Professional Documents

Culture Documents

Credit Card Application Supplementary Cards

Uploaded by

LAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Card Application Supplementary Cards

Uploaded by

LACopyright:

Available Formats

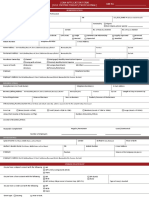

CREDIT CARD APPLICATION

Supplementary Cardholder

Name of Principal Cardholder (First Name, Middle Name, Last Name, Suffix)

Preferred Card Format (choose one): Regular Card Virtual Card (card for Internet use only)

PHP

Monthly Spending Limit (MSL): ____________________

Principal Card Number (Please indicate first 6-digits and last 4-digits)

Note: For Regular Supplementary Card, if no MSL is indicated, the default is the same as the Principal Account’s credit

limit. For Virtual Card, the default MSL is PHP20,000.00 if no MSL is indicated; minimum MSL is

- x x - x x x x - PHP5,000.00.The MSL is shared with the Principal Account’s credit limit.

Notes: 1. Supplementary Card applicant must be at least 13 years old. 3. Incomplete application will be declined.

2. Supplementary Card application is subject to evaluation and approval. 4. Card will be delivered to Principal Cardholder’s address on record.

Name (First Name, Middle Name, Last Name, Suffix) Name to Appear on Card (Maximum of 21 characters including spaces. Nicknames/Aliases are not allowed)

Home Phone No. (include area code) Mobile Phone No. Personal E-mail Address Alternate E-mail Address

Gender Date of Birth (mm/dd/yyyy) Place of Birth (City, Country) Nationality Mother’s Maiden Name (First Name, Middle Name, Last Name) No. of Dependents

Male Philippines Filipino

Female ____________ ________

Civil Status Highest Educational Attainment Home Ownership Car Ownership TIN SSS No. / GSIS No.

Single Married Separated Post-Graduate College Owned Mortgaged Owned Mortgaged

Divorced Widowed High School Undergraduate Rented Living with Parents Leased None

Home/Permanent Address (Unit No./Floor, Building Name, Building/House No., Street, Subdivision/Village, Barangay, City/Municipality, Province) ZIP Code Length of Stay

(months/years)

Present Address (Unit No./Floor, Building Name, Building/House No., Street, Subdivision/Village, Barangay, City/Municipality, Province) ZIP Code Length of Stay

(months/years)

Same as Home/

Permanent Address

Source(s) of Funds (Kindly select all applicable Source/s of Funds)

Business Commission Dividends Funds from Family Member Gifts and Donations Government Assistance Inheritance Interest

Investments Pension Profession Remittance Rent Salary Sale of Property Savings Winnings / Rewards

Employment Type Employer/Business Name Occupation / Designation / Position / Title (Others, kindly specify in the blank)

Employed Self-employed (Business) Self-employed (Professional) Accountant Custom Broker Expatriate/Consular or Ambassadorial Staff

Not Applicable ______________________ Jeweler Lawyer Money Changer Student _____________

Work/Business Address (Unit No./Floor, Building Name, Building No., Street, Subdivision/Village, Barangay, City/Municipality, Province) Zip Code Work/Business Phone No. Years in Work /

Business

Nature of Business / Employment (Others, kindly specify in the blank) Gross Annual Income

Admin/Support Agriculture/Fishing Construction Education Financial/Insurance IT/Communication

Manufacturing Mining/Quarrying Professional Service Transportation/Storage Wholesale/Retail _____________________

Relationship to Principal Cardholder Monthly Spending Limit (Principal and Supplementary Cardholders share the same credit limit) Type of ID Submitted

Passport Voter’s ID Driver’s License

PHP

PRC ID TIN/SSS/GSIS ID __________________

Residency FCBS Non-Resident Indicator: Resident = NO ; Non-Resident = YES

Resident (Filipino / Alien / Special Resident Retiree’s Visa) ACR I-Card No. (if applicable) _______________________________________________________

Non-Resident (Alien / Filipino Immigrant / OFWs with contract to work abroad for more than a year / Sea-based OFWs with immigrant or working visa)

1. Do you have relatives working in China Bank? Yes No Name/Unit __________________________________________ Relationship ______________________

2. Are you / Are you related or associated to a person currently/formerly holding a position Yes No Relationship with the government personnel: Occupying Relative Associate

in any branch of the Philippine or foreign government or an international organization? (Position and Dept. of the Gov’t Personnel ___________________________________________ )

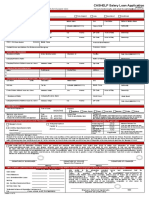

FOREIGN ACCOUNT TAX COMPLIANCE ACT (FATCA) INFORMATION

1. Are you a US Citizen/Green Card Holder or do you meet the Substantial Presence Test?

YES NO

If YES, kindly accomplish FATCA Customer’s Information for U.S. Persons Form.

