Professional Documents

Culture Documents

Colliers-Webinar ICCC 270122 Final-Compressed

Uploaded by

Geraldy Dearma PradhanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Colliers-Webinar ICCC 270122 Final-Compressed

Uploaded by

Geraldy Dearma PradhanaCopyright:

Available Formats

ICCC

Webinar Series

Thursday, 27 January 2022

Identifying Real Estate

Opportunities in 2022

Michael D. Broomell

Managing Director

Identifying Real Estate Opportunities in 2022

Investment

Market

Identifying Real Estate Opportunities in 2022

Economic Indicators

Economic Growth

Economic Growth 2020 - 2021 Daily mortality in 2021 due to Covid-19

8.00%

7.07%

6.00%

4.00%

2.97%

3.51%

2.00%

0.00%

1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21

-0.71%

-2.00%

-2.19%

-4.00%

-3.49%

-6.00% -5.32%

Source: Badan Pusat Statistik (BPS) Indonesia Source: JHU CSSE COVID-19 Data

The impact of government efforts in fighting the Covid-19 pandemic have been apparent in the continuous improvement in

Indonesian economic growth. A drop in growth in 3Q21 was due to the Covid-19 Delta variant, which delivered the hardest

hit so far, during the period from end May to end August.

Identifying Real Estate Opportunities in 2022

Economic Indicators

Vaccine Update

Share of people vaccinated against Covid-19 Vaccination by Province Population

as of Nov 28, 2021 as of Jan 17, 2022

DKI Jakarta 116.39% 91.74%

Bali 89.99% 73.67%

Singapore 92% 1% Yogyakarta 84.10% 71.18%

Riau Islands 81.33% 60.92%

Bangka Islands 67.96% 49.04%

Central Java 67.27% 49.84%

North Kalimantan 66.45% 47.66%

Malaysia 77% 2% West Java 65.60% 43.44%

East Kalimantan 65.59% 50.03%

East Java 65.56% 46.86%

Indonesia 65.37% 44.41% Top 5 province weekly progress

Gorontalo 64.87% 39.60%

Vietnam 51% 22% North Sumatra 64.72% 40.71%

Banten 64.04% 43.57% Highest first dose progress

North Sulawesi 63.57% 38.87%

Central Kalimantan 63.48% 38.82% 1. North Sumatra 7.5%

Bengkulu 62.67% 39.80% 2. West Java 6.6%

Indonesia 34% 16% Jambi

West Nusa Tenggara

61.43%

61.37%

44.00%

41.35% 3. South Sumatra 5.4%

South Sumatra 61.31% 35.20% 4. Aceh 5.4%

Riau 61.29% 37.99%

Lampung 60.72% 36.74%

5. Maluku 5.3%

Philippines 28% 8% South Kalimantan

South Sulawesi

60.43%

58.51%

32.81%

35.68%

Aceh 58.05% 25.13%

Highest full dose progress

West Sumatra 56.61% 36.83% 1. Riau 9.7%

Southeast Sulawesi 56.43% 29.48%

2. Southeast Sulawesi 9.0%

Myanmar 9% 28%

North Maluku

Central Sulawesi

55.66%

54.06%

26.80%

29.67% 3. East Nusa Tenggara 8.0%

West Sulawesi

East Nusa Tenggara

53.82%

53.13%

30.74%

28.74%

4. West Kalimantan 6.1%

West Kalimantan 51.83% 35.22% 5. Aceh 6.0%

0% 20% 40% 60% 80% 100% Maluku 48.05% 23.50%

West Papua 38.50% 25.02%

Papua 17.66% 12.83%

Share of people fully vaccinated against Covid-19 0% 50% 100% 150% 200% 250%

Share of people only partly vaccinated against Covid-19 % First Dose % Full Dose

Source: Our World in Data Source: Bahana

Identifying Real Estate Opportunities in 2022

Economic Indicators

Economic Growth

Indonesia

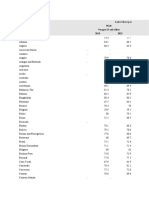

Country 2016 2017 2018 2019 2020 2021 E 2022 E 2023 E 2024 E 2025 E

7.00

6.00 Malaysia 4.41 5.56 5.09 4.74 (3.89) 3.64 5.68 6.77 5.45 4.68

5.00

Philippines 7.18 7 6.41 6.05 (5.67) 1.69 7.69 8.1 6.73 6.13

4.00

Singapore 2.73 4.51 4.28 1.41 (4.45) 5.05 4.05 3.46 3.07 3.03

3.00

2.00 Thailand 3.36 4.02 4.24 2.92 (4.82) 0.64 5.06 6.49 4.54 3.22

1.00

Vietnam 6.68 6.95 7.08 7.02 2.91 6.64 7.79 7.55 6.39 5.99

-

2016

2017

2018

2019

2020

2021 E

2022 E

2023 E

2024 E

2025 E

(1.00) Myanmar 6.41 5.75 6.41 6.5 2.92 (9.87) 5.77 6.19 8.64 7.54

(2.00)

Indonesia 5.03 5.07 5.17 5.02 (2.01) 3.34 6.86 6.32 5.67 5.62

(3.00)

Source: Oxford Economics

Identifying Real Estate Opportunities in 2022

What’s Changing

Office property is challenged as the

Property investment activity is rising but

standard go-to core product globally as

not to the same level as other gateway

values are depressed and occupiers have

cities in Asia Pacific.

not fully sorted their new normal.

