Professional Documents

Culture Documents

Investment Yield Guide October 2020 7537

Uploaded by

metalstormsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Yield Guide October 2020 7537

Uploaded by

metalstormsCopyright:

Available Formats

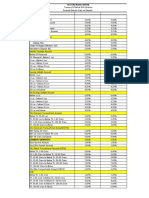

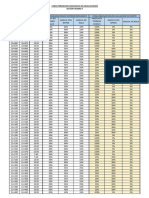

YIELD GUIDE OCTOBER 2020

Sector Oct-19 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Change Market Sentiment

High Street Retail

Bond Street 2.50% - 2.75% 2.75% + 2.75% + 2.75% + 2.75% + 2.75% + 2.75% + 2.75% + NEGATIVE

Oxford Street 2.75% - 3.00% 3.00% + 3.00% + 3.00% - 3.25% 3.00% - 3.25% 3.00% - 3.25% 3.00% - 3.25% 3.00% - 3.25% NEGATIVE

Prime Shops (Bath, Brighton, Cambridge, Glasgow, Oxford) 5.00% - 5.25% 5.75% - 6.00% 6.00% - 6.25% 6.25% - 6.50% 6.25% - 6.50% 6.25% - 6.50% 6.25% - 6.50% 6.25% - 6.50% NEGATIVE

Regional Cities (Birmingham, Manchester) 5.50% + 5.75% - 6.00% 6.00% - 6.25% 6.25% - 6.50% 6.25% - 6.50% 6.25% - 6.50% 6.25% - 6.50% 6.25% - 6.50% NEGATIVE

Good Secondary (Truro, Leamington Spa, Colchester etc) 7.00% 8.00% 8.25% + 8.25% + 8.25% + 8.25% + 8.25% + 8.25% + NEGATIVE

Secondary / Tertiary 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ NEGATIVE

Shopping Centres

Regional Scheme 5.50% 6.25% - 6.50% 6.50% - 6.75% + 7.00% + 7.00% + 7.00% + 7.00% + 7.00% + NEGATIVE

Sub-Regional Scheme 6.75% 7.50% - 7.75% 7.75% - 8.00% + 8.25% + 8.25% + 8.25% + 8.25% + 8.25% + NEGATIVE

Local Scheme (successful) 8.50% + 9.00% - 9.25% 9.00% - 9.25% 9.50% + 9.50% + 9.50% + 9.50% + 9.50% + NEGATIVE

Local Scheme (challenged) 10.50% 12.00% + 12.00% + 12.50% + 12.50% + 12.50% + 12.50% + 12.50% + NEGATIVE

Neighbourhood Scheme (assumes <25% of income from supermarket) 8.50% 9.00% - 9.25% + 9.00% - 9.25% + 9.50% - 9.75% + 9.50% - 9.75% + 9.50% - 9.75% + 9.50% - 9.75% + 9.50% - 9.75% + NEGATIVE

Out of Town Retail

Open A1/Fashion Parks 6.25% 6.75% - 7.00% 6.75% - 7.00% 7.00% + 7.00% + 7.00% + 7.00% + 7.00% + NEGATIVE

Secondary Open A1 Parks 7.75% 8.50% 8.50% 8.75% 8.75% 8.75% 8.75% 8.75% NEGATIVE

Bulky Goods Parks 6.25% 6.75% 6.75% 7.00% 7.00% 7.00% 7.00% 7.00% STABLE

Secondary Bulky Goods Parks 7.75% 8.25% - 8.50% 8.25% - 8.50% 8.50% + 8.50% + 8.50% + 8.50% + 8.50% + NEGATIVE

Solus Open A1 (15 yrs) 5.75% 6.25% - 6.50% 6.25% - 6.50% 6.50% 6.50% 6.50% 6.50% 6.50% STABLE

Solus Bulky (c.50,000 sq ft let to strong covenant for 15 yrs) 6.25% 6.75% 6.75% 6.75% 6.75% 6.75% 6.75% 6.75% STABLE

