Professional Documents

Culture Documents

Cost - Chapter 3

Uploaded by

Shenina Manalo0 ratings0% found this document useful (0 votes)

6 views8 pagesnnnnnn

Original Title

COST_CHAPTER 3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnnnnnn

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views8 pagesCost - Chapter 3

Uploaded by

Shenina Manalonnnnnn

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

CHAPTER 3: COSTS, COST

DRIVERS, COST OBJECTS, AND

2 TYPES OF ASSIGNMENT

COST ASSIGNMENT

1) DIRECT TRACING – used for

COST – incurred when a resource is

assigning direct costs.

used for some purpose.

2) ALLOCATION – used for indirect

COST POOLS – meaningful groups into costs.

which costs are collected.

DIRECT COST – cost that can be

Costs can be grouped in many ways: conveniently and economically traced

directly to a cost pool or a cost object.

1) TYPE OF COST

Labor cost in one pool EX: the number of cartons of tide

Material costs in another produced by P&G or the number of

2) BY SOURCE passengers on flight 617 for delta air

Department 1 lines.

Department 2 INDIRECT COST – not conveniently or

3) BY RESPONSIBILITY economically traceable to a specific cost

Manager 1 pool or cost object.

Manager 2

EX: cost of supervising manufacturing

Ex: an assembly department or a employees and cost of handling

product engineering department might materials

be treated as a cost pool.

COST ALLOCATION – process of

COST DRIVER – factor that causes or assigning indirect costs to cost pools

relates to a change in the total cost of and cost objects.

an activity.

ALLOCATION BASES – cost drivers

COST OBJECT – any product, service, used to allocate or assign cost to cost

customer, activity, or organizational unit objects.

to which costs are accumulated for

some management purpose.

VALUE STREAM – group of related

products; useful for preparing

profitability reports as part of lean

accounting; all the activities required to

create customer value for a family of

products or services.

COST ASSIGNMENT – process of

assigning costs to cost pools or from

cost pools to cost objects.

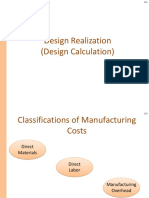

1) Direct materials

2) Direct labors

DIRECT MATERIAL COST – cost of

3) Factory overhead

materials in the product and a

reasonable allowance for scrap and *sometimes combined for simplicity

defective units. and convenience.

Less purchase discounts but PRIME COST - Sum of direct materials

including freight and related and direct labor.

charges.

CONVERSION COST - direct labor and

INDIRECT MATERIAL COST – cost of factory overhead combined into a single

materials used in manufacturing that are amount.

not part of the product or are not easily

COST DRIVERS AND COST

or economically traceable to the finished

BEHAVIOR

product, a component of total

manufacturing overhead. Cost drivers provide two important roles

for the management accountant:

DIRECT LABOR COST – used to

manufacture the product or to provide 1) Enabling the assignment of costs

the service. to cost object

2) Explaining the cost behavior –

Plus, some portion of non-

that is the change in the total

value-added time that is

amount of a cost associated with

normal and unavoidable, such

changes in the level of a cost

as coffee breaks.

driver.

INDIRECT LABOR COST – associated

Generally, an increase in a cost driver

with production that are not considered

will cause an increase in total cost.

direct labor.

FOUR TYPES OF COST DRIVERS

EX: supervision, quality control,

inspection, purchasing and receiving 1) ACTIVITY-BASED COST

DRIVERS – developed at a

OTHER INDIRECT COSTS

detailed level of operations and

OVERHEAD – all the indirect cost are associated with a given

commonly combined into a single cost manufacturing activity

pool; called factory overhead in a Those factors that cause or

manufacturing firm. contribute to the changes in

an activity.

FACTORY OVERHEAD – all the indirect

ACTIVITY ANALYSIS, a

manufacturing cost commonly combined

detailed description of the

into a single cost pool in a

specific activities performed in

manufacturing firm.

the firm’s operations.

THREE TYPES OF COST

VARIABLE COST – changes in total

in response to changes in or more

cost drivers.

FIXED COST – portion of the total

cost that, within the relevant range,

does not change with a change in

the quantity of a designated cost

driver.

