Professional Documents

Culture Documents

Lesson Plan For General Mathematics Second Quarter, Week 5

Uploaded by

Manny MannyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson Plan For General Mathematics Second Quarter, Week 5

Uploaded by

Manny MannyCopyright:

Available Formats

Juan Sumulong High School

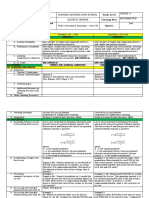

Lesson Plan for General Mathematics Second Quarter, Week 5

December 9, 2022 Friday

Simple Ordinary and General Ordinary Annuities

I. OBJECTIVES

a. Distinguish simple ordinary and general ordinary annuities.

b. Solve Present and Future Values of both simple and general annuities.

c. Compare the present and/or future values to the total deposit/payment of an annuity.

d. React to the comparison of present and/or future values to its total deposit/payment of an

annuity.

II. SUBJECT MATTER

a. Topic: Annuity

b. Subtopic: Simple Ordinary and General Ordinary Annuities

c. Reference: General Mathematics Teacher’s Guide by Department of Education

III. PROCEDURE

a. Prayer

b. Checking of attendance

IV. REVIEW

Definition of terms

a.) Simple Annuity – An Annuity where the payment interval is the same as the interest

period.

b.) General Annuity – An annuity where the payment interval is not the same as the

interest period.

c.) Ordinary Annuity – A type of annuity in which the payments are made at the end of each

payment interval.

The formula for Future and Present Values of Simple Ordinary Annuity.

( ) ( )

tm −tm

r r

1+ −1 1− 1+

m m

F=R r

P=R r

m m

The formula for Future and Present Values of General Ordinary Annuity.

( ) ( )

tm −tm

r r

1+ −1 1− 1+

m m

F=R P=R

(1+ mr ) (1+ mr ) −1

m÷T m÷T

−1

where,

F – future value/maturity value. The amount after the term.

P – Present value/principal. The money borrowed or the one-time payment.

R – Regular or Periodic payment. Equal amount for each payment

r – interest rate per annum.

m – interest period or compounding interest period.

t = term or time in year.

T = total number of payments per year or payment interval.

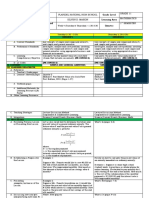

V. LESSON PROPER

Faith’s new year resolution for 2023 is to save 1250 pesos in an investment every

month end. She will end her new year resolution at the end of the year 2026. She has

options to choose between Bank A and Bank B.

Bank A offers 5.25% compounding monthly.

Bank B offers 5.3% compounding quarterly.

1.) What kind of annuity does Bank A offers?

2.) What kind of annuity does Bank B offers?

3.) How much is the future value of investment of Bank A after the year 2026?

4.) How much is the future value of investment of Bank B after the year 2026?

5.) How much is the present value of investment of Bank A after the year 2026?

6.) How much is the present value of investment of Bank B after the year 2026?

7.) How much will be her total deposit?

8.) If you are Faith, which offer will you choose? Why?

VI. SUMMATIVE ASSESSMENT

Mr. Abet wants to avail a housing loan without a down payment. He needs to choose

between two housing loan offers, assume that the two houses are similar and equal.

a. Pabahay Loan offers a 5,000 pesos monthly payment for 30 years with 7.4%

compounding monthly.

b. Tahanan Loan offers a 4,500 pesos monthly payment for 35 years with 7.7%

compounding annually.

1.) How much is the cash price of each housing loan?

2.) How much will be his total payment for each housing loan?

3.) How much will be the amount of each housing loan after its term?

4.) If you are Mr. Abet which offer, will you choose? Why?

VII. GENERALIZATION

What is annuity? What are simple and general annuity? What is the difference between

Simple and General Annuity? Is comparing total deposit or payment to present and/or future

values important? Why?

PREPARED AND SUBMITTED BY:

MANUEL M. BALLON JR.