Expected opportunities to acquire

More capital is seeking investment in discounted hospitality did not really

logistics and landed housing. materialize, so lots of dry powder but no

home for it.

Identifying Real Estate Opportunities in 2022

Strategies

Identify partnership Buy strategic land sites for Find partner opportunities with

opportunities with capital future development at experienced township

partners to monetize significant attractive prices. developers building largely self-

parts of holdings and have liquidating landed products and

capex funds for necessary limited supporting retail and

upgrades, working capital, etc. commercial uses.

Identifying Real Estate Opportunities in 2022

Office Market

Identifying Real Estate Opportunities in 2022

Office

Supply & Occupancy

Cumulative Supply Occupancy

8,000,000 86.0% 85.1%

338,832 127,500 0 0 84.1%

233,933 212,247 110,357 82.8%

481,337 84.0%

501,927 81.0% 80.8%

6,000,000 82.0%

82.6% 79.5%

80.0% 81.9% 82.2% 78.5%

30,000 69,375 80.6% 76.9% 77.4%

249,401 155,874 96,884 117,000 78.0%

4,000,000 96,425 150,999 85,000

76.0%

2,000,000 74.0% 75.8% 75.5% 76.1%

75.1% 74.5%

72.0%

0 70.0%

2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E

CBD Existing Supply CBD Annual Supply

Outside CBD Existing Supply Outside CBD Annual Supply CBD Outside CBD

• Construction activity slowed down during pandemic, highlighted by • Occupancy continued to drop during pandemic.

delay in completion. • The absorption level in the CBD was a historic low in 2021, i.e. below

• Today, quite a few developer are anticipating the right momentum 80%, down 4% compared to before pandemic.

before reactivating new construction. • Similar trend occurred in outside the CBD, a drop of 5% in occupancy

• Future buildings that are currently under-planning are likely to since 2019.

experience delay in completion.

• We expect to see supply-demand equilibrium starting in 2024 onward.

Identifying Real Estate Opportunities in 2022

Office

Rent & Price

Base Rent Selling Price

292,374

IDR 300,000 284,247

276,774 276,228 56,049,855

269,224 IDR 65,000,000 54,405,450 57,731,350

IDR 275,000 257,323

250,807

259,438 55,821,986 58,185,160 55,424,132 53,866,782 55,221,532

244,174

IDR 250,000 IDR 55,000,000

224,602

IDR 225,000 212,027

202,865 IDR 45,000,000 50,521,812

192,284 196,756 195,594 36,168,096 37,448,501

191,158 188,309 191,388 36,621,400 35,405,656 36,401,069 36,710,618

IDR 200,000

IDR 35,000,000 37,635,744

IDR 175,000 37,200,176 37,077,724

IDR 150,000 IDR 25,000,000

2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E

CBD Outside CBD CBD Outside CBD

• Asking base rent in the CBD now is IDR249,537, but we expect to see a • Most landlords and units owners are still offering old price.

further drop by the end of 2021 or 12% decrease compared to 2019. • But we hardly record any strata-title transaction activity during the

• The operation of future Premium-class buildings will lift the overall pandemic.

asking rental tariff in the CBD, however transacted rent will likely to see

pressure from tenants given a huge vacant space in the market. • The addition of new strata-title building will be limited.

• Rent in the CBD will only grow below 2% annually, particularly in 2022 • Price will only grow moderately.

onward.

• The overall rent in outside the CBD similarly declined by 4% during the

pandemic.

• The limited future supply over 2023 – 2024 will help stimulate rent to

increase moderately going forward.

Identifying Real Estate Opportunities in 2022

Companies have adapted to the pandemic conditions

Occupiers Perspective

Contract or expand Renew or relocate

• More and more companies have adapted Companies generally no longer perceive

their businesses according to current relocation as big risk to their business,

conditions and expand by either staying they have started to accept current

where they are or move to a new building pandemic conditions and decided to

execute the relocate plan to a new

• Many companies generally have decided to building if the deal is right. They are taking

reduce their occupied space by about 10 – advantage of the tenant’s market with

30% when renewing or restructuring their competitive rents, and flexible landlords

leases offering terms such as tenant fit-out

allowances and others.

