Professional Documents

Culture Documents

UIN: 104N091V06 Page 1 of 3

Uploaded by

Santosh DavaneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UIN: 104N091V06 Page 1 of 3

Uploaded by

Santosh DavaneCopyright:

Available Formats

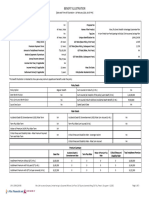

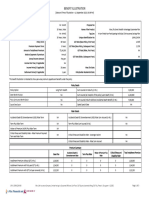

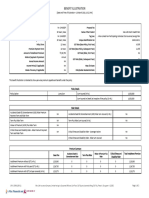

Proposal No: 160127924

Name of the Prospect/Policyholder: Ms. SARIKA VINOD MALI Name of the Product: Max Life Monthly Income Advantage Plan

Age & Gender: 34 Years, Female Tag Line: A Non-Linked Participating Individual Life Insurance Savings Plan

Name of the Life Assured: Ms. SARIKA VINOD MALI Unique Identification No: 104N091V06

Age & Gender: 34 Years, Female GST Rate: 4.50%

Policy Term: 25 Years Max Life State: Maharashtra

Premium Payment Term: 15 Years Policyholder Residential State: Maharashtra

Amount of Installment Premium: `2,15,191

Mode of payment of premium: Annual

How to read and understand this benefit illustration?

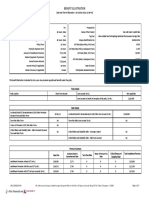

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy, at two assumed rates of interest i.e., 8% p.a. and 4% p.a.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these

will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment returns, of

8%p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including

future investment performance.

Policy Details

Policy Option Sum Assured (in Rs.) 38,27,751

Bonus Type Compound Reversionary Bonus Sum Assured on Death (at inception of the policy) (in Rs.) 38,27,751

Rider Details

Accidental Death & Dismemberment (ADD) Rider Premium

15 Pay 25 Accidental Death & Dismemberment (ADD) Rider Sum Assured (in Rs.) 38,00,000

Payment Term and Rider Term

Term Plus Rider Term NA Term Plus Rider Sum Assured (in Rs.) NA

Critical Illness and Disability Rider Term NA Critical Illness and Disability Rider Variant NA

Critical Illness and Disability Rider Sum Assured NA

Premium Summary

Base Plan Riders Total Installment Premium

Installment Premium without GST (in Rs.) 2,00,000 5,247 2,05,247

Installment Premium with first year GST (in Rs.) 2,09,000 6,191 2,15,191

Installment Premium with GST 2nd year onwards (in Rs.) 2,04,500 6,191 2,10,691

UIN: 104N091V06 Page 1 of 3

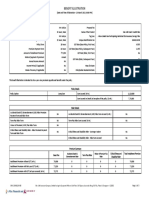

(Amount in Rupees)

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Reversionary Surrender Reversionary Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Bonus Benefit Bonus Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

1 2,00,000 - - - 38,27,751 - - - - - - - - - 38,27,751 38,27,751

2 2,00,000 - - 1,20,000 38,27,751 - 12,249 - 1,37,945 68,900 - 1,49,808 - - 38,27,751 38,27,751

3 2,00,000 - - 2,10,000 38,27,751 - 12,288 - 2,69,258 70,140 - 2,95,049 - - 38,27,751 38,27,751

4 2,00,000 - - 4,00,000 38,27,751 - 12,327 - 4,25,165 71,402 - 4,67,188 - - 38,27,751 38,27,751

5 2,00,000 - - 5,00,000 38,27,751 - 12,367 - 5,82,638 72,687 - 7,58,279 - - 38,27,751 38,27,751

6 2,00,000 - - 6,00,000 38,27,751 - 12,406 - 7,56,303 73,996 - 9,93,800 - - 38,27,751 38,27,751

7 2,00,000 - - 7,00,000 38,27,751 - 12,446 - 9,33,948 75,328 - 12,31,270 - - 38,27,751 38,27,751

8 2,00,000 - - 8,32,000 38,27,751 - 12,486 - 11,22,755 76,684 - 14,86,010 - - 38,27,751 38,27,751

