Professional Documents

Culture Documents

SB 3 Financial Analysis

Uploaded by

Steven DoyleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SB 3 Financial Analysis

Uploaded by

Steven DoyleCopyright:

Available Formats

NORTH CAROLINA GENERAL ASSEMBLY

2023 Session

Legislative Fiscal Note

Short Title: NC Compassionate Care Act.

Bill Number: Senate Bill 3 (Third Edition)

Sponsor(s): Sen. Bill Rabon, Sen. Michael V. Lee, and Sen. Paul A. Lowe, Jr.

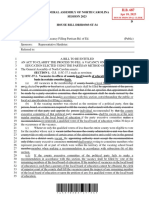

FISCAL IMPACT OF S.B. 3, V.3 ($ in millions)

FY 2023-24 FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28

State Impact

General Fund Revenue - - - - -

Less Expenditures - - - - -

General Fund Impact Partial Estimate Available - Refer to Fiscal Analysis Section

NET STATE IMPACT Partial Estimate Available - Refer to Fiscal Analysis Section

FISCAL IMPACT SUMMARY

S.B. 3 establishes the North Carolina Medical Cannabis Program. The bill specifies that the General

Assembly may appropriate funds for the initial development and implementation of the medical

cannabis supply system, but that ongoing operating costs would be funded solely by the fees

authorized in the bill. Due to uncertainty about the behavior of suppliers and patients, Fiscal

Research is unable to estimate the number of authorized entities that would engage in North

Carolina’s medical cannabis market. Thus, Fiscal Research’s estimates of the project’s impact to the

General Fund are uncertain. Estimates for parts of the bill for which data is available have been

provided in the Fiscal Analysis below.

Revenue

The bill would increase revenue for the State, with revenue generated from patient & caregiver

medical cannabis registry fees, supplier license fees, supplier background check fees, fines, and

gross receipts fees. It is anticipated that over time, patient & caregiver registry card application

fees and gross receipt fees will generate most of the revenue associated with administering this

program.

FISCAL RESEARCH DIVISION Page 1 of 16 February 22, 2023

Table 2: Five-Year Estimated Revenue for Program Components ($ in millions)

Revenue FY 2023-24 FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28

1. Patient & caregiver card

- 15.1 15.1 15.1 15.1

application fees

2. 10% Gross revenue fee

- - 3.0 14.2 29.3

revenue

3. Supplier application fee - No estimate available

4. Center application fee - No estimate available

5. Production facility

- No estimate available

application fee

6. Independent testing

- No estimate available

laboratory licensing fee

7. Miscellaneous Fines No estimate available

8. Supplier renewal fee - - Under 100K/year

9. Center renewal fee - - Under 80K/ year

10. Production facility

- - No estimate available

renewal fee

11. Director and Employee ID

- - No estimate available

Fee

TOTAL REVENUE 0.0 15.1 18.1 29.3 44.4

Numbers may not sum due to rounding.

Expenditures

The bill would increase expenditures by the Department of Health and Human Services (DHHS)

due to the costs of creating and implementing a medical cannabis oversight program. DHHS

expenditures would occur in three program areas: Program Leadership, Legal, and Oversight;

Patient Registry/Trend Analysis; and Supplier Regulation.

The bill would require the State Bureau of Investigation (SBI) to facilitate background checks for

personnel attached to the production and sale of medical cannabis. The bill also requires SBI to

consult on security at production facilities or medical cannabis centers and authorizes SBI to

conduct random inspections of these facilities.

The bill requires the North Carolina Policy Collaboratory (Collaboratory) at the University of

North Carolina at Chapel Hill to create a cannabis research program, which would increase

expenditures by the UNC System to meet the stated research objectives.

Note: The bill provides broad civil and criminal immunity for qualified individuals for purchasing

or possessing cannabis for medical use and contains three criminal penalties. These provisions

may impact the Administrative Office of the Courts, Indigent Defense Services, and the

Department of Public Safety, but potential fiscal impacts from these legal changes are not included

in this memo.

FISCAL RESEARCH DIVISION Page 2 of 16 February 22, 2023

Table 3: Five-Year Estimated Expenditures for Program Components ($ in millions)

Expenditures FY 2023-24 FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28

1. HHS: Program Leadership,

(9.5) (9.8) (10.1) (10.4) (10.7)

Legal, and Oversight

2. HHS: Patient

Registry/Trend Analysis (7.6) (17.5) (18.2) (19.0) (19.7)

3. HHS: Supplier Regulation (14.8) (16.8) (17.4) (17.9) (18.5)

4. NC State Bureau of

(1.9) (1.3) (1.3) (1.3) (1.3)

Investigation

5. North Carolina

(0.2) (0.6) (1.0) (1.4) (1.5)

Collaboratory

TOTAL EXPENDITURES (34.0) (46.0) (48.0) (50.1) (51.7)

Numbers may not sum due to rounding.

Table 4: Five-Year Estimates of FTE

Agency FY 2023-24 FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28

HHS Positions 132.75 271.00 271.00 271.00 271.00

NC State Bureau of

Investigation 9.0 9.0 9.0 9.0 9.0

North Carolina Collaboratory 3.0 4.0 4.0 4.0 4.0

TOTAL FTE 143.75* 284.0* 284.0 284.0 284.0

* Cost estimates assume that some FTES start mid-year.

FISCAL ANALYSIS

North Carolina Medical Cannabis Program Fund

G.S. 90-113.135 establishes the North Carolina Medical Cannabis Program Fund. All fees and

revenue generated by the Medical Cannabis Program are deposited into the Fund to cover the

direct and indirect costs associated with the implementation, administration, and enforcement of

the Medical Cannabis Program. Revenue generated beyond the amount needed to implement,

administer, and enforce the program is to be distributed annually to the State General Fund.

Assumptions about the implementation timeline and its impact on revenue and expenditures

S.B. 3 creates a Medical Cannabis Production Commission and requires the Commission to adopt

rules to establish a Medical Cannabis Supply System; the system would authorize suppliers to

produce cannabis and cannabis-infused products in licensed facilities and distribute them through

medical cannabis centers. The Commission shall adopt rules to establish qualifications and

requirements for licensure of suppliers. The Commission must hold their first meeting not later

than 60 days after the effective date of this act and adopt rules within 270 days of the first

meeting. It will not be possible to evaluate license applications from potential suppliers until the

relevant rulemaking is completed.

Because of the time required for the rulemaking process, this analysis assumes that DHHS will

FISCAL RESEARCH DIVISION Page 3 of 16 February 22, 2023

begin collecting supplier applications and associated fees towards the end of FY 2023-24 (year 1).