Leisure

Prime Leisure Parks 5.25% + 5.50% - 5.75% 6.00% + 6.25% - 6.50% 6.50% + 6.50% + 6.50% + 6.75% - 7.00% +0.25% NEGATIVE

Good Secondary Leisure Parks 6.25% + 6.50% - 6.75% 7.00% + 7.25% - 7.50% 7.50% + 7.50% + 7.50% + 7.75% - 8.00% +0.25% NEGATIVE

Secondary / Tertiary Leisure Parks 7.25% + 8.00% - 8.25% 9.00% + 9.25% - 9.50% 9.50% + 9.50% + 9.50% + 9.75% - 10.00% +0.25% NEGATIVE

Specialist Sectors

Dept. Stores Prime (with fixed uplifts IY) 8.50% 10.00% 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ 10.00% ++ NEGATIVE

Car Showrooms (20 yrs with fixed uplifts & dealer covenant) 4.50% 5.00% + 5.25% + 5.25% + 5.25% + 5.25% + 5.25% + 5.25% + NEGATIVE

Budget Hotels London (Fixed / RPI uplifts 20 yr+ term, Strong Covenant) 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% NEGATIVE

Budget Hotels Regional (Fixed / RPI uplifts 20 yr+ term, Strong Covenant) 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% NEGATIVE

Student Accommodation (Prime London - Direct Let) 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% 4.00% NEGATIVE

Student Accommodation (Prime Regional - Direct Let) 5.25% - 5.25% 5.25% 5.25% 5.25% 5.25% 5.25% 5.25% NEGATIVE

Student Accommodation (Prime London - 25 yr lease, Annual RPI) 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% STABLE

Student Accommodation (Prime Regional - 25 yr lease, Annual RPI) 3.75% 3.75% 3.75% 3.75% 3.75% 3.75% 3.75% 3.75% STABLE

Healthcare (Elderly Care, 30 yr term, indexed linked reviews) 3.75% 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% 3.50% STABLE

Foodstores

Annual RPI increases (IY) (25 year income) 4.25% - 4.25% - 4.25% - 4.25% - 4.25% - 4.25% - 4.25% - 4.25% - POSITIVE

Open market reviews 4.75% - 4.75% - 4.75% 4.75% 4.75% 4.75% 4.75% 4.75% STABLE

Warehouse & Industrial Space

Prime Distribution/Warehousing (20 year income (NIY with fixed uplifts) 4.00% 4.00% - 4.00% - 4.00% - 4.00% - 4.00% - 4.00% - 4.00% - POSITIVE

Prime Distribution/Warehousing (15 year income) 4.25% 4.25% + 4.25% + 4.25% + 4.25% + 4.25% + 4.25% 4.25% POSITIVE

Secondary Distribution (10 year income) 5.00% 5.25% 5.25% + 5.50% 5.50% + 5.50% + 5.50% 5.50% STABLE

SE Estate (exc London & Heathrow) 4.00% 4.00% - 4.25% 4.00% - 4.25% 4.25% + 4.25% 4.25% 4.25% 4.25% - - POSITIVE

Good Modern RoUK Estate 4.50% 4.50% - 4.75% 4.50% - 4.75% 4.75% - 5.00% 4.75% - 5.00% 4.75% - 5.00% 4.75% - 5.00% 4.75% - 5.00% POSITIVE

Secondary Estates 6.00% + 6.25% 6.25% + 6.25% + 6.25% + 6.25% + 6.25% + 6.25% + NEGATIVE

Offices

City Prime 4.00% - 4.25% 4.00% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% STABLE

West End: Prime (Mayfair & St James's) 3.50% - 3.75% 3.50% - 3.75% 3.50% - 3.75% 3.50% - 3.75% 3.50% - 3.75% 3.50% - 3.75% 3.50% - 3.75% 3.50% - 3.75% STABLE

West End: Non-core (Soho & Fitzrovia) 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% 4.00% - 4.25% STABLE

Major Regional Cities (Single let, 15 years) 4.75% 4.75% - 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% NEGATIVE

