Professional Documents

Culture Documents

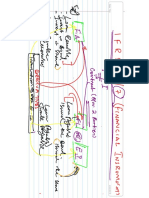

Bank Risk Rating Slide

Bank Risk Rating Slide

Uploaded by

Eric M0 ratings0% found this document useful (0 votes)

9 views11 pagesSpecial mention (SM) assets have potential weaknesses that could negatively impact repayment prospects or the institution's credit position if not addressed. SM assets have elevated risk but weaknesses do not yet justify a substandard classification. SM assets have a higher probability of default than pass assets but default is not imminent.

Original Description:

Original Title

Bank Risk Rating slide

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSpecial mention (SM) assets have potential weaknesses that could negatively impact repayment prospects or the institution's credit position if not addressed. SM assets have elevated risk but weaknesses do not yet justify a substandard classification. SM assets have a higher probability of default than pass assets but default is not imminent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views11 pagesBank Risk Rating Slide

Bank Risk Rating Slide

Uploaded by

Eric MSpecial mention (SM) assets have potential weaknesses that could negatively impact repayment prospects or the institution's credit position if not addressed. SM assets have elevated risk but weaknesses do not yet justify a substandard classification. SM assets have a higher probability of default than pass assets but default is not imminent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Regulatory Definitions3

Special mention (SM) — "A special mention asset has potential

weaknesses that deserve management’s close attention. If left

uncorrected, these potential weaknesses may result in

deterioration of the repayment prospects for the asset or in

the

institution’s credit position at some future date. Special

mention assets are not adversely classified and do not expose

an institution to sufficient risk to warrant adverse

classification.”

Special mention assets have potential weaknesses that may, if not

checked or

corrected, weaken the asset or inadequately protect the institution’s

position

at some future date. These assets pose elevated risk, but their

weakness does

not yet justify a substandard classification. Borrowers may be

experiencing

adverse operating trends (declining revenues or margins) or an

illproportioned

balance sheet (e.g., increasing inventory without an increase in

sales, high leverage, tight liquidity). Adverse economic or market

conditions,

such as interest rate increases or the entry of a new competitor, may

also

support a special mention rating. Nonfinancial reasons for rating a

credit

exposure special mention include management problems, pending

litigation,

an ineffective loan agreement or other material structural weakness,

and any

other significant deviation from prudent lending practices.

The special mention rating is designed to identify a specific level of risk

and

concern about asset quality. Although an SM asset has a higher

probability of

default than a pass asset, its default is not imminent. Special mention

is not a

compromise between pass and substandard and should not be used to

avoid

exercising such judgment

Substandard assets have a high probability of payment default, or they

have

other well-defined weaknesses. They require more intensive

supervision by

bank management. Substandard assets are generally characterized by

current

or expected unprofitable operations, inadequate debt service

coverage,

inadequate liquidity, or marginal capitalization. Repayment may

depend on

collateral or other credit risk mitigants. For some substandard assets,

the

likelihood of full collection of interest and principal may be in doubt;

such

assets should be placed on nonaccrual. Although substandard assets in

the

aggregate will have a distinct potential for loss, an individual asset’s

loss

potential does not have to be distinct for the asset to be rated

substandard.

A doubtful asset has a high probability of total or substantial loss, but

because

of specific pending events that may strengthen the asset, its

classification as

loss is deferred. Doubtful borrowers are usually in default, lack

adequate

liquidity or capital, and lack the resources necessary to remain an

operating

entity. Pending events can include mergers, acquisitions, liquidations,

capital

injections, the perfection of liens on additional collateral, the valuation

of

collateral, and refinancing. Generally, pending events should be

resolved

within a relatively short period and the ratings will be adjusted based

on the

new information. Because of high probability of loss, nonaccrual

accounting treatment is required for doubtful assets.

