Professional Documents

Culture Documents

(Vivek Kbmar) : T4 Tte Haf-400 021

(Vivek Kbmar) : T4 Tte Haf-400 021

Uploaded by

GAURAV SAKHARKAR0 ratings0% found this document useful (0 votes)

12 views1 pageThe Central Bank of India has revised the interest rates for its Cent Grih Lakshmi home loan scheme. For loan amounts of 800 and above and 775 to 799 on the credit information bureau scale, the interest rate has been reduced to 8.45% and 8.5% respectively. The bank is promoting this women-focused loan scheme from March 5th to 31st, 2023, setting branch targets of 5 loans each and regional targets of the number of branches multiplied by 5 loans. Regional heads are advised to aggressively promote the scheme given the competitive interest rates on offer.

Original Description:

RATE OF INTEREST OF HOUSING LOAN

Original Title

ROI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Central Bank of India has revised the interest rates for its Cent Grih Lakshmi home loan scheme. For loan amounts of 800 and above and 775 to 799 on the credit information bureau scale, the interest rate has been reduced to 8.45% and 8.5% respectively. The bank is promoting this women-focused loan scheme from March 5th to 31st, 2023, setting branch targets of 5 loans each and regional targets of the number of branches multiplied by 5 loans. Regional heads are advised to aggressively promote the scheme given the competitive interest rates on offer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 page(Vivek Kbmar) : T4 Tte Haf-400 021

(Vivek Kbmar) : T4 Tte Haf-400 021

Uploaded by

GAURAV SAKHARKARThe Central Bank of India has revised the interest rates for its Cent Grih Lakshmi home loan scheme. For loan amounts of 800 and above and 775 to 799 on the credit information bureau scale, the interest rate has been reduced to 8.45% and 8.5% respectively. The bank is promoting this women-focused loan scheme from March 5th to 31st, 2023, setting branch targets of 5 loans each and regional targets of the number of branches multiplied by 5 loans. Regional heads are advised to aggressively promote the scheme given the competitive interest rates on offer.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

gs am fea

Central Bank of India

CENTRAL TO You sINCE 1911

Central Office, Chander Mukhi,

T4 tte Haf-400 021 Nariman Point, Mumbai400021

RETAIL & CONSUMER LENDING DEPARTMENT

INSTRUCTION CIRCULAR NO: 3500 DATE: 04.03.2023

FILE NO:97 DEPARTMENT RUNNING NO: 526

ALL BRANCHES/ OFFICES

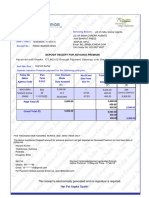

REG: REVISsION OF ROI OF CENT GRIH LAKSHMIM HOME LOAN SCHEME

Cent Grih Lakshmi, being women focused loan & having received good traction in market till

date.

Considering Women's Day on the 8" March 2023 & in line with the peer banks, we are

pleased to inform you realignment of Rate of Interest in Cent Grih Lakshmi (refer eariier

Instruction Circular No: 3433 dated

04.01.2023) in the upper two CIC bracket (800 & above

and 775 to 799).

The Scheme is valid from 05.03.2023 till 31.03.2023. The

details are as under:

REVISED ROI ON CENT GRIH LAKSHMI HOUSING LOAN SCHEME

CIC ROI

Transunion CRIF Experian Benchmark Repo Rate CRP Effective ROI

CIBIL

-800 >710 >=775 1.95 8.45

775-799 695-709 746-774

2.00 8.50

750-774 680-694 731-745 Repo Rate 6.50% 2.30 8.80

725-749

665-679 716-730

2.50 9.00

700-724 650-664 700-715 2.70 9.20

Incase of -1/0 scores of CIC will be treated as equivalent to 725-749

bracket of CIBIL( for borrowers+ Co-borrowers)

(Norelaxation in CIC Score)

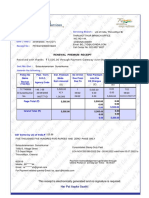

A target of 5 Cent Grih Lakshmi Proposal per branch has been fixed for the next

26 days.

Cumulatively each Region has to achieve a target of No of branches* 5 Cent Grih Lakshmi

loan till 31" March 2023.

Each region Head is advised to push aggressively the scheme with this unbelievable

competitiye Rate of Interest in Cent Grih Lakshmi.

