56 specified major

critical conditions.

· Guaranteed Minor Critical Conditions coverage** of PHP 240,000 is advanced if you are diagnosed with any of the 18

specified minor critical conditions. During the life of your policy, you can claim a maximum of two (2) minor critical conditions.

· Advanced Health Fund, in the form of guaranteed cash endowments, starting age 70, you have the option to withdraw up to

PHP 240,000 or leave it with AXA to accumulate with interest determined by Us.

· Guaranteed life insurance coverage* of PHP 1,200,000 from day one of policy issuance.

· Policy Loan , prior to the availability of the cash endowments, that can be used should there be unexpected needs for the fund.

* The Major Critical Conditions and Life Insurance Benefits are equal to 100% of the sum insured if there are no withdrawals made for the Advanced Health Fund and there are

no claims for Minor Critical Conditions benefit. Any claims, withdrawals, or policy loans will be deducted to the benefits payable accordingly.

** The payable Minor Critical Conditions Benefit should come from different Minor Critical Conditions except for (i) Angioplasty and Other Invasive Treatments for Coronary Artery,

and (ii) Carsinoma-in-situ.

BENEFITS

For You For Your Loved Ones

(Living benefits) (Major Critical Conditions Benefits) (Death Benefits)

When you reach Age 75 When you reach Age 75 If the Insured passes away at age 75

Total Living Benefit (Guaranteed Cash Value + Guaranteed Major Critical Conditions Benefit + Guaranteed Death Benefit + Accumulated

Accumulated Advanced Health Fund with Interest) Accumulated Advanced Health Fund with Interest Advanced Health Fund with Interest

Based on 3.00% Accumulation Based on 3.00% Based on 3.00%

Interest Rate……………PHP 939,426 Accumulation Rate…..……PHP 1,238,226 Accumulation Rate…..……PHP 1,238,226

Or Or Or

Based on 3.50% Accumulation Based on 3.50% Based on 3.50%

Interest Rate.…….......PHP 946,245 Accumulation Rate.….......PHP 1,245,045 Accumulation Rate.….......PHP 1,245,045

The above is only a summary of the benefits illustration. All the amounts shown are based on the assumption that Advanced Health Fund payouts are left with the Corporation

to earn interest. For more information on the above benefit details, please refer to the succeeding pages.

Page 1 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:10 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

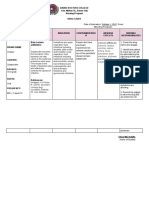

SUMMARY OF BENEFITS

Benefits Benefit Amount (PHP)

· Major Critical Conditions Benefit if the Insured is diagnosed 1,200,000

with one of the 56 covered Major Critical Conditions1

· Minor Critical Conditions Benefit if the Insured is diagnosed 240,000 up to a maximum of two (2) claims

with one of the covered Minor Critical Conditions2

· Death Benefit in the unfortunate event that the Insured 1,200,000

passes away, the beneficiary will receive this amount1

· Maturity Benefit if the Insured is alive at age 1003 1,200,000

· Accumulated Advanced Health Fund - receive guaranteed

cash endowments available on the 70th, 75th, 80th, or 85th

birthday of the insured4

Age Accumulated Advance % of the Sum Insured

Health Fund

70 240,000 20% of Insured

75 420,000 35% of Insured

80 540,000 45% of Insured

85 600,000 50% of Insured

1 The benefit amount for Major Critical Conditions and Death Benefit are reduced by any claim on Minor Critical Conditions Benefits, any withdrawals from Advanced Health Fund,

and/or Policy Loans. Note that the benefit amount for Major Critical Conditions and Death Benefit indicated on the illustration assumes that there are no claims made for Minor Critical

Conditions Benefit and there no withdrawals from the Advanced Health Fund.

2 The amount of benefit paid or payable will be deducted from the Major Critical Conditions Benefit and Death Benefit payable under the Basic Plan. Please refer to the conditions

stated on the subsequent pages for the covered illnesses. The payable Minor Critical Conditions Benefit should come from different Minor Critical Conditions except for (i) Angioplasty

and Other Invasive Treatments for Coronary Artery, and (ii) Carcinoma-in-situ.

3 The benefit amount for the Maturity Benefit assumes that there are no claims made on Major and Minor Critical Conditions Benefits, and no withdrawals from Advanced Health Fund.

4 The benefit amount for Advanced Health Fund assumes that there are no withdrawals made until age 85. Any withdrawals made will reduce the actual accumulated Advance Health

Fund. The Advanced Health Fund may increase if left with the Company to accumulate with interest.

The succeeding pages of this proposal provide more details on the benefits and features of Health MaX.

Again, thank you for your interest in our products. If you have questions, please call me at the number specified below or call the

AXA Customer Care Hotline at Tel. No. 85815-292 or 83231-292

EBBAH, NURTALEEB AMINULA

218525

57923

639260038310

Page 2 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:10 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

PREMIUMS

Plan/Supplements Cover up Sum Insured / Annual Premium

to Age* Coverage (PHP) (PHP)

HEALTH MAX 20-PAY 100 1,200,000 26,232.00

Total Initial Annual Premium 26,232.00

Semi-Annual Premium 13,640.64

Quarterly Premium 7,082.64

Monthly Premium 2,492.04

*Cover up to Age refers to Termination Age

Notes:

The premium rates for Health MaX are not guaranteed and the Company reserves the right to review and adjust the premium rates from time to time. We will

communicate any change in premium rates by mail or in any other applicable form.

For the premium term of the supplement/s, if any, please refer to the supplement definition indicated in the Summary of the Riders attached to this Proposal.

