Professional Documents

Culture Documents

ReSA CPA Review Batch 44 Auditing Pre-Board Exam

Uploaded by

WesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ReSA CPA Review Batch 44 Auditing Pre-Board Exam

Uploaded by

WesCopyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 44 Oct 2022 CPALE 30 July 2022 11:45 AM - 02:45 PM

AUDITING FIRST PRE-BOARD EXAMINATION

INSTRUCTIONS: Select the correct answer for each of the questions. Mark only one

answer for each item by shading the box corresponding to the letter of your choice on

the answer sheet provided. STRICTLY NO ERASURES ALLOWED. Use pencil no. 2 only.

1. The single feature that most clearly distinguishes auditing, attestation, and

assurance is:

a. type of service.

b. training required to perform the service.

c. scope of services.

d. CPA’s approach to the service.

2. One of the elements of an assurance engagement is suitable criteria. As per PFAE,

which of the following least likely describes it?

a. Neutral and comprehensive c. Understandable and reliable

b. Complete and relevant d. Neutral and reliable

3. A practitioner is engaged to compile the financial statements of XYZ Corporation.

The practitioner should refer to which of the following sources for professional

guidance?

I. PSAs III. PSRSs

II. PSAEs IV. ISQM 1

a. I and II only c. II and IV only

b. II and III only d. III and IV only

4. To maximize independence, the director of internal auditing should report to the:

a. audit committee. c. chief financial officer.

b. controller. d. external auditor.

5. Of the following procedures, which is not considered part of “obtaining an

understanding of the client’s environment?”

a. Examining trade publications to gain a better understanding of the

client's industry.

b. Confirming customer accounts receivable for existence and valuation.

c. Touring the client's manufacturing and warehousing facilities to gain a

clearer understanding of operations.

d. Studying the internal controls over cash receipts and disbursements.

6. Which of the following is not a recommendation usually made following the

completion of an operational audit?

a. Economic and efficient use of resources

b. Effective achievement of business objectives

c. Attesting to the fairness of the financial statements

d. Compliance with company policies

7. An initial (first-time) audit requires more audit time to complete than a recurring

audit. One of the reasons for this is that:

a. new auditors are usually assigned to an initial audit.

b. predecessor auditors need to be consulted.

c. the client's business, industry, and internal controls are unfamiliar to

the auditor and need to be carefully studied.

d. a larger proportion of customer accounts receivable need to be confirmed

on an initial audit.

8. Which of the following observations, made during the preliminary survey of a local

department store's disbursement cycle, reflects a control strength?

a. Individual department managers use pre-numbered forms to order

merchandise from vendors.

b. The receiving department is given a copy of the purchase order complete

with a description of goods, quantity ordered, and extended price for all

merchandise ordered.

c. The treasurer's office prepares checks for suppliers based on vouchers

prepared by the accounts payable department.

d. Individual department managers are responsible for the movement of

merchandise from the receiving dock to storage or sales areas as

appropriate.

Page 1 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

9. The auditor is studying internal control policies and procedures within the sales,

shipping, and billing subset of the revenue cycle. Which of the following

conditions suggests a need for additional testing of controls?

a. Internal control is found to be weak with regard to shipping and billing.

b. Internal control over sales, billing, and shipping appears strong, but

80% of sales revenue is attributable to three major customers.

c. Internal control over billing and shipping is thought to be strong and

the auditor considers additional testing of selected controls will result

in a major reduction in substantive testing.

d. Internal control over the recording of sales is found to be weak and the

sales are evenly divided among a large number of customers.

10. In performing an attestation engagement, a CPA typically:

a. supplies litigation support services.

b. assesses control risk at a low level.

c. expresses a conclusion on an assertion about some type of subject matter.

d. provides management consulting advice.

11. Under the current PRC regulations, what is the minimum number of CPD credit units

that a registered professional accountant in commerce and industry should

accumulate for accreditation within the three-year period?

a. 120 credit units c. 15 credit units

b. 0 credit units d. 60 credit units

12. Evaluate the following statements:

Statement 1: The public practice of accountancy is confined to sole

proprietorship and partnership only. (True)

Statement 2: From among PRBOA members, the Chairman of the PRBOA is tasked

to appoint a vice-chairman for a term of three (3) years.

(False)

a. Only statement 1 is correct. c. Only statement 2 is correct.

b. Both statements are correct. d. Both statements are incorrect.

13. Evaluate the following statements:

Statement 1: As per PRBOA Resolution No. 45 Series of 2020 on refresher

course, the certificate of completion as evidenced by TOR issued

by qualified schools shall be valid for four (4) complete CPALE

from the date of completion. (False)

Statement 2: The BIR is represented in both AASC and FRSC. (False)

a. Only statement 1 is correct. c. Only statement 2 is correct.

b. Both statements are correct. d. Both statements are incorrect.

14. Evaluate the following statements:

Statement 1: Similar to PRBOA Chairman, the Chairman of COA is not allowed

to be re-appointed. (False)

Statement 2: The mission of COA is to ensure accountability for public

resources, promote transparency, and help improve government

operations, in partnership with stakeholders, for the benefit

of the Filipino people. (True)

a. Only statement 1 is correct. c. Only statement 2 is correct.

b. Both statements are correct. d. Both statements are incorrect.

15. If differences of opinion arise between the engagement partner and the engagement

quality control reviewer, then the engagement partner should:

a. follow the firm's policies and procedures for resolving differences of

opinion.

b. issue a disclaimer of opinion and report the issue to the entity's audit

committee.

c. discuss the differences of opinion with the entity's management and issue

a modified auditor's report.

d. withdraw from the engagement when permissible under law or regulation.

16. Which of the following correctly identifies the deadline for the completion of

audit documentation?

a. Within 45 days after the last day of fieldwork.

b. Within 90 days after the last day of fieldwork.

c. Within 60 days after the report release date.

d. Within 45 days after the report release date.

Page 2 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

17. Evaluate the following statements:

Statement 1: An engagement quality review is an objective evaluation of the

significant judgments made by the engagement team and the

conclusions reached thereon, performed by the engagement

quality reviewer and completed on or after the date of the

engagement report. (False)

Statement 2: The engagement quality reviewer may be a member of the

engagement team. (False)

a. Only statement 1 is correct. c. Only statement 2 is correct.

b. Both statements are correct. d. Both statements are incorrect.

18. An auditor is required to obtain a basic understanding of the client’s internal

control to plan the audit. The auditor may then decide to perform tests of

controls on all internal control procedures:

a. that would aid in preventing fraud.

b. documented in the flowchart.

c. considered to be weaknesses that might allow errors to enter the

accounting system.

d. considered to be strengths for which the auditor desires further reduction

in the assessed level of control risk.

19. In connection with an audit of financial statements, the auditor would ordinarily

use an engagement letter to:

a. mutually agree upon contingent fees between the company and the auditor.

b. assert that a properly planned audit will detect and identify all material

misstatements.

c. specify any arrangements concerning the involvement of the company's

internal auditors on the audit.

d. determine which of the company's financial statement notes will be

compiled by the auditor during the audit.

20. Before accepting an engagement to audit a new client, a CPA is required to obtain:

a. an understanding of the prospective client's industry and business.

b. the prospective client's signature to a written engagement letter.

c. the prospective client's consent to make inquiries of the predecessor

auditor, if any.

d. an assessment of fraud risk factors likely to cause material

misstatements.

21. Which of the following best describes the purpose of the engagement letter?

a. by clearly defining the nature of the engagement, the engagement letter

helps to avoid and resolve misunderstandings between CPA and client

regarding the precise nature of the work to be performed and the type of

report to be issued.

b. the engagement letter relieves the auditor of some responsibility for the

exercise of due care.

c. the engagement letter should be signed by both the client and the CPA and

should be used only for independent audits.

d. the engagement letter conveys to management the detailed steps to be

applied in the audit process.