• Many companies have decided to apply

hybrid workplace models

• Many companies have had to redesign

their current layouts to be more flexible

and collaborative. There will be more “hot

desking” than fixed desks

Identifying Real Estate Opportunities in 2022

Reasons for companies to relocate during the pandemic

They have been in They have to move They wish to expand They have decided to

the same building for owing to the their business with consolidate their

many years. situation with their caution. operations.

current building; for

example: the building

is under a Build

Operate Transfer

arrangement or is to

be demolished.

Identifying Real Estate Opportunities in 2022

Strategies and Opportunities for 2022

Landlords are advised to show flexibility and be Landlords should focus more on achieving high

accommodative to keep tenants wanting to extend their occupancy rates like 70-80%.

leases, as well as being more flexible to secure new leases.

Flexibility may be offered by providing incentives such as: Landlords should allocate some areas for agile

• Rent free (“face rents” and “net effective” rents) working spaces in their building. Flexible workplace

strategy will become a requirement for many

• Free parking companies.

• Option to surrender

• Early termination option

• Fit-out allowance to be amortised over the lease term

• Option to renew with rental cap

Landlords should support sustainability concept by

• Sub-lease and assignment applying a green building certification.

• Holdover rights

Identifying Real Estate Opportunities in 2022

Retail Market

Identifying Real Estate Opportunities in 2022

Retail

Supply & Occupancy

Jakarta Cumulative Supply & Occupancy Greater Area Cumulative Supply & Occupancy

83.6% 83.5%

4,000,000 85.0% 4,000,000 81.9% 82.5% 85.0%

79.8% 82.5% 82.5%

78.5%

3,000,000 77.4% 80.0% 3,000,000 80.0%

76.2%

74.9% 77.5% 74.5% 75.0% 77.5%

2,000,000 72.1% 72.9% 75.0% 2,000,000 72.6% 75.0%

71.1% 71.1% 71.3%

72.5% 69.3% 72.5%

1,000,000 70.0% 1,000,000 70.0%

67.5% 67.5%

0 65.0% 0 65.0%

2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E

Occupied Spaces Vacant Spaces Occupancy Occupied Spaces Vacant Spaces Occupancy

• At the end of 2021, Pondok Indah Mall 3 and AEON Mall Tanjung Barat.

Annual Supply

200,000

• We anticipate 4 malls to operate within 2022-2025, adding around

200,000 sq m. 150,000

• Most of upcoming shopping centres in greater area of Jakarta are in the 100,000

construction stage.

• The addition of new mall will push occupancy downward, particularly 50,000

because of low commitment during grand opening of new malls.

0

• We anticipate an increase in visitor traffic, along with the loosening 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E

traffic limitation.

Jakarta Greater Area

Identifying Real Estate Opportunities in 2022

Retail

Rent & Service Charge

Average Rent Service Charge

176,287

IDR 800,000 IDR 180,000

735,892 169,507

IDR 170,000 162,987

680,316 156,718

IDR 700,000 IDR 160,000

631,864 148,800 150,691

600,182 607,763 609,003 145,784

595,181 IDR 150,000

IDR 600,000 562,799 566,280 139,127

IDR 140,000 133,738 135,143 133,776

507,606 128,631

468,006 IDR 130,000 122,505

IDR 500,000 117,358 118,937

435,951 IDR 120,000 114,224

111,556

401,277

387,238 384,479 385,071 380,934 379,144

IDR 400,000 IDR 110,000 101,475

IDR 100,000

IDR 300,000 IDR 90,000

2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E

Jakarta Greater Area Jakarta Greater Area

• Rent adjustment in 2021 was mainly triggered by the operation of • Landlords generally maintain service charge tariff, but the overall

Pondok Indah Mall 3 with rental tariff above market average. adjustment is mainly due to the influx of newly operating Pondok

• Mall visitors has gradually shown an upward trend despite still lower Indah Mall 3.

than in the normal time. • Rent and service adjustment are likely to increase moderately in

2022 provided that economic projection achieves the target.

Identifying Real Estate Opportunities in 2022

Retail

Market Update

Most rents and service Landlords are still looking Retailers are getting more In the office sector, we

charges have returned to for replacement tenants confident and are looking still see retailers closing

normal levels, except for in a soft market where to expand again wanting outlets, and it is still

some segments such as retailers know they can to reap the benefits of the difficult for developers to

entertainment and get more favourable soft market. But they find new tenants. F&B

cinemas. rental terms. continue to be very retailers, especially, are

selective in terms of the still very cautious because

locations they take up. of the pandemic.

