Professional Documents

Culture Documents

Wa0000.

Uploaded by

NishanthOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wa0000.

Uploaded by

NishanthCopyright:

Available Formats

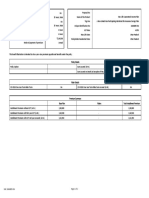

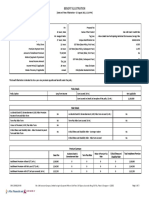

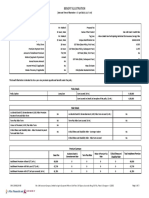

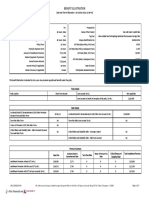

Proposal No:

Name of the Prospect/Policyholder: Mr. Vijay Shankar Choubey Name of the Product: Max Life Savings Advantage Plan

Age & Gender: 27 Years, Male Tag Line: A Non-Linked Participating Individual Life Insurance Savings Plan

Name of the Life Assured: Ms. Mrs Unique Identification No: 104N111V02

Age & Gender: 35 Years, Female GST Rate: 4.50%

Policy Term: 20 Years Max Life State: Delhi

Premium Payment Term: 20 Years Policyholder Residential State: Delhi

Amount of Installment Premium: `1,04,500

Mode of payment of premium: Annual

How to read and understand this benefit illustration?

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy, at two assumed rates of interest i.e., 8% p.a. and 4% p.a.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these

will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment returns, of

8%p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including

future investment performance.

Policy Details

Policy Option Sum Assured (in Rs.) 17,15,266

Bonus Type Paid Up Additions Sum Assured on Death (at inception of the policy) (in Rs.) 18,86,792

Rider Details

Accidental Death & Dismemberment (ADD) Rider Premium

NA Accidental Death & Dismemberment (ADD) Rider Sum Assured (in Rs.) NA

Payment Term and Rider Term

Term Plus Rider Term NA Term Plus Rider Sum Assured (in Rs.) NA

Waiver of Premium (WOP) Plus Rider Term NA

Critical Illness and Disability Rider - Rider Premium

NA Critical Illness and Disability Rider - Coverage Variant NA

Payment Term and Rider Term

Critical Illness and Disability Rider - Rider Sum Assured NA

Premium Summary

Base Plan Riders Total Installment Premium

Installment Premium without GST (in Rs.) 1,00,000 - 1,00,000

Installment Premium with first year GST (in Rs.) 1,04,500 - 1,04,500

Installment Premium with GST 2nd year onwards (in Rs.) 1,02,250 - 1,02,250

UIN: 104N111V02 Page 1 of 3

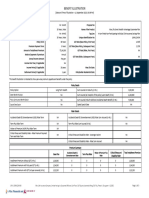

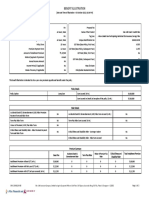

(Amount in Rupees)

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Paid Up Surrender Paid Up Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Additions Benefit Additions Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

1 1,00,000 94,340 - - 18,86,792 - - - - - - - - - 19,81,132 19,81,132

2 1,00,000 94,340 - 85,962 18,86,792 - 11,865 6,672 87,595 27,404 9,177 89,733 - - 20,87,337 21,02,875

3 1,00,000 94,340 - 1,48,373 18,86,792 - 11,960 13,831 1,52,024 27,881 19,662 1,56,845 - - 21,93,637 22,25,096

4 1,00,000 94,340 - 2,64,430 18,86,792 - 12,043 21,495 2,70,554 28,312 31,577 2,78,703 - - 23,00,020 23,47,747

5 1,00,000 94,340 - 3,49,759 18,86,792 - 12,115 29,685 3,58,890 28,740 45,070 3,71,136 - - 24,06,474 30,32,266

6 1,00,000 - - 4,24,061 18,86,792 - 12,203 38,439 4,36,829 29,205 60,319 4,54,086 - - 24,18,677 30,70,442

7 1,00,000 - - 5,03,575 18,86,792 - 12,279 47,778 5,20,717 29,696 77,517 5,44,080 - - 24,30,956 31,09,261

8 1,00,000 - - 5,94,843 18,86,792 - 12,371 57,744 6,17,225 30,168 96,852 6,72,539 - - 24,43,327 31,48,697

9 1,00,000 - - 6,94,130 18,86,792 - 12,476 68,379 7,37,653 30,653 1,18,547 8,41,695 - - 24,55,803 31,88,767

