Professional Documents

Culture Documents

Chapter 6 The Value Added Tax

Uploaded by

Cathy Marie Angela Arellano0 ratings0% found this document useful (0 votes)

19 views20 pagesBebe Leasing Corporation had rental income of P3,120,000 in 2013 from residential and condominium units.

The value added tax model shows output VAT, input VAT, net VAT payable, and any tax credits or payments. Output VAT is charged to customers, while input VAT is paid on purchases.

The document then discusses exempt, zero-rated, and regular sales and the appropriate VAT treatment for each. It provides examples of journal entries for various VAT-related transactions.

Original Description:

Original Title

Chapter-6-The-Value-Added-Tax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBebe Leasing Corporation had rental income of P3,120,000 in 2013 from residential and condominium units.

The value added tax model shows output VAT, input VAT, net VAT payable, and any tax credits or payments. Output VAT is charged to customers, while input VAT is paid on purchases.

The document then discusses exempt, zero-rated, and regular sales and the appropriate VAT treatment for each. It provides examples of journal entries for various VAT-related transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views20 pagesChapter 6 The Value Added Tax

Uploaded by

Cathy Marie Angela ArellanoBebe Leasing Corporation had rental income of P3,120,000 in 2013 from residential and condominium units.

The value added tax model shows output VAT, input VAT, net VAT payable, and any tax credits or payments. Output VAT is charged to customers, while input VAT is paid on purchases.

The document then discusses exempt, zero-rated, and regular sales and the appropriate VAT treatment for each. It provides examples of journal entries for various VAT-related transactions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 20

Chapter 6

• Bebe Leasing Corporation had the following receipts in

2013:

Business property Monthly rent Annual receipts

20 residential units P10,000/unit P2,400,000

3 condominium units P20,000/unit 720,000

Total P3,120,000

The Value Added Tax Model

Output VAT P XXX

Less: Input VAT XXX

Net VAT Payable P XXX

Less: Tax credits or payments XXX

Tax still payable (overpayment) P XXX

• Output VAT is the VAT passed on to customers or clients by

a VAT taxpayer on his sales to customers.

• Types of Output VAT

1. Regular Output VAT – for domestic sales; sellers of goods

or properties (GSP) or sellers of services or lease of

properties (GR)

2. Zero Output VAT – for export and other zero-rated sales

• Input VAT is the VAT paid on the domestic purchases or

VAT paid on the importation of goods or services by the

taxpayer.

• Input VAT also arises from incentives provided by law such

as transitional input VAT and presumptive input VAT.

Types of Sales Description Taxation

a. Exempt sales Sales of exempt goods or services Exempt from VAT

b. Zero-rated sales Export sales, sales to non-resident persons Subject to 0% Output

and those granted zero-rating treatment VAT

c. Sales to government Sales to government agencies or any of Subject to a 5% final

its instrumentalities, including withholding VAT

government-owned and controlled

corporations (GOCCs)

d. Regular sales Sales to domestic or resident private Subject to 12% Output

entities and individuals VAT

• Exempt sales of VAT taxpayers refer to sales of:

• Exempt goods, services or properties

• Services specifically subject to percentage tax

• Exempt sales will not be subject to Output VAT.

• Consequently, the seller is also not allowed to credit input

VAT.

• The input VAT traceable to exempt sales is part of costs or

expenses of the seller and is deductible against gross

income subject to income tax.

• During the month, a VAT-registered persons sold

unprocessed agricultural food products for P400,000 which

he bought for P150,000. He also purchased P100,000 worth

of supplies, exclusive of P12,000 input VAT, which were all

used in connection with these sales.

• Required: Prepare accounting journal entries on the

abovementioned transactions.

• Zero-rated sales are sales of goods or services to non-residents.

• Zero-rated sales include:

• Export sales of goods or services

• Other sales conferred with zero-rating status by law

• Zero-rated sales shall not result in an output VAT but the input

VAT on zero-rated sales is creditable to the zero output VAT.

• VAT payable is inherently negative on zero-rated sales.

• The input VAT on zero-rated sales can be alternatively claimed

through tax refund or tax credit certificate.

• A VAT-registered person exported goods for P400,000.

These goods were purchased for P200,000, exclusive of

P24,000 input VAT.

