Professional Documents

Culture Documents

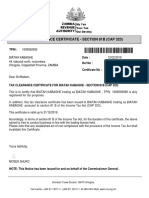

Airbnb Ireland UC - 2019 Tax Residency Certificate

Uploaded by

Gonçalo HenriquesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Airbnb Ireland UC - 2019 Tax Residency Certificate

Uploaded by

Gonçalo HenriquesCopyright:

Available Formats

www.revenue.

ie

Aonad Gnó TCE 1

Information, Communications & Technology

Rannóg na gCásanna Móra Corparáideacha District 1

Teach Ballaugh, 73-79 Sráid an Mhóta íocht Large Corporates Division

Baile Átha Cliath 2. Ballaugh House, 73-79 Lower Mount Street

Dublin 2

To whom it may concern 04/01/2019

Ref : 9827384L

Re : AIRBNB IRELAND UNLIMITED

COMPANY

Certification of Tax Residence for Tax Year 2019

Dear Sir/Madam,

For the purposes of the tax treaties listed below, I confirm that the above named company is registered for corporation tax in Ireland and files its

corporation tax returns, for the year stated above, on the basis that it is resident for tax purposes in Ireland. The company is therefore liable to Irish

corporation tax on all of its profits wherever arising, for the said year.

Yours faithfully,

Tom James Information, Communications &

Information, Communications & Technology District 1

Technology District 1

Large Corporates Division

Large Corporates Division

04/01/2019

Ballaugh House, 73-79 Lower Mount Street

Dublin 2

Ireland has signed Double Taxation Agreements / Treaties with the following countries:

Albania, Armenia, Australia, Austria, Bahrain, Belarus, Belgium, Bosnia & Herzegovina, Botswana, Bulgaria, Canada, Chile, China, Croatia, Cyprus,

Czech Republic, Denmark, Egypt, Estonia, Ethiopia, Finland, France, Georgia, Germany, Greece, Hong Kong, Hungary, Iceland, India, Israel, Italy,

Japan, Kazakhstan, The Republic of Korea, Kuwait, Latvia, Lithuania, Luxembourg, Macedonia, Malaysia, Malta, Mexico, Moldova, Montenegro,

Morocco, the Netherlands, New Zealand, Norway, Pakistan, Panama, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore,

Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, UAE, Ukraine, United Kingdom, USA, Uzbekistan, Vietnam,

Zambia.

You might also like

- Foreign Exchange RateDocument20 pagesForeign Exchange RatePrabhneet100% (1)

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- Certificate of LLC CompanyDocument2 pagesCertificate of LLC CompanybettyNo ratings yet

- Preview 28Document22 pagesPreview 28kakabadzebaiaNo ratings yet

- Re: Summons (The Bear™ Holdings Ltd. vs. Iamnero vs. Her Majesty The Queen)Document1 pageRe: Summons (The Bear™ Holdings Ltd. vs. Iamnero vs. Her Majesty The Queen)ethan8572No ratings yet

- Statement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023Document4 pagesStatement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023tevisthomas205No ratings yet

- Kadena, Kaddex - RWL S.R.L. - Company Registration ReportDocument4 pagesKadena, Kaddex - RWL S.R.L. - Company Registration ReportJason M. RiveraNo ratings yet

- Berkshire's Performance vs. The S&P 500Document11 pagesBerkshire's Performance vs. The S&P 500Joseph AdinolfiNo ratings yet

- Business License - Page 3 168725793479Document3 pagesBusiness License - Page 3 168725793479Kutubuddin AhmedNo ratings yet

- Maury UtilityDocument4 pagesMaury Utilityyusufosoba51No ratings yet

- Nr. Pag. / Pages: AddressDocument2 pagesNr. Pag. / Pages: Addresstenso zangetsuNo ratings yet

- South Africa The Gas Company Gas BillDocument1 pageSouth Africa The Gas Company Gas Billuyên đỗNo ratings yet

- Project Report On Industrial RelationDocument109 pagesProject Report On Industrial Relationushasarthak57% (7)

- Slots, Tables, and All That Jazz: Managing Customer Profitability at The MGM Grand HotelDocument10 pagesSlots, Tables, and All That Jazz: Managing Customer Profitability at The MGM Grand HotelSonali KothariNo ratings yet

- Your TV LicenceDocument1 pageYour TV LicenceAiden CondronNo ratings yet

- Trade LicenseDocument2 pagesTrade LicenseShubham RokadNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: IrelandDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: IrelandKelz YouknowmynameNo ratings yet

- Certificate of EarningsDocument1 pageCertificate of Earningscb4502173No ratings yet

- SCC COMUNICADOS PI Batch0100151115e8f50a18381100 PDFDocument3 pagesSCC COMUNICADOS PI Batch0100151115e8f50a18381100 PDFVolodymyr BokovnyaNo ratings yet