2) VOLUME-BASED COST TOTAL FIXED COST and UNIT

DRIVERS – developed at an VARIABLE COSTS are expected to

aggregate level and relate to the remain approximately constant within

amount produced or quantity of the relevant range.

service provided. MIXED COST – cost that within the

Management accountants relevant range, includes both

commonly call this volume, variable and fixed cost components.

volume of output or simply

output. The determination if whether a cost is

variable depends on the nature of the

The three cost drivers are all volume- cost object.

based cost drivers and are proportional

to each other. When we want to understand the cost of

behavior of a certain cost object, we

The output of complete units have to consider the following three

The quantity (in pounds, etc) questions:

of direct materials

1) What is the cost driver (or cost

The hours of direct labor

drivers if there are two or more)

RELEVANT RANGE – the range of the for this cost object?

cost driver in which the actual value of 2) What is the relevant range if the

the cost driver is expected to fall, and for cost driver for which we are

which the relationship between the cost developing the cost estimate?

and the cost driver is assumed to be 3) What time horizon (usually one

approximately linear. year) are we using for fixed

costs?

3) STRUCTURAL COST

4) EXECUTIONAL COST- both are STEP COSTS – cost that varies with the

involved strategic and operational cost driver, but in discrete steps within

decisions that affect the the relevant range; also called semi-

relationship between these cost fixed cost.

drivers and total cost.

UNIT COST – total cost (materials, 1) WORKFORCE EMPOWERMENT

labor, and overhead) divided by the – firms with strong employee

number of units of output. relationships can reduce

operating costs significantly.

- Aka AVERAGE COST

2) DESIGN OF THE PRODUCTION

STRUCTURAL COST DRIVERS- PROCESS – speeding up the

strategic plans and decisions that have flow of product through the firm

a long-term effect regarding issues such can reduce costs.

as scale, experience, technology, and 3) SUPPLIER RELATIONSHIP –

complexity. maintain a low-cost advantage

partially through agreements with

Four examples of decision involving their suppliers to provide

structural cost drivers: products that meet the

1) SCALE – larger firms have lower companies’ requirements.

overall costs as a result of THE FIVE STEPS OF STRATEGIC

economies of scale. DECISION MAKING FOR PROCTER

2) EXPERIENCE – firms having AND GAMBLE

employees with greater

manufacturing and sales 1) Determine the strategic issues

experience will likely have lower surrounding the problem.

development, manufacturing, and 2) Identify the alternative actions

distribution cost. 3) Obtain information and conduct

3) TECHNOLOGY – new analyses of the alternatives

technologies can reduce design, 4) Based on strategy and analysis,

manufacturing, distribution, and choose, and implement the

customer service costs desired alternative

significantly. 5) Provide an ongoing evaluation of

4) COMPLEXITY – firms with many the effectiveness of

products have higher costs of implementation in step 4

scheduling and managing the

production process.

EXECUTIONAL COST DRIVERS –

factors that the firm can manage in the

short term to reduce costs such as

workforce involvement, design of the

production process, and supplier

relationships.

Three examples of executional cost

drivers:

1) Manufacturing departments can - Helps improve operational and

be considered either cost pools management control in the firm.

or cost objects. - Used to identify activity-based

2) A cost is only incurred when cash cost drivers.

changes hands. (FALSE) 14) Indirect labor includes factory

3) Which of the following is not an supervisors and material

indirect cost when the cost object handlers. (TRUE)

is an airline passenger? 15) Labor can sometimes be both

- Cost of food and beverages direct and indirect depending on

served on the plane. the cost object. (TRUE)

4) When direct tracing is not 16) The law of diminishing marginal

economically feasible, indirect productivity occurs at higher

cost is used to assign cost to cost levels of the cost driver. (TRUE)

pools and cost objects. 17) At low values for the cost driver,

5) The concept of cost objects costs increase at a decreasing

includes products and groups of rate. (TRUE)

products which are called value 18) The total cost curve is

stream/streams. approximately linear within the

6) Assembly workers’ wages are relevant range.

always direct labor but some 19) The pattern of increasing costs

labor costs such as payroll taxes at a decreasing rate is often

and training may be treated as referred to as increasing marginal

indirect labor. productivity.

