Professional Documents

Culture Documents

The Effect of Bank Soundness Ratio Towards Financial Performance On Commercial Banks Moderated by Good Corporate Governance

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Effect of Bank Soundness Ratio Towards Financial Performance On Commercial Banks Moderated by Good Corporate Governance

Copyright:

Available Formats

Volume 8, Issue 1, January – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The Effect of Bank Soundness Ratio towards

Financial Performance on Commercial Banks

Moderated by Good Corporate Governance

Putri Aprilita Hapsari Indra Siswanti

Master of Management, Faculty of Economics and Business Master of Management, Faculty of Economics and Business

Universitas Mercu Buana, Indonesia Universitas Mercu Buana, Indonesia

Abstract:- The purpose of this study is to determine the With the rapid development of the banking sector, the

impact of bank health indicators on bank financial complexity of banking is also increasing, which affects banking

performance governed by good corporate governance. The operations. The high complexity of banking operations can

subjects of this study are commercial banks KBMI IV increase the risks faced by Indonesian banks. Banking is an

registered with the Indonesian Financial Authority (OJK) industry that relies on the public's trust in its business, and

in the period from 2017 to 2021. The sampling technique therefore a stable level of banking must be maintained.

uses the saturation sampling method (census), and the total

sample consists of 4 commercial banks. The measurement According to a World Bank study, the weak

of the variables used in this study was made in the form of implementation of corporate governance systems commonly

a scale of coefficients with a quantitative approach, using referred to as corporate governance is one of the decisive

5 (five) year time series data from the reports published by factors in the direction of the global economic crisis

KBMI IV Bank in the period from 2017 to 2021. The (Nurdiwaty et al., 2019). The low level of implementation of

analysis method used in this study is panel data regression good governance has been the root cause of various financial

analysis supported by Eviews 10 software. The results scandals. The frequent appearance of various banking cases in

show that the financial indicators of banks can be Indonesia provides an opportunity for all business managers to

optimized by maintaining the values of capital adequacy learn and understand the importance of good corporate

and lending indicators within predetermined safety limits governance.

and further strengthening by publicizing good corporate

governance by the company. Meanwhile, non-performing II. LITERATURE REVIEW

loans and corporate social responsibility do not affect

banks' financial performance, although they are A. Agency Theory

supported by corporate governance information. Jensen and Meckling (1976) define agency theory as a

contractual connection between agent and principle in which

Keywords:- Financial Performance, Capital Adequacy Ratio, the tasks, authority, rights, and obligations of agents and

Non-Performing Loans, Loan-To-Deposit Ratio, Corporate principals are defined by a mutually negotiated work contract.

Social Responsibility, Good Corporate Governance. The goal of agency theory is to find the most efficient contracts

that affect principal-agent interactions. Because bank

I. INTRODUCTION management cannot be divorced from the attainment of goals

and the performance of a bank, agency theory presents an

The global economy is developing rapidly, as evidenced updated understanding of banking financial performance. The

by the economic progress that Indonesia has experienced in total assets of a corporation can be used to measure its success.

both developed and developing countries. Even with global and The higher the company's size, the greater the company's

domestic economic conditions still affected by the Covid-19 assets.

pandemic, Bank Indonesia, especially commercial bank KBMI

IV, has proven to be stable until 2021, which is reflected in the B. Signal Theory

bank's fairly stable capital and sufficient liquidity support According to Spence (1973), the signal theory suggests

(OJK, 2021). that the sender (owner of the information) attempts to offer

relevant information in the form of signals or cues that the

The banking sector is one of the most significant keys to receiver may use, and that the receiver subsequently modifies

the country's economic activity since it is critical for the his behaviour by his comprehension of the signal. This explains

continuous growth of significant economic activity. If the why businesses must give users of financial reports clear and

monetary sector does not perform well, the real sector will not accurate indications. This signal takes the form of details

perform well. Banks act as financial institutions to collect funds regarding the steps taken by management to carry out the

from the public in the form of savings and channel the funds owner's wishes. Signals can take the shape of advertisements or

back in the form of loans or act as financial intermediaries details about the company's benefits so that investors can use

(Dewi and Suryanawa, 2018). the financial ratios supplied as a reference to determine the

company's possibilities.

IJISRT23JAN1420 www.ijisrt.com 2374

Volume 8, Issue 1, January – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

C. Commercial Banks public and the equity capital employed. Based on Bank

Commercial banks are defined as banks that conduct Indonesia's regulations No. 6/23/DPNP 2004, which state that

business activities traditionally and/or based on sharia the acceptable range for healthy liquidity is 78% to 92%.

principles, and who through their activities provide services in

payment traffic, under Law Number 10 of 1998 about banking. H. Corporate Social Responsibility

According to the most recent Financial Services Authority rule Corporate social responsibility is defined as a company's

(12/POJK.03/2021) about commercial banks, there are four (4) or organization's ongoing commitment to uphold moral

different bank groups based on core capital (KBMI), with principles, comply with the law, and encourage economic

KBMI IV being the biggest bank group having a core capital progress while improving the lives of employees, their

of more than 70 trillion rupiahs. As a result, KBMI IV is a families, the local community, and society as a whole (Pratiwi

massive bank group with the highest total assets and money & Bahari, 2020). Furthermore, as a means of enhancing

circulation, making it one of the primary foundations of business sustainability, by taking responsibility for the

banking in Indonesia and a good indicator of how Indonesian company's social, economic, and environmental effects of its

commercial banks are doing financially. operational operations.

