Professional Documents

Culture Documents

UIN: 104N091V06 Page 1 of 3

Uploaded by

Aman SaxenaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UIN: 104N091V06 Page 1 of 3

Uploaded by

Aman SaxenaCopyright:

Available Formats

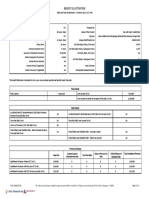

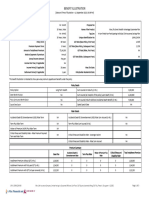

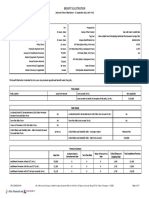

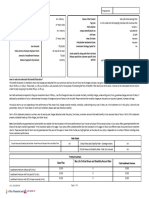

Proposal No:

Name of the Prospect/Policyholder: Mr. Name of the Product: Max Life Monthly Income Advantage Plan

Age & Gender: 18 Years, Male Tag Line: A Non-Linked Participating Individual Life Insurance Savings Plan

Name of the Life Assured: Mr. Unique Identification No: 104N091V06

Age & Gender: 18 Years, Male GST Rate: 4.50%

Policy Term: 25 Years Max Life State: Haryana

Premium Payment Term: 15 Years Policyholder Residential State: Haryana

Amount of Installment Premium: `1,04,500

Mode of payment of premium: Annual

How to read and understand this benefit illustration?

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy, at two assumed rates of interest i.e., 8% p.a. and 4% p.a.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these

will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment returns, of

8%p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including

future investment performance.

Policy Details

Policy Option Sum Assured (in Rs.) 19,52,744

Bonus Type Compound Reversionary Bonus Sum Assured on Death (at inception of the policy) (in Rs.) 19,52,744

Rider Details

Accidental Death & Dismemberment (ADD) Rider Term NA Accidental Death & Dismemberment (ADD) Rider Sum Assured (in Rs.) NA

Term Plus Rider Term NA Term Plus Rider Sum Assured (in Rs.) NA

COVID19 One Year Term Rider Term NA COVID19 One Year Term Rider Sum Assured (in Rs.) NA

Critical Illness and Disability Rider Term NA Critical Illness and Disability Rider Variant NA

Critical Illness and Disability Rider Sum Assured NA

Premium Summary

Base Plan Riders Total Installment Premium

Installment Premium without GST (in Rs.) 1,00,000 - 1,00,000

Installment Premium with first year GST (in Rs.) 1,04,500 - 1,04,500

Installment Premium with GST 2nd year onwards (in Rs.) 1,02,250 - 1,02,250

UIN: 104N091V06 Page 1 of 3

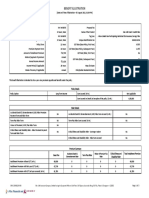

(Amount in Rupees)

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Reversionary Surrender Reversionary Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Bonus Benefit Bonus Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

1 1,00,000 - - - 19,52,744 - - - - - - - - - 19,52,744 19,52,744

2 1,00,000 - - 60,000 19,52,744 - 6,249 - 69,196 35,149 - 75,249 - - 19,52,744 19,52,744

3 1,00,000 - - 1,05,000 19,52,744 - 6,269 - 1,34,641 35,782 - 1,47,799 - - 19,52,744 19,52,744

4 1,00,000 - - 2,00,000 19,52,744 - 6,289 - 2,12,422 36,426 - 2,33,860 - - 19,52,744 19,52,744

5 1,00,000 - - 2,50,000 19,52,744 - 6,309 - 2,91,026 37,082 - 3,78,949 - - 19,52,744 19,52,744

6 1,00,000 - - 3,00,000 19,52,744 - 6,329 - 3,77,903 37,749 - 4,96,797 - - 19,52,744 19,52,744

7 1,00,000 - - 3,50,000 19,52,744 - 6,349 - 4,66,780 38,429 - 6,15,685 - - 19,52,744 19,52,744