22. The pre-engagement activities of an audit engagement for a public accounting firm

do not include:

a. evaluating the public accounting firm's independence with regard to the

audit engagement.

b. obtaining predecessor auditor’s audit documentation.

c. obtaining an engagement letter.

d. ensuring that there are sufficient firm resources to complete the

engagement on a timely basis.

23. This year, Bethel Enterprises engaged a new auditor who must

a. attempt to communicate with the predecessor auditor before accepting the

engagement.

b. review the predecessor auditor's audit documentation if the audit is to

be in accordance with GAAS.

c. seek the SEC's permission to accept the engagement if Bethel is publicly

owned.

d. reject the engagement if the change in auditors resulted from a dispute

with the predecessor.

Page 3 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

24. Prior to beginning the fieldwork on a new audit engagement in which the audit

team does not possess expertise in the industry in which the client operates,

the audit team should

a. reduce audit risk by lowering the preliminary levels of materiality.

b. design special substantive tests to compensate for the lack of industry

expertise

c. engage financial experts familiar with the nature of the industry.

d. obtain knowledge of matters that relate to the nature of the entity's

business.

25. Which of the following is not a way in which auditors use the concept of overall

materiality?

a. As a guide to planning the audit

b. As a guide to the evaluation of evidence

c. As a guide for making decisions about the audit report

d. As a guide for assessing control risk

26. This term refers to inherent risk factor which arises from inherent limitations

in the ability to prepare required information in an objective manner, due to

limitations in the availability of knowledge or information.

a. Change c. Subjectivity

b. Bias d. Constraint

27. Evaluate the following statements:

Statement 1: The objective of the auditor is to identify and assess the risks

of material misstatement, whether due to fraud or error, at the

financial statement and assertion levels thereby providing a

basis for designing and implementing responses to the assessed

risks of material misstatement. (True)

Statement 2: When the auditor intends to use information obtained from the

auditor’s previous experience with the entity and from audit

procedures performed in previous audits, the auditor shall

evaluate whether such information remains relevant and reliable

as audit evidence for the current audit. (True)

a. Only statement 1 is correct. c. Only statement 2 is correct.

b. Both statements are correct. d. Both statements are incorrect.

28. Which of the following statements is most correct concerning audit risk?

a. Audit risk can be eliminated by having the correct audit procedures.

b. Audit risk cannot be quantified with certainty.

c. Audit risk is the same for all audit client in the same industry.

d. Audit risk can be quantified with a reasonable degree of certainty.

29. Which of the following is the best way to compensate for the lack of adequate

segregation of duties in a small organization?

a. Disclosing lack of segregation of duties to the external auditors during

the annual review

b. Replacing personnel every three or four years

c. Requiring accountants to pass a yearly background check

d. Allowing for greater management involvement and oversight of incompatible

activities

30. Which of the following is usually considered a monitoring activity?

a. segregating duties of employees

b. processing entity transactions

c. analyzing new information systems

d. using information from customer complaints

31. Which of the following least likely identifies an inherent limitation to internal

control?

a. breakdowns in internal control because of employee mistakes

b. collusion involving two or more employees

c. faulty decision making by employees

d. an override of internal controls by a low-level employee

32. Which of the following factors would an auditor most likely consider in evaluating

the control environment for an audit client?

a. Monthly bank reconciliations with supervisor sign-offs.

b. The number of employees in each department.

c. The ethical values demonstrated by management.

d. Organizational structure used for tax purposes.

Page 4 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

33. Of the following statements about internal controls, which one is least likely

to be correct?

a. Transactions must be properly authorized before such transactions are

processed.

b. No one person should be responsible for the custodial responsibility and

the recording responsibility for an asset.

c. Control procedures reasonably ensure that collusion among employees

cannot occur.

d. Because of the cost-benefit relationship, a client may apply controls on

a test basis.

34. In response to an increased level of assessed risk of material misstatement, an

auditor would generally:

a. not make changes to the nature, timing, or extent of further audit

procedures.

b. increase the emphasis on professional skepticism when gathering and

evaluating audit evidence with the audit team.

c. perform more substantive audit procedures at an interim date instead of

at period end.

d. perform additional tests of controls at an interim date to eliminate the

need for substantive tests at period end.

35. Which of the following questions would be inappropriate for an auditor to ask a

client when exhibiting an appropriate level of professional skepticism while

completing an audit procedure related to the internal control system?

a. What can go wrong in this process?

b. Which of your employees is a fraudster?

c. What else is important to know about this process?

d. What happens when a key employees goes on vacation?

36. In relation to you audit of England Corp’s cash balances, you traced bank

transfers for the last part of the audit period and first part of the subsequent

period. The audit objective in rendering this procedure is to detect whether

___________. This is relevant to gather evidence regarding __________ assertion

over cash.

a. the cash receipts journal was held open for a few days after the year

end; existence.

b. the last checks recorded before the year and were actually mailed by the

year end; completeness.

c. cash balances were overstated because of kiting; existence.

d. any unusual payments to or receipts from related parties occurred;

completeness.

PROBLEM 1:

In relation to your audit of cash balances of your client, London Corp. for the period

ended December 31, 2020, the client’s accountant provided the following information

from its bank transfer schedule. Further investigation revealed that checks are dated

and issued on December 30, 2020.

Disbursement Date Receipt Date

Check Bank Accounts Per Per Per Per

No. From To Books Bank Books Bank

101 FEB TC PNB Dec. 30 Jan. 4 Dec. 30 Jan. 3

202 PCIB MBTC Jan. 3 Jan. 2 Dec. 30 Dec. 31

303 PNB CBC Dec. 31 Jan. 3 Jan. 2 Jan. 2

404 MBTC BPI Jan. 2 Jan. 2 Jan. 2 Dec. 31

37. Which of the following checks might indicate kiting?

a. #101 and #303.

b. #202 and #404.

c. #101 and #404.

d. #202 and #303.

38. Which of the following checks overstates the overall cash balance per books at

December 31, 2021?

a. #101 and #202.

b. #202 only

c. #202 and #303.

d. #303 only.

Page 5 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

39. Which specific Bank accounts are overstated as per your audit?

a. PCIB and MBTC

b. CBC and BPI

c. MBTC and BPI

d. CBC and MBTC

PROBLEM 2:

Your cash count of the petty cash fund having an imprest balance of P30,000, of Equinox

Corp. in line with your audit of its financial statements for the period ended December

31, 2021 resulted to the following information:

Cash count date: January 4, 2022

Currencies and coins P12,100

Petty cash expense vouchers:

Date Particulars

12/26 Transportation 1,200

12/27 Office repairs 900

12/29 Office supplies 1,300

1/2 Gasoline and oil 600

1/3 Representation expenses 1,300

Checks:

Date Maker

12/20 Ace Corp., customer 8,400

12/26 June Cook, officer 4,500

12/27 Charlie Inc., customer 12,000

12/28 Equinox Corp. payable to the custodian 9,000

12/30 Beta Corp., customer* 6,000

*Marked NSF by the bank

Audit note: The undeposited collection which included cash and check collections, was

also under the custody of the petty cash custodian. Investigation revealed that the

total undeposited collections as of the count date per records was at P22,500.

Required:

40. What is the petty cash shortage or overage as a result of your cash count?

a. 4,800

b. 2,100

c. 1,200

d. 800

41. What is the adjusted balance of the petty cash fund as of December 31, 2021?

a. 26,600

b. 24,400

c. 22,200

d. 25,400

PROBLEM 3:

Information regarding Shogun Corp. cash balance details about transactions for the

month of December revealed the following information:

A. Undeposited collections and outstanding checks by the end of November were at

P216,500 and P129,800, respectively. These items cleared the bank in December.

B. The bank erroneously credited Shogun Corp.’s account in November for a check

deposit of Showgone Co. amounting to P89,000. This was corrected by the bank in

December.

C. Proceeds of a bank loan in November amounting to P200,000 appeared as one of

November bank credits not yet recorded by the company by the end of November.

Bank service charges and customer NSF check amounting to P2,100 and P25,500 were

among the November bank debits. Book reconciling items were recorded in the books

in December.

