Professional Documents

Culture Documents

Title Book

Uploaded by

bap1986Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Title Book

Uploaded by

bap1986Copyright:

Available Formats

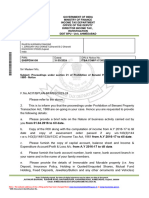

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

INCOME TAX DEPARTMENT

OFFICE OF THE INCOME TAX OFFICER

WARD EXEMPTION, VADODARA

To,

VISHVAKARMA EDUCATION TRUST

RATANPUR KANTADI,AT RATANPUR KANTADI

GODHRA

*ITBA100008346123*

PANCHMAHAL 388710,Gujarat

PAN: AY: Notice No.: Date of Issue:

AABTV8034E 2017-18 ITBA/AIM/S/142(1)/2017- 02/02/2018

18/1008620446(1)

Notice Under Clause(i), Sub-Section (1) of Section 142 of the Income-Tax Act, 1961

Sir/Madam,

In connection with assessment for assessment year 2017-18, you are required to prepare a

true and correct return of your income in respect of which you are assessable under the Income-tax

Act, 1961 (Act), during the previous year relevant to the assessment year, mentioned above.

The said return of income should be in appropriate form as prescribed in Rule 12 of the

Income Tax Rules, 1962 and duly verified in accordance with provisions of section 140 of the Act.

The said return of income is required to be furnished as per the conditions and manner

prescribed in Rule 12 of Income-tax Rules, 1962, on or before 04/03/2018.

HAR NARAYAN AGRAWAL

WARD EXEMPTION, VADODARA

Note: If digitally signed, the date of digital signature may be taken as date of document.

Aayakar Bhawan,Baroda, INCOME TAX OFFICE, RACE COURSE CIRCLE, BARODA, Gujarat, 390007

Email: BARODA.ITO.EXMP@INCOMETAX.GOV.IN, Office Phone:02652327308

You might also like

- Aircraft Hourly Operating Cost CalculatorDocument33 pagesAircraft Hourly Operating Cost CalculatorhenryNo ratings yet

- Tax Invoice: Pest Kare (India) PVT - LTDDocument1 pageTax Invoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Certificate of RegistrationDocument2 pagesCertificate of RegistrationEnrry SebastianNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedArun MohantyNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedpadduNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- The Early Ceramics of The Inca Heartland - Brian S. BauerDocument172 pagesThe Early Ceramics of The Inca Heartland - Brian S. BauerClaudio Rozas0% (1)

- AZ-104T00 Microsoft Azure Administrator: Course DescriptionDocument19 pagesAZ-104T00 Microsoft Azure Administrator: Course DescriptionsargaNo ratings yet

- Mentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticeDocument2 pagesMentioned in The Subject of Your E-Mail. Replies Without DIN Shall Not Be Regarded As Compliance To The NoticePonugoti Pavan kumarNo ratings yet

- Technipfmc Company Presentation: April 2020Document38 pagesTechnipfmc Company Presentation: April 2020Fedi M'hallaNo ratings yet

- Shangai Houton ParkDocument15 pagesShangai Houton ParkHari HaranNo ratings yet

- Customer Relationship ManagementDocument19 pagesCustomer Relationship ManagementAshok SharmaNo ratings yet

- SsvfplAAICS8788C - Show Cause Notice For Proceedings Us 148A - 1041050229 (1) - 19032022Document2 pagesSsvfplAAICS8788C - Show Cause Notice For Proceedings Us 148A - 1041050229 (1) - 19032022Babbar & Co BabbarNo ratings yet

- AARPW1885E - Show Cause Notice For Proceedings Us 148A - 1041373372 (1) - 23032022Document2 pagesAARPW1885E - Show Cause Notice For Proceedings Us 148A - 1041373372 (1) - 23032022Sukalp WarhekarNo ratings yet

- CHLPV7576G - Show Cause Notice For Proceedings Us 148A - 1060077952 (1) - 24012024Document3 pagesCHLPV7576G - Show Cause Notice For Proceedings Us 148A - 1060077952 (1) - 24012024manohargudNo ratings yet

- Notice Under Clause (B) of Section 148A of The Income-Tax Act, 1961Document4 pagesNotice Under Clause (B) of Section 148A of The Income-Tax Act, 1961infoNo ratings yet

- AHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024Document4 pagesAHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024hadassaha VNo ratings yet

- 2023 - AST - 7000000064235807 - 84659914 - 2023 - AST - GSKPS0475R - Notice Us 148 - 1062502871 (1) - 13032024Document1 page2023 - AST - 7000000064235807 - 84659914 - 2023 - AST - GSKPS0475R - Notice Us 148 - 1062502871 (1) - 13032024Rakesh Reddy DammaNo ratings yet

