Professional Documents

Culture Documents

Control testing on payables

Uploaded by

Hamza ZahidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Control testing on payables

Uploaded by

Hamza ZahidCopyright:

Available Formats

i) Control testing on payables

The absence of evidence of authorization by procurement manager of three purchase orders represents

exceptions to effective internal control systems on which the auditor may place reliance. The supporting

documents proving that these were for legitimate business use is not enough. There is a risk that there

are further more orders which are not for legitimate business use. The audit procedures therefore

appear to be inadequate. The audit assistant should have reported the matter to the manager and the

partner for further review and to decide to whom it should be reported to i.e. TCWG. The should have

also been picked up during the review of working papers. Prior to finalising the audit, the audit team

needs to assess the extent and significance of the internal control deficiency and should consider

increasing the original sample size and extending the audit testing. If the extended testing identifies

further exceptions in the effective operation of the control, the auditor should review whether a

controls based approach is appropriate and consider whether more substantive testing on the payables

component is required. The auditor should also consider including the matter in the report to

management.

ii) Petty cash fraud

The personal taxi fares represent a fraudulent activity and should be reviewed in light of auditor’s

and management’s responsibilities to detect and prevent fraud. ISA 240 The Auditor’s

Responsibilities Relating to Fraud in an Audit of Financial Statements states that the primary

responsibility for the prevention and detection of fraud rests with both those charged with

governance of the entity and management. The existence of the fraud may also be further indication

of a weak control environment. The auditor is responsible for obtaining reasonable assurance that

the financial statements taken as a whole are free from material misstatement, whether caused by

fraud or error. The amount of $175 is clearly immaterial to the financial statements and therefore

does not represent a potential source of material error caused by fraud. The auditor should review

the petty cash records for evidence of any further irregularities and discuss the matters identified

with management. However, if the auditor concludes that the matter increases the overall

assessment of fraud and control risk, management should be informed.

In spite of the immateriality of the amounts involved, however, the relationship of the audit

assistant to the petty cashier represents a familiarity threat. The failure of the audit assistant to

highlight the matter prior to the discussion with the engagement quality control reviewer may

indicate a lack of professional integrity on the part of the audit assistant. In line with ISA 220 Quality

Control for an Audit of Financial Statements, the auditor, primarily the audit engagement partner,

has responsibility to monitor ethical requirements throughout the audit process. The firm’s

procedures for assigning staff to audit teams and for reporting personal relationships with client

staff should be reviewed in light of this responsibility. If the auditor concludes that the petty cash

fraud and any additional issues identified on review of the petty cash records increases the overall

assessment of fraud and control risk, the matter should be reported to management with a

recommendation that all petty cash transactions should be adequately reviewed and authorized.

iii) Cut-off testing on revenue

IFRS 15 Revenue from contract with customers require that the revenue is recognized when

the obligation is satisfied by transferring the goods or service to customers. An asset is

transferred when or as the customer obtains control of that asset. On this basis therefore,

revenue has been recognised too early and as a result revenues, receivables and profits are

overstated.

The error identified is in isolation immaterial to the financial statements at 0·2% of revenue

(17,880/8·7 million). The error should be extrapolated based on the incidence of errors

identified and the level of sales to this particular customer in order to assess the potential

for a material misstatement. Based on this assessment, the auditor should extend cut-off

testing in order to assess further the potential for a material error. The auditor should also

confirm with management that the invoicing procedure is isolated to this particular

customer and consider extending their assessment and testing to any other customers as

necessary. The auditor should also review last year’s cut-off procedures in order to

investigate whether there were any compensating errors in the prior year. All

misstatements identified should be communicated to management and the auditor should

request that they are corrected. ISA 260 requires the auditor to communicate to those

charged with governance his or her views about significant qualitative aspects of the entity’s

accounting practices including accounting policies. The non-compliance with the recognition

criteria of IFRS 15 represents a significant finding from the audit and should be

communicated to those charged with governance according to ISA 260.

iv) Tax advice

The provision of assistance in calculating the company’s income tax payable for the year represents

a self-review threat as the tax calculation forms the basis of the tax payable in the statement of

financial position and the tax charge in the statement of profit or loss for the year. This risk is

increased by the listed status of Davis Co and according to the IESBA Code of Ethics for Professional

Accountants the auditor should not prepare tax calculations for listed clients. Davis Co is a listed

client and therefore, as auditors, the firm should not undertake any tax services as the threats to the

auditor’s objectivity and independence which would be created are too high to allow the audit firm

to undertake an engagement to prepare calculations of current or deferred tax liabilities the

purpose of preparing accounting entries which are material to the relevant financial statements.