(VIVEKKBMAR)

GENERAL MANAGER

You might also like

- Mutual Fund StatementDocument3 pagesMutual Fund StatementSaurabh Kumar80% (5)

- Internship ReportDocument28 pagesInternship ReportSobia Jamil100% (3)

- Sample Networking ProposalDocument13 pagesSample Networking ProposalPhilson Nah83% (6)

- Request For Allotment of Petrol PumpDocument3 pagesRequest For Allotment of Petrol PumpshubhsarNo ratings yet

- Mr. Senthil Ram 4477 XXXX XXXX 2001: Customer Name Card Account NoDocument3 pagesMr. Senthil Ram 4477 XXXX XXXX 2001: Customer Name Card Account NoLeonardo GarciaNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Mrs Nithya S No.17 C, 3Rd Cross Street, Sri Sathya Sai Nagar, Rajakilpakkam, CHENNAI-600073Document1 pageMrs Nithya S No.17 C, 3Rd Cross Street, Sri Sathya Sai Nagar, Rajakilpakkam, CHENNAI-600073Prakash ChandrasekaranNo ratings yet

- MD Zulhaidi 1Document1 pageMD Zulhaidi 1limcheeshin94No ratings yet

- 2704221707-Final Tender Document - Engagement of Manpower Service ProviderDocument41 pages2704221707-Final Tender Document - Engagement of Manpower Service Providersandeepsen1100No ratings yet

- Anchor IntimationDocument2 pagesAnchor IntimationNIkhil GuptaNo ratings yet

- 2023 09 16 08 39 30aug 23 - 833201Document4 pages2023 09 16 08 39 30aug 23 - 833201librar.rinki2002No ratings yet

- 17mba22 FM T2 KeyDocument7 pages17mba22 FM T2 KeySwathi ShanmuganathanNo ratings yet

- 2023 05 10 09 09 26mar 23 - 209861Document7 pages2023 05 10 09 09 26mar 23 - 209861shiva vermaNo ratings yet

- Management AccountingDocument4 pagesManagement Accountingbrightnandha2No ratings yet

- 2023 12 07 13 40 24sep 23 - 492015Document8 pages2023 12 07 13 40 24sep 23 - 492015Sanjay SinghNo ratings yet

- MR Solanki Vikram BEHIND I.O.C, 53, Mahadev Colony, Sendra Road Beawar Ajmer, BEAWAR-305901Document1 pageMR Solanki Vikram BEHIND I.O.C, 53, Mahadev Colony, Sendra Road Beawar Ajmer, BEAWAR-305901arsolanki.beawarNo ratings yet

- About LichflDocument17 pagesAbout LichflHyma KavyaNo ratings yet

- Observer Bill AllDocument1 pageObserver Bill Allseetar550No ratings yet

- IT Certificate 668951954Document1 pageIT Certificate 668951954Sidharth SNo ratings yet

- RV 31032010Document218 pagesRV 31032010Shamanth1No ratings yet

- Received With Thanks ' 5,900.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 5,900.00 Through Payment Gateway Over The Internet FromNishant KumarNo ratings yet

- 2023 08 01 16 27 01jun 23 - 521001Document3 pages2023 08 01 16 27 01jun 23 - 521001vinodaaubbriNo ratings yet

- Statement of Account: I-4-17 Sek 2 Pangsapuri Seri Mas Taman Pinggiran Putra Seri Kembangan 43300 SELANGORDocument7 pagesStatement of Account: I-4-17 Sek 2 Pangsapuri Seri Mas Taman Pinggiran Putra Seri Kembangan 43300 SELANGORWa LuvWanNo ratings yet

- 3 in 1 Account Opening - Proposal PDFDocument4 pages3 in 1 Account Opening - Proposal PDFbikash PrajapatiNo ratings yet

- Executive Position Scope of ResponsibilitiesDocument11 pagesExecutive Position Scope of ResponsibilitiesMishe MonaNo ratings yet

- Phase 1 Ext.Document6 pagesPhase 1 Ext.Ali HaiderNo ratings yet

- May CSD Car Price List With DL RegDocument17 pagesMay CSD Car Price List With DL RegkhajaNo ratings yet

- 2024 03 11 10 24 56jun 23 - 110086Document3 pages2024 03 11 10 24 56jun 23 - 110086aslamkhan110084No ratings yet