Page 3 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:10 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

ILLUSTRATION OF LIVING BENEFITS

3.00% Accumulation Rate 3.50% Accumulation Rate

End of Attained Guaranteed Accumulated Accumulated Total Living Benefit Accumulated Total Living Benefit

Year Age Cash Value Advanced Health Advanced Health Advanced Health

Fund Fund with Interest Fund with Interest

1 25 0 0 0 0 0 0

2 26 0 0 0 0 0 0

3 27 1,200 0 0 1,200 0 1,200

4 28 13,200 0 0 13,200 0 13,200

5 29 32,400 0 0 32,400 0 32,400

6 30 52,800 0 0 52,800 0 52,800

7 31 74,400 0 0 74,400 0 74,400

8 32 96,000 0 0 96,000 0 96,000

9 33 118,800 0 0 118,800 0 118,800

10 34 142,800 0 0 142,800 0 142,800

15 39 283,200 0 0 283,200 0 283,200

20 44 426,000 0 0 426,000 0 426,000

25 49 486,000 0 0 486,000 0 486,000

46 70 554,400 240,000 240,000 794,400 240,000 794,400

51 75 481,200 420,000 458,226 939,426 465,045 946,245

56 80 433,200 540,000 651,209 1,084,409 672,327 1,105,527

61 85 406,800 600,000 814,930 1,221,730 858,514 1,265,314

66 90 446,400 600,000 944,727 1,391,127 1,019,645 1,466,045

71 95 450,000 600,000 1,095,198 1,545,198 1,211,019 1,661,019

76 100 600,000 600,000 1,269,634 1,869,634 1,438,310 2,038,310

Product Notes:

1. The Illustration of Living Benefits presents the amounts payable to the Owner once he/she decides to surrender/terminate the plan.

2. The Accumulation Rates (3.00% & 3.50%) are assumed annual rates and are for illustration purposes only, and do not represent maximum or

minimum cash returns.

3. The plan provides Guaranteed Cash Value , which can be paid to the Owner upon termination of the policy prior to death. Any Minor Critical

Conditions benefit claims paid are deductible from the Guaranteed Cash Value. At any time the total Minor Critical Conditions benefit paid is

higher than the Guaranteed Cash Value, the surrender amount is reduced to zero.

4. The Accumulated Advanced Health Fund refers to the sum of the cash endowment benefits available on the 70th, 75th, 80th, and 85th

birthdays of the Insured. Illustration assumes that there were no withdrawals made.

5. The Accumulated Advanced Health Fund with Interest refers to Your accumulated cash endowment, with no withdrawals made, and taking

into account the accumulation rates provided by the Company.

6. The Total Living Benefit is the sum of the Guaranteed Cash Value, and the Accumulated Advanced Health Fund with Interest (if any). The

Advanced Health Fund benefits are to be available 1 day after the end of the policy year.

7. Interest rates on Accumulated Advanced Health Fund are not guaranteed, as these are dependent on the investment performance of the

Corporation.

8. The Illustration assumes that your Advanced Health Fund payouts are left with the Corporation to earn interest. If you decide to withdraw your

Advanced Health Fund, the total living benefits will be reduced accordingly.

9. The plan offers Extended Term Insurance and Premium Loan as premium default options.

10. All amounts are in the currency indicated in the Summary of Benefits page.

11. This proposal is only an illustration of the key features, benefits and assumptions of the recommended insurance plan and does not form part

of the contract. For the complete terms, conditions and limitations of the plan please refer to your policy.

Page 4 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:10 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

ILLUSTRATION OF DEATH BENEFITS / MAJOR CRITICAL CONDITIONS BENEFIT

3.00% Accumulation Rate 3.50% Accumulation Rate

Guaranteed

Death

End of Attained Benefit / Accumulated Accumulated Total Death Benefit Accumulated Total Death Benefit

Year Age Major Critical Advanced Health Advanced Health /Major Critical Advanced Health /Major Critical

Conditions Fund Fund with Interest Conditions Benefit Fund with Interest Conditions Benefit

Benefit

1 25 1,200,000 0 0 1,200,000 0 1,200,000

2 26 1,200,000 0 0 1,200,000 0 1,200,000

3 27 1,200,000 0 0 1,200,000 0 1,200,000

4 28 1,200,000 0 0 1,200,000 0 1,200,000

5 29 1,200,000 0 0 1,200,000 0 1,200,000

6 30 1,200,000 0 0 1,200,000 0 1,200,000

7 31 1,200,000 0 0 1,200,000 0 1,200,000

8 32 1,200,000 0 0 1,200,000 0 1,200,000

9 33 1,200,000 0 0 1,200,000 0 1,200,000

10 34 1,200,000 0 0 1,200,000 0 1,200,000

15 39 1,200,000 0 0 1,200,000 0 1,200,000

20 44 1,200,000 0 0 1,200,000 0 1,200,000

25 49 1,200,000 0 0 1,200,000 0 1,200,000

46 70 960,000 240,000 240,000 1,200,000 240,000 1,200,000

51 75 780,000 420,000 458,226 1,238,226 465,045 1,245,045

56 80 660,000 540,000 651,209 1,311,209 672,327 1,332,327

61 85 600,000 600,000 814,930 1,414,930 858,514 1,458,514

66 90 600,000 600,000 944,727 1,544,727 1,019,645 1,619,645

71 95 600,000 600,000 1,095,198 1,695,198 1,211,019 1,811,019

76 100 600,000 600,000 1,269,634 1,869,634 1,438,310 2,038,310

The Total Death Benefit / Major Critical Conditions Benefit is (1) the sum of the Guaranteed Death Benefit / Major Critical Conditions

Benefit , and the Accumulated Advanced Health Fund with Interest (if any) payable upon the demise of the Insured or the Insured’s diagnosis

of any of the 56 Major Critical Conditions (2) less any Minor Critical Conditions paid, any cash endowments paid, and any indebtedness. The

Advanced Health Fund payable on the 70th, 75th, 80th and 85th birthdays will be credited 1 day after the end of the policy year following the

70th, 75th, 80th and 85th birthdays.