Major Regional Cities (Multi-let, 5 year WAULT) 5.00% 5.50% 5.50% 5.50% 5.50% 5.50% 5.50% 5.50% NEGATIVE

SE Towns (Single let, 15 years) 5.00% + 5.00% - 5.25% 5.25% 5.25% 5.25% 5.25% 5.25% 5.25% NEGATIVE

SE Towns (Multi-let, 5 year WAULT) 5.50% 5.75% 5.75% 5.75% 5.75% 5.75% 5.75% - 6.00% 6.00% +0.25% NEGATIVE

SE Business Parks [Single let, 15 years] 5.00% + 5.00% - 5.25% + 5.25% + 5.25% + 5.25% + 5.25% + 5.25% + 5.25% + NEGATIVE

SE Business Park (Multi-let, 5 year WAULT) 6.00% 6.25% 6.25% 6.50% 6.50% 6.50% 6.50% 6.50% NEGATIVE

Bonds & Rates

Libor 3 mth (16/10/2020) 0.76% 0.65% 0.36% 0.22% 0.09% 0.07% 0.06% 0.05%

Base rate (16/10/2020) 0.75% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10% 0.10%

5 year swap rates (16/10/2020) 0.57% 0.51% 0.40% 0.37% 0.21% 0.17% 0.16% 0.18%

10 yr gilts redemption yield (16/10/2020) 0.37% 0.28% 0.26% 0.34% 0.19% 0.17% 0.20% 0.17%

Based on rack rented properties and disregards bond type transactions.

This yield guide is for indicative purposes only and was prepared on 16 October 2020.

This yield guide was prepared during the COVID-19 (Coronavirus) pandemic

The outbreak of the Novel Coronavirus (COVID-19), declared by the World Health Organisation as a “Global Pandemic” on 11 March 2020, has impacted many aspects of daily life and the global economy - with some real estate markets having experienced lower levels of transactional activity and liquidity. The pandemic and the measures taken to tackle COVID-19 continue to affect economies and real

estate markets globally. Nevertheless, some property markets have started to function again, with transaction volumes and other relevant evidence returning to adequate levels and on 9 September 2020 the Material Valuation Uncertainty Clause was lifted from all UK real estate excluding some assets valued with reference to trading potential. A valuation of such a property may therefore still be

reported as being subject to ‘material valuation uncertainty’ as defined by VPS 3 and VPGA 10 of the RICS Valuation – Global Standards; consequently, less certainty - and a higher degree of caution - should be attached to the valuations of these assets than would normally be the case. Given the unknown future impact that COVID-19 might have on the real estate market and the difficulty in

differentiating between short term impacts and long-term structural changes, we recommend keeping valuations under regular review.

KnightFrank.co.uk

You might also like

- Data and CalculationDocument7 pagesData and CalculationRaphael NgNo ratings yet

- Default Spread by Ratings Class: January 2015 Vs January 2016Document3 pagesDefault Spread by Ratings Class: January 2015 Vs January 2016ruchi gulatiNo ratings yet

- Default Spread by Ratings Class: January 2015 Vs January 2016Document3 pagesDefault Spread by Ratings Class: January 2015 Vs January 2016ruchi gulatiNo ratings yet

- Default Spread by Ratings Class: January 2015 Vs January 2016Document3 pagesDefault Spread by Ratings Class: January 2015 Vs January 2016ruchi gulatiNo ratings yet

- Risk Vs Return at 0.19 Risk Vs Return at 1.0Document6 pagesRisk Vs Return at 0.19 Risk Vs Return at 1.0Kunal NakumNo ratings yet

- Vlookup vs. Index/Match: Construction Schedule (# of Months) Amount To Be Spent in Month 5Document1 pageVlookup vs. Index/Match: Construction Schedule (# of Months) Amount To Be Spent in Month 5bato ceraNo ratings yet

- Amc Calculator - To Share - Updated v3Document8 pagesAmc Calculator - To Share - Updated v3diegocardenas0091No ratings yet

- Example Loan PricingDocument4 pagesExample Loan PricingNino NatradzeNo ratings yet