Identifying Real Estate Opportunities in 2022

Industrial &

Logistics Market

Identifying Real Estate Opportunities in 2022

Industrial

Land Absorption

Annual Land Absorption Land Absorption Along 2021 YTD

1,400

GIIC (Greenland)

1,200

Karawang New Industry City

1,000

Hectares

Jababeka

800 Suryacipta

600 Kawasan Industri Cikembar - Sukabumi

Modern Cikande

400

Krakatau Industrial Estate Cilegon

200 Bekasi Fajar

0 Griya Idola

Kota Bukit Indah (Besland Pertiwi)

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021 YTD

Sentul Industrial Estate

KIIC

Serang Bekasi Karawang Tangerang Bogor - Sukabumi 0 5 10 15 20 25 30 35 40 45 50 55 60

• Total transaction in Q3 was 52.7 hectare.

• Along Jan-Sept 2021 land transaction reached 134.86 hectare (70.5% of total sales in 2020).

• The largest sales in Q3 was from EV manufactures (Hyundai) for the battery module which occurred at KNIC.

• Data centre companies are very aggressive in expanding now and going forward.

• Industrial sector is expected to be first sector to recover in 2022. We anticipate demand in 2022 onward will be 25% higher than this year.

Identifying Real Estate Opportunities in 2022

Industrial

Land Price & Active Sectors (2021)

Industrial Land Price Active Sectors during 2021

USD 350

USD 300

USD 250

USD 200

USD 150

USD 100 4.96%

52.36%

USD 50

USD 0

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Q3 2021

22.13%

Serang Tangerang Bekasi Karawang Bogor

Automotive, 52.36% Textiles, 1.54%

• High-tech industry is very dominant. Data Centre, 22.13% Developer, 1.38%

• Automotive industry is back but more tech oriented like the EV. Chemicals, 4.96% Oil & Gas-related, 0.77%

Packaging, 4.16% Pharmaceutical, 0.60%

• Data centre is quite expansive and will continue to expand in the Construction/Engineering, 3.24% Piping/Valve, 0.48%

future. Logistics/Warehousing, 2.69% Manufacturing, 0.38%

• Other active sectors includes logistics, petro-chemical, food, health, Medical/Health, 1.86% Steel-related, 0.17%

pharmacy and FMCG. Building Material, 1.62% Electronics, 0.03%

Others, 1.60%

Identifying Real Estate Opportunities in 2022

Industrial

Warehouse, logistics, and fulfilment centres

Traditional vs. Automation Express vs. Fulfillment Target areas will have high

• Increased demand for • Increased demand for populations and be close to

warehouse automation fulfilment centres Jakarta: areas such as the

(shuttle racking) south of Jakarta, west of

• Changes as C to C becomes Jakarta, Tangerang and Bekasi.

• In the longer-term, B to C

automation will keep

logistic costs stable

Identifying Real Estate Opportunities in 2022

Industrial

Industrial development supported by the government

For some industrial estates that are supported by

the government, there are advantages that can

be an opportunity, too. The Terms & Conditions

provided, especially in terms of price, can be very

competitive. With the price offered, ownership

can even be up to 80 years. Apart from that,

another advantage is the special incentives which

will be adjusted by BKPM based on the value of

the investment.

Identifying Real Estate Opportunities in 2022

Apartment &

Expatriate Housing

Identifying Real Estate Opportunities in 2022

Residential

Supply

Cumulative Supply: Strata-title Apartment Cumulative Supply: Serviced Apartment

300,000 8,000

470

7,774 360 577

250,000

12,388 7,000

8,257 344

9,769 2,698 3,383

17,524 6,000 0 192 214

200,000 8,115

# Units

5,000

150,000 4,000

3,000

100,000

2,000

50,000

1,000

- 0

2017 2018 2019 2020 2021F 2022F 2023F 2024F 2025F 2017 2018 2019 2020 2021F 2022F 2023F 2024F 2025F

Existing supply New supply Existing supply New supply

• No new project was introduced in 2022. • In 2018 - 2021, additional new apartment for lease was 332 units per

• We anticipate 3,383 new apartment units being completed in 2021. annum.

• Leased and serviced apartment will grow 4.1% CAGR along 2022 –

• Total units projected to close 2021 will be 221,117 unit.

2025.

• In 2022 - 2025 annual supply is 7,195 units, lower that in 2014 – 2021 of

9,540 units per annum.

Identifying Real Estate Opportunities in 2022

Residential

Take-up Rate & Occupancy

Take-up Rate Occupancy

100% 80%

88.5% 89.0% 89.5% 70%

86.9% 87.2% 87.2% 87.5% 88.0%

90% 85.8%

60% 68.1% 67.9%

65.0% 63.0% 65.0%

60.0%

80% 50% 55.2% 55.0%

52.0%

40%

70%

30%

20%

60%

10%

50% 0%

2017 2018 2019 2020 2021 F 2022 F 2023 F 2024 F 2025 F 2017 2018 2019 2020 2021F 2022F 2023F 2024F 2025F

• We are anticipating for a better sales result by the end of 2021. This will • Annual occupancy dropped 10-15% in 2020 – 2021 mainly due to

help lift the absorption rate modestly compared to 2020. Covid-19.

