Professional Documents

Culture Documents

Adzu Tax02 A LP 2 VAT Assignment

Uploaded by

Justine Paul Pangasi-an0 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

Adzu-Tax02-A-LP-2-VAT-Assignment.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageAdzu Tax02 A LP 2 VAT Assignment

Uploaded by

Justine Paul Pangasi-anCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

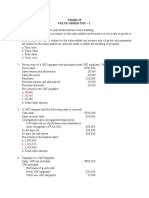

ATENEO DE ZAMBOANGA UNIVERSITY

SCHOOL OF MANAGEMENT AND ACCOUNTANCY

Name: _________________________ Score: _______ Rating: _______

BUSINESS TAXES Assignment

INSTRUCTOR: DF ESTRADA, CPA Tax 2 Section A

Assignment to pass on February 14, 2023 (Tuesday) not later than 5pm.

PROBLEM 1: The following data provided by Blue Archer Company, a VAT Taxpayer, for November CY (VAT

included in sales and purchases):

Gross Sales P 420,000

Purchases from VAT Taxpayer 270,200

Operating Expenses (Non-VAT) 70,000

a. Compute the output tax

b. Compute the input tax

c. Compute the VAT payable.

PROBLEM 2: Green Eagle Merchandising is a VAT taxpayer. The following related to its operation for CY

(exclusive of VAT).

July August September

Sales P 450,000 P 150,000 P950,000

Purchases from VAT Suppliers 120,000 160,000 140,000

Determine the following:

a. Value Added Tax Payable for July.

b. Value Added Tax Payable for August.

c. Value Added Tax Payable for September.

GOOD LUCK

/dfe

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chapter 3-Intro To Bus. TaxDocument8 pagesChapter 3-Intro To Bus. TaxShiNo ratings yet

- Business Tax - Prelim Exam - Set BDocument6 pagesBusiness Tax - Prelim Exam - Set BRenalyn ParasNo ratings yet

- Exercise 2-Chapter 3-Intro To Business TaxationDocument3 pagesExercise 2-Chapter 3-Intro To Business TaxationQuenie De la CruzNo ratings yet

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- Business Tax - Prelim Exam - Set ADocument7 pagesBusiness Tax - Prelim Exam - Set ARenalyn Paras0% (1)

- Income Taxation On Corporations Exercise Problems BSADocument2 pagesIncome Taxation On Corporations Exercise Problems BSARico, Jalaica B.No ratings yet

- Quiz 2 Part 2Document4 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- VAT QuizzerDocument13 pagesVAT QuizzerGrace Managuelod GabuyoNo ratings yet

- VatDocument16 pagesVatCPA100% (1)

- Take Home Quiz 1Document9 pagesTake Home Quiz 1Akira Marantal Valdez100% (1)

- Value Added Tax PracticeDocument7 pagesValue Added Tax PracticeSelene DimlaNo ratings yet

- VAT - AssignmentDocument2 pagesVAT - AssignmentLealyn CuestaNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- 2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsDocument4 pages2.1 Assignment - VAT Exempt, Output Tax On Sale of GoodsKrisha TevesNo ratings yet

- BSA 2105 Atty. F. R. Soriano Vat - Exercises 7: First QuarterDocument2 pagesBSA 2105 Atty. F. R. Soriano Vat - Exercises 7: First Quarterela kikayNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- Value Added TaxDocument5 pagesValue Added TaxRaven Vargas DayritNo ratings yet

- xP04 Value Added Tax Booklet PDFDocument70 pagesxP04 Value Added Tax Booklet PDFmae KuanNo ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- Tax QuizzerDocument33 pagesTax QuizzerClarisse Peter86% (14)

- Philippine Association of Certified Tax TechniciansDocument3 pagesPhilippine Association of Certified Tax Techniciansucc second yearNo ratings yet

- ACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertDocument77 pagesACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertTawanda Tatenda Herbert100% (4)

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- Tax Lecture VATDocument4 pagesTax Lecture VATRozzane Ann RomaNo ratings yet

- 1.1 Problems On VAT (PRTC) PDFDocument17 pages1.1 Problems On VAT (PRTC) PDFmarco poloNo ratings yet

- VAT QuizzerDocument16 pagesVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- Quiz For Business TaxDocument5 pagesQuiz For Business TaxAngela WaganNo ratings yet

- Chapter 9 Part 2 Input VatDocument24 pagesChapter 9 Part 2 Input VatChristian PelimcoNo ratings yet

- Tax 2 PDFDocument16 pagesTax 2 PDFLeah MoscareNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- VAT Pre-TestDocument6 pagesVAT Pre-TestGorden Kafare BinoNo ratings yet

- Tutorial 6Document4 pagesTutorial 6MisteroNo ratings yet

- Tax 2 - Midterm Quiz 1Document6 pagesTax 2 - Midterm Quiz 1Uy SamuelNo ratings yet

- VAT and OPTDocument10 pagesVAT and OPTSharon CarilloNo ratings yet

- DocxDocument14 pagesDocxtrisha100% (1)

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document10 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Assignment - VAT On Sale of Services, Use or Lease of Property, ImportationDocument3 pagesAssignment - VAT On Sale of Services, Use or Lease of Property, ImportationBenzon Agojo OndovillaNo ratings yet

- Midterm Examination BSAISDocument11 pagesMidterm Examination BSAISAlexis Kaye DayagNo ratings yet

- Tax.M-1403 Value Added Tax Problem 1: AnswerDocument28 pagesTax.M-1403 Value Added Tax Problem 1: Answermichean mabao75% (8)

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- CPA Review - VAT Quizzer - 2019Document11 pagesCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- Other Percentage TaxDocument2 pagesOther Percentage TaxGerald SantosNo ratings yet

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- VATDocument5 pagesVATCyril John RamosNo ratings yet

- Answer Key To Quiz 2 MidtermsDocument2 pagesAnswer Key To Quiz 2 MidtermsRyan Christian Balanquit100% (1)

- Vat OptDocument24 pagesVat OptCharity Venus100% (1)

- Quiz - Business TaxesDocument4 pagesQuiz - Business TaxesFery Ann C. BravoNo ratings yet

- Problem 1: CAT LEVEL 3 - SET 4 QuestionsDocument4 pagesProblem 1: CAT LEVEL 3 - SET 4 QuestionsEliza BethNo ratings yet

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Activity 2 Problems Vat On Sale of Goods or PropertiesDocument3 pagesActivity 2 Problems Vat On Sale of Goods or PropertiesNiña Mae NarcisoNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Adzu Tax02 A Course OutlineDocument3 pagesAdzu Tax02 A Course OutlineJustine Paul Pangasi-anNo ratings yet

- Law On Corporation 1Document28 pagesLaw On Corporation 1Justine Paul Pangasi-anNo ratings yet

- Adzu Tax02 A Learning Packet 1 Orientation and Business TaxesDocument4 pagesAdzu Tax02 A Learning Packet 1 Orientation and Business TaxesJustine Paul Pangasi-anNo ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Law On PartnershipDocument15 pagesLaw On PartnershipJustine Paul Pangasi-anNo ratings yet

- DocumentDocument2 pagesDocumentJustine Paul Pangasi-anNo ratings yet

- MANACC01Document4 pagesMANACC01Justine Paul Pangasi-anNo ratings yet

- BusanaDocument5 pagesBusanaJustine Paul Pangasi-anNo ratings yet