7) Cost drivers are also called 20) Within the relevant range of

allocation base/ bases. activity total fixed and per unit

8) A clothing manufacturer would available cost are expected to

most likely treat the cost of thread remain approximately constant.

as a(n) indirect material. 21) At low values for the cost driver,

9) Indirect costs are assigned using costs increase at a decreasing

cost drivers. rate. (TRUE)

10) Enabling the assignment of costs 22)The law of diminishing marginal

to cost objects and explaining productivity occurs at higher

cost behavior are the two levels of the cost driver. (TRUE)

important roles provided by cost 23) The cost driver for a variable

drivers. cost can be either volume-based

11) Conversion costs do not include or activity-based. (TRUE)

direct materials. 24) The determination of whether a

12) When direct tracing is not cost is variable on the cost driver

economically feasible, cost chosen. (FALSE)

allocation is used to assign cost - The determination depends on

to cost pools and cost objects. the nature of the cost object.

13) Activity analysis:

25) Within the relevant range of 36) For a manufacturer, upstream

activity, per unit variable costs and downstream costs are not

and total fixed costs are expected product costs.

to remain approximately

constant. 37) Cost of goods sold is an asset.

26) Costs that are defined for a (FALSE)

period of time rather than in

relation to volume of output are 38) Factors the firm can manage in

fixed costs. the short term to reduce costs are

27) Total cost within the relevant activity-based cost drivers.

range that includes both variable

and fixed components is referred 39) The value chain of a

to as a fixed cost. manufacturer begins with

28) Total cost of resources upstream activities such as

consumed divided by the number design and ends with

of units of output is the downstream activities including

average/unit cost. customer service.

29) Costs that are consumed during

operations are variable cost. 40) Costs that are expensed as

30) FIXED COSTS incurred are called period costs.

- Are generally not expected to

change within a year 41) Workforce empowerment, not an

- Are defined for a period of time example of a decision involving

31) A cost that varies in increments structural cost drivers.

greater that the number of units

as the volume of the cost driver 42) Cost of items are ready for sale

changes is a step cost. are held in finished goods

32) To properly interpret total inventory.

average unit cost, it must be

separated into unit variable and 43) Supplier relationships, example

unit fixed costs. (TRUE) of an executional cost driver.

33) Costs that provide capacity for

operations are fixed cost. 44) Costs added to work-in-process

34) Because they involve decisions inventory include direct labor cost

that have long-term effects on the and overhead cost.

firm’s total costs, structural cost

drivers are strategic in nature. 45) Product costs for a

35) The dollar amount of a product merchandising company include

transferred to the income transportation costs to get the

statement at the time of a sale is product to where it will be sold.

called cost of goods sold.

46) Selling and administrative costs 52) Costs added to work in process

are never product costs. inventory include direct labor cost

and overhead cost.

47) The sum of direct materials used 53) Internal accounting controls:

direct labor and overhead is - Restrict and guide financial

called total manufacturing costs. processing activities

- Consist of policies and

48) Manufacturing companies use procedures

three inventory accounts: - Are designed to prevent or detect

Materials Inventory, Work in errors and fraud.

process inventory and finished 54) The cost of goods finished and

goods inventory. transferred out of the work in

process inventory account during

49) Beginning inventory + cost a specified period is called cost of

added = cost transferred out + goods manufactured.

ending inventory 55) Cost of goods sold: 821000

+Cost of goods manufactured –

50) The accounting records of 854000

Caldwell company revealed the ff +Finished goods 1/1 – 135000

costs: -Finished foods 1/31 – 168000

*changes in work process are

Direct labor used – 170000 incorporated in cost of goods

Direct materials used – 350000 manufactured.

Manufacturing overhead –

56) The cost of delay can be

4000000

significant in many decisions if

Selling and administrative

information is not timely.

expenses – 250000

Product costs total = 920000 57) A primary way to ensure accurate

51) Cost of goods manufactured: data is to have effective internal

215 accounting controls.

+Direct materials used – 75

+Direct labor – 80 58) Having necessary information

+Manufacturing overhead – 100 available to management to facilitate

+Beginning work in process – 10 effective decision making is timeliness.

-Ending work in process – 50 59) Costs added to work in process

52) The calculation of cost of goods inventory include overhead cost and

sold is direct labor cost.

Beginning finished goods + cost 60) Because of the value of cost

of goods manufactured + ending management information, preparation

finished goods. costs should not be a consideration

(FALSE)

61) Point of sale updates to the

inventory levels is occur when using a

perpetual inventory system.

62) Cost of goods manufactured

includes only product costs.

63) Factors that influence the cost of

preparing information for decision

making include:

- level of desired accuracy

- timeliness

- level of aggregation

64) The ending balance of inventory is

determined by a count when using a

periodic inventory system.