• Required: Prepare necessary accounting journal entries.

• The sale to government and government-owned and

controlled corporations (GOCCs) is subject to a 5% final

withholding VAT at source on sales.

• The 5% final withholding VAT is presumed the VAT Payable

of the seller.

• Consequently, the seller need not pay further VAT on the

sale.

• Because of this, the claimable input VAT of the seller is

effectively set by the law at only 7% (12% - 5%) of gross

sale to the government or GOCCs.

• A VAT-registered person sold goods to government

agency for P400,000. These goods were purchased for

P336,000, including P36,000 input VAT.

• Required: Present the necessary accounting journal entries

and compute for the VAT due and payable.

• Regular sales pertain to sales other than:

• Exempt sales

• Sales to government or GOCCs

• Export sales

• A taxpayer made sales of P1,000,000, exclusive of P120,000

output VAT, and purchases of P800,000 exclusive of

P96,000 input VAT.

• Required: Compute for the VAT Due and Payable and

prepare necessary accounting journal entries.

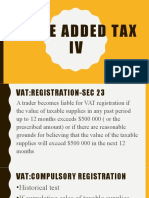

1. Sales of registrable persons – subject to VAT despite their non-

registration as VAT taxpayers but no input VAT credit is

allowed.

2. Sales of non-VAT taxpayers who issues VAT invoice or receipt

– illegally charge VAT on their sales shall be subject to VAT

without the benefit of input VAT plus 50% surcharge and the

usual 3% percentage tax.

3. Exempt sales billed by VAT taxpayers as regular sales – will be

considered as regular sales. Furthermore, exempt sales which

are not so clearly indicated as “Exempt” in the VAT invoice or

VAT receipts shall be considered as regular sales subject to

VAT.

• Under the NIRC, the VAT is due quarterly. However, it is

paid in three installments of two monthly and one

quarterly payments.

• VAT is paid monthly and quarterly.

• A VAT taxpayer using the calendar year had the following

output VAT and input VAT during the month starting

January to April 2018:

January February March April

Output VAT P 80,000 P 90,000 P 85,000 P 75,000

Input VAT 60,000 80,000 65,000 70,000

• Compute for the monthly and quarterly VAT payable.

• A VAT taxpayer had the following sales and purchases,

exclusive of any VAT, in the second quarter of the

calendar year:

Sales April May June Total

Exempt sales P 200,000 P 150,000 P 100,000 P 450,000

Taxable sales 625,000 400,000 800,000 1,825,000

Total sales P 825,000 P 550,000 P 900,000

• Compute for the monthly and quarterly VAT payable.

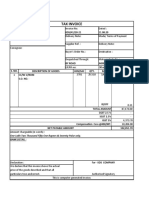

• Using a single invoice or receipt for mixed sales

• A VAT-registered taxpayer may use a single invoice or

receipt involving VAT and non-VAT transactions, provided

that:

a. The invoice or receipt must clearly indicate the

breakdown of the sales or receipt among taxable,

exempt and zero-rated components; and

b. The calculation of VAT on each portion of the sale shall

be shown on the invoice or receipt

• Using a separate invoice or receipt for mixed sales

• A VAT-registered taxpayer may also use different invoice

or receipt for the taxable, exempt and zero-rated

components of its sales. Provided that:

a. If the sale is exempt from VAT, the term “VAT-EXEMPT

SALE” shall be written or printed prominently on the

invoice or receipt

b. IF the sale is subject to zero percent (0%) VAT, the term

“ZERO-RATED SALE” shall be written prominently on the

invoice or receipt

You might also like

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- CHAPTER 6 TaxDocument24 pagesCHAPTER 6 TaxVencint LaranNo ratings yet

- CH11 - Value Added TaxDocument33 pagesCH11 - Value Added TaxDimple AtienzaNo ratings yet

- Bustax Chapter 6Document9 pagesBustax Chapter 6Pineda, Paula MarieNo ratings yet

- Business Tax: Consumption Tax Payable by Persons Engaged in BusinessDocument42 pagesBusiness Tax: Consumption Tax Payable by Persons Engaged in BusinessEmersonNo ratings yet

- TAXATION 2 Chapter 10 Value Added TaxDocument7 pagesTAXATION 2 Chapter 10 Value Added TaxKim Cristian MaañoNo ratings yet