2. If No to Item No. 1. Do you have any of the following records in the US?

Born in the U.S. YES NO

U.S. Residence Mailing Address (including a U.S. Post Office Box) U.S. Telephone Number

Standing Instruction to transfer funds to accounts maintained in the U.S.

Do you have a Power of Attorney or signatory authority granted to a person with a U.S. Address; or “in-care-of” or “hold mail” address?

If YES, kindly submit the following Requirements: U.S. IRS Form W-8BEN* AND valid non-U.S. passport or any similar documentation establishing non-U.S. citizenship (e.g., Driver’s License, Tax Certificate issued by the Government)

Additional Requirement if Born in the U.S.: Copy of Individual’s Certificate of Loss of Nationality of the U.S. OR Written explanation of your renunciation of U.S. Citizenship or reason you did not obtain U.S. citizenship at birth

* Kindly ask the Bank for a copy of U.S. IRS Form W-8BEN (Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting - Individuals)

DECLARATION

By signing below, I/we confirm that the information provided in this application form is true and correct. I/we authorize China Banking Corporation (CBC) and its affiliates/authorized agents to verify and investigate the information contained herein or any document/paper submitted in connection

herewith, as well as updates or corrections thereof, from whatever sources it may deem appropriate. I/We hereby consent and/or was/were authorized to give consent to the collection, retention, processing, disclosure (as provided under applicable confidentiality and data privacy laws of the

Philippines including all subsequent amendments or supplements thereto) of any personal, sensitive personal and privileged information relating to me/us, the Partnership/Corporation/Juridical Entity and its officers, directors and stockholders, whether provided by me/us or coming to CBC’s

possession, and sharing of the said personal, sensitive personal and privileged information to CBC and its offices, branches, subsidiaries and affiliates (Chinabank Insurance Brokers, Inc., China Bank Securities Corporation, China Bank Capital Corporation, China Bank Savings, Inc., China

Bank Properties and Computer Center, Inc., and Manulife-China Bank Life Assurance Corporation, among others), accredited third parties/vendors, or other persons or entities that CBC may reasonably select, personal information processors, credit reporting or credit reference agencies,

credit protection provider, guarantee institutions, debt collection agencies, government agencies and private regulatory organizations and other financial institutions, and other outsourced service providers engaged by CBC as allowed by law and internal Bank policies, for purposes reasonably

required by CBC such as, but not limited to, its conduct of everyday business (processing my/our Credit Card application and transactions, maintenance of my/our account/s), performance of daily technological and operational functions, communications technology services including updates

and automation of the systems of CBC group and its affiliates, compliance with the law and regulatory organizations, research and statistics including conduct of surveys, marketing and cross-selling of products and services of CBC, its subsidiaries and affiliates, client relationship management,

sales lead generation, running credit and negative information checks, conduct of skiptracing, asset and property search and/or verification, statistical and risk analysis, data analytics, client profiling, and in the event of default arising from non-payment of my/our Credit Card obligations with

CBC, and all other purposes as allowed in the banking industry practice, businesses of CBC’s subsidiaries and affiliates, and by law. I/We shall notify CBC in writing, which must be acknowledged by CBC, if I/we do not consent to the processing and disclosure of said information with CBC’s

representative offices, subsidiaries, affiliates, agents and accredited third parties/vendors or other persons or entities that CBC may reasonably select. I/We further acknowledge my/our right to information, access, correction, rectification, erasure of my/our personal, sensitive personal and

privileged information, data portability, objection to processing, file complaint and damages under the Data Privacy Act.