The figures presented are based on the key features, benefits and assumptions listed on the Product Notes portion found in the Illustration of

Living Benefits page.

Page 5 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:11 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

MAJOR CRITICAL CONDITIONS COVERED

Major Critical Conditions

Group 1 Cancer Group 6 Critical Conditions related to the digestive system

1. Cancer 39. Chronic Relapsing Pancreatitis

40. Fulminant Hepatitis

41. Severe Crohn’s Disease

42. Severe Ulcerative Colitis

Group 2 Critical Conditions related to organ failure Group 7 Critical Conditions related to immunology and rheumatology

2. Chronic Adrenal Insufficiency (Addison's Disease) 43. Severe Rheumatoid Arthritis

3. Chronic and Irreversible Kidney Failure 44. Systemic Lupus Erythematosus (S.L.E.) with Lupus Nephritis

4. Chronic Liver Disease 45. Systemic Scleroderma

5. Coma

6. End Stage Lung Disease

7. Loss of Independent Existence#

8. Major Organ Transplantation

9. Medullary Cystic Disease

Group 3 Critical Conditions related to heart and blood vessels Group 8 Critical Conditions related to neurological degeneration

10. Cardiomyopathy 46. Alzheimer’s Disease

11. Coronary Artery Disease Requiring Surgery 47. Parkinson’s Disease

12. Dissecting Aortic Aneurysm 48. Severe Creutzfeld-Jacob Disease (CJD)

13. Eisenmenger’s Syndrome

14. Heart Attack

15. Heart Valve Surgery

16. Primary Pulmonary Arterial Hypertension

17. Severe Infective Endocarditis

18. Surgery to Aorta

Group 4 Critical Conditions related to the nervous system Group 9 Critical Conditions related to the musculoskeletal system

19. Amyotrophic Lateral Sclerosis 49. Amputation of Both Feet due to Complication from Diabetes

20. Apallic Syndrome 50. Major Burns

21. Bacterial Meningitis 51. Necrotizing Fasciitis

22. Benign Brain Tumor 52. Severance of Limbs

23. Blindness

24. Brain Damage^

25. Encephalitis

26. Motor Neuron Disease

27. Multiple Sclerosis

28. Muscular Dystrophy

29. Paralysis

30. Poliomyelitis

31. Progressive Bulbar Palsy

32. Progressive Supranuclear Palsy^

33. Spinal Muscular Atrophy

34. Stroke

35. Tuberculosis Meningitis

Group 5 Critical Conditions related to blood Group 10 Other Critical Conditions

36. AIDS / HIV due to Blood Transfusion 53. Deafness (loss of hearing)

37. Aplastic Anemia 54. Elephantiasis

38. Occupationally Acquired AIDS / HIV 55. Loss of Speech

56. Terminal Illness

#To be eligible to receive a benefit under this Major Critical Condition, the Insured must be between age 15 and age 75 at the time of first diagnosis.

^To be eligible to receive a benefit under this Major Critical Condition, the Insured must be above age 5 at the time of first diagnosis.

MINOR CRITICAL CONDITIONS COVERED

Minor Critical Conditions

Group 1 Children Minor Critical Conditions~ 1. Dengue Hemorrhagic Fever (Grades III and IV)

2. Hemophilia A and Hemophilia B

3. Insulin Dependent Diabetes Mellitus

4. Kawasaki Disease

5. Osteogenesis Imperfecta

6. Rheumatic Fever with Valvular Impairment

7. Still’s Disease

8. Wilson’s Disease

Group 2 Carcinoma-in-situ / Early Stage Cancer 9. Carcinoma-in-situ at Breast, Cervix Uteri, Uterus, Ovary, Fallopian Tube,

Vagina or Testicles

10. Early Stage Cancer of Prostate

Group 3 Angioplasty 11. Angioplasty and Other Invasive Treatments for Coronary Artery Disease

Group 4 Other Minor Critical Conditions 12. Aortic Aneurysm

13. Chronic Auto-immune Hepatitis

14. Facial Reconstructive Surgery for Injury due to Accident

15. Hepatitis with Cirrhosis

16. Insertion of Pacemaker or Defibrillator

17. Skin Transplantation due to Accidental Burning

18. Systemic Lupus Erythematosus (S.L.E.)

~Only an Insured aged under 22 on the 1st diagnosis of these minor Critical Conditions is eligible to claim for the relevant benefit.

Note : The critical condition must occur 60 days after the policy’s effective date for the corresponding Major Illness or Minor Illness Benefit to be payable. Benefits relating to Major

and Minor Critical Conditions are payable according to the definitions of Major and Minor Critical Conditions Benefits as set out in the policy contract.

Page 6 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:11 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

QUICK GUIDE TO COMMON CRITICAL CONDITIONS

COVERED UNDER YOUR HEALTH PLAN

Health Max covers a total of 56 major and 18 minor critical conditions. Here is a quick reference for the 15 most common major critical

conditions and 5 minor critical conditions.

