Professional Documents

Culture Documents

Costsheet Sheet2

Uploaded by

Abhishek kumar sittu0 ratings0% found this document useful (0 votes)

20 views2 pagesAccounts questions and solutions. Cost sheet

Original Title

costsheet_sheet2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounts questions and solutions. Cost sheet

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views2 pagesCostsheet Sheet2

Uploaded by

Abhishek kumar sittuAccounts questions and solutions. Cost sheet

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Cost Sheet Practice Sheet 2

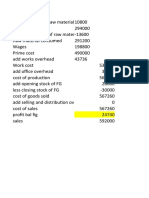

Q6. From the following information prepare cost sheet and find out the amount of Profit: Rs

Raw Material Purchased 24,000

Works Overhead- 20,000

Stocks:

Raw Material as on 1st January 2020 4000

Finished Goods (800 quintals) as on 1st January ,2020 3200

Work in Progress:

1st January, 2020 960

31st January, 2020 3200

Office & Administration Overheads 1600

Sales (Finished Goods) 60,000

Advertising, discount allowed and selling cost is Re 0.40 per quintal. During the month

12,800 quintals of the commodity were produced.

Q7. Prepare cost sheet from the following data provided:

Raw Materials Rs 15,000

Direct Labour Rs 9,000

Machine Hours 900 hours

Machine Hour Rate Rs 5

Production 17,100 units

Sales 16,000 units

Selling Price per unit Rs 4

Selling overhead per unit 50 paise

Office overheads are 20% of works cost

Q8. The cost of sale of Production is made up as follows:

Materials used in Manufacturing 5500

Materials used in packing material 1000

Materials used in selling the product 150

Materials used in the factory 75

Materials used in office 125

Labour required in production 1000

Labour required for supervision of the management of 200

factory

Expenses-direct-factory 500

Expenses-indirect-factory 100

Expenses-office 125

Depreciation-office building and equipment 75

Depreciation-factory 175

Selling expenses 350

Freight on material 500

Advertising 125

Assuming that all products manufactured are sold, what should be the selling price to obtain a

profit 25% on selling price?

You might also like

- Business Genetics: Understanding 21st Century Corporations using xBMLFrom EverandBusiness Genetics: Understanding 21st Century Corporations using xBMLNo ratings yet

- ACMA Unit 7 Problems - Cost Sheet PDFDocument3 pagesACMA Unit 7 Problems - Cost Sheet PDFPrabhat SinghNo ratings yet

- Cost Sheet Practice QuestionsDocument6 pagesCost Sheet Practice Questionsmeenagoyal995650% (2)

- MA-II Assignment I - Cost SheetDocument3 pagesMA-II Assignment I - Cost Sheetshriya2413100% (1)

- Chap 1 Problems Cost SheetDocument5 pagesChap 1 Problems Cost SheetRositaNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- Assignment ProblemDocument7 pagesAssignment ProblemAnantha KrishnaNo ratings yet

- Practice Questions: TH THDocument3 pagesPractice Questions: TH THAhsan MemonNo ratings yet

- Problem Set 1 PDFDocument3 pagesProblem Set 1 PDFrenjith0% (2)

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Cost Accounting MidDocument7 pagesCost Accounting MidHuma NadeemNo ratings yet

- Cost SheetDocument6 pagesCost SheetAishwary Sakalle100% (1)

- Test Cost SheetDocument3 pagesTest Cost SheetIt's MeNo ratings yet

- COST SHEET NumericalsDocument9 pagesCOST SHEET Numericalsmisaki chanNo ratings yet

- Specimen of Cost Sheet and Problems-Unit-1 Cost SheetDocument11 pagesSpecimen of Cost Sheet and Problems-Unit-1 Cost SheetRavi shankar100% (1)

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Accounting Unit Additional Execerses AA025 Sem 2, 2019/2020Document5 pagesAccounting Unit Additional Execerses AA025 Sem 2, 2019/2020nur athirahNo ratings yet

- Cost of Good Manufactured and Sold StatementDocument8 pagesCost of Good Manufactured and Sold StatementAyesha JavedNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- HW 1 MGT202Document4 pagesHW 1 MGT202Rajnish Pandey0% (1)

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Direct Materials Direct Labor: Exercise 2 - Job Order Cost SheetDocument7 pagesDirect Materials Direct Labor: Exercise 2 - Job Order Cost SheetNile Alric AlladoNo ratings yet

- Cost Accounting 1 SW No. 4 With AnswersDocument1 pageCost Accounting 1 SW No. 4 With AnswersApril NudoNo ratings yet

- E1049217046 18320 141590299475Document14 pagesE1049217046 18320 141590299475Sumit PattanaikNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Cost Sheet Questions FastrackDocument8 pagesCost Sheet Questions Fastrackdegikoh540No ratings yet