• The average take-up rate in 2022- 2025 will be 88 - 89%. • We are quite positive to envisage upcoming years, given the current

vaccination rate which will result in the normal human mobility.

Identifying Real Estate Opportunities in 2022

Residential

Price & Rent

Asking Price Rental Rate (IDR/sq m/month)

45 40.97 430,000

Asking Price / sqm (IDR million)

39.39 420,911

37.88

40 36.42 420,000

34.80 35.00 35.02 413,818

33.00 33.80 410,848

35 412,658

410,000

30

404,566

25 400,000

397,985 396,634

392,700

20 390,000

15

380,000 381,378

10

5 370,000

0 360,000

2017 2018 2019 2020 2021 F 2022 F 2023 F 2024 F 2025 F 2017 2018 2019 2020 2021F 2022F 2023F 2024F 2025F

• Apartment price remains at IDR35 million/sq m. • Annual rents was down 4% in 2020 - 2021 as a result of the drop in

• In 2022-2025 we anticipate 4% increase per annum. occupancy.

• But we anticipate a 2.5% CAGR rental increase in 2022 – 2025 mainly

underpinned by sound economic performance and more conducive

situation when Covid-19 can be curbed.

Identifying Real Estate Opportunities in 2022

Market Updates

While overall landed housing prices show some gradual

increases, apartment prices have either held ground or

lost ground in the last few quarters.

Apartment projects with ready stock are competing

better than under construction projects as they can

offer VAT incentive.

Identifying Real Estate Opportunities in 2022

Expatriate Housing

Tenant Market

As the market is still Tenants need to have Tenants need to have Even with its tenant

dynamic, tenants still have smart negotiations with knowledge of the market, market, there are few

more options. owners and use the since not everything that exceptions for high-

flexibility as an occurs in the market is demand residential. Some

opportunity. applicable to all expatriate of these residences have

housing owners. begun to stabilise in

terms of price and

occupancy levels.

Identifying Real Estate Opportunities in 2022

Expatriate Housing

Opportunity in 2022

Companies/tenants need to With the unstable Until Q2 2022, it looks like it

be mindful when conditions, some companies will still continue to be a

embedding clauses in allow their expats to have tenant market. So,

agreements. personal agreements negotiations on leasing

regarding leasing, just as rates and payment terms

long as it complies with the can still transpire with the

companies’ policies. owner for flexibility.

Identifying Real Estate Opportunities in 2022

Hospitality

Market

Identifying Real Estate Opportunities in 2022

Hotel

Hotel Project Cumulative Supply Hotel Room Cumulative Supply

120 20,000

18,000

100 16,000

14,000

80

12,000

60 10,000

8,000

40

6,000

4,000

20

2,000

0 0

2017 2018 2019 2020 2021 2022E 2023E 2024E 2025E 2017 2018 2019 2020 2021 2022E 2023E 2024E 2025E

3-star 4-star 5-star 3-star 4-star 5-star

Hotel supply addition is now growing more moderate. This will be positive for the overall hotel market in the future.

Identifying Real Estate Opportunities in 2022

Hotel

Jakarta

Average Daily Rate (ADR) Average Occupancy Rate (AOR)

USD 90.0 80.0%

USD 80.0 70.0%

USD 70.0

60.0%

USD 60.0

50.0%

USD 50.0

40.0%

USD 40.0

30.0%

USD 30.0

20.0%

USD 20.0

USD 10.0 10.0%

USD - 0.0%

Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec

2018 2019 2020 2021 2018 2019 2020 2021

Identifying Real Estate Opportunities in 2022

Hotel

Bali

Average Daily Rate (ADR) Average Occupancy Rate (AOR)

USD 140.0 90.0%

80.0%

USD 120.0

70.0%

USD 100.0

60.0%

USD 80.0 50.0%

USD 60.0 40.0%

30.0%

USD 40.0

20.0%

USD 20.0

10.0%

USD - 0.0%

Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec

2018 2019 2020 2021 2018 2019 2020 2021

Identifying Real Estate Opportunities in 2022

Hospitality

Jakarta Hospitality Outlook (Business)

Market Resources (MICE & Government)

Indicators

MICE will be the main business of many hotels in Jakarta, whilst support • The Incremental

areas (BODETABEK) will also share the same market segment. However, performance in

support areas will also share the leisure and StayCation sectors better Occupancy and ADR of

outside Jakarta. the total area

• The incremental of

average customer

The government segment will provide occupancy on weekdays and other spending in many

business days, as well as other market sources. businesses is increasing,

even though it is unlikely

to be better than the 2018

performance

New customer habits will be faced by all hospitality industries in many

area, including Jakarta and in other hospitality businesses, such as

accommodation, restaurants, entertainment and others.