Teacher I

CHECKED BY:

JULIETA B. ALBARIDA

Head Teacher III

You might also like

- Daily Lesson Log Plaridel National High School Grade 11 Kilven D. Masion Mathematics 2ndDocument4 pagesDaily Lesson Log Plaridel National High School Grade 11 Kilven D. Masion Mathematics 2ndKILVEN MASIONNo ratings yet

- Lesson 9 Equivalent Rates and General AnnuityDocument29 pagesLesson 9 Equivalent Rates and General AnnuityGeraldine ElisanNo ratings yet

- Simple and Compound InterestDocument3 pagesSimple and Compound InterestLouise DefiñoNo ratings yet

- Gen Math WK 3-4Document32 pagesGen Math WK 3-4Jad AdlawanNo ratings yet

- Interest RateDocument33 pagesInterest RateNoel Salazar JrNo ratings yet

- Quarter 2 - Module 3 What I Know What'S In: Simple Genera L Deferre D Presen T Term Futur E Deferra LDocument3 pagesQuarter 2 - Module 3 What I Know What'S In: Simple Genera L Deferre D Presen T Term Futur E Deferra LJohnNo ratings yet

- NAME: - YR & SEC: - Competency: To The LearnersDocument20 pagesNAME: - YR & SEC: - Competency: To The LearnersCrystaljoy AndaluzNo ratings yet

- Module 2 AnnuitiesDocument20 pagesModule 2 AnnuitiesCatherine CambayaNo ratings yet

- Daily Lesson Log Plaridel National High School Grade 11 Kilven D. Masion Mathematics 1 SemesterDocument5 pagesDaily Lesson Log Plaridel National High School Grade 11 Kilven D. Masion Mathematics 1 SemesterKILVEN MASIONNo ratings yet

- Lesson Plan in Grade 11 General MathematicsDocument3 pagesLesson Plan in Grade 11 General MathematicsJennylyn Rosas100% (1)

- Lesson Plan 11Document3 pagesLesson Plan 11mileneNo ratings yet

- Review Engineering Economics BsceDocument11 pagesReview Engineering Economics BsceHeart Venturanza100% (1)

- Module 4 U2Document9 pagesModule 4 U2Case CiiNo ratings yet

- DLL - Simple InterestDocument4 pagesDLL - Simple InterestAL JoHn S. TY100% (1)

- FYI: For Your Interest!Document8 pagesFYI: For Your Interest!Aguila AlvinNo ratings yet

- Interest and Discount PDFDocument4 pagesInterest and Discount PDFJayrMenesNo ratings yet

- Pamantasan NG Lungsod NG Maynila: Course Code: Mathematics of InvestmentDocument7 pagesPamantasan NG Lungsod NG Maynila: Course Code: Mathematics of InvestmentBaekhyun ByunNo ratings yet

- Week 6Document36 pagesWeek 6allaintamangNo ratings yet

- Simple and General Annuities TrueDocument50 pagesSimple and General Annuities TrueRhomel Phillipe' de GuzmanNo ratings yet

- GenMath 8Document8 pagesGenMath 8ChristoneNo ratings yet

- The Five Types of Cash Flows:: Interest and Money-Time Relationships (Ii)Document4 pagesThe Five Types of Cash Flows:: Interest and Money-Time Relationships (Ii)조이스No ratings yet

- Compound InterestDocument24 pagesCompound Interestsier waltersNo ratings yet

- Simple and General AnnuitiesDocument3 pagesSimple and General AnnuitiesMarielleNo ratings yet

- Genmath-3rd Quarter SummativeDocument3 pagesGenmath-3rd Quarter SummativeJENESA BAGUIONo ratings yet

- Engineering EconomicsDocument153 pagesEngineering EconomicsRJ MCNo ratings yet

- Chapter 2Document28 pagesChapter 2SHIRISH KNo ratings yet

- Intro Finance QuestionsDocument3 pagesIntro Finance QuestionsstanleyNo ratings yet

- Chapter 2 - Interest and Money Time Relationships Week 4Document5 pagesChapter 2 - Interest and Money Time Relationships Week 4Jouryel Ian Roy TapongotNo ratings yet

