Professional Documents

Culture Documents

Annex A Form 101 Checklist of Documents

Uploaded by

Adrian joseph AdrianoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex A Form 101 Checklist of Documents

Uploaded by

Adrian joseph AdrianoCopyright:

Available Formats

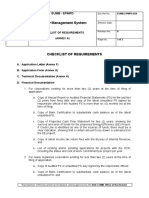

PCNC Form 101

PHILIPPINE COUNCIL FOR NGO CERTIFICATION

Annex A

CHECKLIST OF DOCUMENTS REQUIRED FOR PCNC ACCREDITATION AND

APPLICATION FOR BIR REGISTRATION AS DONEE INSTITUTION

INSTRUCTIONS: The following documents must be submitted in three (3) sets, organized sequentially as

presented below and labeled on the side accordingly for easy identification. PLEASE USE LONG, GREEN

EXPANDABLE FOLDER. DO NOT BIND THE DOCUMENTS. DO NOT USE BINDER OR CLEAR BOOK.

1 Checklist of Documents (PCNC Form 101)

2 Affidavit of Verification (PCNC Form 102)

3 Application for Accreditation Form (PCNC Form 103)

4 Organizational Profile Form (PCNC Form 104)

5 Certificate of Registration with the Securities and Exchange Commission (SEC).

6 SEC certified true copy of the Articles of Incorporation and By-laws (from the first filing, and all

amendments thereafter, if any) that include the following provisions as required by RR No. 13-

98:

a. Registered as a non-stock, non-profit corporation or foundation

c. No part of the net income or asset of the corporation shall belong to or inure to the

benefit of any member, organizer, officer, or any specific person.

e. The level of administrative expenses of the corporation shall, on an annual basis, not

exceed thirty percent (30%) of the total expenses for the taxable year. That not more

than thirty percent (30%) of donations and gifts for the taxable year shall be used for

administration purposes.

b. In the event of dissolution, the assets of corporation would be distributed to another

accredited NGO organized for similar purpose or purposes, or to the State for public

purpose or purposes or would be distributed by a competent court of justice to another

accredited NGO to be used in such manner as in the judgment of said court shall best

accomplish the general purpose for which the dissolved corporation was organized.

d. All the members of the Board of Trustees of the corporation do not receive compensation

or remuneration for their services to the organization.

NOTE: No provisions in the AoI and By-laws are contrary to the above provisions.

7 Latest General Information Sheet (GIS) duly received by SEC

a. Number of trustees and officers are consistent with the provisions in the Articles of

Incorporation and By-laws

b. For family foundation, corporate foundation, and NGO organized by religious

congregation:

- Indicate independent trustee/s

- Statement of Management Representation on Independent Trustee/s (PCNC Form 105)

8 Affidavit of No Relation (PCNC Form 106) stating that the Chair or President is not related to

the Treasurer by consanguinity or affinity up to the second degree

9 Table of organization

10 List of BOT members, officers, and key staff members (PCNC Form 107)

11 Affidavit of Modus Operandi (PCNC Form 108) showing the purpose of the organization, list of

proposed projects/activities for the next two years, sources and utilization of funds, and other

facts or information deemed relevant to qualification as donee institution. (For newly

established organizations operating less than two years.)

Annex A - CHECKLIST OF DOCUMENTS / p. 1 of 3

12 Operations Report (PCNC Form 109) for the last two (2) years . DO NOT attach "Annual

Report".

13 Conflict of Interest Policy (see PCNC Form 110 for sample) signed by the Chair and Corporate

Secretary

14 Certified true copy of BIR Certificate of Registration (BIR Form 2303)

15 Latest Audited Financial Statements received by the BIR with:

a. Statement of Management Responsibility for Financial Statements

b. Statement of Management Responsibility for Annual Income Tax Return

c. Sworn Statement of Sources and Usage of Funds as required by SEC

Note: If the Audited Financial Statement is more than six (6) months old, submit the

latest interim, unaudited FS.