I/We agree that CBC may retain my/our personal and account information for as long as necessary for the fulfilment of the purpose for which it was collected and such other purposes that I/we may have consented to from time to time, as required by pertinent laws and regulations, and provide

information when required to do so in accordance with RA 1405, RA 6426, RA 8791, RA 9510, RA 9160, RA 10173, as amended, and other similar and applicable laws, by court order, and jurisprudence. I/We agree that CBC shall not be liable for any loss or damage arising from CBC’s

disclosure of personal and account information for the above.

I/We consent and authorize the Land Registration Authority, Register of Deeds, Land Transportation Offices, local government unit offices, and other government agencies and instrumentalities to give, provide, share, and disclose any and all information and documents as may be necessary

and required by the Bank and its authorized representatives, in connection with its conduct of skiptracing, asset and property search and/or verification.

I/We hereby authorize the regular submission and disclosure to any and all credit information service providers such as, but not limited to, Credit Card Association of the Philippines and Credit Information Corporation, of any information, whether positive or negative relating to my/our basic

credit data (as defined under R.A. No. 9510) with CBC as well as any updates or corrections thereof. I/We understand that my/our credit data may be shared by the CIC with other authorized lenders and duly accredited reporting agencies, for the purpose of establishing my/our credit

worthiness. The foregoing constitutes my/our written consent for any such submission and disclosure of information relating to my/our accounts for the purpose indicated above and under applicable laws, rules, and regulations. I/we agree to hold CBC free and harmless from any liabilities

that may arise from any such collection, processing, use, retention, sharing, and disclosure of information relating to my/our accounts, properties, or investments with CBC.

I/We understand that falsifying any information in the application or any of the enclosed documents is sufficient ground for legal action and for rejecting my/our application. In the event that my/our application for a CBC Credit Card is disapproved, CBC is under no obligation to provide me with

the reason for such a decision. The accomplished Application Form and requirement(s) submitted become property of CBC. CBC is under no obligation to return the said documents.

I/We agree to indemnify and hold free and harmless CBC, its subsidiaries and affiliates, as well as any of its officers, directors, and employees against any and all losses, claims, damages, penalties, liabilities, choses of actions, and costs of any kind that may arise directly or indirectly from

the execution of this consent.

I/We hereby expressly agree to CBC’s credit policies and procedures in accordance with BSP Circular No. 855 (Sound Credit Risk Management Practices), as well as other applicable and related laws/regulations.

By signing and/or using my/our CBC Credit Card(s), I/we agree to abide and be governed by Terms and Conditions governing the issuance and use of the CBC Credit Card as found in the Bank’s website and all future amendments thereto. Furthermore, I/we hold myself/ourselves liable for

all obligations and liabilities incurred by the Supplementary Cardholder(s). In the event of delinquency, I/we hereby authorize CBC to submit my/our name(s) in negative listing of any credit bureau or institution. I/We also hereby affirm and acknowledge that I/we have understood and fully

agreed that CBC may change any of the provisions in its Terms and Conditions and the fees and charges for its products and/or services from time to time and I/we agreed to be notified of such changes through notice sent to me/us through any of the following means, at the discretion of

CBC, including, but not limited to, mail/e-mail/fax/SMS or telephone, and for any other purpose as CBC may deem appropriate unless I/we request otherwise.

Principal Cardholder’s Signature Over Printed Name / Date Supplementary Card Applicant’s Signature Over Printed Name / Date

FOR BANK’S USE ONLY

Industry Sub-Class Program Code Main Sales Branch Code Area Code Region Code Referrer’s Name

Channel Code

Employee No. ________________________________________________________

CCD-033 (09-21) TMP

You might also like

- Credit Card Application For Principal CardholderDocument1 pageCredit Card Application For Principal CardholderLoay RashadNo ratings yet

- Credit Card Application Principal CardholderDocument1 pageCredit Card Application Principal CardholderBenNo ratings yet

- China BankDocument1 pageChina BankPSC.CLAIMS1No ratings yet

- Credit Card Application: For Principal CardholderDocument1 pageCredit Card Application: For Principal CardholderDe Gala ChrisNo ratings yet

- 11.02.17 Autoplus Loan Application Form (Individual) (CBG-001 (10-17) TMP) - SaveableDocument2 pages11.02.17 Autoplus Loan Application Form (Individual) (CBG-001 (10-17) TMP) - SaveableEdmar CayangaNo ratings yet