- Output VAT ReviewerDocument25 pagesOutput VAT ReviewerLucky Luis GopilanNo ratings yet

- Chapter 6 Introduction To The Value Added TaxDocument27 pagesChapter 6 Introduction To The Value Added TaxJoanna Louisa GabawanNo ratings yet

- Taxation (Input Taxes)Document30 pagesTaxation (Input Taxes)Lara Joy Junio100% (4)

- Value Added Tax (Vat) .PPT FinalDocument57 pagesValue Added Tax (Vat) .PPT FinalNick254No ratings yet

- ACFI6017, Week 8, VAT 2022-23, TutorDocument28 pagesACFI6017, Week 8, VAT 2022-23, Tutorarpita aroraNo ratings yet

- Value Added Tax (VAT) : Transfer and Business TaxDocument58 pagesValue Added Tax (VAT) : Transfer and Business TaxRizzle RabadillaNo ratings yet

- VAT SCOPE GOODS SERVICES EXEMPTDocument24 pagesVAT SCOPE GOODS SERVICES EXEMPTNoriel Justine QueridoNo ratings yet

- Input TaxDocument18 pagesInput TaxAmie Jane MirandaNo ratings yet

- Lecture VAT With ExercisesDocument82 pagesLecture VAT With ExercisesAko C JamzNo ratings yet

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganNo ratings yet

- Lecture Chapter 7 The Regular Output VatDocument17 pagesLecture Chapter 7 The Regular Output VatChristian PelimcoNo ratings yet

- M13 Output VAT Regular Sales Students Copy 1Document28 pagesM13 Output VAT Regular Sales Students Copy 1Tokis SabaNo ratings yet

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezNo ratings yet

- Vatable Transactions PDFDocument5 pagesVatable Transactions PDFJester LimNo ratings yet

- VAT GUIDE 2nd EditionDocument28 pagesVAT GUIDE 2nd EditionLoretta Wise100% (1)

- Chapter 1 Introduction To Business TaxDocument16 pagesChapter 1 Introduction To Business TaxJerome EspinaNo ratings yet

- VAT BasicsDocument25 pagesVAT BasicsAjey MendiolaNo ratings yet

- Chapter 1 Introduction To Consumption TaxDocument15 pagesChapter 1 Introduction To Consumption TaxNesrill Joyce AntonioNo ratings yet

- Business Tax GuideDocument30 pagesBusiness Tax GuideKristelle Mae BautistaNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- Chapter 7 The Regular Output VatDocument22 pagesChapter 7 The Regular Output VatChristian PelimcoNo ratings yet

- Zero-rated VAT Sales GuideDocument13 pagesZero-rated VAT Sales GuideVanessa CruzNo ratings yet

- Business Taxes and Transfer Taxes ExplainedDocument65 pagesBusiness Taxes and Transfer Taxes ExplainedPrincess LimNo ratings yet

- Lesson 6 Business TaxesDocument9 pagesLesson 6 Business TaxesReino CabitacNo ratings yet

- VAT-VALUE ADDED TAX(UAEDocument64 pagesVAT-VALUE ADDED TAX(UAEAlex ko100% (1)

- Value-Added Tax on Regular Sales and TransactionsDocument38 pagesValue-Added Tax on Regular Sales and TransactionsEmersonNo ratings yet

- Value Added TaxDocument20 pagesValue Added Taxrpd2509No ratings yet

- Business TaxDocument13 pagesBusiness TaxMs AJNo ratings yet

- Tax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersDocument20 pagesTax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersKezia SantosidadNo ratings yet

- Value Added Tax-White Paper DocumentDocument117 pagesValue Added Tax-White Paper DocumentVikas MarwahaNo ratings yet

- Value Added Tax IVDocument52 pagesValue Added Tax IVPCNo ratings yet

- M2 Introdution To Business TaxDocument19 pagesM2 Introdution To Business TaxAlicia FelicianoNo ratings yet

- Vat 2023Document310 pagesVat 2023Thapelo LekgethoNo ratings yet

- Sales Tax & VATDocument30 pagesSales Tax & VATAnonymous sfAOc3TKNo ratings yet

- Individuals Income TaxDocument25 pagesIndividuals Income TaxNestor III Dela CruzNo ratings yet