16 Copy of the Auditor's Certificate of Accreditation from the Board of Accountancy (BOA)

17 Annual Income Tax Return (BIR Form 1702)

18 Annual Information Return of Income Tax Withheld on Compensation, Expanded & Final

Withholding Taxes (BIR For 1604) for the last two (2) years

19 Photocopy of the first and last pages of Books of Accounts registered with the BIR for the last

two years (Note: If BIR registration is manual books of accounts, posting of accounts should be

done manually. During evaluation, PCNC will not accept pasted books of accounts. All books of

accounts must always be updated.)

a. General Ledger

b. General Journal

c. Cash Receipts Book

d. Cash Disbursement Book

20 If not using manual books of accounts, BIR permit to use:

a. Loose-leaf system (books of accounts must be stamped "RECEIVED" by the BIR-RDO), or

b. Computerized Accounting System (CAS)

21 BIR permit to use Loose-Leaf Official Receipts and/or Cash Register Machine/POS, if applicable

22 Sample of Official Receipts (OR) registered with BIR

23 BIR Certificate of Tax Exemption or Application for Tax Exemption received by BIR (without the

attachments) per BIR RMO No. 38-2019. (If the application is more than one year, a letter from

the applicant-organization stating the status of the application from RDO is needed.)

24 Certified true copy of certification, accreditation or license from relevant government agency

(DepEd, CHED, DSWD, DOST, DOH, NCCA, etc.). For SWDA or Auxiliary SWDA, a Certificate of

Registration and License to Operate from the DSWD are required per DSWD MC No. 17-2018

and MC 01-2018. For Auxiliary SWDA, a letter from the head of the applicant-organization

stating that the organization is not required to secure DSWD Accreditation is needed.

For applicant-organization For PCNC

Prepared by: Received by:

(Printed Name & Signature) Certification Assistant

Date: Date:

Verified by: Reviewed by:

(Printed Name & Signature) Certification Officer

Annex A - CHECKLIST OF DOCUMENTS / p. 2 of 3

Date: Date:

Updated Sept. 6, 2021

Annex A - CHECKLIST OF DOCUMENTS / p. 3 of 3

You might also like

- Financial Accounting and Reporting - 9th PDFDocument496 pagesFinancial Accounting and Reporting - 9th PDFmikiyo90% (10)

- Homeowners Association ChecklistDocument5 pagesHomeowners Association ChecklistJfm A Dazlac100% (6)

- New Contractors License App From PCABDocument23 pagesNew Contractors License App From PCABRotsen Kho Yute50% (2)

- Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Solution Manual Chapter 1Document25 pagesFinancial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Solution Manual Chapter 1Test bank WorldNo ratings yet

- PCNC Accreditation For NGODocument2 pagesPCNC Accreditation For NGOalexjalecoNo ratings yet

- BIR Revenue Memorandum Order No. 56-2016Document6 pagesBIR Revenue Memorandum Order No. 56-2016PortCalls100% (2)

- LCM Accounts Payable Setup and Landed Cost ReconciliationDocument5 pagesLCM Accounts Payable Setup and Landed Cost Reconciliationjazharscribd100% (1)

- Revised Application Process for Philippine NGO CertificationDocument3 pagesRevised Application Process for Philippine NGO CertificationOmar Jayson Siao Vallejera73% (11)

- PCNC ChecklistDocument3 pagesPCNC Checklistmrbsespkmg LawNo ratings yet

- Steps & Requirements - UpdatedDocument3 pagesSteps & Requirements - UpdatedKaren LabasanNo ratings yet

- Steps & Requirements - UpdatedDocument4 pagesSteps & Requirements - Updatedalfx216No ratings yet

- LCC - Renewal of Contractor's LicenseDocument23 pagesLCC - Renewal of Contractor's LicenseJason LucasNo ratings yet

- Upgrading Contractor License Application DocumentsDocument16 pagesUpgrading Contractor License Application DocumentsAyiNo ratings yet

- PCAB Requirements: A. LegalDocument6 pagesPCAB Requirements: A. LegalGilianne Kathryn Layco Gantuangco-CabilingNo ratings yet

- PCAB contractor license upgrading documentsDocument16 pagesPCAB contractor license upgrading documentsaefNo ratings yet

- Change of Business Name & Status Form - 10192017Document21 pagesChange of Business Name & Status Form - 10192017successonthemaking100% (1)

- PCNC List of Requirements For AccreditationDocument4 pagesPCNC List of Requirements For AccreditationNCRENo ratings yet

- Under Sir Mike Name PCAB2020Document30 pagesUnder Sir Mike Name PCAB2020Daren Anne JatulanNo ratings yet

- RDF B 200514Document4 pagesRDF B 200514SamuelNo ratings yet

- Renewal of Contractor's License Application Form...Document23 pagesRenewal of Contractor's License Application Form...DANILO M. TOLEDANESNo ratings yet

- Call for bank records and details for statutory auditDocument1 pageCall for bank records and details for statutory auditAjay RaoNo ratings yet

- Checklist PcabDocument5 pagesChecklist PcabLyka Amascual ClaridadNo ratings yet