- General Mathematics Q2 Week 3Document18 pagesGeneral Mathematics Q2 Week 3Santos, Mart Czendric Y.No ratings yet

- Engineering Economy Module 2Document4 pagesEngineering Economy Module 2Mark Renbel ParanNo ratings yet

- SEND Q2 GM Week 1Document37 pagesSEND Q2 GM Week 1wilzl sarrealNo ratings yet

- General Mathematics: Quarter 2 - Module 6: Simple and Compound InterestsDocument22 pagesGeneral Mathematics: Quarter 2 - Module 6: Simple and Compound InterestsEldon Kim RaguindinNo ratings yet

- Shs Genmath q2 w3 Studentsversion v1Document10 pagesShs Genmath q2 w3 Studentsversion v1Hanna Zaina AlveroNo ratings yet

- Module 5Document9 pagesModule 53 stacksNo ratings yet

- General Mathematics: Simple and Compound InterestDocument19 pagesGeneral Mathematics: Simple and Compound InterestLynette LicsiNo ratings yet

- LAS - Simple&Compound InterestDocument2 pagesLAS - Simple&Compound InterestJERLYN MACADONo ratings yet

- Engineering Economy Module 2Document33 pagesEngineering Economy Module 2James ClarkNo ratings yet

- General Mathematics: Quarter 2 - Module 1 Simple and Compound InterestsDocument21 pagesGeneral Mathematics: Quarter 2 - Module 1 Simple and Compound InterestsThegame1991ususus100% (1)

- AnnuityDocument10 pagesAnnuityjabstretNo ratings yet

- Chapter 3Document42 pagesChapter 3TARA RUZZLIN MAHINAYNo ratings yet

- Chapter Two Interest and Investment CostDocument6 pagesChapter Two Interest and Investment Costرائد عبد العزيز فرحانNo ratings yet

- MMI1060 Fall 2022 - Class 1 - TVM - STUDENTDocument23 pagesMMI1060 Fall 2022 - Class 1 - TVM - STUDENTxtremewhizNo ratings yet

- Financial Mathematics 1 NotesDocument20 pagesFinancial Mathematics 1 NotesLukong LouisNo ratings yet

- Activity Sheet in Gen Math Q2-AS 1&2Document5 pagesActivity Sheet in Gen Math Q2-AS 1&2Emelyn V. CudapasNo ratings yet

- Genmath Las Week1-2Document13 pagesGenmath Las Week1-2Aguila AlvinNo ratings yet

- Genmath 3RD Q-Set BDocument3 pagesGenmath 3RD Q-Set BJENESA BAGUIONo ratings yet

- Gen. Math - 11 - Q2 - WK2Document8 pagesGen. Math - 11 - Q2 - WK2Jehl T Duran50% (2)

- R 1 F R 1 F P: ExamplesDocument4 pagesR 1 F R 1 F P: ExamplesXander Christian RaymundoNo ratings yet

- PPT02 - Nominal and Effective Interest RatesDocument33 pagesPPT02 - Nominal and Effective Interest RatesImam Al GhazaliNo ratings yet

- Module in General Mathematics Grade 11 Second Quarter, Week 3 To Week 4Document39 pagesModule in General Mathematics Grade 11 Second Quarter, Week 3 To Week 4Hanseuuu100% (1)

- Notes PDFDocument127 pagesNotes PDFKaraboNo ratings yet

- Engineering Economy: Chapter 3: The Time Value of MoneyDocument32 pagesEngineering Economy: Chapter 3: The Time Value of MoneyAhmad Medlej100% (1)

- Lesson 9 Equivalent Rates and AnnuityDocument41 pagesLesson 9 Equivalent Rates and AnnuityGeraldine ElisanNo ratings yet

- General Mathematics Q2 Week 4 1Document11 pagesGeneral Mathematics Q2 Week 4 1Santos, Mart Czendric Y.No ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of Moneytrần thị ngọc trâmNo ratings yet