- ISO2016Document2 pagesISO2016Fadi HamandiNo ratings yet

- 2023 08 31 - Statement 1Document2 pages2023 08 31 - Statement 1ranielysilvaukNo ratings yet

- الرخصة التجارية 2024Document1 pageالرخصة التجارية 2024AL MASSA CONTRACTINGNo ratings yet

- Payment Card Statement From 01.01.2023 To 31.01.2023: New TransactionsDocument2 pagesPayment Card Statement From 01.01.2023 To 31.01.2023: New TransactionsBlacky BurnNo ratings yet

- Setembro :outubroDocument4 pagesSetembro :outubroblackgotravelNo ratings yet

- Current Bill: Tko Sales Inc, Here's What You Owe For This Billing Period. Energy Usage HistoryDocument2 pagesCurrent Bill: Tko Sales Inc, Here's What You Owe For This Billing Period. Energy Usage Historyaccounting2No ratings yet

- Revolut Business Statement EUR 2 1Document1 pageRevolut Business Statement EUR 2 1JakcNo ratings yet

- Statement 10920 01082019 110721Document1 pageStatement 10920 01082019 110721Marcel ZietsmanNo ratings yet

- Monese Statement 01 January 2023 - 28 February 2023Document1 pageMonese Statement 01 January 2023 - 28 February 2023Maxi KiMNo ratings yet

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- Proof of Income Letter - ArtemPavlenko PDFDocument1 pageProof of Income Letter - ArtemPavlenko PDFАлексейNo ratings yet

- NTN Certificate Linko InternationalDocument1 pageNTN Certificate Linko InternationalLinko LinkoNo ratings yet

- DefaultDocument1 pageDefaultSahar SosoNo ratings yet

- Ban204 - RegusDocument4 pagesBan204 - Regusshakhawat_cNo ratings yet

- Criteriu CautareDocument2 pagesCriteriu CautareCraciun OanaNo ratings yet

- FATCA CRS Curing DeclarationDocument1 pageFATCA CRS Curing DeclarationramdpcNo ratings yet

- Titas Gas & Electricity Bill Payment June 2023Document4 pagesTitas Gas & Electricity Bill Payment June 2023YousufNo ratings yet

- 2008 Speich SwitzerlandDocument8 pages2008 Speich SwitzerlandCiobanu CristianNo ratings yet

- AEE Vat CertificateDocument1 pageAEE Vat CertificateM AzharNo ratings yet

- Mortalla, Anjo Lumbres 410, Lucas Cuadra Street,, Caloocan City, Metro Manila, PhilippinesDocument1 pageMortalla, Anjo Lumbres 410, Lucas Cuadra Street,, Caloocan City, Metro Manila, PhilippinesAjiNo ratings yet

- 大江invoiceDocument1 page大江invoiceying yingNo ratings yet

- 3-TAL Trade Register-Company StatusDocument6 pages3-TAL Trade Register-Company StatusreguiiNo ratings yet

- Chabal Laura ClaireDocument4 pagesChabal Laura ClaireITNo ratings yet

- GEPCO - Gujranwala Electric Power CompanyDocument2 pagesGEPCO - Gujranwala Electric Power CompanyAli Ashraf0% (1)

- Transaction Receipt-230623019384124991Document1 pageTransaction Receipt-230623019384124991Victor EmmanuelNo ratings yet

- CT600 2021 Version 3 04 22Document11 pagesCT600 2021 Version 3 04 22Antoon Lorents0% (1)

- Exter New SabawonDocument3 pagesExter New Sabawonxfzm99mr8rNo ratings yet

- 680 - Madhouse Mobile India PVT Ltd. - IMRO56978Document1 page680 - Madhouse Mobile India PVT Ltd. - IMRO56978Prateek PriyadarshiNo ratings yet

- Attempt All The Following Word Problems and Show All The Necessary Steps You Follow To Answer The Required QuestionsDocument3 pagesAttempt All The Following Word Problems and Show All The Necessary Steps You Follow To Answer The Required QuestionsGada NagariNo ratings yet

- Investigation 3Document1 pageInvestigation 3cressidafunkeadedareNo ratings yet

- Marker Research For A RestaurantDocument6 pagesMarker Research For A RestaurantCJ Nuñez CarlosNo ratings yet

- invoice (с)Document1 pageinvoice (с)OlgaNo ratings yet

- 20 - General Bank and Trust Company VDocument2 pages20 - General Bank and Trust Company VMokeeCodillaNo ratings yet

- Tax Clearance Certificate NewDocument1 pageTax Clearance Certificate NewFranklin ShumbaNo ratings yet

- 2 Marsham Street London SW1P 4DF: Home OfficeDocument11 pages2 Marsham Street London SW1P 4DF: Home OfficeIryna KozakevychNo ratings yet

- (B (Qnsmhqwduujj) : Certificate Concerning The Composition of The Family For The Purpose of Granting Family BenefitsDocument4 pages(B (Qnsmhqwduujj) : Certificate Concerning The Composition of The Family For The Purpose of Granting Family BenefitsMese CipresNo ratings yet