- Section 4.110-4 of RR 16-05Document4 pagesSection 4.110-4 of RR 16-05fatmaaleahNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- VAT Input and Output Tax GuideDocument19 pagesVAT Input and Output Tax GuidePCNo ratings yet

- Module 4 EXEMPT SALES AND VAT PART IDocument33 pagesModule 4 EXEMPT SALES AND VAT PART IVenice Marie ArroyoNo ratings yet

- Uae Vat PresentationDocument64 pagesUae Vat PresentationAhammed MuzammilNo ratings yet

- TAXATION 2 Chapter 12 Output VAT Zero Rated SalesDocument4 pagesTAXATION 2 Chapter 12 Output VAT Zero Rated SalesKim Cristian MaañoNo ratings yet

- Output VatDocument16 pagesOutput VatLica Dapitilla Perin100% (1)

- SALES TAX NotesDocument3 pagesSALES TAX NotesMuhammad AhmadNo ratings yet

- Output VAT - Zero Rated Sales Chapter 8Document29 pagesOutput VAT - Zero Rated Sales Chapter 8Vencint LaranNo ratings yet

- Business and Transfer Taxation by BanggawanDocument38 pagesBusiness and Transfer Taxation by BanggawanBryan Orbina Fruto67% (24)

- Business TaxationDocument7 pagesBusiness TaxationZehra LeeNo ratings yet

- Module 5 Philippine Income Taxation CorporationDocument63 pagesModule 5 Philippine Income Taxation CorporationFlameNo ratings yet

- VAT Powerpoint PDFDocument202 pagesVAT Powerpoint PDFRuchie EtolleNo ratings yet

- Business TaxDocument116 pagesBusiness TaxScarlett FernandezNo ratings yet

- TBLTAX Chapter 4 Input and Output TaxDocument16 pagesTBLTAX Chapter 4 Input and Output TaxBeny MiraflorNo ratings yet

- What Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14Document8 pagesWhat Is Value Added Tax (Vat) ?: Vol 2 Issue 2 FY 2013-14EstherNalubegaNo ratings yet

- Chapter 7-The Regular Output VatDocument7 pagesChapter 7-The Regular Output VatJamaica DavidNo ratings yet

- 3.2 Business Profit TaxDocument53 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Chapter 8 Zero Rated SalesDocument39 pagesChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNo ratings yet

- Chapter 8 Zero Rated SalesDocument39 pagesChapter 8 Zero Rated SalesCathy Marie Angela ArellanoNo ratings yet

- Calculate VAT on Sales TransactionsDocument28 pagesCalculate VAT on Sales TransactionsCathy Marie Angela ArellanoNo ratings yet

- Taxes on Various Business ActivitiesDocument12 pagesTaxes on Various Business ActivitiesCathy Marie Angela ArellanoNo ratings yet

- Exempt Sales and VAT RulesDocument49 pagesExempt Sales and VAT RulesCathy Marie Angela ArellanoNo ratings yet

- Chapter 2 VAT On ImportationDocument49 pagesChapter 2 VAT On ImportationCathy Marie Angela ArellanoNo ratings yet

- Chapter 3 Introduction To Business TaxationDocument25 pagesChapter 3 Introduction To Business TaxationCathy Marie Angela ArellanoNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument38 pagesChapter 1 Introduction To Consumption TaxesCathy Marie Angela ArellanoNo ratings yet

- FIRST PB RFBT SolutionsDocument15 pagesFIRST PB RFBT SolutionsCathy Marie Angela ArellanoNo ratings yet

- OYO Traveller Insurance PlanDocument5 pagesOYO Traveller Insurance PlanPriya SharmaNo ratings yet

- Tax Invoice: One Lakh Two Thousand Fifty One Rupees & Seventy Paise Only. Bank DetailDocument3 pagesTax Invoice: One Lakh Two Thousand Fifty One Rupees & Seventy Paise Only. Bank DetailAnuj Kumar GiriNo ratings yet

- 43 PNGDocument2 pages43 PNGReymond IgayaNo ratings yet

- FUNTAMENTALS OF ACCOUNTANCY-Quiz #2Document5 pagesFUNTAMENTALS OF ACCOUNTANCY-Quiz #2ollem mark mamatoNo ratings yet

