Professional Documents

Culture Documents

Materi Lab 1 - Home Office and Branch Office PDF

Uploaded by

PUTRI YANIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Materi Lab 1 - Home Office and Branch Office PDF

Uploaded by

PUTRI YANICopyright:

Available Formats

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

MATERI LAB 1

HOME OFFICE AND BRANCH OFFICE

❖ Definition of Branch Office

Branch offices are part of entities. Branch offices are treated separately in

terms of their accounting system, but not in terms of legal business entities.

❖ The Differences between Branch Offices and Sales Agencies

Aspects Sales Agencies Branches

Sales to Outside Sales are controlled by Branches can do their own

Entities

controlling entities sales to outside entities

Merchandise Inventory Sales agencies do not Branches account for their

account for their inventory, own inventories

but they can display them

Sales Requirements Sales agencies have sales Branches don’t have sales

requirements from requirements from

controlling entities controlling entities

Operating Expenses Controlled by Controlling Branches account for their

Entities, treated similar to own expenses

petty cash

Customer Credit Sales agencies do not pass on Branches pass on customer

customer credit credit

Accounting System Petty cash Branches have their own

accounting system

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

❖ Transactions between Home Office and Branch Office

❖ Combining Home Office and Branch Office Financial Statements

1. Eliminate Reciprocal Accounts

Home office and branch office transactions are reciprocal transactions. To

record this reciprocal transaction, reciprocal accounts are used.

Reciprocal accounts have a corresponding nature, which means whenever

there is a debit entry of a reciprocal account in the home office, there will also

be a credit entry of its matching reciprocal account in the branch office, and

vice versa.

Examples: Home Office & Branch Office, Shipment to Branch Office &

Shipment from Home Office

2. Combine Non-Reciprocal Accounts

❖ Examples

- Creation of a New Branch

A company creates a new branch by transferring an amount of cash and equipment

Home Office (in $) Branch Office (in $)

Branch Office xxx Cash xxx

Cash xxx Equipment xxx

Equipment xxx Home Office xxx

Branch office remits an amount of cash to Home Office

Cash xxx Home Office xxx

Branch Office xxx Cash xxx

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

Branch office transfers $xxx to another branch office

(in this example branch A transfer cash to branch B)

Home Office Branch A Branch B

Branch B xxx Home Office xxx Cash xxx

Branch A xxx Cash xxx Home Office xxx

- Merchandise Shipment

Home Office transfers merchandise to Branch Office at a cost of $xxx

Home Office Branch Office

Branch Office xxx Shipment from HO xxx

Shipment to BO xxx Home Office xxx

Excess Cost (At Cost and At Billing Price)

Home Office transfers merchandise to Branch, the cost is $xxx excluding a markup

of A% using one of the following methods:

• At Cost

Branch Office yyy Shipment from HO yyy

Shipment to BO xxx Home Office yyy

Loading in Branch xxx*A%

xxx = price of merchandise at cost (excluding markup)

xxx*A% = total markup in merchandise

yyy = price of merchandise at billing price (including markup)

yyy = xxx*(100%+A%)

• At Billing Price

Branch Office yyy Shipment from HO yyy

Shipment to BO yyy Home Office yyy

at the end of the period, Home Office records:

Shipment to BO xxx*A% To adjust shipment of merchandise

Loading in Branch xxx*A% to a cost basis

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

to adjust for branch profit, assuming $ppp profit was realized

Loading in Branch ppp

Branch Profit ppp

ppp = realized profit on the period

- Freight Cost

Home Office paid freight cost of $aaa for merchandise transferred to branch office.

The merchandise cost $yyy

Branch Office aaa+yyy Shipment from HO yyy

Shipment to BO yyy Freight In aaa

Cash aaa Home Office aaa+yyy

- Merchandise Return

Branch returned A% of the merchandise from Home Office, Branch paid $bbb for the

shipment back to home office

Shipment to BO yyy*A% Home Office zzz

Loss on Excess Freight ccc Shipment from HO yyy*A%

Branch Office zzz Freight In aaa*A%

Cash bbb

yyy = previous shipment transfers from home to branch

aaa = freight in that was accrued at previous transfer transaction

ccc = (aaa*A%) + bbb

- Expense Allocation

Branch pays $xxx for operating expenses that relates equally to branch and home office

