Professional Documents

Culture Documents

Assignment 1 - W23

Uploaded by

Subscription 1260 ratings0% found this document useful (0 votes)

12 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesAssignment 1 - W23

Uploaded by

Subscription 126Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

ASSIGNMENT 1 – WORTH 10% OF Final Mark

Question 1: Types of Organizational Structures – 20%

You are a newly designated CPA and are contemplating opening your own accounting firm with two of

your colleagues from your graduating class. The three of you have been debating what type of

business structure to use. All three of you are concerned about liability and want to have some

flexibility for tax planning purposes. You seem to the think that the three of you could incorporate, but

one of your colleagues is equally sure that the only available option is a partnership, but she is not

sure what kind. You decide to consult with your former law professor to determine what business

structure options are available for your new firm. What do you discover as part of your research? What

option should be chosen and why?

Question 2: Statement of cash flows (indirect method) – 80%

The net changes in the statement of financial position accounts of Sharma Inc. for the calendar year

2023 are shown below:

Account Debit Credit

Cash ............................................................................................................. $ 62,800

Accounts receivable .................................................................................... $ 32,000

Allowance for expected credit losses ......................................................... 7,000

Inventory ..................................................................................................... 108,600

Prepaid expenses ........................................................................................ 10,000

Long-term investments............................................................................... 72,000

Land ............................................................................................................. 150,000

Buildings ...................................................................................................... 300,000

Machinery .................................................................................................... 50,000

Office equipment......................................................................................... 14,000

Accumulated depreciation:

Buildings .............................................................................................. 12,000

Machinery ............................................................................................ 10,000

Office equipment ................................................................................. 6,000

Accounts payable ........................................................................................ 91,600

Accrued liabilities ........................................................................................ 36,000

Dividends payable ....................................................................................... 64,000

Bonds payable ............................................................................................. 416,000

Preferred shares .......................................................................................... 30,000

Common shares .......................................................................................... 189,600

Retained earnings ....................................................................................... 43,600 __________

$852,600 $852,600

Additional information:

1. Net income for the year was $70,000.

2. Cash dividends of $64,000 were declared December 15, 2023, payable January 15, 2024. A 5%

common stock dividend was issued March 31, 2023, when the market value was $22.00 per share.

At the time there were 36,000 common shares outstanding.

3. The long-term investments were sold for $70,000.

4. A building which had cost $240,000, with a book value of $150,000, was sold for $200,000, and a

new one was purchased.

5. The following entry was made to record an exchange of an old machine for a new one:

Machinery .......................................................................................... 80,000

Accumulated Depreciation—Machinery .......................................... 20,000

Machinery ............................................................................ 30,000

Cash ..................................................................................... 70,000

6. A fully depreciated copier machine, which cost $14,000, was written off.

7. Preferred shares originally issued for $30,000 were redeemed for $40,000.

8. Sharma Inc sold 6,000 common shares on June 15, 2023 for $25 a share.

9. Bonds were sold at 104 on December 31, 2023.

10. Land with a book value of $120,000 was sold for $54,000.

Instructions

Prepare a statement of cash flows (indirect method) for calendar 2023.

You might also like

- The net increase in owners' equity during the year was $25,000 ($225,000 - $200,000Document27 pagesThe net increase in owners' equity during the year was $25,000 ($225,000 - $200,000InciaNo ratings yet

- Ordinary Level (J03)Document16 pagesOrdinary Level (J03)MahmozNo ratings yet

- Test of T.B (2 Copies)Document4 pagesTest of T.B (2 Copies)vriddhi kanodiaNo ratings yet

- Maynard A SolutionDocument3 pagesMaynard A SolutionStranger SinhaNo ratings yet

- Current Assets: Asofjunei As of June 30Document3 pagesCurrent Assets: Asofjunei As of June 30Stranger SinhaNo ratings yet

- Mid-Term - Financial Accounting For Managers July 2010...Document4 pagesMid-Term - Financial Accounting For Managers July 2010...ApoorvNo ratings yet

- Winterschid Company 2008 year-end trial balance and financial statementsDocument6 pagesWinterschid Company 2008 year-end trial balance and financial statementsJa Mi LahNo ratings yet