D. Financial Performance The forms of liability given also vary, ranging from

Financial performance is a description of the company's carrying out activities likely to improve the well-being of the

financial health during a specific period, including features of community environmental improvements, the granting of

raising and dispersing cash. These factors are often gauged by scholarships for studies, the provision of funds for the

indices of capital sufficiency, liquidity, and profitability maintenance of public facilities, as well as community which

(Siswanti, 2018). Financial benchmarks known as financial are social and helpful, especially people who are in the

ratios can be used to assess the success or failure of achieving corporate environment (Aristananda & Risman, 2022). Refers

sufficient corporate performance, as well as good or bad to the GRI (Global Reporting Initiative) G4 instrument, the

banking financial performance. Profitability is the most corporate responsibility disclosure index, which includes

appropriate ratio indicator to use for determining how well a economic performance, environmental performance, social

bank is performing, as represented by Return on Assets, performance, human rights performance, community

among all the many types of financial ratios now in use (ROA). performance, and product performance, and is expected to

This is so because ROA is concerned with how well a firm can have a positive impact on the economy, social, and corporate

profit from all of the assets it is in charge of. environment if implemented (GRI, 2016).

E. Capital Adequacy Ratio I. Good Corporate Governance

Rembet & Baramuli (2020) suggest that a bank's ability Siswanti (2016) proposed a connection between good

to govern its activities with adequate capital is crucial to the corporate governance and risk management on financial

institution's existence. The capital adequacy ratio gauges how performance, stating that good corporate governance

much a bank's hazardous assets—loans, investments in implementation will minimize or minimize the risks that exist

securities, and claims against other banks—are supported by in banking, so if these two variables are applied together, and

its capital in addition to obtaining external funding from obtaining a good predicate will affect the condition of a bank's

sources including government money, loans (debt), and other financial performance. In a bank, openness, accountability,

sources. The bank is in better shape if it has a greater capital responsibility, independence, and justice are all evaluated

adequacy ratio since it can finance bank activities and, under (Argantara et al., 2021). This promotes professional, optimum,

ideal circumstances, contribute significantly to the efficient, and effective corporate management, as well as

profitability of the organization. empowering functions and enhancing the structure's

independence.

F. Non-Performing Loan

According to Setyarini (2020), the ratio of non- III. RESEARCH METHODS

performing loans serves as a measure of both the business risk

and the risk of non-performing loans in a bank. Fixed principle This study employs a quantitative method or one that

and interest payments, which result in non-performing loans, employs data in the form of numbers through statistical

can directly impact a bank's efficiency and render it ineffective analysis. This research, according to this definition, is research

(PBI No. 7/2/PB/2005). Credit quality is divided into five that tries to identify the link between two or more variables.

categories by Bank Indonesia: current, on special notice, This study is causally associative, to test hypotheses and

substandard, questionable, and bad, with a total limitation of determine the causal link (impact) between the independent

5%. variable (X) and the dependent variable (Y). Furthermore, this

research analysis discusses the influence of the independent

G. Loan to Deposit Ratio variable (bank soundness indicator) on the dependent variable

One ratio used to assess a bank's liquidity, or its capacity (financial performance) with the moderating variable in this

to meet its financial commitments, is the ratio of loans to third- study, namely good corporate governance.

party funds (Revita, 2018). In other words, it analyzes the

proportion of total loans made by banks to customers to the

money the banks receive from depositors. This ratio assesses

how the loan amount is distributed in relation to the size of the

IJISRT23JAN1420 www.ijisrt.com 2375

Volume 8, Issue 1, January – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

IV. RESULTS AND DISCUSSION

This study employs secondary data in the form of KBMI

IV public bank publication reports for the 2017-2021 period,

which include a summary of banking performance obtained

from each annual report, governance report, and social

responsibility report for a total of four companies registered

with the financial services authority.

A. Results of Descriptive Statistical Analysis

Descriptive statistics provide an overview of the data that

will be used to create study variables (Kurniawan et al., 2021).

The average value (mean), median value (median), maximum

value (mode), and minimum value of the study data will be

produced through descriptive statistical analysis. The following

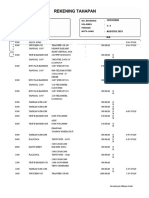

Fig 1. Framework

are the findings of the statistical analysis of the study.

Panel data regression analysis was employed in this study.

Panel data is a mix of time series and cross-section data. Time

series data is data that consists of one or more variables that

will be monitored in one observation unit for a certain length

of time in this study, particularly for five years, from 2017 to

2021. Meanwhile, cross-section data is observation data from

several observation units at the same time, which in this study

are the banking sector firms in the commercial bank sub-sector

KBMI IV that are registered with the financial services

administration (OJK). The Eviews 10 program is used to select

the regression model, assess the influence of independent

variables, and perform moderated regression analysis on Fig 2. Results of Statistic Descriptive Analysis - Eviews 10

research panel data.

According to Figure 2, the return on assets variable has a

A. Population mean value of 2.86% or greater than 0.5%, indicating that the

According to Sugiyono (2017), the population is a broad KBMI IV Commercial Bank may still make profits from asset

category of items or subjects with certain attributes and management throughout the 2017-2021 period. PT. Bank

characteristics chosen by the researcher to be explored and Negara Indonesia, Tbk received the lowest score of 0.54% in

conclusions produced. In this study, the population consisted of 2020, with a net profit of 2020 declining by 78.6% from 2019.

all banking sector enterprises in the commercial bank sub- While PT. Bank Central Asia, Tbk reached the greatest value

sector that, based on their Core Capital, entered KBMI IV of 4.02% in 2019, this was due to BCA's outstanding financial

between 2017 and 2021, namely four banks. This research performance, which increased by 10.5% from the previous

population data is presented in the table below: year.

Based on Figure 2, the capital adequacy ratio variable has

a mean value of 21.42% or > 8%, meaning that the KBMI IV

commercial bank has good financial conditions sourced from

the capital. With the lowest score of 15.83% achieved by PT.