TOP 15 ILLNESSES COVERED UNDER MAJOR CRITICAL CONDITIONS

CONDITION WHAT IS COVERED WHAT IS NOT COVERED

1. Cancer First unequivocal diagnosis of any malignant tumour • Tumors defined as benign, carcinoma in situ,

characterised by the uncontrolled growth of malignant cells pre-malignant, non-invasive, having borderline

and invasion of tissue, and positively diagnosed with malignancy or having low malignant potential

histological confirmation by an appropriate specialist • Tumors treated by endoscopic procedures

and/or by Our medical director or authorized medical alone and urinary bladder tumors that have not

consultant. invaded the muscle layer (Tis and Ta)

• Tumors of the skin with the exception of

The term malignant tumor includes leukemia, sarcoma and malignant melanoma greater than 0.7 mm

lymphoma except cutaneous lymphoma (lymphoma Breslow and/or histologically described by the

confined to the skin). AJCC seventh edition TNM classification greater

than stage T1aN0M0

Breast carcinoma in situ with subsequent radical • All prostate tumors unless histologically

mastectomy and radiotherapy is covered. classified as having a Gleason score greater

than 6 or having progressed to at least clinical

TNM classification T2N0M0

• Thyroid tumor in its early stages that measures

less than 2cm in diameter and histologically

described as T1N0M0 from TNM classification

of the AJCC Seventh Edition

• Chronic lymphotic leukemia unless

histologically classified as having progressed to

at least Binet Stage A

2. Stroke Death of brain tissue caused by hemorrhage, embolism or • Transient Ischaemic Attacks (TIA) or temporary

thrombosis resulting in permanent neurological deficit with stroke-like signs and symptoms

persistent clinical symptoms. There must be clear and • Brain tissue damage caused by head injury

obvious abnormalities of sensory or motor functions during • Death of tissue of the optic nerve or retina /

the physical examination performed by a neurologist and/or eye stroke

by Our medical director or authorized medical consultant.

3. Heart Attack Occurrence of death of a portion of the heart muscle as a • Other acute coronary syndromes

result of inadequate blood supply to the relevant area. • Angina without myocardial infarction

4. Coronary Artery Bypass The undergoing of surgery requiring median sternotomy • Angioplasty

Graft Surgery (CABG) (surgery to divide the breastbone), which is considered • Intra-arterial procedures

medically necessary to correct narrowing or blockage of one • Laser techniques

or more coronary arteries with bypass grafts. • Other non-surgical techniques

5. Heart Valve Surgery An open heart valve surgery should have already • All repairs conducted through intra-

been done to replace or repair one (1) or more heart arterial catheter procedures

valves, as a consequence of defects.

6. Major Organ Recommendation from a specialist to undergo • Other transplants for organs not

Transplantation transplant for any of the following organs: mentioned in the list

• heart, lung, liver, kidney, pancreas, or human

bone marrow

7. Chronic and Irreversible The following symptoms must be present: • At least one kidney is still functioning and

Kidney Failure • Both kidneys are characterized with regular dialysis is not required.

irreversible failure to function

• Has already started regular renal dialysis

• Is either awaiting or has already undergone

kidney transplant

8. Alzheimer’s Disease Evident deterioration or loss of cognitive and/or • Dementia relating to alcohol, drug abuse

intellectual capacity, due to irreversible failure of or AIDS

brain function.

Note: The critical condition must occur 60 days after the policy’s effective date for the corresponding Major Illness or Minor Illness Benefit to be payable.

Benefits relating to Major and Minor Critical Conditions are payable according to the definitions of Major and Minor Critical Conditions Benefits as set out

in the policy contract.

Page 7 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:11 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

TOP 15 ILLNESSES COVERED UNDER MAJOR CRITICAL CONDITIONS (continuation)

CONDITION WHAT IS COVERED WHAT IS NOT COVERED

9. Parkinson’s Disease Definitive signs of progressive and permanent • Drug induced, accidental, or toxic

neurological impairment, evidenced by permanent causes of Parkinson’s Disease

inability to perform at least three (3) out of six (6)

Activities of Daily Living (ADLs)1, in spite of being on

optimal medication.

10. Bacterial Meningitis Evidence of inflammation of the brain membranes or • Viral Meningitis

spinal cord, resulting in significant and permanent

neurological deficit.

11. Benign Brain Tumor Presence of a life threatening, non-cancerous tumor in • Cysts, granulomas (inflammations),

the brain. If it cannot be removed through surgery, the malformations in, or of, the arteries

tumor should cause significant and permanent or veins of the brain, hematomas

neurological deficit persisting for at least 6 consecutive (collection of blood outside the

months. blood vessels) and tumors in the

pituitary gland or spinal cord

12. Paralysis Inability of two (2) or more limbs to function totally and • Paralysis in 1 limb

permanently due to injury or disease of the spinal cord or

brain.

Those classified as Diplegia (paralysis affecting like parts

on both sides of the body, such as both arms or both

legs), Hemiplegia (paralysis of one side of the body), and

Quadriplegia (paralysis of all four limbs) are included.

13. Loss of Independent Permanent inability to perform at least three (3) Activities • Independent capability to perform 4

Existence of Daily Living (ADLs)1, as certified by a medical specialist or more ADLs

and/or AXA’s medical director.

*Only Insured aged between 15 and 75 on first diagnosis

is eligible to receive a benefit under this illness

14. Severe Rheumatoid Evidence of extensive joint deformity of two (2) or more of • Only one joint area is affected and

Arthritis the following joint areas: hands, wrists, elbows, knees, the Insured can still perform 3 or

hips, ankle, cervical spine or feet; and inability to perform more ADLs.

at least 2 Activities of Daily Living (ADLs)1.