- Assets Liabilities and Owner's Equity: Stafford Press Condensed Balance Sheet (Revised To Reflect Move)Document1 pageAssets Liabilities and Owner's Equity: Stafford Press Condensed Balance Sheet (Revised To Reflect Move)Vivek DasguptaNo ratings yet

- MBA FIN QuizDocument1 pageMBA FIN QuizPercy JacksonNo ratings yet

- anthonyIM 01Document15 pagesanthonyIM 01Julz JuliaNo ratings yet

- Solution Manual For Accounting Text andDocument17 pagesSolution Manual For Accounting Text andanon_995783707No ratings yet

- Cost of Capital - Berkshire Instruments CaseDocument3 pagesCost of Capital - Berkshire Instruments CaseAleksandar AndjelkovićNo ratings yet

- Business studies practice paperDocument3 pagesBusiness studies practice paperadeevisgr8No ratings yet

- Key Chapter 2Document11 pagesKey Chapter 2JinAe NaNo ratings yet

- Assignment 1 - SolutionDocument10 pagesAssignment 1 - SolutionKhem Raj GyawaliNo ratings yet

- Longer-Run Decisions: Capital Budgeting: Changes From Eleventh EditionDocument19 pagesLonger-Run Decisions: Capital Budgeting: Changes From Eleventh EditionAlka NarayanNo ratings yet

- Assignment AdvDocument4 pagesAssignment AdvTilahun GirmaNo ratings yet

- Sources of CapitalDocument17 pagesSources of Capitaliniwan.sa.ere0No ratings yet

- NKLT - PR1-3B-GR8Document1 pageNKLT - PR1-3B-GR8kimphuc3819No ratings yet

- Business Plan 1Document23 pagesBusiness Plan 1Wayd TubeNo ratings yet

- Merchandising Exercises Answers PDFDocument4 pagesMerchandising Exercises Answers PDFHamzaFathi100% (3)

- Chap 003Document19 pagesChap 003jujuNo ratings yet

- Buscom 7Document9 pagesBuscom 7dmangiginNo ratings yet

- Practice Exercise - Pas 7Document4 pagesPractice Exercise - Pas 7Martha Nicole MaristelaNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- Module III. Business Combination - Subsequent To Date of AcquisitionDocument5 pagesModule III. Business Combination - Subsequent To Date of AcquisitionAldrin Zolina0% (4)

- SSGA US Government Money Market Annual ReportDocument61 pagesSSGA US Government Money Market Annual ReportnickNo ratings yet

- AHM Chapter 3 Exercises CKvxWXG1tmDocument2 pagesAHM Chapter 3 Exercises CKvxWXG1tmASHUTOSH BISWALNo ratings yet

- Overview of Collecting Bank: True OwnerDocument8 pagesOverview of Collecting Bank: True OwnerHalfani MoshiNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- Chapter 1 TutorialDocument5 pagesChapter 1 TutorialAnisaNo ratings yet

- Financial Reporting 2008Document6 pagesFinancial Reporting 2008zilchhourNo ratings yet

- Module 2 Homework Answer KeyDocument5 pagesModule 2 Homework Answer KeyMrinmay kunduNo ratings yet

- Differential Costing Part IIDocument9 pagesDifferential Costing Part IIxxpinkywitchxxNo ratings yet

- Financial Institution PI - Proposal FormDocument17 pagesFinancial Institution PI - Proposal FormNimesh Prakash /Insurance/SreiNo ratings yet

- Case 2-3: Lone Pine Cafe (A) : Assets Current AssetsDocument5 pagesCase 2-3: Lone Pine Cafe (A) : Assets Current AssetsyashasviNo ratings yet

- Delhi Public School, Nacharam Accountancy - Xi Practice Paper - 4Document4 pagesDelhi Public School, Nacharam Accountancy - Xi Practice Paper - 4lasyaNo ratings yet

- Consolidated Balance Sheet: I. AssetsDocument7 pagesConsolidated Balance Sheet: I. AssetsSatishNo ratings yet

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- PPFAS Mutual Fund SAI Key DetailsDocument138 pagesPPFAS Mutual Fund SAI Key DetailsRaghu RamanNo ratings yet

- Chapter 7 Solutions: Exercise 7-2 Requirement 1 ExercisesDocument22 pagesChapter 7 Solutions: Exercise 7-2 Requirement 1 ExercisesMuhamad BayuNo ratings yet