Operating Expenses xxx*1/2 Operating Expenses xxx*1/2

Branch Office xxx*1/2 Home Office xxx*1/2

Cash xxx

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

- Working Paper Entries

a. To Eliminate Loading in Beginning Branch Inventory

Loading in Branch xxx

Cost of Sales xxx

b. To Eliminate Loading in Current-Year Shipments to Branch

Loading in Branch xxx

Cost of Sales xxx

c. To Eliminate Loading in Ending Branch Inventory

Cost of Sales xxx

Inventories xxx

d. To Eliminate Reciprocal Home Office and Branch Balances

Home Office xxx

Branch Office xxx

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

❖ Illustration

In the beginning of December 2022, Loki Company created a new branch in Bali. Bali

branch purchased merchandise from outside suppliers on account. Below is presented

the Statement of Financial Position of Loki Company’s home office at December 1,

2022 (In thousand):

Home Office

Assets

Cash Rp 210.000

Accounts Receivable-net Rp 25.000

Inventories Rp 85.000

Equipment-net Rp 190.000

Total Assets Rp 510.000

Liabilities and Equity

Accounts Payable Rp 95.000

Other Liabilities Rp 18.000

Capital Stock Rp 200.000

Retained Earnings December 1,

Rp 197.000

2022

Total Liabilities and Equity Rp 510.000

Below are transactions that occurred during December 2022 (In thousand):

Date Transactions

December 1 Loki Company created a new branch in Bali by transferring

Rp45.000 in cash and equipment worth Rp10.000

December 4 Loki Company transferred merchandise to Bali Branch, Rp30.000

in cost excluding a markup of 20% using at billing price method

December 9 Bali Branch remitted Rp7.000 to Loki Company’s Home Office

December 13 Loki Company paid Rp400 for Rp30.000 of merchandise shipped to

Bali Branch at cost

December 15 Bali Branch returned 20% of the merchandise transferred from Loki

Company on December 13, Bali Branch paid Rp100 for the

shipment

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

December 24 Bali Branch paid Rp2.000 for advertising expense equally for

Branch and Home Office

Additional Information (In thousand):

HO BO

Sales Rp250.000 Rp170.000 All sales transactions and purchase

Ending Inventory at transactions were done on account.

Rp 12.000 Rp 6.000

Dec 31, 2022 60% of branch’s ending inventory was

Purchases Rp 98.000 Rp 17.000 acquired from outside entities.

Depreciation Expense Rp 2.000 Rp 2.000

Instructions:

Prepare the necessary journal entries, including adjusting and closing entries for both

home office and branch office to record the transactions above and prepare the working

paper entries and combining working papers. The home office recorded transfers of

inventory using the billing price method.

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

Solutions:

- Journal entries

Home Office Branch Office

Date

(In thousand Rupiah) (In thousand Rupiah)

Dec 1 Bali Branch 55.000 Cash 45.000

Cash 45.000 Equipment 10.000

Equipment 10.000 Home Office 55.000

Dec 4 Bali Branch 36.000 Shipments from HO 36.000

Shipments to BO 36.000 Home Office 36.000

Dec 9 Cash 7.000 Home Office 7.000

Bali Branch 7.000 Cash 7.000

Dec 13 Bali Branch 30.400 Shipments from HO 30.000

Shipments to BO 30.000 Freight In 400

Cash 400 Home Office 30.400

Dec 15 Shipment to BO 6.000 Home Office 6.180

Loss on Excessive Freight 180 Shipments from HO 6.000

Bali Branch 6.180 Freight In 80

Cash 100

Dec 24 Advertising Expense 1.000 Advertising Expense 1.000

Bali Branch 1.000 Home Office 1.000

Cash 2.000

Dec 31 Depreciation Expense 2.000 Depreciation Expense 2.000

Equipment 2.000 Equipment 2.000

Dec 31 Shipment to BO 6.000

Loading in Branch 6.000

(36.000 – (30.000 × 20%))

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

- Adjusting and Closing Entries

Home Office Branch Office

Date

(In thousand Rupiah) (In thousand Rupiah)