- Payment Plan Application FormDocument3 pagesPayment Plan Application FormJojo ArejaNo ratings yet

- Motor Vehicle Loan Application Form: (Months)Document2 pagesMotor Vehicle Loan Application Form: (Months)Pam Bisares100% (1)

- AF - Sole and CAL BB DocusignDocument9 pagesAF - Sole and CAL BB DocusignManuel Castro IINo ratings yet

- Security Bank Mastercard Online Form: PLEASE FAX TO: 840-2436 / 815-3649 / 812-1272Document1 pageSecurity Bank Mastercard Online Form: PLEASE FAX TO: 840-2436 / 815-3649 / 812-1272kaiserdeleonNo ratings yet

- Denr EmbDocument2 pagesDenr EmbELben RescoberNo ratings yet

- China Bank Credit Card Application FormDocument2 pagesChina Bank Credit Card Application FormgregbaccayNo ratings yet

- 2021 Loanappformsoleprop 85 X 13Document4 pages2021 Loanappformsoleprop 85 X 13Jeffrey Ru LouisNo ratings yet

- CREDIT CARD APPLICATION PREFERRED TYPEDocument2 pagesCREDIT CARD APPLICATION PREFERRED TYPEJon SantiagoNo ratings yet

- Form (Form)Document2 pagesForm (Form)cessecseNo ratings yet

- Proposal Form Proposal No:: For Office Use OnlyDocument14 pagesProposal Form Proposal No:: For Office Use OnlyPooja MishraNo ratings yet

- Auto Loan AF - Invidual or Sole ProprietorDocument4 pagesAuto Loan AF - Invidual or Sole ProprietorAllah Rizza MarquesesNo ratings yet

- Maxicare Customer Information Form InstructionsDocument2 pagesMaxicare Customer Information Form InstructionsJoyce HerreraNo ratings yet

- MORESCO Application Form FrontDocument1 pageMORESCO Application Form FrontDwinix John CabañeroNo ratings yet

- Health Ensure PFDocument3 pagesHealth Ensure PFShobhit JainNo ratings yet

- Aub Salary Application FormDocument2 pagesAub Salary Application FormRaymund Platilla50% (2)

- Group Health Insurance Proposal Form for Bajaj Allianz General InsuranceDocument3 pagesGroup Health Insurance Proposal Form for Bajaj Allianz General InsuranceDenver SaldanhaNo ratings yet

- Cis FormDocument1 pageCis Formbdw82qth6bNo ratings yet

- (For IISP Branch Only) : Application AgreementDocument2 pages(For IISP Branch Only) : Application AgreementRachel CabanlitNo ratings yet

- Supplementary Application FormDocument1 pageSupplementary Application FormanaNo ratings yet

- A1 Loan Application FormDocument1 pageA1 Loan Application FormAngie DuranNo ratings yet

- Personal Loan Application Form For WebsiteDocument1 pagePersonal Loan Application Form For Websitealicante.rodel0iNo ratings yet

- State Bank of India: OpeningDocument7 pagesState Bank of India: OpeningNeetu JhaNo ratings yet

- Uniform Residential Loan Application Section 1: Borrower InformationDocument17 pagesUniform Residential Loan Application Section 1: Borrower InformationshandilyasamitNo ratings yet

- Uniform Residential Loan Application Section 1: Borrower InformationDocument9 pagesUniform Residential Loan Application Section 1: Borrower InformationHannie NguyenNo ratings yet

- Retail Credit Card ApplicationDocument2 pagesRetail Credit Card ApplicationNiyomahoro Jean HusNo ratings yet

- Credit Card Application FormDocument19 pagesCredit Card Application FormTasneef ChowdhuryNo ratings yet

- PI Candidate Form-ExcelDocument6 pagesPI Candidate Form-Excelinder24242No ratings yet

- Customer Information Sheet: Please Fill Out All Information BelowDocument1 pageCustomer Information Sheet: Please Fill Out All Information BelowEarl JustinNo ratings yet

- Housing Loan Application FormDocument2 pagesHousing Loan Application FormJudy Ann DivinoNo ratings yet

- Assignment Form: InstructionsDocument2 pagesAssignment Form: InstructionsjahgfNo ratings yet