- Philippine Contractor's License Application RequirementsDocument25 pagesPhilippine Contractor's License Application RequirementsAljohn SebucNo ratings yet

- New Contractor's License Application FormDocument25 pagesNew Contractor's License Application FormAlexander Madayag80% (30)

- PCAB Contractor's License RequirementsDocument25 pagesPCAB Contractor's License RequirementsCyndy SibeliusNo ratings yet

- Construction Industry Authority of the Philippines License Renewal RequirementsDocument24 pagesConstruction Industry Authority of the Philippines License Renewal RequirementsMeralu PagueNo ratings yet

- Quality Management System: Eumb - EpmpdDocument3 pagesQuality Management System: Eumb - EpmpdCecile DuguitNo ratings yet

- Contractor License For PCABDocument24 pagesContractor License For PCABMaggie Benz Dela Torre100% (8)

- PCAB LicenseDocument8 pagesPCAB LicenseJaypee OrtizNo ratings yet

- Uprading of CategoryDocument15 pagesUprading of CategoryApl Dugui-es ToleroNo ratings yet

- Dti Application For Contractor's LicenseDocument23 pagesDti Application For Contractor's Licenseglenn41792% (12)

- BOA RegistrationDocument9 pagesBOA RegistrationGreg AustralNo ratings yet

- Corporate tasklistDocument5 pagesCorporate tasklistTina Reyes-BattadNo ratings yet

- PCAB License Requirements SummaryDocument3 pagesPCAB License Requirements SummaryJorge ParkerNo ratings yet

- ActDocument2 pagesActJeffrey Garcia IlaganNo ratings yet

- Notice of Annual General Meeting (AR2016) For WebsiteDocument6 pagesNotice of Annual General Meeting (AR2016) For WebsiteWaleedNo ratings yet

- Social Housing Builders Accreditation RequirementsDocument2 pagesSocial Housing Builders Accreditation RequirementsCGS77 ConstructionNo ratings yet

- SIRV RequirementsDocument5 pagesSIRV Requirementsskylark74No ratings yet

- PDABJ674Document24 pagesPDABJ674yadisahassenaNo ratings yet

- BACC Resolution Renewal CPA AccreditationDocument4 pagesBACC Resolution Renewal CPA AccreditationDarlon B. SerenioNo ratings yet

- Docs - Downloads - CIAP DOCS - PCAB LICENSE APPLICATION FORMS - NEW CONTRACTOR'S LICENSE PDFDocument24 pagesDocs - Downloads - CIAP DOCS - PCAB LICENSE APPLICATION FORMS - NEW CONTRACTOR'S LICENSE PDFAngel Llenado VillariasaNo ratings yet

- PCNCDocument4 pagesPCNCHerzl Hali V. HermosaNo ratings yet

- Annual and Other Obligations Under Companies ActDocument12 pagesAnnual and Other Obligations Under Companies ActSangram PandaNo ratings yet

- 37-BIR (1945) Certificate of Tax Exemption For CooperativeDocument2 pages37-BIR (1945) Certificate of Tax Exemption For CooperativeEditha Valenzuela67% (3)

- 3application Form - Revised March 20, 2017Document5 pages3application Form - Revised March 20, 2017St. Maximillian DRUG Rehab CenterNo ratings yet

- Annual Report June-19Document73 pagesAnnual Report June-19Umar Sarfraz KhanNo ratings yet

- PICPA Tax Incentive Report (CDA)Document29 pagesPICPA Tax Incentive Report (CDA)francklineNo ratings yet

- Formation of Bop Asset Management CompanyDocument5 pagesFormation of Bop Asset Management Companyanwaar143No ratings yet

- Business Consultants & Business Advisors, Custom Services, Income Tax Sales Tax Consultant.Document1 pageBusiness Consultants & Business Advisors, Custom Services, Income Tax Sales Tax Consultant.TahirBajwaNo ratings yet

- Checklist Forms - Flat Transfer-FormatDocument2 pagesChecklist Forms - Flat Transfer-FormatamitNo ratings yet

- Circular 63-2011 06sept2011Document3 pagesCircular 63-2011 06sept2011MONARCHGANDHINo ratings yet

- PCAB Form NoDocument18 pagesPCAB Form NoRoger E. Lumayag Jr.100% (1)

- Reportorial RequirementsDocument2 pagesReportorial RequirementsNathalie QuinonesNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Research-Introduction MismatchDocument4 pagesResearch-Introduction MismatchAdrian joseph AdrianoNo ratings yet