The Bill requires suppliers to begin cultivation within 120 days of receiving a medical cannabis

supplier license and provides an additional 270 days after initiating cultivation for the supplier to

begin selling cannabis and cannabis-infused products in medical cannabis centers. Provided that

there are no significant legal, production, or product safety issues that extend this timeline, the

State could expect to see the first regulated dispensary sales towards the end of the year 2 or the

beginning of year 3. (See technical consideration 1,2, and 3).

The bill also requires the Department of Health and Human Services to adopt rules within 270

days to establish requirements for issuing registry identification cards to qualified patients and

designated caregivers. Since the initial or renewal registry identification card expires 12 months

after the date of issuance, this analysis assumes that applicants will wait until medical cannabis is

available to apply for a registry card. Therefore, DHHS would begin processing applications for

registry ID cards and collecting application fees in FY 2024-25 (year 2), shortly before the first

batch of medical cannabis becomes available for sale. (See technical consideration 4).

REVENUES

Fee Revenue

Supplier License Fees

Section 1 directs DHHS to establish a regulated Medical Cannabis Supply System to license

medical cannabis suppliers. Each supplier must operate both a “production facility” and at least

one “medical cannabis center” as defined in the bill. The licensing fees outlined in the bill are

listed in Table 4:

Table 5: Initial and Renewal Fees for Cannabis Production/Distribution Licenses

Initial Annual

Application Fee Renewal Fee

$10,000; maximum of 10

Medical Cannabis Supplier $50,000

suppliers-fees received annually

$1,000; maximum of 80 centers-

Cannabis Center $5,000

fees received annually

Cannabis Production Facility $5,000 $1,000

Director & Employee ID Card $250 $250

The minimum cost for the initial supplier license application is $60,000 ($50,000 for the supplier

license and $5,000 each for one production facility and one cannabis center to be operated under

the license). Due to the high cost of an initial application, this analysis assumes that only entities

qualified to perform the tasks specified in the bill will apply for a supplier license. Based on

available data, it is not possible to forecast how many entities might apply for license, how quickly

FISCAL RESEARCH DIVISION Page 4 of 16 February 22, 2023

those entities might expand their operations to the maximum number of allowable centers, or how

many employees a supplier might employ.

Background Check Fees

The bill would require the State Bureau of Investigation (SBI) to facilitate background checks for

personnel attached to the production and sale of medical cannabis. Individuals who are North

Carolina residents would be subject to a name-based State criminal records check, while

individuals who have not lived in the State during the five preceding years would be subject to a

national fingerprint record check. SBI charges $38 for national fingerprint background checks and

$10 for name-based State criminal records checks. These fees are sufficient to cover their

associated costs, and SBI anticipates that any additional costs for the background checks required

under this bill will be covered by the fees. However, since there is no estimate available for the

number of personnel who would be subject to background checks due to S.B. 3, Fiscal Research

cannot provide a revenue estimate for this provision.

New fines

The bill authorizes DHHS to impose a fine of up to $10,000 on suppliers who violate specified

business practices, required disclosures, standards, or safety procedures. As there is no way to

anticipate the number of violations the collective of suppliers may have. There is no estimate

available for the revenue generated by this fine. This bill also includes fines for various infractions

and misdemeanors, the potential fiscal impacts from these legal changes are not included in this

memo.

Independent testing laboratory licensing fee

The bill requires DHHS to establish standards for and license up to five independent testing

laboratories to test cannabis and cannabis-infused products that are to be sold in the State. DHHS

is directed to establish the amount of the licensing fee payable by the independent laboratory to

DHHS. As the fee is not established, there is no estimate of the revenue generated by laboratory

licensing fees.

Registry Identification Card Fees

The bill would require DHHS to issue a registry identification card to any individual who

demonstrates that they have a qualifying debilitating medical condition (“qualifying patient”).

DHHS would also be required to issue registry identification cards to up to two designated

caregivers for each qualifying patient.

The bill specifies that a $50 fee applies to each of the following:

Issuance of a patient registry identification card

Issuance of a caregiver card

Change of address

Change of caregiver

Lost card replacement.

DHHS anticipates processing approximately 300,000 applications for cards each year. This

includes initial and replacement cards for qualified patients and their caregivers, as well as

FISCAL RESEARCH DIVISION Page 5 of 16 February 22, 2023

applications that are rejected because the applicant does not meet program qualifications.

10% Gross Revenue Fee

Section 1 of the bill, in part, creates G.S. 90-113.122, requiring each licensed supplier to pay the

Department of Health and Human Services a monthly fee of 10% of its gross revenue derived from

the sale of medical cannabis. To estimate the amount of gross revenue subject to the fee, the Fiscal

Research Division examined the experiences of other states that have legalized medicinal

cannabis.

The amount of time it has taken states to implement medical cannabis laws has varied widely, but

this analysis estimates that it will take between two and three years between a law’s enactment

and the first dispensary sales. For this analysis, we assume that dispensaries will begin remitting

fee revenue in FY 2025-26.

To estimate the possible fee revenue generated by this section, the Fiscal Research Division looked

at data from the states of Florida and Arizona, both of which operate medical cannabis programs.

Florida’s law is the most similar to the proposed North Carolina program, because neither Florida

nor S.B. 3 directly authorize medical cannabis for chronic pain. In Arizona, over 90% of registered

patients have “chronic pain” as their qualifying health condition. Although Florida’s program does

not authorize chronic pain as a qualifying health condition, the two states have similar rates of

registration for medical cannabis ID cards. This close similarity in card registration despite the

difference in qualifying health conditions may suggest that North Carolina’s experience is likely to

mimic that of these two other states, because omitting “chronic pain” did not appear to reduce

Florida’s card registrations.

The following estimates assume that in the first years of the program, North Carolina’s number of

cardholders will follow a similar pattern as these two states; that North Carolina’s ounces per user

will follow the pattern in Arizona’s first years of implementation (Florida data not available); and

that based on publicly available data from PriceofWeed.com, medical cannabis will sell for

$287/ounce.

Table 6: Estimate for Gross Revenue Fee

Qualified Ounces per Qualified Retail Sales Fee Revenue

Fiscal Year

Patients Patient ($287/Ounce) (10% of Sales)

FY 2025-26 47,000 2.21 $29.9 million $3.0 million

FY 2026-27 94,000 5.26 $142.1 million $14.2 million

FY 2027-28 154,000 6.63 $293.4 million $29.3 million

FY 2028-29 214,000 8.20 $504.3 million $50.4 million

While this fiscal memo only projects overall revenue and expenditures for the first five years from

the bill’s effective date (i.e., through FY 2027 -28). Based on the experiences in other states, Table

FISCAL RESEARCH DIVISION Page 6 of 16 February 22, 2023

6 projects significant revenue growth over the first four years that the program is in operation.