- Month Average Market Month: BOG TBC BOGDocument4 pagesMonth Average Market Month: BOG TBC BOGNino NatradzeNo ratings yet

- Gerenciamento de Banca de HarpoontvDocument4 pagesGerenciamento de Banca de HarpoontvTiago SilvaNo ratings yet

- EarlyRetirementNow SWR Toolbox v2.0 - Save Your Own Copy Before Editing!Document634 pagesEarlyRetirementNow SWR Toolbox v2.0 - Save Your Own Copy Before Editing!yiboNo ratings yet

- Commission ScheduleDocument9 pagesCommission ScheduleAnav MittalNo ratings yet

- Fixed and Saving Deposit Rate VACDocument8 pagesFixed and Saving Deposit Rate VACvinishchandraaNo ratings yet

- Tiered Commission Rates Using SUMPRODUCTDocument9 pagesTiered Commission Rates Using SUMPRODUCTsourabh6chakrabort-1No ratings yet

- Cost of Debt Calculations PDFDocument2 pagesCost of Debt Calculations PDFhukaNo ratings yet

- Dream Gardens Lahore Phase-Ii Plots Price ListDocument1 pageDream Gardens Lahore Phase-Ii Plots Price ListkashieNo ratings yet

- Caso Práctico El Gráfico AbcDocument4 pagesCaso Práctico El Gráfico Abcliner ramon rafaelNo ratings yet

- S-Curve Talang Jimar Rev-8 (New)Document1 pageS-Curve Talang Jimar Rev-8 (New)wahyu hidayatNo ratings yet

- DO 03 CDT TasasDocument1 pageDO 03 CDT TasaskarimengarcorNo ratings yet

- Assignment - Price Indices - CPI and GDP DeflatorDocument5 pagesAssignment - Price Indices - CPI and GDP Deflatoraneeshbadola01No ratings yet

- Projeto 8 Sapapas 6: Nome Da Tarefa DuraçãoDocument4 pagesProjeto 8 Sapapas 6: Nome Da Tarefa DuraçãoFilipinhoNo ratings yet

- Management FinancialDocument5 pagesManagement FinancialThùy LinhNo ratings yet

- 97Document2 pages97Anonymous 1997No ratings yet

- 1H 2013 CapRateTable OfficeCBD KeyRatiosDocument1 page1H 2013 CapRateTable OfficeCBD KeyRatiosrudy_wadhera4933No ratings yet

- 2 & 25 Position Sizing ModelDocument2 pages2 & 25 Position Sizing ModelFauzan RoslanNo ratings yet

- Tabel Sisa MakananDocument8 pagesTabel Sisa MakananRizal PermanaNo ratings yet

- Stiglitz Weiss 1981 Implementation by Kurt HessDocument20 pagesStiglitz Weiss 1981 Implementation by Kurt Hessapi-3763138No ratings yet

- Копия WACC Template v2Document8 pagesКопия WACC Template v2Theodor K GReddyNo ratings yet

- What-If AnalysisDocument8 pagesWhat-If AnalysisMariane MananganNo ratings yet

- Treasury & Market Risk DivisionDocument3 pagesTreasury & Market Risk DivisionShahrun NaharNo ratings yet

- Retail Same Store Sales 20101202Document2 pagesRetail Same Store Sales 20101202andrewbloggerNo ratings yet

- Basic Concepts, Theories, and Core Competencies in Computer Hardware ServicingDocument6 pagesBasic Concepts, Theories, and Core Competencies in Computer Hardware ServicingAndrogel Abalajon100% (1)

- Grafik Capaian KB Bulan Januari S/D Juni Tahun 2018Document7 pagesGrafik Capaian KB Bulan Januari S/D Juni Tahun 2018Anonymous toIb2okJNo ratings yet

- Metrado Tramo 5Document4 pagesMetrado Tramo 5luismchambi27No ratings yet

- Inflation AssignmentDocument2 pagesInflation Assignmentaneeshbadola01No ratings yet