- Affidavit of LossDocument4 pagesAffidavit of LossAljohn SebucNo ratings yet

- Insurance: Irda To Explore New Distribution ChannelsDocument2 pagesInsurance: Irda To Explore New Distribution Channelskarishma2692No ratings yet

- Service Delivery Model TemplateDocument3 pagesService Delivery Model Templatekholofelo letsoaloNo ratings yet

- 6.3 Market Failure and The Role of Government - Public and Private Goods PDFDocument3 pages6.3 Market Failure and The Role of Government - Public and Private Goods PDFfbbr geheNo ratings yet

- BIR Sample Letter of Intent For Efps (Individual)Document1 pageBIR Sample Letter of Intent For Efps (Individual)GraceKayCee50% (10)

- RTO RC Book RequestDocument4 pagesRTO RC Book RequestGanesh MaliNo ratings yet

- (PK 1.2) Contoh Pelan Pelaksanaan Program PROTEGE RTW - Penerima KontrakDocument4 pages(PK 1.2) Contoh Pelan Pelaksanaan Program PROTEGE RTW - Penerima KontrakDum Dida Dida100% (1)

- Case Study (Part 1) Question PDFDocument2 pagesCase Study (Part 1) Question PDFYashrajsing LuckkanaNo ratings yet

- Pay Slip Mar 2023 PDFDocument1 pagePay Slip Mar 2023 PDFDipendra TomarNo ratings yet

- Notice To Withdraw Striking Off Application - Section 553Document1 pageNotice To Withdraw Striking Off Application - Section 553AmirulHafisNo ratings yet

- Background Report on Dorothy King, Age 73 of Independence, KYDocument24 pagesBackground Report on Dorothy King, Age 73 of Independence, KYTina MartinezNo ratings yet

- Form GST REG-06: (See Rule 10 (1) )Document3 pagesForm GST REG-06: (See Rule 10 (1) )aniljeevavatNo ratings yet

- Rau's APRIL Magazine - 2022 FinalDocument131 pagesRau's APRIL Magazine - 2022 FinalDivyanshu SoniNo ratings yet

- CDB Registration No .: Initial Registration Date.:: Up-Gr/Revalidation Date.: Registration Expiry Date.Document2 pagesCDB Registration No .: Initial Registration Date.:: Up-Gr/Revalidation Date.: Registration Expiry Date.Ojhal RaiNo ratings yet

- Proxy Form: Printed Name and Signature of Member / Unit NumberDocument1 pageProxy Form: Printed Name and Signature of Member / Unit NumberAlma SantiagoNo ratings yet

- Ufc 1 300 08 2023Document62 pagesUfc 1 300 08 2023Gerrard MendozaNo ratings yet

- X Checklist - IECDocument4 pagesX Checklist - IECadministratorNo ratings yet

- BGY - Draft Service Agreement LGUDocument4 pagesBGY - Draft Service Agreement LGUCarmencita Balatbat FaundoNo ratings yet

- Bali Home - Inspirational Design IdeasDocument147 pagesBali Home - Inspirational Design IdeasMade Wina SatriaNo ratings yet

- Branch List For Website PDFDocument65 pagesBranch List For Website PDFRakshithNo ratings yet

- SEC Form 23A JDG Yap 01.2021Document3 pagesSEC Form 23A JDG Yap 01.2021Raine PiliinNo ratings yet

- NCVET REGULATES VOCATIONAL EDUCATIONDocument35 pagesNCVET REGULATES VOCATIONAL EDUCATIONsingh.darshan9100% (2)

- Unigrad 2011Document350 pagesUnigrad 2011brett7144No ratings yet

- NQ Mobile Being Investigated by The SECDocument2 pagesNQ Mobile Being Investigated by The SECValueWalkNo ratings yet

- Declaration of BCG ComplianceDocument2 pagesDeclaration of BCG ComplianceSandro WijayaNo ratings yet

- Statement of Axis Account No:920010006130934 For The Period (From: 01-12-2021 To: 09-05-2022)Document13 pagesStatement of Axis Account No:920010006130934 For The Period (From: 01-12-2021 To: 09-05-2022)subhadeepNo ratings yet