The significant projected FY 2028-29 revenue growth goes beyond the 5-year scope of this memo.

Tax Revenue

Sales and Use Tax

Under North Carolina tax law, sales of tangible personal property are subject to sales or use taxes

unless the tangible personal property is specifically exempted from tax in statute. Section 3 of the

bill amends G.S. 105-164.13 to exempt from sales tax “cannabis or cannabis-infused products sold

by a medical cannabis center to a registry identification cardholder.” There is no revenue impact

from this exemption because the products are not currently taxable under State and local sales

and use taxes.

Unauthorized Substances Tax

The bill effectively exempts medical cannabis from the Unauthorized Substances Tax authorized in

Article 2D of G. S. 105. Under G.S. 105-113.107, marijuana and other cannabis products in excess

of 42.5 grams are currently taxable under the Unauthorized Substances Tax, at a rate of $3.50 per

gram ($102 per ounce). This tax also applies to other controlled substances, including illicit

alcoholic beverages. This tax is generally assessed upon arrest of an individual in possession of a

controlled substance and law enforcement is required to report unauthorized substances on

which the excise tax has not been paid. Seventy-five percent (75%) of the money collected is

returned to the state or local law enforcement agency whose investigation led to the assessment.

The remaining twenty-five percent (25%) of the money collected is credited to the General Fund.

The Unauthorized Substance Tax has generated an average of $8.6 million in annual net

collections during the past five fiscal years. The share of this revenue that was obtained from the

tax on marijuana is unknown. Because we expect unauthorized cannabis sales to continue despite

the State-level decriminalization of medical cannabis, we do not expect any significant impact on

this revenue source.

EXPENDITURES

Department of Health and Human Services

Because of the many new functions that DHHS would perform under the bill, the Department

reported that it would create a new operational area (e.g., an office or division) to accomplish the

tasks required by S.B. 3. The following section breaks down required DHHS tasks within S.B. 3

into three major areas: Program Leadership, Legal, and Oversight; Patient Registry and Registry

Trend Analysis; and Supplier Regulation. Each area includes a brief description of the area

subtasks, as well as the FTE that the Department believes will be required to fulfill the

responsibilities within that area.

Area One: Program Leadership, Legal, and Oversight

Estimated FTE cost: $3.2 million

Estimated operating cost: $6.3 million

FISCAL RESEARCH DIVISION Page 7 of 16 February 22, 2023

Leadership staff: DHHS reports that the following leadership and administrative staff would

be required to support the program: director, operations manager, budget staff,

communications staff, policy staff, IT staff, auditing staff, and support staff.

Legal staff: DHHS anticipates the need for additional legal staff to support the development,

evaluation, and promulgation of regulation, policies, standards, and associated legal analysis

and to respond to questions and legal challenges related to the implementation of S.B. 3.

Public Awareness Campaign: DHHS anticipates needing two staff members to oversee an

ongoing Public Awareness Campaign to educate suppliers, the public, and health providers

about the regulations, health and safety considerations related to medical cannabis. The

Department anticipates needing $2 million for a contract to cover educational outreach.

Rent, utilities, and other miscellaneous operating costs.

Table 7: DHHS Estimates of Positions for Area 1- Program Leadership, Legal, and Oversight

Total

Average Salary &

Position Description FTE

Annual Salary Benefits

(in millions)

Executive Director 1.00 $120,000 $0.2

Chief Finance Officer 1.00 $100,000 $0.1

Chief Budget Officer 1.00 $89,992 $0.1

Chief Operating Officer 1.00 $100,000 $0.1

Policy Director 1.00 $89,983 $0.1

Director of Regulatory and Legal Affairs

1.00 $100,000 $0.1

(Attorney)

Assistant General Counsel 3.00 $110,000 $0.5

Regulatory Attorney 2.00 $85,000 $0.2

Legal Assistant 2.00 $58,000 $0.2

Public Health Awareness and Education

2.00 $100,000 $0.3

Campaign Director

Communications Director 1.00 $89,983 $0.1

Executive Assistant 1.00 $40,049 $0.1

Legislative Liaison 1.00 $89,986 $0.1

HS Planning Supervisor I (Contracts and

1.00 $74,128 $0.1

Procurements Supervisor)

HS Program Consultant II (Contract Manager) 1.00 $58,845 $0.1

Fiscal Staff for Revenue, Fee, Penalty Collection

3.00 $74,128 $0.3

and Accounting

Director of Human Resources 1.00 $89,995 $0.1

FISCAL RESEARCH DIVISION Page 8 of 16 February 22, 2023

Total

Average Salary &

Position Description FTE

Annual Salary Benefits

(in millions)

Recruitment Specialist 1.00 $74,128 $0.1

External and Internal Training Development

1.00 $89,998 $0.1

Director

IT Support Staff 1.00 $74,128 $0.1

$3.2

Total FTE 27.0 Total Salary

million

Note 1: The Fiscal Research Division is unable to independently verify these staffing needs.

Note 2: Numbers may not sum due to rounding.

Area 2: Patient Registry and Registry Trend Analysis

Estimated FTE cost: $12.6 million

Estimated operating cost: $4.2 million

This area would manage the Patient Registry, including issuing ID cards. Staff would be needed for

quality assurance and registry trend analysis. In addition to staff for those functions, this Area

would include staff to support the expanded workload of the Controlled Substance Reporting

Service (CSRS), which collects information on dispensed controlled substance prescriptions and

makes that information available to prescribers and dispensers. The following list outlines the

major tasks associated with the requirements of the Patient Registry.

Registry Identification Cards for Qualified Patients and Designated Caregivers. G.S. 90-

113.115 requires the Department to review applications for and issue registry identification

cards for qualified patients and up to two of their caregivers. DHHS estimates that it will

take about an hour to review and process each registry application, and that each staff member

could process 2,080 applications a year. DHHS estimates that it will initially need 145 FTE for

the registry, to enable processing 300,000 applications per year. (See Technical Considerations)

North Carolina Medical Cannabis Verification System: G.S. 90-113.127 establishes a secure

web-based verification system. The System would be accessible to authorized Department

personnel, State and local law enforcement, and medical cannabis centers to determine

whether a registry identification card is valid.