- Consolidated-Financial-Statements-80%-Owned-SubsidiaryDocument10 pagesConsolidated-Financial-Statements-80%-Owned-SubsidiaryBetty SantiagoNo ratings yet

- Paper 1 Advanced AccountingDocument576 pagesPaper 1 Advanced AccountingExcel Champ60% (5)

- Solution Manual For Accounting Text and Cases 13th Edition by AnthonyDocument9 pagesSolution Manual For Accounting Text and Cases 13th Edition by AnthonyDrAndrewFarrelleqdy100% (37)

- Accounting ExerciseDocument6 pagesAccounting Exercisenourhan hegazyNo ratings yet

- AcumaticaERP AccountsPayableDocument284 pagesAcumaticaERP AccountsPayablecrudbugNo ratings yet

- SolAir 2021 2023 SCO Company Business PlanDocument52 pagesSolAir 2021 2023 SCO Company Business Plansizahataban75No ratings yet

- NSE Factbook 2010Document176 pagesNSE Factbook 2010ruchir1944No ratings yet

- Balance Sheet: I. AssetsDocument6 pagesBalance Sheet: I. AssetshfdghdhNo ratings yet

- Chapter Four 4 Consolidated Financial Statements: Subsequent To Date of Business Combination Under Purchase AccountingDocument8 pagesChapter Four 4 Consolidated Financial Statements: Subsequent To Date of Business Combination Under Purchase AccountingN ENo ratings yet

- Individual Finance PDFDocument575 pagesIndividual Finance PDFshivam vajpai100% (1)

- Balance Sheet and Cash Flow AnalysisDocument8 pagesBalance Sheet and Cash Flow AnalysisAntonios FahedNo ratings yet

- American Credit Repair: Everything U Need to Know About Raising Your Credit ScoreFrom EverandAmerican Credit Repair: Everything U Need to Know About Raising Your Credit ScoreRating: 3 out of 5 stars3/5 (3)

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- Tax Loopholes for eBay Sellers: Pay Less Tax and Make More MoneyFrom EverandTax Loopholes for eBay Sellers: Pay Less Tax and Make More MoneyRating: 2.5 out of 5 stars2.5/5 (2)

- Buying for Business: Insights in Purchasing and Supply ManagementFrom EverandBuying for Business: Insights in Purchasing and Supply ManagementNo ratings yet

- India as Destination for Western retailers: Opportunities, Challenges and Strategic DecisionsFrom EverandIndia as Destination for Western retailers: Opportunities, Challenges and Strategic DecisionsNo ratings yet

- Employee Reference LetterDocument3 pagesEmployee Reference LetterSubscription 126No ratings yet

- Auditing8e PPTDocument27 pagesAuditing8e PPTSubscription 126No ratings yet

- Mfin 2021 Web BrochureDocument9 pagesMfin 2021 Web BrochureSubscription 126No ratings yet

- Employment & Salary Report: Employment and Internship StatisticsDocument17 pagesEmployment & Salary Report: Employment and Internship StatisticsSubscription 126No ratings yet

- MFRM 2021 Web BrochureDocument9 pagesMFRM 2021 Web BrochureSubscription 126No ratings yet

- Indica Leaf Extract (200mg/kg) With Low Dose of Pioglitazone (7 MG/KG) May Have Prevented TheDocument11 pagesIndica Leaf Extract (200mg/kg) With Low Dose of Pioglitazone (7 MG/KG) May Have Prevented TheSubscription 126No ratings yet

- Market Forces Determine Equilibrium Price and QuantityDocument17 pagesMarket Forces Determine Equilibrium Price and QuantitySubscription 126No ratings yet

- Test 1Document1 pageTest 1Subscription 126No ratings yet

- Choosing The Right Valuation ModelDocument7 pagesChoosing The Right Valuation ModelSubscription 126No ratings yet

- DCF TemplateDocument21 pagesDCF TemplateShrikant ShelkeNo ratings yet

- Real Estate Investment AnalysisDocument21 pagesReal Estate Investment AnalysisKumbangNo ratings yet

- Time RequiredDocument8 pagesTime RequiredSubscription 126No ratings yet

- Learning Objective: Daftar Komponen Biaya PensiunDocument3 pagesLearning Objective: Daftar Komponen Biaya Pensiuntes doangNo ratings yet