You might also like

- Difference Between A Mortgage and Deed of TrustDocument1 pageDifference Between A Mortgage and Deed of TrustEric MNo ratings yet

- CFA Level 1 FundamentalsDocument5 pagesCFA Level 1 Fundamentalskazimeister1No ratings yet

- Form 8 Assignment For The General Benefit of CreditorsDocument1 pageForm 8 Assignment For The General Benefit of CreditorsRisah ahhhNo ratings yet

- Credit Card Securitization ManualDocument18 pagesCredit Card Securitization ManualRahmi Elsa DianaNo ratings yet

- Real Estate MortgageDocument12 pagesReal Estate MortgageAleezah Gertrude RaymundoNo ratings yet

- Solution ManualDocument17 pagesSolution ManualThùy Linh Lê ThịNo ratings yet

- Introduction To Credit Management: Group 2 BSBA FM 3-10SDocument30 pagesIntroduction To Credit Management: Group 2 BSBA FM 3-10SThamuz Lunox100% (2)

- Mod 1Document41 pagesMod 1Raghav Mehra100% (2)

- CBO bm977 PDFDocument15 pagesCBO bm977 PDFKarnatokarnaNo ratings yet

- Cla 3Document2 pagesCla 3Von Andrei MedinaNo ratings yet

- Collateralized Mortgage Obligations (CMO)Document3 pagesCollateralized Mortgage Obligations (CMO)maria_tigasNo ratings yet

- IFRS 9 NotesDocument42 pagesIFRS 9 NotesSalman Saeed100% (1)

- Contract of LoanDocument3 pagesContract of LoanRom YapNo ratings yet

- Capital Adequacy and PlanningDocument6 pagesCapital Adequacy and Planningdeepak kumarNo ratings yet

- Debt Analysis and ManagementDocument47 pagesDebt Analysis and ManagementRahul AtodariaNo ratings yet

- Delinquency ManagementDocument4 pagesDelinquency ManagementJeff SmithNo ratings yet

- P9-3A Journalize Entries To Record Transactions Related To Bad DebtsDocument1 pageP9-3A Journalize Entries To Record Transactions Related To Bad DebtsDrenyar ScoutNo ratings yet

- Risk Management ManualDocument72 pagesRisk Management ManualEron Man100% (2)

- Week 3 - Ch8 - Interest Rate Risk - The Repricing ModelDocument12 pagesWeek 3 - Ch8 - Interest Rate Risk - The Repricing ModelAlana Cunningham100% (1)

- Rating SubsidiariesDocument12 pagesRating Subsidiariesrostinaustin100% (1)

- Credit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsFrom EverandCredit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsNo ratings yet

- Credit ManagementDocument4 pagesCredit ManagementYuuna HoshinoNo ratings yet

- Activity Sheets in Fundamentals of Accountancy, Business and Management 1 Quarter Iii, Week 2 To 3Document19 pagesActivity Sheets in Fundamentals of Accountancy, Business and Management 1 Quarter Iii, Week 2 To 3clarisse ginezNo ratings yet

- Risk ManagementDocument14 pagesRisk ManagementMichelle TNo ratings yet

- Camel RatingDocument12 pagesCamel RatingRaquibul HasanNo ratings yet

- CH 10Document20 pagesCH 10NGỌC ĐẶNG HỒNGNo ratings yet

- CRM Unit 1 (Autosaved) (Autosaved)Document54 pagesCRM Unit 1 (Autosaved) (Autosaved)Sanjeela JoshiNo ratings yet

- Chapter CRM 6 15Document3 pagesChapter CRM 6 15Selva Bavani SelwaduraiNo ratings yet

- Camels Rating System Appendix ADocument12 pagesCamels Rating System Appendix AMuhammad AlsabriNo ratings yet

- Credit RatingsDocument3 pagesCredit RatingsElvis JoseNo ratings yet

- Banking Technique: LECTURE 11. Credit Risk ManagementDocument21 pagesBanking Technique: LECTURE 11. Credit Risk ManagementVlad-Ștefan NechitaNo ratings yet

- Guidelines On Credit Risk Management (CRM) For Banks: March 08, 2016Document34 pagesGuidelines On Credit Risk Management (CRM) For Banks: March 08, 2016Saifur RahmanNo ratings yet

- Credit Risk Rating ConsiderationsDocument3 pagesCredit Risk Rating ConsiderationsBarno NicholusNo ratings yet

- Loan Delinquency Causes Effects and Stra PDFDocument12 pagesLoan Delinquency Causes Effects and Stra PDFFrancis Joseph C. ArongNo ratings yet

- Risks Associated With ABLDocument2 pagesRisks Associated With ABLBarno NicholusNo ratings yet

- CAMELS Rating SystemDocument13 pagesCAMELS Rating SystemAbdu MohammedNo ratings yet