- Sep2017Document1 pageSep2017ramachariNo ratings yet

- Quotation QMS TrigstationDocument3 pagesQuotation QMS TrigstationNurul JannatiNo ratings yet

- Jul2019 PDFDocument2 pagesJul2019 PDFGaurav KumarNo ratings yet

- Circular Renewal CampaignDocument5 pagesCircular Renewal CampaignSaikat ChakrabortyNo ratings yet

- Estatement20231015 000795996Document2 pagesEstatement20231015 000795996haswini baskaranNo ratings yet

- CSB Bank LTD - IPO Note - Nov'19Document10 pagesCSB Bank LTD - IPO Note - Nov'19puchooNo ratings yet

- UntitledDocument18 pagesUntitledVed Prakash PantNo ratings yet

- School of Management Studies: Summer Internship Program 16Document13 pagesSchool of Management Studies: Summer Internship Program 16samalanuNo ratings yet

- Lic 230922Document1 pageLic 230922Suresh KumarNo ratings yet

- Partial Transaction Listing: L017G-SBI Large & Midcap Fund Regular GrowthDocument3 pagesPartial Transaction Listing: L017G-SBI Large & Midcap Fund Regular GrowthKirti Kant SrivastavaNo ratings yet

- 2024 01 20 09 30 40dec 23 - 763003Document5 pages2024 01 20 09 30 40dec 23 - 763003chinmaychandra833No ratings yet

- 2024 03 29 12 27 22feb 24 - 201102Document4 pages2024 03 29 12 27 22feb 24 - 201102zamirsaifi613No ratings yet

- Sbi So Notification 6Document2 pagesSbi So Notification 6Khushpreet KaurNo ratings yet

- OnlineWL 8378 03 Apr 19 070849Document15 pagesOnlineWL 8378 03 Apr 19 070849velmurug_balaNo ratings yet

- Statement of Account: No. 32A. Tingkat 1 Jalan Bds 2 Bukit Desa Semantan 28000 Temerloh, PahangDocument4 pagesStatement of Account: No. 32A. Tingkat 1 Jalan Bds 2 Bukit Desa Semantan 28000 Temerloh, PahangFerhan IskandarNo ratings yet

- NO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahDocument1 pageNO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahMuhammad ikmail KhusaimiNo ratings yet

- Sbil RPRDocument1 pageSbil RPRjothikumar1405No ratings yet

- Home Loan AllDocument3 pagesHome Loan Allsumanpal78No ratings yet

- 2024 02 02 19 10 38oct 23 - 754028Document6 pages2024 02 02 19 10 38oct 23 - 754028SR CREATIONNo ratings yet

- Siva Sivani 27.05.2023Document1 pageSiva Sivani 27.05.2023Sridhar GandikotaNo ratings yet

- Loan StatusDocument1 pageLoan StatusAshok_naik1No ratings yet

- OfferLetter 712470 31012024 9928 638423112048934621Document6 pagesOfferLetter 712470 31012024 9928 638423112048934621My ArchitectNo ratings yet

- Tyre Sale, Wheel Balancing & Wheel Alignment Workshop: Project Report ofDocument5 pagesTyre Sale, Wheel Balancing & Wheel Alignment Workshop: Project Report ofYASIR HUSSAIN100% (1)

- Primal Hormones Made by Aesthetic Primal 1Document9 pagesPrimal Hormones Made by Aesthetic Primal 1Amar NalawadeNo ratings yet

- May2018Document2 pagesMay2018ranjith123No ratings yet

- Genique Medcrop PVT LTD CmefDocument1 pageGenique Medcrop PVT LTD Cmefmangalsinghsugra26No ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountABhishekNo ratings yet

- 2024 03 29 12 28 15dec 23 - 201102Document6 pages2024 03 29 12 28 15dec 23 - 201102zamirsaifi613No ratings yet

- Super 60 Questions CA Final AFM For MAy 24 ExamsDocument42 pagesSuper 60 Questions CA Final AFM For MAy 24 ExamsHenry HundersonNo ratings yet

- Ajay Kumar: Portfolio SummaryDocument10 pagesAjay Kumar: Portfolio Summaryrameshkumar6005.rjNo ratings yet

- 2024 04 04 16 10 11feb 24 - 248001Document9 pages2024 04 04 16 10 11feb 24 - 248001shrijalsharma28No ratings yet