The condition must be present for at least six (6) months.

15. Severance of Limbs Total and irrecoverable loss of two (2) or more limbs due • Loss of either one (1) hand or one

to illness or accident only. This includes the loss of use of (1) foot only.

both hands or both feet or the use of one (1) hand and

one (1) foot.

1 Activities of Daily Living are as follows: (1) Washing - wash in the bath or shower (including getting into and out of the bath or shower) or wash

satisfactorily by other means; (2) Dressing - put on, take off, secure, and unfasten all garments and, as appropriate, any braces, artificial limbs, or other

surgical appliances; (3) Transferring - move from a bed to an upright chair or wheelchair or vice versa; (4) Mobility - move indoors from room to room on

level surfaces; (5) Toileting - use lavatory or otherwise manage bowel and bladder functions so as to maintain a satisfactory level of personal hygiene;

and (6) Feeding - feed oneself once food has been prepared and made available.

Note: The critical condition must occur 60 days after the policy’s effective date or last reinstatement date, whichever is later for the corresponding Major Illness or

Minor Illness Benefit to be payable. Benefits relating to Major and Minor Critical Conditions are payable according to the definitions of Major and Minor Critical

Conditions Benefits as set out in the policy contract.

NOTE: Benefits relating to major and minor Critical Conditions are payable according to the definitions set out in the policy contract.

Pre-Existing Conditions as defined is permanently excluded.

Major and Minor Critical Conditions Benefits are not payable under any of the following conditions:

(1) for illnesses relating to congenital abnormalities; or

(2) any act of war, declared or not, or while in military, naval or air service for any country at war, declared or not, or any acts of terrorism; or

(3) nuclear, biological or chemical (NBC) contamination; or

(4) any self-inflicted injury or suicide or any attempt thereat, whether sane or insane; or

(5) any unprescribed drug or alcohol abuse.

“Pre-existing condition” means a condition (a) for which the Insured received medical advice, consultation or treatment, or (b) whose signs or symptoms are

evident, or should have been evident to the Insured, even if the Insured did not seek medical advice, consultation or treatment for it prior to the Effective Date or

the date of last reinstatement, if any. “Condition” means any type of illness, specific injury, disease, or infirmity including all underlying or related conditions and

any manifestation thereof, whether in one (1) or more than one body system.

Cooling-off Period: You may return or cancel the contract within 15 days from the date you receive the contract. You will receive a full refund of your Premium. No

refund can be made when you have already made a claim on your rider.

Page 8 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:11 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

TOP 5 ILLNESSES COVERED UNDER MINOR CRITICAL CONDITIONS

CONDITION WHAT IS COVERED WHAT IS NOT COVERED

1. Carcinoma-in-situ (CIS) Cells on biopsy have not yet spread and invaded • Carcinoma-in-situ located in organs not

commonly known as Pre- surrounding tissues or are contained to the place of specified in the definition

Cancer or Stage 0 cancer origin.

Only CIS reported in any of the following organs may

be covered: Cervix Uteri, Uterus, Breast, Vagina,

Fallopian Tube, Ovary, Testicles

Maximum of 2 claims, with the 2nd CIS claim for any

of the other remaining organs listed and not from

the same organ as that of the 1st CIS claim.

2. Angioplasty and other Have already undergone Angioplasty (procedure to • Angioplasty, atherectomy, or laser

Invasive Treatments for widen blocked or narrowed coronary arteries), treatment has not yet been performed

Coronary Artery Disease atherectomy (procedure to remove plaque from the • The procedure was done only for the

inside of a blood vessel) or laser treatment to correct branches of the major coronary arteries

narrowings.

Covered procedure should involve any of the

following coronary vessels: Left main stem artery,

Left anterior descending artery, Circumflex artery,

Right coronary artery except their branches

Maximum of 2 claims, with the 2nd procedure done

in a narrowed vessel of a major coronary artery.

3. Early Stage Cancer of A prostate malignant tumor histologically described • The condition does not satisfy all of the

Prostate as TNM classification T1a, T1b, T1c or which is of specified criteria.

another equivalent classification. Diagnosis must be

supported by a biopsy report.

4. Hepatitis with Liver Inflammation of the liver by the Hepatitis virus • Liver diseases due or related to alcohol

Cirrhosis leading to cirrhosis (healthy liver tissue is replaced abuse

with scar tissue, eventually preventing the liver from

functioning properly).

The liver biopsy must show score 4 in Metavir

grading system or score 13-18 in Knodell score

system or any other imaging test establishing

existence of cirrhosis.

5. Dengue Hemorrhagic Dengue Grades III and IV • Dengue Hemorrhagic Fever I and II

Fever

*Only Insured aged 21 and below on first diagnosis

is eligible to receive a benefit under this illness.

Note: The critical condition must occur 60 days after the policy’s effective date for the corresponding Major Illness or Minor Illness Benefit to be payable.

Benefits relating to Major and Minor Critical Conditions are payable according to the definitions of Major and Minor Critical Conditions Benefits as set out

in the policy contract.

To see the complete list of the 56 covered major critical conditions and 18 covered minor critical conditions

and their detailed coverage, please visit http://axa.com.ph.

Page 9 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:11 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

HEALTH MAX 20-PAY

for: Ms. RICA MAE DELOS REYES MARQUEZ, 24, Female, Non-smoker

DECLARATIONS AND ACKNOWLEDGEMENTS

Declarations

I confirm having read and understood the information contained in the Illustration of Living Benefits Page and the Illustration of

Death Benefits / Major Critical Conditions Benefits Page.