Identifying Real Estate Opportunities in 2022

Hospitality

Bali Hospitality Outlook (Leisure)

Market Resources (MICE & Domestic)

Indicators

Incremental

Occupancy and

ADR throughout

the Bali Area.

As per government Bali and Jakarta will host Revenge Tourism will also

planning, Indonesia is some of these events and create a very positive

going to host several their associated areas will back-up to the number of

International MICE events get benefits of visitors and visitors to Bali.

in 2022 to help boost related activities. The G20

tourism and business in Meeting is one of the

South East Asia. events, with pre-events

starting in March 2022.

Identifying Real Estate Opportunities in 2022

Q&A

Identifying Real Estate Opportunities in 2022

Contact

Scan here to access

our reports

Mike D. Broomell

Managing Director

Identifying Real Estate Opportunities in 2022

You might also like

- Colliers Webinarreal EstateDocument54 pagesColliers Webinarreal EstateOktafia HariniNo ratings yet

- Nutritional Status and Nutrition ProgramDocument11 pagesNutritional Status and Nutrition Programgwen cerenioNo ratings yet

- Kuliah Praktisi Mengajar UAJY-1Document69 pagesKuliah Praktisi Mengajar UAJY-1Easy GamingNo ratings yet

- In Thousand 60kg Bags: Monthly Export Statistics - January 2018Document1 pageIn Thousand 60kg Bags: Monthly Export Statistics - January 2018dorie_dorinaNo ratings yet

- Political Opinion Poll - July 2021Document31 pagesPolitical Opinion Poll - July 2021The Star KenyaNo ratings yet

- 20.08.2020 Covid Response PunjabDocument48 pages20.08.2020 Covid Response PunjabloveydhaliwalNo ratings yet

- Corporate ExposureDocument32 pagesCorporate ExposureAdlin BahriNo ratings yet

- Program BayiDocument11 pagesProgram BayiPraba SintaNo ratings yet

- Cakupan MR Kabupaten IndramayuDocument1 pageCakupan MR Kabupaten IndramayuAyuni PyanNo ratings yet

- Indonesia'S Capital Market Updates: Akhmad NuranyantoDocument35 pagesIndonesia'S Capital Market Updates: Akhmad NuranyantoSiti Hutami pratiwiNo ratings yet

- Soybean Crop ConditionsDocument2 pagesSoybean Crop ConditionsPhương NguyễnNo ratings yet

- Geographical-Spread Term PPRDocument4 pagesGeographical-Spread Term PPRswizelNo ratings yet

- RalentíDocument73 pagesRalentíLEONARDO FABIO ESGUERRA OSPINANo ratings yet

- Assembly Election 2018 - Voter Turnout ReportDocument14 pagesAssembly Election 2018 - Voter Turnout ReportOxigen XenonNo ratings yet

- Format Rekap Capaian VaksinasiDocument6 pagesFormat Rekap Capaian Vaksinasidzul tamvanNo ratings yet

- Item Analysis JHSDocument45 pagesItem Analysis JHSHendrix Antonni EnriquezNo ratings yet

- Item Analysis JHSDocument45 pagesItem Analysis JHSHendrix Antonni EnriquezNo ratings yet

- In Thousand 60kg Bags: Monthly Export Statistics (Members & Non-Members) - December 2020Document1 pageIn Thousand 60kg Bags: Monthly Export Statistics (Members & Non-Members) - December 2020Gemechis BidoNo ratings yet

- Covid-19 Death Analysis Among Vaccinated 1Document3 pagesCovid-19 Death Analysis Among Vaccinated 1බූ බූNo ratings yet

- Poll Percentage 2019Document9 pagesPoll Percentage 2019Pratham KrishnaNo ratings yet

- Book 1Document3 pagesBook 1Marco BrazilNo ratings yet

- Instructional Costs (Category 3,4,5,&6) As % of MCPS Total BudgetDocument12 pagesInstructional Costs (Category 3,4,5,&6) As % of MCPS Total BudgetParents' Coalition of Montgomery County, MarylandNo ratings yet

- Cambridge English - Grade Statistics 2017 - Certificate in Teaching English To Speakers of Other Languages (CELTA)Document2 pagesCambridge English - Grade Statistics 2017 - Certificate in Teaching English To Speakers of Other Languages (CELTA)Lali SalamiNo ratings yet

- Item AnalysisDocument10 pagesItem AnalysisJanet Aban OtanaNo ratings yet

- Rekapan Mutu Kesling Tahun 2021Document2 pagesRekapan Mutu Kesling Tahun 2021Yevi Eryanti EryantiNo ratings yet

- Rekapan Mutu Kesling Tahun 2021Document2 pagesRekapan Mutu Kesling Tahun 2021Yevi Eryanti EryantiNo ratings yet

- Overview of Health Planning in Indonesia in 2018Document64 pagesOverview of Health Planning in Indonesia in 2018Purnawan JunadiNo ratings yet