You might also like

- Cost - Chapter 3 & 4Document11 pagesCost - Chapter 3 & 4Shenina ManaloNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- MDTERM EXAMINATION REVIEWER ACC211bDocument6 pagesMDTERM EXAMINATION REVIEWER ACC211bSITTIE SAILAH PATAKNo ratings yet

- COST ACCOUNTING FUNDAMENTALSDocument4 pagesCOST ACCOUNTING FUNDAMENTALSClariz Angelika EscocioNo ratings yet

- Cost Accounting IntroductionDocument21 pagesCost Accounting Introductionjeyoon13No ratings yet

- 25885110Document21 pages25885110Llyana paula SuyuNo ratings yet

- Finals Reviewer Cost AccDocument12 pagesFinals Reviewer Cost AccLuna KimNo ratings yet

- STRACOSMAN - Chapter 2Document6 pagesSTRACOSMAN - Chapter 2Rae WorksNo ratings yet

- Unit 1 C.ADocument14 pagesUnit 1 C.Ateklay asmelashNo ratings yet

- Cost Terminology and Cost BehaviorsDocument2 pagesCost Terminology and Cost BehaviorsNicole Anne Santiago SibuloNo ratings yet

- Fima PrelimDocument9 pagesFima PrelimCharles IldefonsoNo ratings yet

- BASIC COST MANAGEMENT CONCEPTSDocument7 pagesBASIC COST MANAGEMENT CONCEPTSHeizeruNo ratings yet

- Managerial Accounting Chap 2Document72 pagesManagerial Accounting Chap 2Sankary CarollNo ratings yet

- Unit 1: Classification of Cost ContentDocument14 pagesUnit 1: Classification of Cost ContentSimon MollaNo ratings yet

- Cost Classifications ExplainedDocument2 pagesCost Classifications ExplainedErwin FernandezNo ratings yet

- Review Chapter 1-2-4-18Document55 pagesReview Chapter 1-2-4-18hoangmyduyennguyen2004No ratings yet

- Cost Chapter TwoDocument34 pagesCost Chapter TwoDEREJENo ratings yet

- Managerial Accounting Module: Costs in Managerial AccountingDocument7 pagesManagerial Accounting Module: Costs in Managerial AccountingReynold Raquiño AdonisNo ratings yet

- Week 2 - Lesson 2 Costs in Managerial AccountingDocument7 pagesWeek 2 - Lesson 2 Costs in Managerial AccountingReynold Raquiño AdonisNo ratings yet

- 02 MAS - Cost ConceptDocument10 pages02 MAS - Cost ConceptKarlo D. ReclaNo ratings yet

- Cost AccountingDocument2 pagesCost AccountingSherilyn LozanoNo ratings yet

- CA2 Cost Concepts and ClassificationDocument19 pagesCA2 Cost Concepts and ClassificationhellokittysaranghaeNo ratings yet

- Cost TerminologyDocument2 pagesCost TerminologyChristine TutorNo ratings yet

- Accounting cases cost systems behavior costsDocument28 pagesAccounting cases cost systems behavior costsKrishna RaiNo ratings yet

- Cost Management Concepts ExplainedDocument13 pagesCost Management Concepts Explainedestihdaf استهدافNo ratings yet

- CH 02Document40 pagesCH 02lyonanh289No ratings yet

- Basicconceptsofcostaccounting 141207032058 Conversion Gate02Document53 pagesBasicconceptsofcostaccounting 141207032058 Conversion Gate02sajjadNo ratings yet

- Managerial Accounting and Cost ConceptsDocument57 pagesManagerial Accounting and Cost ConceptsFrances Monique AlburoNo ratings yet

- Ch01 Managerial Accounting and Cost ConceptsDocument34 pagesCh01 Managerial Accounting and Cost ConceptsZahra ZahraNo ratings yet

- Cost AccountingDocument2 pagesCost AccountingKNo ratings yet

- LH - 02 - CAC - Cost Concepts and ClassficationDocument16 pagesLH - 02 - CAC - Cost Concepts and ClassficationDexter CanietaNo ratings yet

- COST ACCOUNTING CONCEPTSDocument2 pagesCOST ACCOUNTING CONCEPTSHoney MuliNo ratings yet

- Managerial Accounting and Cost ConceptsDocument18 pagesManagerial Accounting and Cost ConceptsrisaNo ratings yet

- NOTES - CHAPTER II - Cost Accounting and ControlDocument11 pagesNOTES - CHAPTER II - Cost Accounting and ControlHanna CasasNo ratings yet

