Professional Documents

Culture Documents

AOVPS7267Q - Show Cause Notice Us 270A - 1045781439 (1) - 21092022

Uploaded by

Basavaraj KorishettarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AOVPS7267Q - Show Cause Notice Us 270A - 1045781439 (1) - 21092022

Uploaded by

Basavaraj KorishettarCopyright:

Available Formats

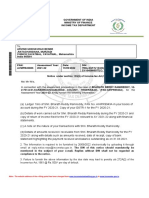

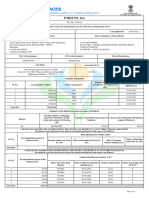

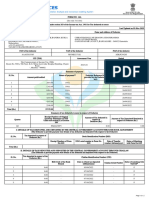

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

INCOME TAX DEPARTMENT

To,

SIMHADRI JAGANMOHAN

1 1 23 2 N SOLE PROP M S SRI MAHALAXMI

TRADERS, RAICHUR ROAD SINDHANUR

DIST RAICHUR 584128, Karnataka

India

*ITBA100052352898*

PAN: Assessment Year: Date : DIN :

AOVPS7267Q 2020-21 21/09/2022 ITBA/PNL/S/270A/2022-

23/1045781439(1)

Notice for Penalty under section 274 read with section 270A of the Income-tax Act,1961

Ms/Mr/M/s,

Whereas in the course of proceedings for the Assessment Year 2020-21, it appears that you have

under-reported income which is in consequence of misreporting thereof as per details given in

the assessment order.

2. You are required to show cause why an order imposing penalty u/s 270A of the Income-tax Act,1961

should not be passed.

3. You are required to submit your reply online electronically in 'e-Proceeding' facility through your

account in e-filing website (www.incometax.gov.in) by the 00:00 AM of 24/10/2022.

4. In case reply is not submitted, the order shall be passed without the benefit of your explanation.

Assessment Unit

Income Tax Department

Note:- The website address of the e-filing portal has been changed from www.incometaxindiaefiling.gov.in to www.incometax.gov.in.

Digitally signed by

ASSESSMENT UNIT, INCOME

TAX DEPARTMENT

Date: 21-09-2022 19:01:33 IST

You might also like

- AOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Document3 pagesAOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Basavaraj KorishettarNo ratings yet

- Mentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticeDocument2 pagesMentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticePonugoti Pavan kumarNo ratings yet

- AACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Document1 pageAACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Hitesh DhingraNo ratings yet

- AAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Document2 pagesAAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Basavaraj KorishettarNo ratings yet

- DEMAND_NOTICEDocument1 pageDEMAND_NOTICEManuNo ratings yet

- Ajrxxxxx5r Q2 2021-22Document3 pagesAjrxxxxx5r Q2 2021-22Tenzin ChoezomNo ratings yet

- Statement Sep 22 XXXXXXXX4970Document4 pagesStatement Sep 22 XXXXXXXX4970Saumya BajpaiNo ratings yet

- 13 - 38223327102780 CR BhuswalDocument3 pages13 - 38223327102780 CR BhuswalAbhishek DahiyaNo ratings yet

- AITPN6389G - Issue Letter - 1053923881 (1) - 23062023Document2 pagesAITPN6389G - Issue Letter - 1053923881 (1) - 23062023Peddaiah KarthiNo ratings yet

- FormDocument20 pagesFormSubramanyam JonnaNo ratings yet

- 2023 - APL - AHEPC8919M - Deficiency Letter - 1058141649 (1) - 22112023Document2 pages2023 - APL - AHEPC8919M - Deficiency Letter - 1058141649 (1) - 22112023RiaZ MoHamMaDNo ratings yet

- AMNPR3273M - Issue Letter - 1054531107 (1) - 23072023Document3 pagesAMNPR3273M - Issue Letter - 1054531107 (1) - 23072023prakash reddyNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

- Optotax Newletter - March - 2021Document6 pagesOptotax Newletter - March - 2021Atmiya DasNo ratings yet

- Signature Not Verified Digitally Signed Tax InvoiceDocument1 pageSignature Not Verified Digitally Signed Tax InvoiceNarendra v reddyNo ratings yet

- PTO Vouchers March.15.2022-Releasing ReceiptDocument1 pagePTO Vouchers March.15.2022-Releasing Receiptcherish nicole lopezNo ratings yet

