Professional Documents

Culture Documents

CAF 2 Autumn 2022

Uploaded by

Baqir KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAF 2 Autumn 2022

Uploaded by

Baqir KhanCopyright:

Available Formats

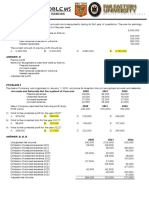

TAX PRACTICES

Summary of Marking Key

Certificate in Accounting and Finance – Autumn 2022

Note regarding marking scheme:

The marking scheme is given as a guide. Markers also award marks for alternative approaches to

a question and relevant/well-reasoned comments/explanations. Moreover, the available marks in

answer may exceed the total marks of a question.

Mark(s)

A.1 (a) Total/taxable income:

– Adjustment in loss before tax in respect of:

o purchase of new machine 4.0

o purchase of specialized software 2.0

o payment of lease rentals 3.0

– Other adjustments 4.0

Tax liability under minimum tax 2.0

(b) Tax implication in respect of scholarship received by Sara 2.0

A.2 (a) Income from salary 8.0

Income from other sources 2.0

Tax credits 3.0

Tax liability 1.0

(b) Tax implication for APL in respect of provision of residential house to Nasir 2.0

A.3 (a) (i) Determination of the amount to be chargeable to tax under the head

‘Capital gain’ 4.0

Reason for ignoring the gain/loss on given assets 2.0

(ii) Computation of tax liability 2.0

(b) Income from property 2.0

Capital gain 2.0

Income from other sources 2.0

Tax liability 1.0

A.4 Discussion on taxability of:

(a) foreign source income of short-term resident individual 3.0

(b) foreign source income of returning expatriate 3.0

(c) foreign source salary of a resident person 2.0

A.5 (a) (i) Discussion on:

normal assessment 1.0

best judgement assessment 2.0

(ii) Stating the requirements that should be complied with by a sole proprietor

on discontinuance of business 2.0

(iii) Listing of additional records 2.0

(b) 0.5 mark for each rule up to maximum of 03 marks 3.0

Page 1 of 2

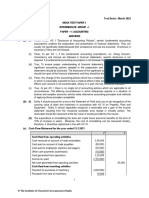

TAX PRACTICES

Summary of Marking Key

Certificate in Accounting and Finance – Autumn 2022

Mark(s)

A.6 (a) Explanation for the requirement of registration of following persons:

A manufacturer 2.0

A retailer 1.0

A distributor 0.5

An exporter 0.5

(b) 01 mark for each exception 3.0

A.7 (a) Sales tax credits – input tax 7.0

Sales tax debits – output tax 4.0

Apportionment of input tax 2.0

Sales tax to be carried forward 1.0

Sales tax to be refundable 1.0

(b) 01 mark for the reason for ignoring any transaction 4.0

A.8 (a) Preparation of tax returns 1.0

Tax calculation for the purpose of preparing accounting entries 4.0

(b) 0.5 mark for identifying the scope of legislation for each tax/duty 3.0

(THE END)

Page 2 of 2

You might also like

- CFAP 5 Summer 2023Document2 pagesCFAP 5 Summer 2023ZainioNo ratings yet

- CFAP 5 Winter 2019Document2 pagesCFAP 5 Winter 2019ZainioNo ratings yet

- CFAP 5 Winter 2022Document2 pagesCFAP 5 Winter 2022ZainioNo ratings yet

- TAX MarkingPlanDocument2 pagesTAX MarkingPlanMuhammad YahyaNo ratings yet

- CFAP 5 Summer 2022Document2 pagesCFAP 5 Summer 2022ZainioNo ratings yet

- CFAP 5 Winter 2021Document2 pagesCFAP 5 Winter 2021ZainioNo ratings yet

- 22-23 Annual IT 02052023 0210pmDocument8 pages22-23 Annual IT 02052023 0210pmWint PaingNo ratings yet

- BPP F3 KitDocument7 pagesBPP F3 KitMuhammad Ubaid UllahNo ratings yet

- CAF-7-Autumn-Past PapersDocument2 pagesCAF-7-Autumn-Past PapersMasroor BashirNo ratings yet

- Annexure III&IIIA-Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA-Form12C&ComputationSheetBhooma Shayan100% (1)

- Annexure III&IIIA Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA Form12C&ComputationSheetkalpNo ratings yet