9 2,00,000 - - 9,90,000 38,27,751 - 12,526 - 13,24,624 78,064 - 17,60,365 - - 38,27,751 38,27,751

10 2,00,000 - - 11,40,000 38,27,751 - 12,566 - 15,39,967 79,469 - 20,55,626 - - 38,27,751 38,27,751

11 2,00,000 - - 12,98,000 38,27,751 - 12,606 - 18,79,677 80,900 - 25,04,546 - - 38,27,751 38,27,751

12 2,00,000 - - 14,88,000 38,27,751 - 12,646 - 21,50,570 82,356 - 28,77,399 - - 38,27,751 38,27,751

13 2,00,000 - - 16,64,000 38,27,751 - 12,687 - 24,41,612 83,838 - 32,80,936 - - 38,27,751 38,27,751

14 2,00,000 - - 18,48,000 38,27,751 - 12,728 - 27,54,056 85,347 - 37,17,394 - - 38,27,751 38,27,751

15 2,00,000 - - 20,70,000 38,27,751 - 12,768 - 30,91,618 86,884 - 41,91,523 - - 38,27,751 38,27,751

16 - - 3,82,775 17,47,225 38,27,751 - 12,809 - 29,35,831 88,447 - 41,81,728 - - 38,27,751 38,27,751

17 - - 3,82,775 14,54,450 38,27,751 - 12,850 - 27,30,148 90,039 - 41,84,166 - - 38,27,751 38,27,751

18 - - 3,82,775 11,31,675 38,27,751 - 12,891 - 25,06,238 91,660 - 41,76,857 - - 38,27,751 38,27,751

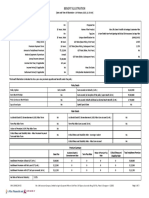

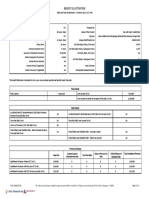

UIN: 104N091V06 Page 2 of 3

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Reversionary Surrender Reversionary Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Bonus Benefit Bonus Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

19 - - 3,82,775 8,08,900 38,27,751 - 12,932 - 22,63,148 93,310 - 41,58,602 - - 38,27,751 38,27,751

20 - - 3,82,775 5,16,124 38,27,751 - 12,974 - 20,00,054 94,990 - 41,28,161 - - 38,27,751 38,27,751

21 - - 3,82,775 1,93,349 38,27,751 - 13,015 - 17,16,159 96,699 - 40,84,597 - - 38,27,751 38,27,751

22 - - 3,82,775 - 38,27,751 - 13,057 - 14,10,567 98,440 - 40,26,396 - - 38,27,751 38,27,751

23 - - 3,82,775 - 38,27,751 - 13,099 - 10,82,109 1,00,212 - 39,51,942 - - 38,27,751 38,27,751

24 - - 3,82,775 - 38,27,751 - 13,141 - 7,07,189 1,02,016 - 38,57,164 - - 38,27,751 38,27,751

25 - - 3,82,775 - 38,27,751 - 13,183 - 3,05,048 1,03,852 - 36,69,070 3,05,048 36,69,070 38,27,751 38,27,751

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods and Service Tax. Refer Sales literature for explanation of terms used in

this illustration.

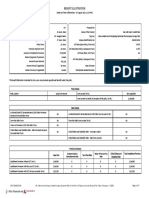

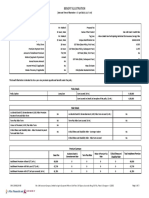

I, Mr. Sunil NARAYAN Pol (name), have explained the premiums, and benefits under the I, SARIKA VINOD MALI (name), having received the information with respect to the above,

product fully to the prospect / policyholder. have understood the above statement before entering into the contract.

