Professional Documents

Culture Documents

Income Tax Comparision

Uploaded by

Hometex decor0 ratings0% found this document useful (0 votes)

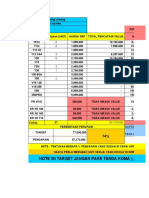

5 views1 pageThe document compares the income tax payable by a senior citizen under the old and new tax regimes for the financial year 2023-24 across various income levels ranging from Rs. 7 lakh to Rs. 20 lakh. It shows that for income levels between Rs. 8-11 lakh, the old tax system is more beneficial, but for incomes above Rs. 12 lakh, the new tax system results in lower taxes payable.

Original Description:

Original Title

INCOME TAX COMPARISION

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares the income tax payable by a senior citizen under the old and new tax regimes for the financial year 2023-24 across various income levels ranging from Rs. 7 lakh to Rs. 20 lakh. It shows that for income levels between Rs. 8-11 lakh, the old tax system is more beneficial, but for incomes above Rs. 12 lakh, the new tax system results in lower taxes payable.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageIncome Tax Comparision

Uploaded by

Hometex decorThe document compares the income tax payable by a senior citizen under the old and new tax regimes for the financial year 2023-24 across various income levels ranging from Rs. 7 lakh to Rs. 20 lakh. It shows that for income levels between Rs. 8-11 lakh, the old tax system is more beneficial, but for incomes above Rs. 12 lakh, the new tax system results in lower taxes payable.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

COMPARISION OF OLD & NEW INCOME TAX REGIME FOR FY 2023-24 (For A Sr.

Citizen)

INCOME TAX

DED. (80C, 80D, INCOME TAX INC. TAX INCL. INC. TAX INCL.

INCOME PAYABLE AS PER

80TTB, 80CCD, STD. PAYABLE AS PER SURCHARGE SURCHARGE RESULT

RANGE (GROSS) NEW TAX REGIME

DED.) OLD REGIME (OLD SYS.) (New Sys.)

(With Std. Ded.)

7,00,000 3,27,000 NIL NIL NIL NIL NO DIFFERENCE

8,00,000 3,27,000 NIL NIL 30,000 31,200 OLD SYS. BENEFICIAL

9,00,000 3,27,000 24,600 25,584 40,000 41,600 OLD SYS. BENEFICIAL

10,00,000 3,27,000 44,600 46,384 52,500 54,600 OLD SYS. BENEFICIAL

11,00,000 3,27,000 64,600 67,184 67,500 70,200 OLD SYS. BENEFICIAL

12,00,000 3,27,000 84,600 87,984 82,500 85,800 NEW SYS. BENEFICIAL

13,00,000 3,27,000 1,04,600 1,08,784 1,00,000 1,04,000 NEW SYS. BENEFICIAL

14,00,000 3,27,000 1,31,900 1,37,176 1,20,000 1,24,800 NEW SYS. BENEFICIAL

15,00,000 3,27,000 1,61,900 1,68,376 1,40,000 1,45,600 NEW SYS. BENEFICIAL

16,00,000 3,27,000 1,91,900 1,99,576 1,65,000 1,71,600 NEW SYS. BENEFICIAL

17,00,000 3,27,000 2,21,900 2,30,776 1,95,000 2,02,800 NEW SYS. BENEFICIAL

18,00,000 3,27,000 2,51,900 2,61,976 2,25,000 2,34,000 NEW SYS. BENEFICIAL

19,00,000 3,27,000 2,81,900 2,93,176 2,55,000 2,65,200 NEW SYS. BENEFICIAL

20,00,000 3,27,000 3,11,900 3,24,376 2,85,000 2,96,400 NEW SYS. BENEFICIAL

You might also like

- RetoSA - EmirDocument21 pagesRetoSA - EmirEdward Marcell BasiaNo ratings yet

- Projected Income Statement For 12 MonthsDocument5 pagesProjected Income Statement For 12 Monthsblueviolet21No ratings yet

- Payroll WTX Less Benefits Activity 4Document34 pagesPayroll WTX Less Benefits Activity 4Ashley Jean CosmianoNo ratings yet

- Test Bank - Income Taxation-CparDocument5 pagesTest Bank - Income Taxation-CparStephanie Ann TubuNo ratings yet

- Tarea Economia GeneralDocument2 pagesTarea Economia GeneralRENZO GLATZERNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument6 pagesIncome Statement - Annual - As Originally ReportedSonia CrystalNo ratings yet

- Aquabest FsDocument28 pagesAquabest FsJohn Kenneth BoholNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument4 pagesIncome Statement - Annual - As Originally ReportedAnkurNo ratings yet

- Finances For Food TruckDocument2 pagesFinances For Food TruckDHRUMIL NEGANDHINo ratings yet

- Target: Note Isi Target Jangan Pake Tanda Koma (,)Document2 pagesTarget: Note Isi Target Jangan Pake Tanda Koma (,)MarcoNo ratings yet

- Book 3Document6 pagesBook 3Titania ErzaNo ratings yet

- Rata Rata PBV 2.55 Rata Rata Roe 19 Harga Wajar Bbri Dengan PBV Rata Rata 5 Tahun 3,790 Harga Future Dengan Roe Rata Rata 5 Tahun Tahun Target HargaDocument4 pagesRata Rata PBV 2.55 Rata Rata Roe 19 Harga Wajar Bbri Dengan PBV Rata Rata 5 Tahun 3,790 Harga Future Dengan Roe Rata Rata 5 Tahun Tahun Target HargaAdnanNo ratings yet

- How To Compute Basic Income TaxDocument11 pagesHow To Compute Basic Income Taxkate trishaNo ratings yet