Dec 31 Loading in Branch* 5.600 Sales 170.000

Branch Profit 5.600 Ending inventory 6.000

Dec 31 Bali Branch 95.680 Shipment from HO 60.000

Branch Profit 95.680 Purchase 17.000

(From branch office journal for reciprocal home office) Freight In 320

Dec 31 Sales 250.000 Depreciation Expense 2.000

Ending Inventory 12.000 Advertising Expense 1.000

Shipments to BO 54.000 Home Office 95.680

Branch Profit 101.280

Beginning Inventory 85.000

Purchases 98.000

Depreciation Expense 2.000

Advertising Expense 1.000

Loss on Excess Freight 180

Retained Earnings 231.100

*Branch Profit Calculations (In thousand Rupiah)

Ending Inventory from HO After Mark-Up of 20% = 6.000 × 40%**

= 2.400

Ending Inventory from HO (Cost Basis) = 2.400 ÷ 120%

= 2.000

Loading in Branch for 2.400 Ending Inventory = 2.400 – 2.000

= 400

Realized Loading Inventory = 6.000 - 400

= 5.600

**40% is percentage inventory acquired from home office

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

- Working paper entries (In Thousand Rupiah)

a. To Eliminate Loading in Current-Year Shipments to Branch

Loading in Branch 6.000

Cost of Sales 6.000

b. To Eliminate Loading in Ending Branch Inventory

Cost of Sales 400

Inventories 400

c. To Eliminate Reciprocal Home Office and Branch Balances

Home Office 107.220***

Bali Branch 107.220

***Obtained from the ending balances of Home Office and Bali Branch before

adjusting and closing

- Cost of Sales Calculations (In Thousand Rupiah)

Home Office Bali Branch

Inventory Dec 1, 2022 85.000 -

Purchases 98.000 17.000

Shipments to BO (54.000)

Shipments from HO 60.000

Goods Available for Sale 129.000 77.000

Inventory Dec 31, 2022 (12.000) (6.000)

Cost of Sales 117.000 71.000

ADIVA – FARHAN – NADYA FATA 2019

MATERI PRAKTIKUM AKUNTANSI KEUANGAN LANJUTAN FATA 2019

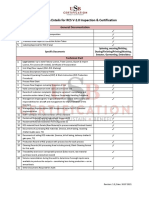

- Combining Working Papers (Trial Balance Approach)

LOKI COMPANY HOME OFFICE AND BRANCH WORKING

PAPERS FOR THE YEAR ENDED DECEMBER 31, 2022

(In Thousand Rupiah)

Home Bali Adjustments and Income Balance

Office Branch Eliminations Statement Sheet

Debits Debit Credit

Cash 171.600 35.900 207.500

Accounts Receivable-net 275.000 170.000 445.000

Inventories 12.000 6.000 b 400 17.600

Equipment-net 178.000 8.000 186.000

Bali Branch 107.220 c 107.220 -

Cost of Sales 117.000 71.000 b 400 a 6.000 (182.400)

Freight-In 320 ( 320)

Advertising Expense 1.000 1.000 ( 2.000)

Depreciation Expense 2.000 2.000 ( 4.000)

Loss on Excess Freight 180 ( 180)

864.000 294.220 856.100

Credits

Accounts Payable 193.000 17.000 210.000

Other Liabilities 18.000 18.000

Loading in Branch 6.000 a 6.000 -

Home Office 107.220 c 107.220 -

Capital Stock 200.000 200.000

Retained Earnings Dec 1, 197.000 197.000

2022

Sales 250.000 170.000 420.000

864.000 294.220

Net Income 231.100 231.100

856.100

ADIVA – FARHAN – NADYA FATA 2019

You might also like

- HSE MANAGEMENT PLAN 2019-Rev1Document4 pagesHSE MANAGEMENT PLAN 2019-Rev1Nadiatul Aisyah Mohd Amirul Hakim85% (13)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- M1 - Home Office and Branch Accounting - General ProceduresDocument15 pagesM1 - Home Office and Branch Accounting - General ProceduresJohn Michael A. PaclibareNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Lesson 1 Home Office and Branch AccountingDocument4 pagesLesson 1 Home Office and Branch AccountingAndy Lalu100% (3)

- DB CEO Email IDDocument9 pagesDB CEO Email IDSundararajan SrinivasanNo ratings yet

- p2 - Guerrero Ch7Document35 pagesp2 - Guerrero Ch7JerichoPedragosa66% (38)

- Home Office and Branch Accounting With Answer KeyDocument11 pagesHome Office and Branch Accounting With Answer KeyGabrielle100% (2)

- Practical Accounting 2: Topic: Home Office and Branch AccountingDocument11 pagesPractical Accounting 2: Topic: Home Office and Branch AccountingJoel Christian MascariñaNo ratings yet

