Professional Documents

Culture Documents

Bi 4299eekb

Uploaded by

chigiliseenaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bi 4299eekb

Uploaded by

chigiliseenaCopyright:

Available Formats

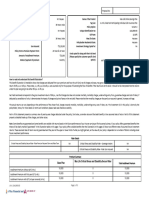

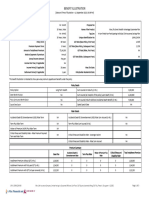

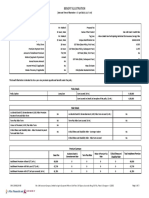

Proposal No:

Name of the Prospect/Policyholder: Mr. Chigili Name of the Product: Max Life Online Savings Plan

Tag Line: A Unit Linked Non Participating Individual Life Insurance Plan

Age & Gender: 22 Years, Male

Policy Option: Variant 1

Name of the Life Assured: Mr. Chigili Unique Identification No: 104L098V05

GST Rate: 18.00%

Age & Gender: 22 Years, Male Max Life State: Haryana

Policyholder Residential State: Haryana

Sum Assured: `3,60,000 Investment Strategy Opted for: NA

Policy Term & Premium Payment Term: 10 Years & 10 Years

Funds opted for along with their risk level

Amount of Installment Premium: `3,000 [Please specify the customer specific fund

Mode of payment of premium: Monthly option):

Midcap Momentum Index Fund (Risk Rating-Very High) :

100%

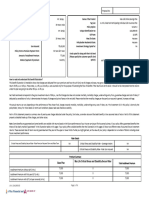

How to read and understand this benefit illustration?

This benefit illustration is intended to show what charges are deducted from your premiums and how the unit fund, net of charges and taxes, may grow over the years of the policy term if the fund earns a gross

return of 8% p.a. or 4% p.a. These rates, i.e., 8% p.a. and 4% p.a. are assumed only for the purpose of illustrating the flow of benefits if the returns are at this level. It should not be interpreted that the returns

under the plan are going to be either 8% p.a. or 4% p.a.

Net Yield mentioned corresponds to the gross investment return of 8% p.a., net of all charges but does not consider mortality, morbidity charges, underwriting extra, if any, guarantee charges and cost of riders, if

deducted by cancellation of units. It demonstrates the impact of charges exclusive of taxes on the net yield. Please note that the mortality charges per thousand sum assured in general, increases with age.

The actual returns can vary depending on the performance of the chosen fund, charges towards mortality, morbidity, underwriting extra, cost of riders, etc. The investment risk in this policy is borne by the

policyholder, hence, for more details on terms and conditions please read sales literature carefully.

Part A of this statement presents a summary view of year-by-year charges deducted under the policy, fund value, surrender value and the death benefit, at two assumed rates of return. Part B of this statement

presents a detailed break-up of the charges, and other values.

Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then

these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment

returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including actual

future investment performance.

Rider Details

Critical Illness and Disability-Secure Rider - Rider Premium Payment Term and Rider Term NA Critical Illness and Disability Rider - Coverage Variant NA

Critical Illness and Disability Rider - Rider Sum Assured NA

Premium Summary

Max Life Critical Illness and Disability-Secure Rider

Base Plan Total Installment Premium

Installment Premium without GST (in Rs.) 3,000 0 3,000

Installment Premium with first year GST (in Rs.) 3,000 0 3,000

Installment Premium with GST 2nd year onwards (in Rs.) 3,000 0 3,000

UIN: 104L098V05 Page 1 of 4

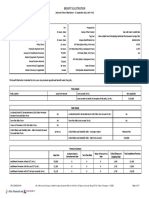

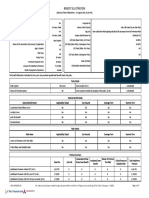

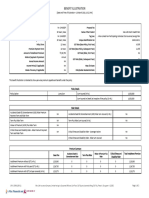

Part A

(Amount in Rupees.)