- Tfgf-Ftf-Ifg - Gg#E - Orh: T.It?M:HDocument8 pagesTfgf-Ftf-Ifg - Gg#E - Orh: T.It?M:HShujaRehmanNo ratings yet

- Conversion To Public From Staff CardDocument1 pageConversion To Public From Staff Cardrikki mae maonNo ratings yet

- RBank Credit Card Supplementary App FormDocument1 pageRBank Credit Card Supplementary App FormJiezel VillanuevaNo ratings yet

- Housing Loan Application Form (HLA-2019-001)Document2 pagesHousing Loan Application Form (HLA-2019-001)Michael DaviesNo ratings yet

- CC App FormDocument7 pagesCC App FormMIHDI PALAPUZNo ratings yet

- KYC FillableDocument4 pagesKYC FillableblissNo ratings yet

- BDO Auto LoanDocument2 pagesBDO Auto LoanRalph Christian Lusanta FuentesNo ratings yet

- Bajaj Allianz Health Insurance ProposalDocument4 pagesBajaj Allianz Health Insurance Proposalrock_on_rupz99No ratings yet

- Credit Application FormDocument1 pageCredit Application Formtrexy jeane sumapigNo ratings yet

- MC Application Form (Generic) FA 021517 LANDBANK CREDIT CARDDocument2 pagesMC Application Form (Generic) FA 021517 LANDBANK CREDIT CARDMariaAurora Fire StationNo ratings yet

- RBD - Common Retail Loan Application Form Co - ApplicantDocument2 pagesRBD - Common Retail Loan Application Form Co - Applicantr_awadhiyaNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Cheery Fernandez SumargoNo ratings yet

- Cargill Group of CompaniesDocument4 pagesCargill Group of CompaniesAndi Roy SitumorangNo ratings yet

- HLF047 ApplicationMoratoriumHLAmortizationPayments V03Document1 pageHLF047 ApplicationMoratoriumHLAmortizationPayments V03JamesNo ratings yet

- No. of Years: For Individuals and Sole ProprietorshipsDocument2 pagesNo. of Years: For Individuals and Sole Proprietorshipsjunil rejanoNo ratings yet

- GE Money: Application and Credit Card AgreementDocument8 pagesGE Money: Application and Credit Card AgreementsewsalesNo ratings yet

- Credit Application Form for Motorcycle/E-Bike FinancingDocument2 pagesCredit Application Form for Motorcycle/E-Bike FinancingProff Yues100% (1)

- ACCOUNTABILITYDocument3 pagesACCOUNTABILITYJaniceNo ratings yet

- Auto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankDocument3 pagesAuto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankChristine GuyalaNo ratings yet

- Buyers Information SheetDocument1 pageBuyers Information SheetOrle VillacarlosNo ratings yet

- Verifacts - BGV FormDocument3 pagesVerifacts - BGV FormHarshal SelkarNo ratings yet

- CREW APPLICATION TITLEDocument8 pagesCREW APPLICATION TITLEViorel StanNo ratings yet

- Sale and transfer of used Hyundai with mortgageDocument2 pagesSale and transfer of used Hyundai with mortgageMeg Tiong-Odvina80% (153)

- Edu en Vcdicm103 Lab IeDocument230 pagesEdu en Vcdicm103 Lab IeLANo ratings yet

- Sample Construction ContractDocument7 pagesSample Construction ContractLANo ratings yet

- DEED OF SALE OF MOTOR VEHICLE-templateDocument2 pagesDEED OF SALE OF MOTOR VEHICLE-templateIvy Mallari QuintoNo ratings yet

- Visa Checklist All Categories and Countries Bangkok Hub 020222Document2 pagesVisa Checklist All Categories and Countries Bangkok Hub 020222Cecilia NuevaNo ratings yet

- Ove 211031 035253Document1 pageOve 211031 035253Sophia BuiserNo ratings yet

- Calaguas 3 D2 NITDocument2 pagesCalaguas 3 D2 NITLANo ratings yet

- RQSTR17838Document1 pageRQSTR17838LANo ratings yet

- Company ID Request Form v1.2Document2 pagesCompany ID Request Form v1.2LANo ratings yet