D. A November P125,000 disbursement was recorded in the books at P12,500. The correct

amount which cleared the bank in November was at P125,000. The error was

discovered and corrected in the books in December.

E. Depositor’s note receivable collected by the bank in December on the company’s

behalf amounted to P140,000. Bank loan and interest payments automatically

charged against the company’s account in December amounted to P21,000 (the amount

includes P1,000 interest).

Page 6 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

F. The bank erroneously charged the company P12,000 for a December disbursement

check of another company. This error was discovered and corrected by the bank in

December.

G. A customer collection check amounting to P85,000 was recorded in the books in

December at P58,000. The error is yet to be corrected by the company as at month

end.

H. A December customer NSF check amounting to P5,000 was returned and redeposited

in December. As this will have no effect on the cash balance, the company did

not record the return and redeposit anymore in its books.

I. The December unadjusted balance per bank statement was at P994,200 while the

December unadjusted balance per the general ledger was at P980,000.

J. Total Book debits and credits amounted to P8,956,000 and P8,735,000,

respectively. Total Bank debits and credits amounted to P8,658,000 and

P8,831,000, respectively.

Required:

42. What is the correct undeposited collection as at the end of December?

a. 325,500

b. 320,500

c. 313,500

d. 298,500

43. What is the correct outstanding checks as at the end of December?

a. 188,700

b. 181,700

c. 193,700

d. 195,800

44. What is the correct cash balance as of November 30?

a. 821,200

b. 759,000

c. 907,900

d. 818,900

45. Lee, CPA is engaged in audit of Snort Internet Corp., an internet provider which

services a rural community. The receivable balances are relatively small, and

customers are billed monthly. As a result of his evaluation of internal control,

he concluded that the controls of interest are effective. To determine the

validity of accounts receivable balances at the balance sheet date, Lee, CPA

would most likely _____________, this is relevant to his audit objective to

gather evidence regarding __________ assertion over receivables.

a. Send positive confirmation requests; valuation

b. Send negative confirmation requests; existence

c. Examine evidence of subsequent cash receipts instead of sending

confirmation requests; valuation

d. Use statistical sampling instead of sending confirmation request;

existence

46. Returns of positive confirmation requests for accounts receivable were very poor.

As an alternative procedure, the auditor decided to check subsequent collections.

The auditor had satisfied himself that the client satisfactorily listed the

customer name next to each check listed on the deposit slip; hence, he decided

that for each customer for which a confirmation was not received that he would

add all amounts shown for that customer on each validated deposit slip for the

two months following the balance sheet date. The major fault in the auditor’s

procedure is that”:

a. Checking of subsequent collection is not an accepted alternative auditing

procedure for confirmation of accounts receivable

b. By looking only at the deposit slip the auditor would not know if the

payments was for the receivable at the balance sheet date or a subsequent

transaction

c. The deposit slip would not be received directly by the auditor as a

confirmation would be

d. A customer may not have made a payment during the two-month period.

Page 7 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

47. As a result of your understanding of the client internal control over its Order

to Cash Business Process (Formerly, Revenue and Receipt Cycle), you have noted

that there might be possible instances of unbilled deliveries to customers since

the billing department is not keen in monitoring the prenumbering of the delivery

receipt in preparing sales invoices to be sent to customers. An effective

procedure to test for these suspected unbilled shipments is to _________. This

is to support the financial statement assertion of __________ over sales and

receivables.

a. Vouch sales journal entries to shipping documents; existence/occurrence.

b. Trace shipping documents to the sales journal; completeness.

c. Vouch sales journal entries to the accounts receivable subsidiary ledger;

existence/occurrence.

d. Trace sales journal to the general ledger sales account; completeness.

PROBLEM 4:

The following receivable reconciliation was provided by Overlord Corp.’s accountant as

part of your examination of its receivable account balance as of December 31, 2021:

Balance per General Ledger 2,940,000

SI dated December 20 for goods delivered on December 20 FOB (29,000)

Destination

SI dated December 30 for goods delivered on December 31 FOB

Shipping Point, goods still in transit as of December 31 (52,000)

SI dated October 11, where customer returned goods as there

were errors in the items delivered. Investigation revealed

that credit memos were approved and recorded only in January 25,000

the following year.

OR dated December 29 for a customer collection check dated 92,000

January 2, 2022

OR dated December 30 for a customer collection check dated 85,000

December 30, 2021

Receivables deemed worthless (SI dated April 20) 24,000

Receivables deemed worthless (SI dated September 20) (30,000)

Balance per Subsidiary Ledger 3,055,000

*SI = Sales Invoice

OR = Official Receipt

There were no other write-off of receivables during the year. A P31,400 previously

written off account was recovered during the year. The January 1, 2021 balance of the

allowance for bad debt amounted to P154,200. An aging of accounts receivable schedule

along with the managements estimate of collectability appears below:

Age Amount % of

collectability

1-60 days 916,500 99%

61-120 days 1,222,000 95%

121-180 days 611,000 90%

More than 180 305,500 80%

days

Required:

48. What is the adjusted accounts receivable balance gross of any allowances?

a. 3,032,000

b. 2,972,000

c. 3,002,000

d. 3,054,000

49. What is the correct amortized cost of accounts receivable as of December 31?

a. 2,800,625

b. 2,815,125

c. 2,813,225

d. 2,815,625

50. What is the correct bad debt expense for the year?

a. 54,775

b. 24,775

c. 30,775

d. 78,775

Page 8 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

PROBLEM 5:

You were assigned to audit the accounts receivable balance of your audit client, Orochi

Corp., for the period ended December 31, 2021. The balance of the accounts receivable

per the general ledger and the corresponding year-end allowance for bad debts amounted

to P2,910,000 and P215,200, respectively. The accountant of the client furnished you

the following receivable aging schedule based on its subsidiary ledger:

Age Amount % uncollectible

Current (1-60 days) 1,178,400 -

1-60 days past due 736,500 5%

61-120 days past due 589,200 10%

More than 120 days 441,900 25%

past due

The following are the exceptions noted as a result of you’re the confirmation letters

sent to selected customers:

Customer Amount Customer’s Reply Remarks

Moderna Co. P125,000 Amount is ok. We will The amount is the selling

remit the amount due price 50 units of products

(less 10% agreed delivered on consignment.

commission) upon selling The company recorded the

the goods. As of delivery in December as

December 31, only 20 usual sales, debiting

units had been sold. receivables and crediting

sales at the said sales

price.

Blazing 210,000 The amount is for an The amount was overlooked

Corp. invoice dated October when preparing the sales

11. The agreed purchase invoice. The approved

order price per unit is price should have been

at P2,500. The invoice P2,500.

price per unit was

P3,000.

Venom Inc. 120,000 The invoice dated August Credit Memo number 211

20 amounting to P40,000 covering the said return

should have been offset was appropriately recorded

by a return of in the general books but

merchandise in were overlooked in posting

September. the transactions to the

subsidiary ledgers.

Saber Corp. 98,000 No reply for 2 sets of Management agreed to

confirmation letters write-off these

receivables as worthless.

The account is more than

120 days past due.

Required:

51. What is the unlocated difference between GL and SL as a result of your audit?

a. None

b. 4,000

c. 36,000

d. 44,000

52. What is the correct amortized cost of accounts receivable as of December 31?

a. 2,512,970

b. 2,573,030

c. 2,517,030

d. 2,547,970

53. What is the correct bad debt expense for the year?

a. 39,230

b. 97,970

c. 93.230

d. 58,770

Page 9 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

54. When is the best timing to render observation of physical count of inventories

in the perspective of an external audit of financial statements audit?

a. Several times during the year under audit.

b. 1 to 2 weeks before the balance sheet date.

c. At the balance sheet date.

d. 1 to 2 weeks after the balance sheet date.