- Caps and FloorsDocument12 pagesCaps and Floorsdry_madininaNo ratings yet

- Construction Report Project ManagementDocument7 pagesConstruction Report Project ManagementTony ValdezNo ratings yet

- Channel Marketing BudgetDocument6 pagesChannel Marketing BudgetDiana TavaresNo ratings yet

- Channel Marketing BudgetDocument6 pagesChannel Marketing BudgetpedrocunhafurtNo ratings yet

- Trial SimulationDocument14 pagesTrial Simulationkhushi kumariNo ratings yet

- Commission Sheet Template 20Document9 pagesCommission Sheet Template 20RonNo ratings yet

- Interest Rates For Last 10 Yr For Major SME ProductsDocument6 pagesInterest Rates For Last 10 Yr For Major SME Productssharad1996No ratings yet

- Self-Made Sampling Plans™: John N. Zorich JR., Silicon Valley CA and Houston TXDocument13 pagesSelf-Made Sampling Plans™: John N. Zorich JR., Silicon Valley CA and Houston TXAdãodaLuzNo ratings yet

- The Stoploss and Re Entry MethodDocument3 pagesThe Stoploss and Re Entry MethodbooleanNo ratings yet

- AR Aging Report (Example)Document1 pageAR Aging Report (Example)Titis Endah TrisetyaNo ratings yet

- Ca Manish Chokshi Presence in Capital MarketDocument127 pagesCa Manish Chokshi Presence in Capital Marketthe libyan guyNo ratings yet

- Galian Timbunan-1Document1 pageGalian Timbunan-1RhezaNo ratings yet

- Loan Amount 100000 Interest Rate (Yearly) 2.00% Term (Years) 30 Changing R Monthly PaymentDocument10 pagesLoan Amount 100000 Interest Rate (Yearly) 2.00% Term (Years) 30 Changing R Monthly Paymentarushi duttNo ratings yet

- Relación Riesgo/Beneficio en Función A La Fiabilidad: Esperanza MatemáticaDocument1 pageRelación Riesgo/Beneficio en Función A La Fiabilidad: Esperanza Matemáticaedison pillpinto butronNo ratings yet

- Discount Matrix: Urban Discount Rural Discount Urban Discount Rural DiscountDocument2 pagesDiscount Matrix: Urban Discount Rural Discount Urban Discount Rural DiscountrameshnuvkekaNo ratings yet

- Digital Metrics Dashboard TemplateDocument20 pagesDigital Metrics Dashboard TemplateZao ZulNo ratings yet

- Quarterly Marketing Budget Template2Document6 pagesQuarterly Marketing Budget Template2Aqil RuldinNo ratings yet

- Retail Same Store Sales 20110516Document2 pagesRetail Same Store Sales 20110516andrewbloggerNo ratings yet

- ESOP Dilution ModelDocument10 pagesESOP Dilution ModelJoel PenningtonNo ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- Calibração SpeedyDocument12 pagesCalibração SpeedyAlanNo ratings yet

- Premium Rate ChartDocument1 pagePremium Rate ChartJNo ratings yet

- 2 Unit CR - SCurveDocument3 pages2 Unit CR - SCurveBlack MambaNo ratings yet

- Tax CalculationDocument2 pagesTax CalculationFasil EVNo ratings yet

- Pepsi ParadoxDocument5 pagesPepsi ParadoxSalman MalikNo ratings yet

- DOC-20240502-WA0002. (1)Document4 pagesDOC-20240502-WA0002. (1)sirsamarvind866No ratings yet

- Cia Candidate Assessment Test: Jakarta, 28 January 2012Document29 pagesCia Candidate Assessment Test: Jakarta, 28 January 2012Bobby IlyasNo ratings yet

- 04 Materials 2030 Initiative INL Lars MonteliusDocument22 pages04 Materials 2030 Initiative INL Lars MonteliusGenci TepelenaNo ratings yet

- Essay Plans 1: Across The Economy and Thus Stimulate Lending, Borrowing, AD and Economic GrowthDocument24 pagesEssay Plans 1: Across The Economy and Thus Stimulate Lending, Borrowing, AD and Economic GrowthAbhishek JainNo ratings yet