- Chapter Six: Credit Risk ManagementDocument23 pagesChapter Six: Credit Risk Managementalee789No ratings yet

- Going Concern Assessment Checklist - Step1Document2 pagesGoing Concern Assessment Checklist - Step1Md. Mostafizur RahmanNo ratings yet

- LO Previous Years QuestionsDocument64 pagesLO Previous Years QuestionsMd. Mokbul HossainNo ratings yet

- Deliquency Act 2Document1 pageDeliquency Act 2Patrick ValenzuelaNo ratings yet

- Chapter 14 Fraud and ErrorDocument7 pagesChapter 14 Fraud and ErrorAlexanNo ratings yet

- Definition of Credit Risk Grading (CRG)Document7 pagesDefinition of Credit Risk Grading (CRG)mdaihNo ratings yet

- Module 13Document3 pagesModule 13AstxilNo ratings yet

- Credit Risk ManagementDocument14 pagesCredit Risk ManagementSandy XavierNo ratings yet

- UNIT 5 TR SirDocument25 pagesUNIT 5 TR SirgauthamNo ratings yet

- Banking Credit ManagementDocument7 pagesBanking Credit ManagementashwatinairNo ratings yet

- Bank Failure: What Are The Bank Failures?Document5 pagesBank Failure: What Are The Bank Failures?Aaftab AhmadNo ratings yet

- Fraud and Error ConditionsDocument3 pagesFraud and Error ConditionsTania Millward JacobsNo ratings yet

- Chapter 2 Soft Copy Introduction To Credit ManagementDocument11 pagesChapter 2 Soft Copy Introduction To Credit ManagementHakdog KaNo ratings yet

- SA 240 Add OnsDocument3 pagesSA 240 Add Onsrohit.impdNo ratings yet

- M. Sohail Aziz Liquidity Risk Management Fa10-Mba-004Document8 pagesM. Sohail Aziz Liquidity Risk Management Fa10-Mba-004Fawad ShahzadNo ratings yet

- Riskmgt CreditriskDocument7 pagesRiskmgt CreditriskAlin StoicaNo ratings yet

- Credit Analysis TechniquesDocument27 pagesCredit Analysis TechniquesJavaria IqbalNo ratings yet

- Early Warning SystemsDocument8 pagesEarly Warning SystemsAngish ShresthaNo ratings yet

- AIFsDocument10 pagesAIFs20ba092No ratings yet

- Going Concern: Risk Assessment ProceduresDocument2 pagesGoing Concern: Risk Assessment ProceduresDaniela Periñan BerrioNo ratings yet

- Financial Credit Analysis-1Document33 pagesFinancial Credit Analysis-1sudhu1606No ratings yet

- Corpgov - Chapter 14-17Document22 pagesCorpgov - Chapter 14-17AlexanNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementlintoNo ratings yet

- How Sovereign Credit Quality May Affect Other RatingsDocument9 pagesHow Sovereign Credit Quality May Affect Other RatingsxanasadjoNo ratings yet

- Chapter07 MCBDocument54 pagesChapter07 MCBanjney050592No ratings yet

- 5 Cs of Credit.Document7 pages5 Cs of Credit.loy zihongNo ratings yet

- Kind of RiskDocument4 pagesKind of RiskNhi Phan TúNo ratings yet

- IndustrialCorp JCRDocument14 pagesIndustrialCorp JCRivokeNo ratings yet

- 03 Winton EntreDocument40 pages03 Winton EntrePrashantKNo ratings yet

- Audit 2 of Loans PDFDocument4 pagesAudit 2 of Loans PDFShaz NagaNo ratings yet

- 5 Credit ScoringDocument4 pages5 Credit ScoringShoyeab Rahman AbirNo ratings yet

- 51) Going ConcernDocument4 pages51) Going ConcernkasimranjhaNo ratings yet

- Arellano University Pas-Asa ST., Caniogan, Pasig City School of Business & AccountancyDocument7 pagesArellano University Pas-Asa ST., Caniogan, Pasig City School of Business & AccountancyJudyann CatanNo ratings yet

- FM 05 Unit IDocument9 pagesFM 05 Unit IMO. SHAHVANNo ratings yet

- CMBS PrimerDocument4 pagesCMBS PrimerEric MNo ratings yet

- FIN 446 SPR 2023 Module 3 5 C'sDocument23 pagesFIN 446 SPR 2023 Module 3 5 C'sEric MNo ratings yet