8 1,00,000 - - 4,16,000 19,52,744 - 6,370 - 5,61,374 39,121 - 7,43,364 - - 19,52,744 19,52,744

9 1,00,000 - - 4,95,000 19,52,744 - 6,390 - 6,62,476 39,825 - 8,80,862 - - 19,52,744 19,52,744

10 1,00,000 - - 5,70,000 19,52,744 - 6,411 - 7,70,637 40,542 - 10,29,158 - - 19,52,744 19,52,744

11 1,00,000 - - 6,49,000 19,52,744 - 6,431 - 9,41,612 41,271 - 12,54,856 - - 19,52,744 19,52,744

12 1,00,000 - - 7,44,000 19,52,744 - 6,452 - 10,78,126 42,014 - 14,42,583 - - 19,52,744 19,52,744

13 1,00,000 - - 8,32,000 19,52,744 - 6,472 - 12,25,003 42,770 - 16,45,980 - - 19,52,744 19,52,744

14 1,00,000 - - 9,24,000 19,52,744 - 6,493 - 13,82,922 43,540 - 18,66,213 - - 19,52,744 19,52,744

15 1,00,000 - - 10,35,000 19,52,744 - 6,514 - 15,53,769 44,324 - 21,05,703 - - 19,52,744 19,52,744

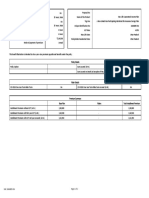

16 - - 1,95,274 8,69,726 19,52,744 - 6,535 - 14,63,066 45,122 - 21,00,877 - - 19,52,744 19,52,744

17 - - 1,95,274 7,19,451 19,52,744 - 6,556 - 13,59,132 45,934 - 21,02,825 - - 19,52,744 19,52,744

18 - - 1,95,274 5,54,177 19,52,744 - 6,577 - 12,46,446 46,761 - 21,00,485 - - 19,52,744 19,52,744

19 - - 1,95,274 3,88,903 19,52,744 - 6,598 - 11,24,619 47,603 - 20,93,315 - - 19,52,744 19,52,744

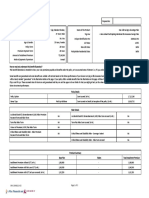

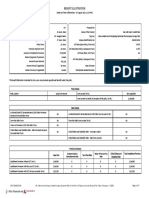

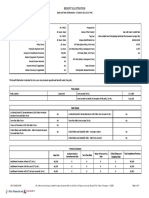

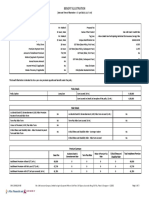

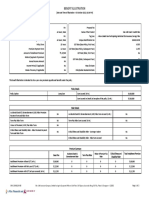

UIN: 104N091V06 Page 2 of 3

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Reversionary Surrender Reversionary Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Bonus Benefit Bonus Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

20 - - 1,95,274 2,38,628 19,52,744 - 6,619 - 9,93,232 48,459 - 20,80,731 - - 19,52,744 19,52,744

21 - - 1,95,274 73,354 19,52,744 - 6,640 - 8,51,975 49,332 - 20,62,333 - - 19,52,744 19,52,744

22 - - 1,95,274 - 19,52,744 - 6,661 - 7,00,392 50,220 - 20,37,459 - - 19,52,744 19,52,744

23 - - 1,95,274 - 19,52,744 - 6,682 - 5,38,002 51,124 - 20,05,429 - - 19,52,744 19,52,744

24 - - 1,95,274 - 19,52,744 - 6,704 - 3,58,256 52,044 - 19,65,364 - - 19,52,744 19,52,744

25 - - 1,95,274 - 19,52,744 - 6,725 - 1,55,621 52,981 - 18,71,792 1,55,621 18,71,792 19,52,744 19,52,744

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods and Service Tax. Refer Sales literature for explanation of terms used in

this illustration.