10 1,00,000 - - 7,99,915 18,86,792 - 12,543 79,691 8,77,863 31,145 1,42,846 10,34,187 - - 24,68,346 32,29,479

11 1,00,000 - - 9,13,201 20,75,472 - 12,648 91,744 10,08,914 31,636 1,70,004 12,18,989 - - 26,69,674 34,59,513

12 1,00,000 - - 10,35,428 20,75,472 - 12,717 1,04,548 11,52,130 32,154 2,00,329 14,22,796 - - 26,82,390 35,01,546

13 1,00,000 - - 11,64,552 20,75,472 - 12,820 1,18,172 13,08,302 32,658 2,34,126 16,46,944 - - 26,95,210 35,44,237

14 1,00,000 - - 13,01,974 20,75,472 - 12,909 1,32,648 14,78,502 33,173 2,71,749 18,93,299 - - 27,08,119 35,87,601

15 1,00,000 - - 14,49,533 20,75,472 - 12,987 1,48,011 16,63,659 33,719 3,13,608 21,63,566 - - 27,21,106 36,31,678

16 1,00,000 - - 16,04,726 20,75,472 - 13,072 1,64,321 18,65,058 34,257 3,60,130 24,59,944 - - 27,34,178 36,76,458

17 1,00,000 - - 17,69,392 20,75,472 - 13,166 1,81,636 20,83,396 34,806 4,11,799 27,83,997 - - 27,47,344 37,21,956

18 1,00,000 - - 19,45,845 20,79,000 - 13,265 2,00,020 23,15,831 35,356 4,69,147 31,38,111 - - 27,64,137 37,71,701

UIN: 104N111V02 Page 2 of 3

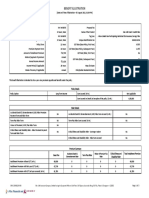

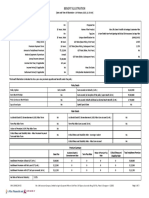

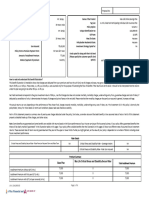

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Paid Up Surrender Paid Up Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Additions Benefit Additions Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

19 1,00,000 - - 21,31,160 21,94,500 - 13,350 2,19,527 25,36,417 35,921 5,32,786 35,24,961 - - 28,92,987 39,34,158

20 1,00,000 - - 22,71,698 23,10,000 23,58,491 13,439 2,40,228 25,98,719 36,492 6,03,375 36,74,152 25,98,719 36,74,152 30,21,926 40,97,360

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods and Service Tax. Refer Sales literature for explanation of terms used in

this illustration.

I, ……………………………………………. (name), have explained the premiums, and benefits I, Vijay Shankar Choubey (name), having received the information with respect to the above,

under the product fully to the prospect / policyholder. have understood the above statement before entering into the contract.

Place:

Date: 1/6/23 Signature / OTP Confirmation Date / Thumb Impression / Date:1/6/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104N111V02 Page 3 of 3

55,35,1715265,3,100000.00,F,b55

You might also like

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3Aman SaxenaNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- DownloadDocument3 pagesDownloadKiran JohnNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Illustration 5Document4 pagesIllustration 5logicloverbharatNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- UIN: 104N113V02 Page 1 of 4Document4 pagesUIN: 104N113V02 Page 1 of 4NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- RaspDocument4 pagesRaspsamvil2007No ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- SWP 12 Pay 15, 44 Age, 5 LacDocument2 pagesSWP 12 Pay 15, 44 Age, 5 LacShivaji ReddyNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3babunidoniNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Iamred Iamred: How To Read and Understand This Benefit Illustration?Document3 pagesIamred Iamred: How To Read and Understand This Benefit Illustration?Suresh RainaNo ratings yet

- BenefitIllustrations 1Document2 pagesBenefitIllustrations 1vonamal985No ratings yet

- Jasvinder MIAPDocument5 pagesJasvinder MIAPDurgeshNo ratings yet

- UIN: 104L082V04 Page 1 of 4Document4 pagesUIN: 104L082V04 Page 1 of 4Indhug SharathNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- USLS. FinMgt2-FinMar. Module 1Document5 pagesUSLS. FinMgt2-FinMar. Module 1Marian Augelio PolancoNo ratings yet