Acknowledgement of Variability

I acknowledge that:

I have applied with AXA Philippines a Whole Life policy, and have reviewed the illustration(s) that shows how a life insurance

policy performs using the company’s assumptions based on Insurance Commission’s guidelines on interest rates.

I understand that only those values described as guaranteed, if any, are guaranteed. All other policy values can change and may

probably be different from those illustrated to me. Actual values may be higher or lower depending on the accumulation rate.

I understand that interest rate on accumulated Advanced Health Fund change from year to year and since these are affected

by the company’s mortality experience, investment returns, expenses, and taxes, and that AXA Philippines will advise me of the

actual amount of the interest rate, if any.

I understand that the illustration(s) given to me will not become part of any issued policy, as these are provided only to show

how policy benefits would change over time under a specific set of assumptions.

CONFORME: These declarations and acknowledgements are made with the

knowledge of the AXA representative whose signature appears below:

Applicant/Policy Owner Date Financial Advisor/Financial Executive Date

Signature over Printed Name Signature over Printed Name

General Disclaimer

All information and opinions provided are of a general nature and for information purposes only. The information and any opinions herein are based upon

sources believed to be reliable, and AXA Philippines, its officers and directors make no representations or warranty, expressed or implied, with respect to

the correctness, completeness of the information and opinions in this document. Please carefully read the policy and endorsements and consider the

risks, charges and expenses before buying the policy. You should seek independent professional advice from your financial, tax, accounting or legal

consultant before buying the Policy.

THIS FINANCIAL PRODUCT OF AXA PHILIPPINES IS NOT INSURED BY THE PHILIPPINE DEPOSIT

INSURANCE CORPORATION (PDIC) AND IS NOT GUARANTEED BY METROBANK OR PS BANK.

Page 10 of 11 of Proposal No. 57923-202302060756-2-02

Printed on: 2/6/2023 7:57:11 PM Created on: 02/06/2023 Expiry Date: 04/07/2023

Version Number: 6.2.0 Plan Code: HMXB20 / Rider Code: N/A Date for Next Insurance Age: 05/08/2023

Reference Number: 57923-202302060756-2-02

FINANCIAL UNDERSTANDING SUMMARY

Dear RICA MAE,

Thank you for providing us with relevant information with regards to your financial needs.

Based on your current financial situation, which includes, among others, your personal

monthly gross income of 18,000.00, and after taking into consideration your objectives, risk

profile and priorities, you have selected Health MaX 20-Pay for your Health need.

The details of your insurance coverage and your insurance premium are summarized in your

Health MaX 20-Pay sales illustration.

EBBAH, NURTALEEB AMINULA

218525

57923

639260038310

This document is not intended to be a part of your sales illustration of your application form. This is a

summary of the financial needs that you have provided during assessment by your distributor.

You might also like

- Axa PhilDocument13 pagesAxa PhilKat EspanoNo ratings yet

- AIA BHD Brochure Protection Inflation Protector PlusDocument25 pagesAIA BHD Brochure Protection Inflation Protector PlusbelrayNo ratings yet

- HealthMax 20 PayDocument11 pagesHealthMax 20 PayJulienne Mhae ReyesNo ratings yet

- RPT Health MaxDocument11 pagesRPT Health MaxNurtaleeb EbbahNo ratings yet

- 25F AXA HealthMax 20P 1.2M (Trad)Document19 pages25F AXA HealthMax 20P 1.2M (Trad)Aljes ReyesNo ratings yet

- 25M AXA HealthMax 20P 1.2M (Trad)Document19 pages25M AXA HealthMax 20P 1.2M (Trad)Aljes ReyesNo ratings yet

- Virgilio Reyes 2024-03-12 03 - 01 - 57Document15 pagesVirgilio Reyes 2024-03-12 03 - 01 - 57Cyber ZoneNo ratings yet

- rptHealthMax Robert1 PDFDocument14 pagesrptHealthMax Robert1 PDFJULIUS TIBERIONo ratings yet

- Mrs. Maria Eloisa Lim Chu Gungon: When You Reach Age 75 When You Reach Age 75 If The Insured Passes Away at Age 75Document11 pagesMrs. Maria Eloisa Lim Chu Gungon: When You Reach Age 75 When You Reach Age 75 If The Insured Passes Away at Age 75John Philip TiongcoNo ratings yet

- RPT Family CIDocument13 pagesRPT Family CINurtaleeb EbbahNo ratings yet

- Health Insurance in INDIADocument36 pagesHealth Insurance in INDIAheema25No ratings yet

- rptFamilyCI 2Document13 pagesrptFamilyCI 2Nurtaleeb EbbahNo ratings yet

- Health Start: Ms. Mariam Castalla SoloDocument13 pagesHealth Start: Ms. Mariam Castalla SolokeithNo ratings yet

- My - Health Medisure Super Top UpDocument20 pagesMy - Health Medisure Super Top UpmanuNo ratings yet

- Great Critical Care Relief GCCRDocument7 pagesGreat Critical Care Relief GCCRraathi_cdiNo ratings yet

- I Great Critical Care BrochureDocument20 pagesI Great Critical Care BrochureHishamNo ratings yet

- Secure ConfidentDocument8 pagesSecure ConfidentharshleenNo ratings yet

- LIC Jeevan Arogya Brochure 2020Document21 pagesLIC Jeevan Arogya Brochure 2020Paul PrakashNo ratings yet

- Op00683123 EbiDocument5 pagesOp00683123 EbirabijitNo ratings yet

- Takafulink Flexi v2.0 31122014Document4 pagesTakafulink Flexi v2.0 31122014amnasufiyaNo ratings yet