According to ISA 260, the significant audit findings which the auditor is required to communicate to

those charged with governance include matters which, in the auditor’s professional judgement, are

significant to the oversight of the financial reporting process. The auditor should therefore report

the lack of skill and up to date knowledge of the finance director and the implications of this for the

recruitment and training procedures at the client. The auditor should also report the independence

issues identified above in relation to the finance director’s request for the auditor to calculate the

tax payable.

You might also like

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Financial Statements, Deals With An External Auditor's Responsibilities However, Both Internal andDocument11 pagesFinancial Statements, Deals With An External Auditor's Responsibilities However, Both Internal andDanisa NdhlovuNo ratings yet

- Audit MCQ - CH 6Document13 pagesAudit MCQ - CH 6Ekta Saraswat VigNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Auditing Standards Summary DK-Dheeraj KukrejaDocument16 pagesAuditing Standards Summary DK-Dheeraj KukrejaRajavati NadarNo ratings yet

- Aicpa Aud Moderate2015Document25 pagesAicpa Aud Moderate2015King MercadoNo ratings yet

- 48 West FargoDocument4 pages48 West FargoAbby HactherNo ratings yet

- Section A Part 2Document9 pagesSection A Part 2Sheda AshrafNo ratings yet

- Summary of SADocument22 pagesSummary of SAEkansh GargNo ratings yet

- ICAEW Advanced Level Corporate Reporting Study Manual Chapter Wise Self-Test Questions With Immediate AnswersDocument244 pagesICAEW Advanced Level Corporate Reporting Study Manual Chapter Wise Self-Test Questions With Immediate AnswersKeranigonj Newmarket100% (1)

- Audit Process Overview Module PosttestDocument3 pagesAudit Process Overview Module PosttestPaul Fajardo CanoyNo ratings yet

- AAVergara Pof Academy Trainings SummaryDocument6 pagesAAVergara Pof Academy Trainings SummaryAbigail VergaraNo ratings yet

- Auditing Accounting Estimates: Preparing for Increased Scrutiny of Assumptions and DocumentationDocument11 pagesAuditing Accounting Estimates: Preparing for Increased Scrutiny of Assumptions and Documentationjhell de la cruzNo ratings yet

- University of Central Punjab: Advanced AuditDocument6 pagesUniversity of Central Punjab: Advanced Auditsumbal malikNo ratings yet

- ASSURANCE & AUDIT PRACTICE SOLUTIONSDocument9 pagesASSURANCE & AUDIT PRACTICE SOLUTIONSsamuel_dwumfourNo ratings yet

- Auditing TutorialDocument20 pagesAuditing TutorialDanisa NdhlovuNo ratings yet

- Engagement Letter AuditDocument7 pagesEngagement Letter AuditJa RedNo ratings yet

- Question 1Document8 pagesQuestion 1Gift MoyoNo ratings yet

- Auditing and Assurance 1 Assignment One 1. Client Acceptance & Continuance. (10 Marks)Document6 pagesAuditing and Assurance 1 Assignment One 1. Client Acceptance & Continuance. (10 Marks)Derek GawiNo ratings yet

- Chapter 8,9 AT 1Document3 pagesChapter 8,9 AT 1De Nev OelNo ratings yet

- ACCTG16A MidtermExamDocument8 pagesACCTG16A MidtermExamJeane BongalanNo ratings yet

- CHAPTER 1. OVERVIEW OF THE AUDIT PROCESSxDocument26 pagesCHAPTER 1. OVERVIEW OF THE AUDIT PROCESSxJerome_JadeNo ratings yet

- Audit and Assurance Fundamentals Level – Skills Module, Paper F8 June 2015 AnswersDocument12 pagesAudit and Assurance Fundamentals Level – Skills Module, Paper F8 June 2015 AnswersChloe ThamNo ratings yet

- Audit definition, fraud characteristics, and audit planningDocument6 pagesAudit definition, fraud characteristics, and audit planningFarhanChowdhuryMehdiNo ratings yet

- 1 1 - Introduction SLAuS 200Document25 pages1 1 - Introduction SLAuS 200Kalana WickramasinghaNo ratings yet

- Audit Review & Opinion Forms for BanksDocument11 pagesAudit Review & Opinion Forms for BanksAsfawosen DingamaNo ratings yet

- At IntroDocument13 pagesAt IntrocmpaguntalanNo ratings yet

- Chapter 6 - Solution ManualDocument29 pagesChapter 6 - Solution Manualjuan100% (2)