- HOBA - Advance AccountingDocument113 pagesHOBA - Advance AccountingChristine Joy Estropia67% (3)

- IQA Checklist - SmpleDocument16 pagesIQA Checklist - SmpleHarits As Siddiq100% (1)

- Lesson 4 Accounting For Home OfficeDocument8 pagesLesson 4 Accounting For Home OfficeheyheyNo ratings yet

- Home Office, Branch and Agency AccountingDocument5 pagesHome Office, Branch and Agency AccountingChincel G. ANINo ratings yet

- Home Office & Branch Lecture NotesDocument32 pagesHome Office & Branch Lecture NotesDrehfcieNo ratings yet

- Lesson 15 Home Office, Branch and Agency AccountingDocument11 pagesLesson 15 Home Office, Branch and Agency AccountingMark TaysonNo ratings yet

- Home-Office Branch Accounting ProceduresDocument5 pagesHome-Office Branch Accounting ProceduresPam CayabyabNo ratings yet

- MidtermQ2 - Home Office Branch Accounting Billing Above CostDocument13 pagesMidtermQ2 - Home Office Branch Accounting Billing Above Costsarahbee100% (2)

- Home office and branch accountingDocument8 pagesHome office and branch accountingDanielle Nicole MarquezNo ratings yet

- HO & Branch AccountingDocument6 pagesHO & Branch AccountingMaria BeatriceNo ratings yet

- Home Office - Branch and Agency AccountingDocument30 pagesHome Office - Branch and Agency AccountingJenina Diaz82% (11)

- 11 Home Office and BranchDocument3 pages11 Home Office and BranchabcdefgNo ratings yet

- Topic 6 Accounting For Home Office, Branch and Agency Transactions ModuleDocument20 pagesTopic 6 Accounting For Home Office, Branch and Agency Transactions ModuleMaricel Ann Baccay50% (2)

- Home Office Branch Accounting 2020 PDFDocument22 pagesHome Office Branch Accounting 2020 PDFJamaica DavidNo ratings yet

- 3004 Home Office and BranchesDocument6 pages3004 Home Office and BranchesTatianaNo ratings yet

- Abhishek REDocument2 pagesAbhishek REDarshan S PNo ratings yet

- MODULE 4 Home Office and Branch Accounting PPT PDFDocument95 pagesMODULE 4 Home Office and Branch Accounting PPT PDFDanicaNo ratings yet

- Project Purchase GoodsDocument13 pagesProject Purchase GoodsGorkhali GamingNo ratings yet

- A Reaction Paper Regarding TQMDocument3 pagesA Reaction Paper Regarding TQMLeonorBagnison80% (5)

- Management of Risk (M - o - R) 2011 - Mini Borchure (01.2011)Document8 pagesManagement of Risk (M - o - R) 2011 - Mini Borchure (01.2011)Compliance Secretária RemotaNo ratings yet

- MATERI HOME AND BRANCH OFFICEDocument11 pagesMATERI HOME AND BRANCH OFFICErahayuNo ratings yet

- Home Office, Branches and AgenciesDocument5 pagesHome Office, Branches and AgenciesBryan ReyesNo ratings yet

- Advance Accounting 2 Home Office and BranchesDocument3 pagesAdvance Accounting 2 Home Office and BranchesCasper John Nanas MuñozNo ratings yet

- 1.1.1. Hoba - General TransactionsDocument29 pages1.1.1. Hoba - General TransactionsJane DizonNo ratings yet

- Home Office Branch and Agency AccountingDocument5 pagesHome Office Branch and Agency AccountingMaria Angelica SergoteNo ratings yet

- Home Office, Agency & Branch AcctgDocument5 pagesHome Office, Agency & Branch Acctgguliramsam5No ratings yet

- Home Office and Bracnch - Special ProblemsDocument22 pagesHome Office and Bracnch - Special ProblemsYeshi Soo YahNo ratings yet

- ACP 312 Quiz 1 Week 1 3Document6 pagesACP 312 Quiz 1 Week 1 3Christ BalinawaNo ratings yet

- 3 1 1 - Hoba-Special-TransactionsDocument20 pages3 1 1 - Hoba-Special-TransactionsRainier BantigueNo ratings yet