At 4% p.a. Gross Investment Return At 8% p.a. Gross Investment Return

Commission

Policy Annualized

payable to

Year Premium Mortality, Morbidity Fund at End Surrender Mortality, Fund at End Surrender

Other Charges* GST Death Benefit Other Charges* GST Death Benefit intermediary

Charges of Year Value Morbidity Charges of Year Value

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

1 36,000 255 246 90 36,174 32,634 3,60,000 255 249 91 36,926 33,386 3,60,000 -

2 36,000 234 707 169 73,266 70,906 3,60,000 233 730 173 76,246 73,886 3,60,000 -

3 36,000 208 1,181 250 1,11,305 1,09,535 3,60,000 204 1,243 260 1,18,121 1,16,351 3,60,000 -

4 36,000 180 1,666 332 1,50,315 1,49,135 3,60,000 173 1,788 353 1,62,718 1,61,538 3,60,000 -

5 36,000 151 2,164 417 1,90,324 1,90,324 3,60,000 138 2,369 451 2,10,215 2,10,215 3,60,000 -

6 36,000 118 2,674 503 2,31,358 2,31,358 3,60,000 99 2,988 556 2,60,803 2,60,803 3,60,000 -

7 36,000 86 3,198 591 2,73,443 2,73,443 3,60,000 58 3,647 667 3,14,684 3,14,684 3,60,000 -

8 36,000 53 3,735 682 3,16,606 3,16,606 3,60,000 15 4,349 785 3,72,070 3,72,070 3,72,070 -

9 36,000 17 4,286 775 3,60,878 3,60,878 3,60,878 - 5,096 917 4,33,153 4,33,153 4,33,153 -

10 36,000 - 4,851 873 4,06,262 4,06,262 4,06,262 - 5,891 1,060 4,98,150 4,98,150 4,98,150 -

*See Part B for details

IN THIS POLICY, THE INVESTMENT RISK IS BORNE BY THE POLICYHOLDER AND THE ABOVE INTEREST RATES ARE ONLY FOR ILLUSTRATIVE PURPOSE.

I ALSO UNDERSTAND THAT WHILST 100% OF MY FIRST YEAR PREMIUM WILL BE INVESTED IN UNIT LINKED INVESTMENT FUNDS THERE ARE CHARGES DURING THE FIRST POLICY

YEAR AS GIVEN IN THE BENEFIT ILLUSTRATION.

I, ……………………………………………. (name), have explained the premiums, charges and I, Chigili (name), having received the information with respect to the above, have understood the

benefits under the policy fully to the prospect / policyholder. above statement before entering into the contract.

Place:

Date: 3/21/24 Signature / OTP Confirmation Date / Thumb Impression / Date:3/21/24 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104L098V05 Page 2 of 4

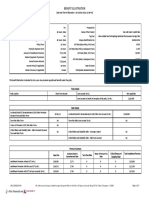

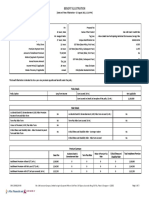

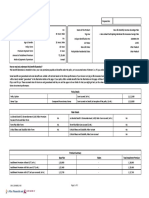

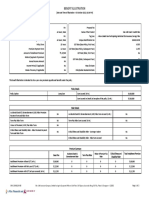

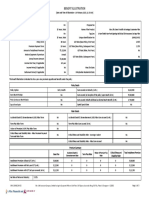

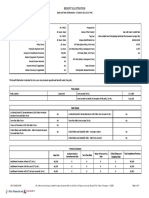

Part B

Gross Yield 8% p.a. Net Yield 6.65% Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