- 9.3 Prospects of Agricultural Insurance: YYY YDocument5 pages9.3 Prospects of Agricultural Insurance: YYY YParvati BoraNo ratings yet

- 2021 Patriot America Platinum PPLAI PPLGADocument39 pages2021 Patriot America Platinum PPLAI PPLGAFaiq QayyumNo ratings yet

- Life Insurance PDSDocument2 pagesLife Insurance PDSAkmal HelmiNo ratings yet

- Insurance DefintionsDocument6 pagesInsurance DefintionsAbbasLiaqatQureshiNo ratings yet

- 2022 Patriot America Plus PATAP PGTAPDocument37 pages2022 Patriot America Plus PATAP PGTAPmaNo ratings yet

- Etiqa+Critical+Care+Plus FAQDocument7 pagesEtiqa+Critical+Care+Plus FAQKeren Karunya SingamNo ratings yet

- Fmi ReportDocument26 pagesFmi ReportHarsha NairNo ratings yet

- Health-Booster BrochureDocument10 pagesHealth-Booster BrochureParasaram SrinivasNo ratings yet

- Product Summary FOR Group Livingcare Insurance (Acceleration Benefit)Document3 pagesProduct Summary FOR Group Livingcare Insurance (Acceleration Benefit)Axel KruseNo ratings yet

- Digit On The Move Policy WordingDocument85 pagesDigit On The Move Policy WordingarunveluNo ratings yet

- CCP&CCM PDFDocument4 pagesCCP&CCM PDFjOHN rEMEDYNo ratings yet

- Proposed Insured: Gene Theodore B Avila Age 39, Male, Smoker Policyowner or Payor: Gene Theodore B Avila Age 39, MaleDocument10 pagesProposed Insured: Gene Theodore B Avila Age 39, Male, Smoker Policyowner or Payor: Gene Theodore B Avila Age 39, Malegene theodore avilaNo ratings yet

- Macquarie FutureWiseDocument80 pagesMacquarie FutureWiseLife Insurance AustraliaNo ratings yet

- Myshield / Myhealthplus: The Plan That Gives You Extra Care and Covers Your Hospital Bills - As ChargedDocument32 pagesMyshield / Myhealthplus: The Plan That Gives You Extra Care and Covers Your Hospital Bills - As ChargedJason TanNo ratings yet

- 4 PDFDocument9 pages4 PDFJocelyn CelynNo ratings yet

- ReportDocument5 pagesReportvinaykumar333777No ratings yet

- Exide Life Secured Income Insurance RPDocument10 pagesExide Life Secured Income Insurance RPrahul sarmaNo ratings yet

- Enhanced Income Select OverviewDocument2 pagesEnhanced Income Select OverviewdjdazedNo ratings yet

- Whole Life InsuranceDocument16 pagesWhole Life Insuranceemilda_samuel211No ratings yet

- OMBF402 - Insurance and Risk ManagementDocument12 pagesOMBF402 - Insurance and Risk ManagementDhanashree BangarNo ratings yet

- Murali ResiptDocument5 pagesMurali Resipt10ashvikaaNo ratings yet

- Product+Disclosure+Sheet Etiqa+Critical+Care+TakafulDocument4 pagesProduct+Disclosure+Sheet Etiqa+Critical+Care+Takafulhakimstars2003No ratings yet

- Now I Can Secure My Family's Future With Just A Click.: Bharti AXA Life ProtectDocument12 pagesNow I Can Secure My Family's Future With Just A Click.: Bharti AXA Life ProtectVenkatram Reddy KamasaniNo ratings yet

- Complete Health Insurance-Brochure PDFDocument16 pagesComplete Health Insurance-Brochure PDFRishi AroraNo ratings yet

- CompleteHealthInsuranceBrochure PDFDocument16 pagesCompleteHealthInsuranceBrochure PDFRishi AroraNo ratings yet

- Insurance ActDocument29 pagesInsurance ActMr. Shopper NepalNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term PlanRKNo ratings yet

- Accidental Death and Dismemberment RiderDocument8 pagesAccidental Death and Dismemberment RiderRicha BandraNo ratings yet

- 904 New Jeevan Arogya PresentationDocument2 pages904 New Jeevan Arogya PresentationDhiman NaskarNo ratings yet

- 增順利增額終身壽險EE 2Document4 pages增順利增額終身壽險EE 2GeneNo ratings yet

- Metlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Document4 pagesMetlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Amit PrasadNo ratings yet

- Arogya Shield Single Pager - V05Document2 pagesArogya Shield Single Pager - V05Yogesh SharmaNo ratings yet

- Proposed Insured: Mr. Renzi Javier de Castro Age 33, Male, Non-Smoker Policyowner or Payor: Mr. Renzi Javier de Castro Age 33, Male Dear RenziDocument12 pagesProposed Insured: Mr. Renzi Javier de Castro Age 33, Male, Non-Smoker Policyowner or Payor: Mr. Renzi Javier de Castro Age 33, Male Dear RenziMarc Darrel OmbaoNo ratings yet

- Medishield PlusDocument3 pagesMedishield PlusBryan GallegoNo ratings yet

- Flexi 5 - Luziah - Shergail BarretoDocument4 pagesFlexi 5 - Luziah - Shergail Barretowheden ludoviceNo ratings yet

- IN-1212869 Insurance MERIEM LAICHOUBIDocument1 pageIN-1212869 Insurance MERIEM LAICHOUBIKarim SelmaniNo ratings yet

- Whole Life Plan - Reliance - 9884635430Document12 pagesWhole Life Plan - Reliance - 9884635430Babujee K.NNo ratings yet