- DSPPS9646E - Notice Us 148 - 1042644182 (1) - 07042022Document1 pageDSPPS9646E - Notice Us 148 - 1042644182 (1) - 07042022b.ramanareddy7226No ratings yet

- Income TaxDocument2 pagesIncome TaxSrinivasarao ObillaNo ratings yet

- 2023 - COM - 7000000057391312 - 75606367 - 2023 - COM - AYDPP9418N - Issue Letter - 1059838284 (1) - 18012024Document2 pages2023 - COM - 7000000057391312 - 75606367 - 2023 - COM - AYDPP9418N - Issue Letter - 1059838284 (1) - 18012024Jaswanth KumarNo ratings yet

- To, Kanakadas Boddu 48-19-4/D, Sri Ramachandra Nagar KRISHNA 520008, Andhra Pradesh IndiaDocument1 pageTo, Kanakadas Boddu 48-19-4/D, Sri Ramachandra Nagar KRISHNA 520008, Andhra Pradesh IndiaSai BodduNo ratings yet

- AMDPN0995Q - Issue Letter - 1049262090 (1) - 31012023Document2 pagesAMDPN0995Q - Issue Letter - 1049262090 (1) - 31012023krishnaNo ratings yet

- AAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Document2 pagesAAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Basavaraj KorishettarNo ratings yet

- AOVPS7267Q - Show Cause Notice Us 270A - 1045781439 (1) - 21092022Document1 pageAOVPS7267Q - Show Cause Notice Us 270A - 1045781439 (1) - 21092022Basavaraj KorishettarNo ratings yet

- 133 (6) NoticeDocument2 pages133 (6) NoticeinfoNo ratings yet

- DSPPS9646E - Intimation Letter - 1049670856 (1) - 13022023Document1 pageDSPPS9646E - Intimation Letter - 1049670856 (1) - 13022023b.ramanareddy7226No ratings yet

- Aayush JainDocument3 pagesAayush Jaindingle2No ratings yet

- AMNPR3273M - Issue Letter - 1054531107 (1) - 23072023Document3 pagesAMNPR3273M - Issue Letter - 1054531107 (1) - 23072023prakash reddyNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- To, Jagannath Reddy Kaila 3-1-171 Hyderugda, Bhadurpura RR DIST, Andhra Pradesh, IndiaDocument1 pageTo, Jagannath Reddy Kaila 3-1-171 Hyderugda, Bhadurpura RR DIST, Andhra Pradesh, IndiaManuNo ratings yet

- 11 16 18 10 06 705Document2 pages11 16 18 10 06 705Finance - SnackerStreetNo ratings yet

- And Services Tax Act, 2017 (Act No.16 of 2017), The Government of Andhra PradeshDocument1 pageAnd Services Tax Act, 2017 (Act No.16 of 2017), The Government of Andhra PradeshsatishNo ratings yet

- Demand NoticeDocument1 pageDemand NoticeManuNo ratings yet

- Form16 Mar 2019 PDFDocument9 pagesForm16 Mar 2019 PDFManish Kumar SinghNo ratings yet

- ADPPB7911B - Show Cause Notice For Proceedings Us 148A - 1041291139 (1) - 23032022Document2 pagesADPPB7911B - Show Cause Notice For Proceedings Us 148A - 1041291139 (1) - 23032022nirmalku2061No ratings yet

- AACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Document1 pageAACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Hitesh DhingraNo ratings yet

- EHBPD5410H - Issue Letter - 1063776688 (1) - 31032024Document3 pagesEHBPD5410H - Issue Letter - 1063776688 (1) - 31032024Shareeq MemonNo ratings yet

- Form 16-2223Document5 pagesForm 16-2223Arthur JosephNo ratings yet

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- AITPN6389G - Issue Letter - 1053923881 (1) - 23062023Document2 pagesAITPN6389G - Issue Letter - 1053923881 (1) - 23062023Peddaiah KarthiNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- Form16 1103Document12 pagesForm16 1103NaveenchdrNo ratings yet

- Webfurther India Private Limited: Form 16Document8 pagesWebfurther India Private Limited: Form 16RAHUL MITTAPALLYNo ratings yet

- 12 16 19 00 41 116Document2 pages12 16 19 00 41 116Venkatesh KumarNo ratings yet

- Amount Chargeable (In Words)Document1 pageAmount Chargeable (In Words)Saurav Kumar SinghNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayPawan BhardwajNo ratings yet

- Invoice WPTM-14850160 PDFDocument2 pagesInvoice WPTM-14850160 PDFPatent AgentNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- Inv23 19202 03Document1 pageInv23 19202 03bharatrajbar63No ratings yet