- CAF-5-Spring-2023 MarkingDocument2 pagesCAF-5-Spring-2023 MarkingFaisal MustqeemNo ratings yet

- Tax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDocument3 pagesTax Calculator For Individual Tax Payer: Data Tax Calculation Old Regime New RegimeDevi PrasannaNo ratings yet

- BC 604, Income Tax Law & Practice, 2022Document12 pagesBC 604, Income Tax Law & Practice, 2022davusingh786No ratings yet

- Form NoDocument1 pageForm Nomurali_mohan_5No ratings yet

- Shail End RaDocument24 pagesShail End Rabharat khandelwalNo ratings yet

- ASX Release: 23 August 2021Document40 pagesASX Release: 23 August 2021Peper12345No ratings yet

- CSS Accounting Papers-1Document2 pagesCSS Accounting Papers-1rabia khanNo ratings yet

- MP April 2020-21Document15 pagesMP April 2020-21SHIVGOPAL KULHADENo ratings yet

- AllrecDocument78 pagesAllrecSashankNo ratings yet

- Adobe Scan 19 Mar 2024Document5 pagesAdobe Scan 19 Mar 2024anilarsha18No ratings yet

- 06-Spring 2014 - BTDocument4 pages06-Spring 2014 - BTpabloescobar11yNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiNo ratings yet

- 21 22-Annual IT 22mar2022 1155pmDocument8 pages21 22-Annual IT 22mar2022 1155pmWint PaingNo ratings yet

- Draft ReportDocument8 pagesDraft Report0264192238No ratings yet

- CAF 7 Autumn 2019Document2 pagesCAF 7 Autumn 2019Masroor BashirNo ratings yet

- 20excels On Solved ProblemsDocument5 pages20excels On Solved ProblemsAtushNo ratings yet

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Document2 pages1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizNo ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- Auditing Problems: Ap - 01: Correction of ErrorsDocument15 pagesAuditing Problems: Ap - 01: Correction of ErrorsPrinces100% (2)

- Lic 2 P&L 31-03-2017 PDFDocument1 pageLic 2 P&L 31-03-2017 PDFjdchandrapal4980No ratings yet

- Sample ITR Page 4Document1 pageSample ITR Page 4Eduardo BallesterNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Figure in Lakh Prepared by - Ca. Shivam GuptaDocument11 pagesFigure in Lakh Prepared by - Ca. Shivam GuptaAayush LohanaNo ratings yet

- R2.TAXM - .L Question CMA June 2021 Exam.Document7 pagesR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaNo ratings yet

- F1 FIOO - L-December-2020Document8 pagesF1 FIOO - L-December-2020Laskar REAZNo ratings yet

- BHAGYALAKSMI CMA LOAN BHBHJDocument15 pagesBHAGYALAKSMI CMA LOAN BHBHJbal balreddyNo ratings yet

- Xii AccDocument4 pagesXii AccSanjayNo ratings yet

- GSTR9 19anypg3791m1zy 032022 PDFDocument8 pagesGSTR9 19anypg3791m1zy 032022 PDFManprit MahalNo ratings yet

- Company Final Accounts: Solutions To Assignment ProblemsDocument9 pagesCompany Final Accounts: Solutions To Assignment ProblemsPalavesa KrishnanNo ratings yet

- Example 1 - Over and Under Provision of Current TaxDocument14 pagesExample 1 - Over and Under Provision of Current TaxPui YanNo ratings yet

- CMA FormatDocument21 pagesCMA Formatapi-377123878% (9)

- 1st Semester Dec 2021 PDFDocument8 pages1st Semester Dec 2021 PDFroshanNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- Rohit Saini Form-16Document2 pagesRohit Saini Form-16Sanjay DuaNo ratings yet

- Control Test 1 - March 2022Document4 pagesControl Test 1 - March 2022yandisaNo ratings yet

- Caf 2 Tax Autumn 2021Document6 pagesCaf 2 Tax Autumn 2021Mueez NaseerNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsRyan VillamorNo ratings yet

- Vat R2 2016 - 2017Document4 pagesVat R2 2016 - 2017Hotel sapphireNo ratings yet

- Income Tax Circular For FY2020-21Document87 pagesIncome Tax Circular For FY2020-21Kartik DeshmukhNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Accounting For Taxes Employee BenefitsDocument6 pagesAccounting For Taxes Employee BenefitsBess Tuico MasanqueNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaRohit SadhukhanNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJohn Lesther PabiloniaNo ratings yet