- Lesson-2 EeDocument24 pagesLesson-2 EeChristian MagdangalNo ratings yet

- Interest Money-Time Relationship Part 2Document9 pagesInterest Money-Time Relationship Part 2Carlnagum 123456789No ratings yet

- Simple Interest Word ProblemsDocument1 pageSimple Interest Word ProblemsManny MannyNo ratings yet

- Simple and Compound Interest QuizDocument2 pagesSimple and Compound Interest QuizManny MannyNo ratings yet

- General Ordinary Annuity SeatworkDocument1 pageGeneral Ordinary Annuity SeatworkManny MannyNo ratings yet

- Math Month 2023Document1 pageMath Month 2023Manny MannyNo ratings yet

- Math Month TarpDocument1 pageMath Month TarpManny MannyNo ratings yet

- FM II CH-4-1Document12 pagesFM II CH-4-1Fãhâd Õró ÂhmédNo ratings yet

- Ffr-1 Axix Bank March 2012Document3 pagesFfr-1 Axix Bank March 2012SURANA1973No ratings yet

- Foundations of Financial Management: Spreadsheet TemplatesDocument8 pagesFoundations of Financial Management: Spreadsheet TemplatesAndika MervinandaNo ratings yet

- Centurion Bank of PunjabDocument7 pagesCenturion Bank of Punjabbaggamraasi1234No ratings yet

- Estimation of Cash FlowsDocument16 pagesEstimation of Cash FlowsAman PoddarNo ratings yet

- Risks and Returns of Cryptocurrency: Yukun LiuDocument39 pagesRisks and Returns of Cryptocurrency: Yukun LiuChristopher AlexanderNo ratings yet

- W25421 PDF EngDocument5 pagesW25421 PDF EngAnand RanjanNo ratings yet

- Debt CovenantDocument5 pagesDebt CovenantSakinKhanNo ratings yet

- Unit 5, 6 & 7 Capital Budgeting 1Document14 pagesUnit 5, 6 & 7 Capital Budgeting 1ankit mehtaNo ratings yet

- ITDocument4 pagesITNamnam PacheNo ratings yet

- Wealth Management Introduction 2020Document115 pagesWealth Management Introduction 2020Budhaditya BiswasNo ratings yet

- Walt Disney Duration Analysis StudentDocument23 pagesWalt Disney Duration Analysis StudentRohan SamriaNo ratings yet

- CFS QuestionsDocument3 pagesCFS QuestionsAayush AgrawalNo ratings yet

- The Rise and Fall of Global Trust BankDocument17 pagesThe Rise and Fall of Global Trust BankShipra Shalini100% (1)

- Chapter 15-Cost of CapitalDocument73 pagesChapter 15-Cost of CapitalInga ȚîgaiNo ratings yet

- WORKING CAPITAL DocxDocument16 pagesWORKING CAPITAL DocxGab IgnacioNo ratings yet

- In Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalDocument20 pagesIn Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalAshish AgarwalNo ratings yet

- DocDocument1 pageDocaccounts 3 life100% (1)

- Pas 20 - 23Document6 pagesPas 20 - 23LEIGHANNE ZYRIL SANTOSNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- آليــــات تنشيـط وتطـوير بـورصة الجزائر (الأداء، المعوقات و الحلول)Document20 pagesآليــــات تنشيـط وتطـوير بـورصة الجزائر (الأداء، المعوقات و الحلول)Sea BenNo ratings yet

- CA FINAL DT Revisions MAY-23 Exams by BBDocument3 pagesCA FINAL DT Revisions MAY-23 Exams by BBKunal BhatnagarNo ratings yet

- Ryan BoA July 2022Document11 pagesRyan BoA July 2022Yooo100% (3)

- Fintech Business Models Applied Canvas Method and Analysis of Venture Capital Rounds (Matthias Fischer) (Z-Library)Document312 pagesFintech Business Models Applied Canvas Method and Analysis of Venture Capital Rounds (Matthias Fischer) (Z-Library)Minh Khánh NguyenNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- ThesisDocument17 pagesThesisKritiNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- MusicDocument30 pagesMusickxnoraNo ratings yet