Compassionate Use Advisory Board: G.S. 90-113.113 establishes the Compassionate Use

Advisory Board consisting of 11 members. The Board would review petitions to add a new

debilitating medical condition to the list of conditions eligible to be treated with medical

cannabis and have the power to add that condition to the list.

Analytics staff to monitor trends in registry data: DHHS anticipates that it will need

additional data analytics staff to process data requests, legislative requests, monitor trends,

identify concerning patterns, answer requests from the press, and assist with producing

FISCAL RESEARCH DIVISION Page 9 of 16 February 22, 2023

reports to the General Assembly. G.S. 90-113.140 requires DHHS to report annually to the

General Assembly.

CSRS: DHHS anticipates the need to expand the CRCS to include a means to track medical

cannabis prescriptions.

Table 8: DHHS Estimates of Positions for Area 2 - Patient Registry

Total Salary &

Average

Position Description FTE Benefits

Annual Salary

(in millions)

Director of Registry Operations 1.0 $89,993 $0.1

Registry Staff Supervisor 3.0 $54,444 $0.2

NC Medical Cannabis Verification System Staff

142.0 $50,080 $10.3

(processing applications, issuing cards, call center)*

Physician Compliance Manager 1.0 $74,128 $0.1

Drug Control Inspector (CSRS compliance)* 1.0 $50,080 $0.1

Physician Prescribing Auditor* 1.0 $89,997 $0.1

Data Analyst* 10.0 $80,000 $1.1

Medical Cannabis Advisory Board Administrative

0.5 $35,000 $0.03

Assistant

HS Program Coordinator II (Community Outreach

2.0 $58,845 $0.2

Liaison)

IT Support Staff 3.0 $74,128 $0.3

Estimated

Total FTE 164.5 $12.6 million

Total Salary

Note 1: This analysis assumes DHHS would not be able to collect ID card registrations until FY

2024-25 (year 2). As a result, some positions designated with an asterisk may not be needed

until year 2 or 3, when regulated cannabis dispensaries are anticipated to begin sales.

Note 2: The Fiscal Research Division is unable to independently verify these staffing needs.

Note 3: Numbers may not sum due to rounding.

Area 3: Regulated Medical Cannabis Supply System

Estimated FTE cost: $7.2 million

Estimated operating cost: $9.0 million

G.S. 90-113.119 requires the establishment of a regulated Medical Cannabis Supply System. This

area would support the Medical Cannabis Production Commission. Among the required tasks are

the establishment of regulations for medical cannabis production, selection of licensed suppliers

and the development of a seed-to-sale tracking system.

FISCAL RESEARCH DIVISION Page 10 of 16 February 22, 2023

The following list outlines the major tasks DHHS has identified as required for regulating a

Medical Cannabis Supply System:

Inspections of medical cannabis suppliers: The Department estimates that facility

inspections will need to be conducted at least quarterly for all locations.

Accept and review applications for a Medical Cannabis Supplier License.

Background Checks: Although S.B. 3 gives the North Carolina State Bureau of

Investigation responsibility for conducting background checks, DHHS expects that it will

need to modify the NC DHHS Automated Background Check Management System

(ABCMS) to facilitate background checks for suppliers’ employees.

Medical Cannabis Production Commission: G.S. 90-113.118 establishes The Medical

Cannabis Production Commission consisting of 11 members. The Commission has the

power to approve applications for supplier licenses upon recommendation by the

Department, and to suspend or revoke a supplier license.

Testing of Cannabis and Cannabis-Infused Products: The Department is required to

establish standards for and then license up to five independent testing laboratories to

test a representative sample of the cannabis or cannabis-infused products.

Seed-to-sale tracking system: The bill requires a seed-to-sale tracking system as part of

the Regulated Medical Cannabis Supply System.

FISCAL RESEARCH DIVISION Page 11 of 16 February 22, 2023

Table 9: DHHS Estimates of Positions for Area 3 - Supplier Regulation

Total Salary &

Position Description FTE Average Annual Salary Benefits

(in millions)

Admin Specialist I 3.00 $40,049 $0.2

Chemist I (Cannabis Testing and

Standards Development for 8.00 $90,000 $1.0

Independent Labs)

Medical Cannabis Supply

Commission Administrative 0.50 $35,000 $0.03

Assistant

Directory of Laboratory Operations 1.00 $100,000 $0.1

Compliance Staff for Reviewing

Monthly Reporting Reviews from 2.00 $74,128 $0.2

Medical Cannabis Licensees*

Chief Compliance Officer/ Deputy

Director of Compliance and 1.00 $100,000 $0.1

Enforcement

Deputy Director of Inspections and

1.00 $100,000 $0.1

Investigations

Environmental Health Program

1.00 $85,000 $0.1

Manager Safety and Compliance

Investigator (all cannabis supplier

sites (cultivation/ processing/ 30.00 $59,500 $2.6

retail)*

Inspector Field Supervisor 1.00 $64,000 $0.1

Inspector (all cannabis supplier sites

30.00 $59,500 $2.6

(cultivation/ processing/ retail)*

Investigator Field Supervisor 1.00 $64,000 $0.1

Total FTE 79.5 Estimated Total Salary $7.2 million

Note: This analysis assumes DHHS would not be able to collect Supplier applications until the

end of FY 2023-24 (year 2). As a result, some positions designated with asterisks may not be

needed until year 2.

Note 3: The Fiscal Research Division is unable to independently verify these staffing needs.

Note 4: Numbers may not sum due to rounding.

FISCAL RESEARCH DIVISION Page 12 of 16 February 22, 2023

North Carolina State Bureau of Investigation

The bill requires SBI to consult on security at production facilities or medical cannabis centers and

authorizes SBI to conduct random inspections of these facilities. Although at least one inspection

must be performed at each facility each calendar year by DHHS, the bill does not place a

requirement on SBI for a minimum number of inspections. However, it is likely that SBI personnel

would be included in these inspections. The bill also instructs the Medical Cannabis Production

Commission to develop inspection procedures in consultation with the SBI.

Although the number of facilities that will require inspection is unknown, Fiscal Research assumes

there will be a minimum of 90 facilities subject to inspection. This assumption is based on the fact

that the bill caps the total number of medical cannabis centers at 80 (10 producers operating a

maximum of eight centers each), and presumably each producer would have at minimum one

production facility. If random inspections were conducted once a year on each of the 90 facilities,

SBI would need to participate in approximately 2 inspections per week. If random inspections

were conducted quarterly on each of the 90 facilities (360 inspections total annually), SBI would

need to participate in 7 inspections per week.