Place:

Date: 4/9/24 Signature / OTP Confirmation Date / Thumb Impression / Date:4/9/24 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104N091V06 Page 3 of 3

93,34,3827751,R,205246.66,F,a93

You might also like

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharFrom EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3vivek0955158No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Illustration 5Document4 pagesIllustration 5logicloverbharatNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001722290821Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001722290821Sankalp SrivastavaNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- DownloadDocument3 pagesDownloadKiran JohnNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- SWP 12 Pay 15, 44 Age, 5 LacDocument2 pagesSWP 12 Pay 15, 44 Age, 5 LacShivaji ReddyNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3babunidoniNo ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- RaspDocument4 pagesRaspsamvil2007No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3Aman SaxenaNo ratings yet

- ILLUSTRATION OF BENEFITS FOR Bharti AXA Life Guaranteed Wealth ProDocument4 pagesILLUSTRATION OF BENEFITS FOR Bharti AXA Life Guaranteed Wealth ProThe Why MindNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlusVamsi Krishna BNo ratings yet

- Illustration Qb22tohnmq5mjDocument3 pagesIllustration Qb22tohnmq5mjMotivational QuotesNo ratings yet

- Oil Opportunities in SudanDocument16 pagesOil Opportunities in SudanEssam Eldin Metwally AhmedNo ratings yet

- Packing List PDFDocument1 pagePacking List PDFKatherine SalamancaNo ratings yet

- RMC 46-99Document7 pagesRMC 46-99mnyng100% (1)

- Acknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisDocument78 pagesAcknowledgement: MANISHA SIKKA - I Would Also Like To Express My Thanks To My Guide in ThisKuldeep BatraNo ratings yet

- Smart Home Lista de ProduseDocument292 pagesSmart Home Lista de ProduseNicolae Chiriac0% (1)

- Revenue Procedure 2014-11Document10 pagesRevenue Procedure 2014-11Leonard E Sienko JrNo ratings yet

- PaySlip 05 201911 5552Document1 pagePaySlip 05 201911 5552KumarNo ratings yet

- Feasibilities - Updated - BTS DropsDocument4 pagesFeasibilities - Updated - BTS DropsSunny SonkarNo ratings yet

- A Study On Green Supply Chain Management Practices Among Large Global CorporationsDocument13 pagesA Study On Green Supply Chain Management Practices Among Large Global Corporationstarda76No ratings yet

- IBDocument26 pagesIBKedar SonawaneNo ratings yet

- Final - APP Project Report Script 2017Document9 pagesFinal - APP Project Report Script 2017Jhe LoNo ratings yet

- What Is Zoning?Document6 pagesWhat Is Zoning?M-NCPPCNo ratings yet

- S03 - Chapter 5 Job Order Costing Without AnswersDocument2 pagesS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoNo ratings yet

- Chap014 Solution Manual Financial Institutions Management A Risk Management ApproachDocument19 pagesChap014 Solution Manual Financial Institutions Management A Risk Management ApproachFami FamzNo ratings yet

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastNo ratings yet

- Flex Parts BookDocument16 pagesFlex Parts BookrodolfoNo ratings yet

- Ifland Engineers, Inc.-Civil Engineers - RedactedDocument18 pagesIfland Engineers, Inc.-Civil Engineers - RedactedL. A. PatersonNo ratings yet

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Document103 pages2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- HPAS Prelims 2019 Test Series Free Mock Test PDFDocument39 pagesHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurNo ratings yet

- Part 1Document122 pagesPart 1Astha MalikNo ratings yet

- Business Economics - Question BankDocument4 pagesBusiness Economics - Question BankKinnari SinghNo ratings yet

- Annex 106179700020354Document2 pagesAnnex 106179700020354Santosh Yadav0% (1)

- Basice Micro - AssignmentDocument2 pagesBasice Micro - AssignmentRamiah Colene JaimeNo ratings yet

- StatementsDocument2 pagesStatementsFIRST FIRSNo ratings yet

- July 07THDocument16 pagesJuly 07THYashwanth yashuNo ratings yet

- Activity 1 - GlobalizationDocument4 pagesActivity 1 - GlobalizationIris leavesNo ratings yet

- InvoiceDocument1 pageInvoicesunil sharmaNo ratings yet

- Strategic Planning For The Oil and Gas IDocument17 pagesStrategic Planning For The Oil and Gas ISR Rao50% (2)

- QQy 5 N OKBej DP 2 U 8 MDocument4 pagesQQy 5 N OKBej DP 2 U 8 MAaditi yadavNo ratings yet

- Emergence of Entrepreneurial ClassDocument16 pagesEmergence of Entrepreneurial ClassKavya GuptaNo ratings yet