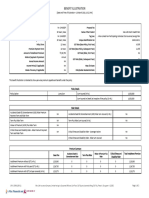

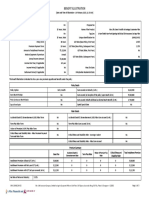

I, ……………………………………………. (name), have explained the premiums, and benefits I, ……………………………………………. (name), having received the information with respect

under the product fully to the prospect / policyholder. to the above, have understood the above statement before entering into the contract.

Place:

Date: 4/26/21 Signature / OTP Confirmation Date / Thumb Impression / Date:4/26/21 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104N091V06 Page 3 of 3

93,18,1952743,R,100000.00,M,a93

You might also like

- The Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowFrom EverandThe Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowRating: 5 out of 5 stars5/5 (1)

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- Max Life Savings Advantage Plan proposal summaryDocument3 pagesMax Life Savings Advantage Plan proposal summaryAman SaxenaNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Max Life Savings Advantage Plan proposal analysisDocument3 pagesMax Life Savings Advantage Plan proposal analysisNishanthNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- Monthly Income Plan BenefitsDocument3 pagesMonthly Income Plan Benefitsvivek0955158No ratings yet

- Max Life Savings Advantage Plan proposal summaryDocument3 pagesMax Life Savings Advantage Plan proposal summaryvivek0955158No ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- 56be09dc-0cbb-41c5-bd0c-5a7a16ff34eaDocument3 pages56be09dc-0cbb-41c5-bd0c-5a7a16ff34eaSantosh DavaneNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Max Life Smart Wealth Plan Benefit IllustrationDocument2 pagesMax Life Smart Wealth Plan Benefit IllustrationLakhwinder RaundNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Illustration 5Document4 pagesIllustration 5logicloverbharatNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- c7fe7770-f489-4e8a-8cbb-05ba762879c0Document4 pagesc7fe7770-f489-4e8a-8cbb-05ba762879c0rishitrivedi2176No ratings yet

- Max Life Smart Wealth Plan benefit illustrationDocument2 pagesMax Life Smart Wealth Plan benefit illustrationvivek0955158No ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Max Life Smart Wealth Plan benefit illustrationDocument3 pagesMax Life Smart Wealth Plan benefit illustrationparikshitNo ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3babunidoniNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- SWP 12 Pay 15, 44 Age, 5 LacDocument2 pagesSWP 12 Pay 15, 44 Age, 5 LacShivaji ReddyNo ratings yet

- RaspDocument4 pagesRaspsamvil2007No ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- UIN: 104N113V02 Page 1 of 4Document4 pagesUIN: 104N113V02 Page 1 of 4NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- DownloadDocument3 pagesDownloadKiran JohnNo ratings yet

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- UIN: 104L082V04 Page 1 of 4Document4 pagesUIN: 104L082V04 Page 1 of 4Indhug SharathNo ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- Sampoorna Raksha Supreme - 2023-09-15T150349.974Document4 pagesSampoorna Raksha Supreme - 2023-09-15T150349.974Karthikeyan SakthivelNo ratings yet

- BI-4299EEKBDocument4 pagesBI-4299EEKBchigiliseenaNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- Benefit Illustration for HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration for HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- 1579172394environment Science TechDocument213 pages1579172394environment Science TechAman SaxenaNo ratings yet

- Group Discussion SkillsDocument52 pagesGroup Discussion SkillsAman SaxenaNo ratings yet

- Guestimation ProblemsDocument51 pagesGuestimation ProblemsLucio Gomes100% (2)

- Group Discussion FAQs eBookDocument26 pagesGroup Discussion FAQs eBookAman SaxenaNo ratings yet

- Previous Years GD Topics: Group DiscussionDocument25 pagesPrevious Years GD Topics: Group DiscussionAman SaxenaNo ratings yet