- Resarch Introduction AlgebrDocument4 pagesResarch Introduction AlgebrAdrian joseph AdrianoNo ratings yet

- Green Simple Elementary NewsletterDocument1 pageGreen Simple Elementary NewsletterAdrian joseph AdrianoNo ratings yet

- 2 A The Polarity of A MoleculeDocument41 pages2 A The Polarity of A MoleculeAdrian joseph AdrianoNo ratings yet

- 1 MIL IntroductionDocument28 pages1 MIL IntroductionAdrian joseph AdrianoNo ratings yet

- Managing The Systems Development Life Cycle: Accounting Information Systems 9e James A. HallDocument37 pagesManaging The Systems Development Life Cycle: Accounting Information Systems 9e James A. HallJesia DjaduNo ratings yet

- BRS PreparationDocument16 pagesBRS PreparationAcorda AngelinaNo ratings yet

- SAGC Newsletter Edition #1Document20 pagesSAGC Newsletter Edition #1Sunway UniversityNo ratings yet

- Payroll Interview QuestionsDocument6 pagesPayroll Interview Questionssamirever100% (1)

- Controlling TechniquesDocument35 pagesControlling TechniquesKrishna Yadav100% (2)

- Week 2 Workshop SolutionsDocument14 pagesWeek 2 Workshop SolutionsAssessment Help SolutionsNo ratings yet

- Rahul Singh: Union Bank of India (UBI) Is One of The Largest Government-Owned Banks of India (TheDocument2 pagesRahul Singh: Union Bank of India (UBI) Is One of The Largest Government-Owned Banks of India (Thesmirti123No ratings yet

- Introduction to Transaction Processing CyclesDocument4 pagesIntroduction to Transaction Processing CyclesDeanNo ratings yet

- CMA CGM - Consolidated Financial Statements - December 2018 - SignedDocument82 pagesCMA CGM - Consolidated Financial Statements - December 2018 - SignedSanchit RathiNo ratings yet

- Chingaya Joshua EconomicsDocument81 pagesChingaya Joshua EconomicsBiPiend Nguyễn100% (1)

- Comprehensive Annual: Mayor Chokwe A. LumumbaDocument237 pagesComprehensive Annual: Mayor Chokwe A. Lumumbathe kingfishNo ratings yet

- Management Review Agenda ISO 45001Document2 pagesManagement Review Agenda ISO 45001aryopandu baskoroNo ratings yet

- MoeDocument214 pagesMoemahmud517No ratings yet

- @ProCA - Inter Company Audit Correct & IncorrectDocument10 pages@ProCA - Inter Company Audit Correct & IncorrectSonu SharmaNo ratings yet

- Continuous Monitoring Approach (CMA) for Universal Safety Oversight Audit Programme (USOAPDocument14 pagesContinuous Monitoring Approach (CMA) for Universal Safety Oversight Audit Programme (USOAPDaniel100% (1)

- DBP V COA, GR No. 88435 (2002)Document19 pagesDBP V COA, GR No. 88435 (2002)Jericho UyNo ratings yet

- SOW For D365 F&O.Document21 pagesSOW For D365 F&O.narayananaliveNo ratings yet

- FR-212 Iso 9001-2015 Stage 2-Surveillance Audit ReportDocument5 pagesFR-212 Iso 9001-2015 Stage 2-Surveillance Audit ReporttriveshNo ratings yet

- Social AuditDocument9 pagesSocial AuditAshwin KVNo ratings yet

- Bookkeeping and Accounting GuideDocument16 pagesBookkeeping and Accounting GuideAnuska ThapaNo ratings yet

- Bank Audit Analysis Documentation - Check ListDocument6 pagesBank Audit Analysis Documentation - Check Listrao_gmailNo ratings yet

- PT Akasha Wira International TBK Swot Analysis BacDocument13 pagesPT Akasha Wira International TBK Swot Analysis BacVanesa SyalomithaNo ratings yet

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarDocument14 pagesForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarPrabin JainNo ratings yet

- City of Winter Springs Transmittal Letter and PTDocument16 pagesCity of Winter Springs Transmittal Letter and PTJacob Langston100% (1)

- Ais Chapter SixDocument6 pagesAis Chapter Sixtarekegn gezahegnNo ratings yet

- KPMG - Co-Op 2Document9 pagesKPMG - Co-Op 2ConnieLowNo ratings yet

- Acs Ethics Case Studies v2.12Document45 pagesAcs Ethics Case Studies v2.12swatagodaNo ratings yet