Bank Negara Indonesia, Tbk in 2017 due to BNI providing high

loans, there were restructured loans with an extension of the

Table 1. Population and Sample loan maturity, and a decrease in interest rates. While the highest

value of 25.83% was achieved by PT. Bank Central Asia, Tbk

B. Sample in 2020 because BCA always maintains adequate capital

A sample is a smaller portion of a population's actual conditions.

amount and characteristics (Sugiyono, 2017). The saturation

sampling approach was used in this study to determine the Figure 2 shows that the nonperforming loan variable has

sample if Every member of the population is sampled. This is a mean value of 0.76%, or 2%. PT. Bank Mandiri, Tbk got the

done when the population size is very small, less than 30, or lowest score of 0.41% in 2021 because Bank Mandiri received

when the research aims to make broad generalizations with an AA (idn) credit rating from Fitch Rating Indonesia,

relatively small inaccuracies. As can be observed in Table 1, indicating a very low risk of default. While PT. Bank Negara

the bank sample in this research includes all KBMI IV Indonesia, Tbk obtained the highest score of 1.25% in 2019,

commercial banks registered with the financial services this was owing to a drop in commercial business productivity

authorities for the 2017-2021 period. and the quality of corporate loans during the year.

IJISRT23JAN1420 www.ijisrt.com 2376

Volume 8, Issue 1, January – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

According to Figure 2, the loan-to-deposit ratio variable

has a mean value of 83.94%, indicating that the commercial

bank KBMI IV has a liquidity capability larger than the

quantity of credit. PT. Bank Central Asia, Tbk obtained the

lowest score of 61.96% in December 2021 owing to CASA,

which is substantially larger than credit growth. While PT.

Bank Mandiri, Tbk received the highest score of 96.74% in

2018, this was owing to a reaction to the depreciation of the

Rupiah currency rate and the increasing current account deficit,

which caused banks’ liquidity conditions to tighten due to a rise Fig 4. Hausman Test Results - Eviews 10

in LDR.

Based on the test results, it is possible to infer that the

According to Figure 2, the corporate social responsibility fixed effect model is the best model for estimating panel data

variable has a mean value of 0.62%, indicating that the KBMI regression in this study.

IV Public Bank appropriately implements social responsibility

disclosures in order to improve the company's reputation and C. Coefficient of Determination (R2) Test Results

contribute to overall performance improvement. With the The coefficient of determination indicates how the

lowest score of 0.55% in 2017, PT. Bank Mandiri, Tbk will independent variable's impact on the dependent variable varies.

focus more on implementing community empowerment In other words, as a percentage of all independent factors' effect

initiatives. PT. Bank Rakyat Indonesia, Tbk had the best score on the dependent variable. The value of R-Square or Adjusted

of 0.70% from 2017 to 2021. R-Square may be used to calculate the coefficient of

determination. With a threshold value between '0' and '1', the

According to Figure 2, the excellent corporate governance higher the R-Square value, the better the prediction model of

variable has a mean value of 1.65%, indicating that the KBMI the suggested research model.

IV commercial bank employs solid management practices in

managing the organization in order to improve its performance.

The four organizations with the lowest score, namely the

composite score of '2', were PT. Bank Rakyat Indonesia, Tbk;

PT. Bank Mandiri, Tbk; PT. Bank Negara Indonesia, Tbk; and

PT. Bank Central Asia, Tbk. With a composite value of '1,' PT.

Bank Rakyat Indonesia, Tbk, PT. Bank Mandiri, Tbk, and PT.

Bank Central Asia, Tbk received the highest score.

B. Panel Data Regression Results Fig 5. R2 Test Results - Eviews 10

Panel data regression analysis may be used to evaluate

model estimates using one of three approaches: the common The Adjusted R-Square value in the graph above is

effect model, the fixed effect model, or the random effect 0.537643, which means that 53.76% of the influence of the

model (Prawoto, 2017). The most appropriate model for independent variable (banking health indicator) on the

handling research panel data is chosen based on statistical dependent variable (financial performance) is influenced by

considerations in order to generate precise and efficient other variables that are not in regression models, such as credit

estimates using tests such as the Chow Test and the Hausman risk, operational costs, or management efficiency.

Test.

D. Results of t-Test (Partial)

The Partial t-test seeks to demonstrate how far the

independent factors' effect is in partially explaining the

dependent variable (Ghozali, 2018).

Fig 3. Chow Test Results - Eviews 10

Fig 6. t Test Results – Eviews 10

IJISRT23JAN1420 www.ijisrt.com 2377

Volume 8, Issue 1, January – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The influence of the Capital Adequacy Ratio on the that GCG moderates the effect of NPLs on the financial

Financial Performance of Commercial Banks KBMI IV performance of Commercial Banks KBMI IV is pronounced

Based on Figure 6, it is known that the probability value unproven.

of the CAR variable is 0.0068 < α = 0.05. This means that CAR

has an effect on the financial performance of Commercial Good Corporate Governance (GCG) moderates the

Banks KBMI IV. Thus the hypothesis proposed by the author influence of the Loan to Deposit Ratio (LDR) on the

which states that CAR has a significant positive effect on the Financial Performance of Commercial Banks KBMI IV

financial performance of Commercial Banks KBMI IV is According to Figure 7, the probability value of the GCG

pronounced proven. variable that plays a significant role in minimizing the impact

of LDR on ROA is 0.0460 < α = 0.05. This indicates that GCG

The Influence of Non-Performing Loans on the Financial reduces LDR's influence on ROA. Thus, the author's

Performance of Commercial Banks KBMI IV hypothesis that GCG moderates the effect of LDR on the

Figure 6 shows that the probability value of the NPL financial performance of Commercial Banks KBMI IV is

variable is 0.0557 > α = 0.05. This indicates that the NPL has pronounced proven.