SBI does not currently inspect facilities or provide regulatory oversight in any capacity for any

purpose. As such, the Bureau would need to set up an entirely new “inspections unit” to handle the

inspection requirements of this bill. SBI divides the State into eight divisions. As a result, this bill

would require an additional eight Special Agents (one for each division of the State) and one

Special-Agent-in-Charge (SAC) to oversee the new inspections unit at a total cost of $1,268,327

recurring and $604,575 nonrecurring (9 FTE).

University of North Carolina System

The bill requires the North Carolina Policy Collaboratory (Collaboratory) at the University of

North Carolina at Chapel Hill to create a program to be known as the North Carolina Cannabis

Research Program (Research Program). The Research Program is to undertake scientific research

on the administration of cannabis or cannabis-infused products as part of medical treatment.

The Collaboratory states that to meet the requirements of the bill, they would establish a

competitive grant program available to institutes of higher learning in North Carolina to perform

the research objectives of the legislation. Costs to the Collaboratory would include:

1. Personnel needed to direct, manage, and administer the Research Program and its grants

2. Operating costs including funds for supplies, information technology (IT) needs, and travel

3. Competitive grant funds to North Carolina institutes of higher education

The Collaboratory estimates that the full cost of the Research Program will be $1,500,000 per year

after 5 years. Those cost estimates, along with how costs would scale up from years one to five, are

provided in Table 10 below. The Collaboratory emphasizes that these cost estimates may change

but are based on the best information available after consulting with cannabis research leaders

and after reviewing existing programs and funding.

FISCAL RESEARCH DIVISION Page 13 of 16 February 22, 2023

Table 10. North Carolina Cannabis Research Program Projected Costs, Years 1 to 5

Cost Description FY 2023-24 FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28

Project Director

$87,500 $175,000 $175,000 $184,211 $184,211

(1.0 FTE)

Program

Compliance $87,500 $175,000 $175,000 $184,211 $184,211

Manager (1.0 FTE)

Program

Office/Admin. $40,000 $80,000 $80,000 $84,210 $84,210

Manager (1.0 FTE)

Program Grant

- $100,000 $100,000 $105,263 $105,263

Manager (1.0 FTE)

Supplies, IT, Travel,

and Other Non-

$20,000 $40,000 $40,000 $42,105 $42,105

Personnel

Operating Expenses

Competitive Grants - - $400,000 $800,000 $900,000

Total Cost $235,000 $570,000 $970,000 $1,400,000 $1,500,000

Source: FRD analysis of information provided by the North Carolina Policy Collaboratory

TECHNICAL CONSIDERATIONS

1. The Department of Health and Human Services does not currently have any programs that

regulate the cultivation of plants; regulate the production, sale, and safety testing of a

pharmaceutical products (medical cannabis); or produce secure beneficiary photo-IDs. The

Department will have to recruit senior level program managers and scientists with

appropriate expertise prior to the Department beginning the process of supporting the

development of a regulated medical cannabis supplier system. Those senior positions

would also need to be in place before the Department could proceed with creating the

infrastructure and soliciting contracts to support the required regulatory and oversight

actions. The Department has reported it would need exceptions from State Human Resource

and State procurement rules/policies if it is to implement the requirements of the act within the

first year.

2. Qualla Enterprises, a tribal subsidiary of the Eastern Band of Cherokee Indians is already in

the process of a establishing a medical cannabis program that would operate under the

laws of the Eastern Band of Cherokee Indians within North Carolina’s Qualla Boundary. It

is unknown if Qualla Enterprise would participate in a State run system.

FISCAL RESEARCH DIVISION Page 14 of 16 February 22, 2023

3. The Bill requires rulemaking to be completed within 270 days of the first meeting of the

Medical Cannabis Production Commission. Many of the factors that determine the length of

the rulemaking process are outside the scope of the agency developing rules. For example,

if 10 or more objections are filed following Rules Review Committee approval of the rules,

the effective day of the rules is delayed at least until after start of the subsequent legislative

session. To accomplish the 270-day target for the registry and medical cannabis rules,

DHHS has requested an exemption from the initial round of rulemaking.

4. The Bill requires the Department to adopt rules pertaining to the registry as defined in G.S.

90-113.115(h) within 270 days of the law being signed (year 1). The Department reports

that if the intent is to have fully operational registry within 9 months, all implementation

work must be done in parallel, which means that staff must be available to work with the

licensees to ensure that they succeed in meeting the requirements for sale per SB3. DHHS

has reported that it would need $45.2 million to fund all required positions and operating

costs, including hiring all registry staff in the first year, even if patients wait until

dispensaries are ready to begin sales to apply for the registry card.

5. Registry participation is an unknown variable that is difficult to predict. To establish a

realistic range for registry participation, DHHS analyzed medical cannabis registry data

from multiple states and determined that 1% to 5% of a state’s population participated in

the registry. This would equate to between 104,000 and 500,000 participants in North

Carolina. As a result, the Department anticipates needing to process an average of 301,600

applications per year.

6. DHHS has expressed concern about this being structured as a fully-receipt supported

program. The bill states that “The General Assembly may appropriate funds for the initial

development and implementation of the medical cannabis supply system, but neither the

Department nor the Commission shall use any appropriations from the General Fund to

operate the system. The intent of the General Assembly is that the system shall be funded

solely by the fees...” Given the uncertainty surrounding the market for regulated medical

cannabis, it is not clear how the State would cover fixed costs, if receipts were

underrealized in a given year.

DATA SOURCES

Arizona Department of Health Services; Florida Board of Medicine and Board of Osteopathic

Medicine; Florida Department of Health; Marijuana Policy Project; National Conference of State

Legislators, North Carolina Department of Health and Human Services; North Carolina

Department of Revenue; North Carolina Policy Collaboratory; Priceofweed.com; State Bureau of

Investigation

LEGISLATIVE FISCAL NOTE – PURPOSE AND LIMITATIONS

FISCAL RESEARCH DIVISION Page 15 of 16 February 22, 2023

This document is an official fiscal analysis prepared pursuant to Chapter 120 of the General

Statutes and rules adopted by the Senate and House of Representatives. The estimates in this

analysis are based on the data, assumptions, and methodology described in the Fiscal Analysis

section of this document. This document only addresses sections of the bill that have projected

direct fiscal impacts on State or local governments and does not address sections that have no

projected fiscal impacts.

CONTACT INFORMATION

Questions on this analysis should be directed to the Fiscal Research Division at (919) 733-4910.

ESTIMATE PREPARED BY

Jessica T. Meed, Stephen Bailey, Brent Lucas, and Mark White.