- Title BookDocument1 pageTitle Bookbap1986No ratings yet

- Form 16Document9 pagesForm 16Satyam MaramNo ratings yet

- Demand Notice - Us 156 - Dhanush - AY 2016-17Document1 pageDemand Notice - Us 156 - Dhanush - AY 2016-17client itNo ratings yet

- DSPPS9646E - Intimation Letter - 1049670856 (1) - 13022023Document1 pageDSPPS9646E - Intimation Letter - 1049670856 (1) - 13022023b.ramanareddy7226No ratings yet

- AG0000001339Document4 pagesAG0000001339Puneet GuptaNo ratings yet

- MR - Vipin SharmaDocument1 pageMR - Vipin SharmaVIPIN SHARMANo ratings yet

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)dhirajNo ratings yet

- Aino Communique 110th Dec EditionDocument12 pagesAino Communique 110th Dec EditionSwathi JainNo ratings yet

- Pag IbigDocument1 pagePag IbigVenus AgustinNo ratings yet

- Due Date Calendar June 22Document1 pageDue Date Calendar June 22HAKIMI MZNNo ratings yet

- INVL-21957-SCOM10837Document1 pageINVL-21957-SCOM10837Shashank PalaiNo ratings yet

- NP Collectionreceipt 38415400Document2 pagesNP Collectionreceipt 38415400Kirti VithaniNo ratings yet

- AHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024Document4 pagesAHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024hadassaha VNo ratings yet

- GST registration cancellation orderDocument1 pageGST registration cancellation orderP .Yazhini ParthibanNo ratings yet

- Purnachandra Samal: Account StatementDocument6 pagesPurnachandra Samal: Account StatementManika JenaNo ratings yet

- XXXXXXXXXXXXX 2023-24 SignedDocument2 pagesXXXXXXXXXXXXX 2023-24 SignedpinkyyymehtaNo ratings yet

- Aaaak3661l.ac728 Insight Ver 01 285ba (5) 2021-22 20200000184850001 23032022Document2 pagesAaaak3661l.ac728 Insight Ver 01 285ba (5) 2021-22 20200000184850001 23032022K M Subbaiah e-TDSNo ratings yet

- Invoice from RTADocument1 pageInvoice from RTAPupinder SinghNo ratings yet

- Medipath TDS 2nd Nov 2022Document1 pageMedipath TDS 2nd Nov 2022asok maitiNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSeeni Sathish KumarNo ratings yet

- Skylink Nov2022Document3 pagesSkylink Nov2022Dharmaraj ManojNo ratings yet

- Form16 Mar 2019 PDFDocument9 pagesForm16 Mar 2019 PDFManish Kumar SinghNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToMUNNA SKNo ratings yet

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Mayank GandhiNo ratings yet

- TDS Certificate Form 16 SummaryDocument3 pagesTDS Certificate Form 16 Summarydingle2No ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- In1 2022 1009 80085208Document2 pagesIn1 2022 1009 80085208Careers and DreamsNo ratings yet

- Sanjay Sarju ITR-V APKPG2803C 2021-22 580822850301221Document1 pageSanjay Sarju ITR-V APKPG2803C 2021-22 580822850301221vijay mishraNo ratings yet

- GST Invoice for Home Interior Design ServicesDocument3 pagesGST Invoice for Home Interior Design ServicesramaniNo ratings yet

- Statement of Account details for Mohammed Akheel AhmedDocument1 pageStatement of Account details for Mohammed Akheel AhmedASHIQ HUSSAINNo ratings yet

- Sidel Tax Invoice 292Document1 pageSidel Tax Invoice 292cnanda89No ratings yet

- Sbi Tax PayDocument1 pageSbi Tax Paykalpataru.mallickNo ratings yet

- StatementOfAccount 7157238650 22092022 182727Document4 pagesStatementOfAccount 7157238650 22092022 182727JANE 20COHE016No ratings yet

- Invoice Books 1Document1 pageInvoice Books 1Rizvan MasroorNo ratings yet

- Ulb 114 11 75Document3 pagesUlb 114 11 75psatyam2921No ratings yet

- CBDTSMChallanForm02 09 2022Document1 pageCBDTSMChallanForm02 09 2022asok maitiNo ratings yet

- Channai Tex RiciptDocument1 pageChannai Tex RiciptANISH SHAIKHNo ratings yet

- Adlpc4428j Q2 2023-24 1Document2 pagesAdlpc4428j Q2 2023-24 1jayashrimohanreddyNo ratings yet