1 36,000 - 36,000 255 91 - - - - 36,972 249 36,926 33,386 3,60,000

2 36,000 - 36,000 233 173 - - - - 76,341 730 76,246 73,886 3,60,000

3 36,000 - 36,000 204 260 - - - - 1,18,267 1,243 1,18,121 1,16,351 3,60,000

4 36,000 - 36,000 173 353 - - - - 1,62,919 1,788 1,62,718 1,61,538 3,60,000

5 36,000 - 36,000 138 451 - - - - 2,10,475 2,369 2,10,215 2,10,215 3,60,000

6 36,000 - 36,000 99 556 - - - - 2,61,126 2,988 2,60,803 2,60,803 3,60,000

7 36,000 - 36,000 58 667 - - - - 3,15,073 3,647 3,14,684 3,14,684 3,60,000

8 36,000 - 36,000 15 785 - - - - 3,72,531 4,349 3,72,070 3,72,070 3,72,070

9 36,000 - 36,000 - 917 - - - - 4,33,689 5,096 4,33,153 4,33,153 4,33,153

10 36,000 - 36,000 - 1,060 - - - - 4,98,767 5,891 4,98,150 4,98,150 4,98,150

Gross Yield 4% p.a. Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

1 36,000 - 36,000 255 90 - - - - 36,219 246 36,174 32,634 3,60,000

2 36,000 - 36,000 234 169 - - - - 73,357 707 73,266 70,906 3,60,000

3 36,000 - 36,000 208 250 - - - - 1,11,443 1,181 1,11,305 1,09,535 3,60,000

4 36,000 - 36,000 180 332 - - - - 1,50,502 1,666 1,50,315 1,49,135 3,60,000

5 36,000 - 36,000 151 417 - - - - 1,90,559 2,164 1,90,324 1,90,324 3,60,000

6 36,000 - 36,000 118 503 - - - - 2,31,644 2,674 2,31,358 2,31,358 3,60,000

7 36,000 - 36,000 86 591 - - - - 2,73,782 3,198 2,73,443 2,73,443 3,60,000

8 36,000 - 36,000 53 682 - - - - 3,16,998 3,735 3,16,606 3,16,606 3,60,000

9 36,000 - 36,000 17 775 - - - - 3,61,325 4,286 3,60,878 3,60,878 3,60,878

10 36,000 - 36,000 - 873 - - - - 4,06,765 4,851 4,06,262 4,06,262 4,06,262

UIN: 104L098V05 Page 3 of 4

*There are no charges included in other charges. There are no additions included on Additions to the fund.

Notes: 1. Refer the sales literature for explanation of terms used in this illustration.

2. Fund management charge is based on the specific fund option(s) chosen.

3. In case rider charges are collected explicitly through collection of rider premium, and not by way of cancellation of units, then, such charges are not considered in this illustration. In other cases, rider charges are included in

other charges.

I, ……………………………………………. (name), have explained the premiums, charges and I, Chigili (name), having received the information with respect to the above, have understood the

benefits under the policy fully to the prospect / policyholder. above statement before entering into the contract.

Place:

Date: 3/21/24 Signature / OTP Confirmation Date / Thumb Impression / Date:3/21/24 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104L098V05 Page 4 of 4

You might also like

- Role of Integreted Marketing Communication in Life Insurence New PDFDocument99 pagesRole of Integreted Marketing Communication in Life Insurence New PDFSora Ghosh0% (1)

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- Bi 4258jcbuDocument5 pagesBi 4258jcburayees khanNo ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- UIN: 104L082V04 Page 1 of 4Document4 pagesUIN: 104L082V04 Page 1 of 4Indhug SharathNo ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- Max Life UlipDocument4 pagesMax Life Ulipjagdevwasson761No ratings yet

- Bi 0655kgueDocument9 pagesBi 0655kguevanselimNo ratings yet

- UIN: 104L098V03 Page 1 of 4Document4 pagesUIN: 104L098V03 Page 1 of 4sajeet sahNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Benefit IllustrationDocument4 pagesBenefit IllustrationAbhilash KumarNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001420020721Document6 pagesE SymbiosysFiles Generated OutputSIPDF 10200001420020721Sankalp SrivastavaNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- SWP 12 Pay 15, 44 Age, 5 LacDocument2 pagesSWP 12 Pay 15, 44 Age, 5 LacShivaji ReddyNo ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N118V05 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N118V05 Page 1 of 3Mahesh GediyaNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- UIN: 104N113V02 Page 1 of 4Document4 pagesUIN: 104N113V02 Page 1 of 4NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- Benefit Illustration: UIN: 104N118V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N118V02 Page 1 of 3Bhim Worf ShankarNo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001487090721Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001487090721Sankalp SrivastavaNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- Illustration 5Document4 pagesIllustration 5logicloverbharatNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- TNTNDocument4 pagesTNTNsamvil2007No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- Illustration - 2023-11-09T154448.741Document2 pagesIllustration - 2023-11-09T154448.741raamshankar11No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- Illustration - 2023-11-09T153903.144Document2 pagesIllustration - 2023-11-09T153903.144raamshankar11No ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Critical Illness: Your Companion in Critical TimesDocument2 pagesCritical Illness: Your Companion in Critical TimesAmal ..No ratings yet

