Professional Documents

Culture Documents

31 1 To 31 4

Uploaded by

Away To PonderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

31 1 To 31 4

Uploaded by

Away To PonderCopyright:

Available Formats

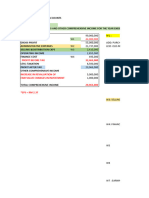

PROBLEM 31-1

1 % of AD = 900/4,500 = 20%

LIFE = 3/20% = 15 years

2 Machinery (7.2m - 4.5m) 2,700,000

AD 540,000

Revaluation Surplus 2,160,000

3 Depreciation (7.2m/15) 480,000

AD 480,000

Previous Dep. (4.5m/15) 300,000

New Dep. 480,000

Increase in Dep. (2.7m/15) 180,000

4 Revaluation Surplus (2.16m/12) 180,000

Retained Earnings 180,000

PROBLEM 31-2

1 LIFE = 5/(750/3,000) = 20 years

2 Equipment 1,800,000

AD 450,000

Revaluation Surplus 1,350,000

3 Depreciation (4.8m/20) 240,000

AD 240,000

4 Revalaution Surplus (1.35m/15) 90,000

Retained Earnings 90,000

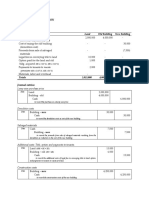

PROBLEM 31-3

*Proportional Approach

1 Building 3,000,000

AD 750,000

Revaluation Surplus 2,250,000

Gross Revalued Amount (6m/75%) 8,000,000

Cost 5,000,000

Total increase 3,000,000

AD (3,000,000 x 25%) 750,000

Net increase 2,250,000

Depreciation (8m/40) 200,000

AD 200,000

Revaluation Surplus (2.25m/30) 75,000

Retained Earnings 75,000

*Elimination Approach

2 AD 1,250,000

Building 1,250,000

Building 2,250,000

Revaluation Surplus 2,250,000

Depreciation (6m/30) 200,000

AD 200,000

Revaluation Surplus (2.25m/30) 75,000

Retained Earnings 75,000

PROBLEM 31-4

Equipment 2,700,000

AD 500,000

RS 2,200,000

New Dep. Amt (9.2m - 200k) 9,000,000

Multiply to 2/12 *2/12

Revised AD 1,500,000

AD per book (6m x 2/12) 1,000,000

Increase in AD 500,000

DRC = 9.2m - (9m x 2/12) 7,700,000

CA per book = 6.5m - (6m x 2/12) 5,500,000

RS 2,200,000

Depreciation (9m/12) or 7.5m/10 750,000

AD 750,000

RS (2.2m / 10 220,000

RE 220,000

Entry to record the sale:

Cash 8,000,000

AD (9,000,000 x 3/12) 2,250,000

Equipment 9,200,000

Gain on sale 1,050,000

RS 2,200,000 - 220,000 1,980,000

RE 1,980,000

You might also like

- INTACC2 - Chapter 29Document4 pagesINTACC2 - Chapter 29Shane TabunggaoNo ratings yet

- Intermediate Accounting 3Document18 pagesIntermediate Accounting 3Cristine MayNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- Hilarious Company Required 1 300,000 12 Years Required 2Document10 pagesHilarious Company Required 1 300,000 12 Years Required 2Anonn0% (1)

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- 30 1 To 30 4Document2 pages30 1 To 30 4Away To PonderNo ratings yet

- Chap 18 - Revenue RecognitionDocument11 pagesChap 18 - Revenue RecognitionResnika TanNo ratings yet

- Group 1Document9 pagesGroup 1Cherie Soriano AnanayoNo ratings yet

- Pre-Final Exam in Audit 2-3Document5 pagesPre-Final Exam in Audit 2-3Shr BnNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1CJ alandyNo ratings yet

- Analysis of Investments in Associates of An SME1Document3 pagesAnalysis of Investments in Associates of An SME1Jan ryanNo ratings yet

- Ia3 FinalsDocument4 pagesIa3 FinalsGeraldine MayoNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Quali Review Interim Reporting Complete SolutionDocument7 pagesQuali Review Interim Reporting Complete SolutionPaul Ivan CabanatanNo ratings yet

- Group 1Document11 pagesGroup 1Cherie Soriano AnanayoNo ratings yet

- Revision - 29 Aug, 28 Aug 2022Document9 pagesRevision - 29 Aug, 28 Aug 2022Kartik SujanNo ratings yet

- Solutions 6352 To 6372Document33 pagesSolutions 6352 To 6372river garciaNo ratings yet

- IA 1 Valix 2020 Ver. Problem 28Document6 pagesIA 1 Valix 2020 Ver. Problem 28Ariean Joy DequiñaNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Discontinued Operations, Segment and Interim Reporting, Biological AssetsDocument5 pagesDiscontinued Operations, Segment and Interim Reporting, Biological AssetsElaine Joyce GarciaNo ratings yet

- Moong Leah Sophia - PPEDocument8 pagesMoong Leah Sophia - PPEKate Crystel reyesNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1Sharmaine JoyceNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- IA 1 Valix 2020 Ver. Problem 29Document3 pagesIA 1 Valix 2020 Ver. Problem 29Ariean Joy DequiñaNo ratings yet

- July 22 Far620Document8 pagesJuly 22 Far620FARAH ZAFIRAH ISHAMNo ratings yet

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Document15 pagesSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Rezzan Joy Camara MejiaNo ratings yet