- MS03 - Cost Behavior and Cost Classification PDFDocument12 pagesMS03 - Cost Behavior and Cost Classification PDFTina PascualNo ratings yet

- Chap002 - Manag Acc & Cost ConceptDocument29 pagesChap002 - Manag Acc & Cost Conceptlilis astriyani sinagaNo ratings yet

- L1-Manufacturer's CostDocument19 pagesL1-Manufacturer's CostomarNo ratings yet

- Garrison Lecture Chapter 2Document61 pagesGarrison Lecture Chapter 2Ahmad Tawfiq Darabseh100% (2)

- Lean JIT Manufacturing CostsDocument3 pagesLean JIT Manufacturing CostsErika May EndencioNo ratings yet

- LP3-Product Costing MethodsDocument12 pagesLP3-Product Costing MethodsCarla GarciaNo ratings yet

- Cost Accounting Overview: Classifications, Methods, TechniquesDocument21 pagesCost Accounting Overview: Classifications, Methods, TechniquesYogita SinghNo ratings yet

- Design CostDocument21 pagesDesign CostDr. Ashish AggarwalNo ratings yet

- Managerial Accounting Chapter 2Document61 pagesManagerial Accounting Chapter 2Wajeeh RehmanNo ratings yet

- Cost Concepts and Analysis: Management Advisory ServicesDocument7 pagesCost Concepts and Analysis: Management Advisory ServicesAlexander QuemadaNo ratings yet

- Week 1 COST ACCOUNTINGDocument12 pagesWeek 1 COST ACCOUNTINGAlthea Lorraine MedranoNo ratings yet

- CA 02 - Costs - Concept and ClassificationsDocument8 pagesCA 02 - Costs - Concept and ClassificationsJoshua UmaliNo ratings yet

- 3.1 Nature of Cost, Cost Pools, Cost Objects, and Cost DriversDocument6 pages3.1 Nature of Cost, Cost Pools, Cost Objects, and Cost Driverslang droidNo ratings yet

- c1 - Introduction To Cost AccountingDocument2 pagesc1 - Introduction To Cost AccountingAndrea Camille AquinoNo ratings yet

- CMA CH 1 - Cost Concept, Behavior and Estimations March 2019-2Document58 pagesCMA CH 1 - Cost Concept, Behavior and Estimations March 2019-2Henok FikaduNo ratings yet

- Managerial Accounting and Cost ConceptsDocument61 pagesManagerial Accounting and Cost Conceptshaccp bkipmNo ratings yet

- Chapter 5-CLCDocument14 pagesChapter 5-CLCVăn ThànhNo ratings yet

- Chapter 2Document10 pagesChapter 2Aklil TeganewNo ratings yet

- Basic Concepts of Cost AccountingDocument51 pagesBasic Concepts of Cost AccountingMary ANo ratings yet

- Financial Accounting Management Accounting: Internal Users Managers For PlanningDocument4 pagesFinancial Accounting Management Accounting: Internal Users Managers For PlanningEpfie SanchesNo ratings yet

- Managerial Accounting For Managers 3rd Edition Noreen Solutions ManualDocument35 pagesManagerial Accounting For Managers 3rd Edition Noreen Solutions Manualrenewerelamping1psm100% (24)

- Managerial Accounting and Cost ConceptsDocument61 pagesManagerial Accounting and Cost ConceptsBobbles D LittlelionNo ratings yet

- Managerial Accounting and Cost ConceptsDocument44 pagesManagerial Accounting and Cost ConceptsQUANG NGUYỄN VINHNo ratings yet

- Cost Classification and BehaviorDocument5 pagesCost Classification and BehaviorShannonNo ratings yet

- An Introduction To Cost Terms and PurposesDocument33 pagesAn Introduction To Cost Terms and PurposesAi LatifahNo ratings yet

- Sa1 Reviewer PT.1Document8 pagesSa1 Reviewer PT.1Shenina ManaloNo ratings yet

- Cost ch6Document8 pagesCost ch6Shenina ManaloNo ratings yet

- Promissory NotesDocument7 pagesPromissory NotesShenina ManaloNo ratings yet

- Accounting Worksheet GuideDocument3 pagesAccounting Worksheet GuideShenina ManaloNo ratings yet

- Configure Quality Inspection in Ewm Step by Step ProcessDocument34 pagesConfigure Quality Inspection in Ewm Step by Step Processlostrider_991100% (4)