- HobaDocument6 pagesHobaGIGI BODONo ratings yet

- Ho and Branch and Agency AcctgDocument38 pagesHo and Branch and Agency AcctgNiño Dwayne TuboNo ratings yet

- Lesson 2 Home and Branch Accounting - Special ProblemsDocument3 pagesLesson 2 Home and Branch Accounting - Special ProblemsAndy LaluNo ratings yet

- Home Office and Branch Accounting ProceduresDocument24 pagesHome Office and Branch Accounting ProceduresFrances Chariz YbioNo ratings yet

- Home Office and Branch AccountingDocument27 pagesHome Office and Branch AccountingKRABBYPATTY PHNo ratings yet

- An Illustration of Journal Entries Recorded For Interoffice Transactions FollowDocument4 pagesAn Illustration of Journal Entries Recorded For Interoffice Transactions FollowIyah AmranNo ratings yet

- Ac3101 Homebranch 1Document5 pagesAc3101 Homebranch 1jumbo hotdogNo ratings yet

- Home Office Chap. 2Document13 pagesHome Office Chap. 2Rei GaculaNo ratings yet

- ACC5116 - Module 1Document6 pagesACC5116 - Module 1Carl Dhaniel Garcia SalenNo ratings yet

- p2Document8 pagesp2elizaNo ratings yet

- HOBA - General Procedures-DLSAUDocument25 pagesHOBA - General Procedures-DLSAUJasmine LimNo ratings yet

- Materi Lab 1 - Home Office Branch Office PDFDocument4 pagesMateri Lab 1 - Home Office Branch Office PDFHelga NadilaNo ratings yet

- ACC132 - Home Office and Branch Accounting PDFDocument50 pagesACC132 - Home Office and Branch Accounting PDFRolando G. Cua Jr.92% (12)

- Lamagna - Act 2 HOBADocument4 pagesLamagna - Act 2 HOBARichard LamagnaNo ratings yet

- APrE04 01E Home-Office and BranchDocument6 pagesAPrE04 01E Home-Office and BranchMendoza Ron NixonNo ratings yet

- Module 1 Home Office and Branch Accounting General ProceduresDocument4 pagesModule 1 Home Office and Branch Accounting General ProceduresDaenielle EspinozaNo ratings yet

- 1 AccountingforAgencyHomeOfficeandBranchOfficeDocument10 pages1 AccountingforAgencyHomeOfficeandBranchOfficenonen3872No ratings yet

- 08 Home Office Branch AccountingDocument4 pages08 Home Office Branch AccountingMila Casandra CastañedaNo ratings yet

- Home Office Branch Agency AccountingDocument11 pagesHome Office Branch Agency AccountingDarence IndayaNo ratings yet

- Advanced Financial Accounting Chapter 2 LECTURE - NOTESDocument14 pagesAdvanced Financial Accounting Chapter 2 LECTURE - NOTESAshenafi ZelekeNo ratings yet

- Home and Branch Accounting General ProceduresDocument30 pagesHome and Branch Accounting General ProceduresCleah WaskinNo ratings yet

- Home Office Books J.entriesDocument4 pagesHome Office Books J.entriesMichelle RibleNo ratings yet

- Home Office and BranchDocument9 pagesHome Office and BranchLive LoveNo ratings yet

- Advance Financi Al Accounting I I: Lyka Sanchez, CPADocument16 pagesAdvance Financi Al Accounting I I: Lyka Sanchez, CPATokkiNo ratings yet

- Uloa. Understand The Entries To Record Agency and Branch TransactionsDocument20 pagesUloa. Understand The Entries To Record Agency and Branch Transactionsalmira garciaNo ratings yet

- Materi Lab 1 - HoboDocument4 pagesMateri Lab 1 - HoboMuhamad Rizki PratamaNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- 2017 COSO ERM Integrating With Strategy and Performance Executive SummaryDocument16 pages2017 COSO ERM Integrating With Strategy and Performance Executive Summarydeleonjaniene bsaNo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Accounting EquationDocument5 pagesSoal Dan Jawaban Tugas Lab 1 - Accounting EquationPUTRI YANINo ratings yet

- COSO ERM Framework Lessons Eligible 2april2018Document49 pagesCOSO ERM Framework Lessons Eligible 2april2018PUTRI YANINo ratings yet

- Putri Yani - UTS Oil Dan GasDocument4 pagesPutri Yani - UTS Oil Dan GasPUTRI YANINo ratings yet