- January ExpatDocument5 pagesJanuary ExpatjawadkaNo ratings yet

- 2024 04 07 15 23 29feb 24 - 641603Document4 pages2024 04 07 15 23 29feb 24 - 641603Pratap PratapNo ratings yet

- Evaluation of BC ModelDocument46 pagesEvaluation of BC ModelPiyuksha PargalNo ratings yet

- ISO 50001 Course ContentsDocument4 pagesISO 50001 Course ContentsgiridharNo ratings yet

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDocument36 pagesLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNo ratings yet

- Impact A Guide To Business Communication Canadian 9th Edition Northey Solutions ManualDocument11 pagesImpact A Guide To Business Communication Canadian 9th Edition Northey Solutions ManualMarkJoneskjsme100% (13)

- Form16A - Amazon - AAJCA9880A - 2021-2022 - Q4Document3 pagesForm16A - Amazon - AAJCA9880A - 2021-2022 - Q4hello8434No ratings yet

- Glitter Laser Machines CashDocument5 pagesGlitter Laser Machines CashAns JoaquinNo ratings yet

- Classroom, Docs and FormDocument4 pagesClassroom, Docs and FormRavishankar HobannaNo ratings yet

- 1016 - How To Make $2,000 Per Week With Beyond InfinityDocument10 pages1016 - How To Make $2,000 Per Week With Beyond InfinityPolly WopsNo ratings yet

- Fall/Winter 2009 Fairmont Employee DialogueDocument29 pagesFall/Winter 2009 Fairmont Employee DialogueKatie PearseNo ratings yet

- Media Literature Review ExampleDocument8 pagesMedia Literature Review Exampleafdtrtrwe100% (1)

- Lesson 14 - Maintenance of Registers and RecordsDocument4 pagesLesson 14 - Maintenance of Registers and RecordshemaNo ratings yet

- Juniper IDP OverviewDocument55 pagesJuniper IDP OverviewPichai Ng-arnpairojhNo ratings yet

- Alpha - ESS - Economic-On (LatAm) - Draft-AgreementDocument5 pagesAlpha - ESS - Economic-On (LatAm) - Draft-AgreementLu VernNo ratings yet

- SGS Textile Sustainability EN 11Document8 pagesSGS Textile Sustainability EN 11Utilities2No ratings yet

- Presentation On: Department of Business and Administration Course Code: MIS-202Document12 pagesPresentation On: Department of Business and Administration Course Code: MIS-202TAWHID ARMANNo ratings yet

- Deed of Absolute Sale: TCT NO. T-123456Document2 pagesDeed of Absolute Sale: TCT NO. T-123456Aianna Bianca Birao (fluffyeol)0% (1)

- Cultural Drivers of Corruption in GovernanceDocument2 pagesCultural Drivers of Corruption in GovernanceJonalvin KENo ratings yet

- Industry 4.0 - A Way From Mass Customization To Mass Personalization ProductionDocument10 pagesIndustry 4.0 - A Way From Mass Customization To Mass Personalization ProductionHazim FawziNo ratings yet

- Whole Cloud Computing 2Document261 pagesWhole Cloud Computing 2Prince PatilNo ratings yet

- Hyperion 2 PDFDocument1 pageHyperion 2 PDFAbhishek Gite100% (1)

- Theories of EntrpreneurshipDocument36 pagesTheories of EntrpreneurshipRicha BhatiaNo ratings yet

- Taipei GEAF MinisetDocument22 pagesTaipei GEAF MinisetPhilip ZhengNo ratings yet

- Ocampo Vs NLRC PDFDocument2 pagesOcampo Vs NLRC PDFKristine NebresNo ratings yet

- Course Note 2 - RA6117284 - Sofia Rizki AuliaDocument2 pagesCourse Note 2 - RA6117284 - Sofia Rizki Auliasofia auliaNo ratings yet

- An Experimental Analysis On Overall Equipment EffectivenessDocument16 pagesAn Experimental Analysis On Overall Equipment EffectivenessInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Power: Contrasting Leadership and PowerDocument17 pagesPower: Contrasting Leadership and PowerPrasanna PrasannaNo ratings yet

- Accounting Level 3 Assignment 1Document9 pagesAccounting Level 3 Assignment 1Markos Getahun100% (2)

- Dokumen - Tips Zara Swot Analysis and TowsDocument9 pagesDokumen - Tips Zara Swot Analysis and TowsAlperen CeliktasNo ratings yet