- New Regime Vs Old Regime AY 2024-25 - CA Sai Pratap KopparapuDocument1 pageNew Regime Vs Old Regime AY 2024-25 - CA Sai Pratap Kopparapuviswa081No ratings yet

- Universidad Autónoma Juan Misael Saracho Facultad de Ciencias Económicas Y Financieras Carrera de Administración de EmpresasDocument4 pagesUniversidad Autónoma Juan Misael Saracho Facultad de Ciencias Económicas Y Financieras Carrera de Administración de EmpresasAlvaro Quispe ToconasNo ratings yet

- EventDocument182 pagesEventAbdel LucasNo ratings yet

- Internal Rate of ReturnDocument3 pagesInternal Rate of ReturnRohit SethNo ratings yet

- Tax Calculator by Tax GurujiDocument4 pagesTax Calculator by Tax GurujiSunitKumarChauhanNo ratings yet

- Reward ProgramDocument8 pagesReward ProgramMercie AzarconNo ratings yet

- Cash Flows 1Document2 pagesCash Flows 1ssembatya reaganNo ratings yet

- 7 CPC Pay MatrixDocument1 page7 CPC Pay Matrixramana adepuNo ratings yet

- Summary Sheet: NLNG Counter EstimateDocument1 pageSummary Sheet: NLNG Counter EstimateUchenna IgweNo ratings yet

- Hitung PPH 21 Gaji & THR 2024 - Simulasi Sent To HRDocument13 pagesHitung PPH 21 Gaji & THR 2024 - Simulasi Sent To HRmuhammad.pandiaNo ratings yet

- Initial Outlays Year 0 Year 1 Year 2Document6 pagesInitial Outlays Year 0 Year 1 Year 2Monikams SNo ratings yet

- REV AFAR2 - Partnership (Operation)Document10 pagesREV AFAR2 - Partnership (Operation)Richard LamagnaNo ratings yet

- X-Value Y-Value or Observed Cost Y-Value or Predicted CostDocument8 pagesX-Value Y-Value or Observed Cost Y-Value or Predicted CostIlpram YTNo ratings yet

- IWK - Good Water (PACKAGE1) (Civil Done)Document187 pagesIWK - Good Water (PACKAGE1) (Civil Done)jasmanibinsaliminNo ratings yet

- Detalles de Cuenta: Saldos AjustesDocument11 pagesDetalles de Cuenta: Saldos AjustesEsfmMauri Claros UgarteNo ratings yet

- Annafunan FSDocument8 pagesAnnafunan FSAring BaquiranNo ratings yet

- Calpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01Document68 pagesCalpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01KshitishNo ratings yet

- X-Value Y-Value or Observed Cost Y-Value or Predicted CostDocument8 pagesX-Value Y-Value or Observed Cost Y-Value or Predicted Costmiranti dNo ratings yet

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsDocument1 pageCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal67% (3)

- AAccounting Equation Kumala Dry Cleaners AsliDocument6 pagesAAccounting Equation Kumala Dry Cleaners Aslisilvi NurainiNo ratings yet

- T AccountsDocument1 pageT AccountsJericko LianNo ratings yet

- Bab16 BepDocument17 pagesBab16 Bepnovia272No ratings yet

- 6030challenge P - L StatementDocument2 pages6030challenge P - L StatementMegha AaradhyaNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Projected Cash FlowDocument1 pageProjected Cash FlowChristabelle Delos SantosNo ratings yet

- Form Analisa Kebutuhan PegawaiDocument21 pagesForm Analisa Kebutuhan Pegawaiyuni malitafirda17No ratings yet

- Perhitungan Cash FlowDocument10 pagesPerhitungan Cash FlowhafizhNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Business Math PraticeDocument12 pagesBusiness Math PraticeJames CorpuzNo ratings yet

- SSAW PipeDocument15 pagesSSAW PipeAissamNo ratings yet

- Adam - Monthly Cash Flow 2014Document9 pagesAdam - Monthly Cash Flow 2014Ismi RochaniNo ratings yet

- Calculo Retenciones 2020Document8 pagesCalculo Retenciones 2020Danny Aguilera MonascalNo ratings yet

- Cabanillas Ochoa JesusDocument3 pagesCabanillas Ochoa Jesusandrea martinez paredesNo ratings yet

- Laboratorium 2019 - OK PDFDocument24 pagesLaboratorium 2019 - OK PDFYonnasNo ratings yet

- Etude FinanciereDocument28 pagesEtude Financieresalma elkeltoumiNo ratings yet

- Case 1: Market PriceDocument6 pagesCase 1: Market PriceNoor ul HudaNo ratings yet

- BC XCDocument6 pagesBC XCKaren Sofía Villa RealNo ratings yet

- Price List Bintang Motor Bekasi APRIL 2022Document4 pagesPrice List Bintang Motor Bekasi APRIL 2022jarijari koeNo ratings yet

- C.1. Regangan Aksial Rayapan Tekan Batupasir R-1Document8 pagesC.1. Regangan Aksial Rayapan Tekan Batupasir R-1Agustina Elfira RidhaNo ratings yet

- Elec-Consumo Luz 2Document24 pagesElec-Consumo Luz 2Ruben FloresNo ratings yet

- DSHRDocument10 pagesDSHRDIV DOCNo ratings yet

- SIG FurnitureDocument121 pagesSIG FurnituregrahagNo ratings yet

- Salarios y PrestacionesDocument2 pagesSalarios y PrestacionesWalner Elias Asprilla MosqueraNo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- PRGR-633 Renewable Energy Systems & Energy Efficiency in BuildingsDocument4 pagesPRGR-633 Renewable Energy Systems & Energy Efficiency in BuildingsHoda MekkaouiNo ratings yet