- IIMA Casebook 2016-17 (3rd Edition) PDFDocument124 pagesIIMA Casebook 2016-17 (3rd Edition) PDFanantdeepsingh1994100% (5)

- Guestimation ProblemsDocument51 pagesGuestimation ProblemsLucio Gomes100% (2)

- 0 PDFDocument9 pages0 PDFAnonymous HUY0yRexYfNo ratings yet

- Social Network Analytics Session1Document38 pagesSocial Network Analytics Session1Aman SaxenaNo ratings yet

- Git Cheatsheet EN Grey PDFDocument2 pagesGit Cheatsheet EN Grey PDFCarlos Ivan CastroNo ratings yet

- Social Network Analytics Session2Document34 pagesSocial Network Analytics Session2Aman SaxenaNo ratings yet

- Social Network Analytics Session3Document18 pagesSocial Network Analytics Session3Aman SaxenaNo ratings yet

- IIMA Casebook 2016-17 (3rd Edition) PDFDocument124 pagesIIMA Casebook 2016-17 (3rd Edition) PDFanantdeepsingh1994100% (5)

- Machine Learning Cheatsheet GuideDocument5 pagesMachine Learning Cheatsheet GuideJeevikaGoyalNo ratings yet

- BM Course Outline Prof. Kalla 2021-22 (With R&C)Document5 pagesBM Course Outline Prof. Kalla 2021-22 (With R&C)Aman SaxenaNo ratings yet

- Social Network Analytics Session4Document21 pagesSocial Network Analytics Session4Aman SaxenaNo ratings yet

- Getting Started Data Science GuideDocument76 pagesGetting Started Data Science GuideKunal LangerNo ratings yet

- Final Course Outline Retail Man 2021Document5 pagesFinal Course Outline Retail Man 2021Aman SaxenaNo ratings yet

- International Management Institute, New Delhi: PGDM (2020-22) Term-V Combined Time TableDocument1 pageInternational Management Institute, New Delhi: PGDM (2020-22) Term-V Combined Time TableAman SaxenaNo ratings yet

- W15412 PDF EngDocument6 pagesW15412 PDF EngAman SaxenaNo ratings yet

- AN-IM707 Social Network Analytics PGDM Batch 2020-22Document6 pagesAN-IM707 Social Network Analytics PGDM Batch 2020-22Aman SaxenaNo ratings yet

- ForeVision Workshop ScheduleDocument1 pageForeVision Workshop ScheduleAman SaxenaNo ratings yet

- FV - Technical AnalysisDocument75 pagesFV - Technical AnalysisAman SaxenaNo ratings yet

- Certificate of Training: VisionDocument1 pageCertificate of Training: VisionAman SaxenaNo ratings yet

- IIMA Casebook 2016-17 (3rd Edition) PDFDocument124 pagesIIMA Casebook 2016-17 (3rd Edition) PDFanantdeepsingh1994100% (5)

- FV - Pitch Deck - Company NameDocument12 pagesFV - Pitch Deck - Company NameAman SaxenaNo ratings yet

- Zoom Link Pre MidDocument4 pagesZoom Link Pre MidAman SaxenaNo ratings yet

- Guestimation ProblemsDocument51 pagesGuestimation ProblemsLucio Gomes100% (2)

- Machine Learning Cheatsheet GuideDocument5 pagesMachine Learning Cheatsheet GuideJeevikaGoyalNo ratings yet

- Wharton Consulting Club: Interview Study GuideDocument59 pagesWharton Consulting Club: Interview Study GuideAman SaxenaNo ratings yet

- Midterms Gov AccountingDocument72 pagesMidterms Gov AccountingEloisa JulieanneNo ratings yet

- Feminist TheologyDocument3 pagesFeminist TheologyMikoi Langzya100% (1)

- The First Epistle of Paul To The CorinthiansDocument14 pagesThe First Epistle of Paul To The Corinthiansmaxi_mikeNo ratings yet