- Important Theorertical QuestionsDocument3 pagesImportant Theorertical QuestionsKuldeep Singh GusainNo ratings yet

- Important Theorertical QuestionsDocument3 pagesImportant Theorertical QuestionsKuldeep Singh GusainNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- Cost of Goods Sold Statement - Practice QuestionDocument3 pagesCost of Goods Sold Statement - Practice QuestionMuhammad MansoorNo ratings yet

- 6-Cost Sheet (Unsolved) (25-02-2024)Document17 pages6-Cost Sheet (Unsolved) (25-02-2024)Kajal BindalNo ratings yet

- Assignment 1Document2 pagesAssignment 1mkmanish1No ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Cost Accounting CycleDocument3 pagesCost Accounting CycleSheng1828No ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Tutorial AnswersDocument3 pagesTutorial AnswersshivnilNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- MANUFACTURING and Partnership AccountsDocument40 pagesMANUFACTURING and Partnership Accountslord67% (3)

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Cost Concepts - Cost SheetDocument24 pagesCost Concepts - Cost SheetFaraz SiddiquiNo ratings yet

- Week 52Document7 pagesWeek 52Mariola AlkuNo ratings yet

- Cost Strategic Management - Chap3Document28 pagesCost Strategic Management - Chap3Alber Howell MagadiaNo ratings yet

- Introduction To Cost AccountingDocument5 pagesIntroduction To Cost AccountingDaniel Jackson100% (1)

- Job CostingDocument4 pagesJob CostingZoya RehmanNo ratings yet

- Cost Sheet PDFDocument73 pagesCost Sheet PDFsaloniNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- CA Assignment QuestionsDocument7 pagesCA Assignment QuestionsShagunNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingKrizia Mae FloresNo ratings yet

- Cost Accounting 1 ACT201 InstructorsDocument4 pagesCost Accounting 1 ACT201 InstructorsAdhamNo ratings yet

- Manufacturing BusinessDocument18 pagesManufacturing BusinessJeon JeonNo ratings yet

- Cost Sheet-3Document77 pagesCost Sheet-3nahi batanaNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- TUTORIAL ManufacturingDocument9 pagesTUTORIAL ManufacturingmaiNo ratings yet

- CVPanalysis SolutionsDocument3 pagesCVPanalysis SolutionsAbhishek kumar sittuNo ratings yet

- Change SlidesDocument15 pagesChange SlidesAbhishek kumar sittuNo ratings yet

- Q14 N 15 Cost SheetDocument7 pagesQ14 N 15 Cost SheetAbhishek kumar sittuNo ratings yet

- Assignment of FMDocument11 pagesAssignment of FMAbhishek kumar sittuNo ratings yet

- CVPanalysisDocument2 pagesCVPanalysisAbhishek kumar sittuNo ratings yet

- CVP Analysis Sheet2Document2 pagesCVP Analysis Sheet2Abhishek kumar sittuNo ratings yet

- Dabur STPRDocument93 pagesDabur STPRAbhishek kumar sittuNo ratings yet

- Bio-Data Personal Details: Contact No.Document2 pagesBio-Data Personal Details: Contact No.Abhishek kumar sittuNo ratings yet

- CVP Analysis Sheet2Document2 pagesCVP Analysis Sheet2Abhishek kumar sittuNo ratings yet

- Rambol KumarDocument2 pagesRambol KumarAbhishek kumar sittuNo ratings yet

- Project Report On Training and DevelopmentDocument50 pagesProject Report On Training and Developmentkaur_simran23275% (143)

- Mkw0, 0Ih0Ts0 Vcnqy Dyke Mkw0, 0Ih0Ts0 Vcnqy Dyke Izkfof/Kd Fo'Ofo - Ky Izkfof/Kd Fo'Ofo - KyDocument1 pageMkw0, 0Ih0Ts0 Vcnqy Dyke Mkw0, 0Ih0Ts0 Vcnqy Dyke Izkfof/Kd Fo'Ofo - Ky Izkfof/Kd Fo'Ofo - KyAbhishek kumar sittuNo ratings yet

- Department of MBA Format For Research Project Report KMB405Document4 pagesDepartment of MBA Format For Research Project Report KMB405Abhishek kumar sittuNo ratings yet

- Mendel Spea Plants Lesson PlanDocument5 pagesMendel Spea Plants Lesson PlanAbhishek kumar sittuNo ratings yet

- Project Report On Training and DevelopmentDocument50 pagesProject Report On Training and Developmentkaur_simran23275% (143)

- TT CSME 2019 Engl PDFDocument1 pageTT CSME 2019 Engl PDFFiroz AhmedNo ratings yet