55. Which of the following is the best audit procedure for the discovery of damaged

merchandise in a client’s ending inventory and which financial statements

assertion over inventories would be affected by such discovery?

a. Compare the physical quantities of slow-moving items with

corresponding quantities in the prior-year; Valuation

b. Observe merchandise and raw materials during the client’s physical

inventory taking; Valuation

c. Review the management’s inventory representation letter for accuracy;

completeness

d. Test overall fairness of inventory values by comparing the company’s

turnover ratio with the industry average; existence

PROBLEM 6:

In line with your audit of Zodiac Distributions Inc.’s inventories as of the period

ended December 31, 2021, you decided to render cut-off procedures on its recorded sales

and purchases. The physical count of the goods which resulted to P312,000, was rendered

on December 29, 2021. As a result all goods delivered on or before December 29 were

excluded from the count and all goods received on or before December 29 were included

in the physical count.

A. PURCHASES CUT-OFF

DECEMBER PURCHASE JOURNAL ENTRIES

Receiving Receipt Date Amount Remarks

Report #

21291 Dec. 26 P5,300 FOB Shipping point

21292 Dec. 27 4,600 FOB Destination – Received from consignor

21293 Dec. 28 8,000 FOB Buyer

21295 Dec. 29 7,200 Free Alongside the Vessel

21296 Dec. 30 5,500 FOB Destination

JANUARY PURCHASE JOURNAL ENTRIES

Receiving Receipt Date Amount Remarks

Report #

21297 Dec. 31 P5,300 FOB Shipping point

21298 Jan. 2 4,600 FOB Destination – Goods in-transit as of Dec. 31

21299 Jan. 2 8,000 FOB Seller – Goods in transit as of Dec. 31

21300 Jan. 3 5,500 Purchased under “Bill and Hold” Agreement

executed in December

Note that receiving report number 21294 were for goods costing P6,200 received on

December 29. The sales invoice of the suppliers is yet to be received by the client,

thus it yet to be recorded in the purchases journal.

B. SALES CUT-OFF

DECEMBER SALES JOURNAL ENTRIES

Sales Delivery Amount Remarks

Invoice # Date

52284 Dec. 27 P18,000 FOB Shipping point

52285 Dec. 28 12,000 FOB Destination – Goods still in-transit as of Dec. 31

52286 Dec. 29 15,000 Goods delivered on a “Sale with repurchase agreement”

52287 Dec. 30 16,000 Free Alongside the Vessel – Goods still in-transit as

of Dec. 31

52288 Dec. 30 20,000 FOB Destination

Page 10 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

JANUARY SALES JOURNAL ENTRIES

Sales Delivery Amount Remarks

Invoice # Date

52289 Dec. 31 P10,000 FOB Buyer – Goods still in-transit as of Dec. 31

52290 Dec. 31 8,000 FOB Shipping Point – Goods still in-transit as of

Dec. 31

52291 Dec. 31 14,000 FOB Seller – Goods still in transit as of Dec. 31

52292 Jan. 3 18,000 Sold under “Bill and Hold” Agreement executed in

December

Note that Sales Invoice number 52286 covering a sale with repurchase agreement requires

the company to repurchase the goods at the same selling price three months later, plus

10% interest on the amount. Gross profit based on all sales is at 40%.

Required:

56. What is the adjusted balance of the inventories as a result of your audit?

a. 302,300

b. 308,500

c. 296,800

d. 297,000

57. What is the net adjustment to accounts payable?

a. 20,400 credit

b. 25,000 credit

c. 14,200 credit

d. 4,600 debit

58. What is the net adjustment to accounts receivable?

a. 1,000 debit

b. 5,000 credit

c. 13,000 debit

d. 1,000 credit

PROBLEM 7:

Rockwell Co. maintains records under the periodic method and rendered physical count

of inventories on December 31, 2021. Only goods that are physically with the company

on the said count date were included in the physical count which amounted to P345,000.

This was then set-up by the client as part of its closing entries at year-end. As part

of your substantive analytical procedures however, you gathered the following

information:

December 31, 2020 Inventories (traced to prior year’s P390,000

working papers)

Payments to suppliers of inventories for the year 3,945,000

Purchase discounts taken on purchases 210,000

Purchase returns and allowances on purchases (all done 385,000

before payments)

Normal spoilages (at sales price) 200,000

Abnormal spoilages (at cost) 120,000

Sales for the year 5,620,000

Sales discounts (taken by customers) 450,000

Special discounts granted to employees and officers 220,000

Sales returns 300,000

Sales allowance 124,000

Accounts payable, December 31, 2020 275,000

Accounts receivable, December 31, 2020 320,000

Accounts payable, December 31, 2021 310,000

Accounts receivable, December 31, 2021 254,000

Audit notes: Sales included the delivery to a customer in Baguio City on December 30,

2021. The goods which were invoiced at P180,000 were still in-transit as of the balance

sheet date. Freight term is FOB Baguio City.

59. What is the accrual basis gross purchases for the year?

a. 3,980,000

b. 4,190,000

c. 4,365,000

d. 4,575,000

Page 11 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

60. Assuming Gross Profit is 30% based on sales, what is the estimated ending

inventory as a result of your audit?

a. 498,000

b. 232,000

c. 512,000

d. 358,000

61. Assuming Gross profit is 60% based on cost, what is the estimated inventory

shortage as a result of your audit?

a. 304,000

b. 113,000

c. 317,500

d. 457,500

62. In testing the reasonableness of the client’s depreciation charges under

straight-line method in line with your audit of the clients property, plant and

equipment, which of the following might indicate that depreciation in the current

and prior years might have been understated?

a. The client uses too long of a useful life in depreciating its assets

as indicated by the many fully depreciated assets still in records

and are still being used.

b. The client uses too short of a useful life in depreciating its assets

as indicated by its recurring experience of recognizing excessive

retirement losses on its assets.

c. Similar company within the same industry utilizing relatively the same

set of equipment uses the diminishing method of depreciation.

d. The client uses too long of a useful life in depreciating its assets

as indicated by its recurring experience of recognizing excessive

retirement losses on its assets.

63. You were assigned to audit the property, plant and equipment of Huskies

Incorporated for the year ended December 31, 2022. Which of the following is the

least audit objective when auditing manufacturing equipment and the related

depreciation and accumulated depreciation?

a. To determine whether costs and related depreciation for all significant

retirements, abandonments, and disposals of property have been properly

recorded

b. To determine whether the balances in the property accounts, including

the amounts carried forward from the preceding year, are properly stated

c. To determine whether additions represent properties that are installed,

constructed or rented

d. To determine whether the balances in accumulated depreciation accounts

are reasonable, considering expected useful lives of property units and

possible net salvage values

64. The auditor’s procedure to search for unrecorded retirement of property, plant

and equipment is consistent with the auditor’s objective of auditing which

financial statement assertion over PPE?

a. Existence

b. Completeness

c. Valuation

d. Rights and Obligation

PROBLEM 8:

You were assigned to audit the Property, plant and equipment account of your continuing

audit client Chances Corp. for the period ended December 31, 2021. The following is a

PPE schedule lifted from the prior-year working paper:

December 31, 2020 balances Debit Credit

Land 5,000,000

Office Building 4,200,000

Accumulated depreciation – OB 1,444,380

Office Equipment 2,500,000

Accumulated depreciation – OE 1,250,000

Automotive Equipment 2,000,000

Accumulated depreciation - AE 1,112,727

Page 12 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

All assets were acquired at the inception of operations at the beginning of 2017 and

are being depreciated through the following policies:

Office Building – Double-declining balance over 20 years (10% salvage value

based on cost)

Office Equipment – Straight-line method over 8 years (no salvage value)

Automotive Equipment – SYD over 10 years (10% salvage value based on cost)

Transactions for 2021 were as follows:

a. A left wing on the Office Building was constructed and completed in early January

of 2021. The construction costed a total of P800,000.

b. On September 30, the company traded in a new automotive equipment with a cash

price of P1.5M for one of its old automotive equipment with an original cost of

P800,000. The trade-in value agreed upon on the old automotive equipment was at

P320,000. The company paid the difference in cash.

c. On November 1, a piece of office equipment was sold for P450,000. The office

equipment had an original cost of P1.2M. On December 1, a replacement office

equipment was acquired on installment basis. A P500,000 down-payment was made

plus a P1.5M note payable in three equal installments starting December 1, 2022.