ESTIMATE APPROVED BY

Brian Matteson,

Director of Fiscal Research

Fiscal Research Division

February 22, 2023

Signed copy located in the NCGA Principal Clerk's Offices

FISCAL RESEARCH DIVISION Page 16 of 16 February 22, 2023

You might also like

- Social Security and Medicare Trustees ReportDocument28 pagesSocial Security and Medicare Trustees ReportAustin DeneanNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- BCFP Remittance-rule-Assessment Report Corrected 2019-03Document168 pagesBCFP Remittance-rule-Assessment Report Corrected 2019-03agray43No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 2023 Riverside County Pension Advisory Review Committee ReportDocument24 pages2023 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- 2020 Economic Impact ReportDocument62 pages2020 Economic Impact ReportBrandon DorfmanNo ratings yet

- 2021 Riverside County Pension Advisory Review Committee ReportDocument16 pages2021 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- Northeast Center For Youth and FamiliesDocument51 pagesNortheast Center For Youth and FamiliesNewspapers of New EnglandNo ratings yet

- Assignment 6 The Correct OnesDocument12 pagesAssignment 6 The Correct OnessyafiraNo ratings yet

- Alberta Pension Plan - Analysis of Costs, Benefits, Risks and ConsiderationsDocument95 pagesAlberta Pension Plan - Analysis of Costs, Benefits, Risks and Considerationsedmontonjournal100% (3)

- Improved Delivery of Reemployment AssistanceDocument204 pagesImproved Delivery of Reemployment AssistanceDale Greenstein100% (1)

- AOM Draft (GAD) ISPSCDocument6 pagesAOM Draft (GAD) ISPSCJasmine Kay ReyesNo ratings yet

- Embargoed Alberta Pension Plan ReportDocument95 pagesEmbargoed Alberta Pension Plan ReportCTV CalgaryNo ratings yet

- Final Decision Notice Sanctions Against PWC in Relation To PwC's Audit of Kier 07 06 22Document46 pagesFinal Decision Notice Sanctions Against PWC in Relation To PwC's Audit of Kier 07 06 22TomNo ratings yet

- Supporting Statement Part A Medicare Parts C and D Program Audit Protocols and Data Requests CMS-10191, OMB 0938-1000Document18 pagesSupporting Statement Part A Medicare Parts C and D Program Audit Protocols and Data Requests CMS-10191, OMB 0938-1000Khizar WaheedNo ratings yet

- Spending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)Document6 pagesSpending Cap: ($10.4 B) ($4.3 B) ($2.6 B) ($7.1 B) ($5.1 B) ($1.9 B)tvanootNo ratings yet

- Institue For Global Health Subaward Invoice Guide - 31oct22Document14 pagesInstitue For Global Health Subaward Invoice Guide - 31oct22David McFarlandNo ratings yet

- PCAOB Proposal To Increase Auditor Vigilance Against Fraud and Other Forms of Noncompliance With Laws and RegulationsDocument146 pagesPCAOB Proposal To Increase Auditor Vigilance Against Fraud and Other Forms of Noncompliance With Laws and RegulationsAdrienne GonzalezNo ratings yet

- SIFMA Letter On QI Agreement 3-23-20 FINALDocument7 pagesSIFMA Letter On QI Agreement 3-23-20 FINALABC DEFNo ratings yet

- Hmo Msa OverviewDocument28 pagesHmo Msa Overviewmamatha mamtaNo ratings yet

- Revised Methodology 23.12.2015Document38 pagesRevised Methodology 23.12.2015ykbharti101No ratings yet

- Regulatory Assets and LiabilitiesDocument5 pagesRegulatory Assets and LiabilitiesMatthew Dickerson100% (1)

- T Proc Notices Notices 100 K Notice Doc 95823 274045222Document32 pagesT Proc Notices Notices 100 K Notice Doc 95823 274045222mahadNo ratings yet

- Highlights of The Governors Budget ProposalDocument44 pagesHighlights of The Governors Budget ProposalRichard Costigan IIINo ratings yet

- Riverside County Auditor-Controller Report On FY 2021/22 Overtime SpendingDocument86 pagesRiverside County Auditor-Controller Report On FY 2021/22 Overtime SpendingThe Press-Enterprise / pressenterprise.comNo ratings yet

- 10 7 Baucus LetterDocument27 pages10 7 Baucus LetterBrian AhierNo ratings yet

- 2011 Americorps State and National Application Instructions: Omb Control #: 3045-0047 Expiration Date: 5/31/2012Document64 pages2011 Americorps State and National Application Instructions: Omb Control #: 3045-0047 Expiration Date: 5/31/2012Michelle NusumNo ratings yet

- ACC 497 GENIUS Possible Is EverythingDocument36 pagesACC 497 GENIUS Possible Is Everythingalbert0124No ratings yet

- State Board of Elections: Audit ReportDocument37 pagesState Board of Elections: Audit ReportMark NewgentNo ratings yet

- ACC 497 GENIUS Empowering and InspiringDocument34 pagesACC 497 GENIUS Empowering and Inspiringalbert0123No ratings yet

- Latest NRB CircularsDocument20 pagesLatest NRB CircularsNista ShresthaNo ratings yet

- CONGRESSIONAL BUDGET OFFICE COST ESTIMATE H.R. 2542 Regulatory Flexibility Improvements Act of 2013Document3 pagesCONGRESSIONAL BUDGET OFFICE COST ESTIMATE H.R. 2542 Regulatory Flexibility Improvements Act of 2013nalgrstealthNo ratings yet

- 2021 PERS Valuation and Projection ReportsDocument82 pages2021 PERS Valuation and Projection Reportsthe kingfishNo ratings yet

- SRB Evaluation For Six English RegionsDocument238 pagesSRB Evaluation For Six English RegionsMatthew TerryNo ratings yet

- Josefina Executive Summary 2017Document8 pagesJosefina Executive Summary 2017Virgo Philip Wasil ButconNo ratings yet

- Cuac 202 AssignmentssDocument18 pagesCuac 202 AssignmentssJoseph SimudzirayiNo ratings yet

- AAA Question PracticeDocument8 pagesAAA Question PracticenishantsayshiNo ratings yet

- CBO Cost Estimate For H.R. 1628 Obamacare Repeal Reconciliation Act of 2017Document19 pagesCBO Cost Estimate For H.R. 1628 Obamacare Repeal Reconciliation Act of 2017CNBC.comNo ratings yet

- Energy Market Impacts of A Clean Energy Portfolio Standard - Follow-UpDocument41 pagesEnergy Market Impacts of A Clean Energy Portfolio Standard - Follow-UpJagath PrasangaNo ratings yet