no impact on the KBMI IV Commercial Bank's financial

performance. Thus, the author's premise that NPLs have a Good Corporate Governance (GCG) moderates the

major negative influence on the financial performance of influence of Corporate Social Responsibility (CSR) on the

Commercial Banks KBMI IV is pronounced unproven. Financial Performance of Commercial Banks KBMI IV

According to Figure 7, the probability value of the GCG

The Influence of Loan to Deposit Ratio on the Financial variable that plays a significant role in moderating the effect of

Performance of Commercial Banks KBMI IV CSR on ROA is 0.8209 > α = 0.05. This indicates that GCG has

According to Figure 6, the probability value of the LDR no influence on CSR's effect on ROA. Thus, the author's claim

variable is 0.0070 < α = 0.05. This suggests that LDR has an that GCG moderates the impact of CSR on the financial

impact on the KBMI IV financial performance of commercial performance of Commercial Banks KBMI IV is pronounced

banks. Thus, the author's premise that LDR has a considerable unproven.

favourable influence on the financial performance of

Commercial Banks KBMI IV is pronounced proven. E. Results of Moderation Regression Analysis (MRA)

Moderation is used to assess how significant the

The influence of Corporate Social Responsibility on regression analysis connection of more than one variable

Financial Performance of Commercial Banks KBMI IV through the regression. The regression equation found in this

According to Figure 6, the probability value of the CSR study is shown below.

variable is known to be 0.2983 > α = 0.05. This indicates that

CSR has no impact on KBMI IV Commercial Banks' financial

performance. Thus, the author's premise that CSR has a

considerable beneficial influence on the financial performance

of Commercial Banks KBMI IV is pronounced unproven.

The coefficient value for the Capital Adequacy Ratio

(CAR) variable is 0.058202 <0.05. Because the regression

coefficient is lower than the alpha, CAR has a positive

influence on financial performance. If CAR improves by

1% and all other factors remain constant, financial

performance will improve by 0.058202%.

Fig 7. t Test Results with Moderation Variable – Eviews 10 The Non-Performing Loan (NPL) variable has a coefficient

value of 0.671680 > 0.05. The regression coefficient has a

Good Corporate Governance (GCG) moderates the effect bigger value than the alpha, indicating that NPL has no

of Capital Adequacy Ratio (CAR) on Financial influence on financial performance.

Performance of Commercial Banks KBMI IV The Loan to Deposit Ratio (LDR) variable has a coefficient

According to Figure 7, the likelihood value of the GCG value of 0.006147 <0.05. Because the regression coefficient

variable playing a significant role in moderating the effect of is lower than the alpha, LDR has an influence on financial

CAR on ROA is 0.0245 < α = 0.05. This indicates that GCG performance. If the LDR rises by 1% and all other factors

mitigates CAR's influence on ROA. Thus, the author's remain constant, financial performance will rise by

hypothesis that GCG moderates the effect of CAR on the 0.006147%.

financial performance of Commercial Banks KBMI IV is

The Corporate Social Responsibility (CSR) variable has a

pronounced proven.

coefficient value of 0.184797 > 0.05. The regression

Good Corporate Governance (GCG) moderates the effect coefficient has a larger value than the alpha, indicating that

of Non-Performing Loans (NPL) on the Financial CSR has no influence on financial performance.

Performance of Commercial Banks KBMI IV The interaction variable Capital Adequacy Ratio (CAR)

According to Figure 7, the probability value of the GCG with Good Corporate Governance (GCG) has a coefficient

variable playing a significant role in minimizing the impact of value of 0.027271 < 0.05. The regression coefficient value

NPL on ROA is 0.5058 > α = 0.05. This indicates that GCG has is less than the alpha, indicating that the interaction between

no influence on NPL's effect on ROA. Thus, the author's claim CAR and GCG has a positive influence on financial

IJISRT23JAN1420 www.ijisrt.com 2378

Volume 8, Issue 1, January – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

performance. This demonstrates that GCG enhances CAR's accompanied by a high rate of return, which can boost bank

effect on financial performance. If the interaction between profitability.

CAR and GCG grows by 1% and all other variables remain

constant, financial performance will improve by In order to boost the company's reputation, KBMI IV has

0.027271%. properly declared its social responsibilities. However, these

The interaction variable of Non-Performing Loans (NPL) disclosures have not improved the company's overall

with Good Corporate Governance (GCG) has a coefficient performance. This is because social disclosure is still not a

standard for investors, and the public views it primarily as a

value of 1.139036 > 0.05. Because the coefficient value is

promotional event, resulting in low positive opinions.

higher than the alpha, the interaction between NPL and

GCG has no influence on financial performance. This KBMI IV establishes a strong governance structure

indicates that increasing the interaction of NPL with GCG within the organization in order to control the risk of potential

by 1%, providing all other variables remain constant, has no losses. The establishment of corporate governance has had a

effect on financial performance. positive effect as a finance control tool, as evidenced by the

The interaction variable of Loan to Deposit Ratio (LDR) bank's capital and liquidity improvement. Even if the

with Good Corporate Governance (GCG) has a coefficient corporation does not adopt effective corporate governance, it

value of 0.023497 < 0.05. Because the coefficient value is will continue to issue a credit to the public and earn credit

lower than alpha, the interaction between LDR and GCG interest. And there are still many investors who do not base

has a positive influence on financial performance. This their investment decisions on social responsibility disclosure or

indicates that GCG increases the influence of LDR on governance reports. Thus, persistent implementation of good

financial performance. If the interaction between LDR and corporate governance is anticipated to continue for the sake of

GCG grows by 1% while all other variables remain the company's long-term viability.

constant, financial performance will improve by

0.023497%. REFERENCES

Variabel The interaction variable of Corporate Social

Responsibility (CSR) with Good Corporate Governance [1]. Aristananda, A., & Risman, A. (2022). The Effect of

Firm Size, Profitability and Leverage on Corporate

(GCG) has a coefficient value of 2.253268 > 0.05. The Social Responsibility (Case Study on Jakarta Islamic

regression coefficient has a bigger value than alpha, Index, 2016-2020). Indikator: Jurnal Ilmiah Manajemen

indicating that the interaction between CSR and GCG has dan Bisnis, 6(3), 105 - 117.

no influence on financial performance. This indicates that [2]. Argantara, Z. R., Mujibno, M., & Priyojadmiko, E.