- Test 12Document2 pagesTest 12Shehzad KhanNo ratings yet

- IAS 12 - Income Taxes Handout and Tutorial PackDocument19 pagesIAS 12 - Income Taxes Handout and Tutorial Packmakaziwemvalo02No ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Economic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresFrom EverandEconomic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresNo ratings yet

- Head of Account (B-02384) : Sindh Sales Tax On ServicesDocument1 pageHead of Account (B-02384) : Sindh Sales Tax On ServicesAzhar NawazNo ratings yet

- Goods and Services Tax (GST) in India: CA. Preeti GoyalDocument30 pagesGoods and Services Tax (GST) in India: CA. Preeti GoyalArvind PalNo ratings yet

- Tax Amnesties - Impact On Development of TaxDocument32 pagesTax Amnesties - Impact On Development of TaxA QNo ratings yet

- Invoice FormatsDocument2 pagesInvoice FormatsVenu Madhav JNo ratings yet

- PCI Slide PresentationDocument16 pagesPCI Slide PresentationsomethingNo ratings yet

- Agri Dhamaka Poster April 2024Document2 pagesAgri Dhamaka Poster April 2024astropragya11No ratings yet

- 2035-Wanjau Kabuchi KabuchiDocument1 page2035-Wanjau Kabuchi KabuchiKabuchi WanjauNo ratings yet

- Introduction To Income TaxationDocument4 pagesIntroduction To Income TaxationJean Diane JoveloNo ratings yet

- Just Online Registration Receipt For Transaction - 106682Document3 pagesJust Online Registration Receipt For Transaction - 106682Mohamad Adli AbdullahNo ratings yet

- CHAPTER 6 7 and 8 TAXDocument38 pagesCHAPTER 6 7 and 8 TAXMark Lawrence Yusi100% (1)

- S. No. Major Head 1 Minor Head 1Document49 pagesS. No. Major Head 1 Minor Head 1ankit_gadiya24No ratings yet

- Ejercicio 7.23Document1 pageEjercicio 7.23Enrique M.No ratings yet

- Income Tax Numericals SolutionsDocument9 pagesIncome Tax Numericals SolutionsBrown BoiNo ratings yet

- ITR's and AssessmentDocument11 pagesITR's and Assessmentashutosh4iipmNo ratings yet

- Form 26asDocument6 pagesForm 26asSubramanyam JonnaNo ratings yet

- IT CalculatorDocument49 pagesIT CalculatorMotheesh ReddyNo ratings yet

- HB 6765 - Digital Economy Tax Act Reformatted 21052020 2Document9 pagesHB 6765 - Digital Economy Tax Act Reformatted 21052020 2Edrese AguirreNo ratings yet

- Inbound 1400148020110951276Document3 pagesInbound 1400148020110951276MarielleNo ratings yet

- Auditing AssignmentDocument8 pagesAuditing AssignmentApril ManjaresNo ratings yet

- Mt. Sinai Hospital Kra PinDocument1 pageMt. Sinai Hospital Kra Pinmike kiroreNo ratings yet

- Movement Report DefinitionsDocument2 pagesMovement Report DefinitionsJames DimaculanganNo ratings yet

- Invoice APFR 440Document1 pageInvoice APFR 440Loren AbantoNo ratings yet

- Tugas Cash Flow Lapkeu 1Document2 pagesTugas Cash Flow Lapkeu 1Leonardus WendyNo ratings yet

- Chapter 2 - Income TaxDocument30 pagesChapter 2 - Income TaxRochelle ChuaNo ratings yet

- ACK138389790080523Document1 pageACK138389790080523Vishal GoyalNo ratings yet

- Annualized Withholding TaxDocument22 pagesAnnualized Withholding Taxsai78No ratings yet

- Compliance HandbookDocument36 pagesCompliance HandbookGiri SukumarNo ratings yet

- Basic Principles of TaxationDocument33 pagesBasic Principles of TaxationHenicel Diones San Juan100% (1)

- 7198 3Document1 page7198 3aravind029No ratings yet

- All About Annual Information Statement (AIS)Document79 pagesAll About Annual Information Statement (AIS)NEERAJ MAURYANo ratings yet