The interest rate appropriate for this transaction was ascertained at 10%.

Installation and commissioning cost were incurred at P29,316. Estimated

decommissioning cost upon retirement was also estimated at P101,302.

(Note: Present Value Factor is rounded up to 6-decimal places.)

Required:

65. What is the gain or loss on trade- in on September 30?

a. 20,000

b. 24,000

c. 34,909

d. 15,273

66. What is the gain or loss on the disposal of the office equipment on November 1?

a. 150,000

b. 125,000

c. 25,000

d. 75,000

67. What is the total depreciation expense for the year?

a. 920,111

b. 901,153

c. 900,111

d. 931,183

PROBLEM 9:

Your investigation of Samsung Corp. intangibles transactions for 2021 revealed the

following information:

a. Samsung Corp.’s reported a Trademark at P520,000 at the end of 2021 after an

amortization for the year at P130,000. The company spent P120,000 legal fees in

successfully defending a trademark at the beginning of 2018. The legal fees was

capitalized in 2018 and was amortized over the remaining life of the trademark

at the beginning of 2018 which was 8 years. By the end of the year the company

estimates that the expected net cashflows from the Trademark’s continued use is

at P151,426 The prevailing market rate of interest at the end of the year is

10%.

b. A franchise agreement was entered with Sharp Corp. at the beginning of 2020. The

initial franchise fee was at P5M. The amount was paid P1M down-payment with a 4M

note payable in five equal installments starting December 31, 2020. The franchise

agreement, which was for an indefinite term, also calls for a continuing franchise

fee set at 5% of the company’s annual revenue in excess of P4M. The company’s

actual revenue in 2020 and 2021 were at P4.5M and P5.2M, respectively. Net cash

flows from the franchise continued use has been estimated at P420,000 annually.

The prevailing market rate of interest at the end of 2019, 2020 and 2021 were at

12%, 11% and 10%, respectively.

(Note: Present Value Factor is rounded up to 6-decimal places.)

Page 13 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

Required:

68. What is the correct carrying value of the trademark as of December 31, 2021?

a. 520,000

b. 480,000

c. 460,000

d. 450,000

69. What is the total expense related to the franchise to be recognized in 2020?

a. 411,698

b. 346,059

c. 436,698

d. 331,183

70. What is the correct carrying value of the franchise as of December 31, 2021?

a. 3,818,182

b. 4,200,000

c. 4,000,000

d. 3,883,821

- END of EXAMINATION -

ANSWERS & SOLUTIONS/CLARIFICATIONS

1 C 26 C 51 B

2 A 27 B 52 C

3 D 28 B 53 D

4 A 29 D 54 C

5 B 30 D 55 B

6 C 31 D 56 A

7 C 32 C 57 A

8 C 33 C 58 C

9 C 34 B 59 D

10 C 35 B 60 D

11 B 36 C 61 C

12 A 37 B 62 D

13 D 38 B 63 C

14 C 39 A 64 A

15 A 40 C 65 B

16 C 41 D 66 C

17 D 42 A 67 A

18 D 43 C 68 C

19 C 44 D 69 C

20 C 45 B 70 D

21 A 46 B

22 B 47 B

23 A 48 C

24 D 49 D

25 D 50 A

36. Ans. C.

PROBLEM 1: LONDON CORP.

37. Ans. B.

38. Ans. B.

39. Ans. A.

PROBLEM 2: EQUINOX CORP.

40. Ans. C.

Accountability:

Petty Cash Fund, imprest balance 30,000

Undeposited collections, per records 22,500

Total 52,500

Page 14 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

Valid supports

Cash items:

Currencies and coins 12,100

Replenishment check 9,000

Accomodated check 4,500

Customer collection check (not NSF only) 20,400

Non cash items (as of count date):

Petty cash expense voucher 5,300 51,300

Petty cash shortage 1,200

41. Ans. D.

Adjusting entries as of Decmeber 31:

Expenses (up to 12/31 only) 3,400

Petty cash shortage 1,200

Petty cash fund 4,600

Imprest balance 30,000

Adjustment (4,600)

Petty cash fund, adjusted balance 25,400

Alternative Solution:

Cash items as of January 4 (count date)

Currencies and coins 12,100

Replenishment check 9,000

Accomodated check 4,500

Customer collection check (not NSF only) 20,400 46,000

Add: Petty cash vouchers paid after 12/31 1,900

Less: Undeposted collections (22,500)

Cash items as of December 31 from the Petty Cash Fund 25,400

PROBLEM 3: SHOGUN CORP.

42. Ans. A.

43. Ans. C.

44. Ans. D.

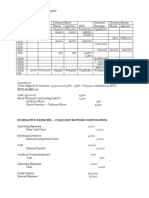

PROOF OF CASH

November Receipts Disbursements December

Unadjusted balances per bank 821,200 8,831,000 8,658,000 994,200

Undeposited collection - Nov. 216,500 (216,500)

Undeposited collection - Dec. 325,500 325,500

Outstanding check - Nov. (129,800) (129,800)

Outstanding check - Dec. 193,700 (193,700)

Error in Nov.; Corrected in Dec. (89,000) (89,000)

Error in Dec.; Corrected in Dec. (12,000) (12,000)

818,900 8,928,000 8,620,900 1,126,000

Unadjusted balances per books 759,000 8,956,000 8,735,000 980,000

Unrecorded bank credit - Nov. (Loan Proceeds) 200,000 (200,000)

Unrecorded bank credit - Dec. (Note collection) 140,000 140,000

Unrecorded bank debit - Nov. (Bank charges) (2,100) (2,100)

Unrecorded bank debit - Nov. (NSF Check) (25,500) (25,500)

Unrecorded bank debit - Dec. (Loan and 21,000 (21,000)

interest payments)

Error in Nov., Corrected in Dec. (112,500) (112,500)

Error in Dec., Not yet corrected 27,000 27,000

NSF Check - Returned and Redeposited in Dec. 5,000 5,000

818,900 8,928,000 8,620,900 1,126,000

Page 15 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

45. Ans. B.

46. Ans. B.

47. Ans. B.

PROBLEM 4: OVERLORD CORP.

48. Ans. C.

49. Ans. D.

More

General Subsidiary 1-60 days 61-120 121-180 than 180

Ledger Ledger days days days

Unadjusted balances 2,940,000 3,055,000 916,500 1,222,000 611,000 305,500

SI dated Dec. 20 VALID SALE 29,000 29,000

SI dated Dec. 30 VALID SALE 52,000 52,000

SI dated Oct. 11 VALID SALES (25,000) (25,000)

RETURNS

OR dated Dec. 29 NOT VALID 92,000

COLLECTION

OR dated Dec. 30 VALID COLLECTION (85,000) (85,000)

SI dated April 20 AR WRITE-OFF (24,000) (24,000)

SI dated Sept. 20 AR WRITE-OFF (30,000)

Adjusted balances 3,002,000 3,002,000 912,500 1,197,000 611,000 281,500

Required Allowance for Bad Debt in % 1% 5% 10% 20%

Required Allowance for Bad Debt in PhP 186,375 9,125 59,850 61,100 56,300

AR, Amortized Cost 2,815,625

50. Ans. A.

Allowance for bad debt, end 186,375

Add: Write-off of AR during the year 54,000

Less: Recovery of previous write-of (31,400)

Allowance for bad debt, beg (January 1) (154,200)

Bad Debt Expense 54,775

PROBLEM 5: OROCHI CORP.