(2021). Pengaruh Karakteristik Bank Terhadap

increasing the interaction of CSR with GCG by 1%, while Profitabilitas Perbankan Syariah Melalui Good

all other variables remain constant, has no effect on Corporate Governance (GCG) Sebagai Variabel

financial performance. Moderasi. Jurnal Lentera: Kajian Keagamaan, Keilmuan

Dan Teknologi, 20(2), 276-288.

[3]. Dewi, P. I. T., & Suryanawa, I. K. (2018). Pengaruh

V. CONCLUSION NPL, LDR, dan CAR pada ROA Perusahaan Perbankan

yang Terdaftar di BEI Tahun 2014-2016. E-Jurnal

According to the findings of this study, the management Akuntansi, 24(3), 2096-2120

[4]. Ghozali, Imam. (2018). Aplikasi Analisis Multivariate

of Commercial Bank KBMI IV must make several efforts to Dengan Program IBM SPSS 25. Semarang: Universitas

improve the quality of company capital and maintain the Diponegoro.

stability of financial ratios, as well as implement aspects of [5]. Jensen, MC, and Meckling, WH, (1976). Theory of the

good corporate governance in order to achieve the company's firm: Managerial Behaviour, Agency Cost and

sustainability and sustainability. Ownership Structure. Jurnal Ekonomi Keuangan, 3(1),

305-360.

[6]. Kurniawan, T., Mulyana, B., & Risman, A. (2021).

KBMI IV can fulfil capital demands organically. The Comparison Of Financial Performance Of Government

more the capital of the bank, the larger the chance to boost Banks And National Private Banks In Book Category 4.

profitability. Companies must drastically boost their capital The Euraseans: Journal On Global Socio-Economic

ratio in order to continue functioning and generating optimal Dynamics, 3(28), 24-36.

[7]. Nurdiwaty, Diah. (2019). Pengaruh Good Corporate

profits. In other words, the stronger the bank's capital situation, Governance (GCG) Terhadap Kinerja Keuangan (Studi

the greater its potential to support the long-term growth of the Pada Perbankan Yang Terdaftar Di BEI Tahun 2015-

company. 2017). Seminar Nasional Manajemen Ekonomi dan

Akuntansi (SENMEA), 1(1), 61-71.

[8]. Otoritas Jasa Keuangan. (2021). Statistik Perbankan

KBMI IV has an extremely low default risk, with an Indonesia Desember 2021. www.ojk.go.id

average of 2%. This proves that non-performing loans do not [9]. Pratiwi, A. R., & Bahari, A. (2020). Pengaruh Good

have a significant impact on the profitability of KBMI IV Corporate Governance Terhadap Profitabilitas

Commercial Banks. It is hoped, however, that the company Perusahaan Dengan Corporate Social Responsibility

would continue to enhance credit quality and default risk Sebagai Variabel Moderasi Pada Perusahaan Peserta

Corporate Governance Perception Index Pada Tahun

management, in addition to better quality and focused credit 2013-2017. Jurnal Akuntansi Keuangan dan Bisnis,

expansion. 13(1), 11-20.

[10]. Prawoto, B. (2017). Analisis Regresi Dalam Penelitian

KBMI IV has a strong ability to channel third-party Ekonomi & Bisnis: Dilengkapi Aplikasi SPSS Dan

funding. As a result, the bank's situation is becoming Eviews. Jakarta: Rajawali Pers.

increasingly liquid. This proves that the bank is able to meet its

commitments to pay funds to customers or depositors for loans

provided, as well as that, while credit provision is high, it is

IJISRT23JAN1420 www.ijisrt.com 2379

Volume 8, Issue 1, January – 2023 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[11]. Rembet, W. E., & Baramuli, D. N. (2020). Pengaruh

CAR, NPL, NIM, BOPO, LDR Terhadap Return on

Asset (ROA) (Studi Pada Bank Umum Swasta Nasional

Devisa Yang Terdaftar Di BEI). Jurnal EMBA: Jurnal

Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi, 8(3),

342-352.

[12]. Revita, M. L. D. E. (2018). Pengaruh GCG, CAR, LDR

Terhadap Kinerja Keuangan Serta Harga Saham

Perbankan. Jurnal Ecodemica, 2(2), 156-176.

[13]. Siswanti, I. (2016). Implementasi Good Corporate

Governance pada kinerja bank syariah. Jurnal Akuntansi

Multiparadigma, 7(2), 307-321.

[14]. Siswanti, I. (2018). The Influence of Financial

Performance and Non-Financial Performance on Islamic

Social Responsibility Disclosure: Evidence from Islamic

Banks in Indonesia. Int. J. Account. Bus. Soc, 26(2), 81-

96.

[15]. Spence, Michael. (1973). Job Market Signaling. The

Quarterly Journal of Economics, 3(87), 355-374.

[16]. Sugiyono, S. (2017). Metode Penelitian Kuantitatif,

Kualitatif, dan R&D. Bandung: Alfabeta, CV.