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Template Tuto Group ProjectDocument6 pagesTemplate Tuto Group ProjectNur Athirah Binti MahdirNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Intermediate Accounting 2 (Chapter 16 Answers)Document30 pagesIntermediate Accounting 2 (Chapter 16 Answers)Jamaica FloresNo ratings yet

- INTACC2 - Chapter 30Document2 pagesINTACC2 - Chapter 30Shane TabunggaoNo ratings yet

- Auditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DDocument14 pagesAuditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DKim Cristian MaañoNo ratings yet

- TAX SOLUTIONS (2) Corrected 2Document15 pagesTAX SOLUTIONS (2) Corrected 2ketty sambaNo ratings yet

- HO#5 Aug 18 HFSADocument3 pagesHO#5 Aug 18 HFSAMakoy BixenmanNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocument25 pagesComprehensive Audit of Balance Sheet and Income Statement AccountsLuigi Enderez Balucan100% (1)

- Non-Current Assets Held For Sale and Discontinued OperationsDocument3 pagesNon-Current Assets Held For Sale and Discontinued OperationsFrost GarisonNo ratings yet

- Chapter 18 Govt GrantsDocument6 pagesChapter 18 Govt Grantsrobinady dollaga100% (2)

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- Afar SolutionDocument8 pagesAfar SolutionAsnifah AlinorNo ratings yet

- Genuime Company Required 1 Debit CreditDocument15 pagesGenuime Company Required 1 Debit CreditAnonnNo ratings yet

- IAS16 Assignment 1Document6 pagesIAS16 Assignment 1Mantej SinghNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- 13.4 IAS 21 - SolutionsDocument21 pages13.4 IAS 21 - SolutionsStaid LynxNo ratings yet

- Chapter 1-Problems Problems 1 Problems 2Document3 pagesChapter 1-Problems Problems 1 Problems 2Angela Ricaplaza ReveralNo ratings yet

- Module Number 6 (Ppe Revalution) Question No. 1Document4 pagesModule Number 6 (Ppe Revalution) Question No. 1ARISNo ratings yet

- Qualifying Exam Review Financial Accounting & ReportingDocument21 pagesQualifying Exam Review Financial Accounting & ReportingClene DoconteNo ratings yet

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Solution Meriah Megahacc (1) IjulDocument11 pagesSolution Meriah Megahacc (1) IjulIzzul HafizNo ratings yet

- Special Sales Pricing/ Special Order Pricing/Accept or Reject An Order/Distress PricingDocument7 pagesSpecial Sales Pricing/ Special Order Pricing/Accept or Reject An Order/Distress PricingJillian Dela CruzNo ratings yet

- Problem 2-1Document18 pagesProblem 2-1ILIG, Pauline Joy E.No ratings yet

- Test FAR570 Feb2021 Test FAR570 Feb2021Document5 pagesTest FAR570 Feb2021 Test FAR570 Feb2021Athira Adriana Bt RemlanNo ratings yet

- MAS-03 WorksheetDocument32 pagesMAS-03 WorksheetPaupauNo ratings yet

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYFrom EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNo ratings yet

- Prof Ed 2 M2, L2Document3 pagesProf Ed 2 M2, L2Away To PonderNo ratings yet

- Content No. 06 Basic Documents and Transactions Related To Bank DepositsDocument3 pagesContent No. 06 Basic Documents and Transactions Related To Bank DepositsAway To PonderNo ratings yet

- Edited Module - Docx August 25 2020Document206 pagesEdited Module - Docx August 25 2020Away To PonderNo ratings yet

- Solutions To 2 1 To 2 5Document5 pagesSolutions To 2 1 To 2 5Away To PonderNo ratings yet

- Content No. 07 Bank Reconciliation StatementDocument3 pagesContent No. 07 Bank Reconciliation StatementAway To PonderNo ratings yet

- ACCT104 Prelim Exam 38 47Document2 pagesACCT104 Prelim Exam 38 47Away To PonderNo ratings yet

- ACCT105 Quiz 02 and 03 Prelim SolutionDocument3 pagesACCT105 Quiz 02 and 03 Prelim SolutionAway To PonderNo ratings yet

- ACCT104 Quizzes SolutionsDocument2 pagesACCT104 Quizzes SolutionsAway To PonderNo ratings yet

- ACCT105 Quizzes and SolutionsDocument8 pagesACCT105 Quizzes and SolutionsAway To PonderNo ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- GE 5 MODULE 2 - The Structures of GlobalizationDocument7 pagesGE 5 MODULE 2 - The Structures of GlobalizationAway To PonderNo ratings yet

- 30 1 To 30 4Document2 pages30 1 To 30 4Away To PonderNo ratings yet

- Week 1 LessonsDocument50 pagesWeek 1 LessonsAway To PonderNo ratings yet

- GDP Quiz1Document4 pagesGDP Quiz1Away To PonderNo ratings yet

- Module - Week 6 STSDocument6 pagesModule - Week 6 STSAway To PonderNo ratings yet

- Binalbagan Catholic College: Course Guide Science, Technology and Society (STS)Document5 pagesBinalbagan Catholic College: Course Guide Science, Technology and Society (STS)Away To PonderNo ratings yet

- Module - Week 5 STSDocument8 pagesModule - Week 5 STSAway To PonderNo ratings yet

- Revised Second Module For Purposive CommunicationDocument13 pagesRevised Second Module For Purposive CommunicationAway To PonderNo ratings yet