- Dáil Eireann Debate OF PESCO EU ARMY IN SECRETDocument488 pagesDáil Eireann Debate OF PESCO EU ARMY IN SECRETRita CahillNo ratings yet

- Insurance Licenses Required for Foreign Insurer and Local AgentDocument2 pagesInsurance Licenses Required for Foreign Insurer and Local AgentAbilene Joy Dela CruzNo ratings yet

- 018 005 WaterproofingDocument7 pages018 005 WaterproofingSujani MaarasingheNo ratings yet

- Tangan Vs CADocument1 pageTangan Vs CAjoyNo ratings yet

- Cadastral Act ReviewerDocument2 pagesCadastral Act ReviewerArla Agrupis100% (1)

- Conformity Certificate TemplateDocument1 pageConformity Certificate TemplateShahbaz Khan100% (1)

- Introduction To Philippine HistoryDocument20 pagesIntroduction To Philippine HistoryCatie Raw AyNo ratings yet

- Jude Whole Study PDFDocument15 pagesJude Whole Study PDFStar RangerNo ratings yet

- International Accounting & Multinational Enterprises: Lee H. Radebaugh Sidney J. Gray Ervin L. BlackDocument26 pagesInternational Accounting & Multinational Enterprises: Lee H. Radebaugh Sidney J. Gray Ervin L. BlackAdrin Ma'rufNo ratings yet

- Sample Motion To Dismiss Petition For Facial InsufficiencyDocument5 pagesSample Motion To Dismiss Petition For Facial InsufficiencybrandonNo ratings yet

- Question On Oliver With Answer (1-29)Document12 pagesQuestion On Oliver With Answer (1-29)hoda69% (13)

- LANPoker EULA ENGDocument2 pagesLANPoker EULA ENGMealone NiceNo ratings yet

- Spares Sarita 0401Document24 pagesSpares Sarita 0401Heidi De VliegherNo ratings yet

- Consolidated Building Maintenance v. Asprec, G.R. No. 217301, 6 June 2018.Document15 pagesConsolidated Building Maintenance v. Asprec, G.R. No. 217301, 6 June 2018.BREL GOSIMATNo ratings yet

- BL 3 - Final Exam Answer SheetDocument1 pageBL 3 - Final Exam Answer SheetCarren Abiel OberoNo ratings yet

- External Aids - IiiDocument84 pagesExternal Aids - IiiPrasun TiwariNo ratings yet

- SocialinequalityDocument8 pagesSocialinequalityapi-353143592No ratings yet

- ADC Exam2 PDFDocument3 pagesADC Exam2 PDFrahulpatel1202No ratings yet

- ECN: Commissioners Appointed in 2011Document1 pageECN: Commissioners Appointed in 2011Milton LouwNo ratings yet

- IntervalsDocument10 pagesIntervalsJohn Leal100% (2)

- Coca ColaDocument31 pagesCoca ColaAnmol JainNo ratings yet

- Ugrd-Ncm6308 Bioethics Prelim To Final QuizDocument39 pagesUgrd-Ncm6308 Bioethics Prelim To Final QuizMarckyJmzer033 OgabangNo ratings yet

- Invoice With Finance ChargeDocument1 pageInvoice With Finance ChargeD ¡ a R yNo ratings yet

- Canucks 2011-12 schedule and resultsDocument3 pagesCanucks 2011-12 schedule and resultsTBaby038392No ratings yet

- Islamic Reformism and ChristianityDocument6 pagesIslamic Reformism and ChristianityJojo HohoNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument24 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Department of Labor: WHITE FERNANDO DEMEC V NATURALLY FRESH INC 2006STA00016 (SEP 24 2007) 075113 CADEC SDDocument2 pagesDepartment of Labor: WHITE FERNANDO DEMEC V NATURALLY FRESH INC 2006STA00016 (SEP 24 2007) 075113 CADEC SDUSA_DepartmentOfLaborNo ratings yet