- Evaluation of MisstatementsDocument6 pagesEvaluation of MisstatementsAhmad FarooqNo ratings yet

- As 2201Document3 pagesAs 2201Aliya JamesNo ratings yet

- Test 1 7ddDocument94 pagesTest 1 7ddMbadilishaji DuniaNo ratings yet

- Auditing QuestionsDocument10 pagesAuditing Questionssalva8983No ratings yet

- Test 5Document12 pagesTest 5Maithili KulkarniNo ratings yet

- F8 - AA - Mock A - 202103Document14 pagesF8 - AA - Mock A - 202103Thandi MazibukoNo ratings yet

- Flat Cargo BerhadDocument6 pagesFlat Cargo BerhadWan Khaidir100% (1)

- Graded Forum - 070921 Financial Statement ReportingDocument3 pagesGraded Forum - 070921 Financial Statement ReportingheyNo ratings yet

- Accounts Receivable Audit ProceduresDocument5 pagesAccounts Receivable Audit ProceduresVivien NaigNo ratings yet

- Auditing Unit 1Document10 pagesAuditing Unit 1Kailasam SritharNo ratings yet

- AICPA Released Questions AUD 2015 ModerateDocument25 pagesAICPA Released Questions AUD 2015 ModerateTavan ShethNo ratings yet

- 6.12 Explain Each of The Seven Generally Accepted Objectives of Internal Control ActivitiesDocument4 pages6.12 Explain Each of The Seven Generally Accepted Objectives of Internal Control ActivitiesRashi ParwaniNo ratings yet

- 14 Fraud, Error & Non-ComplianceDocument6 pages14 Fraud, Error & Non-Compliancerandomlungs121223No ratings yet

- Adv. Aud. CH 6 Auditor Resp.Document5 pagesAdv. Aud. CH 6 Auditor Resp.HagarMahmoudNo ratings yet

- Detecting Financial Fraud: Auditor's Guide to SAS 82Document8 pagesDetecting Financial Fraud: Auditor's Guide to SAS 82dushyantNo ratings yet

- ABC Internal Controls PDFDocument2 pagesABC Internal Controls PDFice manga100% (3)

- Auditing Quiz + NotesDocument16 pagesAuditing Quiz + NoteswamahibawiNo ratings yet

- Audit Quality Controls for Zimbabwe Open UniversityDocument6 pagesAudit Quality Controls for Zimbabwe Open UniversityDenny ChakauyaNo ratings yet

- Acc12 - PrelimsDocument5 pagesAcc12 - PrelimsLuise MauieNo ratings yet

- Stephen f8 Question and AnswerDocument8 pagesStephen f8 Question and AnswerStephen FrancisNo ratings yet

- Answers To Questions: Risk Assessment - Part IDocument12 pagesAnswers To Questions: Risk Assessment - Part IIlyn BayaniNo ratings yet

- Presentansi Kelompok 5Document24 pagesPresentansi Kelompok 5vira_oktafiyNo ratings yet

- Auditor S ResponsibilityDocument31 pagesAuditor S ResponsibilityAldonNo ratings yet

- Audit Top 70 Questions by CA VIDHI CHHEDADocument64 pagesAudit Top 70 Questions by CA VIDHI CHHEDAManoj VenkatNo ratings yet

- Akka HyuiDocument15 pagesAkka HyuiAkkamaNo ratings yet

- December 19 AnswersDocument5 pagesDecember 19 AnswersSophie ChopraNo ratings yet

- ACCA AAA - Audit Risks of Newly Listed ClientsDocument18 pagesACCA AAA - Audit Risks of Newly Listed Clientsayush nandaNo ratings yet

- Assessing Control Environment and Risk of Financial Statement FraudDocument6 pagesAssessing Control Environment and Risk of Financial Statement FraudPrince GueseNo ratings yet

- Auditing and Assurance Services 1Document6 pagesAuditing and Assurance Services 1Daniel AmonNo ratings yet

- Significant Audit RiskDocument3 pagesSignificant Audit RiskRey Joyce AbuelNo ratings yet

- Auditing - Chapter 3Document54 pagesAuditing - Chapter 3Tesfaye SimeNo ratings yet

- Aaa 5Document3 pagesAaa 5Hamza ZahidNo ratings yet

- AAA Assignment 2Document1 pageAAA Assignment 2Hamza ZahidNo ratings yet

- AAA AssignmentDocument1 pageAAA AssignmentHamza ZahidNo ratings yet

- Aaa 2Document2 pagesAaa 2Hamza ZahidNo ratings yet

- Customer Satisfaction Towards Patanjali Ayurvedic ProductsDocument42 pagesCustomer Satisfaction Towards Patanjali Ayurvedic ProductsAnirudh Singh ChawdaNo ratings yet