- Medical Examiner AuditDocument21 pagesMedical Examiner AuditTim KnaussNo ratings yet

- Solutions Chapter 24Document5 pagesSolutions Chapter 24Avi SeligNo ratings yet

- Inflation Reduction Act: Preliminary Estimates of Budgetary and Macroeconomic EffectsDocument5 pagesInflation Reduction Act: Preliminary Estimates of Budgetary and Macroeconomic EffectsJohn SmithNo ratings yet

- Risk ManagementDocument15 pagesRisk ManagementanupkallatNo ratings yet

- Wainfleet Development Charge ReportDocument129 pagesWainfleet Development Charge ReportDave JohnsonNo ratings yet

- AO25 IATF Memorandum Circular 2022 1Document15 pagesAO25 IATF Memorandum Circular 2022 1raymund pabilarioNo ratings yet

- Memorandum Circular No 2022 1 Dated March 24 2022 Latest Performance Based BunosDocument74 pagesMemorandum Circular No 2022 1 Dated March 24 2022 Latest Performance Based BunosRexlin Azarcon Nayecious PetsNo ratings yet

- Report On How To Recruit and Retain Riverside County EmployeesDocument5 pagesReport On How To Recruit and Retain Riverside County EmployeesThe Press-Enterprise / pressenterprise.comNo ratings yet

- Claims Billing Audits 2007Document7 pagesClaims Billing Audits 2007Ahmed GoudaNo ratings yet

- Cap and Invest NYCI Pre-Proposal Outline FinalDocument33 pagesCap and Invest NYCI Pre-Proposal Outline FinalrkarlinNo ratings yet

- Philippine Drug Enforcement Agency Executive Summary 2020Document4 pagesPhilippine Drug Enforcement Agency Executive Summary 2020jancel maeNo ratings yet

- FASB Credit Loss AccountingDocument291 pagesFASB Credit Loss AccountingTom, Dick and HarryNo ratings yet

- ASC Social Auditing Methodology: BackgroundDocument12 pagesASC Social Auditing Methodology: Backgroundell maiNo ratings yet

- Dangerous Drugs Board Executive Summary 2017Document5 pagesDangerous Drugs Board Executive Summary 2017Natoy BatumbakalNo ratings yet

- Ghana National Health Insurance Scheme: A World Bank Study A World Bank StudyDocument71 pagesGhana National Health Insurance Scheme: A World Bank Study A World Bank StudyQuofi SeliNo ratings yet

- Department of The Treasury: WASHINGTON, D.C. 20220Document26 pagesDepartment of The Treasury: WASHINGTON, D.C. 20220ForkLogNo ratings yet

- GST ReviewDocument146 pagesGST ReviewStephanie AndersonNo ratings yet

- Regulator's Report On UFCW Pension Plan (Part 1)Document86 pagesRegulator's Report On UFCW Pension Plan (Part 1)Wanda Pasz100% (1)

- Fiscal Note & Local Impact Statement: O L S CDocument3 pagesFiscal Note & Local Impact Statement: O L S CNevin SmithNo ratings yet

- Conference Committee Agenda: February 23Document20 pagesConference Committee Agenda: February 23kyamamuraNo ratings yet

- The New Senate Bill 631Document3 pagesThe New Senate Bill 631Steven DoyleNo ratings yet

- Final Version of Senate Bill 3Document28 pagesFinal Version of Senate Bill 3Steven Doyle100% (1)

- Committee Substitute To SB 49Document6 pagesCommittee Substitute To SB 49Steven DoyleNo ratings yet

- Amendment To Address SB. 20Document4 pagesAmendment To Address SB. 20Steven DoyleNo ratings yet

- Senate-Adjusted HB 574Document4 pagesSenate-Adjusted HB 574Steven DoyleNo ratings yet

- Senate-Adjusted HB 574Document4 pagesSenate-Adjusted HB 574Steven DoyleNo ratings yet

- Elon Poll ReportDocument25 pagesElon Poll ReportSteven DoyleNo ratings yet

- This Version of HB 347 Was ApprovedDocument28 pagesThis Version of HB 347 Was ApprovedSteven DoyleNo ratings yet

- This Is The Amendment To HB 347Document9 pagesThis Is The Amendment To HB 347Steven DoyleNo ratings yet

- Planned Parenthood LawsuitDocument32 pagesPlanned Parenthood LawsuitJessacaNo ratings yet

- Carolina Forward May 2023 Poll ReportDocument4 pagesCarolina Forward May 2023 Poll ReportSteven DoyleNo ratings yet

- Bishop Carter's LetterDocument2 pagesBishop Carter's LetterSteven DoyleNo ratings yet

- Bishop Carter's LetterDocument2 pagesBishop Carter's LetterSteven DoyleNo ratings yet

- Senate Bill 636Document10 pagesSenate Bill 636Steven DoyleNo ratings yet

- House Bill 189Document10 pagesHouse Bill 189Steven DoyleNo ratings yet

- HB 259 BudgetDocument387 pagesHB 259 BudgetSteven DoyleNo ratings yet

- Court Ruling About Georgia MethodistsDocument8 pagesCourt Ruling About Georgia MethodistsSteven DoyleNo ratings yet

- Senate Bill 636Document11 pagesSenate Bill 636Steven DoyleNo ratings yet

- Senate Bill 20Document46 pagesSenate Bill 20Steven DoyleNo ratings yet

- House Bill 470Document9 pagesHouse Bill 470Steven DoyleNo ratings yet

- Driver's License BillDocument2 pagesDriver's License BillSteven DoyleNo ratings yet

- Holmes v. MooreDocument91 pagesHolmes v. MooreSteven DoyleNo ratings yet

- Senate's Transgender Sports BillDocument2 pagesSenate's Transgender Sports BillSteven DoyleNo ratings yet

- House's Transgender Athlete BillDocument4 pagesHouse's Transgender Athlete BillSteven DoyleNo ratings yet

- Senate Bill 321Document11 pagesSenate Bill 321Steven DoyleNo ratings yet

- House Bill 687Document2 pagesHouse Bill 687Steven DoyleNo ratings yet

- House Bill 614Document2 pagesHouse Bill 614Steven DoyleNo ratings yet

- Updated Version of HB 334Document2 pagesUpdated Version of HB 334Steven DoyleNo ratings yet

- House Bill 673Document1 pageHouse Bill 673Steven DoyleNo ratings yet

- Mickey's Freedom Restoration ActDocument2 pagesMickey's Freedom Restoration ActSteven DoyleNo ratings yet