- Report PDFDocument2 pagesReport PDFJBStringerNo ratings yet

- SsvfplAAICS8788C - Show Cause Notice For Proceedings Us 148A - 1041050229 (1) - 19032022Document2 pagesSsvfplAAICS8788C - Show Cause Notice For Proceedings Us 148A - 1041050229 (1) - 19032022Babbar & Co BabbarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument5 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceRahul JhaNo ratings yet

- Rights and Obligations of Banker and CustomerDocument12 pagesRights and Obligations of Banker and Customerbeena antu100% (1)

- BofA StatementDocument8 pagesBofA StatementJonathan Seagull Livingston100% (1)

- Life Insurance and Annuity Models for Multiple LivesDocument16 pagesLife Insurance and Annuity Models for Multiple LivesFion TayNo ratings yet

- PL SBI 3 L Statement-1Document2 pagesPL SBI 3 L Statement-1Om PrakashNo ratings yet

- Disbursement Voucher: Ministry of Social Services and DevelopmentDocument2 pagesDisbursement Voucher: Ministry of Social Services and DevelopmentHyrin GuludahNo ratings yet

- Tutorial 2 - QuestionsDocument6 pagesTutorial 2 - Questionsjunming laiNo ratings yet

- BibliographyDocument3 pagesBibliographySocialist GopalNo ratings yet

- The Bank System in The Slovak Republic Contains All The BankDocument5 pagesThe Bank System in The Slovak Republic Contains All The Bankvekonyviktoriaerasmus2023No ratings yet

- Ca Foundation Lacture 1 ppt-1Document23 pagesCa Foundation Lacture 1 ppt-1idealNo ratings yet

- Resume of Ronaldperry1966Document2 pagesResume of Ronaldperry1966api-23836341No ratings yet

- Statement of Account: American Express® Platinum CardDocument5 pagesStatement of Account: American Express® Platinum Cardkuldeep.sharmaNo ratings yet

- FayazDocument15 pagesFayazamiramir9086003904No ratings yet

- List of Creditors Version 1Document505 pagesList of Creditors Version 1Siddhesh Vishnu GaikwadNo ratings yet

- SAVEINSTPL-3249953316714 001 SignedDocument14 pagesSAVEINSTPL-3249953316714 001 SignedAbhayNo ratings yet

- Life Insurance Basics EbookDocument11 pagesLife Insurance Basics Ebooknoexam1100% (3)

- Phrasal Verbs Related To MoneyDocument4 pagesPhrasal Verbs Related To MoneyKinder ArtNo ratings yet

- Loan Documents SubmissionDocument6 pagesLoan Documents SubmissionWilhelm RegaladoNo ratings yet

- Salary Loan Application FormDocument4 pagesSalary Loan Application FormWilfrid Jan AldeNo ratings yet

- EMPLOYEE BENEFITS THEORY EXPLAINEDDocument3 pagesEMPLOYEE BENEFITS THEORY EXPLAINEDTracy Ann Acedillo100% (1)

- Chapter - 1 (Introduction)Document6 pagesChapter - 1 (Introduction)Tanmay Sarkar100% (1)

- LPMPC Products and Services - Part 1 - As of Octob 3Document8 pagesLPMPC Products and Services - Part 1 - As of Octob 3phoebekayleonaNo ratings yet

- Internship Report On BAJK 2022Document37 pagesInternship Report On BAJK 2022Husnain AwanNo ratings yet

- Statement 445Document4 pagesStatement 445yarec79954No ratings yet

- Exercises MortgagesDocument2 pagesExercises MortgagesNicu BotnariNo ratings yet

- NSCCL SGF Inv Policy 0Document2 pagesNSCCL SGF Inv Policy 0Amit KumarNo ratings yet

- Service Charges W.E.F 18.11.2022Document58 pagesService Charges W.E.F 18.11.2022anandNo ratings yet

- Sample Chapter 13 PetitionDocument47 pagesSample Chapter 13 PetitionMaxwell Law Firm, PLLC100% (1)

- Coin Deposit MachinesDocument1 pageCoin Deposit MachinesUmie Adam & HaWaNo ratings yet

- Internship Report On "Credit Cards of South East Bank LTD.": Submitted ToDocument26 pagesInternship Report On "Credit Cards of South East Bank LTD.": Submitted ToTushar ShahiNo ratings yet