- BANK MUSCAT-Tariff Eng BookDocument14 pagesBANK MUSCAT-Tariff Eng BookmujeebmuscatNo ratings yet

- Chapter 15 Using Management and Accounting InformationDocument22 pagesChapter 15 Using Management and Accounting InformationPete JoempraditwongNo ratings yet

- Boston Beer Company IPO ValuationDocument6 pagesBoston Beer Company IPO ValuationHridi RahmanNo ratings yet

- AssignmentPledge&Mortgage MacatangayC3SDocument2 pagesAssignmentPledge&Mortgage MacatangayC3Schad macatangayNo ratings yet

- Finan MGT DoneDocument22 pagesFinan MGT DonesnehitachatterjeeNo ratings yet

- Pakistan Oil and Gas - The Undiscovered Value (Detailed Report)Document79 pagesPakistan Oil and Gas - The Undiscovered Value (Detailed Report)Faiz MehmoodNo ratings yet

- Global Model Risk ManagementDocument24 pagesGlobal Model Risk ManagementrichdevNo ratings yet

- Why Money is ImportantDocument2 pagesWhy Money is ImportantMokshi shahNo ratings yet

- Accounting For Income Taxes ExercisessDocument5 pagesAccounting For Income Taxes ExercisessdorothyannvillamoraaNo ratings yet

- Financial Statement Analysis of Citizen BankDocument44 pagesFinancial Statement Analysis of Citizen BankNijan JyakhwoNo ratings yet

- Philip Capital (Objective To Conclusion)Document20 pagesPhilip Capital (Objective To Conclusion)Shubhani PandeyNo ratings yet

- Faugere Gold Required Yield TheoryDocument34 pagesFaugere Gold Required Yield TheoryZerohedgeNo ratings yet

- 11 Ias 8Document5 pages11 Ias 8Irtiza AbbasNo ratings yet

- 3005 RF-16431384 00 000Document4 pages3005 RF-16431384 00 000RAJA DURGA RAONo ratings yet

- Securities and Exchange Board of IndiaDocument20 pagesSecurities and Exchange Board of IndiaShashank50% (2)

- Sol Q5Document3 pagesSol Q5Shubham RankaNo ratings yet

- Money Collocations: Match The Collocation With The Correct DefinitionDocument3 pagesMoney Collocations: Match The Collocation With The Correct DefinitionMamadou KaNo ratings yet

- Cyprus Companies LawDocument298 pagesCyprus Companies LawNikhil MahajanNo ratings yet

- M1. B5. U5. FInancial Managment, Accounts & Computing at SCDocument29 pagesM1. B5. U5. FInancial Managment, Accounts & Computing at SCSonali SwainNo ratings yet

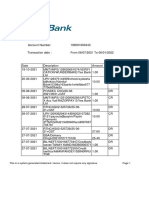

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument5 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signaturegaming boyNo ratings yet

- CH 15Document45 pagesCH 15Mohamed AdelNo ratings yet

- Jain Irrigation Systems Strategy Report (HBS Case Study)Document17 pagesJain Irrigation Systems Strategy Report (HBS Case Study)Vineet Singh100% (3)

- Foreign Currency Translation and ConsolidationDocument15 pagesForeign Currency Translation and ConsolidationYing LiuNo ratings yet

- CEO President VP Director CFO in California Resume David JosephDocument3 pagesCEO President VP Director CFO in California Resume David JosephDavid JosephNo ratings yet

- Guide to Recording Non-Current AssetsDocument5 pagesGuide to Recording Non-Current AssetsSteven JiangNo ratings yet

- Primary Dealer System - A Comparative StudyDocument5 pagesPrimary Dealer System - A Comparative Studyprateek.karaNo ratings yet

- Accounting For Management: Total No. of Questions 17Document2 pagesAccounting For Management: Total No. of Questions 17vikramvsuNo ratings yet

- Acca f9 Cbe PracticeDocument25 pagesAcca f9 Cbe PracticeSylvia NatashaNo ratings yet

- NBFC Group 2 (Sales Incentive Structure)Document9 pagesNBFC Group 2 (Sales Incentive Structure)jay jariwalaNo ratings yet