- Order Us 143 (3) FY 2015-16 Disallowance 14ADocument4 pagesOrder Us 143 (3) FY 2015-16 Disallowance 14ADiksha SharmaNo ratings yet

- #MPSO10 Invoice August 2020 PDFDocument2 pages#MPSO10 Invoice August 2020 PDFashutoshNo ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- 02012020fin RT4 PDFDocument1 page02012020fin RT4 PDFPAO TPT PAO TPTNo ratings yet

- Sales GST 281Document1 pageSales GST 281ashish.asati1No ratings yet

- Form 16-2021-2022Document12 pagesForm 16-2021-2022Kunal BansodeNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raviNo ratings yet

- Accounting Voucher2Document1 pageAccounting Voucher2Saurabh GargNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Modi joshiNo ratings yet

- Invoicef 2 K 1 Bibdfh 2 RPWKZ 2 JP 5 Nku 4Document1 pageInvoicef 2 K 1 Bibdfh 2 RPWKZ 2 JP 5 Nku 4sandeep sainiNo ratings yet

- AQGxxxxx2Q G22 PDFDocument2 pagesAQGxxxxx2Q G22 PDFLatha YerurNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- GrihaDocument0 pagesGrihabharath18No ratings yet

- Feature Advantage Benefit (CelCulture CO2 Incubator Range)Document4 pagesFeature Advantage Benefit (CelCulture CO2 Incubator Range)Michael G. BasaNo ratings yet

- Activating Art Cam SoftwareDocument5 pagesActivating Art Cam SoftwareMuamerNo ratings yet

- Training ReportDocument16 pagesTraining ReportJay MavaniNo ratings yet

- CS 310-Algorithms-Imdad Ullah Khan-Arif ZamanDocument3 pagesCS 310-Algorithms-Imdad Ullah Khan-Arif ZamanAli ShahidNo ratings yet

- External Factor Evaluation: Dr. Priyanka ShrivastavDocument13 pagesExternal Factor Evaluation: Dr. Priyanka ShrivastavRajan SinghNo ratings yet

- Modeling and Simulation of EHV (402034MJ) : Unit 4: Electric Vehicle ConfigurationDocument90 pagesModeling and Simulation of EHV (402034MJ) : Unit 4: Electric Vehicle Configurationsagar kordeNo ratings yet

- PUN Hlaing, Hsu Yadanar AungDocument2 pagesPUN Hlaing, Hsu Yadanar AungHsu Yadanar AungNo ratings yet

- Minutes AircraftSafetySubcom 03242015Document19 pagesMinutes AircraftSafetySubcom 03242015Elmer VillegasNo ratings yet

- Rateek OEL: Areer BjectiveDocument2 pagesRateek OEL: Areer BjectiveSapna SinghNo ratings yet

- ISGLT en IC - Inicio Temprano para Beneficios RapidosDocument10 pagesISGLT en IC - Inicio Temprano para Beneficios RapidosAnonymous envUOdVNo ratings yet

- Sintering Process of MagnetsDocument3 pagesSintering Process of MagnetsSAMIT JAINNo ratings yet

- Wicked Women - Women & Pre-Code HollywoodDocument6 pagesWicked Women - Women & Pre-Code HollywoodNickyNo ratings yet

- Luconyl® Yellow 1244 - BASFDocument3 pagesLuconyl® Yellow 1244 - BASFjsdanielinNo ratings yet

- 1.2 Nationalized Banks in India: Axis BankDocument4 pages1.2 Nationalized Banks in India: Axis BankUsman KulkarniNo ratings yet

- RR Regulador Retificador ORIGINAL TestDocument5 pagesRR Regulador Retificador ORIGINAL TestLeonardo HalonNo ratings yet

- Gujarat Technological University: Project EmpathyDocument7 pagesGujarat Technological University: Project EmpathyKaval PatelNo ratings yet

- Proposal NewDocument17 pagesProposal NewbaseNo ratings yet

- ABCD Risk Management TeachingDocument16 pagesABCD Risk Management TeachingSherweet A. AlsaadanyNo ratings yet

- Chandigarh BillsDocument35 pagesChandigarh BillsDarshit VyasNo ratings yet

- Howo, D12 Euro-IIDocument19 pagesHowo, D12 Euro-IIyb7knvNo ratings yet

- AF33-5 Reverse InhibitDocument4 pagesAF33-5 Reverse InhibitgabotoyoNo ratings yet

- Groovy Tutorial PDFDocument35 pagesGroovy Tutorial PDFPratishta TambeNo ratings yet

- Team-1 Module 2 Practice-ProblemsDocument10 pagesTeam-1 Module 2 Practice-ProblemsMay May MagluyanNo ratings yet