- Terms Related To Mortgage and Their Related DefinitionsDocument4 pagesTerms Related To Mortgage and Their Related DefinitionsEric MNo ratings yet

- FIN 446 SPR 2023 Module 1Document22 pagesFIN 446 SPR 2023 Module 1Eric MNo ratings yet

- Understanding User NeedsDocument48 pagesUnderstanding User NeedsEric MNo ratings yet

- Risk Ratings of A BankDocument6 pagesRisk Ratings of A BankEric MNo ratings yet

- Sample Lease To Go Over in ClassDocument98 pagesSample Lease To Go Over in ClassEric MNo ratings yet

- Course Syllabus-3Document7 pagesCourse Syllabus-3Eric MNo ratings yet

- Sid Ramnarace-Cuisinart-for BADM 329Document24 pagesSid Ramnarace-Cuisinart-for BADM 329Eric MNo ratings yet

- Individual Assignment 3Document2 pagesIndividual Assignment 3Eric MNo ratings yet

- Penn-Wharton Budget Model Brief "Forgiving Student Loans: Budgetary Costs and Distributional Impact"Document7 pagesPenn-Wharton Budget Model Brief "Forgiving Student Loans: Budgetary Costs and Distributional Impact"CurtisNo ratings yet

- Maimonides Q2 2019Document7 pagesMaimonides Q2 2019Jonathan LaMantiaNo ratings yet

- CAIIBDocument41 pagesCAIIBNidhi RanjanNo ratings yet

- A: What Would It Have Been If The Bonds Were Priced at 100% (Price at Par), 99% and 101% of Face Value?Document47 pagesA: What Would It Have Been If The Bonds Were Priced at 100% (Price at Par), 99% and 101% of Face Value?juan planas rivarolaNo ratings yet

- Sources of Long Term FinanceDocument14 pagesSources of Long Term FinanceRakesh GuptaNo ratings yet

- Obligations With A Period (Arts. 1193 - 1198)Document5 pagesObligations With A Period (Arts. 1193 - 1198)Nailiah MacakilingNo ratings yet

- CHAPTER 2 Discount Rate and Cash DiscountDocument10 pagesCHAPTER 2 Discount Rate and Cash DiscountKiki PurwaningsihNo ratings yet

- Loan Amortization Schedule1 IBFDocument4 pagesLoan Amortization Schedule1 IBFM Shiraz KhanNo ratings yet

- Tpa Assignment 5TH Sem (Shivam)Document16 pagesTpa Assignment 5TH Sem (Shivam)Atithi dev singhNo ratings yet

- A. ConsumableDocument1 pageA. ConsumableKAYE JAVELLANANo ratings yet

- Kinds of MortgageDocument5 pagesKinds of MortgageRajivNo ratings yet

- Loan SchemesDocument48 pagesLoan SchemesbalwinderNo ratings yet

- Education Loan - Interest Certificate FY23Document1 pageEducation Loan - Interest Certificate FY23Marzook SuhailNo ratings yet

- Pangea Mortgage Capital Closes $8.5 Million LoanDocument3 pagesPangea Mortgage Capital Closes $8.5 Million LoanPR.comNo ratings yet

- Business Mathematics 10Document11 pagesBusiness Mathematics 10EyaNo ratings yet

- V1 Rev - Application Form Term Loan Covid-19 - 010420Document1 pageV1 Rev - Application Form Term Loan Covid-19 - 010420Mohd Nazrol IdrisNo ratings yet

- A Cco ExerciseDocument13 pagesA Cco ExerciseClarisse Anne SajoniaNo ratings yet

- Assignment of Corporate LawDocument4 pagesAssignment of Corporate LawawaisdotcomNo ratings yet

- Cooperative and Agricultural Credit BankDocument40 pagesCooperative and Agricultural Credit BankMonika DhakaNo ratings yet

- Rockwell Ludden The MERS Mortgage in Massachusetts Genius Shell Game or Invitation To FraudDocument42 pagesRockwell Ludden The MERS Mortgage in Massachusetts Genius Shell Game or Invitation To Fraudchunga85No ratings yet

- Gold Loan StatmentDocument7 pagesGold Loan StatmentDipra DasNo ratings yet