- Ardac 2009Document192 pagesArdac 2009Bogdan BobinaNo ratings yet

- Mario Volk C314Document1 pageMario Volk C314Kaya volkNo ratings yet

- OpenRent Sample Referencing Report Comprehensive RG052016Document4 pagesOpenRent Sample Referencing Report Comprehensive RG052016Mr FakeNo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Sman 1 Lumbis: NO Description AmountDocument4 pagesSman 1 Lumbis: NO Description AmounthaerilNo ratings yet

- State of GeorgiaDocument2 pagesState of GeorgiaVanessaNo ratings yet

- Fedex Commercial Invoice WordDocument2 pagesFedex Commercial Invoice WordAlbertoNo ratings yet

- Allegations Cancellation Notice For Aditya TelengDocument3 pagesAllegations Cancellation Notice For Aditya TelengAaditya TelangNo ratings yet

- Inbound Regular InvoiceDocument3 pagesInbound Regular InvoiceMutiara RachmawatyNo ratings yet

- It TCC PDFDocument1 pageIt TCC PDFIsrael Harrington MatamboNo ratings yet

- Sample Telephone BillDocument2 pagesSample Telephone BillAnonymous e29tN9pNo ratings yet

- LI Ireland 2019 TRCDocument1 pageLI Ireland 2019 TRCNikolina Vujkovac PadjenNo ratings yet

- WAHHROIHO - Letter of Intent To Replace Buyer or LesseeDocument1 pageWAHHROIHO - Letter of Intent To Replace Buyer or LesseeLenin Rey PolonNo ratings yet

- Payment SystemDocument63 pagesPayment SystemSanjana MehtaNo ratings yet

- 09-29-2010 Term Sheet - Wednesday, Sept. 2919Document5 pages09-29-2010 Term Sheet - Wednesday, Sept. 2919Sri ReddyNo ratings yet

- 0 Keep in Order: This Chapter Has 122 QuestionsDocument21 pages0 Keep in Order: This Chapter Has 122 QuestionsDinesh DhalNo ratings yet

- Background: Power of Attorney & InstructionsDocument5 pagesBackground: Power of Attorney & InstructionsPrakash Chandra TripathyNo ratings yet

- Format of Bank Balance SheetDocument14 pagesFormat of Bank Balance SheetAmi Tanu100% (1)

- Sibilski OdpDocument35 pagesSibilski Odpkalineczka.rausNo ratings yet

- Chanda D. Kochhar: Executive ProfileDocument5 pagesChanda D. Kochhar: Executive ProfileRahul PandeyNo ratings yet

- Investment Centers and Transfer PricingDocument52 pagesInvestment Centers and Transfer Pricinganup akasheNo ratings yet

- Industry and Competitive AnalysisDocument39 pagesIndustry and Competitive AnalysisNahian HasanNo ratings yet

- Product Line 2020Document7 pagesProduct Line 2020Da GwapingsNo ratings yet

- Home Loan Application IDBIDocument10 pagesHome Loan Application IDBIMuthuKumaran NadarNo ratings yet

- CID ReportDocument26 pagesCID ReportRashedul Islam BappyNo ratings yet

- Study On Financial Report of Emami and Calculation of RatiosDocument30 pagesStudy On Financial Report of Emami and Calculation of RatiosanupsharmahrmNo ratings yet

- Audit Report - Deepali ShekhawatDocument29 pagesAudit Report - Deepali ShekhawatDeepali ShekhawatNo ratings yet

- Description: S&P Latin America Ex-Mexico Bmi Materials (Sector)Document6 pagesDescription: S&P Latin America Ex-Mexico Bmi Materials (Sector)tmayur21No ratings yet

- Withholding Tax Agents Duties & Resonsibilities.10.08.21.FinalDocument116 pagesWithholding Tax Agents Duties & Resonsibilities.10.08.21.FinalRobert CastilloNo ratings yet

- Group - 06 - ING - Direct - Canada - Case - Study FinalDocument13 pagesGroup - 06 - ING - Direct - Canada - Case - Study Finalrutuja gaikwad100% (1)

- Group Annual Report 2020Document260 pagesGroup Annual Report 2020Prysmian GroupNo ratings yet

- R.K.International Manpower Recruitment Agency in India For Gulf-Middle East Countries.Document16 pagesR.K.International Manpower Recruitment Agency in India For Gulf-Middle East Countries.R.K.International Manpower Recruitment Agency In IndiaNo ratings yet

- Kilimo Kwanza Resolution - FinalDocument2 pagesKilimo Kwanza Resolution - FinalVincs KongNo ratings yet

- Human ResourceDocument6 pagesHuman ResourceKarl Tabanao50% (2)

- Man Kiw Chapter 14 Solutions ProblemsDocument7 pagesMan Kiw Chapter 14 Solutions ProblemsRod Utreras100% (2)