- LetterDocument3 pagesLetterSandy MageshNo ratings yet

- 17.04.1295 DPDocument4 pages17.04.1295 DPUt SamNo ratings yet

- Traditional Commerce V/s E-Commerce and Impact of Demonetization On E-CommerceDocument7 pagesTraditional Commerce V/s E-Commerce and Impact of Demonetization On E-CommerceAatif KhanNo ratings yet

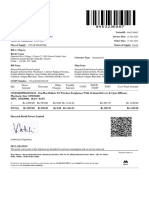

- BCD Travel India Pvt. Ltd. invoiceDocument2 pagesBCD Travel India Pvt. Ltd. invoiceBharat BhushanNo ratings yet

- Export Advance Payment - ApplicationDocument1 pageExport Advance Payment - ApplicationKumar SwamyNo ratings yet

- MGT101 QUIZ 3 MODULES 11-14Document6 pagesMGT101 QUIZ 3 MODULES 11-14Nauman Marwat100% (1)

- Inventory Valuation (Ias 2)Document30 pagesInventory Valuation (Ias 2)Patric CletusNo ratings yet

- 6.3.21 Draft RFP-RFQ 115NFedHwy For BRD MTG AttachmentDocument24 pages6.3.21 Draft RFP-RFQ 115NFedHwy For BRD MTG AttachmentMatt PapaycikNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceriteshv077777No ratings yet

- Discussion Green ProcurementDocument10 pagesDiscussion Green ProcurementNurul AdilaNo ratings yet

- Grade 10Document115 pagesGrade 10Manuelo Vangie100% (1)

- WHAT IS LEADERSHIP (Essay)Document1 pageWHAT IS LEADERSHIP (Essay)Nate Dela VegaNo ratings yet

- Antoine Resume 52020Document2 pagesAntoine Resume 52020api-512211605No ratings yet

- Car Policy: Salient FeaturesDocument2 pagesCar Policy: Salient FeaturesZahid Shaikh100% (1)

- Yacapin Legal Services Adjusted Trial BalanceDocument3 pagesYacapin Legal Services Adjusted Trial BalanceCleah WaskinNo ratings yet

- Inventory MGT TechniquesDocument21 pagesInventory MGT TechniquesTambe Chalomine AgborNo ratings yet

- Chapter 2 - Project Life CycleDocument36 pagesChapter 2 - Project Life Cyclehailegebrael100% (1)

- BATA Company AnalysisDocument21 pagesBATA Company AnalysisSuraj SatpathyNo ratings yet

- Draft RR Registration EOPT - For Public ConsultationDocument18 pagesDraft RR Registration EOPT - For Public ConsultationGennelyn OdulioNo ratings yet

- SP3DProgGuide PDFDocument194 pagesSP3DProgGuide PDFBracusNo ratings yet

- The Eviction in the Sale-Purchase ContractDocument11 pagesThe Eviction in the Sale-Purchase ContractMa. Cristila FernandezNo ratings yet

- An Insight Into M&a - A Growth Perspective (By Vinod Kumar & Priti)Document227 pagesAn Insight Into M&a - A Growth Perspective (By Vinod Kumar & Priti)Adeel AhmedNo ratings yet

- Research Design Dissertation ExampleDocument6 pagesResearch Design Dissertation ExampleWriteMyEconomicsPaperFortCollins100% (1)

- Account Reconciliation Policy - Sample 2Document5 pagesAccount Reconciliation Policy - Sample 2Muri EmJayNo ratings yet

- CASE 2.1 Hector Gaming CompanyDocument2 pagesCASE 2.1 Hector Gaming CompanyGopal MahajanNo ratings yet

- Walt Disney Case Analysis PDFDocument10 pagesWalt Disney Case Analysis PDFDominic LeeNo ratings yet

- Unit 6 7 Lesson Guide in Tourism Hospitality MarketingDocument36 pagesUnit 6 7 Lesson Guide in Tourism Hospitality MarketingSalvacion CalimpayNo ratings yet

- Ocobee River Rafting Company profit analysisDocument4 pagesOcobee River Rafting Company profit analysiskristine torresNo ratings yet

- Chapter 11Document34 pagesChapter 11JaneNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Electronic Health Records: An Audit and Internal Control GuideFrom EverandElectronic Health Records: An Audit and Internal Control GuideNo ratings yet

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet