Professional Documents

Culture Documents

FM & Eco Grand Test 2

Uploaded by

moniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM & Eco Grand Test 2

Uploaded by

moniCopyright:

Available Formats

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

Roll No……………..

Total No. of Questions – 11 Total No. of Printed Pages – 8

Time Allowed – 3 Hours Maximum Marks - 100

NAC (FME 2)

CA Intermediate (New Syllabus)

Paper – 8: Financial Management and Economics for Finance

SECTION A – Financial Management

Question No. 1 is compulsory.

Answer any four questions out of the remaining five questions.

Working notes should form part of the answer.

(4 × 5 = 20 Marks)

1. Answer the followings:

(a) Following information relating to Jee Ltd. are given:

Profit after tax : `10,00,000

Dividend payout ratio : 50%

Number of Equity shares : 50,000

Cost of equity : 10%

Rate of return on investment : 12%

(1) What would be the market value per share as per as per Walter’s Model?

(2) What is the optimum dividend payout ratio according to Walter’s Model and market value of

equity share at that payout ratio?

(b) Tarus Ltd. has an estimated cash payments of `8,00,000 for a one month period and the payments

are expected to steady over the period. The fixed cost per transaction is `250 and the interest rate on

marketable securities is 12% p.a.

Calculate the optimal transaction size, average cash and number of transactions during one

month.

(c) RES Ltd. is an all equity financed company with a market value of `25,00,000 and cost of equity Ke

21%. The company wants to buyback equity shares worth `5,00,000 by issuing and raising 15%

perpetual amount (Debt).

Rate of tax may be taken as 30%. After the capital restructuring and applying MM model with

taxes.

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

You are required to calculate:

(a) Market value of RES Ltd.

(b) Cost of Equity Ke.

(c) Weighted average cost of capital and comment on it.

(d) Door ltd. is considering an investment of `4,00,000 this investments expected to generate substantial

cash inflows over the next five years. Unfortunately the annual cash flows from this investment is

uncertain, but the following probability distribution has been established:

Annual Cash Flow (`) Probability

50,000 0.3

1,00,000 0.3

1,50,000 0.4

At the end of its 5 years life, the investment is expected to have a residual value of `40,000. The cost

of capital is 5%.

(1) Calculate NPV under the three different scenarios.

(2) Calculate expected net present value

(3) Advise Door Ltd. on whether the investment is to be undertaken.

Year 1 2 3 4 5

DF @ 5% 0.952 0.907 0.864 0.823 0.784

2. SRS Ltd has furnished the following ratios and information relating to the year ended 31st

March,2015.

Sales `60,00,000

Return on Net Worth 25%

Rate of Income Tax 50%

Share Capital to Reserve 7: 3

Current Ratio 2

Net Profit to Sales (after tax) 6.25%

Inventory Turnover 12

(Based on cost of goods sold and closing stock)

Cost of Goods Sold `18,00,000

Interest on Debenture @ 15% `60,000

Sundry Debtors `2,00,000

Sundry Creditors `2,00,000

You are required to:

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

(i) Calculate the operating expenses for the year ended 31st March,2015.

(ii) Prepare Balance Sheet as on 31st March,2015.

(10 Marks)

3. ANP Ltd. Is providing the following information:

Annual cost of saving `96,000

Useful life 5 years

Salvage value zero

Internal rate of return 15%

Profitability index 1.05

Table of discount factor:

Discount Years

Factor 1 2 3 4 5 Total

15% 0.870 0.756 0.658 0.572 0.497 3.353

14% 0.877 0.769 0.675 0.592 0.519 3.432

13% 0.886 0.783 0.693 0.614 0.544 3.52

You are required to calculate:

(a) Cost of the project

(b) Payback period

(c) Net present value of cash inflow

(d) Cost of capital

(10 Marks)

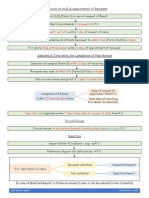

4. The management of Royal industries has called for a statement showing the working capital needs to

finance a level of 1,80,000 units of output for the year. The cost structure for the company's product

for the above mentioned activity level is detailed below:

Cost per Unit (`)

Raw materials 20

Direct labour 5

Overheads (including depreciation of `5 per unit) 15

Total cost 40

Profit 10

Selling price 50

Additional Information:

(a) Minimum desired cash balance is `20,000.

(b) Raw materials are held in stock on an average for 2 months.

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

(c) Work-in-progress (assume 50% completion stage) will approximate to half month's

production.

(d) Finished goods remain in warehouse on an average for a month.

(e) Suppliers of materials extend a month's credit and debtors are provided two month's credit.

(f) Cash sales are 25% of total sales.

(g) There is a time lag in payment of wages of a month and half a month in case of overheads.

From the above data, you are required to:

(1) Prepare a statement showing working capital needs; and

(2) Determine the maximum working capital finance available under the first two methods

suggested by Tandon Committee.

(10 Marks)

5. A company had the following Balance Sheet as on 31st March, 2014:

[in crores]

Liabilities ` Assets `

Equity Share Capital 5.00 Fixed Assets (Net) 12.50

(50 lakh shares of `10 each) Current Assets 7.50

Reserve and Surplus 1.00

15% Debentures 10.00

Current Liabilities 4.00

20.00 20.00

The additional information given is as under:

Fixed cost per annum (excluding interest) 4 crores

Variable operating cost ratio 65%

Total assets turnover ratio 2.5

Income Tax rate 30%

Required:

(i) Earnings Per Share

(ii) Operating Leverage

(iii) Financial Leverage

(iv) Combined Leverage

(10 Marks)

6. Answer the following:

(a) Explain in brief following Financial Instruments:

(i) Euro Bonds

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

(ii) Floating Rate Notes

(iii) Euro Commercial paper

(iv) Fully Hedged Bond

(1 x 4 = 4 Marks)

(b) Discuss the Advantages of Leasing.

(4 Marks)

(c) Write two main objectives of Financial Management.

OR

Write two main reasons for considering risk in Capital Budgeting decisions.

(2 Marks)

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

SECTION B – Economics for Finance

Question No. 7 is compulsory.

Answer any three questions from the rest.

Working notes should form part of the answer.

Question 7 (1)

"World Trade Organisation (WTO) has a three-tier system of decision making." Explain.

(2 Marks)

Question 7 (2)

In a two sector economy, the business sector produces 7,500 units at an average price of `7.

(a) What is the money value of output?

(b) What is the money income of households?

(c) If households spend 75 percent of their income, what is the total consumer expenditure?

(d) What is the total money revenues received by the business sector?

(e) What should happen to the level of output?

(5 Marks)

Question 7 (3)

Explain the objectives of Fiscal Policy.

(3 Marks)

Question 8 (1)

Which types of Government interventions are applied for correcting information failure?

(2 Marks)

Question 8 (2)

Compute M1 supply of money from the data given below:

Currency with public `2,13,279.8 Crores

Time deposits with bank `3,45,000.7 Crores

Demand deposits with bank `1,62,374.5 Crores

Post office savings deposit `382.9 Crores

Other deposits of RBI `765.1 Crores

(3 Marks)

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

Question 8 (3)

Describe the determinants of demand for money as identified by Milton Friedman in his restatement

of Quantity Theory of demand for money.

(3 Marks)

Question 8 (4)

The Nominal Exchange rate of India is `56/1$, Price Index in India is 116 and Price Index in USA is

112. What will be the Real Exchange Rate of India?

(2 Marks)

Question 9 (1)

The table given below shows the number of labour hours required to produce Sugar and Rice in two

countries X and Y:

Commodity Country X Country Y

1 Unit of Sugar 2.0 5.0

1 unit of Rice 4.0 2.5

(a) Compute the Productivity of labour in both countries in respect of both commodities.

(b) Which country has absolute advantage in production of Sugar?

(c) Which country has absolute advantage in production of Rice?

(3 Marks)

Question 9 (2)

Calculate the Average Propensity to Consume (APC) and Average Propensity to Save (APS) from the

following data:

Income Consumption

`4,000 `3,000

(2 Marks)

Question 9 (3)

Explain with example how Ad Valorem Tariff is levied.

(3 Marks)

Question 9 (4)

Describe features of public goods.

(2 Marks)

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

FM & ECO GRAND TEST 2 BY CA NAMIT ARORA SIR

Question 10 (1)

Distinguish between Personal Income and Disposable Personal Income.

(3 Marks)

Question 10 (2)

Explain the role of Government in a market economy as stated by Richard Musgrave.

(3 Marks)

Question 10 (3)

Why is the central bank referred to as a "banker's bank"?

(2 Marks)

Question 10 (4)

"World Trade Organisation (WTO) has a three-tier system of decision making." Explain.

(2 Marks)

Question 11 (1)

Describe the meaning and mechanism of 'crowding out' effect of public expenditure.

(3 Marks)

Question 11 (2)

"Money has four functions: a medium, a measure, a standard and a store." Elucidate.

(2 Marks)

Question 11 (3)

What will be the total credit created by the commercial banking system for an initial deposit of `3,000

at a Required Reserve Ratio (RRR) of 0.05 and 0.08 respectively? Also compute credit multiplier.

(2 Marks)

Question 11 (4)

What are the modes of Foreign Direct Investment (FDI)?

(3 Marks)

Youtube: https://www.youtube.com/user/canamitarora; Contact: 9891314730

You might also like

- Debt Instrument Project PDFDocument50 pagesDebt Instrument Project PDFRohit VishwakarmaNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- The Trader Hacker's Ultimate PlaybookDocument64 pagesThe Trader Hacker's Ultimate Playbookpta123100% (1)

- ACCA F9 Mock Examination 2Document5 pagesACCA F9 Mock Examination 2daria0% (1)

- Launching New Ventures An Entrepreneurial Approach 7th Edition Allen Solutions Manual DownloadDocument3 pagesLaunching New Ventures An Entrepreneurial Approach 7th Edition Allen Solutions Manual DownloadWilma Willingham100% (21)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Understanding Intangible AssetsDocument8 pagesUnderstanding Intangible AssetsMya B. Walker100% (1)

- Reviewer For Quiz 1Document4 pagesReviewer For Quiz 1pppppNo ratings yet

- Mock Test Paper 2: Financial Management & Economics for FinanceDocument6 pagesMock Test Paper 2: Financial Management & Economics for FinanceMayank RajputNo ratings yet

- Bos 51397 Interp 8Document30 pagesBos 51397 Interp 8Yogita SoniNo ratings yet

- FM & Eco Grand Test 1Document8 pagesFM & Eco Grand Test 1moniNo ratings yet

- RTP May2022 - Paper 8 FM EcoDocument30 pagesRTP May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- FM EcoDocument30 pagesFM Ecoovais kanojeNo ratings yet

- FM & ECO GRAND TEST 3 BY CA NAMIT ARORA SIRDocument9 pagesFM & ECO GRAND TEST 3 BY CA NAMIT ARORA SIRmoniNo ratings yet

- 73153bos58999-p8Document27 pages73153bos58999-p8Sagar GuptaNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Mutual fund NAV calculationDocument6 pagesMutual fund NAV calculationAnkitNo ratings yet

- Shareholder Value Creation-2Document5 pagesShareholder Value Creation-2tanadof294No ratings yet

- Paper14-SolutionDocument15 pagesPaper14-Solutionharshrathore17579No ratings yet

- CA Intermediate - Financial Management: Swapnil Patni's ClassesDocument3 pagesCA Intermediate - Financial Management: Swapnil Patni's ClassesAniket PatelNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- P18 Syl2012 Set1Document22 pagesP18 Syl2012 Set1Aswin KumarNo ratings yet

- 27. SEP23 QUES-1Document5 pages27. SEP23 QUES-1absankey770No ratings yet

- Internal Examination: Nandkunvarba Mahila BBA CollegeDocument3 pagesInternal Examination: Nandkunvarba Mahila BBA CollegeShivani JoshiNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument27 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalNo ratings yet

- Financial Management Project AnalysisDocument10 pagesFinancial Management Project AnalysisAlisha Shaw0% (1)

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- Question paper-TYBMS-SSF-Oct10Document2 pagesQuestion paper-TYBMS-SSF-Oct10Sneha Parab100% (1)

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- MTP_19_53_QUESTIONS_1713430127Document12 pagesMTP_19_53_QUESTIONS_1713430127Murugesh MuruNo ratings yet

- Faculty of Commerce and LawDocument4 pagesFaculty of Commerce and LawFaith MpofuNo ratings yet

- 01 LeveragesDocument11 pages01 LeveragesZerefNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument27 pagesPaper - 8: Financial Management and Economics For Finance Part A: Financial Management Questions Ratio AnalysistilokiNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument26 pages© The Institute of Chartered Accountants of IndiaChandana RajasriNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- All-Chapter-FM (1) (1) - 230602 - 235400Document19 pagesAll-Chapter-FM (1) (1) - 230602 - 235400alomgirhussan740No ratings yet

- Accs June 16Document8 pagesAccs June 16manasNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Investment Decision QuestionsDocument44 pagesInvestment Decision QuestionsAkash JhaNo ratings yet

- Maximizing Firm Value Through Optimal Financing DecisionsDocument16 pagesMaximizing Firm Value Through Optimal Financing DecisionsTanmay AroraNo ratings yet

- Question No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)Document6 pagesQuestion No.1 Is Compulsory. Answer Any Questions From The Remaining Six Questions Working Notes Should Form Part of The Answers (MARKS 100)rahul26665323No ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- Higher National Diploma in Accountancy Strategic Financial Management Model PaperDocument5 pagesHigher National Diploma in Accountancy Strategic Financial Management Model PaperdechickeraNo ratings yet

- RTP CA Final New Course Paper 2 Strategic Financial ManagemeDocument26 pagesRTP CA Final New Course Paper 2 Strategic Financial ManagemeTusharNo ratings yet

- Consolidated Financial Statements of Mind Ltd. and its Subsidiary Tree LtdDocument7 pagesConsolidated Financial Statements of Mind Ltd. and its Subsidiary Tree LtdAlankrita TripathiNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingHarsh DedhiaNo ratings yet

- CA Inter FM ECO Suggested Answer Nov 2022 (1)Document27 pagesCA Inter FM ECO Suggested Answer Nov 2022 (1)Abhishant KapahiNo ratings yet

- Paper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingDocument25 pagesPaper - 2: Strategic Financial Management Questions Risk Analysis in Capital BudgetingJINENDRA JAINNo ratings yet

- Dividend DecisionDocument6 pagesDividend DecisionYasin Misvari T MNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Test, FMDocument61 pagesTest, FMNeeraj GuptaNo ratings yet

- BBA FM 21Document3 pagesBBA FM 21Kundan JhaNo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Exercise Final SECTION B 2019Document5 pagesExercise Final SECTION B 2019Arman ShahNo ratings yet

- UntitledDocument6 pagesUntitledAlok TiwariNo ratings yet

- COST OF CAPITALDocument10 pagesCOST OF CAPITALYasin Misvari T MNo ratings yet

- FM & ECO GRAND TEST 3 BY CA NAMIT ARORA SIRDocument9 pagesFM & ECO GRAND TEST 3 BY CA NAMIT ARORA SIRmoniNo ratings yet

- Cost Grand Test 2Document4 pagesCost Grand Test 2moniNo ratings yet

- Cost Grand Test 1Document5 pagesCost Grand Test 1moniNo ratings yet

- Peer Review ChartDocument1 pagePeer Review ChartmoniNo ratings yet

- Corporate Financial StartegyDocument5 pagesCorporate Financial StartegyAli RazaNo ratings yet

- Venture Capital and Private Equity Contracting: An International PerspectiveDocument58 pagesVenture Capital and Private Equity Contracting: An International PerspectiveAli LatifNo ratings yet

- Cash Flows Capital BudgetingDocument57 pagesCash Flows Capital Budgetingvivek patelNo ratings yet

- Takeovers ExplainedDocument10 pagesTakeovers ExplainedCuong Huy NguyenNo ratings yet

- PROCESS COSTING REPORTDocument3 pagesPROCESS COSTING REPORTMita PutryanaNo ratings yet

- Amit Kumar 1682585701964Document2 pagesAmit Kumar 1682585701964amitk32892No ratings yet

- Chapter 7—International Arbitrage and Interest Rate ParityDocument11 pagesChapter 7—International Arbitrage and Interest Rate ParityRim RimNo ratings yet

- IE 490 Financial Engineering SyllabusDocument2 pagesIE 490 Financial Engineering SyllabusGaya RajNo ratings yet

- Rapport de MadioDocument88 pagesRapport de Madioroni jeufoNo ratings yet

- Does IT Pay Off HSBC and Citi Case StudyDocument8 pagesDoes IT Pay Off HSBC and Citi Case StudyIIMnotesNo ratings yet

- ExamView - Homework CH 10Document9 pagesExamView - Homework CH 10Brooke LevertonNo ratings yet

- Tan, Ma. Cecilia ADocument20 pagesTan, Ma. Cecilia ACecilia TanNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- Law RTP NOV 23Document60 pagesLaw RTP NOV 23Kartikeya BansalNo ratings yet

- Chapter 9Document9 pagesChapter 9Kristelle Joy Pascual100% (1)

- Evalute The Trading System of Dhaka Stock ExchangeDocument62 pagesEvalute The Trading System of Dhaka Stock ExchangeLikhon MiyaNo ratings yet

- Exercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Document3 pagesExercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Sylvia GynNo ratings yet

- Chapter 4 Branch AccountingDocument31 pagesChapter 4 Branch AccountingAkkamaNo ratings yet

- Volatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketDocument14 pagesVolatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketrehanbtariqNo ratings yet

- Nurwilda-Rate of ChangeDocument3 pagesNurwilda-Rate of ChangeNur WildaNo ratings yet

- Business Operating Cycle-2Document9 pagesBusiness Operating Cycle-2Mohamed Abd El-monemNo ratings yet

- Under Armour: Time Heals All Wounds, and UA Needs More Time Maintain HOLD, $20 PTDocument8 pagesUnder Armour: Time Heals All Wounds, and UA Needs More Time Maintain HOLD, $20 PTAnonymous Feglbx5No ratings yet

- Feedvisor Amazon Buy Box Guide Sellers Retailers 2024Document27 pagesFeedvisor Amazon Buy Box Guide Sellers Retailers 2024cjbesmonte01No ratings yet

- Cases&Exercises - Chapter 4Document3 pagesCases&Exercises - Chapter 4Barbara AraujoNo ratings yet

- Research Project - The Effects of Inflatin On The Performance of NSE, Kenya (School Version)Document55 pagesResearch Project - The Effects of Inflatin On The Performance of NSE, Kenya (School Version)ephantusNo ratings yet

- AC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With CommentsDocument74 pagesAC1025 2016 Exam Paper With Comments AC1025 2016 Exam Paper With Comments전민건No ratings yet