- PHD Report Security Survey FinalDocument9 pagesPHD Report Security Survey FinalChristian Dave Tad-awan100% (2)

- CCSD Gender Diverse PolicyDocument8 pagesCCSD Gender Diverse PolicyAshley ForestNo ratings yet

- Application For General Registration As An Enrolled Nurse Registered Nurse or Midwife For IQNMs - AGOS 40 PDFDocument14 pagesApplication For General Registration As An Enrolled Nurse Registered Nurse or Midwife For IQNMs - AGOS 40 PDFTerzky TerceroNo ratings yet

- ADDC ProcessDocument19 pagesADDC ProcessfaizalpsNo ratings yet

- Aadhaar Update Learner GuideDocument72 pagesAadhaar Update Learner GuideLEL- Let Emit the LaughterNo ratings yet

- Punjab National Bank Recruitment of Management Trainee 775 PostsDocument9 pagesPunjab National Bank Recruitment of Management Trainee 775 PostsFreshers Plane IndiaNo ratings yet

- Tax File Number - Application or Enquiry For Individuals: Section ADocument8 pagesTax File Number - Application or Enquiry For Individuals: Section ARebecca BakerNo ratings yet

- Annexure - A - DoT GuidelinesDocument13 pagesAnnexure - A - DoT GuidelinesARPIT TELECOMNo ratings yet

- S2 Application FM-CSVlrd-01NEW 29july2016Document2 pagesS2 Application FM-CSVlrd-01NEW 29july2016Sherwin Anoba Cabutija100% (1)

- Digitizing Govt Payments Kenya Study - FINAL PDFDocument32 pagesDigitizing Govt Payments Kenya Study - FINAL PDFOPIYO ONYANGONo ratings yet

- E-Governance Initiative in Afghanistan Opportunities and ChallengesDocument11 pagesE-Governance Initiative in Afghanistan Opportunities and ChallengesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Your Booking at de Pavilion Hotel Is Confirmed!: TicketDocument4 pagesYour Booking at de Pavilion Hotel Is Confirmed!: TicketgurpreetNo ratings yet

- Admit CardDocument1 pageAdmit CardKaushal Kishor TripathiNo ratings yet

- Motorcycle Safety Program Military Waiver Application: Section 1Document1 pageMotorcycle Safety Program Military Waiver Application: Section 1C ckNo ratings yet

- Https WWW - Irctc.co - in Eticketing PrintTicketDocument1 pageHttps WWW - Irctc.co - in Eticketing PrintTicketmantosh chaudharyNo ratings yet

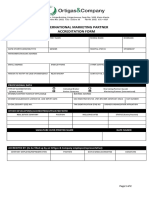

- International Marketing Partner Accreditation Form: Personal BackgroundDocument2 pagesInternational Marketing Partner Accreditation Form: Personal BackgroundLeytonDelaCruzNo ratings yet

- Joining InstructionsDocument5 pagesJoining InstructionsEvarist EdwardNo ratings yet

- City Facilities Management - ASDA Cleaning - Application FormDocument4 pagesCity Facilities Management - ASDA Cleaning - Application FormMohammad Nasfikur Rahman Khan40% (5)

- 1 NF 998 BilangualDocument24 pages1 NF 998 BilangualShakeer HussainNo ratings yet

- 20 HolidayDocument2 pages20 HolidayAttila ZsohárNo ratings yet

- Adult Model Release AgreementDocument2 pagesAdult Model Release AgreementTroy AmbroseNo ratings yet

- PRMO2Document1 pagePRMO2Aarya AttreyNo ratings yet

- Beat The Law - Diplomatic Immunity - State Citizen PassportDocument32 pagesBeat The Law - Diplomatic Immunity - State Citizen PassportPhil100% (41)

- 3 RD Callup AFCAT022011Document140 pages3 RD Callup AFCAT022011grbavithraNo ratings yet

- Oct 26Document2 pagesOct 26Subbulakshmi RamalingamNo ratings yet

- Naplex-Mpje Bulletin 070113Document35 pagesNaplex-Mpje Bulletin 070113Shan ShaniNo ratings yet

- Velciti Consulting Engineers - Offer LetterDocument6 pagesVelciti Consulting Engineers - Offer Lettermg.placement23No ratings yet

- Gnitchandbookfinal PDFDocument80 pagesGnitchandbookfinal PDFlavanyatumuNo ratings yet

- Your Ticket: Merwan BourknaDocument1 pageYour Ticket: Merwan BourknaMerwan BourknaNo ratings yet

- Kyc Format HpgasDocument2 pagesKyc Format HpgasRam Narendra NathNo ratings yet

- Torts: QuickStudy Laminated Reference GuideFrom EverandTorts: QuickStudy Laminated Reference GuideRating: 5 out of 5 stars5/5 (1)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyFrom EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyRating: 5 out of 5 stars5/5 (2)

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsFrom EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsRating: 3 out of 5 stars3/5 (2)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersFrom EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersRating: 5 out of 5 stars5/5 (4)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersFrom EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersRating: 5 out of 5 stars5/5 (2)

- Legal Writing in Plain English: A Text with ExercisesFrom EverandLegal Writing in Plain English: A Text with ExercisesRating: 3 out of 5 stars3/5 (2)

- Admissibility of Expert Witness TestimonyFrom EverandAdmissibility of Expert Witness TestimonyRating: 5 out of 5 stars5/5 (1)

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsFrom EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsRating: 4 out of 5 stars4/5 (18)

- Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayFrom EverandSolve Your Money Troubles: Strategies to Get Out of Debt and Stay That WayRating: 4 out of 5 stars4/5 (8)

- Legal Writing in Plain English, Third Edition: A Text with ExercisesFrom EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNo ratings yet

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- How to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!From EverandHow to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Rating: 5 out of 5 stars5/5 (1)

- Commentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769From EverandCommentaries on the Laws of England, Volume 1: A Facsimile of the First Edition of 1765-1769Rating: 4 out of 5 stars4/5 (6)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionFrom EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionRating: 5 out of 5 stars5/5 (1)

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersFrom EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- Everybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeFrom EverandEverybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeNo ratings yet

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolFrom EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNo ratings yet

- Busted!: Drug War Survival Skills and True Dope DFrom EverandBusted!: Drug War Survival Skills and True Dope DRating: 3.5 out of 5 stars3.5/5 (7)

- Flora and Vegetation of Bali Indonesia: An Illustrated Field GuideFrom EverandFlora and Vegetation of Bali Indonesia: An Illustrated Field GuideRating: 5 out of 5 stars5/5 (2)