- Format For Summer Training Project ReportDocument3 pagesFormat For Summer Training Project ReportAbhishek kumar sittuNo ratings yet

- Part 15Document3 pagesPart 15Abhishek kumar sittuNo ratings yet

- Master of Arts (History) : Programme GuideDocument51 pagesMaster of Arts (History) : Programme GuideUdit PandeyNo ratings yet

- COVID-19 Vaccination Appointment Details: Center Date Time Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Date Time Preferred Time SlotAbhishek kumar sittuNo ratings yet

- RPSC Ras Pre Syllabus EnglishDocument5 pagesRPSC Ras Pre Syllabus EnglishAbhishek kumar sittuNo ratings yet

- THEIMPACTOFTRAININGDocument10 pagesTHEIMPACTOFTRAININGKushal MpvsNo ratings yet

- THEIMPACTOFTRAININGDocument10 pagesTHEIMPACTOFTRAININGKushal MpvsNo ratings yet

- 633720175796320000Document56 pages633720175796320000pandu143123No ratings yet

- Finals Quiz 1 CostDocument6 pagesFinals Quiz 1 CostChloe Oberlin100% (1)

- MI CH 1. The Fundamental of CostingDocument4 pagesMI CH 1. The Fundamental of CostingPonkoj Sarker TutulNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- Responsibility Acctg Transfer Pricing GP Analysis 1Document21 pagesResponsibility Acctg Transfer Pricing GP Analysis 1John Bryan100% (1)

- Joint Products & by Products: © The Institute of Chartered Accountants of IndiaDocument0 pagesJoint Products & by Products: © The Institute of Chartered Accountants of IndiaVinay BabuNo ratings yet

- AACE Cost EstimationDocument26 pagesAACE Cost Estimationdmscott1093% (14)

- Skans Schools of Accountancy CAF-8: Product Units RsDocument2 pagesSkans Schools of Accountancy CAF-8: Product Units RsmaryNo ratings yet

- JVA OverviewDocument31 pagesJVA OverviewPradeep Reddy100% (1)

- MANACC Class Handout - Process Costing-1Document6 pagesMANACC Class Handout - Process Costing-1Ritwik MahajanNo ratings yet

- CH PDFDocument68 pagesCH PDFFabrienne Kate Eugenio LiberatoNo ratings yet

- South Dakota FRSDocument79 pagesSouth Dakota FRSMatt BrownNo ratings yet

- BAB 3 Job Order Costing - Cost Flows and External ReportingDocument48 pagesBAB 3 Job Order Costing - Cost Flows and External ReportingNurainin AnsarNo ratings yet

- Management Services101Document24 pagesManagement Services101Jan ryanNo ratings yet

- Tutorial Job Costing CADocument4 pagesTutorial Job Costing CAmiranti dNo ratings yet

- Chap 8 - Responsibility AccountingDocument51 pagesChap 8 - Responsibility AccountingKrisdeo Pardillo67% (3)

- Garrison 14e Practice Exam - Chapter 6Document4 pagesGarrison 14e Practice Exam - Chapter 6Đàm Quang Thanh TúNo ratings yet

- Chapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingDocument70 pagesChapter 10 Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer PricingEninta SebayangNo ratings yet

- SMChap 009Document58 pagesSMChap 009Widdic100% (3)

- Relevent Cost MathDocument2 pagesRelevent Cost MathFahim MahmudNo ratings yet

- STANDARD COSTING AND VARIANCE ANALYSIS (Repaired)Document24 pagesSTANDARD COSTING AND VARIANCE ANALYSIS (Repaired)Arlyn Alonzo100% (1)

- Cost Accounting Practices in The Service IndustryDocument4 pagesCost Accounting Practices in The Service Industryasma zainNo ratings yet

- Flexible BudgetDocument2 pagesFlexible BudgetLhorene Hope DueñasNo ratings yet

- Company Profile (Acc) Edited-1Document12 pagesCompany Profile (Acc) Edited-1Watch IdmdnNo ratings yet

- Strategic Cost Management 1Document44 pagesStrategic Cost Management 1Samantha Nicole Dela CruzNo ratings yet

- True FalseDocument5 pagesTrue FalseCarlo ParasNo ratings yet

- Automobile Body BuildingDocument4 pagesAutomobile Body BuildingVikram BorkhediyaNo ratings yet

- Nov 2019 Paper 2A Questions EngDocument10 pagesNov 2019 Paper 2A Questions EngTerry MaNo ratings yet

- Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Document4 pagesSaint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Esheikell ChenNo ratings yet

- Assigment 5.34Document7 pagesAssigment 5.34Indahna SulfaNo ratings yet