- Fiverr 2020 Ebook Stys PDFDocument23 pagesFiverr 2020 Ebook Stys PDFcesarNo ratings yet

- Strunal CZ, A.s.: Strunal Schönbach S.R.O. Is A String Instrument Manufacturer BasedDocument4 pagesStrunal CZ, A.s.: Strunal Schönbach S.R.O. Is A String Instrument Manufacturer BasedXAREG VARNo ratings yet

- Vision: WWW - Visionias.inDocument19 pagesVision: WWW - Visionias.inDivyanshu SinghNo ratings yet

- Business English 9th Edition Guffey: Full Download atDocument20 pagesBusiness English 9th Edition Guffey: Full Download atPhươngNo ratings yet

- Reading Test (B1)Document11 pagesReading Test (B1)ngocanhnguyenthi1911No ratings yet

- Auditing Theories and Problems Quiz WEEK 1Document19 pagesAuditing Theories and Problems Quiz WEEK 1Sarah GNo ratings yet

- The Audit Process: Principles, Practice and Cases Seventh EditionDocument16 pagesThe Audit Process: Principles, Practice and Cases Seventh Editionyossy kawiNo ratings yet

- Integrated Accounting 8th Edition Klooster Allen and Owen Solution ManualDocument22 pagesIntegrated Accounting 8th Edition Klooster Allen and Owen Solution Manualjanice100% (28)

- Advanced Manufacturing Tutorial AnswersDocument12 pagesAdvanced Manufacturing Tutorial Answerswilfred chipanguraNo ratings yet

- Les Super Médicaments D'alex - Heather JenkinsDocument17 pagesLes Super Médicaments D'alex - Heather JenkinsNathalie VanVrNo ratings yet

- Tanmay Hagawane TYBBADocument19 pagesTanmay Hagawane TYBBAHetik PatelNo ratings yet

- SF 5.2A Training Center Inspection ReportDocument9 pagesSF 5.2A Training Center Inspection ReportPriyaranjan NayakNo ratings yet

- Midterm Examination in Business MathematicsDocument3 pagesMidterm Examination in Business MathematicsRica De CastroNo ratings yet

- Jaspersoft Studio User GuideDocument270 pagesJaspersoft Studio User GuideMohamad Amin100% (2)

- Gathering Information From SurveysDocument4 pagesGathering Information From SurveysQueenieCatubagDomingoNo ratings yet

- Lean, Sustainability and The Triple Bottom Line Performance - A Systems Perspective-Based Empirical ExaminationDocument21 pagesLean, Sustainability and The Triple Bottom Line Performance - A Systems Perspective-Based Empirical ExaminationAhmed HassanNo ratings yet

- Module 1 Basic Concepts in Management AccountingDocument9 pagesModule 1 Basic Concepts in Management AccountingNorfaidah IbrahimNo ratings yet

- Sfom Impl B2ceDocument28 pagesSfom Impl B2cesergio paredesNo ratings yet

- Confirmed - Exhibitors ElecramaDocument9 pagesConfirmed - Exhibitors ElecramaMujib AlamNo ratings yet

- CVFlorencio Ismael Ordonez MartínezDocument3 pagesCVFlorencio Ismael Ordonez MartínezSoluciones Capital HumanoNo ratings yet

- AP 003 C.1 Audit of Invty Prob. 1Document4 pagesAP 003 C.1 Audit of Invty Prob. 1Justine Joy DiazNo ratings yet

- Keyway Jis StandartDocument1 pageKeyway Jis StandartNeo Dinastian OnssalisNo ratings yet

- Engineering Economy ProblemsDocument2 pagesEngineering Economy ProblemsBenj Paulo AndresNo ratings yet

- Chapter 5 CGTMSEDocument17 pagesChapter 5 CGTMSEMikeNo ratings yet

- Boat Airdopes 131 Bluetooth Headset: Grand Total 979.00Document1 pageBoat Airdopes 131 Bluetooth Headset: Grand Total 979.00Ankit chaurasiyaNo ratings yet