- Food&BeveragesDocument3 pagesFood&Beveragesdian sulistianiNo ratings yet

- Country/ States/ Union Territories Name Literacy Rate (Persons) - Total - 2001Document13 pagesCountry/ States/ Union Territories Name Literacy Rate (Persons) - Total - 2001Jagadish KumarNo ratings yet

- Table A3. Education: Primary Level Net Enrolment Ratio, Pupils StartingDocument2 pagesTable A3. Education: Primary Level Net Enrolment Ratio, Pupils Startingapi-17744395No ratings yet

- whs2023 Annex1Document54 pageswhs2023 Annex1AGBAHOUNGBANo ratings yet

- Survey Activity Report 2022Document2 pagesSurvey Activity Report 2022Michael Scott DavidsonNo ratings yet

- Pencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Document1 pagePencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Johari AbdullahNo ratings yet

- ITEM ANALYSIS - SecondDocument9 pagesITEM ANALYSIS - SecondJanet Aban OtanaNo ratings yet

- NFHS 2005 2006Document4 pagesNFHS 2005 2006bazme araNo ratings yet

- Internal Control Activities & Road MapDocument12 pagesInternal Control Activities & Road MapStephen AzebeokhaiNo ratings yet

- POVERTY in Laua An Research in NSTPDocument5 pagesPOVERTY in Laua An Research in NSTPSheena Mae GallerosNo ratings yet

- Izza InvestmentDocument3 pagesIzza InvestmentizzaNo ratings yet

- Exportaciones ICO 2019Document1 pageExportaciones ICO 2019ceibogabNo ratings yet

- DAFNA FactSheetDocument2 pagesDAFNA FactSheetfxarb098No ratings yet

- Rekap Laporan Progress Mingguan Menara Santosa - 13.01.2021Document9 pagesRekap Laporan Progress Mingguan Menara Santosa - 13.01.2021yoga pratamaNo ratings yet

- 10 EducationDocument18 pages10 EducationshaheeraneesNo ratings yet

- Unit 1.introduction To Economics PDFDocument30 pagesUnit 1.introduction To Economics PDFDunston Chi EsquivelNo ratings yet

- Giignl 2021 Annual Report Apr27Document2 pagesGiignl 2021 Annual Report Apr27Andres SerranoNo ratings yet

- Corporate Exposure RKO 2018 - PRAJAB PLN GROUP 20180914Document76 pagesCorporate Exposure RKO 2018 - PRAJAB PLN GROUP 20180914Adam ArmandoNo ratings yet

- Livon Apr Dec08Document20 pagesLivon Apr Dec08Jignesh ShahNo ratings yet

- MacroDocument4 pagesMacroLina M Galindo GonzalezNo ratings yet

- Update Pelaksanaan Vaksinasi COVID-19 01 November 2022Document20 pagesUpdate Pelaksanaan Vaksinasi COVID-19 01 November 2022rickyvebrinoNo ratings yet

- Performance of Bongaigaon Electrical CircleDocument8 pagesPerformance of Bongaigaon Electrical Circlemr hrdNo ratings yet

- Survey of Mining Companies 2014 Figures and TablesDocument203 pagesSurvey of Mining Companies 2014 Figures and TablesCamilo SierraNo ratings yet

- IE ProjectDocument48 pagesIE ProjectJulija KondratjevaNo ratings yet

- Quarterly MPS 2018-2019Document74 pagesQuarterly MPS 2018-2019BENJAMIN FALLADONo ratings yet

- MTCDocument23 pagesMTCsozodaaaNo ratings yet

- Table 3. Projected Provincial Life Expectancy at Birth and SexDocument1 pageTable 3. Projected Provincial Life Expectancy at Birth and Sexjade capalacNo ratings yet

- For DPOs - LIS-LESF-Enrollment-Variances-as-of-July-27-2020-8amDocument1,352 pagesFor DPOs - LIS-LESF-Enrollment-Variances-as-of-July-27-2020-8amNancy Nicasio SanchezNo ratings yet

- Program PrioritasDocument28 pagesProgram Prioritasnurul kusumaNo ratings yet

- ENG - Market Insight - Advisory - Transit Oriented Development TOD Area Investment Opportunity in Jakarta - R5 - 190123Document6 pagesENG - Market Insight - Advisory - Transit Oriented Development TOD Area Investment Opportunity in Jakarta - R5 - 190123Geraldy Dearma PradhanaNo ratings yet

- Q4 2022 ColliersQuarterly JakartaDocument38 pagesQ4 2022 ColliersQuarterly JakartaGeraldy Dearma Pradhana100% (2)

- Q3 2022 ID ColliersQuarterly JakartaDocument27 pagesQ3 2022 ID ColliersQuarterly JakartaGeraldy Dearma PradhanaNo ratings yet