- Complete Health Insurance BrochureDocument5 pagesComplete Health Insurance BrochureDeepak SureshNo ratings yet

- Medical Insurance - The Hallucinationof CoverDocument2 pagesMedical Insurance - The Hallucinationof CoverMuhammadAbdulNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Application For Life Insurance: Important NotesDocument23 pagesApplication For Life Insurance: Important NotesNurtaleeb EbbahNo ratings yet

- RPT Family CIDocument13 pagesRPT Family CINurtaleeb EbbahNo ratings yet

- rptFamilyCI 2Document13 pagesrptFamilyCI 2Nurtaleeb EbbahNo ratings yet

- ZCLYDP 2023 2025weditDocument67 pagesZCLYDP 2023 2025weditNurtaleeb EbbahNo ratings yet

- Distributor's Report 2Document1 pageDistributor's Report 2Nurtaleeb EbbahNo ratings yet

- 2023 CbydpDocument13 pages2023 CbydpNurtaleeb Ebbah100% (1)

- Distributors ReportDocument1 pageDistributors ReportNurtaleeb EbbahNo ratings yet

- Natural Law Theory - AripinDocument1 pageNatural Law Theory - AripinNurtaleeb EbbahNo ratings yet

- Sistem Pelaporan Dan Pembelajaran Keselamatan Pasien RS Arjaty 2022Document13 pagesSistem Pelaporan Dan Pembelajaran Keselamatan Pasien RS Arjaty 2022vera kusunyadewiNo ratings yet

- Sample Protest Art WriteupDocument2 pagesSample Protest Art Writeupapi-266674779No ratings yet

- 20 OncoDocument115 pages20 OncomichelleNo ratings yet

- Communicable DiseasesDocument20 pagesCommunicable DiseasesCai SolanoNo ratings yet

- E1. EpidemiologyDocument108 pagesE1. EpidemiologyEshetu WondimuNo ratings yet

- First Aid BasicsDocument12 pagesFirst Aid Basicswa laNo ratings yet

- SULTAMICILLINDocument2 pagesSULTAMICILLINChoox PriiNo ratings yet

- Domestic Violence and AbuseDocument19 pagesDomestic Violence and AbuseCahya Dwi LestariNo ratings yet

- Anaphylaxis QuizDocument3 pagesAnaphylaxis QuizMeliza BancolitaNo ratings yet

- Result Entry ReportDocument1 pageResult Entry Reportpoojagasti39No ratings yet

- How Is Type 2 Diabetes Treated - What To Know If You Are Newly DiagnosedDocument2 pagesHow Is Type 2 Diabetes Treated - What To Know If You Are Newly DiagnosedRatnaPrasadNalamNo ratings yet

- Takeuchi Excavator Tb240 Parts Workshop Operators ManualDocument22 pagesTakeuchi Excavator Tb240 Parts Workshop Operators Manualbrianwright040195tmo100% (117)

- Antenatal and Intrapartum CareDocument22 pagesAntenatal and Intrapartum Caresanjay vigneshNo ratings yet

- Lecture 1 - Smear Positive PTBDocument40 pagesLecture 1 - Smear Positive PTBNasibah Tuan YaacobNo ratings yet

- Community-Acquired Pneumonia in Children - Outpatient Treatment - UpToDateDocument38 pagesCommunity-Acquired Pneumonia in Children - Outpatient Treatment - UpToDateJosué Pablo Chicaiza AbadNo ratings yet

- Pediatric Achalasia Nejmicm2108193Document1 pagePediatric Achalasia Nejmicm2108193Nelson Da VegaNo ratings yet

- Homeopathy For EpilepsyDocument14 pagesHomeopathy For EpilepsySiddharth Prabhu100% (1)

- HB EstimationDocument15 pagesHB EstimationHaider AliNo ratings yet

- Onco 4 Prostate CancerDocument30 pagesOnco 4 Prostate CancerTej Narayan Yadav100% (1)

- Haemophilia - Global - Having A Child With HaemophiliaDocument10 pagesHaemophilia - Global - Having A Child With HaemophiliaMiriam BlejerNo ratings yet

- Chapter 27 ViolenceDocument28 pagesChapter 27 ViolenceSraddha PatelNo ratings yet

- Ekyana Retreat: Interated Healing Through Yoga, Ayurveda & NaturopathyDocument4 pagesEkyana Retreat: Interated Healing Through Yoga, Ayurveda & Naturopathykapiskumar1No ratings yet

- Inbound 6622251263463521221Document2 pagesInbound 6622251263463521221Haji Ehsan Ullah EhsanNo ratings yet

- Laporan Kunjungan Karyawn Rich's Jan-Des 2022Document19 pagesLaporan Kunjungan Karyawn Rich's Jan-Des 2022Andri AngbawiNo ratings yet

- Patho PediaDocument4 pagesPatho PediaFretzgine Lou ManuelNo ratings yet

- My Notebook - Microsoft OneNote OnlineDocument3 pagesMy Notebook - Microsoft OneNote Onlineatharva sawantNo ratings yet

- Panniculitis 2021Document45 pagesPanniculitis 2021karimahihdaNo ratings yet

- InTech-Surgical Management of Nasal HemangiomasDocument14 pagesInTech-Surgical Management of Nasal HemangiomasghNo ratings yet

- Health DLP STAGES OF INFECTIONDocument9 pagesHealth DLP STAGES OF INFECTIONmarielabianaNo ratings yet

- s11255 019 02200 7Document10 pagess11255 019 02200 7adri20121989No ratings yet