- Downlaod BrochureDocument13 pagesDownlaod BrochureAkshay SaxenaNo ratings yet

- Unit 1 Banking and InsuranceDocument57 pagesUnit 1 Banking and InsuranceAkankshya Kaushik MishraNo ratings yet

- Even Earlier Protection: For Your Unborn BabyDocument21 pagesEven Earlier Protection: For Your Unborn BabyPARVEEN KAUR A/P MONHEN SINGH MoeNo ratings yet

- Kotak Assured Income Accelerator Product Presentation 21122021 (2) 1Document15 pagesKotak Assured Income Accelerator Product Presentation 21122021 (2) 1Vaibhav ShirodkarNo ratings yet

- SUN Fit and Well Advantage 20Document9 pagesSUN Fit and Well Advantage 20John Jefferson LegaspiNo ratings yet

- Pro-Fit - Internal Booklet (Print)Document24 pagesPro-Fit - Internal Booklet (Print)Meet GohilNo ratings yet

- Prime Senior ProspectusDocument18 pagesPrime Senior ProspectuslovingbabiluNo ratings yet

- Aditya Birla Sun Life Insurance Life Shield PlanDocument12 pagesAditya Birla Sun Life Insurance Life Shield PlanRitesh AgrawalNo ratings yet

- Benefits:: Participation in ProfitsDocument10 pagesBenefits:: Participation in Profitslakshman777No ratings yet

- Employee Spouse & Children Mediclaim Policy Presentation-2016-17Document24 pagesEmployee Spouse & Children Mediclaim Policy Presentation-2016-17SurendarNo ratings yet

- 2020 - Living Benefit Essentials - Canada LifeDocument5 pages2020 - Living Benefit Essentials - Canada LifeAaron PhuaNo ratings yet

- HDFC Life Giip BrochureDocument12 pagesHDFC Life Giip BrochureAkshay ChaudhryNo ratings yet

- A-Plus Beyond Critical Shield A-Plus Beyond Early Critical Shield Brochure 8thDocument21 pagesA-Plus Beyond Critical Shield A-Plus Beyond Early Critical Shield Brochure 8thNavin IndranNo ratings yet

- Insurance Plan HDFCDocument11 pagesInsurance Plan HDFCniranjan sahuNo ratings yet

- Mindef Mha Product SummaryDocument40 pagesMindef Mha Product SummaryJedrek TeoNo ratings yet

- TAL Accelerated Protection PDSDocument44 pagesTAL Accelerated Protection PDSLife Insurance AustraliaNo ratings yet

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Document4 pagesFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Charan ManchikatlaNo ratings yet

- Exam Result For English Chapter Mock Test 03Document6 pagesExam Result For English Chapter Mock Test 03Manu kaulNo ratings yet

- Ytp Product BrochureDocument41 pagesYtp Product BrochureTedtNo ratings yet

- MC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochureDocument8 pagesMC0620179935 HDFC SL YoungStar Super Premium - Retail - BrochuresapmayanNo ratings yet

- HDFC Life Youngstar Super PremiumDocument6 pagesHDFC Life Youngstar Super PremiumabbastceNo ratings yet

- 11 - Chapter 3Document42 pages11 - Chapter 3Nithyananda PatelNo ratings yet

- Max Life Smart Wealth Advantage Guarantee - Plan - ProspectusDocument34 pagesMax Life Smart Wealth Advantage Guarantee - Plan - ProspectusRajkamal CSNo ratings yet

- Syllabus Ic38 Insurance Agents (Health Insurance) : Section IDocument2 pagesSyllabus Ic38 Insurance Agents (Health Insurance) : Section IMajhar HussainNo ratings yet

- Famlove PrimerDocument7 pagesFamlove PrimerBernadette Hazel Valerie TuazonNo ratings yet

- A-SME-Platinum BrochureDocument62 pagesA-SME-Platinum BrochureAIA Sunnie YapNo ratings yet

- ICICI Pru Iprotect SmartDocument16 pagesICICI Pru Iprotect SmartVipul KumarNo ratings yet

- Tata AIA Life Insurance Non-Linked Comprehensive Health Rider (UIN: 110B031V02)Document28 pagesTata AIA Life Insurance Non-Linked Comprehensive Health Rider (UIN: 110B031V02)saravanaraj4uNo ratings yet