51. Ans. B.

52. Ans. C.

General Subsidiary Current 1-60 days 61-120 More than

Ledger Ledger PD days PD 120 days

PD

Unadjusted balances 2,910,000 2,946,000 1,178,400 736,500 589,200 441,900

Moderna Co. - comm. on portion (5,000) (5,000) (5,000)

sold (P125,000/50*20)*10%

Moderna Co. - portion not yet sold (75,000) (75,000) (75,000)

(P125,000/50*30)

Blazing Corp. - overpriced invoice (35,000) (35,000) (35,000)

(See note a)

Venom Inc. - sales returns not (40,000) (40,000)

posted in the SL

Saber Corp. - write-off of (98,000) (98,000) (98,000)

receivables

Adjusted balances 2,697,000 2,693,000 1,098,400 701,500 549,200 343,900

Unlocated difference (4,000)

Adjusted balance 2,693,000 1,098,400 701,500 549,200 343,900

Required Allowance for Bad Debt 0% 5% 10% 25%

in %

Required Allowance for Bad Debt (175,970) - 35,075 54,920 85,975

in PhP

AR, Amortized Cost 2,517,030

Note A: Blazing Corp.

Correct invoice price (210,000/3,000) *P2,500 175,000

Erroneous invoice price 210,000

Overstatement in Blazing Corp. receivable (35,000)

Page 16 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

53. Ans. D.

Allowance for BD, end 175,970

Add: Write-off per audit 98,000

Less: Recovery per audit -

Allowance for BD, unadjusted end (215,200)

Bad debt expense 58,770

54. Ans. C.

55. Ans. B.

PROBLEM 6: BLAZING CORP.

56. Ans. A.

57. Ans. A.

58. Ans. C.

Inventories AP AR

Unadjusted balance 312,000

December purchase journal entries

RR21292 Goods received on consignment (4,600) (4,600)

RR21296 Valid purchase, goods received after Dec. 29 5,500

January purchase journal entries

RR21297 Valid purchase, goods received after Dec. 29 5,300 5,300

RR21299 Valid purchase in transit (FOB-Seller) 8,000 8,000

RR21300 Valid purchase (Bill and Hold Agreement) 5,500 5,500

Audit note:

RR21294 Valid purchase 6,200

December sales journal entries

SI52285 Not valid sale in-transit (FOB Dest) 7,200 (12,000)

SI52286 Not valid sale (Sale with repurchase agreement) 9,000 (15,000)

SI52287 Valid sale in-transit (FAV) (9,600)

SI52288 Valid sale (but delivery was after count date) (12,000)

January sales journal entries

SI52290 Valid sales in-transit (FOB Shipping Point) (4,800) 8,000

SI52291 Valid sales in-transit (FOB Seller) (8,400) 14,000

SI52292 Valid sale (Bill and Hold Agreement) (10,800) 18,000

Adjusted balance/Net adjustment 302,300 20,400 13,000

PROBLEM 7: ROCKWELL CO.

59. Ans. D.

Payments to suppliers for the year 3,945,000

Add: Purchase discount 210,000

Purchase returns 385,000

Accounts payable, end 310,000

Less: Accounts payable, beg (275,000)

Gross purchases (Accrual Basis) 4,575,000

60. Ans. D.

Inventory, Dec. 31, 2020 390,000

Add: Net purchases

Gross purchases 4,575,000

Less: Purchase discount (210,000)

Purchase returns (385,000) 3,980,000

Less: Abnormal spoilage (120,000)

Cost of goods available for sale 4,250,000

Less: Estimated Cost of Sales** (3,892,000)

Estimated Inventory, end per audit 358,000

Inventory per count, unadjusted 345,000

Add: Sales in-transit FOB Baguio (180,000*70%) 126,000 471,000

Estimated Inventory Overage (113,000)

Page 17 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

**Gross sales 5,620,000

Sales in transit (FOB Baguio) - Not valid sale yet (180,000)

Adjusted Gross sales 5,440,000

Less: Sales returns (300,000)

Add: Special discounts to employees and officers 220,000

Add: Normal spoilage 200,000

Sales (for Inventory estimation purposes) 5,560,000

Multiply by: Cost ratio 70%

Estimated cost of sales 3,892,000

61. Ans. C.

Inventory, Dec. 31, 2020 390,000

Add: Net purchases

Gross purchases 4,575,000

Less: Purchase discount (210,000)

Purchase returns (385,000) 3,980,000

Less: Abnormal spoilage (120,000)

Cost of goods available for sale 4,250,000

Less: Estimated Cost of Sales** (3,475,000)

Estimated Inventory, end per audit 775,000

Inventory per count, unadjusted 345,000

Add: Sales in-transit FOB Baguio (180,000/160%) 112,500 457,500

Estimated Inventory Shortage 317,500

**Gross sales 5,620,000

Sales in transit (FOB Baguio) - Not valid sale yet (180,000)

Adjusted Gross sales 5,440,000

Less: Sales returns (300,000)

Add: Special discounts to employees and officers 220,000

Add: Normal spoilage 200,000

Sales (for Inventory estimation purposes) 5,560,000

Multiply by: Cost ratio 160%

Estimated cost of sales 3,475,000

62. Ans. D.

63. Ans. C.

64. Ans. A.

PROBLEM 8:

65. Ans. B.

Trade in value of asset given up 320,000

Carrying value

Cost 800,000

Accum. Depr. as of September 30, 2021

(800,000*90%) (34/55) (445,091)

(800,000*90%) (6/55) *9/12 (58,909) 296,000

Gain on trade in 24,000

66. Ans. C.

Selling price 450,000

Carrying value

Cost 1,200,000

Accum. Depr. as of Sept. 1

(1.2M*4/8) (600,000)

(1.2M/8years)*10/12 (125,000) 475,000

Loss on sale of equipment (25,000)

Initial cost of replacement office equipment

Cash price equivalent of the new office equipment:

Downpayment 500,000

Bal: 500,000*2.486852 1,243,426

Cash price equivalent of the new office equipment: 1,743,426

Page 18 of 19 0915-2303213 resacpareview@gmail.com

AUDITING

ReSA Batch 44 – October 2022 CPALE Batch

30 July 2022 11:45 AM to 02:45 PM AUD First Pre-Board Exam

DACs 29,316

PV of future retirement cost (101,302*0.46651) 47,258

Initial cost of replacement office equipment 1,820,000

67. Ans. A.

Depreciation expense - Building 375,562

Depreciation expense - Office Equipment 306,458

Depreciation expense - Automotive Equipment 238,091

Total Depreciation Expense 920,111

Depreciation on office buildings (under double declining balance method over 20 years)

Carrying Value, Jan. 1 (4.2M*90%*90%*90%*90%) 2,755,620

Multiply by: Double declining balance rate 10% 275,562

Depreciation on the building expansion (under double decling balalance method over 16 years)

Cost 800,000

Multiply by: Double Decl. rate over remaining life (16 yrs) 12.50% 100,000

Total Depreciation Expense - Office Building 375,562

Depreciation on office equipment (under SL Method over 8 years with no salvage value)

Equipment Disposed on November 1

(1.2M/8years) *10/12 125,000

Equipment Purchased on December 1

(1.82M/8years) *1/12 18,958

Equipment balance

(1.3M/8years) 162,500

Total Depreciation Expense - Office Equipment 306,458

Depreciation on Automotive Equipment (under SYD over 10 years with 10% salvage value)

Automotive Equipment Disposed on September 30

(800,000*90%) *6/55*9/12 58,909

Automotive Equipment Acquired on September 30

(1.5M*90%) *10/55*3/12 61,364

Machinery balance

(1.2M*90%) *6/55 117,818

Total Depreciation Expense - Factory Machinery 238,091

PROBLEM 9: SAMSUNG CORP.