- Q2 2022 ColliersQuarterly Jakarta IndustrialEstateDocument6 pagesQ2 2022 ColliersQuarterly Jakarta IndustrialEstateGeraldy Dearma PradhanaNo ratings yet

- Interest Rate - Cap Rate Economics 2018Document15 pagesInterest Rate - Cap Rate Economics 2018Geraldy Dearma PradhanaNo ratings yet

- Presentation To Investors-FY-2015Document35 pagesPresentation To Investors-FY-2015Geraldy Dearma PradhanaNo ratings yet

- Baileys LagoonDocument17 pagesBaileys LagoonGeraldy Dearma PradhanaNo ratings yet

- Land Laws Including Tenure and Tenancy SystemDocument41 pagesLand Laws Including Tenure and Tenancy SystemAnkita ChawlaNo ratings yet

- Shopping Centre Business Plan SampleDocument17 pagesShopping Centre Business Plan SampleDougs Itèlè Orisunbáré Ayèálayé65% (17)

- Statement of Delinquent RentDocument2 pagesStatement of Delinquent RentAdmin OfficeNo ratings yet

- 44 Circuit Road Rental Agreement 20-06-22Document19 pages44 Circuit Road Rental Agreement 20-06-22SRINI TNNo ratings yet

- Arkansas Statury Law UnlawfulDocument13 pagesArkansas Statury Law UnlawfulRonnie LongNo ratings yet

- Tenancy Agreement Ciculated July 2020Document7 pagesTenancy Agreement Ciculated July 2020KienlevyNo ratings yet

- Conciliation Case StudiesDocument2 pagesConciliation Case StudiesGunreddy RajareddyNo ratings yet

- Level 3 Award in Residential Letting and Property Management Qualification SpecificationDocument13 pagesLevel 3 Award in Residential Letting and Property Management Qualification Specificationchee pin wongNo ratings yet

- GESE Sample Advanced Listening Tasks (Grades 10-12)Document15 pagesGESE Sample Advanced Listening Tasks (Grades 10-12)Mary24200094% (16)

- Roscommon Newspapers Volume 3Document16 pagesRoscommon Newspapers Volume 3St. John's Parish Heritage Group.No ratings yet

- Sample Monthly House Rental AgreementDocument5 pagesSample Monthly House Rental AgreementMarlene LunaNo ratings yet

- The Maharashtra Rent Control ActDocument40 pagesThe Maharashtra Rent Control ActPrashant WaghmareNo ratings yet

- New York Standard Lease Agreement Residential 2017-03-29Document10 pagesNew York Standard Lease Agreement Residential 2017-03-29ev xvNo ratings yet

- Housing VocabDocument5 pagesHousing Vocabdung lêNo ratings yet

- SPLC Amicus BriefDocument50 pagesSPLC Amicus BriefZachary HansenNo ratings yet

- Immovable Property - NotesDocument28 pagesImmovable Property - NotesJoseph Brown91% (11)

- Ex Parte Motion To Stay ExecutionDocument7 pagesEx Parte Motion To Stay ExecutionJames Alan Bush100% (8)

- Rent Agreement Mohit BhaiyaDocument4 pagesRent Agreement Mohit BhaiyaVibhor BhatiaNo ratings yet

- LAND LAW CPJMMMMDocument15 pagesLAND LAW CPJMMMMketan cpjNo ratings yet

- Landlord and TennantDocument12 pagesLandlord and TennantJosephine TappNo ratings yet

- 7 HOUSING FINANCE 1 MergedDocument192 pages7 HOUSING FINANCE 1 MergedKristien GuanzonNo ratings yet

- Lease Misserrie - Long LeaseDocument7 pagesLease Misserrie - Long LeaseBritney Samuel ScottNo ratings yet

- Domestic Violence Lease TerminationDocument2 pagesDomestic Violence Lease TerminationJeremy PageNo ratings yet

- Real-Estate Legalization - Dubai - Part4Document26 pagesReal-Estate Legalization - Dubai - Part4Ahmad ShafiqNo ratings yet

- Bond Refund FormDocument2 pagesBond Refund FormMerlynRamirezNo ratings yet

- Texas Association of Realtors Residential Lease AgreementDocument14 pagesTexas Association of Realtors Residential Lease AgreementDallasDamien67% (6)

- Seven Years To 7 Figure Wealth PDFDocument20 pagesSeven Years To 7 Figure Wealth PDFErin SpindleNo ratings yet

- S206 (3) National Land CodeDocument25 pagesS206 (3) National Land CodeCarmel Grace PhilipNo ratings yet

- Commercial Lease Agreement Template 01Document7 pagesCommercial Lease Agreement Template 01Jai Prakash SharmaNo ratings yet

- Idfc Institute Housing ReportDocument118 pagesIdfc Institute Housing ReportDhruval Jignesh PatelNo ratings yet