- Soal Dan Jawaban Tugas Lab 2 - Business CombinationDocument4 pagesSoal Dan Jawaban Tugas Lab 2 - Business CombinationPUTRI YANINo ratings yet

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Soal Dan Jawaban Latihan Lab 2 - Business CombinationDocument10 pagesSoal Dan Jawaban Latihan Lab 2 - Business CombinationPUTRI YANINo ratings yet

- Soal Dan Jawaban Tugas Lab 3 - Stock Investment PDFDocument4 pagesSoal Dan Jawaban Tugas Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Soal Dan Jawaban Latihan Lab 3 - Stock InvestmentDocument8 pagesSoal Dan Jawaban Latihan Lab 3 - Stock InvestmentPUTRI YANINo ratings yet

- PT Adhi Medika Indonesia SOFPDocument7 pagesPT Adhi Medika Indonesia SOFPPUTRI YANINo ratings yet

- Company Profile PT Adhi Medika Indonesia PDFDocument9 pagesCompany Profile PT Adhi Medika Indonesia PDFPUTRI YANINo ratings yet

- Soal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficeDocument6 pagesSoal Dan Jawaban Tugas Lab 1 - Home Office and Branch OfficePUTRI YANINo ratings yet

- Kickstart CVDocument6 pagesKickstart CVTamara RueeggNo ratings yet

- Special Trans Activity 2Document15 pagesSpecial Trans Activity 2Rachelle JoseNo ratings yet

- Strama Module 9 PDFDocument27 pagesStrama Module 9 PDFLeoan DomingoNo ratings yet

- STAFF IDsDocument106 pagesSTAFF IDsNiyomahoro Jean HusNo ratings yet

- Trust 2Document12 pagesTrust 2mochamad sirodjudinNo ratings yet

- RCS Audit ChecklistDocument1 pageRCS Audit ChecklistAnwar Hossain HM100% (1)

- Forecasting Power PointDocument58 pagesForecasting Power Pointdanielolamide260No ratings yet

- Dissertation Transfer PricingDocument7 pagesDissertation Transfer PricingHelpMeWithMyPaperAnchorage100% (1)

- Inventory management and cost optimization questionsDocument9 pagesInventory management and cost optimization questionsMaha HamdyNo ratings yet

- Bachelor of Business Administration (Hons) Finance (BM242/BA242)Document3 pagesBachelor of Business Administration (Hons) Finance (BM242/BA242)nur fatinNo ratings yet

- Pricing Decisions, Including Target Costing and Transfer PricingDocument105 pagesPricing Decisions, Including Target Costing and Transfer PricingSaffan MohamedNo ratings yet

- Week 1 Strategic Marketing PlanningDocument13 pagesWeek 1 Strategic Marketing Planningphil kaundaNo ratings yet

- Branding essentials for successDocument29 pagesBranding essentials for successFrances BarenoNo ratings yet

- Guidelines For Developing A Mutual Recognition Arrangement/agreementDocument43 pagesGuidelines For Developing A Mutual Recognition Arrangement/agreementLia RayyaNo ratings yet

- Final Examination Course: Audit and Assurance Services Course Code: Aud4033 Duration: 3 HoursDocument7 pagesFinal Examination Course: Audit and Assurance Services Course Code: Aud4033 Duration: 3 HoursAmirul HafiyNo ratings yet

- BSI Using The Balanced Scorecard To Align Your Organization PDFDocument4 pagesBSI Using The Balanced Scorecard To Align Your Organization PDFabhishek tyagiNo ratings yet

- Inovation ReportDocument7 pagesInovation ReportagungNo ratings yet

- Free ConceptDocument2 pagesFree ConceptSalvatory AluteNo ratings yet

- 1 CBMEC - 1 Strategic Management Nature of Strategic ManagementDocument25 pages1 CBMEC - 1 Strategic Management Nature of Strategic ManagementMc VillafrancaNo ratings yet

- Construction Management (CE754) : Ramesh Banstola 1Document41 pagesConstruction Management (CE754) : Ramesh Banstola 1Naresh JirelNo ratings yet

- MB 0042Document30 pagesMB 0042Rehan QuadriNo ratings yet

- MIM Membership BrochureDocument2 pagesMIM Membership BrochurejulisuzlinNo ratings yet

- Abbas Khalil EEDocument4 pagesAbbas Khalil EEAbas KhalelNo ratings yet