68. Ans. C

Trademark, CV per books 12/31/2021 520,000

CV of Legal Fees capitalized in 1/1/2018

(120,000*4years/8years) -60,000

Trademark, CV per audit 12/31/2021 460,000 No Impairment

Recoverable Value/Value in use (151,426*3.169865) 480,000

69. Ans. C.

Intial Cost of Franchise (Cash price equivalent)

Downpayment 1,000,000

Balance: (800,000*3.604776) 2,883,821

Carrying value, 12/31/2020 (no amortization) 3,883,821

Recoverable value, 12/31/2020 (420,000/11%) 3,818,182 Lower

Impairment Loss 65,639

Interest in 2020 (2,883,821*12%) 346,059

Cont. Franchise Fee in 2020 (500,000*5%) 25,000

Impairement Loss in 2020 65,639

Total expense related to the franchise in 2020 436,698

70. Ans D.

CV, 12/31/2020 3,818,182

Recoverable value, 12/31/2021 (420,000/10%) 4,200,000

Recovery gain (to the extent of the previous loss) 65,639

Thus, CV of franchise will be brought back to the original cost 3,883,821

Page 19 of 19 0915-2303213 resacpareview@gmail.com

You might also like

- ReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDocument21 pagesReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- ReSA B45 AUD Final PB Exam Questions Answers Solutions-1Document19 pagesReSA B45 AUD Final PB Exam Questions Answers Solutions-1Jaycee Cabigao100% (3)

- ReSA B43 AUD First PB Exam Questions Answers SolutionsDocument20 pagesReSA B43 AUD First PB Exam Questions Answers SolutionsLuna V100% (1)

- ReSA B42 AUD First PB Exam Questions Answers Solutions PDFDocument24 pagesReSA B42 AUD First PB Exam Questions Answers Solutions PDFNamnam KimNo ratings yet

- ReSA B42 AUD Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B42 AUD Final PB Exam - Questions, Answers - SolutionsLuna VNo ratings yet

- T R S A: HE Eview Chool of CcountancyDocument12 pagesT R S A: HE Eview Chool of CcountancyNamnam KimNo ratings yet

- 93 - Final Preboard AFARDocument18 pages93 - Final Preboard AFAREpfie SanchesNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Preliminary Audit Engagement ActivitiesDocument4 pagesPreliminary Audit Engagement ActivitiesMadelyn Jane IgnacioNo ratings yet

- Substantive Test Cash and Cash Equivalents QuizDocument2 pagesSubstantive Test Cash and Cash Equivalents QuizMarieNo ratings yet

- Total Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Document8 pagesTotal Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Anonymous LC5kFdtcNo ratings yet

- AP Quiz 005 2015 AR and InvestmentsDocument6 pagesAP Quiz 005 2015 AR and InvestmentsGwenneth BachusNo ratings yet

- Batch 93 FAR First Preboard February 2023Document15 pagesBatch 93 FAR First Preboard February 2023Ameroden AbdullahNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Review Handouts and Materials: Semester Auditing Problems INTEGR 2-004 Agriculture and LiabilitiesDocument8 pagesReview Handouts and Materials: Semester Auditing Problems INTEGR 2-004 Agriculture and LiabilitiesKarlayaanNo ratings yet

- The Professional CPA Review School - Auditing Problems First Preboard ExamDocument18 pagesThe Professional CPA Review School - Auditing Problems First Preboard ExamRodmae VersonNo ratings yet

- ReSA B43 AFAR First PB Exam Questions, Answers & SolutionsDocument22 pagesReSA B43 AFAR First PB Exam Questions, Answers & SolutionsBella Choi100% (1)

- Chapter 23 Multiple-Choice QuestionsDocument21 pagesChapter 23 Multiple-Choice QuestionsMark Gelo WinchesterNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Free Trial HandoutsDocument31 pagesFree Trial HandoutsCHRISTINE TABULOGNo ratings yet

- Quiz For 3rd ExamDocument2 pagesQuiz For 3rd ExamSantiago BuladacoNo ratings yet

- NJPIA REGION 3 COUNCIL PRACTICAL ACCOUNTING 2 MOCK EXAMDocument6 pagesNJPIA REGION 3 COUNCIL PRACTICAL ACCOUNTING 2 MOCK EXAMJessica Marie B. Mendoza0% (1)

- Chapter 9 - Shareholders' Equity AnalysisDocument4 pagesChapter 9 - Shareholders' Equity AnalysisJudy Ann Acruz100% (1)

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- PRTC AUD 1stPB - 10.21Document15 pagesPRTC AUD 1stPB - 10.21Luna VNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Document15 pagesManila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Bella Choi100% (1)

- Ap-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash EquivalentsDocument27 pagesAp-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash Equivalentsruel c armillaNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- 9005 - Corporate LiquidationDocument5 pages9005 - Corporate LiquidationAjmerick AgupeNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- ReSA Final Pre-Board Exam ReviewDocument24 pagesReSA Final Pre-Board Exam ReviewLuna V100% (2)

- Auditing Problems Test Bank 2 Auditing Problems Test Bank 2Document16 pagesAuditing Problems Test Bank 2 Auditing Problems Test Bank 2xjammerNo ratings yet

- CPA Review School Philippines Financial Accounting PreboardDocument18 pagesCPA Review School Philippines Financial Accounting PreboardAllyson VillalobosNo ratings yet

- FIRST PB RFBT SolutionsDocument15 pagesFIRST PB RFBT SolutionsCathy Marie Angela ArellanoNo ratings yet

- Aud Prob - 2nd PreboardDocument13 pagesAud Prob - 2nd PreboardKim Cristian MaañoNo ratings yet

- TAXATION EXAM REVIEWDocument16 pagesTAXATION EXAM REVIEWMOTC INTERNAL AUDIT SECTIONNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- Quiz 1 Specialized IndustriesDocument5 pagesQuiz 1 Specialized IndustriesLyca Mae CubangbangNo ratings yet

- Since 1977: Philippine TaxationDocument6 pagesSince 1977: Philippine TaxationXyza JabiliNo ratings yet

- AP-03 Audit of Intangible AssetsDocument11 pagesAP-03 Audit of Intangible AssetsMitch MinglanaNo ratings yet

- Comprehensive Reviewer Auditing TheoryDocument91 pagesComprehensive Reviewer Auditing TheoryMary Rose JuanNo ratings yet

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocument25 pagesComprehensive Audit of Balance Sheet and Income Statement AccountsLuigi Enderez Balucan100% (1)

- FINANCING CYCLE AuditDocument12 pagesFINANCING CYCLE AuditEl Yang100% (1)

- Compre 3Document7 pagesCompre 3casio3627No ratings yet

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Document35 pagesLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagNo ratings yet

- Unit I: Audit of Investment PropertyDocument11 pagesUnit I: Audit of Investment PropertyAnn SarmientoNo ratings yet

- Fourth Year - Bsa: University of Makati Set BDocument11 pagesFourth Year - Bsa: University of Makati Set BYedam BangNo ratings yet

- Auditing Problems Midterm - 2021 - DDocument17 pagesAuditing Problems Midterm - 2021 - DjasfNo ratings yet

- Loans and Receivables Handout1Document3 pagesLoans and Receivables Handout1hwoNo ratings yet

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- Ap-1403 ReceivablesDocument18 pagesAp-1403 ReceivablesElaine YapNo ratings yet

- Calculating FVTOCI and investment income for Judi CorpDocument17 pagesCalculating FVTOCI and investment income for Judi CorpmarkNo ratings yet

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- Audit procedures and standards under 40 charactersDocument23 pagesAudit procedures and standards under 40 charactersGelyn CruzNo ratings yet

- ReSA B44 AUD First PB Exam No AnswerDocument35 pagesReSA B44 AUD First PB Exam No AnswerAlliah Mae AcostaNo ratings yet

- 2022 Resa PreboardDocument36 pages2022 Resa PreboardaceNo ratings yet

- 2022 - April-AUD - Preboard PDFDocument12 pages2022 - April-AUD - Preboard PDFVianney Claire RabeNo ratings yet

- Use The Following Information To Answer The Question(s) BelowDocument43 pagesUse The Following Information To Answer The Question(s) BelowWesNo ratings yet

- UntitledDocument8 pagesUntitledWesNo ratings yet

- Chapter 17 Payout Policy: Corporate Finance, 2E, Global Edition (Berk/Demarzo)Document40 pagesChapter 17 Payout Policy: Corporate Finance, 2E, Global Edition (Berk/Demarzo)WesNo ratings yet