- Dagnachew GetachewDocument91 pagesDagnachew GetachewAhsan HumayunNo ratings yet

- Navi Consumer Loans Case SubmissionDocument4 pagesNavi Consumer Loans Case SubmissionABHIRAM MOLUGUNo ratings yet

- S216 FinalDocument7 pagesS216 FinalrudolNo ratings yet

- 5 Tips To Building Effective IBM Cognos Active ReportsDocument3 pages5 Tips To Building Effective IBM Cognos Active ReportsZameer SayedNo ratings yet

- Depreciation. PART 1 (Straight Line Variable Method) - 021728Document60 pagesDepreciation. PART 1 (Straight Line Variable Method) - 021728UnoNo ratings yet

- Excellence in Services: 24th International ConferenceDocument5 pagesExcellence in Services: 24th International ConferencemariagianniNo ratings yet

- Managerial Accounting II Case Study Analysis Harsh ElectricalsDocument7 pagesManagerial Accounting II Case Study Analysis Harsh ElectricalsSiddharth GargNo ratings yet

- 1-1 Introduction To Failure Analysis and PreventionDocument21 pages1-1 Introduction To Failure Analysis and PreventionIAJM777No ratings yet

- The corridor of customer satisfaction and loyalty in B2B marketsDocument16 pagesThe corridor of customer satisfaction and loyalty in B2B marketsJohn SmithNo ratings yet

- Sales and Marketing Channel Management (M3) : Course ObjectiveDocument37 pagesSales and Marketing Channel Management (M3) : Course ObjectiveDhanek NathNo ratings yet

- Step 6 Prepare Technology NegotiationsDocument6 pagesStep 6 Prepare Technology NegotiationsjaviarangoNo ratings yet

- Diwali Stock Picks for Samvat 2077/TITLEDocument9 pagesDiwali Stock Picks for Samvat 2077/TITLEJeevan RNo ratings yet

- Snap Inc FinalDocument35 pagesSnap Inc Finalapi-461693941No ratings yet

- Tesla Supplier Code of ConductDocument4 pagesTesla Supplier Code of ConductT.Y.A3 BHISARA SHREYANo ratings yet

- Google Adwords Fundamental Exam Questions & AnswersDocument21 pagesGoogle Adwords Fundamental Exam Questions & AnswersAvinash VermaNo ratings yet

- Adobe Scan 12-Jan-2024Document7 pagesAdobe Scan 12-Jan-2024Paawni GuptaNo ratings yet

- Event Tree Analysis ExplainedDocument13 pagesEvent Tree Analysis Explainedananthu.u100% (1)

- Unfuckyourbusiness PreviewDocument5 pagesUnfuckyourbusiness PreviewtesterNo ratings yet

- 01-BacarraIN2020 Audit ReportDocument91 pages01-BacarraIN2020 Audit ReportRichard MendezNo ratings yet

- IGEM 2016 Key in Enquiry 10 Oct 2016Document38 pagesIGEM 2016 Key in Enquiry 10 Oct 2016rexNo ratings yet

- Desktop Surveillance: National Accreditation Board For Testing and Calibration Laboratories (NABL)Document8 pagesDesktop Surveillance: National Accreditation Board For Testing and Calibration Laboratories (NABL)anupriya mittalhy6No ratings yet

- Cost of DebtDocument6 pagesCost of DebtrajisumaNo ratings yet

- DEED OF SALE and Assumption MortasgeDocument2 pagesDEED OF SALE and Assumption MortasgeGenyl Joy IlaganNo ratings yet

- Consumer Behavior 12th Edition Schiffman Test BankDocument31 pagesConsumer Behavior 12th Edition Schiffman Test Bankrowanbridgetuls3100% (24)

- CH 10. Globalization of Ethical Decision Making. Ed.10Document39 pagesCH 10. Globalization of Ethical Decision Making. Ed.10Karola MocanNo ratings yet

- International Business and Trade GuideDocument9 pagesInternational Business and Trade GuideGilbert Ocampo100% (2)

- Preventing Scope Creep To Avoid Project Delay NICEDocument15 pagesPreventing Scope Creep To Avoid Project Delay NICEzeekel1612No ratings yet

- Final Payment Certificate DomesticDocument1 pageFinal Payment Certificate DomesticDen OghangsombanNo ratings yet

- Case - INOXDocument2 pagesCase - INOXRam PowruNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)