IJISRT23JAN1420 www.ijisrt.com 2380

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- IJAEB+(1.4)+2770-2785Document16 pagesIJAEB+(1.4)+2770-2785WahyuNo ratings yet

- KeywordsDocument9 pagesKeywordsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Characteristics of Nigerian Deposit Money Banks and Their Financial OutcomeDocument8 pagesCharacteristics of Nigerian Deposit Money Banks and Their Financial OutcomeEditor IJTSRDNo ratings yet

- The Effect of Financial Performance On Firms Value On Banking Companies Listed On Indonesia Stock Exchange From 2017 Until 2021Document21 pagesThe Effect of Financial Performance On Firms Value On Banking Companies Listed On Indonesia Stock Exchange From 2017 Until 2021International Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Liquidity On Profitability of Commercial Banks in NepalDocument14 pagesImpact of Liquidity On Profitability of Commercial Banks in Nepalybashreejana5No ratings yet

- Keywords:-Digital Finance, Foreign Ownership, Capital: Adequacy, Efficiency, Asset Qualit, ProfitabilityDocument8 pagesKeywords:-Digital Finance, Foreign Ownership, Capital: Adequacy, Efficiency, Asset Qualit, ProfitabilityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- New Financial Performance of Icici BankDocument10 pagesNew Financial Performance of Icici BankcityNo ratings yet

- Jurnal UTAMA - Cost Efficiency, Innovation and Financial Performance of Banks in IndonesiaDocument17 pagesJurnal UTAMA - Cost Efficiency, Innovation and Financial Performance of Banks in IndonesiadiolanaNo ratings yet

- Credit Risk, Liquidity Risk and Profitability in Nepalese Commercial BanksDocument9 pagesCredit Risk, Liquidity Risk and Profitability in Nepalese Commercial BanksKarim FarjallahNo ratings yet

- Analysis of Financial Performance OfSOE CommercialBanks Usingthe RGECMethodBefore AndDuringthe Covid19 PandemicDocument6 pagesAnalysis of Financial Performance OfSOE CommercialBanks Usingthe RGECMethodBefore AndDuringthe Covid19 PandemicInternational Journal of Advance Study and Research WorkNo ratings yet

- Capital Structure and Bank Performance in IndonesiaDocument9 pagesCapital Structure and Bank Performance in IndonesiaMamush JWNo ratings yet

- Factors Affecting Banking Profitability in IndonesiaDocument11 pagesFactors Affecting Banking Profitability in IndonesiaAbraham GraviroNo ratings yet

- Analysis of The Effect of Bank Financial Performance Characteristics On Bank Profitability Book 4 On IDXDocument10 pagesAnalysis of The Effect of Bank Financial Performance Characteristics On Bank Profitability Book 4 On IDXInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Efficiency On Voluntary Disclosure of Non-Banking Financial Company-Microfinance Institutions in IndiaDocument21 pagesImpact of Efficiency On Voluntary Disclosure of Non-Banking Financial Company-Microfinance Institutions in IndiaManisha ChourasiaNo ratings yet

- INDUSIND by Nishant BhatiDocument31 pagesINDUSIND by Nishant Bhatiprashantbhati0440No ratings yet

- JETIR1906667Document9 pagesJETIR1906667Pooja MNo ratings yet

- The Good Corporate Governance Effect Towards FirmValue Mediated by Bank Soundness RatioDocument5 pagesThe Good Corporate Governance Effect Towards FirmValue Mediated by Bank Soundness RatioInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Some Innovative Applications of DEA in the Interest of Investors: An Efficiency Substantiate of Indian Banking SectorDocument24 pagesSome Innovative Applications of DEA in the Interest of Investors: An Efficiency Substantiate of Indian Banking SectorRam PhalNo ratings yet

- Universal BankingDocument13 pagesUniversal BankingShrutikaKadamNo ratings yet

- Proper ReportDocument56 pagesProper ReportvijaypratapsinghjaipurNo ratings yet

- Financial Performance of Icici BankDocument15 pagesFinancial Performance of Icici BankcityNo ratings yet

- Public Bank & Private BankDocument97 pagesPublic Bank & Private BankHimangini Singh100% (2)

- Profitabilitas Dalam Sektor Manufaktur Barang Konsumsi Indonesia: Investigasi EmpirisDocument16 pagesProfitabilitas Dalam Sektor Manufaktur Barang Konsumsi Indonesia: Investigasi EmpirisOkto BriaNo ratings yet

- ID Analisis Rasio Rentabilitas Dan Rasio Likuiditas Pada Bank Bumn Yang Terdaftar DDocument11 pagesID Analisis Rasio Rentabilitas Dan Rasio Likuiditas Pada Bank Bumn Yang Terdaftar DMieta Salma HayatieNo ratings yet

- Impact of mergers on Indian banking sectorDocument5 pagesImpact of mergers on Indian banking sectorNids volgNo ratings yet

- Financial Statement Analysis EvidenceDocument7 pagesFinancial Statement Analysis EvidenceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- BalagobeiDocument14 pagesBalagobeiPham NamNo ratings yet

- Corporate Governance Practices and Financial Statement Analysis in Rwanda A Case Study of Bank of RwandaDocument9 pagesCorporate Governance Practices and Financial Statement Analysis in Rwanda A Case Study of Bank of RwandaEditor IJTSRDNo ratings yet

- 1 FINALLY (RIZA) NEW FixDocument12 pages1 FINALLY (RIZA) NEW FixtheincreptorNo ratings yet

- SIP Project finaniceDocument32 pagesSIP Project finanicerahulgandole132000No ratings yet

- Intern AsionalDocument13 pagesIntern AsionalHildaNo ratings yet

- Admin,+Journal+Manager,+Debby+Mulia+Octavia+ (74 84)Document11 pagesAdmin,+Journal+Manager,+Debby+Mulia+Octavia+ (74 84)Dwiyan TeguhNo ratings yet

- 139 April2019Document11 pages139 April2019vaibhav pachputeNo ratings yet

- Pre Merger and Post Merger Financial Analysis of Indian BankDocument12 pagesPre Merger and Post Merger Financial Analysis of Indian BankKRISHNA PRASAD SAMUDRALANo ratings yet

- Content ServerDocument5 pagesContent Serverangelamonteiro1234No ratings yet

- Disclosure Practices of Banking CompaniesDocument9 pagesDisclosure Practices of Banking CompaniesYashika DamodarNo ratings yet

- L-A Comparative Study of The Performance of Hybrid Banks in India-Dr S.M.Tariq ZafarDocument18 pagesL-A Comparative Study of The Performance of Hybrid Banks in India-Dr S.M.Tariq ZafarchaubeydsNo ratings yet

- IIBF Macro Resarch Project Report Revised 23.12.19Document103 pagesIIBF Macro Resarch Project Report Revised 23.12.19Aditya SinghNo ratings yet

- The Effect of Profitability and Leverage On Corporate Social Responsibility Disclosure: Case Study On Sharia Commercial Banks in IndonesiaDocument8 pagesThe Effect of Profitability and Leverage On Corporate Social Responsibility Disclosure: Case Study On Sharia Commercial Banks in Indonesiaai.rina.akun421No ratings yet

- 1 Background To The StudyDocument4 pages1 Background To The StudyNagabhushanaNo ratings yet

- The Effect of Earning Management, Profitability, and Firm Sizeon Audited Financial Statement TimelinessDocument11 pagesThe Effect of Earning Management, Profitability, and Firm Sizeon Audited Financial Statement TimelinessAnonymous izrFWiQNo ratings yet

- Research PDFDocument13 pagesResearch PDFZEKERIASASSEFANo ratings yet

- Effects of Corporate Governance On Financial Performance of Commercial Banks in NigeriaDocument11 pagesEffects of Corporate Governance On Financial Performance of Commercial Banks in NigeriaBitrusNo ratings yet

- Credit Management Practices and Bank Performance: Evidence From First BankDocument10 pagesCredit Management Practices and Bank Performance: Evidence From First BankJames UgbesNo ratings yet

- Impact of NonDocument30 pagesImpact of NonAmardeep SinghNo ratings yet

- SSRN Id3525666Document17 pagesSSRN Id3525666v1v1subrotoNo ratings yet

- AnalysisOfFinancialRatiosForMeasuringPerformanceOfIndianPublicSectorBanks (152 162)Document11 pagesAnalysisOfFinancialRatiosForMeasuringPerformanceOfIndianPublicSectorBanks (152 162)Devi MohanNo ratings yet

- Determinant of The Efficiency of Islamic Commercial Banks in IndonesiaDocument8 pagesDeterminant of The Efficiency of Islamic Commercial Banks in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Impact of Merger Deal On Shareholders'Value Creation AnInstance of State Bank of India GroupDocument6 pagesImpact of Merger Deal On Shareholders'Value Creation AnInstance of State Bank of India GroupInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Synopsis GlobalisationDocument11 pagesSynopsis GlobalisationSumit Aggarwal100% (1)

- Q - 5 Changing Role of Bank in IndiaDocument3 pagesQ - 5 Changing Role of Bank in IndiaMAHENDRA SHIVAJI DHENAKNo ratings yet

- Nexus Between Marketing of Financial Services and Banks' Profitability in Nigeria: Study of United Bank For Africa PLC (Uba)Document13 pagesNexus Between Marketing of Financial Services and Banks' Profitability in Nigeria: Study of United Bank For Africa PLC (Uba)Ellastrous Gogo NathanNo ratings yet

- Determinants of Profitability in Indian BanksDocument7 pagesDeterminants of Profitability in Indian BanksmajorraveeshNo ratings yet

- A Study On The Financial Performance of Scheduled Commercial BanksDocument15 pagesA Study On The Financial Performance of Scheduled Commercial BanksSadaf SayedqejklpNo ratings yet

- Pratap SynopsisDocument8 pagesPratap Synopsisanon_653770705No ratings yet

- FINANCIAL RATIO ANALYSIS REVEALS BANK PERFORMANCE FACTORSDocument9 pagesFINANCIAL RATIO ANALYSIS REVEALS BANK PERFORMANCE FACTORSVinky Eva AriestaNo ratings yet

- 1 PBDocument12 pages1 PBsainada osaNo ratings yet

- Analysis of Financial Performance of Selected Commercial Banks in IndiaDocument18 pagesAnalysis of Financial Performance of Selected Commercial Banks in IndiaSadaf SayedqejklpNo ratings yet

- Sana DessertationDocument80 pagesSana DessertationNaghul KrishnaNo ratings yet

- An Analysis on Mental Health Issues among IndividualsDocument6 pagesAn Analysis on Mental Health Issues among IndividualsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Insights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesDocument8 pagesInsights into Nipah Virus: A Review of Epidemiology, Pathogenesis, and Therapeutic AdvancesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Compact and Wearable Ventilator System for Enhanced Patient CareDocument4 pagesCompact and Wearable Ventilator System for Enhanced Patient CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Smart Cities: Boosting Economic Growth through Innovation and EfficiencyDocument19 pagesSmart Cities: Boosting Economic Growth through Innovation and EfficiencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Implications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewDocument6 pagesImplications of Adnexal Invasions in Primary Extramammary Paget’s Disease: A Systematic ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Parkinson’s Detection Using Voice Features and Spiral DrawingsDocument5 pagesParkinson’s Detection Using Voice Features and Spiral DrawingsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolDocument31 pagesThe Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Harnessing Open Innovation for Translating Global Languages into Indian LanuagesDocument7 pagesHarnessing Open Innovation for Translating Global Languages into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Air Quality Index Prediction using Bi-LSTMDocument8 pagesAir Quality Index Prediction using Bi-LSTMInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatDocument16 pagesInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Advancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisDocument8 pagesAdvancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractDocument7 pagesExploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Document2 pagesDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIDocument6 pagesThe Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterDocument11 pagesThe Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Digital Marketing Dimensions on Customer SatisfactionDocument6 pagesThe Impact of Digital Marketing Dimensions on Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Document9 pagesDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyNo ratings yet

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Terracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonDocument14 pagesTerracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Explorning the Role of Machine Learning in Enhancing Cloud SecurityDocument5 pagesExplorning the Role of Machine Learning in Enhancing Cloud SecurityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Review: Pink Eye Outbreak in IndiaDocument3 pagesA Review: Pink Eye Outbreak in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Hepatic Portovenous Gas in a Young MaleDocument2 pagesHepatic Portovenous Gas in a Young MaleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Navigating Digitalization: AHP Insights for SMEs' Strategic TransformationDocument11 pagesNavigating Digitalization: AHP Insights for SMEs' Strategic TransformationInternational Journal of Innovative Science and Research Technology100% (1)

- Automatic Power Factor ControllerDocument4 pagesAutomatic Power Factor ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ratecard Tribun Jatim Network. - 2023Document17 pagesRatecard Tribun Jatim Network. - 2023amerta.midtransNo ratings yet

- PT Trakindo Utama: QuotationDocument2 pagesPT Trakindo Utama: QuotationJUNA RUSANDI SNo ratings yet

- JAP - VOLUME 1, NO. 2, JUNI 2023 Halaman 210-216Document7 pagesJAP - VOLUME 1, NO. 2, JUNI 2023 Halaman 210-216Jaka MediaNo ratings yet

- Marketing Material Nov 2021Document37 pagesMarketing Material Nov 2021wagistaNo ratings yet

- Hotel Event BookingDocument2 pagesHotel Event BookingSunarto HadiatmajaNo ratings yet

- Track Transaction Status ID 202107021323939929Document2 pagesTrack Transaction Status ID 202107021323939929Ridayat SisNo ratings yet

- Master SuplyerDocument178 pagesMaster Suplyerstevie baraNo ratings yet

- Pembayaran PoltekkesDocument12 pagesPembayaran PoltekkesteffiNo ratings yet

- STUR 8301380472, 3516 Sedulun r1Document5 pagesSTUR 8301380472, 3516 Sedulun r1denny palimbungaNo ratings yet

- Mutasi Transaksi - PermataME6574 - 81202124819Document4 pagesMutasi Transaksi - PermataME6574 - 81202124819jainulNo ratings yet

- Material Topics Matrix and Contribution to SDGsDocument1 pageMaterial Topics Matrix and Contribution to SDGsGalla GirlNo ratings yet

- BCA 2020 Annual Report Highlights Digital Transformation and Pandemic ResponseDocument739 pagesBCA 2020 Annual Report Highlights Digital Transformation and Pandemic ResponseAman S Zendr Zendr100% (1)

- Bluaccount 007284521827 Desember2022Document11 pagesBluaccount 007284521827 Desember2022H.m.a. RoufNo ratings yet

- Fera TagihanDocument2 pagesFera TagihanGabe alberth sinagaNo ratings yet

- Offering Letter - Ashley HotelDocument4 pagesOffering Letter - Ashley HotelS1.KepTiur Y.M. GultomNo ratings yet

- Reputasi Perusahaan Dan Kepercayaan Terhadap Loyalitas Nasabah Pengguna ATM Pasca Isu Cybercrime (Studi Pada Nasabah BCA Di Surabaya)Document18 pagesReputasi Perusahaan Dan Kepercayaan Terhadap Loyalitas Nasabah Pengguna ATM Pasca Isu Cybercrime (Studi Pada Nasabah BCA Di Surabaya)jumowoNo ratings yet

- BCA API Tech Doc OAuth & SignatureDocument12 pagesBCA API Tech Doc OAuth & Signaturerangga appNo ratings yet

- Bara Cool OringDocument2 pagesBara Cool OringPujiono PujitechNo ratings yet

- Membership Translate Yuanta FINALDocument49 pagesMembership Translate Yuanta FINALAmita Shindu KusumaNo ratings yet

- LOI GOLD Buyer Terms XXXDocument3 pagesLOI GOLD Buyer Terms XXXMarlon Rantung75% (4)

- FFS PINNSEF 30 November 2020Document1 pageFFS PINNSEF 30 November 2020teguhsunyotoNo ratings yet

- J.P.morgan Indonesia 6des2020Document44 pagesJ.P.morgan Indonesia 6des2020ReisanNo ratings yet

- Case Study - BCA Employer Branding - The Challenge AheadDocument15 pagesCase Study - BCA Employer Branding - The Challenge AheadFajar Nur kholikNo ratings yet

- Payment Salary Document Bank Code ListDocument12 pagesPayment Salary Document Bank Code ListReza Ramdani Tri NoviantoNo ratings yet

- Bca Ar 2022 InggrisDocument762 pagesBca Ar 2022 InggrisAhsan MaulanaNo ratings yet

- Profil Komisaris enDocument7 pagesProfil Komisaris enPutu HerdyNo ratings yet

- New Supplier Account Registration Form: (For Taxable Company) (For Individual)Document2 pagesNew Supplier Account Registration Form: (For Taxable Company) (For Individual)Zahra Gita ShafiraNo ratings yet

- Indonesia Open 2022 Badminton ChampionshipsDocument12 pagesIndonesia Open 2022 Badminton ChampionshipsHaditsa Ghani FalahNo ratings yet

- Rekening Koran Bca - Edya Triwulan - AgustusDocument2 pagesRekening Koran Bca - Edya Triwulan - AgustusKolosebo100% (1)

- Intro Letter - Bank Central AsiaDocument3 pagesIntro Letter - Bank Central AsiaRoberto DianNo ratings yet