- 03 Arbitrage and Financial Decision MakingDocument35 pages03 Arbitrage and Financial Decision MakingWesNo ratings yet

- Chapter 15 Debt and Taxes: Corporate Finance, 2E, Global Edition (Berk/Demarzo)Document42 pagesChapter 15 Debt and Taxes: Corporate Finance, 2E, Global Edition (Berk/Demarzo)WesNo ratings yet

- 01 The CorporationDocument10 pages01 The CorporationWesNo ratings yet

- 07 Fundamentals of Capital BudgetingDocument18 pages07 Fundamentals of Capital BudgetingWesNo ratings yet

- Chapter 18 Capital Budgeting and Valuation With Leverage: Corporate Finance, 2E, Global Edition (Berk/Demarzo)Document46 pagesChapter 18 Capital Budgeting and Valuation With Leverage: Corporate Finance, 2E, Global Edition (Berk/Demarzo)WesNo ratings yet

- ReSA B44 MS Final PB Exam Questions Answers and SolutionsDocument12 pagesReSA B44 MS Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- Use The Following Information To Answer The Question(s) BelowDocument28 pagesUse The Following Information To Answer The Question(s) BelowWesNo ratings yet

- ReSA B44 AUD Final PB With AnswerDocument21 pagesReSA B44 AUD Final PB With AnswerAlliah Mae Acosta100% (1)

- RFBT03-19k - Answer Key On Banking LawsDocument1 pageRFBT03-19k - Answer Key On Banking LawsWesNo ratings yet

- ReSA B44 FAR Final PB Exam Questions Answers and SolutionsDocument22 pagesReSA B44 FAR Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- 00 CopyrightDocument1 page00 CopyrightWesNo ratings yet

- Online Test Item File: Corporate FinanceDocument1 pageOnline Test Item File: Corporate FinanceWesNo ratings yet

- ReSA B44 RFBT First PB Exam Questions and AnswersDocument13 pagesReSA B44 RFBT First PB Exam Questions and AnswersWesNo ratings yet

- ReSA CPA Review Batch 44 Final Pre-Board ExamDocument28 pagesReSA CPA Review Batch 44 Final Pre-Board ExamWesNo ratings yet

- RFBT03-19c - iCARE Accountancy Review Inc. Banking Laws QUIZZER - 5sept2021Document43 pagesRFBT03-19c - iCARE Accountancy Review Inc. Banking Laws QUIZZER - 5sept2021WesNo ratings yet

- ReSA B44 FAR First PB Exam Questions Answers SolutionsDocument17 pagesReSA B44 FAR First PB Exam Questions Answers SolutionsWesNo ratings yet

- ReSA B44 MS First PB Exam Questions Answers - SolutionsDocument13 pagesReSA B44 MS First PB Exam Questions Answers - SolutionsWesNo ratings yet

- Article 1561 - 1581 ExplanationsDocument8 pagesArticle 1561 - 1581 ExplanationspovaNo ratings yet

- RFBT03-19a - Banking Laws - Supplemental Notes (Part 1)Document11 pagesRFBT03-19a - Banking Laws - Supplemental Notes (Part 1)WesNo ratings yet

- ReSA B44 AFAR First PB Exam Questions Answers SolutionsDocument22 pagesReSA B44 AFAR First PB Exam Questions Answers SolutionsWes100% (1)

- ReSA B44 TAX First PB Exam Questions Answers SolutionsDocument14 pagesReSA B44 TAX First PB Exam Questions Answers SolutionsWes100% (1)

- RFBT03-19b - Banking Laws - Supplemental Notes (Part 2)Document4 pagesRFBT03-19b - Banking Laws - Supplemental Notes (Part 2)WesNo ratings yet

- Warranty against eviction explainedDocument6 pagesWarranty against eviction explainedWesNo ratings yet

- Corruption ScriptDocument7 pagesCorruption ScriptWesNo ratings yet

- This Study Resource Was: I. Fill in The BlanksDocument4 pagesThis Study Resource Was: I. Fill in The BlanksWesNo ratings yet

- RFBT03-19 - Banking LawsDocument41 pagesRFBT03-19 - Banking LawsWesNo ratings yet

- Books for Physicians to Read for Personal Finance and InvestingDocument8 pagesBooks for Physicians to Read for Personal Finance and Investingmchallis100% (1)

- FRM 5Document4 pagesFRM 5irfanhaidersewagNo ratings yet

- A Study of Credit Rating Agency Crisil PDFDocument65 pagesA Study of Credit Rating Agency Crisil PDFwarghade academyNo ratings yet

- Foreign Exchange MarketDocument12 pagesForeign Exchange MarketJoksmer MajorNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnDagnachew Amare DagnachewNo ratings yet

- Here are the journal entries for Complex Company for 2015 and 2016:JOURNAL ENTRIESDocument20 pagesHere are the journal entries for Complex Company for 2015 and 2016:JOURNAL ENTRIESJudith Gabutero100% (2)

- Why Study Money, Banking, and Financial Markets?Document17 pagesWhy Study Money, Banking, and Financial Markets?Trang VũNo ratings yet

- Starbucks Part IIDocument7 pagesStarbucks Part IIShuting QinNo ratings yet

- Discover The Power of PitchBook PDFDocument11 pagesDiscover The Power of PitchBook PDFwpairoNo ratings yet

- Caiib Success Class-7 (BRBL Module-C Part-1) : 7 PM 6 Nov. 2023Document17 pagesCaiib Success Class-7 (BRBL Module-C Part-1) : 7 PM 6 Nov. 2023Hari RajNo ratings yet

- PFRS 7Document22 pagesPFRS 7Princess Jullyn ClaudioNo ratings yet

- Course Binder ADM3350XY S 2022Document218 pagesCourse Binder ADM3350XY S 2022Han ZhongNo ratings yet

- Lecture Notes On Inventories - 000Document8 pagesLecture Notes On Inventories - 000judel ArielNo ratings yet

- b4 Indicator v3 - 0Document7 pagesb4 Indicator v3 - 0Juan AponteNo ratings yet

- Predicting Movement of Stock of Y Using Sutte IndicatorDocument11 pagesPredicting Movement of Stock of Y Using Sutte Indicatoransari1621No ratings yet

- Earnings Tasty Trade ResearchDocument9 pagesEarnings Tasty Trade ResearchJaime ZzaaNo ratings yet

- Stock Markets TrainingDocument7 pagesStock Markets TrainingCornelius MasikiniNo ratings yet

- 5 Favorite Options Setups PDFDocument40 pages5 Favorite Options Setups PDFquantum70No ratings yet

- 223-NIdhi RathodDocument33 pages223-NIdhi RathodNidhi RathodNo ratings yet

- Crc-Ace Review School, Inc.: Management Accounting Services (1-40)Document8 pagesCrc-Ace Review School, Inc.: Management Accounting Services (1-40)LuisitoNo ratings yet

- Exchange RatioDocument2 pagesExchange RatioctifinNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument34 pagesFinancial Statement Analysis: K R Subramanyam John J WildAgus Tina100% (1)

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- Business CombinationDocument8 pagesBusiness CombinationJSNo ratings yet

- Wonderland Staking and Minting Calculator (4,4)Document8 pagesWonderland Staking and Minting Calculator (4,4)Dina Maya0% (4)

- Swap ValuationDocument14 pagesSwap ValuationHANSHU LIUNo ratings yet

- Term Paper Financial Management: AcknowledgementDocument24 pagesTerm Paper Financial Management: AcknowledgementKaran Veer SinghNo ratings yet

- Topic8. PPT. WCM - Inventory ManagementDocument21 pagesTopic8. PPT. WCM - Inventory ManagementHaidee Flavier Sabido100% (1)

- CFA 2024 Curriculum SummaryDocument39 pagesCFA 2024 Curriculum SummaryANUP MUNDENo ratings yet

- 1 - Mutual Funds and BenefitsDocument19 pages1 - Mutual Funds and BenefitsManika AggarwalNo ratings yet