- Test Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve DolvinDocument48 pagesTest Bank For Fundamentals of Investments Valuation and Management 9th Edition Bradford Jordan Thomas Miller Steve Dolvinchrisrasmussenezsinofwdr100% (29)

- James L Horvath, David W. Chodikoff - Taxation, Valuation & Investment Strategies in Volatile Markets-Carswell (2010)Document1,320 pagesJames L Horvath, David W. Chodikoff - Taxation, Valuation & Investment Strategies in Volatile Markets-Carswell (2010)Artur CoelhoNo ratings yet

- Pyq - Mat112 - Jun 2019Document5 pagesPyq - Mat112 - Jun 2019isya.ceknua05No ratings yet

- Dunkin' (Formerly Known As Dunkin Donuts)Document1 pageDunkin' (Formerly Known As Dunkin Donuts)Shayne PaduaNo ratings yet

- Profit Loss and Interest Questions For CATDocument10 pagesProfit Loss and Interest Questions For CATSreeparna DasNo ratings yet

- Income Taxation of IndividualsDocument26 pagesIncome Taxation of Individualsarkisha100% (1)

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- Fixed Income AnalysisDocument3 pagesFixed Income Analysisjackie555No ratings yet

- 11 - Final Accounts Assessment 4 PDFDocument7 pages11 - Final Accounts Assessment 4 PDFShreyas ParekhNo ratings yet

- A Study On Level of Customer Satisfaction Towards Maruti Suzuki Baleno in Lucknow CityDocument104 pagesA Study On Level of Customer Satisfaction Towards Maruti Suzuki Baleno in Lucknow CityHarshit KashyapNo ratings yet

- Social Responsibility of BusinessDocument15 pagesSocial Responsibility of BusinessVatsal ChangoiwalaNo ratings yet

- Put Ratio SpreadsDocument15 pagesPut Ratio SpreadsSasikumar ThangaveluNo ratings yet

- Finance Business Cases ExamplesDocument4 pagesFinance Business Cases Examplestebobe7929No ratings yet

- Infrastructure Outlook 2023Document14 pagesInfrastructure Outlook 2023zackzyp98No ratings yet

- Loksewa Sarathi Banking NoteDocument37 pagesLoksewa Sarathi Banking NotePankaj YadavNo ratings yet

- CAIIB ABFM Module B Mini Marathon 1Document21 pagesCAIIB ABFM Module B Mini Marathon 1Nandagopal KannanNo ratings yet

- Trends in Valuation and Fundraising Challanges of StartupDocument73 pagesTrends in Valuation and Fundraising Challanges of StartupVRUSHTI PAPOLINo ratings yet

- Resume Vladimir Doklestic 2023Document2 pagesResume Vladimir Doklestic 2023Brat VelikiNo ratings yet

- Accounting For Business Combinations ExaminationDocument20 pagesAccounting For Business Combinations ExaminationJanella Umieh De UngriaNo ratings yet

- VivoDocument4 pagesVivoKarthina RishiNo ratings yet

- Measuring The Level of Digital Marketing Capabilities Digital Marketing Strategies and Challenges and IssuesDocument18 pagesMeasuring The Level of Digital Marketing Capabilities Digital Marketing Strategies and Challenges and IssuesNikki mae David100% (1)

- DividendsPolicy 23Document20 pagesDividendsPolicy 23haymanotandualem2015No ratings yet

- (Ambition) Malaysia 2023 Market Insights ReportDocument46 pages(Ambition) Malaysia 2023 Market Insights ReportMaz Izman BudimanNo ratings yet

- Accountancy PQDocument15 pagesAccountancy PQseema chadhaNo ratings yet

- Thesis On Capital Market DevelopmentDocument7 pagesThesis On Capital Market Developmentafjrydnwp100% (2)

- Trader's Guide: Supply & Demand IndicatorDocument17 pagesTrader's Guide: Supply & Demand IndicatorKaleab Kaleab100% (2)

- Advertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Test Bank Full Chapter PDFDocument36 pagesAdvertising and Promotion An Integrated Marketing Communications Perspective 11Th Edition Belch Test Bank Full Chapter PDFjames.graven613100% (16)

- UBL-01-Jun-2023 14:21:09Document1 pageUBL-01-Jun-2023 14:21:09Muhammad AbubakarNo ratings yet

- Annexure-I: DOB............... Age... ... Date of Retirement...........................Document8 pagesAnnexure-I: DOB............... Age... ... Date of Retirement...........................Inked IntutionsNo ratings yet