- Record Sheet, Year 1: Please Submit These Record Sheets To Your Instructor After Completing The Simulation. Thank You!Document5 pagesRecord Sheet, Year 1: Please Submit These Record Sheets To Your Instructor After Completing The Simulation. Thank You!Grayson Lee0% (1)

- In Search of Crisis Alpha:: A Short Guide To Investing in Managed FuturesDocument8 pagesIn Search of Crisis Alpha:: A Short Guide To Investing in Managed FuturesclaytonNo ratings yet

- Report On Project AppraisalDocument99 pagesReport On Project Appraisalswapnil2288No ratings yet

- Additional Eco Mcqs-1Document42 pagesAdditional Eco Mcqs-1MunibaNo ratings yet

- Firewood Business PlanDocument45 pagesFirewood Business PlanJoseph QuillNo ratings yet

- Determinants of Forward and Futures PricesDocument24 pagesDeterminants of Forward and Futures PricesSHUBHAM SRIVASTAVANo ratings yet

- The Promotion MixDocument5 pagesThe Promotion Mixkeshavrathi175% (4)

- Verloop - Io OverviewDocument12 pagesVerloop - Io OverviewSaurav SharmaNo ratings yet

- IRCA QMS Internal Auditor Training CourseDocument1 pageIRCA QMS Internal Auditor Training Coursesilswal1988No ratings yet

- Company Profile TNSBDocument13 pagesCompany Profile TNSBMoktar BakarNo ratings yet

- HR Practices Comparison of Two OrganizationsDocument9 pagesHR Practices Comparison of Two OrganizationsROhit NagPalNo ratings yet

- Entrepreneurship roles in quality of lifeDocument2 pagesEntrepreneurship roles in quality of lifeMarianne Grace YrinNo ratings yet

- Practical Guide to Plant Turnaround ManagementDocument11 pagesPractical Guide to Plant Turnaround Managementt_saumitra100% (2)

- Dominguezdomenech enDocument3 pagesDominguezdomenech enapi-296087053No ratings yet

- Format Neraca Lajur ExcelDocument2 pagesFormat Neraca Lajur ExcelPipit Ella FiantiaNo ratings yet

- Entrepreneurship and Its Importance in Organizations: Ebrahim Chirani Farzin Farahbod Forough PourvahediDocument5 pagesEntrepreneurship and Its Importance in Organizations: Ebrahim Chirani Farzin Farahbod Forough PourvahediNabory MdemuNo ratings yet

- Lending Procedures at Standard BankDocument4 pagesLending Procedures at Standard BankAshraf Uddin AhmedNo ratings yet

- Amma I Loove UDocument97 pagesAmma I Loove UDeepesh Fal DessaiNo ratings yet

- TERM PAPER For 2nd Semester MUJDocument17 pagesTERM PAPER For 2nd Semester MUJmisba shaikhNo ratings yet

- Eckert Sandra Bachelor ThesisDocument98 pagesEckert Sandra Bachelor ThesisNauman SaddiquiNo ratings yet

- Work Order AgreementDocument3 pagesWork Order AgreementBimo Mahendra PutraNo ratings yet

- Scheme of Work MKT410 2013Document5 pagesScheme of Work MKT410 2013Syahirah SbmbNo ratings yet

- The Impact of Upstream Supply and Downstream Demand Integration On Quality Management and Quality PerformanceDocument20 pagesThe Impact of Upstream Supply and Downstream Demand Integration On Quality Management and Quality PerformancejoannakamNo ratings yet

- Purpose: ObjectiveDocument5 pagesPurpose: Objectiveteck yuNo ratings yet

- Far410 Chapter 5 Ppe NoteDocument19 pagesFar410 Chapter 5 Ppe NoteAQILAH NORDINNo ratings yet

- Tax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDocument1 pageTax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDoita Dutta ChoudhuryNo ratings yet

- CFE Exam Content Outline 2023Document10 pagesCFE Exam Content Outline 2023Julia BaldinNo ratings yet

- Uk Pestle Analysis Part 3Document10 pagesUk Pestle Analysis Part 3S Waris HussainNo ratings yet

- Staffing to SelectionDocument3 pagesStaffing to SelectionMuhammad WaqasNo ratings yet

- Post-Quiz - XPDocument4 pagesPost-Quiz - XPSunetra Mukherjee100% (3)